How To Use Our Mortgage Payment Calculator

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

Add All Fixed Costs And Variables To Get Your Monthly Amount

Figuring out whether you can afford to buy a home requires a lot more than finding a home in a certain price range. Unless you have a very generous and wealthy relative who’s willing to give you the full price of your home and let you pay it back without interest, you can’t just divide the cost of your home by the number of months you plan to pay it back and get your loan payment. Interest can add tens of thousands of dollars to the total cost you repay, and in the early years of your loan, the majority of your payment will be interest.

Many other variables can influence your monthly mortgage payment, including the length of your loan, your local property tax rate and whether you have to pay private mortgage insurance. Here is a complete list of items that can influence how much your monthly mortgage payments will be:

Using Apr To Shop For A Mortgage

As noted above, APR provides a more accurate indication of the true cost of a mortgage than simply looking at the mortgage rate. In some cases, mortgage lenders may charge higher fees to offset an unusually low rate they may be offering. APR can help you detect that.

By law, the APR must be disclosed in any loan estimate, including mortgages, and in any advertising for loans that specifies an interest rate. Such advertising for mortgage rates must also include the number of discount points the rate is based on, the more discount points that are included, the larger the difference there will be between the rate and the mortgage APR. While mortgage APR is a useful guide for comparing the costs of different loan offers, it does have some shortcomings. Because it is based on annualized cost of fees amortized over the full length of the loan, it will not give a fully accurate picture of costs if you sell or refinance before the loan is paid off. As a rule of thumb, it’s often better to accept higher fees in return for a lower rate on a long-term loan, where you have more time to amortize their cost. But if you’re only going to have the loan for a few years, it’s often better to minimize fees even if you’re paying a higher rate.

FAQ: See FAQ above under section Mortgage Loan APR Explained for APRs on an Adjustable Rate Mortgage .

Also Check: 10 Year Treasury Vs Mortgage Rates

Whats The Monthly Payment On A 250 000 Mortgage

The monthly payment on a £250 000 mortgage will vary based on the APR which you pay on the mortgage. e.g over a term of 25 years at an APR of 5.5% you will pay £1525.22 as your monthly payment but with an APR of 1.5% over the exact mortgage term of 25 years, you will pay £999.84 as your monthly payment.

What Salary Do I Need To Buy A House

Data compiled for Nine News by RateCity shows with a 20 per cent deposit, a household needs to earn at least $147,629 a year to buy a median priced house. The latest Corelogic figures show the median Sydney house price is sitting at $1,112,671.

How much house can I afford if I make 60000 a year? The usual rule of thumb is that you can afford a mortgage two to 2.5 times your annual income. Thats a $120,000 to $150,000 mortgage at $60,000.

How much house can I afford 80k salary?

So, if you make $80,000 a year, you should be looking at homes priced between $240,000 to $320,000. You can further limit this range by figuring out a comfortable monthly mortgage payment. To do this, take your monthly after-tax income, subtract all current debt payments and then multiply that number by 25%.

How much mortgage can I afford if I make 70000 a year? So if you earn $70,000 a year, you should be able to spend at least $1,692 a month and up to $2,391 a month in the form of either rent or mortgage payments.

Recommended Reading: Chase Mortgage Recast Fee

Can I Borrow More Than My Equity

Remember that lenders will still impose a maximum amount you can borrow, often 80 percent or 85 percent of your available equity so a new loan or a refinance makes the most sense if the value of your home has increased or youve paid down a significant portion of your mortgage.

What happens when you sell a house that is underwater? Now, when you sell while your home value is down, you do lose money. The only way you can sell your home through a normal home-selling process when youre underwater is if you have cash on hand to make up the difference between how much you owe and how much your home is worth.

Can you use VA loan for furniture?

The VA limits the closing costs lenders can charge to VA loan applicants. This is another way that a VA loan can be more affordable than other types of loans. Money saved on closing costs can be used for furniture, moving costs, home improvements, or anything else.

How much would a 30 year mortgage be on 200 000? On a $200,000, 30-year mortgage with a 4% fixed interest rate, your monthly payment would come out to $954.83 not including taxes or insurance. Monthly payments for a $200,000 mortgage.

| Interest rate |

|---|

Oct 11, 2021

How Much Do I Need To Earn To Get A Mortgage Of 250 000 Uk

How much do I need to earn to get a £250,000 mortgage? As a rule of thumb, you can borrow up to 4 and a half times your income so combined earnings of around £55,500 should in theory enable you to get a £250,000 mortgage.

Thereof How much do I need to earn to get a mortgage of 200 000 UK? How much do I need to earn to get a £200,000 mortgage? In most cases, mortgage providers cap what theyre willing to lend you at 4.5x your annual salary. In some situations this will exceed to 5x your income and a minority to 6x in exceptional circumstances.

Can I get a mortgage on 20k a year? How Much Mortgage Do I Qualify for If I Make $20,000 a Year? As discussed above, a home loan lender does not want your monthly mortgage to surpass 28% of your monthly income, which means if you make $20,000 a year or $1,676 a month, your monthly mortgage payment should not exceed $469.

Beside this, How much of a mortgage can I afford based on my salary? The general rule is that you can afford a mortgage that is 2x to 2.5x your gross income. Total monthly mortgage payments are typically made up of four components: principal, interest, taxes, and insurance .

You May Like: 10 Year Treasury Yield And Mortgage Rates

Tracker 250 000 Mortgages:

You can access a host of tracker mortgages from most mortgage lenders. These mortgages will usually track the bank of Englands rate and will move in line with it although it may not be the exact rate but rather a rate which will increase by the same point or increase by the same point as the bank of England rate.

How Much Do I Need To Earn To Get A Mortgage Of 170 000 Uk

Some lenders in the UK use income multiples, starting from 4.5 ranging all the way up to 6 in a handful of circumstances. A lot of lenders calculate how much theyll lend you using an income multiple of 4.5, so for a mortgage worth £170,000, you would need a minimum income of £37,777 a year.

How much is a 100k mortgage per month UK? Monthly payments on a £100,000 mortgage

At a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total £477.42 a month, while a 15-year might cost £739.69 a month. Note that your monthly mortgage payments will vary depending on your interest rate, taxes and PMI, among related fees.

Can I afford a 300k house on a 60k salary?

The usual rule of thumb is that you can afford a mortgage two to 2.5 times your annual income. Thats a $120,000 to $150,000 mortgage at $60,000. Lenders want your principal, interest, taxes and insurance referred to as PITI to be 28 percent or less of your gross monthly income.

What mortgage can I afford with 100k salary? When attempting to determine how much mortgage you can afford, a general guideline is to multiply your income by at least 2.5 or 3 to get an idea of the maximum housing price you can afford. If you earn approximately $100,000, the maximum price you would be able to afford would be roughly $300,000.

Don’t Miss: Rocket Mortgage Conventional Loan

Apply For A 250000 Mortgage

To find out more about our range of £250,000 mortgages simply make an application with our approved mortgage experts found here on the website. Rates are available from across the market either on a fixed rate or variable rate deal. Mortgages and lenders to suit most credit types and applicants including buy to let property.

Explore this product

Why Use An Apr Mortgage Calculator

Your lender will figure your APR for you, and will advertise it in loan offers. However, you may wish to see yourself how the APR will vary if you make certain changes in the loan, such as buying more or fewer points. Or you may want to compare loan offers from lenders with different fee schedules and want to see how different fee schedules affect the APR and total cost of the loan.

FAQ: It is also helpful if you: Are working with a tight budget and need to know exactly how much you can afford.

FAQ: You want to compare the true total monthly payment required from two or more providers. For the best way to do this, .

Don’t Miss: How Much Is Mortgage On A 1 Million Dollar House

Speak To A Mortgage Affordability Expert Today

If you like anything in this article or youd like to know more, call Online Mortgage Advisor today on 0808 189 2301 or make an enquiry.

Then sit back and let us do all the hard work in finding the broker with the right expertise for your circumstances. We dont charge a fee, and theres no obligation or marks on your credit rating.

Got a question?

We can help!We know everyone’s circumstances are different, that’s why we work with expert brokers who specialise in finding the best deals.Ask us a question and we’ll get the best expert to help.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

Maximise your chances of approval, whatever your situation. Find your perfect mortgage broker

Buy To Let Properties

Is your £250k mortgage application for a BTL investment? If so, the rules are quite different than for standard residential mortgage products.

Usually, lenders will require a larger deposit , and affordability is calculated not by income multiples alone, but rather your estimated earnings from letting out the property.

Click here to visit our buy to let section.

Read Also: Recasting Mortgage Chase

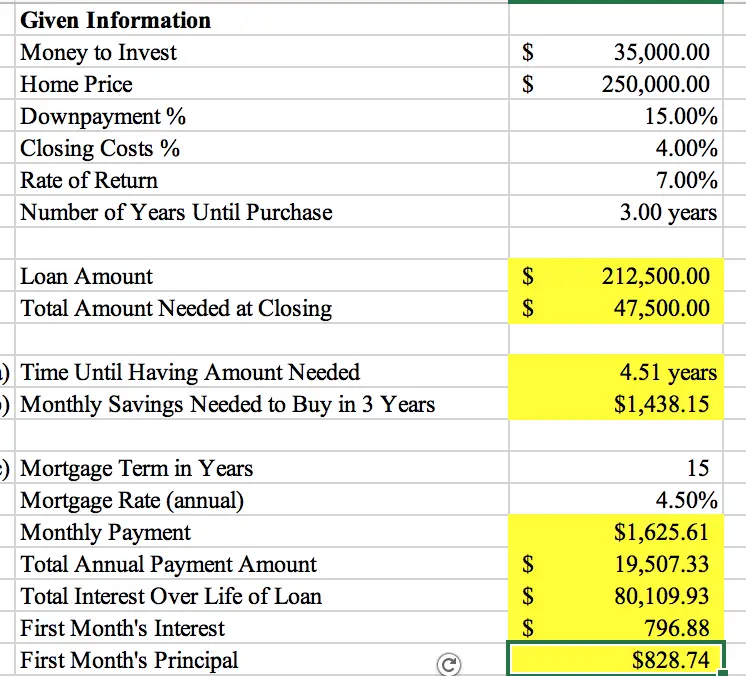

How To Calculate Your Mortgage Payment

Mortgage calculators take into account a variety of different factors when determining your monthly mortgage costs. They can include the price of your home, your down payment, your monthly interest rate and the term length of your mortgage. If your math skills are a little rusty, a mortgage calculator does the hard work for you in order to determine your monthly payment and associated costs.

The basic formula for calculating your mortgage costs: P = A/

- P stands for your monthly payment

- A stands for your loan amount

- T stands for the term of your loan in months

- R stands for the monthly interest rate for your loan

For example, lets say that John wants to purchase a house that costs $125,000 and has saved up a $25,000 down payment. His loan amount is $100,000, the term length is 15 years and the monthly interest rate is 4.20%. In this scenario, Johns monthly mortgage payment will be $749.75.

Johns mortgage cost formula will look like: 749.75 = 100,000[4.2^180/[^180-1)

If John wants to purchase the same house with a 30-year term length, the formula works in much the same way. In this scenario, his loan amount is $100,000, term length is 30 years and monthly interest rate is 4.20%. With a 30-year mortgage, Johns monthly mortgage payment will be $489.02.

Johns mortgage cost formula will look like: 489.02 = 100,000[4.2^360/[^180-1)

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

You May Like: How Much Is Mortgage On 1 Million

Amortization Schedule On A $250000 Mortgage

An amortization schedule spells out the annual principal and interest costs for each year of a home loan and can be a good way to gauge the long-term costs of financing your house.

As the examples below show, your monthly mortgage payments go mostly toward interest at the beginning of your loan and more toward principal further into your term.

Heres what an amortization schedule for a 30-year, $250,000 loan looks like, assuming a 4% APR:

| Year |

|---|

| $0.00 |

How Much Income Do I Need To Buy A House

If you have an HOA rate in your private home, please include it in the annual insurance amount for those humans to calculate yours. Your down charge is another important factor in determining how well you may have to earn to shop for a household.

Mortgage lenders use a complex set of standards to determine if you are eligible for a home mortgage. They qualify for the maximum traditional mortgage your normal mortgage cost cannot exceed 36% of your gross monthly income.

They are very worthy of you, and their income is included in the same way. You will be able to withdraw the savings or convert the property into cash to cover your monthly mortgage bill. Use a home mortgage calculator to estimate your EMI and the hobby you pay.

Most creditors do not want your month-to-month loan payments to exceed 28 per cent of your gross month-to-month profits get a mortgage of £150 000. We have more accurately displayed the information available about goods tax and homeowner’s coverage costs.

Some monthly non-home loans are high however, your normal debt repayments will be more than 36% of gross profit. Upload your total month-to-month non-mortgage loan bill, including your monthly credit card or car bill.

If you want to shop for a home within the subsequent one or two years, you will have to shop for $ 12,500 to $ 25,000 with the year. At the same time, as the debt loan gets secured towards the house, it creates doubts about your profit.

Read Also: Can You Do A Reverse Mortgage On A Mobile Home

Is 10000 Enough For A House Deposit

Conventional mortgages, like the traditional 30-year fixed rate mortgage, usually require at least a 5% down payment. If youre buying a home for $200,000, in this case, youll need $10,000 to secure a home loan. FHA Mortgage. For a government-backed mortgage like an FHA mortgage, the minimum down payment is 3.5%.

How much income is needed for a 200k mortgage?

A $200k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $54,729 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator.

Can 1 person buy a house? Share: Homeownership isnt just for married folks. Though going it alone can sometimes be a little more challenging than purchasing with a partner, single people can benefit from owning their own home just as much as anyone else.

What mortgage can I afford on 70k salary? How much should you be spending on a mortgage? According to Brown, you should spend between 28% to 36% of your take-home income on your housing payment. If you make $70,000 a year, your monthly take-home pay, including tax deductions, will be approximately $4,328.