As You Pay Down Your Mortgage

In the long run, having a mortgage and paying it off as agreed can help you build a stronger credit profile.

A study by LendingTree found that U.S. borrowers saw an average credit score drop of 20.4 points after getting a mortgage. It took an average of 165 days after closing for credit scores to reach their low points, and another 174 to rebound. In total, the decline and rebound averaged 339 daysjust shy of a year.

While your score will likely drop initially, a track record of on-time monthly payments on the sizable loan will help to improve your score and trustworthiness as a borrower.

Do Mortgage Quotes Affect Credit Scores

- You can request free mortgage quotes from lenders without them pulling credit

- This will have absolutely no effect on your credit scores since youre only giving them a verbal estimate

- They may tell you that your credit scores could differ but its a perfectly fine starting point

- Once youve gathered several quotes you can take things a step further and let them run your credit if you wish to move forward

Weve discussed mortgage inquiries, but what about simple mortgage quotes?

Well, as long as the lender doesnt actually pull your credit, or uses a service that only results in a soft inquiry, it wont affect your credit in the slightest.

Assuming youre just calling around and comparing rates from lender to lender, or broker to broker, your credit will remain untouched.

Theres nothing wrong with just giving these folks a ballpark FICO score and seeing what rates they quote you.

Sure, your actual credit scores may fluctuate if and when you apply, but its pretty easy to check your credit for free these days and use that as an estimate.

Your actual scores shouldnt be too different since these free services come straight from the credit bureaus, so this is a fine alternative to shop without letting lenders dig into your actual credit report and scores.

Once you have a better idea of which mortgage lender you want to move forward with, you can let them pull your actual credit report and lock in pricing.

How Mortgage Rate Shopping Affects Your Credit Score

A credit inquiry occurs when a lender or other entity checks your credit.

Too many inquiries could have a significant impact on your credit score. It tells the lender that you are aggressively seeking credit.

That could mean you are in financial trouble, or that you are about to get in over your head in debt.

According to MyFico, consumers who have six or more inquiries are eight times more likely to declare bankruptcy than people with no inquiries at all.

Seeking too much credit in a short period, then, drags down your credit score. A lower credit score typically means a higher interest rate, and a harder time getting a mortgage.

For most people, though, a hard credit pull affects their credit scores by less than 5 points.

The negative impact will vary according to the type of creditor behind the inquiry, the type of loan, and the strength of the homebuyers current credit profile.

Read Also: How Does The 10 Year Treasury Affect Mortgage Rates

Can A Mortgage Inquiry Lower Your Credit Score

Either way, one credit inquiry will likely only lower your credit score by five points or less, so it may not even be a concern if you already have a solid credit score. Of course, mortgage inquiries can and will affect consumers differently based on their credit profile, so theres no absolute rule in terms of impact.

How Does Mortgage Pre

A pre-approval works by using verified information to approve you, as a buyer, for a mortgage loan. You should always contact a lender to see what loan amount you can qualify for before house hunting.

A mortgage expert will review your financial documents and use the information to determine what you are eligible for, go over your loan options, and provide a detailed estimate, including interest rate, closing costs, and your monthly housing payment.

All the information they review in the pre-approval process determines the mortgage amount and interest rate you qualify for currently.

The pre-approval reviews details like:

- Tax returns

- Housing payment history

Your pre-approval is typically good for 90 days. The mortgage and interest rate they provide give you a reliable amount to work with for your house hunting. It enables you to forecast your mortgage payments and accurately calculate the maximum property value you want to afford.

Don’t Miss: Chase Mortgage Recast

How Do Multiple Credit Inquiries Affect Your Score

Can multiple credit inquiries have a negative effect on your credit score? It depends on what kind of credit youre shopping for.

If youre rate shopping to find the best interest rate on something like a mortgage or an auto loan, the major credit bureaus and FICO understand that youre likely to have multiple credit inquiries on your account. Thats why multiple inquiries for the same type of credit are considered as a single inquiry if they occur within a specific time span. Older FICO scoring models consolidate inquiries made within two weeks, while the newest FICO score gives consumers 45 days to shop around for the best rates and terms.

If you apply for multiple credit cards in a short time period, each application will add a new hard credit inquiry to your credit report. This could make a big difference in your interest rates if you are on the border between good credit and excellent creditand its one of the reasons why its a good idea to wait at least 90 days between credit card applications.

How Does A Hard Inquiry Affect Your Credit Score

A single hard inquiry can shave up to 5 points off your FICO score. However, with the most-used FICO model, all inquiries within a 45-day period are considered as one inquiry when you are rate shopping, such as for mortgage, student and auto loans. Older FICO models and VantageScore, FICO’s competitor, also group inquiries for rate shopping, but into a 14-day period. A VantageScore spokesman said a hard inquiry can shave up to 10 points off a VantageScore.

Most lenders or card issuers will pull a credit report from just one of the three major credit bureaus Equifax, Experian or TransUnion. So the inquiry will show up on only one of your credit reports. The exception is for a mortgage, when all three credit bureaus are usually checked.

It is smart to limit hard inquiries. Before you apply for credit, check to be as certain as you can that you are likely to be approved so you don’t lose score points without getting the approval you seek. Avoid applying for credit on impulse. Consider whether a discount or bonus you are hoping to receive is worth the potential ding to your credit score. If you have excellent credit, a few points may not be a big deal. However, if you have borderline credit quality, think twice.

You May Like: Reverse Mortgage On Condo

How Much Deposit Will I Need

Were frequently asked about the amount of deposit borrowers with bad credit will need to put down. The deposit amount is normally determined by how much perceived risk the borrower poses to the lender and they may give you a higher credit score if you have a larger deposit.

Currently lenders will loan a maximum of 95% for residential properties, 85% for a buy to let property and 75% when it comes to bridging finance. So the minimum deposit you would need is 5%, although there are a handful of lenders who will lend 100% mortgages known as Guarantor Mortgages or Family Deposit Mortgages.

How Do Inquiries For Mortgages Auto Loans And Other Loans Impact Your Credit Score

Hard credit inquiries, like other information on your credit reports, are seen by the major consumer credit scoring models, FICO® and VantageScore®. Having multiple hard inquiries within a short period of time can be predictive of credit risk, so having too many inquiries for different types of credit can result in a lower credit score.

While all hard inquiries resulting from loan applications were once considered separate events by credit scoring models, that hasn’t been the case for many years. FICO® and VantageScore have evolved in their treatment of multiple inquiries as a way to avoid unfairly penalizing a consumer for being a smart rate shopper.

In the contemporary versions of FICO®’s credit scores, for example, hard inquiries related to mortgage, auto loan and student loan applications are entirely ignored for 30 days from the date of the inquiry. So if you settle on a loan during that 30-day time period, your scores will not be affected by inquiries.

After those inquiries have aged past 30 days, they still may not be counted as independent inquiries by credit scoring models. That’s because FICO® considers similar loan-related inquiries that have occurred within 45 days of each other as a single inquiry in the scoring process.

In VantageScore’s credit scoring systems, all hard inquiries that occur within 14 days of each other are considered as one inquiry for the scoring process. This applies to all hard inquiries, regardless of the lender.

Also Check: Chase Recast Mortgage

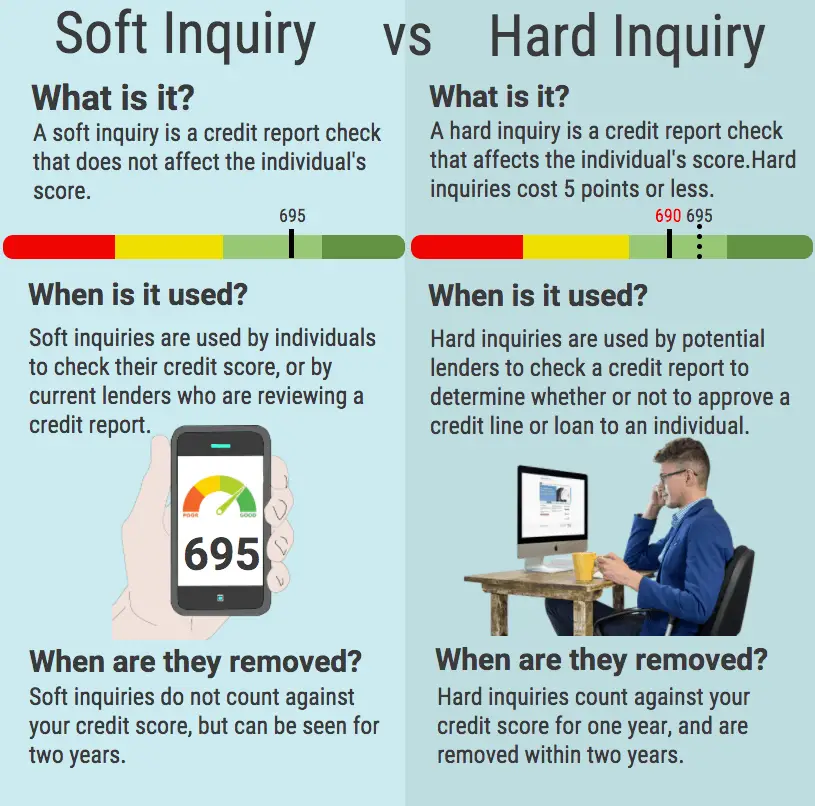

Hard Inquiries Vs Soft Inquiries

The essential difference between a hard inquiry and a soft inquiry is whether or not you gave the lender permission to check your credit report.

Generally speaking, if you let a lender scrutinize your credit report, its a hard inquiry. If a lender or bank peers into your credit report without your knowledge or permission, its a soft inquiry.

As far as your credit score is concerned, soft inquiries are harmless and will mostly go unnoticed. Hard inquiries, however, can leave a mark on your credit report, especially for anyone rapidly applying for credit in a short time span.

How Many Times Can You Pull Credit For A Mortgage

Whether youre a firsttime homebuyer or homeowner looking to refinance, most borrowers worry about the impact multiple credit inquiries have on their credit scores.

After all, your credit score determines your interest rate, and a low interest rate can save you thousands of dollars during the life of your home loan.

The good news is, multiple inquiries from different lenders are typically counted as only a single inquiry as long as theyre made within the same 14 to 45 days.

So if youre concerned if rate shopping will hurt your credit, heres what to understand about multiple credit inquiries for a mortgage loan.

Read Also: Rocket Mortgage Conventional Loan

Practice Good Financial Habits

A good credit score starts with good financial habits. This will show lenders that you are a responsible borrower and can handle an additional credit account.

If you want to show lenders that you are a responsible borrower, commit to the following:

- Paying bills on time and in full

- Keeping track of balances

- Monitoring your credit score

What If Your Credit Score Goes Down Before Applying For A Mortgage

- Its possible to be negatively impacted by a credit inquiry such as a mortgage application

- It can push you below a key credit scoring threshold, such as from 625 to 619

- This could make you ineligible for a home loan or increase your interest rate

- In this case you could ask for an exception or take action to boost your scores

There are cases where a credit score just a few points lower could actually result in a higher mortgage rate, or completely jeopardize your loan application.

For example, a 620 FICO score is the general cutoff for Fannie Mae- and Freddie Mac-backed mortgages.

If for some reason one of your scores dropped from 625 to 619 just as you applied, you could be out of luck.

Assuming you find yourself right below a certain credit scoring threshold, you may be able to use an older credit report if all the information is the same other than the mortgage inquiries.

Or you can ask for an exception from the lender if theres a clear and compelling reason.

After all, it wouldnt be fair to penalize you simply for shopping around for the lowest mortgage rate, now would it?

Alternatively, you could take a few quick actions to boost your scores, such as paying off some debt to reduce your credit utilization.

Then look into a rapid rescore. Your loan officer or mortgage broker should have skills in this department to help.

You May Like: Rocket Mortgage Loan Types

Refrain From Applying For New Credit

You want to try not to apply for new credit while you shop around for a mortgage. New credit only makes up around 10% of your scores, but if you want the best rates possible, you’ll put yourself at the best advantage if you don’t open up a lot of new credit while you look for a new home.

For example, a new credit card application will trigger a hard inquiry, reducing your credit score a few points.

This might not seem like a big deal, but what if your scores hover close to the 620 range? It could affect your lender’s decision to grant you a mortgage. Furthermore, inquiries stay on your credit reports for 2 years. However, FICO® only considers credit history and inquiries from the past 12 months. Based on this information, you may want to avoid getting new credit a full year prior to shopping around for a mortgage.

The age of your accounts also gets taken into consideration. In other words, you’d rather have had a credit card for 5 years versus 5 weeks as you shop around for your mortgage.

How Do Hard Credit Inquiries Affect Your Credit Score

Multiple credit inquiries in a short period of time can hurt your chance of approval in two ways: they lower your score and can show lenders that you are hasty with credit decisions.

Most lenders will set a maximum credit inquiry limit that will deny you a loan if you surpass it.

Not all credit inquiries are created equal. When we talk about credit inquiries, we are either referring to a hard inquiry or a soft inquiry.

While both of these are used to gauge your score and risk level, they are very different when it comes to the impact on your score.

Read Also: Rocket Mortgage Launchpad

The Bottom Line: Getting Preapproved Is The Smart Move

If youre ready to buy a home, it makes sense to get preapproved with a mortgage lender today. Sellers will be more receptive to your offers, and having a preapproval letter means you wont waste your time looking at homes that are outside your price range.

If youre ready to start the homebuying process, be sure to get preapproved with Rocket Mortgage® today.

Get preapproved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Once Your Mortgage Is Finalized

Once your mortgage is finalized, youre officially a new homeowner. What does that mean for your credit score? In the beginning, your credit score will likely drop because credit scoring models dont yet have any proof that youll successfully make the payments. Another drop can occur due to the new account causing your average account age to decrease.

On the other hand, if you dont have any installment loans yet, a mortgage can improve your score by diversifying your .

Don’t Miss: Rocket Mortgage Requirements

What Is Mortgage Pre

A mortgage pre-approval is a letter from a lender that estimates how much you can borrow on a home loan. The pre-approval is based on details like your income, credit history, assets, and debts.

During the process, a loan officer will go over pre-approval documents such as your credit reports, recent pay stubs, personal bank statements, and your federal personal income tax returns.

Theyll use this information to determine whether you qualify for the mortgage loan and the amount you can receive.

- Mortgage pre-approval: Requires a more in-depth review of your finances to confirm your creditworthiness and determine the loan amount you qualify for.

- Mortgage prequalification: A lender gives you an interest rate quote based on information you tell them, usually without documentation.

What Is A Credit Inquiry And Who Can Make One

A credit inquiry is a formal request to see your credit report. Also known as a credit check, a credit inquiry is usually made by a financial institution such as a bank or credit card company. Employers, landlords and property managers can also check your credit. And you can inquire about your own credit as well.

The Fair Credit Reporting Act outlines your rights pertaining to your credit report and who can make a credit inquiry. It prohibits accessing your credit report unless there is a “permissible purpose” such as processing your application for a loan or insurance, or with your consent. The FCRA also lists the actions you can take if your rights are violated.

Don’t Miss: Mortgage Rates Based On 10 Year Treasury

Soft Inquiries Happen In The Background

Jacob Dayan, chief executive officer and co-founder of Chicago-based Finance Pal, said that soft inquiries often occur without you even knowing about them. This usually happens when creditors check your credit to see if you qualify for their credit card offers, Dayan said.

“If every time a creditor checked your credit for unsolicited reasons it dinged your credit score, everyone would have poor credit,” Dayan said. “Therefore, soft pulls do not harm your credit score.”

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

Don’t Miss: Rocket Mortgage Qualifications