Ready To Make A Smart Move

Another reason to consider an ARM is if you plan to sell your home in just a few years. If you intend to sell your new home before the loan adjusts, you may be able to save money with an ARM over a fixed-rate loan. For example, if you know that you will be switching jobs soon, or getting transferred to a new area, an ARM would be the better option. Because ARMs have low initial rates, they are the better option for mobile professionals, homeowners who plan to upsize or downsize, and anyone who will live in their home for the short-term.

Finally, an ARM is a great option if you want more house. By applying for an Adjustable Rate Mortgage, there is a possibility that you will qualify for a higher loan amount and can buy a home with a larger price tag.

There you have it. While both Fixed Rate Loans and Adjustable Rate Mortgage Loan Options are great choices, the information outlined above can give you a better idea of which is the best option for you. Now that you have the tools to make an educated decision, there is only one thing left to do: start saving for that down payment! Reach out to our team of mortgage professionals to get started.

A Historic Opportunity To Potentially Save Thousands On Your Mortgage

Chances are, interest rates won’t stay put at multi-decade lows for much longer. That’s why taking action today is crucial, whether you’re wanting to refinance and cut your mortgage payment or you’re ready to pull the trigger on a new home purchase.

The Ascent’s in-house mortgages expert recommends this company to find a low rate – and in fact he used them himself to refi . and see your rate. While it doesn’t influence our opinions of products, we do receive compensation from partners whose offers appear here. We’re on your side, always. See The Ascent’s full advertiser disclosure here.

What Is A Good 30

Just because advertised mortgage rates are low, doesnt mean that youll receive that from the lender. A good rate will depend on the borrowers financial profile. Lenders look at factors such as income, credit history, the down payment, and other debts.

In most cases, someone who has a high credit score tends to be offered lower mortgage rates than someone who has a lower credit score or higher monthly debt obligations. Understanding what might affect your individual rate is helpful for borrowers to find the most competitive rate.

You May Like: How Does A Retired Person Qualify For A Mortgage

How Does Credible Calculate Refinance Rates

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage refinance rates. Credible average mortgage refinance rates are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no discount points and a down payment of 20%.

Credible mortgage refinance rates will only give you an idea of current average rates. The rate you receive can vary based on a number of factors.

How Mortgage Payments Are Calculated

With most mortgages, you pay back a portion of the amount you borrowed plus interest every month. Your lender will use an amortization formula to create a payment schedule that breaks down each payment into principal and interest.

If you make payments according to the loan’s amortization schedule, the loan will be fully paid off by the end of its set term, such as 30 years. If the mortgage is a fixed-rate loan, each payment will be an equal dollar amount. If the mortgage is an adjustable-rate loan, the payment will change periodically as the interest rate on the loan changes.

The term, or length, of your loan, also determines how much youll pay each month. The longer the term, the lower your monthly payments will typically be. The tradeoff is that the longer you take to pay off your mortgage, the higher the overall purchase cost for your home will be because youll be paying interest for a longer period.

Don’t Miss: What Mortgage Lenders Use Vantagescore

Current Mortgage Refinance Rates

The average refinance rates for 30-year loans, 15-year loans and ARMs are:

- The refinance rate on a 30-year fixed-rate refinance is 3.773%.

- The refinance rate on a 15-year fixed-rate refinance is 2.681%.

- The refinance rate on a 5/1 ARM is 2.476%.

- The refinance rate on a 7/1 ARM is 2.704%.

- The refinance rate on a 10/1 ARM is 4.005%.

‘window Of Opportunity’ Will Shrink

Millions of homeowners still have an opportunity to slash their housing costs by refinancing. And some of them have gotten the message, based on new data from the Mortgage Bankers Association.

Refi applications in the most recent week were up 9% compared with the previous week, the trade group says.

Borrowers are continuing to act on these opportunities, but if rates trend higher as MBA is forecasting, the window of opportunity to refinance will continue to get smaller, Joel Kan, the group’s forecaster, says.

Assuming omicron doesnt become a serious problem, rates could easily climb in the weeks ahead, says Peter Warden, editor of The Mortgage Reports.

As long as investors have grounds for optimism about omicron, mortgage rates are likely to drift slowly higher, he writes.

Don’t Miss: What Mortgage Can I Afford On 120k

Mortgage Rates Are Personal And Can Change Between Lenders

Mortgage rates arent cut and dry. While economic conditions and your own personal finances play a role, so does the lender you choose. Keep in mind that you can also influence your rate by paying points, so be sure to factor this in when comparing your loan options.

If you want the best mortgage rate, its critical that you compare loan offers from multiple mortgage lenders. Credible makes this fast and easy: Just fill out some information, get pre-approved in three minutes, and youll be able to compare lenders without it affecting your credit score.

Credible makes getting a mortgage easy

- Actual personalized rates: In 3 minutes, get actual prequalified rates without impacting your credit score

- Smart Technology: We streamline the questions you need to answer and automate the document upload process

- End-to-end experience: Complete the entire process from rate comparison to closing all on Credible

How The Federal Reserve Affects Mortgage Rates

Among the missions of the Federal Reserve, one of them is to maintain a stable rate of inflation. Their primary tool for doing this is something called the federal funds rate. The federal funds rate is the rate at which banks borrow money from each other overnight.

The Federal Reserve has been keeping short-term interest rates at or near 0% most recently in response to COVID-19. This has the effect of keeping mortgage rates lower.

Typically, when the federal funds rate is low, that would have the effect of pushing inflation up over time. However, so far that hasnt been the case. Inflation has fallen short of the Feds 2% annual goal for the last several years now. The Fed would actually like to see prices go up a little bit each year because it stimulates the economy by pushing people to buy now rather than wait, especially if they think prices might rise in the future.

The Federal Reserve also has a balance sheet and they can choose to invest funds in areas where it thinks the overall economy might be. One of the things theyve invested in really since the 2008 financial crisis is mortgage bonds. Because a big buyer in the bond market has the effect of raising bond prices and lowering yields, mortgage rates have also been lower as a result of the Fed campaign.

Read Also: How Long Does Fha Mortgage Insurance Last

Mortgage Rates Vs Jobs Report

One of the biggest economic factors that affects mortgage rates is the jobs report, formally known as the The Employment Situation from the U.S. Bureau of Labor Statistics.

It is released on the first Friday of every month, and its contents can dictate what happens in the wider economy, along with how the Fed may direct its policy.

Its basically a health report for the U.S. economy by way of employment numbers, including total nonfarm payroll employment and the unemployment rate.

Similar to other economic trends, good news in the jobs report will typically result in higher mortgage rates, while bad news should lead to lower rates.

For example, if the latest jobs report from the BLS revealed that total nonfarm payroll employment rose in the previous month while unemployment fell, expect higher mortgage rates.

The reason why is because those numbers indicate an improved economic outlook, which can spur inflation and cause interest rates to rise.

The opposite is also true if you want lower mortgage rates, youre essentially rooting for a bad jobs report.

Expect mortgage rate volatility around this time of the month, and tread carefully if deciding to float vs. lock.

Meet Fannie And Freddie

Fannie Mae and Freddie Mac are huge financial institutions that buy mortgages and bundle them into securities that behave like bonds. Then they sell the mortgage-backed securities to investors.

Fannie and Freddie exist to keep money flowing through the mortgage finance system. When you get a mortgage, the lender sells the loan on the secondary market. By selling the mortgage, the lender gets its money back quickly so it can lend the money again, to another mortgage borrower.

RATE SEARCH: Find the lowest mortgage rates now.

Also Check: Does Prequalifying For A Mortgage Hurt Credit

Whats The Difference Between Interest Rate And Apr

The interest rate is the percentage that the lender charges for borrowing the money. The APR, or annual percentage rate, is supposed to reflect a more accurate cost of borrowing. The APR calculation includes fees and discount points, along with the interest rate.

A major component of APR is mortgage insurance a policy that protects the lender from losing money if you default on the mortgage. You, the borrower, pay for it.

Lenders usually require mortgage insurance on loans with less than 20% down payment or less than 20% equity .

Whether You Buy Points

Lenders sometimes offer borrowers a lower interest rate if they buy “points” or “mortgage discount points.” Points are prepaid interest. A point usually costs you 1% of your mortgage amount and lowers your rate by one-eighth to one-quarter percent . Whether points are worth buying depends on how long you intend to live in the house — for them to be cost-effective, you need to own the home long enough to save more in interest than you pay up front. The longer you keep the house, the more likely you are to save money by purchasing points.

Recommended Reading: How Do You Buy Down A Mortgage Rate

Mortgage Rates By State

Real Estate Economist and Associate Dean in Florida Atlantic University’s College of Business

With mortgage rates near historic lows, what can homebuyers do right now to ensure theyre getting the best deal when purchasing a home?

Individuals should begin their mortgage search before they begin their home search. This will put them at the price point they can best afford and allow them to potentially prioritize their offer with sellers over other buyers, since they will be ready to close quickly.

What causes mortgage rates to rise or fall?

Increases or decreases in 10-year Treasury yields directly influence 30- and 15-year mortgage rates. Currently, the Federal Reserve is actively buying 10-year Treasury notes, which increases the demand for these securities and drives their price up and yields down. So, our near record low mortgage rates are directly tied to the Federal Reserve Board’s response to COVID-19 in efforts to keep financial markets open. When it begins to taper significantly, mortgage rates will rise.

Should current homeowners consider refinancing with rates that are this low?

Looking At Todays Mortgage Refinance Rates

Todays mortgage refinance rates were volatile compared to yesterday, with rates for the longest term edging down, the shortest moving upward, and middle terms holding steady. If youre considering refinancing an existing home, check out what refinance rates look like:

- 30-year fixed-rate refinance: 3.125%, down from 3.190%, -0.065

- 20-year fixed-rate refinance: 2.875%, unchanged

- 15-year fixed-rate refinance: 2.375%, unchanged

- 10-year fixed-rate refinance: 2.375%, up from 2.250%, +0.125

here. Actual rates may vary.

A site like Credible can be a big help when youre ready to compare mortgage refinance loans. Credible lets you see prequalified rates for conventional mortgages from multiple lenders all within a few minutes. Visit Credible today to get started.

Credible has earned a 4.7-star rating on Trustpilot and more than 4,500 reviews from customers who have safely compared prequalified rates.

Don’t Miss: How To Apply For A 2nd Mortgage

Today’s Mortgage Rates: Still Near Historic Lows

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

For today, December 13th, 2021, the current average mortgage rate for a 30-year fixed-rate mortgage is 3.344%, the average rate for a 15-year fixed-rate mortgage is 2.579%, and the average rate for a 5/1 adjustable-rate mortgage is 3.019%. Rates are quoted as annual percentage rate for new purchase.

A home is one of the biggest purchases you’ll ever make. Current mortgage rates are significantly lower than they were a year ago. You can save thousands of dollars simply by paying attention to the interest rate on your loan.

To land the best mortgage deal for you, it’s important to shop around with multiple lenders. Check out the most recent mortgage rates and get personalized quotes as well as a full rundown of your estimated monthly payment.

Where Are Mortgage Rates Headed In 2021

Rates on mortgages are likely to remain fairly low through 2021. Nonetheless, they have been steadily rising and will likely be higher by the end of the year. Interest rates will likely rise in the coming year as the economy continues to bounce back, but it will take some time for it to fully recover. These are some of the factors limiting the rise we could see in mortgage rates.

Read Also: Can You Get A Reverse Mortgage On A Manufactured Home

Economic Conditions Play A Role

What happens in the economy and, specifically, how those events affect investors confidence, influences mortgage pricing. Oddly, though, good and bad economic news have an opposite impact on the direction of mortgage rates.

This reality is on full display in 2020. Mortgage rates already were low when COVID-19 began to spread in the U.S. The springs sharp declines in employment and spending pushed rates even lower.

Bad economic news is often good news for mortgage rates, McBride says. When concern about the economy is high, investors gravitate toward safe-haven investments like Treasury bonds and mortgage bonds, pushing bond prices higher but the yields on those bonds lower.

Good economic news increases in consumer confidence and spending, positive GDP growth and a solid stock market tend to push mortgage rates higher. Thats because the higher demand means more work for lenders who only have so much money to lend and manpower to originate loans, says Jerry Selitto, president of Better.com, an online mortgage lender.

How The Fed’s Actions Affect Mortgage Rates

When the Fed cuts interest rates, especially by a large or repeated percentage-point drop, people automatically assume that mortgage rates will fall.

But if you follow mortgage rates, you will see that most of the time, the rates fall very slowly, if at all. Historically, when the Feds have dramatically cut rates, mortgage rates remain almost identical to the rates established months before the cut as they do months after the cut. The Feds moves arent totally irrelevant, though. They tend to have a delayed and indirect impact on home loan rates.

For example, when investors worry about inflation, this concern will push rates up. When Congress wants to stimulate action and raise money for a deficit, it will create more U.S. Treasuries for folks to buy. This added supply of new Treasuries can also cause mortgage rates to move higher.

Even more crucial is when a buyer is in the process of making a decision whether to lock a loan just before a Fed rate cut. Say a buyer is in a contract and is thinking the Fed is going to lower rates next week. The buyer might be tempted to wait before locking the loanbig mistake.

You May Like: How Do You Get A Second Mortgage On Your House

How Do I Find My Best Mortgage Rate

Getting quotes from multiple lenders is a good way to find the most competitive mortgage rate based on your financial situation. When you do, make sure to look at the loan estimate document carefully to see exactly youll be paying. If youre a first-time homebuyer, most states have programs that offer below market rates to accelerate your path to homeownership.

How Bonds Affect Mortgage Rates

Contrary to popular belief, mortgage rates are not based on the 10-year Treasury note. They’re based on the bond market, meaning mortgage bonds or mortgage-backed securities. When shopping for a new home loan, many people jump online to see how the 10-year Treasury note is doing, but in reality, mortgage-backed securities drive the fluctuations in mortgage rates.

In fact, it is not unusual to see them move in completely different directions and, without professional guidance, that confusing movement could cause you to make make a poor financial decision.

Mortgage-backed securities are mortgage loans are packaged into groups or bundles of securities and then sold in the bond market. The price of these bundled debt securities is driven by national and global news events, which also affects individual mortgage rates.

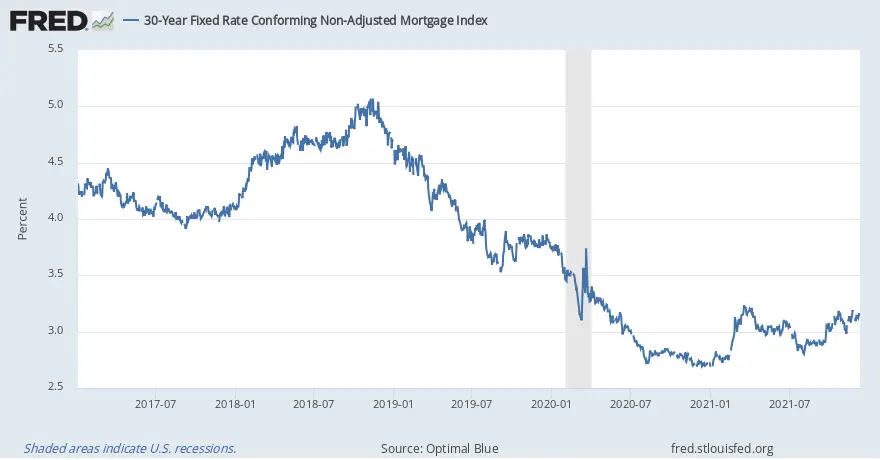

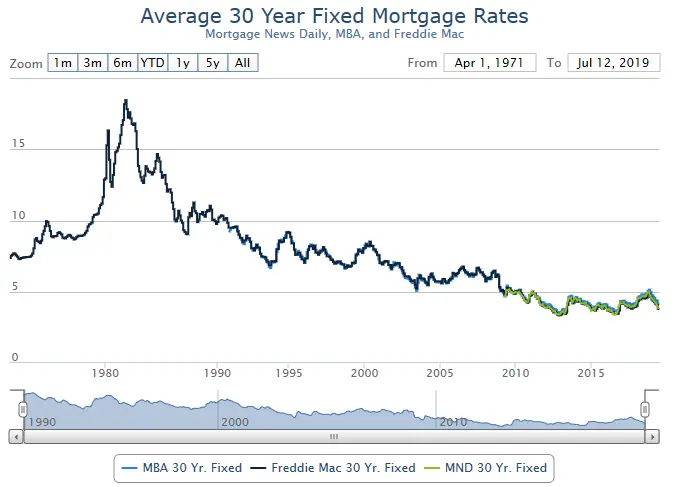

The graph below illustrates the 30-year fixed mortgage rate average from 2000 through today:

Read Also: Can You Refinance Mortgage Without A Job