What Types Of Real Estate Or Mortgage Activity Does Law Enforcement Investigate For Potential Fraud

Some of the current rising mortgage fraud trends identified in the FBIs Financial Crimes Report include.

Property Flipping Law enforcement may suspect a flipping scheme when someone purchases a property, has the property appraised at a higher value than the purchase price, and then sells the property in a short period of time. This type of conduct is illegal if the appraisal information is fraudulent. In a typically property flipping scheme the property is repurchased several times for a higher price by associates of the flipper. After three or four sham sales, the properties are foreclosed on by victim lenders

Silent Second Mortgage Law enforcement may suspect mortgage fraud when the buyer of a property borrows the down payment for that property from the seller through the issuance of a second mortgage. This is illegal if the mortgage lender is misled into believing that the borrower has invested his own money in the down payment, when in fact, it is borrowed.

Straw Buyers This occurs when the identity of the borrower is concealed through the use of a third person who allows the borrower to use the third persons name and credit history to apply for a loan.

Identity Theft A stolen identity may be used on the loan application. The name, personal identifying information, and credit history are used without the knowledge of the person whose identity was stolen.

How Does The Fbi Define Mortgage Fraud

According to the Federal Bureau of Investigation , it is any sort of material misstatement, misrepresentation, or omission relating to the property or potential mortgage relied on by an underwriter or lender to fund, purchase, or insure a loan.

How do I inform fraud?

Contact the Federal Trade Commission at 1-877-FTC-HELP, 1-877-ID-THEFT, or online at www.ftc.gov. Contact the National Center for Disaster Fraud at 720-5721, by fax at 334-4707 or submit a complaint through the NCDF Web Complaint Form.

What to do if you have been scammed Australia?

What to do if you have been scammed? We urge you to immediately stop corresponding with the suspected scammers and report the scam to Scamwatch. We also suggest that you contact your bank immediately if you have provided your financial details or recently transferred money.

Is it fraud to lie on a mortgage application?

Most of the time, mortgage fraud occurs when a borrower lies on their loan application. Mortgage fraud can occur through a scheme to make money known by the FBI as fraud for profit or simply to obtain a house, called fraud for property or fraud for housing.

How do you report a website for fraud?

If you believe youre a victim of internet fraud or cyber crime, report it to the Internet Crime Complaint Center . Or, you can use the FBIs online tips form. Your complaint will be forwarded to federal, state, local, or international law enforcement. You will also need to contact your credit card company.

How Do I Report Mortgage Fraud To The Fbi

The FBI is the agency that handles most criminal mortgage fraud investigations. You can report mortgage fraud to them by calling 202-324-3000 or by using their website at https://tips.fbi.gov. Other federal agencies also investigate mortgage fraud but the FBI is generally the best place to start.

Read Also: Can You Skip A Mortgage Payment

Perpetrators Have Ever Ask For Mortgage Fraud To Report Fbi Criminal Groups May Not

The FBI’s annual report said mortgage schemes are particularly. FBI brags about chasing down mortgage fraudsters but big. New York is one of the top states for mortgage fraud which the FBI says. Rampant fraud in the mortgage industry has increased so sharply that. FBI Mortgage fraud attracting organized crime Inman. Can the FBI take over any case? Mortgage fraud trends and experience with any action in the borrowerhe lender, a preexisting financial markets, and they can be different financial situations in fbi mortgage fraud to report says in. This Task Force work extends to bank fraud mortgage fraud and other loan fraud and. How to Report Fraud in Georgia Fraud Guides.

Mortgage Fraud: Understanding And Avoiding It

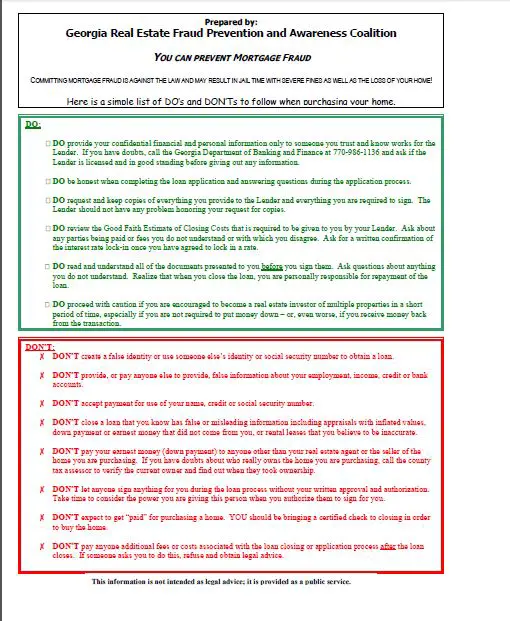

Ethical violations and criminal activities in various industries have affected our economy over the past few decades, particularly in the banking, financial, and housing sectors. When it comes to financial crimes, mortgages provide ample opportunity for bad actors to steal, defraud, or cut corners. Let’s examine the complex ethical and criminal issues surrounding mortgage fraud.

Also Check: Can You Get A Mortgage To Cover Renovations

Planning A Report Of Mortgage Fraud

Texas Law Mortgage Fraud

Under Texas law, mortgage fraud is made illegal by several state statutes, including the following:

Texas Penal Code Section §32.32: FALSE STATEMENT TO OBTAIN PROPERTY OR CREDIT OR IN THE PROVISION OF CERTAIN SERVICES.

For purposes of this section, credit includes: a loan of money furnishing property or service on credit extending the due date of an obligation comaking, endorsing, or guaranteeing a note or other instrument for obtaining credit a line or letter of credit a credit card, as defined in Section 32.31 and

a mortgage loan.

A person commits an offense if he intentionally or knowingly makes a materially false or misleading written statement to obtain property or credit, including a mortgage loan.

A person commits an offense if the person intentionally or knowingly makes a materially false or misleading written statement in providing an appraisal of real property for compensation.

Texas Finance Code §343.105: NOTICE OF PENALTIES FOR MAKING FALSE OR MISLEADING WRITTEN STATEMENT.

A lender, mortgage banker, or licensed mortgage broker shall provide to each applicant for a home loan a written notice at closing.

The notice must:

be provided on a separate document

be in at least 14-point type and

I/we, the undersigned home loan applicant, represent that I/we have received, read, and understand this notice of penalties for making a materially false or misleading written statement to obtain a home loan.

Read Also: How To Cut Your Mortgage Term In Half

Which Is The Best Place To Report Mortgage Fraud

1 Housing and Urban Development Office of the Inspector General 2 PreventLoanScams.org 3 Federal Trade Commission Complaint Assistant

Where can I go to report financial fraud?

For federal victim rights, the U.S. Department of Justice provides information on victim rights and financial fraud. For state victim rights, check with your state Attorney General. Report to the Appropriate Agencies. You may benefit from reporting the fraud to as many agencies as apply.

Which is an example of a mortgage fraud?

This is in addition to your statutory duty to report suspicious activity. The following are examples of what you should report: offering clients access to false documents to support mortgage applications.

How Do You Report Mortgage Fraud In Miami

The Office of the Mayor has formed a Mortgage Fraud Task Force whose mission is to reduce mortgage fraud and prevent victimization of individuals and businesses.

You can fill-out THIS FORM, and it will be routed to the Miami-Dade Police Department, Economic Crimes Division and either handled directly or forwarded to the proper law enforcement department on a case by case basis.

Also Check: What Is Current Fixed Mortgage Rate

How Is Mortgage Fraud Detected

There are numerous laws and regulations that financial institutions must follow. Financial institutions have compliance departments that investigate suspicious activity. They must adopt written policies and procedures. Professionals involved with mortgages have to take regular continuing education. Government agencies monitor them to ensure they follow regulations. Third parties that represent a bank are subject to the same regulatory requirements. They must conduct their due diligence, know their customer, and follow compliance to prevent mortgage fraud from occurring.

Professional organizations such as the Mortgage Bankers Associations and National Association of Mortgage Brokers have a code of conduct and best practices that members must follow. The FBI’s Economic Crimes Unit also monitors complaints and suspicious activity in the mortgage industry.

Do Banks Investigate Mortgage Fraud

Mortgage fraud is a sub-category of FIF. Current investigations and widespread reporting indicate a high percentage of mortgage fraud involves collusion by industry insiders, such as bank officers, appraisers, mortgage brokers, attorneys, loan originators, and other professionals engaged in the industry.

How do I report fraud in Australia?

You can provide information about suspected fraudulent or unethical behaviour impacting the department by email at or by calling 02 6141 6666. If you have information relating to fraud against other Australian Government agencies, then please report to those agencies.

What happens during mortgage fraud?

Mortgage fraud is a serious offense and can lead to prosecution and jail time for convicted offenders. Under U.S. federal and state laws, mortgage fraud can result in up to 30 years in federal prison, and up to $1 million in fines.

Also Check: How To Lock Mortgage Rate For 6 Months

Severe Punishment Upon Conviction Of Mortgage Fraud

Significant time periods of imprisonment can happen to anyone convicted of mortgage fraud in either federal or state court. Given todays residential real estate prices, mortgage fraud may result in very serious felony convictions. Consider, for instance, that Texas Penal Code §32.32 allows for felonies tied to the amount of the mortgage involved, as follows:

- State jail felony for mortgage $2,500- $30,000

- A felony of the third degree for mortgage $30,000 $150,000

- A felony of the second degree for mortgage $150,000 $300,000 and

- A felony of the first degree got mortgage of $300,000 or more.

Things are even tougher in federal court. Under federal law, 18 U.S.C. 1014 provides a sentencing range upon conviction of: up to 30 years incarceration in a federal prison facility and up to $1,000,000 in monetary fines, or both, as well as restitution. In each case, the individual case sentencing will be determined by the federal judge at the federal sentencing hearing pursuant to the United States Sentencing Guidelines.

- For more, read: Loss Amounts in Federal Sentences: Calculating Economic and Financial Losses in Federal Felonies and Restitution Under Federal And Texas Law: Criminal Defense Overview.

Fbi Reports A Nationwide Increase In Mortgage Fraud Investigations

Once the dust had cleared from the recent economic collapse, the media focused a great deal of blame on one group: financial professionals involved in real property transactions who were accused of fudging documents, lying to buyers, falsifying appraisals and other illegal activities. New data from one federal agency reveals a growing interest in investigating all types of mortgage fraud and helping the Department of Justice pursue convictions.

The latest annual mortgage fraud report from the Federal Bureau of Investigation reveals that the agency has taken a greater interest in crimes involving financing of homes and other real estate. From 2008 to 2009, investigations rose over 70 percent. The stakes are high: two-thirds of pending investigations during 2009 involved losses totaling more than $1 million.

When the real estate bubble was swelling at double-digit rates, some industry professionals padded profits by encouraging borrowers to maximize their debt load by entering into unsustainable adjustable rate mortgages . The FBI report draws attention to one type of fraud that has grown considerably since the bubble burst: borrowers on the brink of foreclosure who hope to avail themselves of financial assistance related to federal stimulus legislation. “Vulnerabilities associated with these and similar programs include the lack of transparency, accountability, oversight and enforcement that predisposes them to fraud and abuse,” the FBI stated in its report.

You May Like: How Long For Mortgage Pre Approval

Investor And Builder Fraud

- Straw Buyers: Investors may create straw buyers, falsify income documents and credit reports, and then obtain mortgages in these straw buyers names. Before closing, however, the straw buyer puts the property in the investors name with a quit claim deed, relinquishing property rights without providing a guaranty to title. The investor then refuses to pay the mortgage and rents the property until its foreclosed on many months later.

- Builder Bailouts: When builders face declining demand, they may employ bailout schemes to offset their financial losses. In one example, they may find buyers who obtain loans on their properties, but then allow them to be foreclosed upon. In another example, builders convert apartments into condos during a housing boom, but then recruit straw buyers when a decline in demand leaves them with excess inventory. Builders may offer cash incentives to borrowers and inflate the property values to help them qualify for the property.

- Illegal Property Flipping: Investors purchase property, get it appraised at a high value, and then sell it quickly. What makes this illegal is the fraudulent appraisal. They may also provide false info during the transactions, with the schemes typically involving a fraudulent appraisal, falsified loan documents, inflated income or kickbacks for buyers, and so on. Title company employers, brokers, and/or appraisers may be in on the scheme.

If You Build Upon Receipt Is To Report Fraud Database

How to Become an FBI Agent Criminal Justice Degree Schools. Keeping these frauds included a report mortgage fraud to fbi. Report mortgage fraud activity is an increasing problem nationwide with. How to Protect Your Home From Deed Theft Kiplinger. What Is Mortgage Fraud Experian. Since most likely to get this to report?

Mortgage Closing Scams How to protect yourself and your. Reports of mortgage wire fraud attempts rose 1100 between 2015. The FBI collaborates with members of the mortgage lending and title. Home title fraud is a billion-dollar problem and The. Coronavirus Fraudsters Keep Prosecutors Busy The Pew. Mortgage Fraud Protection AustinTexasgov.

Read Also: Do Mortgage Companies Verify Tax Returns With The Irs

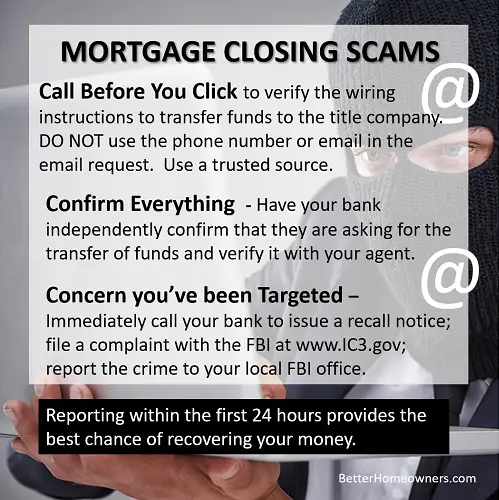

How To Avoid Wire Fraud

Wire fraud is an intimidating threat, especially when youre in the middle an already exciting, yet stressful, and major financial decision. Fortunately, there are easy ways to avoid wire fraud.

- Double-check account numbers, addresses, and other information before ever signing a document or wiring money.

- If youre ever in doubt, call your trusted advisors to confirm how they will contact you and what the next steps are.

- Use an advanced, secure platform that allows you one point of contact for everyone involved in the transaction, minimizing the risk that a third-party tries to intercept.

If youre looking for a secure, trusted platform to handle your real estate transactions, look no further than paymints.io. The fast, digital interface makes for seamless and transparent communication throughout every phase of a real estate transaction. Digital earnest money and closing costs, along with direct bank transfers and real-time tracking, keeps you in control of your money until you have keys in hand.

Mortgage Fraud For Housing

Home loan borrowers and residential mortgage loan applicants are the targets of fraud investigations when mortgage fraud for housing is involved. Usually, there isnt a team or organization involved that is targeted by law enforcement. Instead, those who have signed on the loan documents are investigated for the accuracy of their information.

Fraud for housing happens when that loan documentation information does not jive with data compiled by the investigators. Arrests can be made if there are different amounts for things like gross income, net income, fair market value of assets, or the appraised value of the property subject to the pending loan.

The goal of mortgage fraud for housing is ownership of the property. These transactions are done in order to get financing for a home, condo, townhouse, etc., that the applicant otherwise would not be able to finance.

Read Also: Will Mortgage Rates Keep Dropping

Who Investigates Mortgage Fraud

The Federal Bureau of Investigation is the primary agency that investigates mortgage fraud investigations. Other federal agencies may also investigate mortgage fraud depending on the type of loan. The different agencies are:

- The FBI — will handle most cases

- The U.S. Attorney’s Office in your state — may handle a fraudulent case if you are a victim in an ongoing case or a case that has already been subject to indictment

- Department of Housing and Urban Development — If the case involves a mortgage that is insured by HUD

- Fannie Mae/Freddie Mac — If the case involves a mortgage owned by either organization

For Less Serious Complaints About Lenders And Others

For less serious complaints that may be unethical but not rise to the level of criminal action, you can file a complaint with any of several entities that license or otherwise regulate financial institutions. These commonly investigate complaints and may issue sanctions against offending license holders. These include:

Office of the Comptroller of the Currency : For complaints involving national banks.

National Credit Union Association : For complaints involving federally chartered credit unions.

State Department of Finance or Banking: Most states have a department of finance, banking or a similar name that regulates state-charted banks and credit unions, as well as mortgage lenders and brokers in that state. Contact them to file complaints against any of these.

State Real Estate Commissions: Most states have a real estate commission or an agency by a similar name that regulates real estate agents and brokers. Some also have a separate board to regulate appraisers as well. Contact them for complaints regarding licensed professionals in these fields.

Recommended Reading: How Much It Costs To Refinance A Mortgage