How Much Does 100000 Add To A Mortgage Payment

In most instances, for every $100,000 of purchasing power your total principal interest taxes and insurance payment changes by $600 per month. Simply put for every $100,000 of house it translates to $600 per month in payment. That means a house for $300,000 would be around $1900 in total monthly mortgage payment.

Does Mortgage Payments Include Property Tax

Many mortgage lenders require you to payproperty taxesthrough your lender in your regular mortgage payment, with your lender then paying your municipality. This is because failing to pay your property taxes can lead to your municipality placing a lien on your property, which will be placed in the front-of-the-line before your lender’s claim on your home.

If you pay your property taxes through your lender, then your lender will estimate an amount that would need to be paid every month in order to cover the total amount of property taxes for the entire year. If the amount that the lender collected is not enough to cover the actual property tax due, then the lender will advance the due amounts to the municipality and charge you for the shortfall.

Your lender may charge you interest on the amount of any shortfall. The lender may pay you interest if you have overpaid and have a surplus. Property tax bills or property tax notices are required to be sent to your lender, as failing to send it may mean the collected property tax amounts are not accurate.

Some lenders allow you to pay property taxes on your own. However, they have the right to ask you to provide evidence that you have paid your property tax.

If paying property taxes on your own, your municipality may have different property tax due dates. Property tax might be paid one a year, or in installments through a tax payment plan. Installments might be monthly or semi-annually.

How Much Is A Down Payment On A House

How much down payment you need for a house depends on which type of mortgage you get.

The most popular loan option, a conventional mortgage, starts at 3% to 5% down. On a $250,000 house, thats a $7,500$12,500 down payment.

But to avoid private mortgage insurance on one of these loans you need 20% down. Thats $50,000 on a $250,000 home.

FHA loans let you buy with 3.5% down, which would be $8,750 on the same house.

Some loan types will even let you buy with zero down.

These include governmentbacked USDA and VA loans, which let you finance 100% of the home price and put $0 toward the purchase price. However, youll likely still have to cover some or all of your upfront closing costs with cash.

So, you only need to put down around 35% in most cases. But that begs the question: How much money should you put down?

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

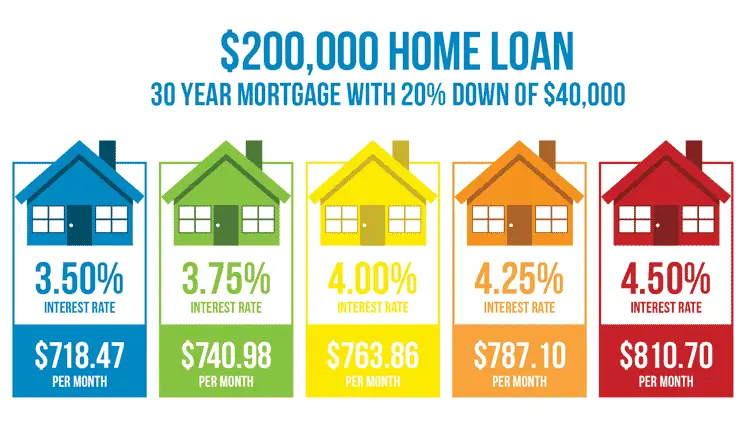

Get The Best Interest Rate You Can And Pick Your Mortgage Term

Dont start worrying about exact interest rates until you find a place you love, advises Davis. Then start speed dating mortgage lenders to get at least three different quotes. Each quote will likely include different closing costs as well.

Some will pad the interest rate to give you no closing costs, said Davis. Some people will pad the closing cost to give you a lower interest rate. Not all quotes will look the same, so the more your shop around, the more likely you are to find a lender that fits your needs.

Dont be afraid to source quotes from a variety of different sized lenders as well, says Watson who notes:

Sometimes the local bank in your area will have special discounts for first-time homebuyers or young families moving into certain neighborhoods.

Typically, a larger down payment will lead to a lower interest rate, since your loan is smaller and less of a risk to take on. The bigger your down payment, the less youll borrow overall, meaning youll save money in the long term. For a closer look at how your down payment influences interest rate, check out the Consumer Financial Protection Bureaus interest rate calculator.

Your credit or FICO, score, on the other hand, can have a much larger impact on your interest rate. Heres how much youd pay in interest on a median-priced home based on your credit score:*

| FICO Score |

- Mean less wiggle room for savings, emergencies, or job instability.

30-year mortgages:

% Down Isnt Your Only Option

However, you dont need a 20% down payment to buy a house. In fact, the national median down payment on a home in 2018 was 13%. To put it in perspective, down payments truly run the gamut: Gosh, the other day I saw a 3% down conventional loan, says first-time homebuyer specialist and top Fort Worth, Texas area real estate agent Jordan Davis.

The more you can put down, however, the less youll pay in interest over time . Plus, a higher down payment reduces your monthly mortgage bill and your mortgage rate, saving you more money over time.

Howeverplot twist!as much as a higher down payment is great, you also dont want to empty your bank account to afford a higher down payment. Youll need emergency funds on hand for maintenance and surprise repairs.

As a buyer, you can increase your down payment percentage and still keep your budget in check by purchasing a lower-priced home. Your monthly mortgage payments will also go up or down depending on which mortgage term you select .

Lets look at some examples. Back to our average buyer who brings in $5,000 a month, and can afford a $1,500 mortgage payment, including principal, interest, taxes, insurance, and PMI where necessary.

These would be a few options at their disposal, depending on how much money they had on reserve:

15-Year Mortgage

- $183,400 home with a 10% down payment

- $214,000 home with a 20% down payment

- $239,200 home with a 30% down payment

- $272,200 home with a 40% down payment

30-Year Mortgage

Don’t Miss: Rocket Mortgage Qualifications

How Much A $1000000 Mortgage Will Cost You

A 30-year, $1,000,000 mortgage with a 4% interest rate costs about $4,774 per month and you could end up paying over $700,000 in interest over the life of the loan.

Edited byChris JenningsUpdated January 5, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

A $1,000,000 mortgage could be your ticket to a Midwestern mansion or a Bay Area bungalow. Whatever type of home youre after, a substantial income and top-notch credit can help you get the jumbo mortgage you need.

In addition to your down payment, youll need money to cover the loan origination fee, home appraisal, and other closing costs. But here, well focus on the monthly payment you can expect under different scenarios as well as how much a $1,000,000 mortgage might cost in the long run.

If youre applying for a $1,00,000 mortgage, heres how much that loan should cost you each month with interest:

How To Calculate Mortgage Payments Using Our Calculator

Whether youre shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments. Follow these steps to use the Forbes Advisor mortgage calculator:

1. Enter the home price and down payment amount. Start by adding the total purchase price for the home youre seeking to buy on the left side of the screen. If you dont have a specific house in mind, you can experiment with this number to see how much house you can afford. Likewise, if youre considering making an offer on a home, this calculator can help you determine how much you can afford to offer. Then, add the down payment you expect to make as either a percentage of the purchase price or as a specific amount.

2. Enter your interest rate. If youve already shopped around for a loan and have been offered a range of interest rates, enter one of those values into the interest rate box on the left. If you havent prequalified for an interest rate yet, you can enter the current average mortgage rate as a starting point.

Recommended Reading: Chase Recast Calculator

The First Necessary Step In The Car Buying Process

Whether you buy new or used, it’s wise to get pre-approved for a loan before you ever step on a car lot. Go to your bank or credit union and ask the agent if you qualify for a loan and how much. The agent will check your FICO credit score and other obligations and provide you with an amount and interest rate. A FICO score can be between 300 and 850. The higher the score the lower the interest rate you will be offered. People with a bad credit history may pay interest rates that are more than double prime rates. You can also shop for auto loans online if you aren’t concerned about where your personal information goes. Armed with a pre-approved loan you are now in control and have a choice to go with dealer financing or stick with your bank, whichever rate is lower.

Get Approved By An Underwriter

After you complete your mortgage application, an underwriter will review it along with supporting documents you must supply, such as bank statements, pay stubs, and tax returns. The faster you provide this additional information, the sooner your mortgage can close.

The lender will also send an appraiser out to evaluate the condition and value of the home you want to buy. If all goes well, it will appraise for the purchase price or higher.

Also Check: Recast Mortgage Chase

Calculate Your Homebuying Budget

To figure out how much house you can afford, create a detailed account of your annual income and expenses. Then, factor in the new costs youll take on as a homeowner.

Besides your mortgage principal and interest, there will be property taxes, homeowners insurance, and home maintenance. Some properties also require homeowners association fees and special hazard insurance, such as flood insurance. Your utilities may be higher, too.

What Salary Do I Need For A 500k Mortgage

The Income Needed To Qualify for A $500k Mortgage A good rule of thumb is that the maximum cost of your house should be no more than 2.5 to 3 times your total annual income. This means that if you wanted to purchase a $500K home or qualify for a $500K mortgage, your minimum salary should fall between $165K and $200K.

Recommended Reading: Chase Mortgage Recast Fee

How Often Can I Skip Mortgage Payments

| Lender |

|---|

| – |

RBC lets you make a mortgage prepayment that is up to the amount of your regular mortgage payment during your regular payment date. The minimum amount for Double-Up payments is $100, and goes up to 100% of your regular payment amount. The Double-Up payment is used to pay your mortgage principal balance.

Scotiabanks Match-a-Payment allows you to double your regular mortgage payment for any payment. You’ll also be able to increase your mortgage payment by up to 15% once per year.

You can choose to increase your regular TD mortgage payments by up to 100% once every calendar year, up until the increase is equivalent to 100% of your regular mortgage payment. This allows you to double your regular payments.

BMO allows you to increase your regular mortgage payments by up to 20% once per calendar year, or up to 10% for BMO Smart Fixed Mortgages.

You can double your mortgage payments or increase it up to 100% at any time with CIBC.

National Bank lets you make an additional payment on top of your regular payment, which can be up to 100% of your regular payment amount, on each of your regular payment dates.

Is Mortgage Insurance Mandatory

Mortgage default insurance is required for mortgages with a down payment of less than 20% at a federally-regulated mortgage lender, such as at a bank. If you make a down payment that is 20% or larger, then you will not need to get an insured mortgage. Mortgage default insurance premiums are added as a one-time lump-sum onto your mortgage balance at closing, which means that youll be paying for it in your mortgage payments over the life of your mortgage.

Unregulated lenders, such asprivate mortgage lenders, may allow you to get an uninsured mortgage with a down payment that is less than 20%.

Recommended Reading: How Does 10 Year Treasury Affect Mortgage Rates

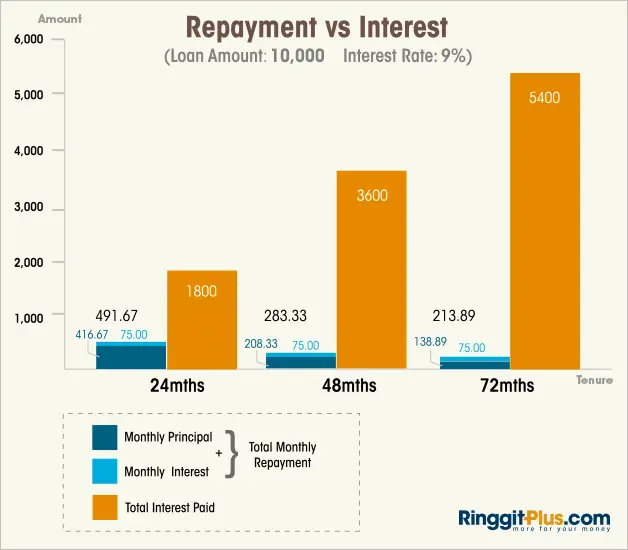

Take A Longer Mortgage Term

The longer your mortgage term, the lower your monthly payment. If you take a longer term, you spread your payments over a larger number of months and years, which reduces the amount youll owe each month. While taking a longer term will increase the amount you pay in interest over time, it can free up more cash to keep your DTI low.

What Controls A Variable Interest Rate

Variable interest rates change based on your lendersprime rate, which is controlled by your lender. If your lender increases their prime rate, then your variable interest rate will increase.

Lenders will usually only change prime rates to match movements in theBank of Canadas policy interest rate. If the lenders funding cost increases, such as through the Bank of Canada increasing their policy rate, then the lender will in turn increase variable mortgage rates. Prime rates are generally similar or identical between different lenders, with all Canadian banks currently having a prime rate of 2.45% as of July 2021.

Yourvariable mortgage rateis priced at a discount or a premium to your lenders prime rate.

Recommended Reading: Rocket Mortgage Loan Types

What To Consider Before Applying For A $1000000 Mortgage

A $1,000,000 mortgage is considered a jumbo loan, and these loans are a bit different from the smaller conforming loans you more often read about. Qualifications can vary a lot from one lender to the next, but heres what youll typically need:

- A down payment of at least 10%

- A credit score of at least 680

- A debt-to-income ratio no higher than 43%

Learn: How Long It Takes to Buy a House

There Aren’t Any Hard

Lindsay VanSomeren is a credit card, banking, and credit expert whose articles provide readers with in-depth research and actionable takeaways that can help consumers make sound decisions about financial products. Her work has appeared on prominent financial sites such as Forbes Advisor and Northwestern Mutual.

If you’re in the market to buy a home, one of the biggest questions to ask yourself is “how much house can I afford?” This is especially important to consider because a lender might be willing to approve you for far more than what you can comfortably pay for.

Many factors can affect how affordable it is for you to buy a home. Lets go through them and help you come up with a solid number for how much home to buy.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

How Do Lenders Calculate My Mortgage Payments

Lenders use a number of different details and criteria to calculate your mortgage repayments, even if you have £1,000 a month for those payments. They include:

- Your earnings

- The LTV rate of your mortgage

- Your age

- An interest rate based on whats available and determined by all the above

Following the global credit crunch of 2008 when it was discovered some banks didnt have enough capital to shore up their institutions during times of financial difficulties and high interest rates, new rules encouraged lenders to calculate their lending to consumers on an affordability basis.

Most mortgage lenders now base their mortgage calculations on your take-home earnings, minus any regular debt repayments, plus any regular monthly payments you might make.

Even if you think you would be comfortable with paying £1,000 per month for a mortgage, you will only be able to do that if your lenders affordability calculations confirm that to be the case.

Sometimes, it can be worthwhile waiting a few months and repaying other debts before applying for a mortgage. An experienced mortgage advisor can take you through lender affordability calculations and options available to you to try and make your £1,000 a month mortgage payments go further and secure you the home you want.

Who Is This Calculator For +

This calculator is most useful if you:

- Calculate mortgage rates you are considering

- Compare differences of various home loan term programs

- Haven’t decided on what type of loan you want yet

- Want to get an idea of monthly or annual cost of buying a property

- Are looking to assess the long term benefit of making prepayments in addition to regular loan repayments

Recommended Reading: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

What Is A Deductible

A deductible is the amount you are responsible to pay before your insurance kicks in to cover a claim . The deductible is whats deducted from your claim payment.

Lets say your home is insured for $50,000 on your homeowners policy. You have a deductible of $1,000. Unforeseen water damage ends up costing you $3,000. When you submit a claim, you would be responsible to pay $1,000, and your insurance company would send you a check for the remaining $2,000 in lost property.

But lets say that the water damage only costs $800. This is less than your deductible of $1,000, so your insurance company wouldnt pay you anything.

Keep in mind that the insurer will only pay up to your coverage limits. Lets say the water damage equates to $55,000 in damage. You would still be responsible for $1,000 due to your deductible. Then, your insurance company would cover $50,000 in losses, because that is the total amount of insurance coverage on your home. That means you would be missing $4,000 you would have to pay out of pocket.