What Happens To My Cmhc Insurance If I Change Lenders

If you choose to change lenders when its time to renew your insured mortgage, you do not have to pay for CMHC insurance again. CMHC insurance covers your mortgage until it is paid off, and will follow you from lender to lender. Simply provide your CMHC certificate of insurance or certificate number.

Why Term Life Insurance Is The Better Option

Term life insurance is the better option for most Canadian families.

Itâs usually more affordable. But price isn’t the only reason we typically recommend buying term life insurance instead of mortgage protection insurance.

Here are five advantages of term life insurance over mortgage life insurance:

1. The beneficiary is your family, not the bank.Itâs an important difference, as a mortgage insurance payout just goes to the financial institution that holds your mortgage. So your beneficiaries wonât receive any of the money.

2. Your family can pay off debts and expenses other than your mortgage.In other words, your loved ones can take care of all the expenses they need to, including the mortgage, instead of just having their mortgage paid off.

3. The death benefit comes to your beneficiaries as atax-free lump sum.They can use this money any way they like, from immediate expenses to mortgage payments to longer-term investments.

4. Your death benefit doesn’t decrease over your policy term.A term life insurance policy might pay out $500,000 if you passed away in the first year of the term, or $500,000 if you passed away 15 years later. With mortgage insurance, remember the payout will only be the amount of your mortgage, whether that is $500,000 or $50,000.

Term life insurance also allows you flexibility in how you structure your coverage and premiums.

For example, you could:

How To Get Rid Of Pmi

If you opt for BPMI when you close your loan, you can write to your lender in order to avoid paying it once you reach 20% equity. If you’re a Rocket Mortgage® client, you can avoid the process of finding a stamp altogether and just give us a call at 508-0944.

Your letter should be sent to your mortgage servicer and include the reason you believe youre eligible for cancellation. Reasons for cancellation include the following:

- Reaching 20% equity in your home.

- Based on significant improvements to your home. If youve made home improvements that substantially increase the value of your home, you can have mortgage insurance removed. If your loan is owned by Fannie Mae, you must have 25% equity or more. The Freddie Mac requirement is still 20%.

- Based on increases in your home value not related to home improvements. If youre requesting removal of your mortgage insurance based on natural increases in your property value due to market conditions, Fannie Mae and Freddie Mac require you to have 25% equity if the request is made 2 5 years after you close on your loan. After 5 years, you only have to have 20% equity. In any case, youll be paying for BPMI for at least 2 years.

For your request to cancel mortgage insurance to be honored, you have to be current on your mortgage payments and an appraisal has to be done to verify property value.

Recommended Reading: Rocket Mortgage Requirements

Federal Home Loan Mortgage Protection

There is an additional type of mortgage insurance. However, it is only used with loans underwritten by the Federal Housing Administration. These loans are better known as FHA loans or FHA mortgages. PMI through the FHA is known as MIP. It is a requirement for all FHA loans and with down payments of 10% or less.

Furthermore, it cannot be removed without refinancing the home. MIP requires an upfront payment and monthly premiums . The buyer is still required to wait 11 years before they can remove the MIP from the loan if they had a down payment of more than 10%.

Fha’s Mortgage Insurance Premium Through The Years

The FHA has changed its MIP multiple times in recent years. Each time the FHA raised its MIP, FHA loans became more expensive for borrowers. Each increase also meant some prospective borrowers weren’t able to qualify for or afford the higher monthly mortgage payments due to the MIP.

In January 2015, the FHA reversed course and cut its MIP to 0.85 percent for new 30-year, fixed-rate loans with less than 5 percent down. The FHA projected that this decrease would save new FHA borrowers $900 per year, or $75 per month, on average. The actual savings for individual borrowers depends on the type of property they own or purchase, their loan term, loan amount and down payment percentage.

Changes in FHA’s MIP apply only to new loans. Borrowers who’ve closed their loans don’t need to worry that their MIP will get more expensive later.

- Company

Also Check: Can You Do A Reverse Mortgage On A Condo

Us Department Of Veterans Affairs Home Loans

A benefit of employment in the U.S. armed services is eligibility for a VA loan. VA loans do not require a down payment or monthly mortgage insurance.

Key Takeaways

VA Loan Insurer

The VA pays most of the cost for insuring VA loans. The VA limits the amount it will insure based on the location of the home.

VA Loan Insurance Cost

Most VA borrowers pay an upfront funding fee. The fee ranges from 1.25 percent to 3.3 percent of the loan amount, depending on the borrowers category of military service, down payment percentage and whether the loan is the borrowers first VA loan. The fee can be paid in cash or financed.

Mortgage Default Insurance Rates 1

To determine which mortgage default insurance premium rate you have to pay, the first step is to calculate how much your down payment is as a percentage of your homes purchase price. The chart below outlines the premium rates for each down payment scenario:

| Loan-to-Value | ||

|---|---|---|

| Up to and including 95% | 4.00% | 6.30% |

*These mortgages have a down payment of greater than 20%. While you won’t be paying the CMHC insurance premiums in this case, coverage is still available to your lender, and they will often take out CMHC insurance on your mortgage anyway.

These same rates are charged by all three providers: CMHC, Genworth and Canada Guaranty. Keep in mind that you’ll also need to pay provincial sales tax on your premiums if you live in Manitoba, Quebec, Ontario, and Saskatchewan. PST can’t be added to your mortgage, so you’ll need to pay upfront, in cash.

Also Check: Does Rocket Mortgage Sell Their Loans

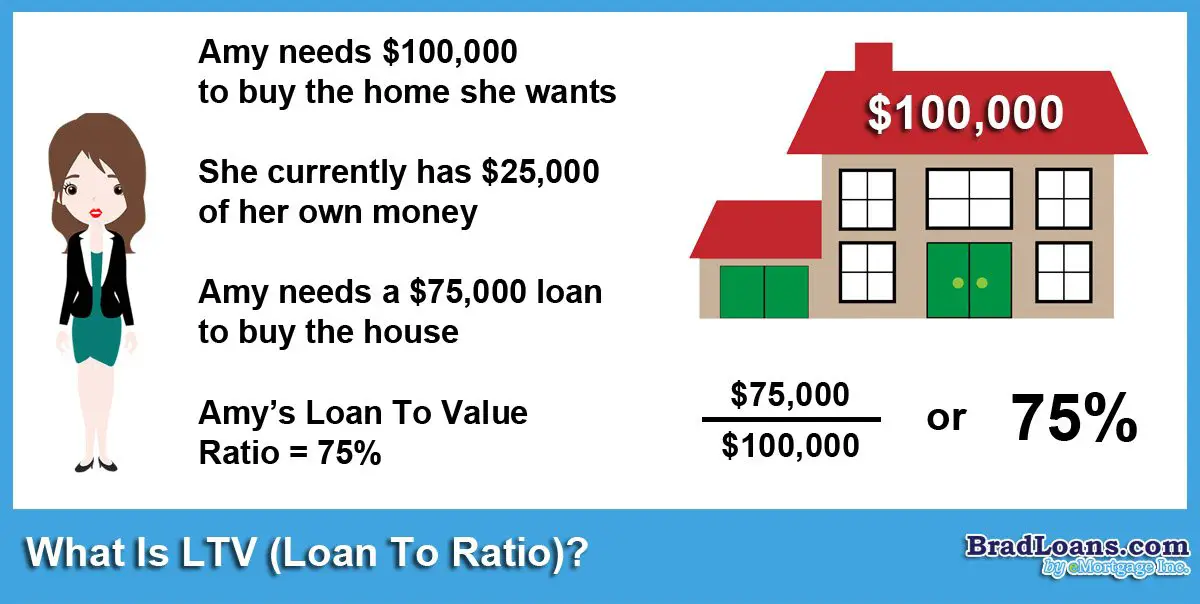

When Is Lmi Required

Generally a lender will require you to pay for LMI if your home loan deposit is less than 20% of the total value of your property so if your loan-to-value ratio is more than 80%. However, as different lenders may have different rules, it could be worth checking what each individual lenders policy is.

If youre looking to avoid paying LMI but you dont have enough of a deposit saved up, you may be better off not entering the housing market just yet, and waiting until you have saved up the 20% deposit that is generally required to avoid paying LMI. You could also consider the First Home Loan Deposit Scheme, if you are eligible.

If youre currently considering a home loan, the comparison table below displays some of the variable rate home loans on our database with links to lenders websites that are available for first home buyers. This table is sorted by Star Rating , followed by comparison rate . Products shown are principal and interest home loans available for a loan amount of $350K in NSW with an LVR of 80% of the property value and that offer an offset account. Before committing to a particular home loan product, check upfront with your lender and read the applicable loan documentation to confirm whether the terms of the loan meet your needs and repayment capacity. Use Canstars home loan selector to view a wider range of home loan products.

*Comparison rate based on loan amount of $150,000 and a term of 25 years. Read the Comparison Rate Warning.

Conforming Loans With Private Mortgage Insurance

Conforming loans get their name because they meet or conform to Fannie Mae or Freddie Mac guidelines for the loan amount and the borrower’s creditworthiness.

Key Takeaways

Conforming Loan Insurer

A loan conforming to Fannie Mae or Freddie Mac’s standards is not insured by either Fannie or Freddie. PMI is not government insured it’s backed by private companies.

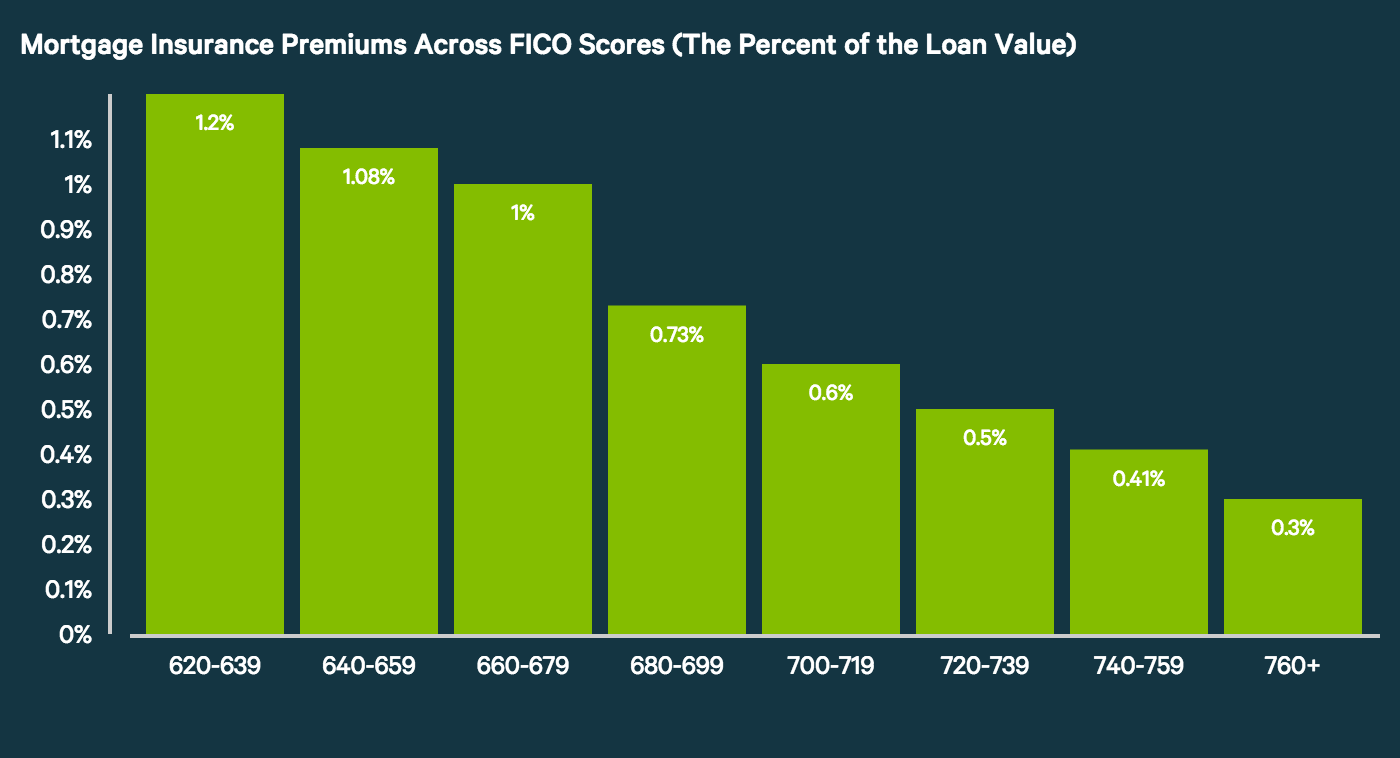

PMI Cost for Conforming Loans

PMI is generally cheaper than the mortgage insurance premiums on FHA loans. How much a borrower will pay for PMI depends on the loan type, down payment percentage, property type, location and other factors.

Recommended Reading: Does Getting Pre Approved Hurt Your Credit

States With The Lowest Mortgage Insurance Costs

In places like West Virginia, Ohio and Iowa, where the costs of single-family homes are among the lowest in the country, PMI is far less expensive. Mortgage insurance costs are about $3,329 per year, or $277.45 per month, in West Virginia, where the median listing price of a single-family home was $179,000 in September.

Your Home Your Lifestyle Protect Both With Homeprotector Insurance

When you choose the security of HomeProtector® Insurance for your RBC Royal Bank® mortgage, youâre helping to protect your home and family against lifeâs what-ifs. Youâre also helping to preserve your savings and other insurance you may have for what they were intended.

To view this video please enable JavaScript, and consider upgrading to a web browser that supports HTML5 video

Don’t Miss: Reverse Mortgage On Condo

How To Cancel Pmi

You may need to pay a PMI premium when you first buy your home, but there are also four ways to get rid of PMI:

- Automatic cancellation: By law, your mortgage servicer can’t require you to pay for PMI forever. It must automatically cancel the policy when you’re scheduled to reach 22% equity , or when you’re halfway through the repayment term. The timeline is based on the original loan’s repayment schedule and value.

- Request cancellation: You may request a cancellation a little earlieronce you reach 20% equity based on the home’s original value. However, you may need to meet other qualifications, such as not having a second mortgage, and you may have to pay for an appraisal.

- Reappraise your home: While the above methods depend on the home’s original value, you may be able to pay for a reappraisal and request the PMI be canceled based on the current value and your equity. This can be beneficial if your home has quickly appreciated in value or if you’ve made home improvements that increased its value.

- Refinance your mortgage: Another option is to replace your mortgage with a new one. If you have at least 20% equity based on the current valuation, you may qualify for a conventional loan without PMI.

You may want to get rid of PMI as soon as possible to lower your mortgage payments. There’s little downside, as the insurance doesn’t protect borrowers.

How To Lower Your Monthly Mortgage Payment

- Choose a long loan term

- Buy a less expensive house

- Pay a larger down payment

- Find the lowest interest rate available to you

You can expect a smaller bill if you increase the number of years youre paying the mortgage. That means extending the loan term. For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because youre paying the loan off in a compressed amount of time.

An obvious but still important route to a lower monthly payment is to buy a more affordable home. The higher the home price, the higher your monthly payments. This ties into PMI. If you dont have enough saved for a 20% down payment, youre going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments.

Finally, your interest rate impacts your monthly payments. You dont have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible.

You May Like: Rocket Mortgage Launchpad

Why Do I Need To Pay For Pmi When It Is For The Lenders Benefit

The reason for this is because the lender is taking on additional risk by lending to you while youre putting up less money upfront and can default on future payments.

However, it is important to understand that it isbeneficial for you too because if PMI or insurance was not an option, lenders may not have offered a mortgage for anything less than a 20% down payment, preventing a lot of individuals from becoming homeowners.

PMI also has an additional benefit because lenders can give you a bettermortgage rateif you take PMI. The reason for this is because PMI allows lenders to recover a greater portion of their investment as compared to individuals who do not take PMI, allowing them to give you a better rate on your mortgage.

Mortgage Life Insurance Vs Term Or Permanent Life Insurance

As you pay down your mortgage, mortgage life insurance covers a smaller amount of money.

Term or permanent life insurance may provide better value than mortgage life insurance. With term or permanent life insurance, the death benefit, or amount payable to your beneficiaries, won’t decrease over the term of the policy. Upon your death, your beneficiaries may use the insurance money to pay for the mortgage.

Read Also: Does Rocket Mortgage Service Their Own Loans

Have A Family Member Go Guarantor

A guarantor is someone who guarantees part or all of your loan so that in the event that you cant pay, the responsibility would fall to them. This eliminates much of the risk for a lender, but can place a great deal of risk on the person or people acting as the guarantor.

This decision should not be taken lightly. After all, the person going guarantor is potentially risking their own savings and assets, including their home in some cases. You can read more about going guarantor on a home loan here. Since it is a major decision to make, it may be a good idea to seek professional advice before making a decision.

Mortgage Disability And Critical Illness Insurance

Mortgage disability and critical illness insurance may make mortgage payments to your lender if you can’t work due to a severe injury or illness.

Mortgage disability and critical illness insurance is usually a combination of several insurance products, including:

- critical illness insurance

- job loss insurance

- life insurance

Most insurance plans have a number of conditions attached to them, including a specific list of illnesses or injuries that are covered or excluded. Pre-existing medical conditions are usually not covered. These terms and conditions of insurance are listed in the insurance certificate. Ask to see the insurance certificate before you apply, so you understand what the insurance covers.

Before you buy mortgage disability or critical illness insurance, check if you already have insurance coverage that meets your needs through your employer or another policy.

Don’t Miss: Can You Get A Reverse Mortgage On A Mobile Home

How Long Do You Have To Buy Private Mortgage Insurance

Borrowers can request that monthly mortgage insurance payments be eliminated once the loan-to-value ratio drops below 80%. Once the mortgage’s LTV ratio falls to 78%, the lender must automatically cancel PMI as long as you’re current on your mortgage. That happens when your down payment, plus the loan principal you’ve paid off, equals 22% of the home’s purchase price. This cancellation is a requirement of the federal Homeowners Protection Act, even if your homes market value has gone down.

What Is Lenders Mortgage Insurance

LMI protects your lender in the event that you default on your home loan and there is a shortfall. A shortfall happens when the proceeds from the sale of your home are not enough to cover the outstanding amount you owe to your lender.

Your lender may be able to recover the shortfall from the LMI provider but even if they do, it doesnt mean youre off the hook. The LMI provider may seek to recover the shortfall amount from you.

If LMI is required, youll have to pay the insurance premium. But its important to remember that LMI doesnt provide you with any protection even though you pay for it its there for your lenders protection.

Read Also: 10 Year Treasury Vs Mortgage Rates

Pmi For Conventional Mortgages

Many lenders offer conventional mortgages with low down payment requirements some as low as 3%. A lender likely will require you to pay for private mortgage insurance, or PMI, if your down payment is less than 20%.

Before buying a home, you can use a PMI calculator to estimate the cost of PMI, which will vary according to the size of your home loan, credit score and other factors. Typically, the monthly PMI premium is included in your mortgage payment. You can ask to cancel PMI after you have over 20% equity in your home.

» MORE:Calculate your PMI costs

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

You May Like: How Does Rocket Mortgage Work