Are Origination Fees Just Junk Fees

- Loan origination fees arent necessarily so-called junk fees

- They are commissions paid out for helping you obtain a loan

- And just because you arent charged the fee directly doesnt mean its the better deal

- Look at the big picture to determine the best offer

The loan origination fee is not necessarily a junk fee seeing that many loan originators dont get paid salaries, as noted. So they need to get paid somehow.

But some lenders may not charge them and refer to them as unnecessary or excess charges as a result.

However, if they dont charge you directly, it just means theyre making money a different way, perhaps via a higher interest rate and/or by charging other lender fees.

Certain mortgage bankers can earn a service release premium after the loan closes by selling it to an investor on the secondary market.

This isnt a fee imposed on the borrower directly, though a higher-rate mortgage may fetch a higher SRP.

In any case, someone will be making money for originating your loan, as they should for providing a service.

So dont get fired up about it, just try to negotiate costs lower as best you can. Or go elsewhere for your loan if youre not impressed.

The reason its sometimes given junk fee status is that its often a fixed percentage, which means its not necessarily tailored to your specific loan or the amount of time/risk involved.

If these fees were based on a dollar amount instead, skeptics may not consider them junk. Or may think theyre less junky.

What Is The Difference Between Origination And Underwriting

Origination fees are typically intended to cover a range of miscellaneous lender costs, including the processing of your loan application the cost of underwriting the loan, which involves verifying everything from your income and assets to your job history and preparing your mortgage documentation.

Saving On Your Origination Fees

If you can afford it, the most cost-effective strategy is to pay your origination fee and other closing costs upfront. This way, you know exactly what youre spending, plus youll get a lower rate as no additional interest payments are involved.Paying fees to lenders at all is largely unavoidable. Still, even if you cant pay everything in one go, there are ways you can reduce spending by making savings on your mortgage origination fees and closing costs.

You May Like: Does Rocket Mortgage Use Fico 8

You May Like: Would I Be Eligible For A Mortgage

What Is A Loan Origination Fee And Is It Negotiable

Several fees come along with a mortgage. One of the more typical is the loan origination fee charged by your lender for processing and, sometimes, underwriting your loan.

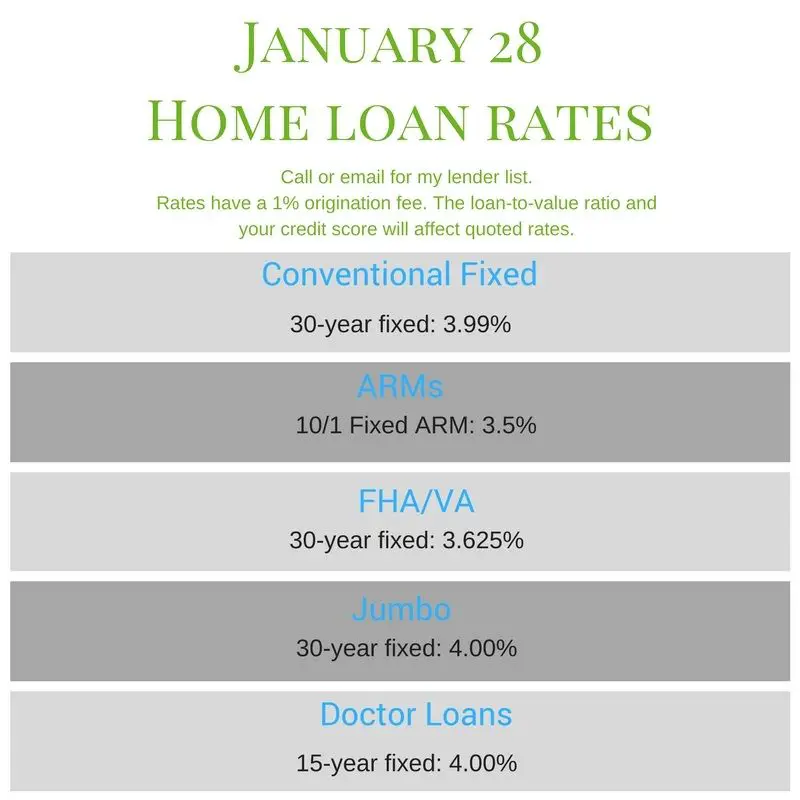

The exact cost of these fees varies from one lender to the next, but they generally clock in at 1% or less of your total loan balance.

To get a feel for what your loan origination fee may be, get pre-approved for your mortgage loan. This will give you a good idea of your total loan costs both at closing and long-term.

Other Fees Associated With A Mortgage

There are many other fees youll likely pay during the mortgage process and at closing. Some of the more common fees include:

- Title settlement and other fees

You might also see certain junk fees, or fees that are either unnecessarily high or unnecessary entirely. Take a look at your application fee, underwriting fee, rate-lock fee, processing fee and broker rebate to determine if theyre comparable to the fees you see with other lenders. If you believe theyre too high, contact your lender to find out if you can reduce or eliminate them.

Read Also: Are There Any Mortgage Lenders For Bad Credit

How Mortgage Lenders Make Money

A loan’s interest rate already comes with some built-in markup for the lender. To help make their interest rates appear more competitive, some mortgage companies will charge additional lender fees instead of profiting only from the rate.

Its one way of framing the product to make it appear more attractive than it is.

“It’s one way of framing the product to make it appear more attractive than it is,” says Casey Fleming, a mortgage advisor who works in Silicon Valley.

When comparison shopping lenders, the key is identifying the fees that are valid, perhaps even negotiable, and the fees that are tacked onto a loan to pump up a lenders profit.

What Mortgage Rates Can I Get

Mortgage interest rates vary widely based on several factors, including your credit score, the amount of debt you want to refinance, your homes value, and more. That said, interest rates for refinancing are typically very competitive among lenders, which is a good thing for you.

Source YCharts

Keep in mind that the lowest rate isnt always the least expensive loan when it comes to refinancing. There are fees associated with the refinancing process that could run into thousands of dollars. These charges stem from the appraisal process, application fees, and title insurance. Its a good idea to compare the five-year cost of new mortgages when shopping around for lenders to get a sense of what youll end up paying.

You May Like: Should I Get 15 Year Mortgage

How Much Are Home Equity Loan Closing Costs

Home equity loans can be an appealing way to turn your existing home value into cash that you can use to accomplish your financial, homeownership and lifestyle goals, particularly if you dont want to refinance your primary mortgage. But determining whether any loan makes sense is always an arithmetic problem. To solve, you need to make sure you know what all the inputs are.

Today, well discuss the ins and outs of one of those inputs: home equity loan closing costs. Lets start by looking at the scope of what were dealing with.

How To Negotiate Mortgage Origination Fees

As with everything else in the world of business, mortgage loan origination fees are negotiable. And there are a few tactics you can use to reduce the fees you pay.

The simplest is to ask your loan officer or lender to waive or reduce them. Theres no harm in asking, and the worst that can happen is theyll say no. One way to strengthen your position is to show your lender a preapproval from another lender thats charging lower fees.

You could also ask your lender about a no-closing-cost or no-origination-fee mortgage. These loans let you skip the upfront fee but usually have higher interest rates. That can be a good choice for people who want to buy a home despite limited savings. But the higher interest costs mean youll lose out if you stay in the home for a long time.

If youre in a buyers market, you can also ask for seller concessions to cover a portion of the fee. You can negotiate with the current homeowner to determine how much theyre willing to pay for the loan application fee and other origination costs.

Don’t Miss: How Much To Get A Mortgage

How To Find The Best Mortgage Lender

Theres no single mortgage lender thats best for everyone each has its own set of loan options, eligibility criteria, fees and other features. The most important way to make sure you get the best deal on your mortgage is to shop around and compare multiple lenders.

A mortgage broker can help you with this process, but keep in mind that they typically only work with a set number of lenders, so you might still want to submit a few applications on your own.

As you compare various offers, look at the interest rates , fees and other aspects of each loan to determine which one is right for you.

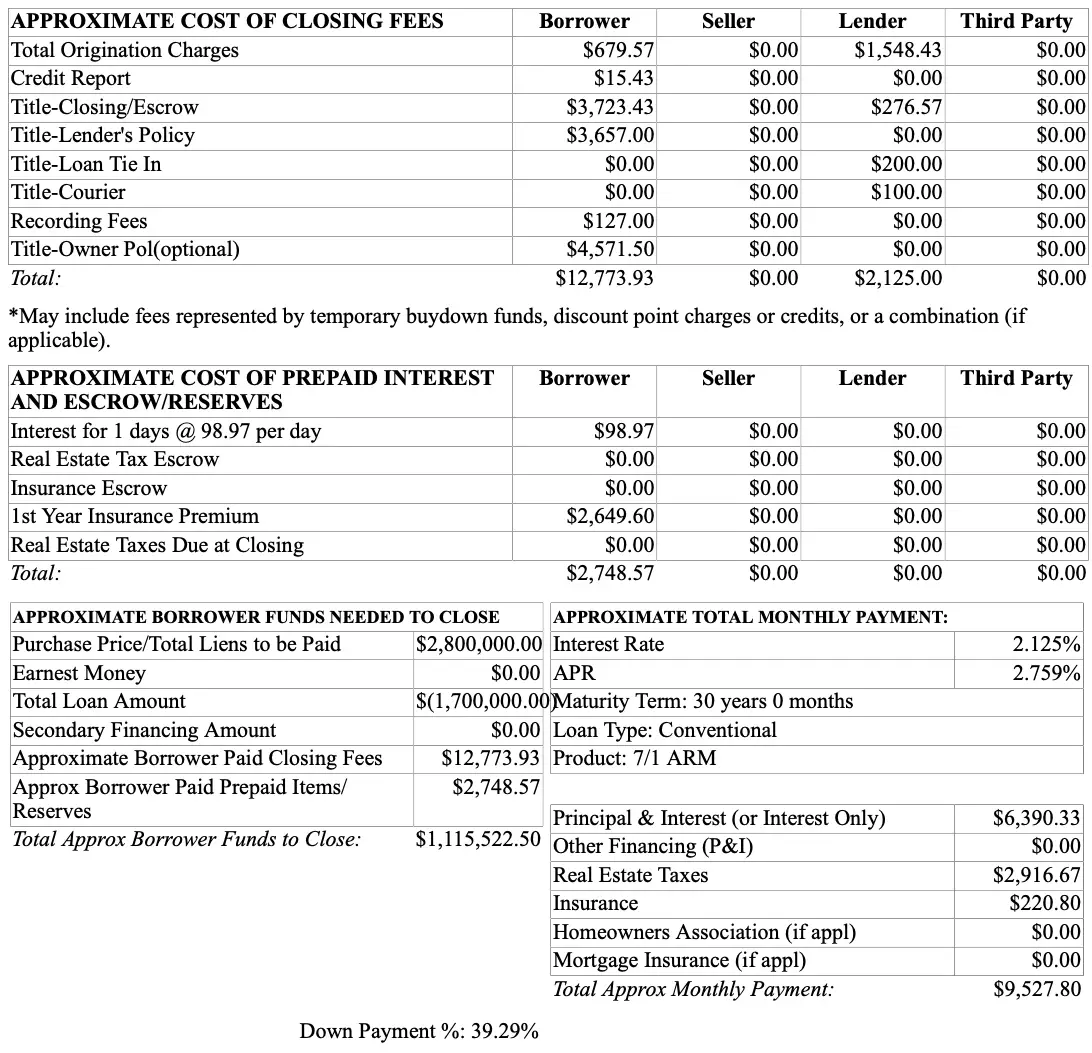

What Are Some Other Closing Costs

Many loans, especially mortgage loans, charge other closing costs in addition to origination fees.

Some examples of closing costs you may have to pay include:

This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. This information is not a recommendation to buy, hold, or sell an investment or financial product, or take any action. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. All investments involve risk, including the possible loss of capital. Past performance does not guarantee future results or returns. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy.

Robinhood Financial LLC , is a registered broker dealer. Robinhood Securities, LLC , provides brokerage clearing services. Robinhood Crypto, LLC provides crypto currency trading. All are subsidiaries of Robinhood Markets, Inc. .

1771482

Read Also: How To Get Removed From A Mortgage

Think About Seller Concessions

If youre buying the property and moving into a new home, you can sometimes negotiate with the seller to get them to pay for certain closing costs, which may include your origination fee. Seller concessions have to be included as part of your purchase agreement to utilize this strategy.

There are, however, a couple of drawbacks to this strategy.

First, sellers may be more hesitant to take your offer if it requires them to pay a bunch of fees.

Additionally, they may actually be limited in the amount they can give you, as all major loan programs have upper limits on how much sellers can pay for in closing costs, expressed as a percentage of the overall loan amount.

Home Equity Loan Vs Heloc Closing Costs And Fees

Another option for accessing your equity is a home equity line of credit . Before we get into the way the costs and fees for this work, lets briefly discuss how a HELOC compares to a home equity loan.

You can think of a HELOC as having two separate phases: a draw period and the repayment period. During the draw period, it works much like a credit card. You can draw out up to the amount you are approved for and youre only responsible for the interest payments. You can also pay money back to access it later for another project.

After a number of years at the beginning of the loan, the repayment period starts. At this time, the balance freezes and you can no longer take money out, and you make payments of both principal and interest over the remainder of the term.

With a HELOC, at the beginning of the term, you only have to make interest payments. With a home equity loan, you pay principal and interest from the beginning. One of the advantages to a home equity loan is the availability of fixed rates. HELOCs tend to have variable rates like credit cards, so your monthly payment isnt necessarily consistent, especially if the Federal Reserve is moving interest rates.

Like credit cards, HELOCs tend to have low or no closing costs. However, there are other fees to worry about:

Don’t Miss: What Is The Current Prime Mortgage Interest Rate

What Is A Loan Origination Fee And How Does It Work

A loan origination fee is charged by the lender and can also be referred to as an application, processing or underwriting fee. Its purpose is to cover the costs of preparing documents, processing and underwriting your loan and any third-party fees that are incurred along the way.

How much your loan origination fee will cost depends, in part, on the type of loan youre applying for. In some cases, you may be able to reduce the amount you pay or waive the fee entirely. Keep reading to learn what to expect in origination fees for different loan types.

In this guide, youll find

Can You Negotiate A Mortgage Origination Fee

Although it is possible to negotiate which of your closing costs the seller is willing to pay on your behalf, you may be hard-pressed to find a lender willing to negotiate their origination fee. Remember to shop around before choosing a mortgage lender, as not all mortgage companies will charge the same amount in fees.

Read Also: How Much Mortgage Could I Get Approved For

How Much Should You Pay In Origination Fees

Origination fees typically vary from loan to loan but they average between 18% of the amount that you borrow.

Mortgage lenders tend to charge flat amounts or low percentages of the amount that you borrow.

Generally, you should aim to pay the lowest fee possible, though paying a higher fee often makes sense if it reduces the total cost of the loan due to other factors, such as a lower interest rate.

Negotiating A Lower Origination Fee

Keep in mind that — unlike other closing costs — origination fees are often negotiable. If you’re taking out a larger mortgage, then you may be able to work your way down to a lower fee. The most common way to do so is to agree to a higher mortgage interest rate in return.

If you’re planning to sell your home or refinance in the near future, then this type of arrangement might work out in your favor. However, if you’re planning to stay in your home long-term, you’re probably better off paying an origination fee and keeping your lower interest rate. Among other things, a low interest rate can help keep your monthly mortgage payments low.

As with any financial decision, you’ll need to run the numbers to see which option makes the most sense for you.

Read Also: How Much Of My Budget Should Go To Mortgage

Loan Origination Fees Vs Closing Costs: Identifying The Differences

A simple rule of thumb to keep in mind is that loan origination fees are closing costs, but closing costs aren’t exclusive to loan origination fees. You will pay your loan origination fees at closing, but they wont be the only fees included in your closing costs: others include private mortgage insurance, appraisal costs, and property taxes .

Can My Lender Increase The Origination Fee After Issuing Its Loan Estimate

It is illegal for lenders to deliberately underestimate the costs on your Loan Estimate. However, lenders are allowed to change some costs under certain circumstances, according to the CFPB.

In other words, nothing can change without good cause. So your interest rate might go up or down before you lock it. And your deal might alter if your credit score takes a tumble or if your appraisal comes in below or over what you expected.

And, of course, fees for services you can shop for might go up or down, depending on how well you negotiated with your chosen suppliers.

But, in principle, the lender is legally obliged to give you its best, most honest assessment of your likely total cost. Thats why these used to be called good faith estimates. And it can only change things if it has objectively good grounds for doing so.

As for its origination fees, those are among the most difficult for the lender to change. Indeed, unless there is a material change in the circumstances surrounding your loan, it cannot change them at all. Of course, theres an exception if you manage to negotiate them down.

If those grounds arise, it should send you a revised loan estimate. And, the CFPB says, If the costs have increased more than the allowed limits and your application has not had a change in circumstances, you are entitled to a refund of the amount above the allowable limits.

Also Check: What Is A Reverse Mortgage For Dummies

Homeowners Association Transfer Fee

Your homeowners association transfer fee covers the cost of moving the burden of HOA fees from the seller to the buyer. It ensures that the seller is up to date on their HOA dues. It also provides you with a copy of the associations payment and due schedule as well as their financials.

Most of the time, the seller covers this cost. However, you might need to pay for your own transfer fee if youre buying in a very competitive market, or if you agree to cover all closing costs.

The amount youll pay for your transfer depends on your HOAs policies. If you live in an area without an HOA, you wont pay this fee at all.

Whats Included In Origination Charges

This category includes lender fees for underwriting and processing your loan. Every lender is slightly different in how they label their fees in this section, so the names you might see in this section are:

- Underwriting fee

- Application fee

Some lenders combine all of these into one single fee, and some break them out.

One thing all lenders will show consistently here is whether theyre charging a percentage of the loan amount as an additional fee on top of the fees noted above. These fees are also known as points, and should be labeled as points on the Loan Estimate and Closing Disclosure.

Points are an extra fee you pay for a lower rate. You arent required to pay points, so ask your lender to explain the rate difference between points and no-points options, and also ask them to tell you how long it will take the rate savings from paying points to repay the cost of the points.

Recommended Reading: How To Get A Renovation Mortgage

How Does An Origination Fee Work

Origination fees are typically intended to cover a range of miscellaneous lender costs, including the processing of your loan application the cost of underwriting the loan, which involves verifying everything from your income and assets to your job history and preparing your mortgage documentation.

The fee is charged based on a percentage of the loan amount. Typically, this range is anywhere between 0.5% and 1%. For example, on a $200,000 loan, an origination fee of 1% would be $2,000.

One important thing to note is that in the same area where youll see the origination fee, you may also see a charge for mortgage discount points. One prepaid interest point is equal to 1% of the loan amount, but these can be bought in increments down to 0.125%. These points are paid in exchange for a lower interest rate.

The points, together with any origination fee, will be included on the Origination Charges section of your Loan Estimate.