How To Access A Chase Mortgage Account

KENNETH W. MICHAEL WILLS

As a customer with a mortgage through Chase Bank, you may access your account through the Chase Bank website, where you can review your account and pay your mortgage online. You must register for an online account, provide some personal information, obtain an identification number and create a password.

Visit the Chase Bank customer website and on the home page, click on the Go button. This is where you will enroll in the online account access program.

Input your social security number and your Chase Bank mortgage account number when they are requested. Then, select your preference for receiving the required personal identification code to access your account. Click the Next button to continue.

Check your email or answer your phone to secure your personal identification number. Once you have the identification number, continue from the enrollment page by inputting the identification number as requested, then clicking on the Next button.

Create a password as requested by the system to finish your enrollment, and then click on the Next button. This will take you to your account.

Review the My Accounts page and look for the Mortgage link. Click on that link and review your account.

About the Author

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Can I Pay Additional Money Towards My Principal And Have My Loan Re

Some loans qualify for a Principal Reduction Modification. PNC Mortgage will allow you to pay a minimum of $10,000 towards your principal and re-amortize your loan, which will reduce your monthly principal and interest payment. To find out if this option is available to you, please call one of our Customer Service Representatives at , or mail your request to:

PNC Mortgage

Dayton, OH 45401-8807

Don’t Miss: Rocket Mortgage Requirements

Can I Ask For A Quote To Redeem My Mortgage Online

You can get a redemption figure quote by logging on to online banking and from your mortgage account, selecting ‘Manage’ and Select changes. From here, youll then be able to ask for a redemption quote.

Your redemption figure will be generated within a few seconds, and will be available to download and print immediately.

This quote is for your indicative purposes only. Your solicitor will have to ask for an official redemption statement if necessary.

You can get a redemption figure quote by logging on to online banking and from your mortgage account, selecting ‘Manage’ and Select changes. From here, youll then be able to ask for a redemption quote.

Your redemption figure will be generated within a few seconds, and will be available to download and print immediately.

Transaction History Since Last Statement

This section details the date, description, and amount of all recent charges or credits to the account as of the borrowerâs last mortgage statement.

For example, your transaction activity could detail an escrow reimbursement or credit if, at the end of the year, your mortgage company determines you paid too much for property taxes or homeowners insurance premiums and have a surplus in your account.

Don’t Miss: Chase Recast Mortgage

If I Am Closing On My House Or Have Requested A Payoff Statement Do I Still Need To Make My Payment This Month

Yes. It is important that you continue to submit your monthly payment as you normally would.

If your payment is submitted using our Electronic Funds Transfer program, notify us at least 10 days in advance of the next scheduled draft so your EFT can be canceled. Should the payment be deducted from your bank account after your loan is paid in full, we will return it to you within two weeks. You may also go to PNC Online Banking to log-in to your secured account and cancel your existing EFT payment.

How Do I Initiate A Principal Reduction Modification

A letter of request must be submitted stating that you would like to have your monthly payment re-amortized. The letter and the fee should be mailed to:

PNC MortgageP.O. Box 1820Dayton OH 45401-1820

The lump sum principal payment is usually included, but can be made at any PNC Bank, if preferred. Once the principal balance has been reduced, a Loan Modification Agreement is prepared and sent to you for your signature. Once we receive the signed document, we update our database with your new payment amount.

Also Check: How Does 10 Year Treasury Affect Mortgage Rates

How Do I Find Out The Current Balance On My Mortgage

If youre registered for Online Banking, you can log in to your account and check the balance there. Youll find your mortgage in the list of accounts displayed on your Online Banking homepage. Just click on the ‘View information’ link for more.

You can also find it in the Barclays app. To register for the app youll need a current account with Barclays.

You can also call us on 0800 022 4022. Lines are open 8:30am to 5:30pm, Monday to Friday, and 9am to 1pm on Saturday. .

To maintain a quality service, we may monitor or record phone calls.

Yes We Offer An Array Of Options For Making Your Mortgage Payment Online

Yes, we offer an array of options for making your mortgage payment online.

It’s easy to make a mortgage payment using PNC Online Banking and there is no fee. Pay your mortgage from a PNC or non PNC Checking or Savings account by clicking Make a Payment from your account activity page. Make a one time payment for today or pay later with a future dated or recurring monthly payment.

You can automate your monthly mortgage payments and avoid writing checks and paying for postage each month. To authorize an automated payment, complete the online form and follow the mailing or fax instructions. Once you get setup, your mortgage payment is automatically paid each month on the same day.

Read Also: Does Prequalifying For A Mortgage Affect Your Credit

Why Use A Mortgage Company Instead Of A Bank

Mortgage companies sell the servicing. … Unlike a mortgage broker, the mortgage company still closes and funds the loan directly. Because these companies only service mortgage loans, they can streamline their process much better than a bank. This is a great advantage, meaning your loan can close quicker.

Did This Answer Your Question

Bank of Ireland is regulated by the Central Bank of Ireland. In the UK, Bank of Ireland is authorised by the Central Bank of Ireland and the Prudential Regulation Authority and subject to limited regulation by the Financial Conduct Authority and Prudential Regulation Authority. Details about the extent of our authorisation and regulation by the Prudential Regulation Authority, and regulation by the Financial Conduct Authority are available from us on request. By proceeding any further you will be deemed to have read our Terms and Conditions and Privacy Statement.

- About the group

Also Check: Can You Do A Reverse Mortgage On A Condo

Explanation Of Amount Due

The explanation of amount due is a further breakdown of the amount you owe for the current month. It will detail the following:

-

The principal payment, which is the portion for the current month thatâs paying off the remaining loan balance.

-

The interest payment, which is the portion for the current month being applied to interest on the remaining loan balance.

-

The escrow payment, which is the portion for the current month going into your escrow account. Your escrow account pays for property taxes, homeowners insurance, and private mortgage insurance if itâs required.

-

The total payment for the month, which is the sum of the previous three items.

-

Any fees, which could include charges like late fees.

-

The past due amount, which will be indicated if you still owe money from any previous monthsâ statements.

Does Pnc Mortgage Hold The Deed To My Property

No. You should have received a copy of the Deed after the closing on your loan when you purchased the property. The original Deed was sent for recording at the Recorder’s Office of the county in which your property resides. The Deed should then have been returned to you. You may obtain a copy of the recorded Deed from your County Recorder’s Office.

Don’t Miss: Bofa Home Loan Navigator

How Do I Pay By Mail

Use the form on your billing statement to make your monthly mortgage payments to PNC Mortgage.

If you misplace your billing statement, you can mail your payment to one of the following addresses:

WEST: AK, AZ, AR, CA, CO, HI, ID, IA, KS, LA, MN, MS, MO, MT, NE, NV, NM, ND, OK, OR, SD, TX, UT, WA, WY

PNC Mortgage Payments

How To Make A Mortgage Payment

Most lenders provide multiple ways of making your mortgage payments, including:

- Online: The simplest way to make payments is online through your loan servicers website. Consider setting up automatic payments to ensure you pay on time.

- : Your mortgage statement will probably have a portion that you can detach and return by mail with your payment. If paying by mail, allow enough time before your mortgage due date. If youre close to the due date or the end of the grace period, get a receipt from the post office or consider using next-day delivery.

- : Some lenders provide an option to call and make your mortgage payments over the phone. Just make sure your loan servicer doesnt charge a fee for this service.

- In person: If your lender or bank has brick-and-mortar locations, you can make your mortgage payments in person. Be sure to get a receipt. The law requires lenders to credit a payment the day you make it, so if your servicer charges a late fee, then the receipt will prove you paid on time.

Don’t Miss: Requirements For Mortgage Approval

When Does My Lower Payment Go Into Effect After The Principal Reduction Modification Has Been Completed

There is a six to eight week processing time before the new payment becomes effective. However, you will have the benefit of paying less interest immediately, so any payments made after the principal has been reduced and before the new payment amount becomes effective are applied to the principal balance of your loan.

How Can I Stop My Mortgage From Being Sold

How to Avoid Having Your Mortgage Sold. There is a clause in most mortgage contracts that says the lender has the right to sell the mortgage to another servicing company. 6 If you’re getting a notice that your loan is being sold, you have two options: go along with it, or refinance with another company.

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

I Already Sent My Monthly Payment To My Previous Servicer Will My Payment Be Forwarded To Pnc

After the effective date of transfer, your previous servicer may either forward your payment directly to PNC or return it to you. If your payment is returned, you will need to forward it to us. For 60 days after the effective date of transfer, you will not be charged a late fee if your timely payment is received by your previous servicer instead of PNC.

Confirm Your Security Profile

Please review the information below and confirm that everything is correct. It is important to remember the security questions that you chose and their corresponding answers. You will need them to restore your account or to set a new password if required. If all of the information is correct, please click continue to complete your registration by reviewing and accepting the My Mortgage Terms and Conditions.

Your My Mortgage username

Read Also: Chase Mortgage Recast Fee

How Can I Tell Who Owns My Mortgage

You can look up who owns your mortgage online, call, or send a written request to your servicer asking who owns your mortgage. The servicer has an obligation to provide you, to the best of its knowledge, the name, address, and telephone number of who owns your loan.

Its not always easy to tell who owns your mortgage. Many mortgage loans are sold and the servicer you pay every month may not own your mortgage. Whenever the owner of your loan transfers the mortgage to a new owner, the new owner is required to send you a notice.

If you dont know who owns your mortgage, there are different ways to find out.

Im Part Of A Joint Application

Our mortgage offers are valid for 6 months. Once the first applicant has accepted the offer, you have two weeks for the second person to complete the process too. If both parties dont sign the document in this time, the offer will need to be reissued. To reissue your offer document, please log in to your application.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

Setting Up Your Account Is Easy To Begin You Simply Need:

Every time you log in to My Mortgage, you will need a username and password. The email address that you provide below will act as your username. Please set a secure password for all future log ins.

Must contain at least 8 characters, including one uppercase letter, one lowercase letter and one number.

What Is A Mortgage Statement

Mortgage lenders are legally required to provide consumers with a mortgage statement for each billing cycle of their loan. Each mortgage statement includes up-to-date information about the loan, including the principal balance, interest rate changes , current payment amount and the payment breakdown.

In the past, the layout of mortgage statements and the information on them varied greatly between lenders. But the Dodd-Frank Act, passed as a direct result of the 2008 financial crisis, changed that. Now, mortgage servicers follow a standardized model for mortgage statements, and they must include specific loan information.

Also Check: Chase Mortgage Recast

Tracing Old Mortgage Accounts

The charges register held by the Land Registry contains the details of all mortgages secured against a property. It will only name the lender and the address of their head office, but it will give you a start.

Please note that you may have trouble obtaining the information due to the Data Protection Act and your daughter may have to make the application.

If this fails then she may be able to get copies of her bank statements for the relevant period and if she was paying by standing order or direct debit these could show the lender and the account number.

Answers provided in response to Ask the experts are based on the information provided and do not constitute advice under the Financial Services & Markets Act. They reflect the personal views of the authors and do not necessarily represent the views, positions, strategies or opinions of John Charcol. All comments are made in good faith, and John Charcol will not accept liability for them.We recommend you seek professional advice with regard to any of these topics where appropriate.

Make A Mortgage Payment

Keep your budget on track knowing your mortgage payments are made on time, every time. Key has several convenient payment options for you to make your payments as quickly and easily as possible.

If youre having trouble making payments on a KeyBank mortgage, home equity loan or home equity line of credit because of the coronavirus pandemic, you can ask for deferral. For information on other assistance options, please visit KeyBanks Borrower Assistance page.

Don’t Miss: How Much Is Mortgage On A 1 Million Dollar House

Switch Deals Manage Overpayments Or Change Term

Use our online Mortgage Manager to:

-

Switch to a new dealApply for a new mortgage deal and work out if you’ll pay any Early Repayment Charges .

-

Change your mortgage termApply to extend or reduce the length of your mortgage.

-

Manage overpaymentsMake overpayments, change your regular overpayments, or manage your preferences.

-

Get a property value estimateGet an idea of what your property might be worth based on the prices in your area.

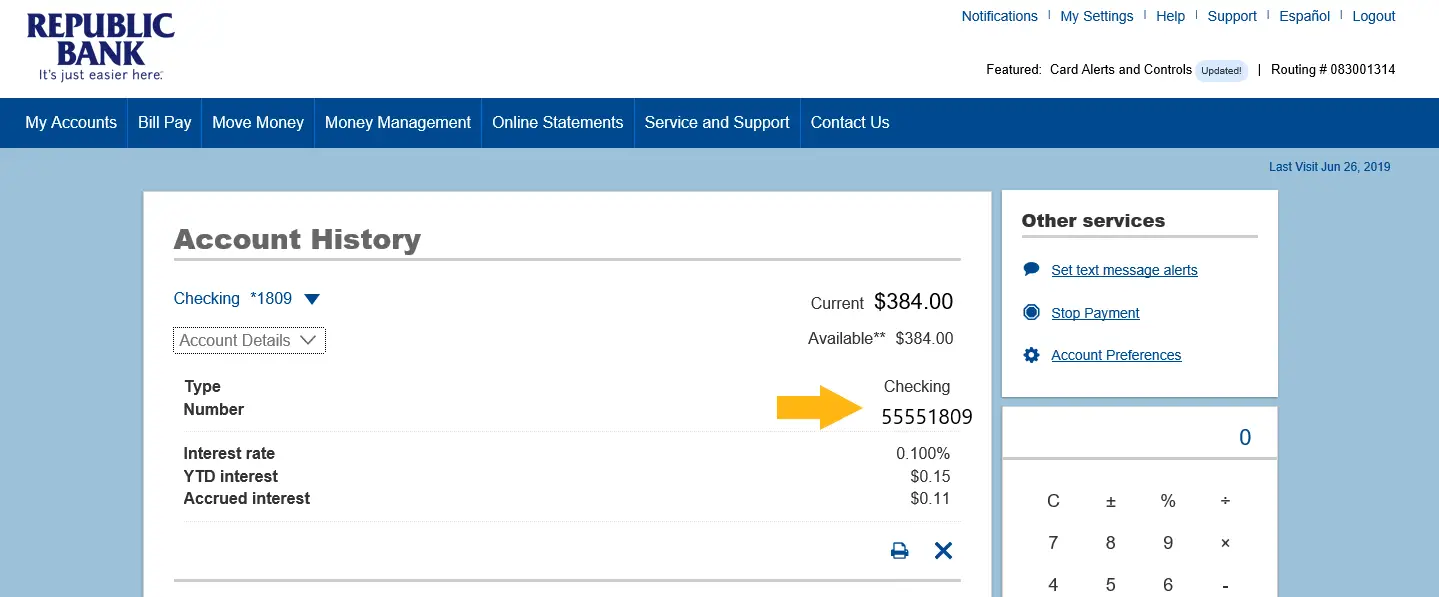

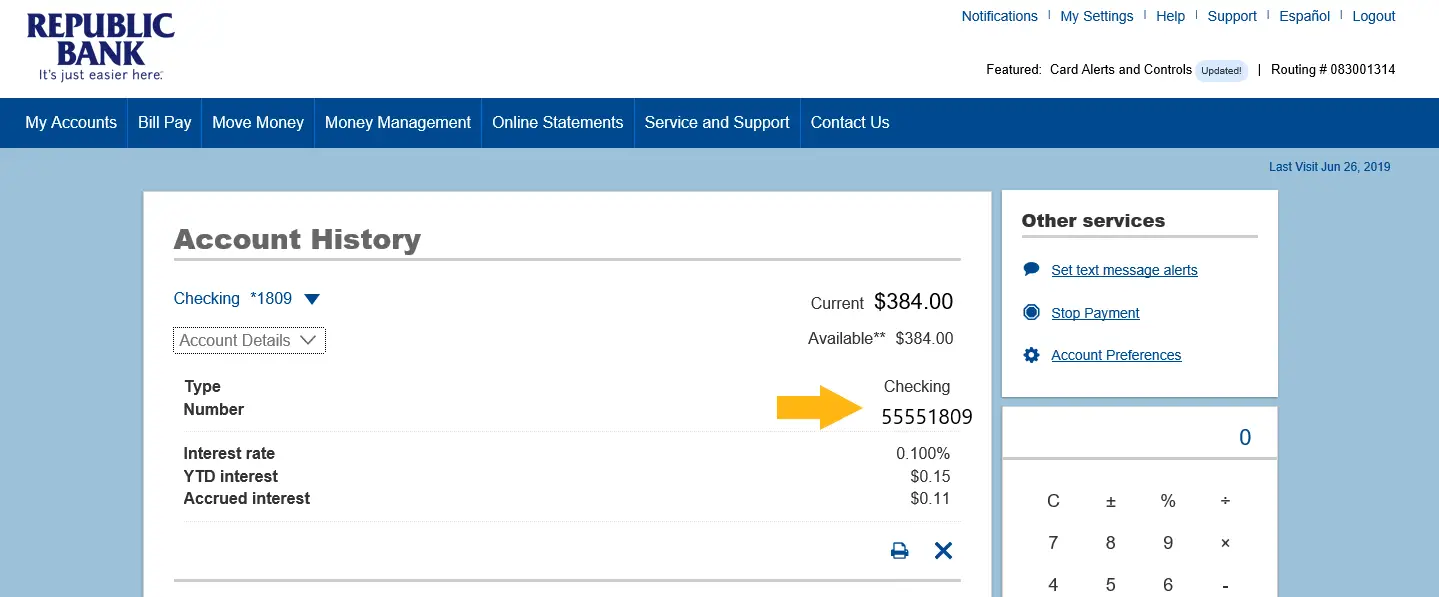

How Do I Set Up My Online Account For The First Time

To create a new account select Register Now from the Login page. You will need your ten-digit loan number to set up your account the first time, which can be located on your monthly mortgage statement or Welcome Letter. If you have trouble logging on, please contact our Customer Care representatives at 855-690-5900. We are available to assist you Monday through Friday from 8 a.m. to 10 p.m., and Saturday from 9 a.m. to 6 p.m. Eastern Time.

Read Also: Reverse Mortgage On Condo