How Long Does A Preapproval Last

Many mortgage preapprovals are valid for 90 days, though some lenders will only authorize a 30- or 60-day preapproval.

If your preapproval expires, getting it renewed can be as simple as your lender rechecking your credit and finances to make sure there have been no major changes to your situation since you were first preapproved. Just keep in mind that this might count as another hard pull against your credit, dropping your score by a few points.

You Dont Have To Take It All

Heres a tip that the lender probably wont tell you. You dont have to use every dollar they offer you. Sure, they crunched the numbers and came up with an amount that they are confident you can pay. However, that doesnt mean the amount wont leave you overextended or cash poor. Do you really want to live in a reality where you can only afford your home if you drive a 15-year-old car, eat Ramen noodles four times a week, and never take a vacation? Maybe that works for you. But maybe it shouldnt.

Just because your lender pre-approves you for $750,000 doesnt mean you cant look at houses in the $650,00 range. In fact, we recommend that you do. Its perfectly okay advisable, even to not use every bit of your pre-approval amount. As an added bonus, your down payment will now go a bit farther and your monthly payments will be a bit lower. Use those savings to invest more or pay down other debt. Or, you know, to buy a car that was built this decade.

Also Check: What Are The Chances Of Getting A Mortgage

Consider Other Associated Costs

As you go through the mortgage process, itâs important to think about the true cost of owning a home. Besides the costs required at closing and regular mortgage payments, there are other recurring costs such as property tax, home insurance, heating costs, condo fees and more. Even though pre-approval specifies an amount you may be approved for, consider a lower principal amount to reduce regular expenses while leaving money for other unforeseen expenses.

Also Check: What Is A Good Home Mortgage Rate

Also Check: Can You Skip A Mortgage Payment

Get Your Financial Paperwork In Order

You are under no obligation by getting pre-approved, but you want to be comfortable with the amount and terms of your pre-approved mortgage. That’s why it’s essential that you review all your personal expenses and have a good idea of your future expenses before you talk with a mortgage broker or lender about pre-approval. Learn more about knowing how much you can afford.

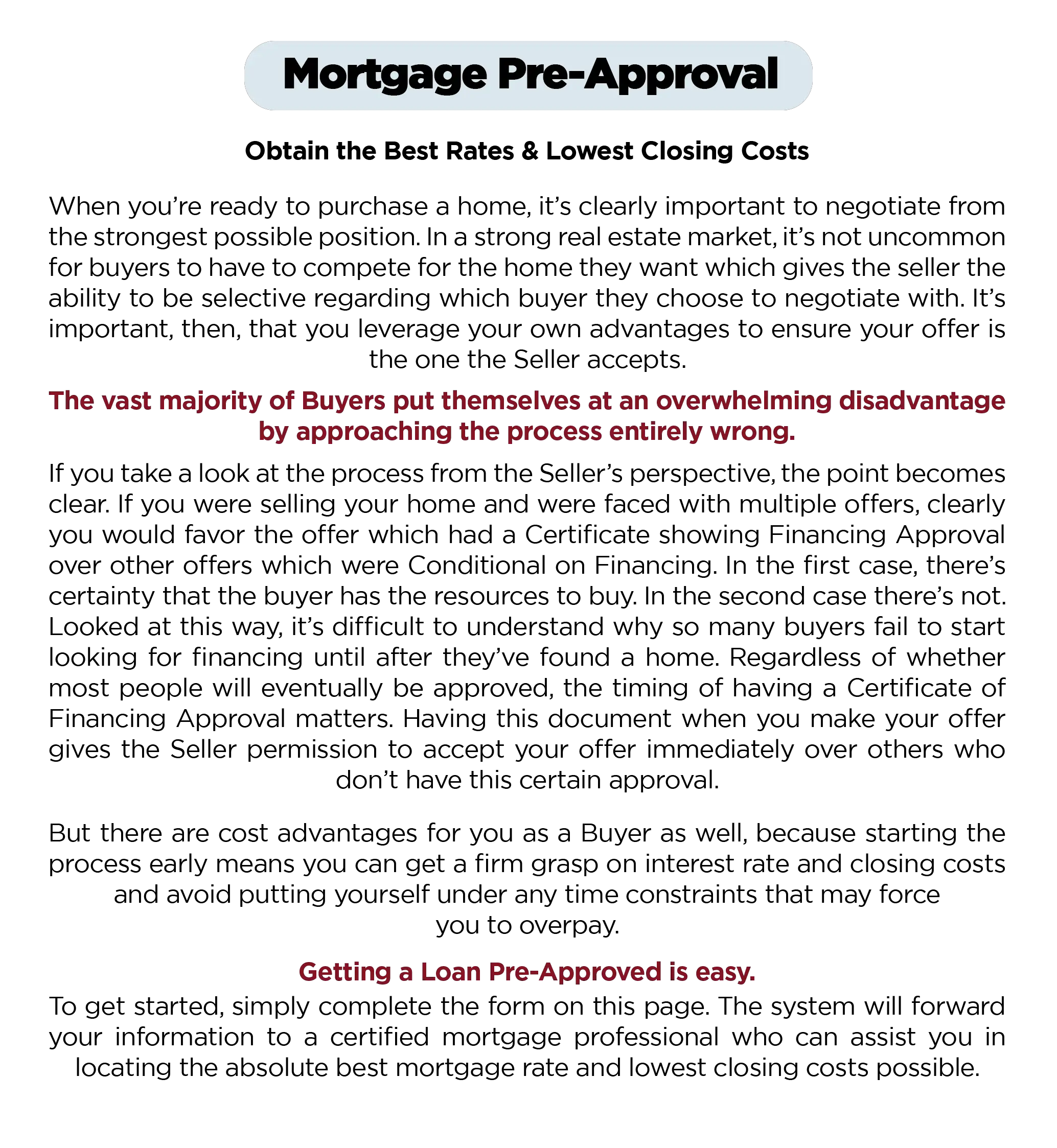

Is There Anything Better Than A Mortgage Pre

With this competitive housing market, mortgage pre-approval letters have unfortunately started losing their authority. Most buyers have them, and in a multiple-offer situation, they just dont have what it takes to make you stand out.

Fortunately for you, theres something better!

If you want a true competitive advantage, Churchill Mortgages Certified Homebuyer program is a great option. When you become a certified homebuyer, you have all the advantages of a pre-approval like credibility as a homebuyer, confidence in your search, and an accelerated closing process.

But unlike with pre-approved mortgages that only involve a loan officer, your certified homebuyer application is reviewed by a mortgage underwriterwhich is a huge advantage when you start shopping for houses! Youll be able to close faster and have a leg up on other buyers who will probably have to wait for an underwriter to review their application.

Dont sell yourself short with a standard pre-approval. Take your home-buying credentials to the next level today and get in touch with a Churchill Mortgage expert!

About the author

Ramsey Solutions

Also Check: Can You Use Land As Collateral For A Mortgage

When To Get Pre

You may want to get pre-approved if youve already defined your price range, have a real estate agent and are currently shopping for homes. A pre-approval is usually only good for 90 days and it will likely show as an inquiry on your credit report, so dont apply for pre-approval until youre ready to start making offers.

When youre ready to start house hunting, getting prequalified and pre-approved at the right time can help. With a prequalification, you can feel confident knowing youre looking at houses in the right price range for you. And getting pre-approved for a mortgage helps you act quickly and show sellers youre serious about making an offer. Two useful tools to streamline the mortgage application process and get you from house hunter to homeowner.

Lets get you closer to your new home.

An experienced mortgage loan officer is just a phone call or email away, with answers for just about any home loan question.

Understanding What A Prequalification Is

A mortgage prequalification is something you work through with a lender or bank. Going through the process will help the lender determine if you have the necessary criteria in terms of income, credit, and debt. It can be an eye-opening step to not only deem if you are ready to buy, but how much you can actually spend.

Don’t Miss: Should I Pay Extra On My Mortgage Or Refinance

Check Your Credit Score

Your lender also needs to understand your debts to calculate your debt-to-income ratio, an important metric that compares your monthly debt to your monthly income. The higher your DTI, the more likely you will struggle to repay a mortgage. As such, 43% is often the highest DTI you can have and still qualify for a mortgage.

Your lender may ask for a detailed list of your monthly debts and authorization to access your credit reports and scores. It’s wise to check your credit six to twelve months before applying for a mortgage so you’ll have time to clear up any credit issues that could impact your mortgage. You’re legally entitled to a free credit report every 12 months from each of the three major consumer reporting companies and requesting them won’t hurt your credit score. To get those free credit reports, go to AnnualCreditReport.com.

What Mortgage Term Should I Input In The Mortgage Pre

The term is there to allow you to see how much your mortgage balance would be after 1 to 5 years. Most people choose a 5 year term, but you can choose any term.

If you are interest in knowing how much principle you have paid off after 1 year, or 2 years, etc., then change the term to 1 or 2 years, etc. and see the result at the bottom right of the calculator results.

A principle and interest payment and total housing costs is important to know so that you can do some budgeting.

It’s also nice to know how quickly your mortgage is being paid down based on these payments.

Read Also: What Is Needed For A Mortgage Loan

How To Estimate Mortgage Preapproval

When a lender preapproves your mortgage, it means she’s reviewed your financial information and is willing to approve a mortgage up to a certain amount, even if you don’t have a house picked out. This can work to your advantage when you find a house: If the seller has competing offers, knowing that you can guarantee the mortgage may close the deal for you. If you’re not ready to deal with a specific lender yet, you can do some rough calculations on your own to estimate what you might qualify for.

1.

Calculate your monthly income. If your take-home pay varies from month to month–commission sales, for example–take your total income for a year, then average it out over 12 months, the Get Prequalified website states. If your family includes a second income, or any sort of investment that pays regularly, figure that in, too.

2.

Figure out your debts. Add up the minimum monthly payments on your credit cards, car loans, student loans, alimony payments and child support payments–the things you’re not going to be able to skip without consequences.

3.

Estimate what 28 percent of your income would be. That’s the standard percentage lenders think should be spent on your monthly housing payments, American Bank states, meaning mortgage payment plus taxes, plus insurance. Look up what the property tax rates and homeowners insurance payments are in your area and you can estimate how big a mortgage you can handle.

References

How Do I Get A Mortgage Pre

First, find out how much you can spend on a mortgage with our mortgage affordability calculator. Then book an appointment with us for more help. Meet with usOpens a new window in your browser..

Scott on: CIBC Mortgage Advisors

Dont forget, once you find your dream home, you need to complete a full application to be approved for a mortgage2.

Ensure you have all the documents necessary for the mortgage application process with our required mortgage documents checklist .Opens a new window in your browser.

Recommended Reading: What Is Private Mortgage Insurance

How To Use The Pre

Our pre-qualification calculator can provide an idea of what to expect out of the process before you talk to a lender. Filling out this calculator will not pre-qualify you for a mortgage. If youre ready to get pre-qualified, you can reach out to one of our recommended lenders to start the process.

To use our calculator, provide the following information:

Enter your annual income before taxes.

Enter the term of the mortgage youre considering.

Select your credit score range.

Tell us about your employment status.

Tell us if you have a down payment.

Tell us about past foreclosures or bankruptcy.

Enter your monthly recurring debt payments.

After completing each required field, youll see the loan amount we recommend, as well as a higher loan amount. We show two pre-qualification amounts because:

Different loans have different debt-to-income requirements. For example, conventional loans usually have stricter DTI requirements than FHA loans, insured by the Federal Housing Administration.

Its not always smart to borrow 100% of what a lender offers. The maximum loan amount is the most the lender is willing to loan you, not what makes sense for your budget. A higher loan amount will mean a higher monthly mortgage payment. Borrowing too much could make it difficult to ride unexpected financial bumps, such as a job loss or a big medical bill.

Fill Out Your Application

Next up, you’ll fill out a mortgage application. This application includes your Social Security number and identifying information so that the mortgage lender can run a credit check.

A credit check to qualify for a mortgage counts as a hard credit inquiry, but if you’re shopping lenders within a 45-day time span, the combined checks would count as a single credit pull.

A sample mortgage application may look like this:

Also Check: What To Know Before Applying For A Mortgage

Questions To Ask Your Lender Or Broker When Getting Preapproved

When getting preapproved, ask your broker or lender the following:

- how long they guarantee the preapproved rate

- if you will automatically get the lowest rate if interest rates go down while youre preapproved

- if the pre-approval can be extended

Ask your lender or broker about anything you dont understand.

Learn More About A Mortgage Pre

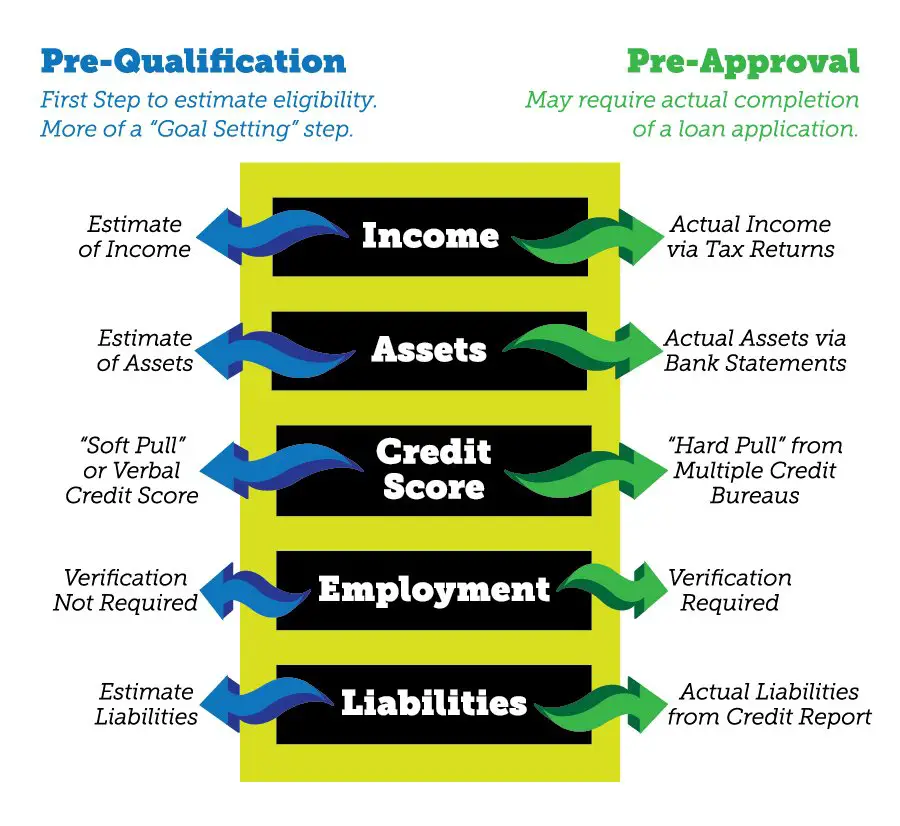

The first step in buying a property is knowing the price range within your means. You can get an estimate for this amount through a mortgage pre-qualification, or for more certainty, a mortgage pre-approval.

A mortgage pre-qualification is a rough estimate of your borrowing capacity to purchase a property. Its calculated based on your basic financial information such as your income and current debt. No credit check is involved, nor is it a guarantee of the approved financing which you may receive by National Bank.

A mortgage pre-approval certifies your borrowing capacity based on several criteria including your credit rating. It confirms the amount that National Bank agrees to lend you under certain conditions and protects the rate of this loan against potential rises for 90 days. A pre-approval demonstrates your seriousness to sellers and your real estate agent and does not impose any obligation for you to commit to the loan.

Start your pre-approval request online now. Our mortgage experts will then contact you to finalize your request.

Read Also: What Documents Do I Need For A Mortgage

How Much Can I Get Pre

The amount a lender can pre-approve you for depends on multiple factors such as your income, your current DTI ratio, loan term, and interest rate. In addition to that, a lender will consider your pre-approval only in the case if:

- Your credit score is above 620,

- You have money for the down payment,

- You have proof of stable employment history,

- You have not declared bankruptcy or foreclosed on your home within the last 4 and 7 years respectively.

Another condition that should be satisfied is that your monthly debt payments should not exceed 43% of your monthly gross income. If all the mentioned requirements are met, the lender can do the following calculations to determine how much they can pre-approve you.

First, they need to calculate how much you can add to your monthly debt payments to keep your DTI ratio under 43%. Your DTI equals monthly debt payments divided by monthly gross income. Using this simple formula, the lender can calculate your maximum monthly debt payments as follows:

When the lender knows the maximum monthly debt payments you can make while keeping your DTI at 43%, the lender needs to subtract your current monthly debt payments to find your monthly mortgage payments.

The monthly mortgage payments found are the maximum fixed monthly payments on a loan a lender can pre-approve you for. Based on this number, the lender can calculate the loan value they can provide using the following formula.

Sponsored: Add $17 Million To Your Retirement

A recent Vanguard study revealed a self-managed $500,000 investment grows into an average $1.7 million in 25 years. But under the care of a pro, the average is $3.4 million. Thats an extra $1.7 million!

Maybe thats why the wealthy use investment pros and why you should too. How? With SmartAssets free financial adviser matching tool. In five minutes youll have up to three qualified local pros, each legally required to act in your best interests. Most offer free first consultations. What have you got to lose?

You May Like: How Much Is The Average Mortgage Insurance

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Should I Input For The Credit Card & Loc Balances Section Of The Mortgage Pre

For this section of the calculator add up all outstanding balances that you keep on your credit cards or lines of credit each month.

If you use your credit cards and pay them off to zero each month, then type in “0”. If you pay off your credit cards but keep a balance on your line of credit of $5,000 then add “5000” to this section.

The calculator will determine the minimum payment that you are required to make based on the balance that you input. The qualifying mortgage amount is then calculated based on all the input including your credit card and line of credit debt.

You will noticed that you can have a credit card balance without any effect on the approved mortgage amount. Once you increase the balance over a certain number, then qualifying mortgage amount decreases.

Play around with the numbers, it’s fun to see how different revolving balances will change the results.

Also Check: How Much Are House Mortgages

How Do I Use Propertynests Mortgage Calculator

Finding out how much you might be able to afford is as simple as entering your income and credit score range. Customize your breakdown to a particular property by entering property tax and HOA information if you have it.

You should feel good about your chances of getting prequalified for a mortgage. We don’t know your full credit history, but your credit score and risk profile are consistent with what lenders find attractive. Your income and debt levels will act as key factors in determining how much you prequalify for.

You’re likely to prequalify for at least the amount below:

A lender might still prequalify you for a mortgage of as much as:

Search for Home Sales in NYC

Search for your next home based on a credit score, price, neighborhood & more.

How To Fill Out And Sign A Form Online

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Feel all the benefits of completing and submitting legal documents on the internet. Using our service submitting MORTGAGE LOAN PRE-APPROVAL usually takes a matter of minutes. We make that possible through giving you access to our feature-rich editor capable of transforming/correcting a document?s original text, inserting unique fields, and e-signing.

Fill out MORTGAGE LOAN PRE-APPROVAL in just a few minutes by simply following the guidelines listed below:

Send your new MORTGAGE LOAN PRE-APPROVAL in an electronic form right after you are done with completing it. Your information is securely protected, since we keep to the most up-to-date security standards. Join numerous happy clients who are already filling in legal forms straight from their homes.

You May Like: Which Mortgage Lender Should I Use

Recommended Reading: How To Calculate P& i Mortgage