Keep An Eye On The Market

There are better and worse times to try negotiating with your mortgage lender.

If interest rates are high, its best to wait until they drop before securing a home mortgage, if you can. No matter how great your credit score is, youll find it harder to negotiate low rates if the market is simply not in your favor.

Watch market trends, and see if the rates are going up or down. Read financial forecasts and know the climate. Timing is important.

What Affects Mortgage Interest Rate

Mortgage ratesFactorsaffectinterest rate

What factors affect mortgage interest rates?

Also know, what factors affect mortgage interest rates? Here are seven key factors that affect your interest rate that you should know

- Home price and loan amount.

are mortgage rates going down in 2019?mortgage2019ratesexpected

Contents

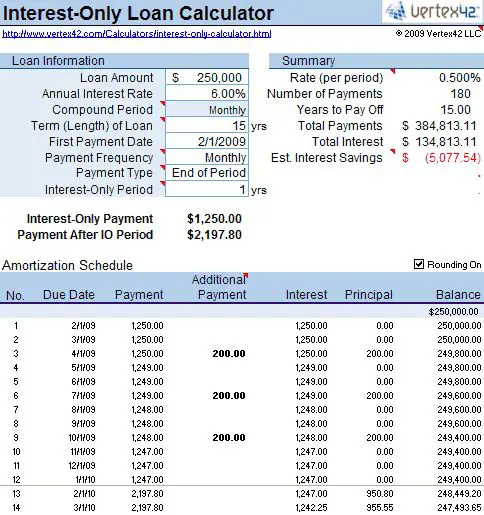

Tip: Use A Mortgage Calculator And Pull Your Credit History

Using a mortgage calculator can help you understand how down payment, credit score, and interest rate impact your mortgage payment.

Additionally, if you havent checked your credit history, you can do so by requesting free copies of your credit reports from the three major credit bureaus: TransUnion, Equifax, and Experian.

Recommended Reading: How Much Are House Mortgages

Can You Negotiate Refinance Rates

Negotiation is often possible in real estate transactions, and you may be able to work with your lender to negotiate a lower refinance rate.

Having a good to excellent credit score, low debt-to-income ratio and good income may help in negotiations. Being open to compromise may also help. For example, your lender may agree to a lower interest rate if youre willing to pay mortgage discount points upfront.

The best way to ensure you get the lowest possible interest rate is to compare rates and loans from multiple mortgage lenders.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at and your question might be answered by Credible in our Money Expert column.

As a Credible authority on mortgages and personal finance, Chris Jennings has covered topics that include mortgage loans, mortgage refinancing, and more. Hes been an editor and editorial assistant in the online personal finance space for four years. His work has been featured by MSN, AOL, Yahoo Finance, and more.

Be A Responsible Borrower

Before you even think about asking if you can get a reduced interest rate, its smart to make sure you are the model borrower.

Having a history of late repayments, for example, will likely reduce your chances of getting a lower rate.

If you werent the perfect borrower in the past, its a good idea to take the time to work on making regular, on-time repayments so that you can justify requesting a lower interest rate.

Other things that can put you in an ideal position to haggle include:

Factors that can reduce your negotiation power may include:

- A poor credit score

- Missed loan or credit card repayments

- Having a high LVR

- Being a riskier borrower .

Don’t Miss: Who Is A Lender In Mortgage

What Part Of Closing Costs Can You Negotiate

There are a number of closing costs you may be able to negotiate down with your lender, including application fees, fees associated with rate locks or the purchase of points, and the real estate commissions paid to your agent and the seller’s agent. Non-negotiable closing costs typically include things like appraisal fees, property taxes, and flood certification fees.

Getting Started With A Better Mortgage Rate

An IG Mortgage Specialist can discuss the kinds of mortgages and rates available to you for your particular circumstances, and an IG Consultant can help you integrate your mortgage into your financial plan. Contact us today to get started.

You can see more details on current rates and conditions here.

An IG Consultant can also help you to integrate your mortgage into your financial plan. Contact us today to get started.

1 Minimum mortgage amount of $100,000. Certain conditions apply. For full details contact an IG Mortgage Specialist.

Investors Group Trust Co. Ltd. is a federally regulated trust company and is the mortgagee. Mortgages are offered through I.G. Investment Management, Ltd.* Inquiries will be referred to a Mortgage Planning Specialist .

*In ON and NS, registered as a Mortgage Brokerage and a Mortgage Administrator , in QC, registered as a financial services firm and in NB, registered as a Mortgage Brokerage.

You May Like: How To Get Approved For A Larger Mortgage

Knowing When To Walk Away

There is such a thing as over-negotiating, however. If you find yourself returning to the negotiation table again and again, Carrel advises you to step back to reassess the situation. Dont lose sight of what is really important to you, she says.

Try your best to avoid emotionality during the transaction. If youre in love with a house that desperately needs a new roof but dont have the budget to replace it, be realistic, and dont let your emotions cloud your financial reality. Its OK to consider walking away, says Carrel. Just make sure you have the proper protections written into your contract, so that if it comes down to it you can back out of the deal legally.

How To Negotiate Your Closing Costs

When it comes to buying a new home, closing costs are an unavoidable evil. The average cost to close on a single-family home increased 13.4% in 2021, to $6,905, according to a survey conducted by ClosingCorp. When you add in taxes, that jumps to $10,765.

Though the days of zero-closing-cost mortgages are long gone, there are ways to lower some of the upfront closing costs that homebuyers are required to cover. To do that, borrowers first have to understand the fees they are expected to pay.

Recommended Reading: Why Is Mortgage Interest Rate Different From Apr

What Is A Mortgage

When you buy a home, you may only be able to pay for part of the purchase price. The amount you pay is a down payment. To cover the remaining costs of the home purchase, you may need help from a lender. The loan you get from a lender to help pay for your home is a mortgage.

A mortgage is a legal contract between you and your lender. It specifies the details of your loan and its secured on a property, like a house or a condo.

With a secured loan, the lender has a legal right to take your property. They can do so if you dont respect the conditions of your mortgage. This includes paying on time and maintaining your home.

Unlike most types of loans, with a mortgage:

- your loan is secured by a property

- you may have a balance owing at the end of your contract

- you normally need to renew your contract multiple times until you finish paying your balance in full

- you may have to meet qualification requirements including passing a stress test

- you need a down payment

- you may need to break your contract and pay a penalty

- your loan is typically for an amount in the hundreds of thousands of dollars

Use A Mortgage Broker

If you dont have the time to shop around, you may want to enlist the services of a mortgage broker. Mortgage brokers dont work for one specific lender, so they can approach multiple lenders to find you the lowest rate and best terms. Mortgage brokers are also helpful for applicants who have unique situations, such as those who are self-employed. Since mortgage brokers get paid by the lender, theres no reason to not use one.

Don’t Miss: What Are Mortgage Interest Rates At

When You Can And Cant Negotiate Your Mortgage Rate

In many cases, a lender cant give you a better deal than they give another similar borrower. That would be considered discriminating against the other borrower.

However, there is some room for negotiation.

For example, lenders are allowed to credit closing costs to a borrower when delays result in a blown rate lock, or when its necessary to be competitive if rates suddenly fall.

The big caveat, though, is that the loan officers commissionable income must not be affected by the negotiations.

A successful mortgage rate negotiation reduces income to the lender, therefore, but never to the loan officer. This keeps the loan officers interest aligned with the customers, and this is good.

For customers looking for the best possible mortgage rate, then, its always good to ask.

Lenders have less flexibility to change rates or fees, but there are situations when its possible especially when unforeseen events increase your loan closing costs.

Save On Homeowners Insurance

Every lender is going to require homeowners insurance, but whether or not you get it through your lender could determine how much you pay for it each month. Get quotes from at least three insurance companies or brokers, making sure to use the same coverage amount. And be sure to ask about discounts for bundling homeowners insurance with other types of coverage.

Also Check: Does Chase Allow Mortgage Recast

Getting A Better Mortgage

Did you know you might be able to negotiate a better mortgage rate with your bank?

Most people mistakenly believe that when they receive their mortgage renewal offer, they must either accept it or switch lenders.

While switching lenders should always be an option worth considering, many mortgage lenders send out standard renewal offers that may not take into account your specific situation. Most mortgage renewal proposals are up for discussion, you just need to know the best way to go about it.

There is a wide selection of mortgage lenders out there, all vying for your business. If you have steady income and a decent credit rating, you may be able to find a different lender willing to offer you a better deal. And your current lender knows this.

One of the main reasons many people accept their lenders first offer is for the convenience. In many instances, you dont have to do anything your mortgage will be automatically renewed, with the terms and mortgage interest rate that your bank has offered. This could be an extremely costly convenience, however.

Others think that it will cost too much to switch lenders. And there can be several fees that you may need to pay to switch lenders including appraisal costs, assignment fees, legal fees, etc.

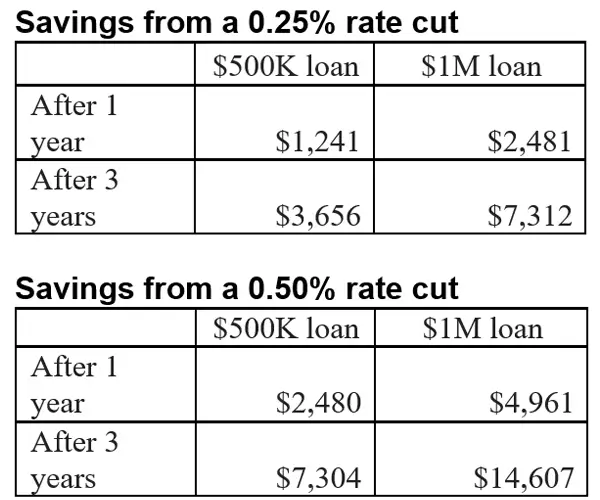

While this can seem like a lot, many lenders will cover some of the costs if you switch your mortgage to them. And, typically, the savings you will make with a new mortgage dwarf these costs.

The mortgage rate being offered

Confirm If The Lender Offers Discount Points

Discount points are fees paid when you close on your new house. These points lower your long-term interest rateâusually 1 percent of your loan.

For example: On a $100,000 mortgage, you could potentially pay $1,000 to buy a point, then reduce your interest rate by 0.25 percent. It doesnât sound like a lot now, but think long-term. It adds up. In the Mortgage 2 scenario above, you could save $15 per month and $5,704 over the life of your loan.

Recommended Reading: How To Remove Mortgage From Credit Report

Go Back To The Lender Who Provided The Best Quote

Once your shopping is complete, you can go back to the lender who offered you the best deal and ask for a slightly lower rate or reduced closing costs.

You can do this by using another bank or brokers offer as leverage, even if it doesnt really exist.

Theres a chance youre not getting the rock-bottom rate the first time around, so why just accept it as the best offer?

Always haggle! Especially when something has the potential to hit your pocketbook for the next 360 months!

Mortgage brokers in particular should really be able to negotiate rates because they work with multiple lenders and may have flexible compensation plans.

This means they can provide you with rate quotes from a variety of different banks at once, and if the rate isnt good enough for you, they might just come up with a lower one from a different lending partner of theirs.

For example, they may get paid more from Bank A, which happens to offer slightly higher rates than Bank B, which happens to pay them a slightly lower commission.

Want a fast, free rate quote? Quickly get matched with a top mortgage lender today!

Of course, youll never know this if you dont take the time to ask or complain that the initial rate is too high!

Conversely, someone working at a big bank may just be limited to what their computer program tells them.

In this case, they may not actually be able to go lower, but that doesnt mean you cant just pick up the phone and try other lenders.

What Mortgage Closing Costs Are Negotiable

Negotiating your closing costs could save you a lot of money, but not every cost is negotiable. So before approaching your lender, its a good idea to understand which fees are negotiable and which ones arent.

For instance, borrowers have a lot of room to negotiate the terms of the mortgage and any fees charged by a lender. In comparison, any fees charged by the government or another third-party provider are harder to negotiate.

And if theres a lot of competition for your home, you may want to hold off on negotiating closing costs. Lets look at when its a good idea to negotiate and when you may want to hold off.

Read Also: What Are Current 20 Year Mortgage Rates

How Mortgage Rates Have Changed Over Time

Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 16.63% in 1981. A year before the COVID-19 pandemic upended economies across the world, the average interest rate for a 30-year fixed-rate mortgage for 2019 was 3.94%. The average rate for 2021 was 2.96%, the lowest annual average in 30 years.

The historic drop in interest rates means homeowners who have mortgages from 2019 and older could potentially realize significant interest savings by refinancing with one of todays lower interest rates.

If youre ready to take advantage of current mortgage refinance rates that are below average historical lows, you can use Credible to check rates from multiple lenders.

Use Loan Estimates To Negotiate A Lower Rate

A loan officer has 3 days from the time you complete your loan application, and they pull credit to give you the loan estimate breaking down the loan fees. The interest rate, closing costs, and other lender fees will be listed on the loan estimate.

You can take the best loan estimate to each lender and have them try to beat the offer. They will most likely come back with a lower rate and closing costs to get the deal done.

If there is a loan officer you feel the most comfortable with being capable of getting your loan closed on time, then you can give them the best loan estimate you got and tell them to beat it to earn your business.

Recommended Reading: How Do You Get A Second Mortgage On Your House

Can You Still Negotiate At Closing

Technically, a home purchase agreement is still negotiable up to the moment you sign off on the closing documents. If you have an issue or question, you can ask your real estate agent to raise it ahead of closing. Just keep in mind that attempting any last-minute negotiations may delay closing on the home.

Factors That Determine Your Mortgage Rate

Mortgage rates are primarily driven by whats going on in the bond market and mortgage-backed securities, but then vary based on a number of additional factors. When you request a quote, the lender calculates a customized rate based on criteria including your personal credit and income situation, the type of loan youre seeking, and characteristics of the home itself. Heres how it breaks down.

You May Like: Is Chase A Good Bank To Refinance My Mortgage

Play The Loyalty Card

As already mentioned, use your loyalty as a bargaining chip if you must. Many borrowers stay with the same lender for years, and if you have a good history with them, it can help when it comes to negotiating a lower rate.

Prior to asking for a lower interest rate, review your position and check that you have been making your repayments on time and that your LVR (Loan to Value Ratio has gradually been getting lower.

With this, you now have a current timeline of your loyalty and proof of being a reliable customer. This can be very helpful.

Find out if you have the lowest rate possible here.

Afraid youre not getting the best home loan?

Compare rates from 35+ banks to see how much you could save.

Dont Miss: Rocket Mortgage Loan Types

Yes You Can Negotiate Your Mortgage With So Many Options Here’s Where To Start

Negotiating a mortgage is a bit different than haggling in a souk, but just barely. Danielle Kubes outlines what you need to know

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Recommended Reading: Can You Consolidate Credit Card Debt Into Mortgage

Improve Your Credit Score

Regardless of the loan you choose, youre likely to get a better mortgage rate if you have a higher credit score. Similar to making a bigger down payment on your mortgage, a high credit score can help you qualify for better rates and lower monthly payments.

To a lender, your credit score is indicative of your riskthe lower the score, the higher the risk. That’s why lenders may charge higher interest rates to applicants with lower credit scores. If you apply for a loan and have a good credit score, you’re more likely to be offered a low interest rate. However, if you already have a loan, its not too late to improve your credit score and qualify for better rates with a mortgage refinance.

To improve your credit score, first go over your credit report to see if you have any outstanding balances. Consider paying those and be sure to make your payments on time every month. Also look for and correct any errors on your credit report as these can negatively impact your credit. While a high credit score is ideal for mortgage approval, some affordable lending programs do accept lower credit scores.