Mortgage Preapproval Vs Prequalification

| Youll have a good idea of what you can afford | Youll have evidence that youre a serious buyer with financing lined up |

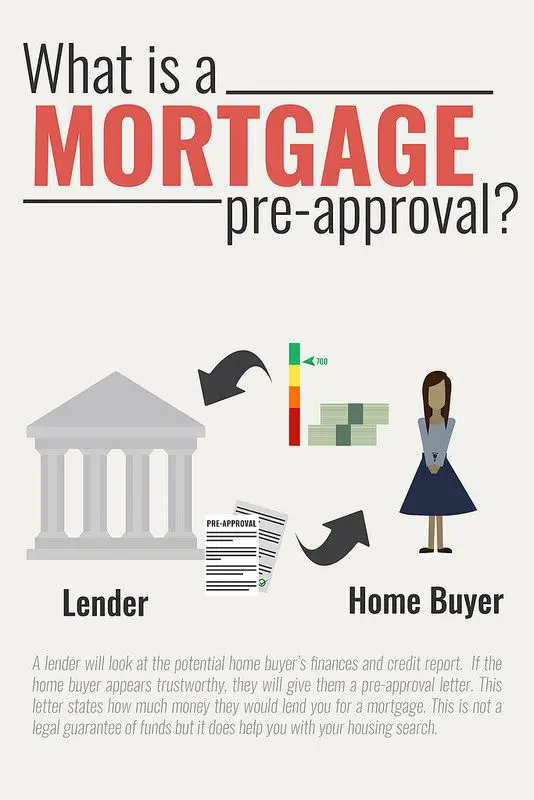

A mortgage prequalification is not the same as a mortgage preapproval. While these two terms sound similar, a preapproval generally carries greater weight and more detail about the loan youll be approved for and in todays market, youll need a preapproval letter in hand before you even consider making an offer on a home.

A prequalification, on the other hand, can help you determine what price range of homes you should be considering, and many times there is no cost or fee involved. When you really want to buy a home, the preapproval letter provides more concrete proof that you can make the deal happen. From the sellers perspective, theyre looking for a preapproval, not a prequalification.

Getting preapproved tends to take more time than getting prequalified, too, because the lender reviews much more documentation. A lender will examine your debt, your tax returns and a range of other indicators that help them assess your ability to repay the loan.

Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2s, recent pay stubs, bank statements and tax returns, Reynolds says. The lender will then use these documents to determine exactly how much you can be preapproved to borrow.

What’s The Difference Between Mortgage Prequalification Vs Preapproval

Prequalification is a based on financial information which the lender does not verify. For example, your lender is likely to ask you what your annual income is but wont ask you for W2s or other documents to prove it.

Preapproval requires you to provide documents that verify financial information like your income. This is a less simple process but it results in a mortgage amount which real estate agents and home sellers are more likely to trust.

How Long Is A Home Loan Pre

The good-for period varies with the lender, but typically anywhere from a month to 90 daysand, in some cases, six months. Its good practice to keep track of the expiration date so that you dont run into a situation where you find a dream home that you can afford only to learn that your pre-approval has expired.

Also Check: Rocket Mortgage Payment Options

How To Get Prequalified For A Mortgage

Jump start your home search with prequalification

Prequalification and preapproval are terms you hear during the home buying process. They sound similar but they are not quite the same. Both are a type of proof for real estate agents and home sellers that demonstrate you may qualify for a mortgage to buy a home.

Gather The Information Youll Need

Depending on where you get your pre-approval letter, traditional lenders require you to upload your documents upfront.

But if you choose to get an instant streamlined pre-approval letter online with Credible, the process is much quicker. To receive your letter, youll just need to have your information on hand so you can enter it into the signup form.

Heres some of the information you should have ready:

- Proof of income: Such as pay stubs or W-2 forms

- Federal income tax returns: Your tax returns for the past two years

- Bank and investment account statements: Bank and investment account statements that show your current balances and contributions

- Drivers license or passport: Some form of identification

- Debt statements: Any outstanding debt statements that show your remaining balance and monthly payment, like student loans

Learn More: Your Mortgage Pre-Approval Checklist: Every Document Youll Need

Also Check: Chase Recast Calculator

Does Getting Prequalified For A Mortgage Hurt Your Credit Score

Prequalification typically doesnt affect your credit score because it involves a soft credit pull. On the other hand, preapproval usually requires a hard credit pull and may affect your credit score if you try to get pre-approved by several lenders.

If youre considering more than one lender, try to request your home loan pre-approvals around the same time since credit bureaus typically count these separate requests as one single credit check.

Get Your Financial Paperwork In Order

You are under no obligation by getting pre-approved, but you want to be comfortable with the amount and terms of your pre-approved mortgage. That’s why it’s essential that you review all your personal expenses and have a good idea of your future expenses before you talk with a mortgage broker or lender about pre-approval. Learn more about knowing how much you can afford.

Also Check: How To Get Preapproved For A Mortgage With Bad Credit

Budget For A Down Payment

The more money you can put down, the lower the interest rate and monthly payments will be. If you put down less than 20% of the homes purchase price, youll have to pay for private mortgage insurance on top of the cost of the home loan.

The type of mortgage you apply for will affect how much of a down payment youll need. For example, for most mortgages, youll need to put down 3% to 20%. But if you qualify for a Federal Housing Administration loan, you can put down just 3.5%.

Credibles monthly mortgage payment calculator makes this easy. Simply enter your loan information below to see how much youll pay monthly and over the life of the loan.

Enter your loan information to calculate how much you could pay

Checking rates won’t affect your credit score

If You Get Declined For Your Preapproval Dont Despair

- Find out why you were declined, so you can figure out what to do to improve your chances of getting a loan in the future.

- Ask the lender to explain why you were declined. Was your credit score too low? Was there specific negative information on your credit report?

- Ask to see a copy of the credit score the lender used. If the lender used your credit score to deny your preapproval request, the lender must send you a notice with the credit score they used to make the decision and instructions on how to get a free copy of your credit report.

- If there are errors on your credit report, get them corrected.

- If you need help improving your credit, contact a HUD-approved housing counselor. You can find a counselor online or by calling 1-800-569-4287.

Don’t Miss: Will Mortgage Pre Approval Hurt Credit Score

Will Bad Credit Keep You From Buying A Home

Pied Piper Group helps those with varying financial history all the time. You can have money in the bank with a great job and still struggle with your credit score. Unfortunately, it can limit your ability to apply for credit cards, get a good rate on your insurance, find a new job, and even affects getting a home, business, commercial, or even an auto loan. That said, the three-digit number from FICO does not need to hold back your housing dreams.

Our Branch Managers can walk you through available options to improve your credit and secure your financial positioning. While many proactive solutions can build your creditworthiness, certain behaviors could harshly affect your chances of improving your score. Making a big purchase or co-signing on a loan for someone elses purchase could worry creditors regardless of whether you buy a car, appliance, or even new furniture.

Similarly, this time should not be spent opening, closing, or holding a large charge on any lines of credit you may have. Showing stability factors into your credit score, so changing your bank or job could seem like a red flag. Furthermore, paying bills late and making large deposits could cause suspicion. Both during the process and in the months leading up to your search, developing a credit plan could set you up for success.

Why Should You Get Prequalified

While prequalification isnt a guarantee of anything, if can be an important step in guiding your home search. Having an idea of what you can afford and what price range you should be shopping in can help your or your agent find appropriately priced homes for you to consider and tour.

If youre not thrilled about the results of your prequalification, you can take a break from the home buying process, no strings attached, and try to improve your financial picture.

Read Also: How Much Is Mortgage On 1 Million

How Long Is A Mortgage Pre

While the offer typically remains valid anywhere from 45 to 90 days, Pied Piper Group offers the full 90 days to all of our potential buyers. Nevertheless, that 3 month window should not scare you. Since your loan estimate should be as current as possible, financial institutions provide renewals. Your pre-approval letter is revised based on any changes youve made to your credit and a better reflection of current rates. When your house hunting takes a little longer than expected, you can get back out there without starting from square one. However, you should not continue renewing if you plan to put a pause on your search. Pre-approval for a mortgage is intended to help you close quickly on a home, not to have a standing proposal.

What Happens If You Dont Get Pre

In order to qualify for a mortgage, you must meet specific criteria for income, credit score, down payment, and debt-to-income ratio. Not everyone will pre-qualify for a mortgage, and not everyone will get pre-qualified for amount of money they think they would. If you find yourself in that scenario, there are some things you can do:

- Increase your down payment amount. This can help increase the loan amount you would qualify for, and also help lower your monthly mortgage payments. Learn more about down payments and see why 20% is ideal.

- Decrease your overall debt to improve your debt-to-income ratio. Typically, a debt-to-income ratio of 36 percent or less is preferable 43 percent is the maximum ratio allowed. Use our debt-to-income calculator to estimate your debt-to-income ratio.

- Work to improve your credit score by doing things like correcting errors on your credit report, addressing any red flags such as late or missed payments, and reducing the number of hard credit inquiries on your report. Even if you are deemed to have bad credit, you may still be able to qualify for a mortgage. But in general, a score of 720 and higher will help you get the most favorable interest rates.

Ready to get pre-qualified? In minutes, you can find a local lender on Zillow who can help pre-qualify you for a mortgage.

Current Mortgage Rates

You May Like: Reverse Mortgage On Condo

How Do You Prequalify For A Mortgage

When you want to prequalify for a mortgage, you should expect to provide the following types of information:

- Income

- Assets and investments

If you are seeking preapproval, you may need to provide pay stubs, employment history, tax returns, credit history, outstanding bills, bank statements, and other financial documents.

Understand The Difference Between Pre

A mortgage pre-qualification is often a basic financial evaluation. A TD mortgage pre-approval on the other hand, is in-depth. It includes a more thorough assessment of your finances. It also offers a rate hold of up to 120 days , while a pre-qualification does not. Plus, if you apply for a TD mortgage pre-approval online, it has no impact on your credit score. These benefits make a pre-approval an important part of the mortgage process.

You May Like: Recasting Mortgage Chase

What Is Primelending’s Float

When you get approved for a mortgage loan, the terms are based on a specific, agreed-upon interest rate. In most approved loan agreements, this rate is locked, meaning it wont change even if the market rates go up or down. That protects your rate from rising, but what if you learn that rates went down? At PrimeLending, we allow you to make a request to float down your rate one-time within twenty days of your closing if there has been adequate market improvement.

The Float Down option gives you the ability to lock-in, meaning your rate wont rise, and also rest easy knowing that if you learn there has been a significant drop in interest rates, you have an option to request to reduce your rate with PrimeLending.

About Us

When Should You Get Preapproved

The best time to get preapproved is a few weeks or months before purchasing. You shouldnt get preapproved too early. In most cases, a preapproval will expire after about 90 days.

You should also get preapproved before meeting with a real estate agent and actively looking at homes. If you dont know your budget, you could potentially make an offer on a home that you cant afford.

Plus, a preapproval provides additional information to help you prepare for a purchase. Youll not only receive information about loan amounts, but also estimates regarding interest rates, down payment amounts, and monthly mortgage payments.

To prepare for a preapproval, gather your documents early and submit these to a mortgage lender in a timely manner.

Borrowers typically need to submit the following documents along with their mortgage application:

- Tax returns and W2s from the past two years

- Recent pay stubs

- Bank statements for savings accounts and other assets

- A copy of your drivers license

- Employment verification

- Rental history

Depending on your circumstances, you might also provide a gift letter, a yeartodate Profit and Loss statement , as well as courtordered information about alimony or child support, if using this income for qualifying purposes.

If you have alternative sources of income, issues in your credit history, or unusual deposits in your bank account, you should be prepared to explain these anomalies to your loan officer.

You May Like: Does Prequalifying For A Mortgage Affect Your Credit

What To Do If You Cant Get Preapproved

If you cant get a preapproval, try to find out from the lender why you were denied. If its an issue you can remedy, like an error on your credit report thats causing the lender to reject your application, you can address that right away and seek a preapproval again when its resolved.

If you have too low of a credit score or other financial roadblocks preventing you from being preapproved, you can work to improve those areas, too. Raise your score by making payments on time and paying down your debt load, for example, or lower your debt ratio by finding a way to increase your income. Depending on your situation, this could take time, but itll go a long way.

Some lenders have very stringent qualifying criteria, so another option is to work with a different, more flexible lender. If youre an account holder with a local bank or member of a credit union, these institutions might be more willing to work with you to get you preapproved.

An Expert Mortgage Broker In Your Corner For Now And Later

Why us? Because mortgages are all we do. Unlike the banks, we’re obsessed with providing you with unbeatable service. It’s all about helping you with one of the biggest financial decisions you’ll make.

Our True North Mortgage Brokers are knowledgeable, friendly and easy to get a hold of â real people who care about getting your best mortgage fit. We’re here for your lifetime of mortgage needs.

You May Like: How Does Rocket Mortgage Work

Documents Required To Get A Mortgage Pre

While the process of getting pre-approved might seem like an intimidating task it is actually not that hard, as long as you have all the right documentation and information. In Canada, the bank requires this information from you.

- Identification in the form of a photo I.D.

- Name, address, telephone number of your solicitor/notary

- Proof of employment, salary and the amount of time youve been employed

- Bank account information and any information on other investments you might have

- Confirmation of your down payment

- Information on your assets: vehicles, investments, other property that you might own

- Information on all of you liabilities: credit card balances, lines of credit, car loans, student loans

What Factors Are Considered For Preapproval

In addition to considering your credit score, lenders will want to verify your employment and income. Theyll also be considering your debt-to-income ratio , which is a calculation of your total monthly debts, divided by your monthly income. This ratio, expressed as a percentage, helps lenders make sure you have enough income to reasonably cover your debts.

The exact DTI needed for mortgage approval varies by loan type. But generally speaking, youll want your debt-to-income ratio to be 50% or lower.

Don’t Miss: Chase Recast Mortgage

Do You Need More Than One Prequalification Letter

You wont usually need more than one prequalification letter unless you switch loan programs. For example, if you received a conventional loan approval but decide to buy a home in a rural area that is eligible for a mortgage backed by the U.S. Department of Agriculture , youll need a new prequalification letter for a USDA loan.

THINGS YOU SHOULD KNOW Your prequalification letter is tied to a specific loan program. A conventional prequalification letter wont be valid if you opt for a loan insured by the Federal Housing Administration . Heres a quick refresher of the most common home loan programs and their minimum requirements.

| Loan program |

| Backed by the U.S. Department of Agriculture for low- to moderate-income borrowers in designated rural areas |

How To Calculate A Down Payment

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

You May Like: Can You Do A Reverse Mortgage On A Mobile Home