The Bad Credit Mortgage Market Analysed

When Which? Money looked at nearly 5,000 residential mortgage deals in January 2019, we found that one third of them were available to customers with past credit issues. The majority of these deals were:

- 75% LTV or lower meaning you would need at least a 25% deposit to qualify.

- Fixed-rate mortgages with introductory periods of two or five years.

Read the full report to find out more: getting a mortgage with bad credit in 2019

Other Factors That Could Affect Eligibility

Although a provider will look at your credit history when assessing your application, they might also base their lending decision on the following variables

- Your income and employment status:The more you earn, the more you could borrow, but how you make your money will also be of interest to the provider when theyre calculating the size of your mortgage. A specialist provider might be needed if youre self-employed or are hoping to get a mortgage based on bonuses, overtime or commission. Furthermore, there are specialist lenders for customers who are looking for a mortgage on low income.

- Your age:Some providers wont cater for borrowers over 75, others 85 and a minority will lend with no upper age limit, as long as theyre confident the borrower will be capable of repaying their loan debt in retirement.

- Your outgoings:Other significant outgoings may affect the amount youre able to borrow.

- The property type:Properties with non-standard construction might require a specialist.

What Is Bad Credit

Your is an electronic document containing your financial history that lenders can see if you apply for credit like a mortgage, loan or credit card.

Being rejected for credit historically doesnt always mean that you have a poor credit score, as different lenders have their own criteria for deciding which applicants to lend to.

However, certain factors may suggest you are a higher risk borrower than the average person. If your credit record includes missed payments, too much debt or problems like bankruptcy and CCJs, this is known as bad credit.

Also Check: Will Mortgage Pre Approval Hurt Credit Score

Youve Built Up 20% Equity In Your Home

One of the benefits of FHA loans is that they only require 3.5% down. However, you are required to pay a mortgage insurance premium over the full term of the loan. Once youve reached 20% equity in your home, you may be able to refinance into a conventional loan and eliminate the FHA insurance premium, which typically costs 1.75% of the loan amount.

Increase Your Available Credit

Once you get a better handle on things and have started improving your score, increasing your available credit can help raise it a little faster. You can do this by either paying down balances or making a credit limit increase request. This effort helps increase your score because you will decrease your credit utilization, which is a huge factor in determining your credit score.

And guess what: Most credit card companies allow you to request as many increases as you like without it causing a hard pull on your credit.

Also Check: Does Rocket Mortgage Service Their Own Loans

A Backup Plan: Fix Your Credit And Then Refinance

If you find problems in your credit history after applying for a mortgage loan, it may be too late to increase your credit score. If you continue the home buying process, expect a higher monthly payment especially on a conventional loan.

But you may be able to refinance your mortgage in a few months or years after your credit score improves.

Refinancing could help you replace your existing mortgage with a new one that has a lower rate and better terms, once your finances are looking better.

What Is ‘bad Credit’

Having bad credit means that you have a low credit score. This can be due to missing repayments on loans or credit cards, or not paying bills on time.

You can get a bad credit rating if you have:

- A high amount of debt

- Been recently declared bankrupt

- Defaulted on payments

- Been served a County Court Judgement

In the UK, three main credit reference agencies hold a credit report on you. These are:

- Experian

- Equifax

- TransUnion

The information each one holds, and their scoring method may differ, but they should align in terms of giving you a good or bad credit rating.

If you have never taken out credit or any type of loan, you will not have a credit history. This makes it hard for CRAs to assess you and can lead to a low credit score.

Also Check: Are Discount Points Worth It

What Should I Do After Being Rejected For A Mortgage

If youâre rejected for a mortgage or any other type of credit, you should try and get as much information as possible about why your application was turned down. If your credit history influenced the decision there are steps you can take to try and help improve it.

You can read more about credit hygiene in this article about factors that affect your credit score. The key things to tackle are making repayments on time, settling outstanding debts, getting on the electoral register and making sure you donât have an excessive amount of credit available.

You should also avoid making multiple applications in a short space of time, as this can suggest that youâre desperate for credit. If youâre rejected for a mortgage, you might want to wait and assess your situation before trying again. Taking time to save for a bigger deposit or establishing a credit history could help improve your chances of a successful mortgage application.

If youâre interested in checking details of your credit history, you can get online access to yourEquifax Credit Report & Score which is free for 30 days and £7.95 monthly after that.

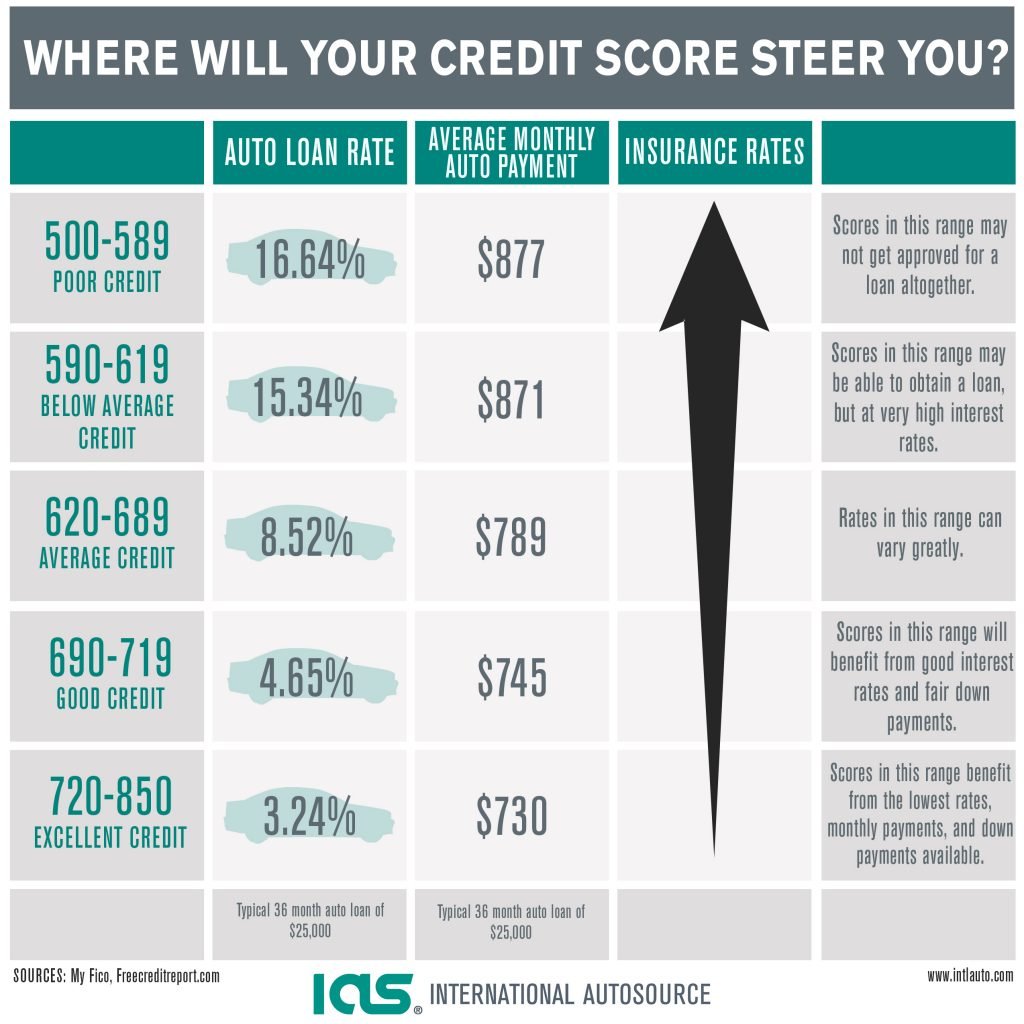

How Your Mortgage Rate Is Set

Interest rates are set partly based on your riskiness as a borrower. The riskier you are to a lender, the higher your interest rates will be. Mortgage lenders use credit scores to determine whether you qualify for the mortgage and to determine risk and the likelihood that you will default on your mortgage loan. The higher your credit score, the lower the risk that youll default on your loan, and the lower the interest rate youll qualify for.

A high credit score demonstrates responsibility with your previous credit obligations. Youve made your payments on time, youve kept your balances low, and youve avoided major credit blunders like debt collections and charge-offs.

A low credit score, on the other hand, is the result of falling behind on credit card payments, keeping high balances, and perhaps having major delinquencies on your credit record.

This chart illustrates the relationship between credit scores and interest rates, and how one impacts the other:

Read Also: Recast Mortgage Chase

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How To Improve Your Credit Score

So, its clear that a good credit score is one of the more important factors when trying to gain mortgage approval. Since its also a factor in calculating the interest rate youll be given, a favourable score can also save you thousands of dollars over the course of your amortization. Therefore, its best to get your credit score in the best shape you can manage before you apply with any lender. If your score is lower than 600-650, or you would simply like to improve it as much as possible, there are a few simple tricks you can use.

- Paying bills on time and in full

- Do not carry a large amount of unpaid debt

- Use no more than 30% of your available credit card limit

- Dont apply for too much new credit in a short amount of time

- Review a copy of your credit report for mistakes or signs of identity theft

- Consider a secured credit card if youre building from the ground up

Recommended Reading: Chase Recast Mortgage

You Want To Change Your Loan Term Or Type Of Mortgage

You may have originally opted for a 15-year fixed-rate mortgage but are now struggling with the higher monthly payments. Refinancing into a 30-year mortgage may lower your monthly payment. Another reason may be to change from an adjustable-rate mortgage to a fixed-rate mortgage, which will provide greater stability in terms of the monthly payment.

Sort Your Paperwork To Speed Things Up

Lenders need proof of your income before they can offer mortgages, so it makes sense to get your paperwork together in advance. Sending all the paperwork in one batch speeds up the process as it reduces the chances of your application being reviewed by more people.

If your lender won’t accept PDFs, uploads or printed internet bank statements, you may need your bank to send you original copies. Ask for these a few weeks in advance in case you need to wait for the originals to arrive.

Your lender may want to see any or all of:

Recommended Reading: Rocket Mortgage Launchpad

Why Is It Difficult To Get A Mortgage With Bad Credit

Since the credit crunch in 2008, affordability rules brought in by the Bank of England have forced lenders to be more careful when issuing mortgages. These rules mean its become more difficult to get a mortgage if you have a bad credit rating. If you have a history of not paying back money in full or on time, lenders will be more wary about lending you money. Thats especially true given how large the sums involved in mortgages are. Also, there are fewer lenders willing to offer bad credit mortgages, so theres less competition and less choice available.

What Is The Credit Score Needed To Refinance A Home Loan

Beyond credit score, it should also be taken into account if you possess the funds to pay closing costs and fees associated with refinancing, which includes any prepayment penalties your original lender may charge. You generally require at least 20% equity in your property to refinance as well it means you have made sufficient headway on your mortgage to own a part of the home.

Lenders check your debt-to-income ratio too, or your total monthly debt payments compared with your income. It is ideal for your debt obligations to be no more than 36% of your monthly earnings, though some lenders will accept a higher amount.

Don’t Miss: How Does Rocket Mortgage Work

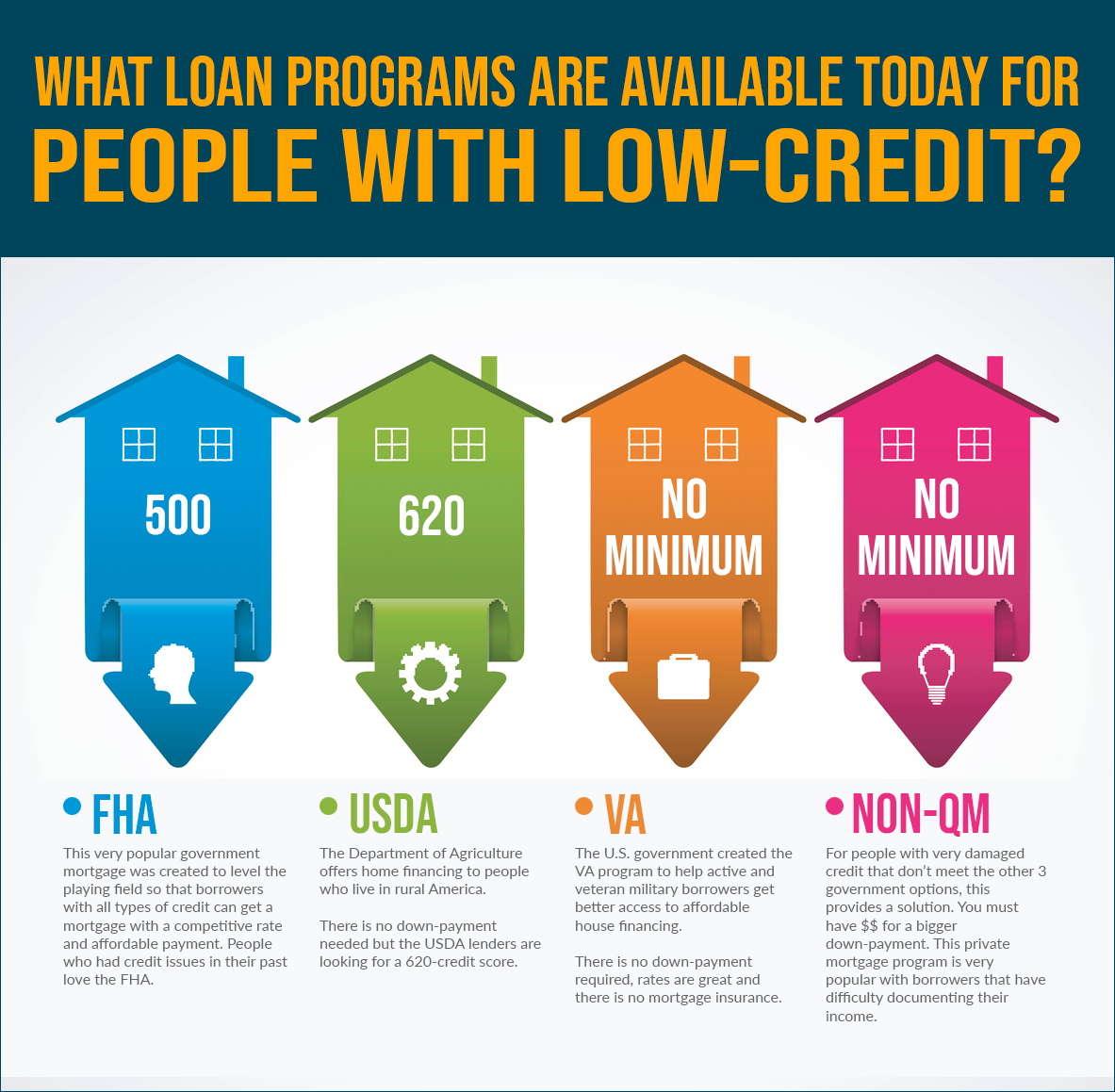

What Are My Mortgage Loan Options If I Have Bad Credit

If you have credit between 600 and 700, it is likely that any lender will work with you. However, if you have a score below 600, the large banks in Canada will not consider you for a mortgage loan. In this case, you will need to look for an alternate lender, and if you are working with a Mortgage Broker / private mortgage lender like The Mortgage Station, they will find solutions to meet your needs.

If you are looking to work with a Mortgage Broker, you will need to provide information such as:

- Permission for them to request your Credit Score

- Mortgage Application information

- Debt information

- Income information

You will also likely need to put down a larger down payment as the lender is taking a larger risk in helping someone out who has poor credit. While this may seem overwhelming, putting down a larger down payment will benefit you in the long run as you may receive a better mortgage rate, and avoid having to pay the high ratio mortgage insurance premium .

How To Refinance A Home With Bad Credit

When refinancing a mortgage, a borrowers goal is to get a lower interest rate, especially if market conditions have led to reduced rates overall, from the time you first took a home loan. However, you could be looking for something apart from reducing the interest rate for instance, to cash out a portion of the equity, transition to a fixed-rate loan, or get a loan term that is shorter. There are quite a few options for home refinance with bad credit, but it also means that lenders arent likely to offer you competitive interest rates.

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home

Fixing Or Preventing Bad Credit

Having bad credit is not the end of the world. It still may be possible for lenders to give you a loan, provided your credit score is not too low. But be aware that you may pay a higher interest rate and more fees since you are more likely to default . So its in your best interest to improve your credit score in order to get a lower interest rate, which can save you thousands in the long run.

Mortgage lenders look at the age, dollar amount, and payment history of your different credit lines. That means opening accounts frequently, running up your balances, and paying on time or not at all can impact your credit score negatively. Just changing one of these components of your spending behavior can positively affect your credit score.

There are ways you can improve your credit score, such as paying down your debts, paying your bills on time, and disputing possible errors on your credit report. But on the flip side, there are ways you can also hurt your score, so remember:

- DONT close an account to remove it from your report .

- DONT open too many credit accounts in a short period of time.

- DONT take too long to shop around for interest rates. Lenders must pull your credit report every time you apply for credit. If you are shopping around with different lenders for a lower interest rate, there is generally a grace period of about 30 days before your score is affected.

What Does Your Credit Score Mean

Your credit score is a number that reflects your creditworthiness. Banks, credit unions and other financial institutions use your credit score to determine your risk level as a borrower. To calculate your credit score, credit bureaus use formulas that weigh factors like:

- How many loan and credit card accounts you have and the remaining balances

- The age of your loan and credit card accounts

- If you pay your bills on time

- How much debt you have

- The number of times you’ve recently requested more credit

It’s easy to assume that you have just one credit score, but that isn’t the case. In fact, several organizations have their own credit scoring models. Lenders may rely on one or more to assess your creditworthiness, but mortgage lenders typically use the Fair Isaac Corporation model.

Lenders use credit scores to determine which home loans borrowers qualify for. In most cases, borrowers with a high credit score are eligible for home loans with lower interest rates and more favorable terms.

Also Check: Recasting Mortgage Chase

What Checks Do Lenders Make

When you apply for a mortgage, the lender will run a check on the Central Credit Register to see your credit history.

This credit report shows the lender your past and current credit commitments, and the way youve managed them.

Your outstanding credit, other outgoings, income, and number of dependants, will help them assess your affordability, and affect the amount you could borrow.

You can find out more about credit checks, credit scores and your credit check rights in our guide: How to check your credit record.

Do You Have Any Credit Problems Such As Judgments Or Defaults

- Im bankrupt declined

- Im a discharged bankrupt declined

- I have more than 2 defaults OR my defaults are over $1,000 in total OR my defaults are not yet paid declined

- I have 2 or less defaults AND my defaults total to less than $1,000 AND theyve been paid very high risk

- My credit history is clear! negligible risk

Read Also: Reverse Mortgage On Mobile Home

What Is A Bad Credit Mortgage

A bad credit mortgage is for borrowers with adverse credit, a poor credit score or low credit rating. Specialist providers will provide loans to bad credit applicants, although the rates and payments offered might be higher than for customers with clean credit. If you have enough income or a healthy deposit, it may be possible to find a competitive deal.

Specialists who sell niche financial products like this tend to be more flexible in their lending and decisions will be based on the age, severity and cause of the credit issue in question, as well as how likely they are to reoccur.

What Is The Minimum Credit Score Required For A Home Loan

Of course, private lenders are free to set their own credit score requirements, so there is no hard and fast rule specifying the minimum FICO score for a conventional loan. A survey of different lenders indicates that the minimum score may be around 620.

If you want an FHA or VA loan, youll need a credit score of at least 580. However, if you are willing to put down 10%, you can get an FHA home loan with a score as low as 500.

If your credit score is below 500, you may want to take steps to improve your credit, such as credit repair or debt management.

The process involves combing through your credit reports, which you can get for free from AnnualCreditReport.com, the only source authorized by federal law. Common mistakes include unknown accounts, unauthorized credit checks, and incorrect balances.

While DIY credit repair is possible, it is time-consuming and requires good organizational skills. Many consumers prefer to use credit repair companies to do all the heavy lifting with a credit bureau.

Typically, charge between $50 and $150 per month, depending on the level and aggressiveness of service. The usual subscription period is six months, but you can cancel or extend it as you see fit.

While these companies cant guarantee success, they commit to challenging a set number of questionable items each month. Your score should improve within two months after removing derogatory items that dont belong on your credit reports.

Recommended Reading: Rocket Mortgage Vs Bank