How Is My Mortgage Interest Rate Determined

Lenders determine your mortgage interest rate based on the type of loan you take out, your credit score, and the overall loan amount, as well as your down payment amount and the length of the loan.

- Loan Type: Government-backed loans are handled differently than conventional loans.

- : People with high credit scores generally receive lower interest rates. Although those with lower credit scores may still qualify, their mortgage terms may not be as favorable.

- Loan Amount: Your mortgage rate will be influenced by the total amount of money you need to borrow. Higher amounts tend to suggest higher interest rates.

- Down Payment Amount: A higher down payment can significantly lower your interest rate.

- Length of Loan: Long-term loans tend to bring lower monthly payments with higher interest rates, while short-term loans bring higher monthly payments and lower interest rates.

Summary Of Current Mortgage Rates

This week’s rate averages were lower for all loan types:

- The current rate for a 30-year fixed-rate mortgage is 3.05% with 0.7 points paid, 0.07 percentage points lower week-over-week. Last year, the average rate was 2.66%.

- The current rate for a 15-year fixed-rate mortgage is 2.30% with 0.7 points paid, a of 0.04 percentage points from last week. A year ago the average rate was 2.19%.

- The current rate on a 5/1 adjustable-rate mortgage is 2.37% with 0.4 points paid, down by 0.o8 percentage points from last week. The average rate was 2.79% last year.

- Categories

Which Mortgage Loan Is Best

The best mortgage for you depends on your financial situation and your goals.

For instance, if you want to buy a high-priced home and you have great credit, a jumbo loan is your best bet. Jumbo mortgages allow loan amounts above conforming loan limits which max out at $548,250 in most parts of the U.S.

On the other hand, if youre a veteran or service member, a VA loan is almost always the right choice.

VA loans are backed by the U.S. Department of Veterans Affairs. They provide ultra-low rates and never charge private mortgage insurance . But you need an eligible service history to qualify.

Conforming loans and FHA loans are great low-down-payment options.

Conforming loans allow as little as 3% down with FICO scores starting at 620.

FHA loans are even more lenient about credit home buyers can often qualify with a score of 580 or higher, and a less-than-perfect credit history might not disqualify you.

Finally, consider a USDA loan if you want to buy or refinance real estate in a rural area. USDA loans have below-market rates similar to VA and reduced mortgage insurance costs. The catch? You need to live in a rural area and have moderate or low income to be USDA-eligible.

Recommended Reading: 10 Year Treasury Vs Mortgage Rates

When Should I Lock My Mortgage Rate

Right now, mortgage rates are historically low, so its a good idea to lock your rate as early in the mortgage application process as possible. Rates move up and down from day to day, and knowing exactly where theyll move is impossible. A rate lock will protect you from potential interest rate increases, which could unexpectedly increase the cost of your home loan.

If youre concerned about interest rates dropping after you lock in your rate, ask your lender for a float down. With this option, you get the lower of the two rates. Pay attention to the fine print, though. Typically, you can only reduce your mortgage rate if it drops by a certain percentage, and there are likely to be fees associated with this option.

Cardinal Financial Company Best Non

Cardinal Financial Company, which also does business as Sebonic Financial, is a national mortgage lender with both brick-and-mortar locations and online service. It offers a diverse range of mortgage products, including conventional and government loans.

Strengths: Cardinal Financial is one of many mortgage lenders that accepts a down payment as low as 3 percent for a conventional loan . The lender also accepts lower credit scores for some government loans, which can make it easier to get approved for a mortgage.

Weaknesses: You wont find a breakdown of interest rates or costs on Cardinal Financials website youll need to fill out a form online to consult with a loan officer and get a rate quote.

You May Like: Mortgage Rates Based On 10 Year Treasury

Why Save Up For A Large Down Payment If The Mortgage Rate Is Higher

In most cases, a high-ratio insured mortgage will have a mortgage rate that is lower than a low-ratio mortgage with a down payment greater than 20%. Why bother saving up for a large down payment if you can make a small down payment and get an even lower mortgage rate? The answer lies in the cost of the mortgage default insurance, which isnt free.

CMHC insurance premiumscan add thousands of dollars to the cost of your mortgage. The cost of this mortgage default insurance will either need to be paid upfront or it will be added to your mortgage principal balance. Adding the cost of the mortgage insurance to your principal means that you will be paying interest on the insurance over time, adding on to the cost of your mortgage. The CMHC insurance premium will depend on the size of your down payment.

How To Find The Best Mortgage For You

Once youve decided which term is right for you, youll want to do your due diligence to find the best mortgage. Here are five kinds of mortgages to consider. Youll want to do some research and compare mortgage rates from several entities, which could include traditional banks, online lenders and mortgage brokers. Prepare by reviewing your credit report to confirm its correct and have an idea of how much you can afford to pay each month.

The good news is that any time of year can be a good time to shop for a mortgage. Mortgage rates are tied to the bond market, so there’s not a good or bad season, Moffitt explains. He adds that fees for a 10-year mortgage will be similar to those of other mortgages.

If you choose a mortgage with a longer repayment term and decide you want to pay it off faster say in 10 years calculate what your monthly payment would be if you had a 10-year mortgage rate and pay that amount each month. Be sure to instruct your lender to apply the extra funds to the principal. This is a good option for borrowers who want to pay aggressively but who dont want to be locked into higher payments.

Other useful tools:

You May Like: Can You Get A Reverse Mortgage On A Mobile Home

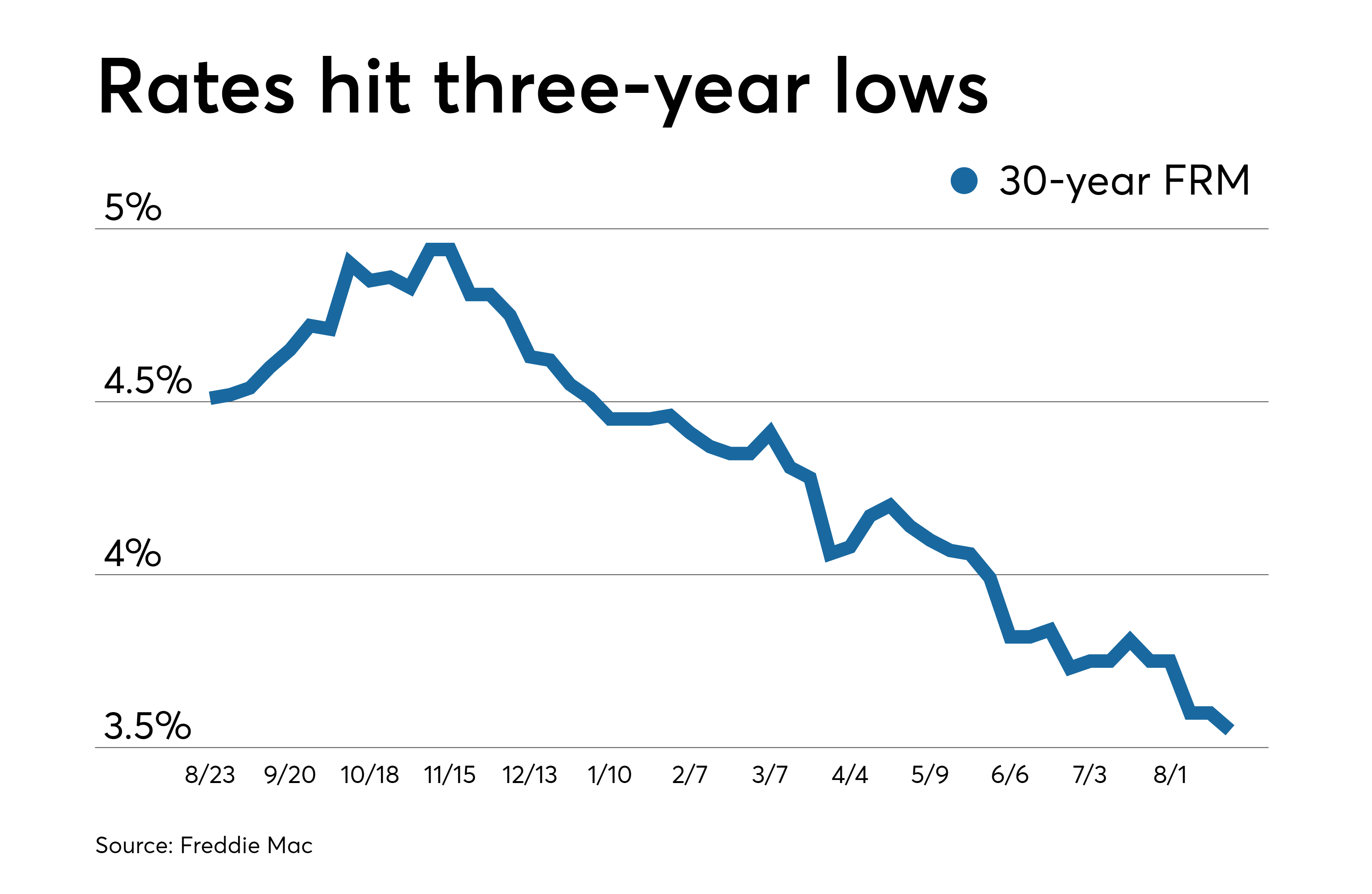

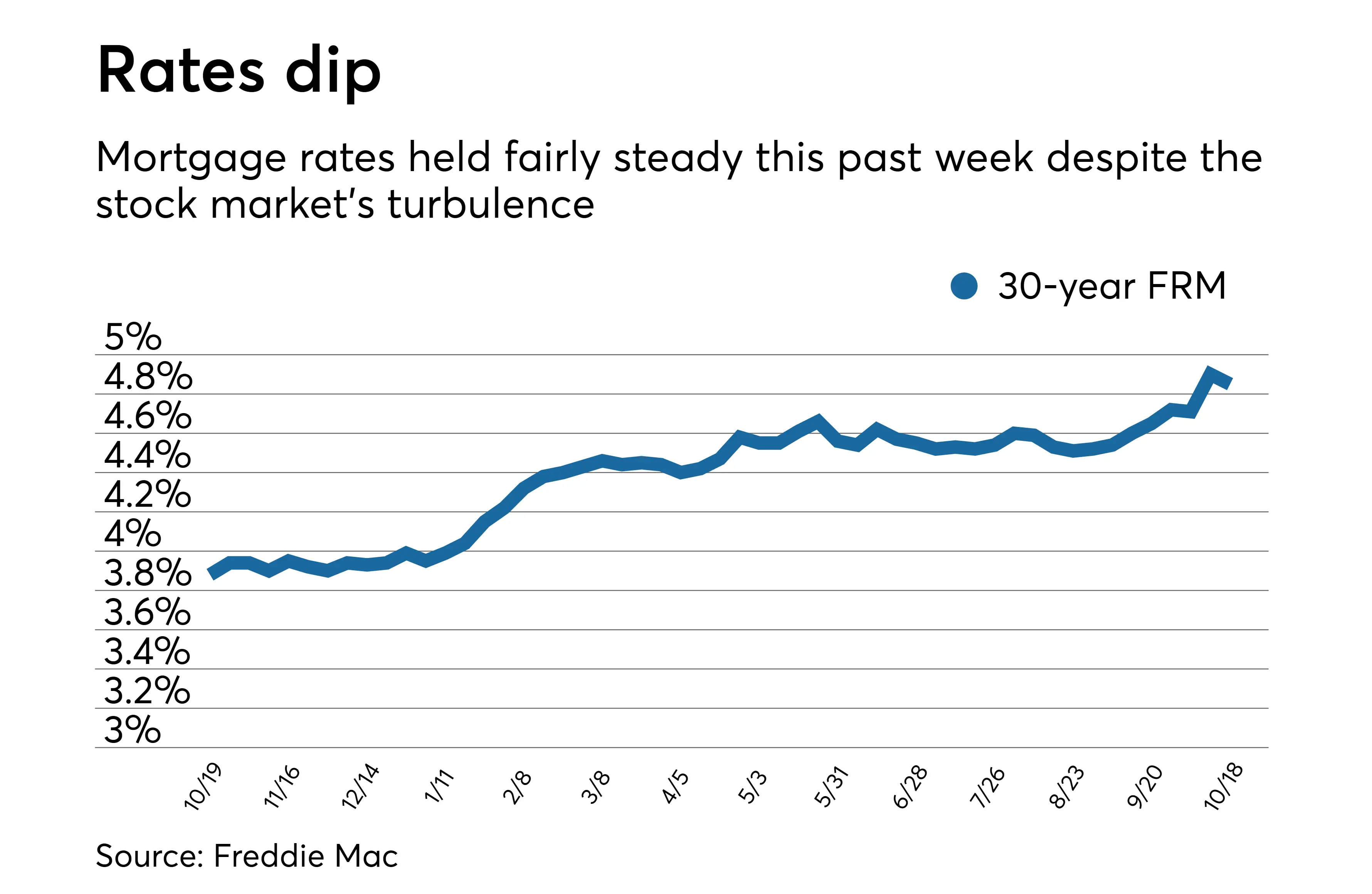

Average Mortgage Rates 2019 To Today

Since 2019, the real estate market has seen historic changes that have had a significant impact on mortgage interest rates. While rates remained relatively steady throughout 2019, the coronavirus pandemic changed the living priorities for millions of people, resulting in a rush of prospective homebuyers looking for a new home.

According to FreddieMac, a typical mortgage rate for a 15-year fixed loan in 2019 came with a 3.5% interest rate, down a half percentage point from the year before. Throughout 2020, however, mortgage rates saw a steep drop that followed the COVID-19 outbreak. By December of that year, the national average mortgage rate for a home purchase on a 15-year plan fell to 2.2%.

That trend continued in the early weeks of 2021, but ended with a rise in mortgage rates toward the end of January. As you can see in the graphs above, current mortgage rates can heavily fluctuate from year to year.

About Our Data Source For This Tool

The lenders in our data include a mix of large banks, regional banks, and credit unions. The data is updated semiweekly every Wednesday and Friday at 7 a.m. In the event of a holiday, data will be refreshed on the next available business day.

The data is provided by Informa Research Services, Inc., Calabasas, CA. www.informars.com. Informa collects the data directly from lenders and every effort is made to collect the most accurate data possible, but they cannot guarantee the datas accuracy.

Read Also: Rocket Mortgage Requirements

How Are Mortgage Rates Impacting Home Sales

The total number of mortgage applications inched lower during the week ending December 17, 2021. The 0.6% decline was driven by a decrease in the number of purchase loan applications, according to the Mortgage Bankers Association.

- The total number of purchase loan applications decreased by 6% week-over-week, breaking a five-week run of increases. Compared to the same week last year, there were 9% fewer applications.

- Refinance applications, on the other hand, increased by 2% from the week prior but were 42% lower year-over-year. Refis made up a little over 65% of all applications.

What You Can Do To Protect Yourself If Interest Rates Rise

If the interest rate rises, your payments increase. Make sure that you can adjust your budget in case your payments increase.

Ask your lender if they offer:

- an interest rate cap: a maximum interest rate your lender can charge on a mortgage. You never have to pay more in interest than the maximum cap, even if the interest rates rise

- a convertibility feature: where, at any time during your term, you can convert or change your mortgage to a fixed interest rate

Note that if you choose a convertibility feature and change your mortgage to a fixed interest rate:

- you usually have to pay a fee

- certain conditions may apply

You May Like: Rocket Mortgage Qualifications

Year Mortgage Rate Forecast For 2021 2022 2023 2024 And 2025

| Month |

| 31.1% |

30 Year Mortgage Rate forecast for .Maximum interest rate 3.14%, minimum 2.96%. The average for the month 3.05%. The 30 Year Mortgage Rate forecast at the end of the month 3.05%.

Mortgage Interest Rate forecast for .Maximum interest rate 3.07%, minimum 2.89%. The average for the month 3.00%. The 30 Year Mortgage Rate forecast at the end of the month 2.98%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.02%, minimum 2.84%. The average for the month 2.94%. The 30 Year Mortgage Rate forecast at the end of the month 2.93%.

Mortgage Interest Rate forecast for .Maximum interest rate 2.98%, minimum 2.80%. The average for the month 2.90%. The 30 Year Mortgage Rate forecast at the end of the month 2.89%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.10%, minimum 2.89%. The average for the month 2.97%. The 30 Year Mortgage Rate forecast at the end of the month 3.01%.

Mortgage Interest Rate forecast for May 2022.Maximum interest rate 3.25%, minimum 3.01%. The average for the month 3.11%. The 30 Year Mortgage Rate forecast at the end of the month 3.16%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.37%, minimum 3.16%. The average for the month 3.24%. The 30 Year Mortgage Rate forecast at the end of the month 3.27%.

Mortgage Interest Rate forecast for .Maximum interest rate 3.42%, minimum 3.22%. The average for the month 3.31%. The 30 Year Mortgage Rate forecast at the end of the month 3.32%.

Bettercom Best Online Lender

Better.com, an online mortgage lender also known as Better Mortgage, is one of Bankrates top lenders overall, and also a best lender for refinancing and cash-out refinancing.

Strengths: Better.coms digital home loan process allows you to get a preapproval in as little as three minutes and view 20-year and other mortgage rates online. The lender doesnt charge origination or hidden fees, either.

Weaknesses: If youre looking for an in-person experience when you get a mortgage, youll need to look elsewhere, as Better.com has no brick-and-mortar locations.

Don’t Miss: Rocket Mortgage Conventional Loan

What Is A Mortgage

A mortgage is a type of secured loan that is used to purchase a home. The word mortgage actually has roots in Old French and Latin.. It literally means death pledge. Thankfully, it was never meant to be a loan you paid for until you died , but rather a commitment to pay until the pledge itself died .

You can also get a mortgage to replace your existing home loan, known as a refinance.

What Are Prepayment Options

Prepayment options outline the flexibility you have to increase your monthly mortgage payments, or pay down your mortgage principal as a whole. The monthly prepayment option is a percentage increase allowance on your original monthly mortgage payment.

For example, if your monthly mortgage payment is $1,000 and your prepayment allowance is 25%, then you can increase your monthly payments up to $1,250. The lump sum prepayment option on the other hand, applies to the original mortgage amount. So, if your lump sum prepayment allowance is 25% on a $100,000 mortgage amount, then you can pay $25,000 off the principal every year.

Recommended Reading: Rocket Mortgage Launchpad

Do I Need To Pay A High Mortgage Interest Rate

You can usually pay discount points to lower the rate you’re offered. These points are essentially a form of prepaid interest. One point equals 1% of the total loan balance, and it lowers your interest rate for the life of your mortgage. The amount it lowers your rate depends on your individual lender and the current market.

This is often called buying down your rate. Calculate your break-even pointthe time it will take for you to recoup the costs of the points you purchasedto determine if this is the right move for you. Will you be in the home long enough to make it worthwhile? The longer you plan to live there, the more that paying discount points makes sense.

You can also negotiate your mortgage interest rateit doesn’t hurt to ask whether the lender can make a better offer, and you could save a significant amount over the term of the loan.

How Much Will I Need For A Down Payment

The minimum youll need to put down will depend on the type of mortgage. Many lenders require a minimum of 5% to 20%, whereas others like government-backed ones require at least 3.5%. The VA loan is the exception with no down payment requirements.

Generally, the higher your down payment, the lower your rate may be. Homeowners who put down at least 20 percent will be able to save the most.

Recommended Reading: Reverse Mortgage On Condo

Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate will not change during your mortgage term.

- A variable interest rate can change during your mortgage term.

Having a fixed rate means that your mortgage rate will not change until your mortgage term is over. You can choose to get a fixed-rate mortgage for a long term length if you think rates will increase soon, or for a short term length if you think rates will stay the same or decrease. The 5-year fixed rate mortgage is the most popular mortgage type in Canada.

On the other hand, avariable mortgage ratecan change at any time. Your mortgage payments will still stay the same, but what changes is the percentage of your payment that goes towards paying off the mortgage principal. If rates decrease, a larger amount of your monthly payments will be going towards your principal. This means that if interest rates decrease, youll be able to pay off your mortgage faster with a variable rate.

If interest rates rise, a larger amount of your monthly payments will go towards your mortgage interest. Your monthly payment amount is fixed for the duration of your term, so you wont have to pay more money if rates rise. However, your mortgage payments must be enough to cover at least your monthly interest cost. If interest rates increase significantly, where your mortgage payment no longer covers the interest cost, then your mortgage payment amount will need to be increased.

Mortgage Demand Falls As Interest Rates Surge To Multiyear Highs

- The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances increased to 4.27% from 4.09% for loans with a 20% down payment.

- Applications to refinance a home loan, which are most sensitive to weekly rate moves, fell 3% for the week, seasonally adjusted, and were 49% lower than the same week one year ago.

- Mortgage applications to purchase a home rose just 1% for the week and were 8% lower than the same week one year ago.

A sharp jump in mortgage rates last week soured demand from both current homeowners and potential homebuyers, causing mortgage applications to drop. With rates now back on the expected upward trajectory, following a brief drop at the start of the Russian invasion of Ukraine, mortgage volume is likely to fall further in the coming weeks.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances increased to 4.27% from 4.09%, with points rising to 0.54 from 0.44 for loans with a 20% down payment, according to the Mortgage Bankers Association.

“Mortgage rates continue to be volatile due to the significant uncertainty regarding Federal Reserve policy and the situation in Ukraine. Investors are weighing the impacts of rapidly increasing inflation in the U.S. and many other parts of the world against the potential for a slowdown in economic growth due to a renewed bout of supply-chain constraints,” said Joel Kan, an MBA economist.

Read Also: 10 Year Treasury Yield And Mortgage Rates

Avoid Higher Rates With A Short

In a rising mortgage rate environment, there are certain strategies you can use to secure a lower interest rate. One is choosing a shorter loan term.

Homeowners who refinance from a 30-year mortgage into a 15-year mortgage often secure far lower interest rates. Just look at Freddie Macs survey as an example:

On November 18, 2021, 30-year fixed rates were averaging 3.10%. But 15-year fixed rates were averaging just 2.39% more than 50 basis points lower than a 30-year loan term.

And thats not unusual.

15-year fixed rates are almost always significantly lower than 30-year rates.

That represents a huge savings opportunity for homeowners who refinance into a 15-year mortgage. Doing so could easily save you thousands over the life of the loan.

Just keep in mind that 15-year loan terms come with higher payments. So youll need to compare your options and choose the loan type that makes the most sense for your monthly budget.