Option 2 Refinance The Mortgage

If youre the borrower and you want to move out but still keep the home, you can refinance your reverse mortgage into a traditional mortgage loan. Just remember that youll need to start making payments on the new loan to keep the home.

Refinancing it back into a traditional loan will mean having to make regular payments toward the mortgage again, Mazzara says, but it would also mean keeping the house as part of your estate.

A Little About What A Reverse Mortgage Is

As always here at truehecm.com, lets start a the beginning by explaining what a HECM reverse mortgage is. A reverse mortgage is essentially just what it says, a mortgage in reverse. That means that rather than slowly paying your home off over time and building equity, you will use the equity youve already built in your home to pay you.

It may be the only way available to unlock the equity in your home as a cash benefit to you while retaining ownership of the property AND not incurring a mortgage payment! This means that the equity in the home will decrease month by month as the equity is used to pay the mortgage payments.

How To Fix Your Bad Credit In 6 Easy Steps

If a bad credit score is keeping you from applying for a conventional loan, do not lose hope! You may qualify for a reverse mortgage in AZ, so long as you have enough equity. Seniors can apply for the reverse mortgage Arizona program and use the money to finance their retirement. This includes traveling, paying medical bills, clear outstanding home mortgages, and anything they wish to spend the money on.

However, rather than wait to apply for a reverse mortgage in Arizona, you can work on credit score improvement to help qualify for a mortgage. In this post, I will take you through six tips to help you fix your bad credit.

Recommended Reading: How Much Can You Save By Paying Extra On Mortgage

Check Your Credit Report And Credit Score

Your first step toward getting a mortgage with bad credit is to find out exactly what information is contained in your credit report . You can do this by requesting a copy of your from one of the three major credit bureaus Experian, Transunion or Equifax.

You would normally be able to get one free credit report per year from each one of the credit bureaus. However, because of the economic impact of the pandemic, you are able to request a free weekly report until April 2022.

Learning to read your credit report is important because youll be able to verify that all the information included is correct. If you do spot errors, you can remove items from your credit report, which can provide a boost to your score.

Your next step is to find out what your credit score is. You can buy this information from any of the credit reporting bureaus, but you can also get it for free from sites such as Credit Karma. Some credit card and bank loan statements will also include the information at no cost.

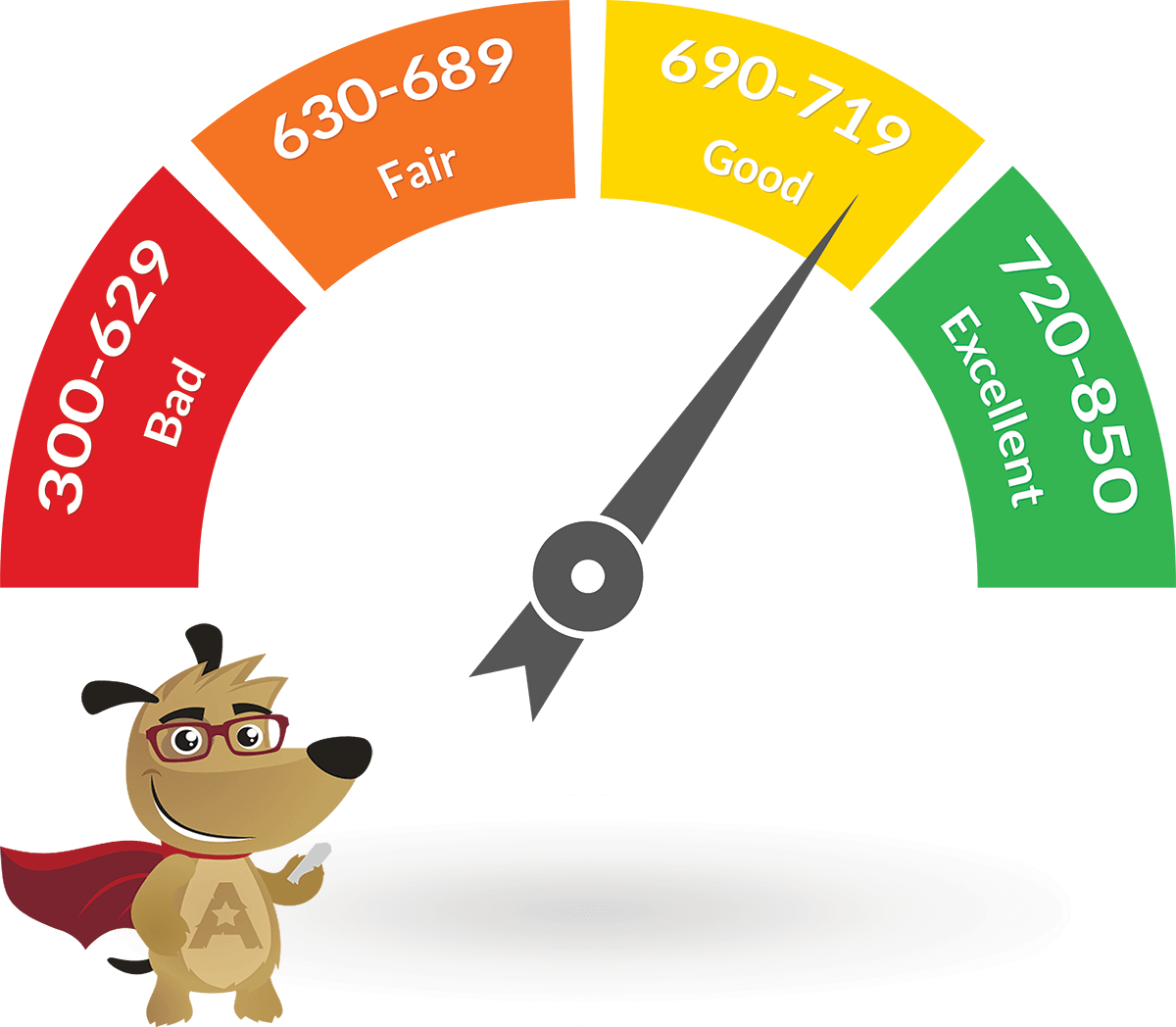

What Do Lenders Consider A Bad Credit Score

There are two major credit scoring models used by lenders: FICO and VantageScore. Both pull from TransUnion, Experian, and Equifax to determine your credit score. Most lenders use the FICO score, but theres always a chance youll come across one that uses the VantageScore. In this article, we will use the FICO score as a basis for understanding credit ratings since more lenders use FICO.

FICO score range:

- 740 to 799 Very good

- 800 to 850 Excellent

If you intend to take out a mortgage with a traditional lender, youll need a credit score of at least 620. Its possible to get a mortgage with a lower score, but youll have to look at FHA loans, or VA Loans and similar loan products. Traditional lenders are less likely to consider your application if youre significantly under the 620 score.

Remember that having bad credit does not mean you wont get a home loan. What it does mean is that youre likely to pay a higher rate of interest and more in the way of fees. The same is true when youre looking for the best home equity loans for bad credit.

Real estate brokerage contracts for sale and rent with insurance concepts.

Recommended Reading: How Much Does A Down Payment Lower A Mortgage

Apply With Multiple Lenders

Shopping around for a loan with multiple lenders is a smart move, regardless of your credit score. Each lender will have different terms and conditions, such as annual percentage rate , possible prepayment penalties, and needs. Apply with several lenders you trust and have them compete for your business to get more favorable terms.

Be aware of dishonest lenders. Some may create specific terms under which they know you’ll default. Watch out for lenders who want you to sign blank documents, change set terms, or push you to sign without time for a full review.

What Is A Bad Credit Mortgage

Mortgages available to folks with FICO scores below 630 are bad credit mortgages. They have features that make it easier for consumers with poor credit and/or a low income to buy, fix up, or refinance a home.

Bad credit mortgages are often guaranteed by a federal agency, including the Federal Housing Administration, the U.S. Department of Veterans Affairs, and the U.S. Department of Agriculture. Eligibility requirements are different for each loan program.

Some of the benefits of guaranteed loans include:

- Low minimum down payments.

- Down payments can include money from financial gifts or grants.

- Acceptance of low credit scores.

- Programs for buying, refinancing, and improving homes.

- Reverse mortgage programs.

Generally, the federal agency programs guarantee mortgages, but some federal programs also make direct loans to qualified applicants.

Private lenders both participate in guaranteed loan programs and compete against them, usually at the same time. These lenders can offer features not necessarily available from guaranteed loans, including 100% financing, no maximum income limits, seller contributions to the sale price, and a waiver of private mortgage insurance.

The minimum credit score varies by program as well. For example, you may qualify for an FHA home loan with a credit score in the 500 to 579 range, but youll have to put 10% down. If your score is 580 or higher, the FHA down payment requirement is 3.5%.

You May Like: Is It Possible To Get An Interest Only Mortgage

Can I Get A Fixed Interest Rate On A Reverse Mortgage

Yes, borrowers can get a fixed rate. However, you will have to choose a lump-sum distribution of proceeds.

About the Author

Gina Pogol writes about mortgages and personal finance for several national publications. Pogol is a licensed Nevada mortgage lender with more than 20 years of experience. Gina is a well-rounded business professional with experience as an estate planning and bankruptcy paralegal, a systems consultant for Experian and a tax accountant with Deloitte. She loves teaching and empowering consumers.

Look For Down Payment Assistance Programs

Down payment assistance programs can be an option if you want to buy a home but havent saved enough. DPAs are usually available through state and local governments as well as some charitable organizations and mortgage lenders. They are designed to help low to moderate income buyers who otherwise may not be able to become homeowners.

Most of these programs will be available only to first-time homebuyers planning on using the home as a primary residence investment or rental property wont qualify. Each program will have its own definition of a first-time buyer, but many define the term as meaning someone who hasnt owned a home in the past three years. There will also be different income and credit requirements.

There are different types of assistance you may qualify for:

Grants

Grant money is considered a gift and doesnt have to be repaid.

Second mortgages

Some DPAs offer additional loans at 0% or a very low interest rate. You can use the funds from this second mortgage as a down payment. However, you will have to make a monthly payment on this loan as well as on your primary mortgage.

Forgivable loans

Deferred loans

Another type of second mortgage at 0% interest, the debt of a deferred loan isnt forgivable and has to be repaid. You are deferring the payments on the loan until you move, sell, refinance or pay down your primary mortgage.

Matched savings programs

Read Also: Can You Refinance 1st Mortgage Only

Alternatives To A Reverse Mortgage

If you dont have enough equity, or youre not old enough to take out a reverse mortgage, but you do have enough retirement income to qualify, consider these reverse mortgage alternatives:

HOME EQUITY LOAN

A home equity loan loan allows you to borrow as much equity as you need in a lump sum with a fixed-rate payment. Home equity loans often come in terms of five to 15 years, but youll need to show you make enough income to qualify.

HOME EQUITY LINE OF CREDIT

A home equity line of credit works like a credit card that you can use as needed. Youll usually make interest-only payments on the amount you draw for a set time, called a draw period. After the draw period ends, the balance is paid in installments during the repayment period. HELOCs tend to have variable rates.

CASH-OUT REFINANCE

A cash-out refinance replaces your current mortgage with a new loan that has a higher balance, which allows you to pocket the difference in cash. Conventional and FHA cash-out refinances allow you to borrow up to 80% of your homes value. Eligible military borrowers may qualify to tap up to 90% of their homes value with a cash-out refinance guaranteed by the U.S. Department of Veterans Affairs .

Reverse Mortgage Quotes:

Chat with a lender about whether a reverse mortgage is right for you.

Cut Up Your Credit Cards

Another tip to help you fix bad credit is cutting up your credit cards. Remove the temptation of increasing your credit card balance before repaying the existing debts. This helps you get out of the debt cycle.

As tempting as it may be to increase your credit card balance to survive hard economic times, it takes a toll on your overall credit score. Therefore, we recommend that you only use your credit card after you have repaid the debt in full.

You May Like: What Fees Are Involved In Refinancing A Mortgage

Reverse Mortgage Pros And Cons

There are several pros and cons when considering a reverse mortgage. The pros and cons may vary based on the type of reverse mortgage in which you are interested.

Watch on

In addition to variances from the type of reverse mortgage, not everyone has the same lifestyle considerations. Make sure you weigh your individual pros and cons when deciding on the best way to move forward.

Build Equity In Your Home

You need equity in your home to borrow against it, and there are a few ways you could increase it.

If you can afford to pay more than your monthly payment amount on your mortgage or can pay on a biweekly schedule, you can pay down your balance more quickly and build more equity.

If its been a few years since your home was appraised, you could have that done again. If the value comes back as $350,000, but the last appraisal was $300,000, you just gained $50,000 in equity. This is only recommended if home values have increased since you last got an appraisal.

Don’t Miss: Is It Better To Pay Off Your Mortgage Or Not

Will A Reverse Mortgage Impact My Credit Score

A good credit score isnt crucial to secure a reverse mortgage, and a bad credit score wont necessarily disqualify you. However, that doesnt mean a lender will completely dismiss your credit score either. Heres what potential borrowers will want to know about credit scores and getting a reverse mortgage.

What Is The Minimum Credit Score Required For A Home Loan

Of course, private lenders are free to set their own credit score requirements, so there is no hard and fast rule specifying the minimum FICO score for a conventional loan. A survey of different lenders indicates that the minimum score may be around 620.

If you want an FHA or VA loan, youll need a credit score of at least 580. However, if you are willing to put down 10%, you can get an FHA home loan with a score as low as 500.

If your credit score is below 500, you may want to take steps to improve your credit, such as credit repair or debt management.

The process involves combing through your credit reports, which you can get for free from AnnualCreditReport.com, the only source authorized by federal law. Common mistakes include unknown accounts, unauthorized credit checks, and incorrect balances.

While DIY credit repair is possible, it is time-consuming and requires good organizational skills. Many consumers prefer to use credit repair companies to do all the heavy lifting with a credit bureau.

Typically, charge between $50 and $150 per month, depending on the level and aggressiveness of service. The usual subscription period is six months, but you can cancel or extend it as you see fit.

While these companies cant guarantee success, they commit to challenging a set number of questionable items each month. Your score should improve within two months after removing derogatory items that dont belong on your credit reports.

Read Also: Where Are Mortgage Interest Rates Going

Gather Information On Your Current Mortgage

When applying for a home equity loan or line of credit, your potential lender will likely ask for details on your existing mortgage. Gather this documentation beforehand to streamline the process and make your application move along faster.

This might include providing them with your most recent mortgage statement and a current payoff quote.

Make Your Case With A Letter

Consider a proactive approach when applying for a home equity loan as a bad credit borrower. This could mean drafting a letter for potential lenders beforehand, explaining your situation, and giving them some personal insight.

For example, if you have bad credit due to a divorce or serious illness, explain that. You may also want to provide documentation that could serve as further explanation. This could include bankruptcy filing papers, divorce decrees, and more.

Read Also: What Is An Overlay In Mortgage Lending

How Do Reverse Mortgages Work

When you have a regular mortgage, you pay the lender every month to buy your home over time. In a reverse mortgage, you get a loan in which the lender pays you. Reverse mortgages take part of the equity in your home and convert it into payments to you a kind of advance payment on your home equity. The money you get usually is tax-free. Generally, you dont have to pay back the money for as long as you live in your home. When you die, sell your home, or move out, you, your spouse, or your estate would repay the loan. Sometimes that means selling the home to get money to repay the loan.

There are three kinds of reverse mortgages: single purpose reverse mortgages offered by some state and local government agencies, as well as non-profits proprietary reverse mortgages private loans and federally-insured reverse mortgages, also known as Home Equity Conversion Mortgages .

More On Reverse Mortgages With Less Than Perfect Credit

Equity & Age Requirements

In order to qualify for a reverse mortgage, homeowners must be 62 years of age or older and have substantial equity in their homes. This means they need to either own their home outright , or have an existing mortgage balance that can be paid off with the proceeds of a reverse mortgage. Typically, the total amount of the reverse mortgage loan should be less than 80% of the value of the home.

Taxes & Insurance

Although reverse mortgage borrowers no longer need to make monthly mortgage payments , they will still be required to pay their homeowners insurance premiums and property taxes. Not doing so is grounds for the loan to be called due, and if the borrower is unable to repay the reverse mortgage loan, then they could go into default and possibly face foreclosure. If you feel like you may have difficulty paying the taxes and insurance on your home, a reverse mortgage may not be the best option.

Residency Requirements

Income Not Necessarily a Huge Factor

In 2014, the FHA implemented financial assessments for those applying for reverse mortgages. Although they are not as strict as income guidelines for traditional mortgages, these assessments make applying for a reverse mortgage safer for seniors who are on a fixed income. These assessments were put into place to help determine whether or not a borrower has the financial ability to continue paying their taxes and insurance by analyzing their cash flow and other debts.

Recommended Reading: How To Apply A Mortgage Loan

Is A Reverse Mortgage A Good Idea

A reverse mortgage is a good idea if you fully understand the pros and cons listed above, and dont have other financial resources to retire comfortably. The table below provides some reverse mortgage food for thought:

| A reverse mortgage may be a good idea if: | A reverse mortgage may not be a good idea if: |

|

|