What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points If a larger down payment could help you avoid paying PMI premiums, for example.

When Will Inflation Slow Down

Thats tough to predict. Supply-chain snarls are dragging on amid the Omicron wave, while gasoline prices an outsized factor in higher inflation have been rising this month.

Regardless, the inflation rate should ease this year. On Wednesday, the Bank of Canada projected the annual rate of inflation will ebb to around 3 per cent by the end of 2022. Of course, that doesnt mean the central bank will be right it has consistently underestimated the path of inflation over the pandemic. As recently as October, the Bank of Canada said inflation would ease to around 2 per cent by the end of this year. Despite the upward revisions, financial analysts tend to agree that inflation should wane over the coming year.

Keep in mind, a slowing of inflation to 2 per cent from 5 per cent does not mean that average prices would decline merely that the pace of growth would decelerate.

Al Lord Founder Lexerd Capital Management

30year mortgage rates forecast: 3.75%

15year mortgage rates forecast: 3%

Al Lord, founder of Lexerd Capital Management, say two widely talked about factors will influence the direction of mortgage rates in 2022.

The first is the Feds tapering of the asset repurchases program. Reducing asset repurchases creates less money supply in the market and increases interest and mortgage rates, he says.

Second is the shortage of homes for sale and limited new construction activity. The high home prices and the limited supply of homes, either from resale or new construction, will keep the demand for mortgages lower compared to 2021. As a result, mortgage rates will tend to remain near the same or marginally decline, I believe. The result of these two counteracting factors will lead to higher mortgage rates by the middle of 2022, if not earlier.

Expect inflation to accelerate in 2022 while home prices continue to escalate.

Thats why my advice to homeowners is to purchase a property sooner than later and lock in still moderate mortgage rates, adds Lord.

You May Like: How Does The 10 Year Treasury Affect Mortgage Rates

How To Shop For The Best Mortgage Rate

You can get a personalized mortgage rate by reaching out to your local mortgage broker or using an online calculator. Make sure to take into account your current financial situation and your goals when looking for a mortgage. Things that affect what the interest rate you might get on your mortgage include: your credit score, down payment, loan-to-value ratio and your debt-to-income ratio. Having a good credit score, a larger down payment, a low DTI, a low LTV, or any combination of those factors can help you get a lower interest rate. Aside from the mortgage interest rate, other factors including closing costs, fees, discount points and taxes might also affect the cost of your house. Make sure you talk to several different lenders — for example, local and national banks, credit unions and online lenders — and comparison shop to find the best mortgage loan for you.

Check Your Refinance Options Even If Youre Not Sure Youd Qualify

According to Black Knights September Mortgage Monitor, nearly 12 million homeowners could still qualify to refinance and cut their interest rate by at least 0.75%.

And yet, many homeowners hesitate to refinance because they dont think theyd be eligible or because refinance closing costs are too high.

Lenders recognize these challenges. And Fannie Mae and Freddie Mac are working to address homeowners refi concerns.

Two new refinance programs, Fannie Maes RefiNow and Freddie Macs Refi Possible, are expanding refinance opportunities to low- and moderate-income homeowners.

If you make average income for your area and have a high mortgage interest rate, you might qualify to refinance with reduced closing costs.

To learn more about these programs and check your eligibility, read:

Recommended Reading: Mortgage Rates Based On 10 Year Treasury

Find Your Lowest Rate Today

You should comparison shop widely, no matter what sort of mortgage you want. As federal regulator the Consumer Financial Protection Bureau says:

Shopping around for your mortgage has the potential to lead to real savings. It may not sound like much, but saving even a quarter of a point in interest on your mortgage saves you thousands of dollars over the life of your loan.

Mortgage rate methodology

The Mortgage Reports receives rates based on selected criteria from multiple lending partners each day. We arrive at an average rate and APR for each loan type to display in our chart. Because we average an array of rates, it gives you a better idea of what you might find in the marketplace. Furthermore, we average rates for the same loan types. For example, FHA fixed with FHA fixed. The end result is a good snapshot of daily rates and how they change over time.

The Details Of Your Situation Will Show If Refinancing Makes Sense

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

It’s not a bad idea to consider refinancing your mortgage when interest rates are low, and right now, they are plummeting. In January 2021, mortgage rates had dropped to 2.65%, their lowest point since July 2016. However, at some point, they will inevitably start to rise again. How should that affect your decision to refinance? That, of course, depends on the interest rate you are currently paying on your mortgage.

Even in times of rising rates, an older mortgage could still have a higher interest rate than those currently being offered. Also, with rising rates, it may pay to lock in a current rate if you think rates will rise a lot.

In a relatively low-interest-rate climate, there are both pros and cons to refinancing a mortgage. For example, your improved credit ratingor a decision to change the length of your mortgagecould also bring refinance terms that could save you money in the long run. But maybe youre not planning to stay for the long run. Some special refinancing programs can be particularly beneficial for those who qualify. Heres how to work through the decision-making process.

You May Like: Does Prequalifying For A Mortgage Affect Your Credit

The Indicators To Watch That Will Determine When Interest Rates Go Up Or Down

The BOE uses a number of economic indicators when deciding whether rates will rise or be cut. So understanding the key economic indicators is important when judging when interest and mortgage rates are likely to rise or be cut. Below is a roundup of the most important indicators to keep an eye on. Of course in the short term the impact of the coronavirus on the UK economy is likely to have the largest influence over where interest rates go next.

Work Out What You Can Afford

If your mortgage repayments are likely to go up, work out if you can afford the increase. Create a budget and see if there are any areas you might be able to cut back. If the increases are likely to be in the future, then start building up a savings buffer so youll be able to afford your mortgage when they hit.

Don’t Miss: Rocket Mortgage Qualifications

Interest Rates Going Up: Now May Be The Time To Buy A House In Kinston

As we head into 2022, interest rates are expected to rise and local realtors and lenders say now is the prime time to buy your home.

The Federal Reserve is likely to raise interest rates significantly by March and inflation factors into the interest rate hike. The Fed doesnt set the interest rate, but rate changes are brought about by their actions and policies, according to The Mortgage Reports website.

According to the Kinston Realty Groups Josh Hardison, the sellers market, which began about two years ago will continue with low inventory. He also said a potential buyer shouldn’t hesitate.

go ahead and get the process started because interest rates and mortgages are projected to go up, Hardison said.

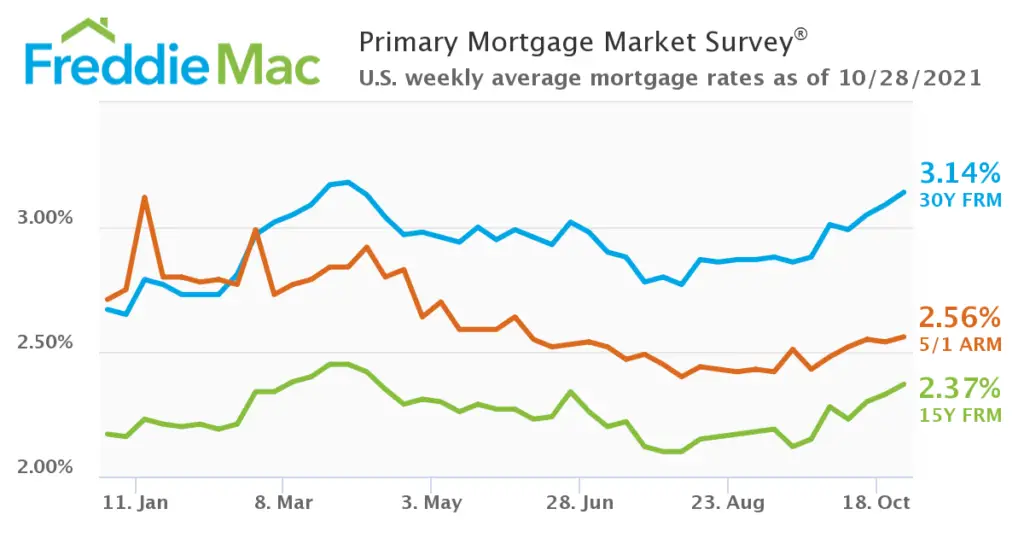

He said current interest rates are around 3.5%, up from 3.25% late last year for a 30-year mortgage, and a 15-year mortgage is 2.875%.

Its just about the best time for buyers because of low-interest rates. Most of the 2010s you were hovering around anywhere between 6 percent, and it got down to about 4.5, until about two and a half years ago, he said.

According to Hardison, interest rates have stayed low by the government to keep the economy functioning and avoid bottoming out like it did in 2008. The rates will increase as the Fed tapers off mortgage-backed securities bonds that are secured for real estate and home loans.

The Market Consensus On The Mortgage Rate Forecast In Canada Is For The Central Bank To Increase Mortgage Interest Rates By 125% In 2022

The main tool we have when reading the current mortgage rate market is the Government of Canada Bond Yield. The Canadian bond is essentially a government debt security that pays a return to an investor. The % based return is called the yield and it is considered to be one of the safest investments because the Government would have to go bankrupt, in order for it not to pay its investors.

The Government of Canada 5 year Bond Yield factors in all known economic data on a day to day, and even a minute to minute basis. Simply put when the market/ bond traders think that the Central Bank of Canada will increase rates, the Bond Yield increases. When the Bond market thinks the Central Bank rate will decrease, then the yield drops. In other words, the Bond yield trades, or is priced in anticipation of where the Central Bank of Canada rates will move. The Central Bank of Canada makes its rate decisions, based on the status of the economy.

Currently, the Canadian Bonds are priced in anticipation of a 1.25% increase in rates in 2022. However, the Bond yield at the time of writing is down from an October 2021 high of 1.51%. The trend seems to be downwards, however, there will likely be volatility in this yield in early 2022 as the market digests and prices in a huge amount of economic data.

You May Like: Rocket Mortgage Payment Options

What You Can Do To Protect Yourself If Interest Rates Rise

If the interest rate rises, your payments increase. Make sure that you can adjust your budget in case your payments increase.

Ask your lender if they offer:

- an interest rate cap: a maximum interest rate your lender can charge on a mortgage. You never have to pay more in interest than the maximum cap, even if the interest rates rise

- a convertibility feature: where, at any time during your term, you can convert or change your mortgage to a fixed interest rate

Note that if you choose a convertibility feature and change your mortgage to a fixed interest rate:

- you usually have to pay a fee

- certain conditions may apply

What Happened In November

As November dawned, I predicted that inflation would push mortgage rates higher but they wouldn’t rise steeply.

But instead of the slow rise that I expected, mortgage rates meandered up and down most of November. The average rate on the 30-year fixed-rate mortgage was almost the same as October’s despite inflation rising to 6.2%, according to the Consumer Price Index.

About the author:Holden Lewis is NerdWallet’s authority on mortgages and real estate. He has reported on mortgages since 2001, winning multiple awards.Read more

You May Like: Reverse Mortgage Manufactured Home

Jumbo Loan Interest Rate Climbs +018%

The average rate youll pay for a jumbo mortgage is 4.19 percent, an increase of 18 basis points over the last seven days. Last month on the 21st, jumbo mortgages average rate was below that, at 3.69 percent.

At todays average rate, youll pay principal and interest of $482.04 for every $100k you borrow. Thats an extra $6.93 compared with last week.

The Bank Of Canada Is Set To Raise Interest Rates In March Heres What It Means For Your Finances And The Economy

A sign for the Bank of Canada building in Ottawa, Wednesday, June 2, 2021.Ashley Fraser/The Globe and Mail

The Bank of Canada held its benchmark interest rate at 0.25 per cent on Wednesday, paving the way for an increase at the next opportunity on March 2. Here are the implications of that pending move.

Don’t Miss: Does Rocket Mortgage Service Their Own Loans

Mortgage Rate Trends By Loan Type

Many mortgage shoppers dont realize there are different types of rates in todays mortgage market.

But this knowledge can help home buyers and refinancing households find the best value for their situation.

Following are 3-month mortgage rate trends for the most popular types of home loans: conventional, FHA, VA, and jumbo.

Hybrid Or Combination Mortgages

You could choose to opt for a hybrid or combination mortgage. In these mortgages, part of your interest rate is fixed and the other is variable.

The fixed portion gives you partial protection in case interest rates go up. The variable portion provides partial benefits if rates fall.

Each portion may have different terms. This means hybrid mortgages may be harder to transfer to another lender.

Read Also: Monthly Mortgage On 1 Million

How High Could Mortgage Rates Go

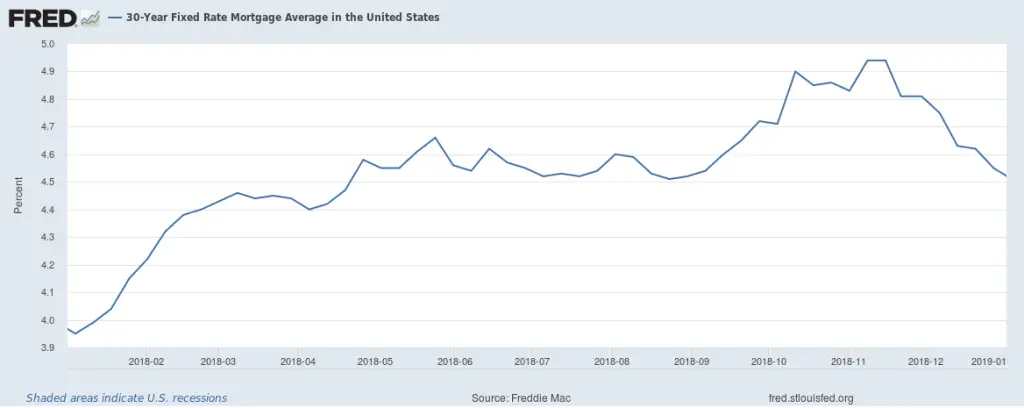

As much as people may be shocked by the recent mortgage rate hikes, rates still aren’t anywhere close to historically high levels or even what we’ve seen just a few years ago.

The average 30-year rate was 4% nearly three years ago back in May 2019, according to Gumbinger at HSH.com.

But the last time borrowers saw 30-year rates routinely in the 5% range was 2011.

If you go back to January 1982, when inflation was hot, the average 30-year fixed rate was more than 18%, he said.

Amazingly, he said, the low point during the pandemic was back in January 2021 when the average 30-year rate hit 2.65%.

“The lowest mortgage rates come in the worst economic climates,” Gumbinger said.

Gumbinger said he does not expect rates to shoot up to 4% and stay there in 2022. Instead, he’s expecting that the 30-year rate could peak at around 3.75% or 3.8% this year. But he was surprised by the rapid climb so far.

If inflation cools off, mortgage rates could trend somewhat lower, too.

Expert Mortgage Rate Forecasts

Looking further ahead, Fannie Mae, Freddie Mac and the Mortgage Bankers Association each has a team of economists dedicated to monitoring and forecasting what will happen to the economy, the housing sector and mortgage rates.

And here are their current rate forecasts for the four quarters of 2022 .

The numbers in the table below are for 30year, fixedrate mortgages. Fannies were published on Feb. 18 and Freddies and the MBAs on Jan. 21.

| Forecaster | |

| 3.7% | 4.0% |

Of course, given so many unknowables, the whole current crop of forecasts may be even more speculative than usual.

You May Like: What Does Gmfs Mortgage Stand For

What To Expect From The Housing Market Now That The Fed Has Signaled Rate Hikes

Plan to buy a house in 2022? The good news is that conditions wont rapidly get out of control the way they did last year. The bad news is that supply remains tight and prices are still on an upswing and the likelihood of higher mortgage rates looms on the horizon.

Real estate pros say the real estate market this year wont match the fever pitch it reached in 2021, and the pace of home sales this year will be far less frenzied. As we move through the year, we will see slower sales activity, said Lawrence Yun, chief economist at the National Association of Realtors. Intense multiple-offer days are over people can take their time.

Theres no expectation that prices will fall, but our forecast suggests that price appreciation will slow, said Doug Duncan, senior vice president and chief economist at Fannie Mae. Duncan predicted that while prices wont repeat the meteoric 18 percent increase they sustained last year, they will still rise somewhere in the neighborhood of 7.5 percent. Thats not much of a breather, especially because interest rates will be rising at the same time, he pointed out.

Theres no expectation that prices will fall, but our forecast suggests that price appreciation will slow.

Theres still a lack of homes for sale, so it is a sellers market, but the houses that are overpriced are tending not to move, said Ralph DiBugnara, CEO of Home Qualified, an online real estate information and lending resource.

How Will Interest Rate Rises Affect Me

If you have a loan or mortgage that charges you a variable interest rate, you might find that the cost of your repayments go up.

Say you have a £130,000 mortgage that you want to pay off over 25 years. If the interest rate on the mortgage is 2.5%, the monthly repayment will be £583.

But if the interest rate is 0.25% higher the amount we raised Bank Rate in February 2022 the monthly repayment rises by £17 to £600.

If youre on a fixed rate you wont see any change until the end of your fixed period.

Its important to understand how a change in interest rates could impact your ability to pay. You can use a mortgage calculator to work out how your monthly payments might be affected.

If you have savings in a bank account that pays interest then you might see interest rates on your savings go up.

Also Check: 10 Year Treasury Vs Mortgage Rates