Understanding The Fha Mortgage Insurance Premium

What is PMI or Primary Mortgage Insurance? Do I need it and can I get a mortgage without it? Bert Sanderfur answers your questions in our latest Youtube video!

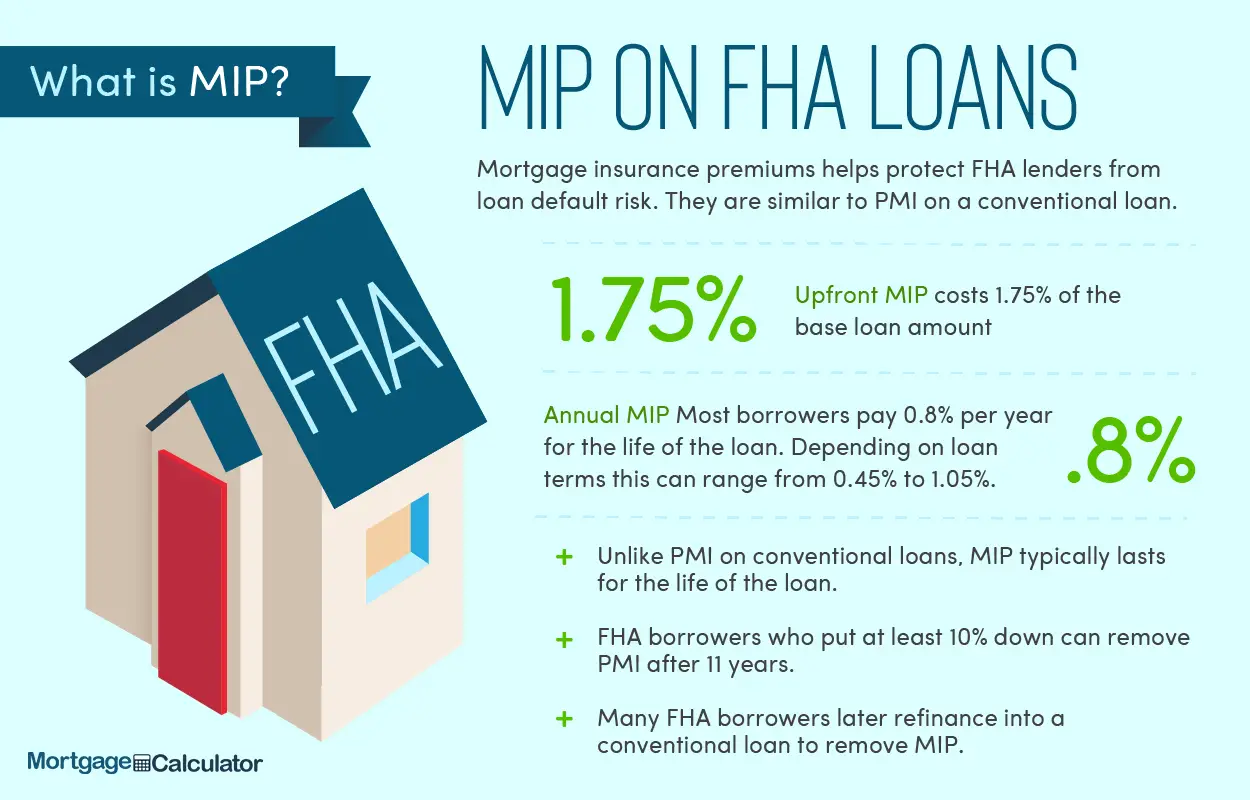

Mortgage insurance is a policy that protects lenders against losses that result from defaults on home mortgages. FHA requires both upfront and annual mortgage insurance for all borrowers, regardless of the amount of down payment. This information is reflective as of 1-1-17 and is subject to change per regulatory guidnace from The Department of Housing and Urban Development .

How To Remove Conventional Private Mortgage Insurance

You have more options to cancel mortgage insurance if you have a conventional loan with private mortgage insurance .

You can simply wait for your PMI coverage to drop off. Because of the Homeowners Protection Act of 1989, lenders must cancel conventional PMI when you reach a 78% loantovalue ratio.

Many home buyers opt for a conventional loan because PMI drops while FHA MIP does not go away on its own unless you put down 10% or more.

Keep in mind most mortgage lenders base the 78% LTV on their last appraised value and not the original value at the time of purchase.

If your property value has gone up substantially, contact your current loan servicer and check its requirements to cancel early.

The servicer may require a new appraisal, or rely on its own internal valuation tools to determine your homes uptodate value.

You can also cancel conventional PMI with a refinance.

The appraisal for your refinance loan serves as proof of current value. If your loan amount is 80% or less of your current value, you do not incur new PMI costs.

What Is Private Mortgage Insurance

Private mortgage insurance is a type of insurance that a borrower might be required to buy as a condition of a conventional mortgage loan. Most lenders require PMI when a homebuyer makes a down payment of less than 20% of the home’s purchase price.

When a borrower makes a down payment of less than 20% of the property’s value, the mortgage’s loan-to-value ratio is over 80% .

Unlike most types of insurance, the policy protects the lender’s investment in the home, not the individual purchasing the insurance . However, PMI makes it possible for some people to become homeowners sooner. For individuals who elect to put down between 5% to 19.99% of the residence’s cost, PMI allows them the possibility of obtaining financing.

However, it comes with additional monthly costs. Borrowers must pay their PMI until they have accumulated enough equity in the home that the lender no longer considers them high-risk.

PMI costs can range from 0.25% to 2% of your loan balance per year, depending on the size of the down payment and mortgage, the loan term, and the borrower’s . The greater your risk factors, the higher the rate you’ll pay. And because PMI is a percentage of the mortgage amount, the more you borrow, the more PMI youll pay. There are several major PMI companies in the United States. They charge similar rates, which are adjusted annually.

You May Like: Can You Do A Reverse Mortgage On A Mobile Home

Upfront Mortgage Insurance Premium Vs Annual Mortgage Insurance Premium

In addition to paying UFMIP, FHA borrowers are required to pay an annual mortgage insurance premium . The main difference between the two types of insurance premiums is that the UFMIP is a one-time payment due at closing, whereas the AMIP is an ongoing monthly expense.

The AMIP is calculated annually and paid on a monthly basis. The exact cost of the AMIP varies depending on the loan amount, whether you took out a 15-year or 30-year mortgage, and your current loan-to-value ratio. The total cost of the AMIP ranges between 0.45% and 1.05%.

| UFMIP | |

| One-time payment due at closing | Calculated annually and paid in monthly installments |

| 1.75% of the home purchase price | Varies depending on the loan amount, loan term, and LTV ratio |

Four Ways To Get Rid Of Pmi

Understandably, most homeowners would rather not pay for private mortgage insurance .

Luckily, there are multiple ways to get rid of PMI if youre eligible. Not all homeowners have to refinance to get rid of mortgage insurance.

Homeowners with conventional loans have the easiest way to get rid of PMI. This mortgage insurance coverage will automatically fall off once the loan reaches 78% loantovalue ratio .

Or, the homeowner can request that PMI be removed at 80% LTV instead of waiting for it to be taken off automatically when home equity reaches 22% .

When requesting PMI removal, the loantovalue ratio may be calculated based on your homes original purchase price or based on your original home appraisal .

Or, if your homes value has risen, you may be able to order another appraisal and remove PMI based on your homes current value.

Don’t Miss: Reverse Mortgage Manufactured Home

Refinance To Remove Fha Mip

Most FHA homeowners today have a loan with the following characteristics:

- Opened on or after June 3, 2013

- Less than 10% original down payment

- 30year loan

These FHA mortgage loans are not eligible for automatic mortgage insurance cancellation.

To stop paying mortgage insurance premiums youd need to refinance out of your FHA loan.

The good news is that there are no restrictions on refinancing out of FHA into a conventional loan with no PMI. Plus, there are never any prepayment penalties on FHA loans, so you can refinance any time you want.

You will need about 20% home equity to do so. To find your home equity, subtract your current mortgage balance from the value of your home.

You also need a credit score of at least 620 to refinance into a conventional loan with most lenders. The higher your credit score, the more you could save on your monthly mortgage payments.

Mortgage Insurance Premiums Defined

MIP is an insurance policy required on all FHA loans. Borrowers must pay upfront MIP at closing and will also have their annual premium added to their monthly mortgage payments.

UFMIP is equal to 1.75% of the loan amount. Annual premiums can range between 0.45 1.05% of the loan amount, depending on how much you borrow, how much you put down and your loan term. The one exception to this is if youre doing an FHA Streamline refinance on a loan that was endorsed prior to June 1, 2009. Well get more into all this in a minute.

On a conventional mortgage, mortgage insurance is referred to as private mortgage insurance . Borrowers with a conventional mortgage will pay PMI if they make a down payment less than 20%. This differs from FHA loans, on which youll pay mortgage insurance regardless of the size of your down payment.

Whats the purpose of mortgage insurance? Mortgage insurance helps offset the lenders risk when a borrower makes a low down payment, as lower down payments increase the amount of money your lender loses if you default . MIP and PMI insure the lender from this loss.

Also Check: What Does Gmfs Mortgage Stand For

How To Get Rid Of Fha Mortgage Insurance

Paying for FHA mortgage insurance for 11 years or longer might sound like a drag, but the expense doesnt have to last forever.

Many borrowers use FHA loans as a stepping stone that can help them reach the dream of homeownership, says Gary Acosta, co-founder and CEO of the National Association of Hispanic Real Estate Professionals. From there, they take steps to improve their credit scores and acquire more equity in their homes so they can refinance out of their FHA loan into a conventional loan with better terms.

The FHA is a wonderful starter loan but, at some point, it can also be beneficial to refinance out of it for lower monthly payments, including no or PMI, Acosta says.

Its also possible to get out of FHA mortgage insurance by paying down your mortgage, but that can take a significant amount of resources to do. Before paying off your loan, make sure to weigh the financial pros and cons.

Private Mortgage Insurance Coverage

First, you should understand how PMI works. For example, suppose you put down 10% and get a loan for the remaining 90% of the propertys value$20,000 down and a $180,000 loan. With mortgage insurance, the lender’s losses are limited if the lender has to foreclose on your mortgage. That could happen if you lose your job and can’t make your payments for several months.

The mortgage insurance company covers a certain percentage of the lenders loss. For our example, lets say that percentage is 25%. So if you still owed 85% of your homes $200,000 purchase price at the time you were foreclosed on, instead of losing the full $170,000, the lender would only lose 75% of $170,000, or $127,500 on the homes principal. PMI would cover the other 25%, or $42,500. It would also cover 25% of the delinquent interest you had accrued and 25% of the lenders foreclosure costs.

If PMI protects the lender, you may be wondering why the borrower has to pay for it. Essentially, the borrower is compensating the lender for taking on the higher risk of lending to youversus lending to someone willing to put down a larger down payment.

Also Check: Chase Recast Calculator

Do You Qualify To Eliminate Mortgage Insurance

You probably never wanted to pay mortgage insurance , but when you had dreams of buying a home, that added cost made it possible at the time. If youve been making your on-time mortgage payments for a while, though, you may be wondering when you can stop paying mortgage insurance or at least reduce your payments.

Has your home increased quite a bit in value since you got your original Conventional loan? The value might be high enough to allow you to have a new appraisal completed and then contact your lender to eliminate private mortgage insurance . Have your financial circumstances improved since you were approved for your FHA loan? You may be able to refinance into another loan product, like a Conventional loan, that doesnt come with lifetime mortgage insurance premium .

The bottom line? You have options. But first, its important to understand the differences between types of mortgage insurance and how they affect you. Whether you have PMI or MIP depends on what kind of mortgage you have. Read below to learn the differences between these two types of mortgage insurance.

What Is Mip Mortgage Insurance Premium Explained

If youre a first-time mortgage borrower, you might be asking yourself, What is MIP? Home buyers considering getting a loan from the Federal Housing Administration will find MIP, or mortgage insurance premium, especially relevant because all FHA loans require insurance.

Heres what you need to know about MIP, including the rate you can expect to pay and how these fees actually benefit home buyers who qualify for FHA loans.

Essentially, MIP is an insurance policy required by the government on an FHA loan. Since the down payment on FHA loans can be as little as 3.5% of the total price, the government requires added financial protection.

The purpose of mortgage insurance is to protect the lender, not the borrower, says Brian Sullivan, the supervisory public affairs specialist for the FHA. With FHA loans, the insurance is to protect the federal government in the event a borrower defaults on the mortgage.

Recommended Reading: Chase Mortgage Recast Fee

Advantages And Disadvantages Of Fha Mortgage Insurance

Here are some of the advantages of FHA MIP:

- Premiums are set FHA mortgage insurance premiums dont fluctuate according to credit score.

- Easier to qualify FHA mortgage insurance helps borrowers who might not otherwise qualify for a conventional loan. With MIP, mortgage lenders are able to absorb more risk and therefore extend loans to less-creditworthy borrowers.

- Lower down payment With the insurance, borrowers with a credit score of 580 and up can put down as little as 3.5 percent on an FHA loan. Those with scores between 500 and 579 can put down as little as 10 percent.

Here are some of the disadvantages of FHA MIP:

- Adds to overall loan cost The upfront and annual costs of FHA mortgage insurance increase both your total loan amount and monthly payment.

- Difficult to get rid of Generally, there are only a couple of ways out of paying for FHA mortgage insurance you can either refinance into a conventional loan or pay off your mortgage in full.

Fha Mortgage Insurance Premium

If you cant qualify for a conventional loan product, you might consider an FHA loan. Like some conventional loan products, FHA loans have a low-down payment optionas little as 3.5% downand more relaxed credit requirements.

Lenders require mortgage insurance for all FHA loans, which are paid in two parts: an up-front mortgage insurance premium, or UFMIP, and an annual mortgage insurance premium, or annual MIP. Both costs are listed on the first page of your loan estimate and closing disclosure.

Recommended Reading: 70000 Mortgage Over 30 Years

Fha Mortgage Insurance Faq

What is FHA MIP?

FHA MIP is the mortgage insurance program for FHA loans. It includes an upfront charge equal to 1.75 percent of the loan amount, as well as a monthly premium included in your mortgage payment. This insurance coverage protects FHA lenders, allowing them to offer competitive rates on FHA loans even when the borrower makes a small down payment and has only average credit.

Does FHA require PMI without 20 percent down?

PMI is required on conventional loans with less than 20 percent down. But the rules are different with FHA. All FHA loans require mortgage insurance premium , regardless of down payment size. So you will have to pay FHA mortgage insurance even. If you put own 20 percent or more.

Can PMI be removed from FHA loans?

Mortgage insurance is removed from conventional mortgages once the loan reaches 78 percent loantovalue ratio. But removing FHA mortgage insurance is a different story. Depending on your down payment, and when you first took out the loan, FHA MIP usually lasts 11 years or the life of the loan. MIP will not fall off automatically. To remove it, youll have to refinance into a conventional loan once you have enough equity.

How do I get rid of FHA mortgage insurance?Are there lenders that specialize in FHA-to-conventional refinances?Can you take cash out when you do a mortgage insurance elimination refi?How can I get rid of PMI without 20 percent down?How is mortgage insurance calculated by FHA?Can FHA mortgage insurance increase?

Canceling Qualified Mortgage Insurance

Using a conventional loan, the buyer may cancel the PMI once they pay 20% of the loan’s value or after the loan is 11 years old. However, the FHA may not allow you to take this reduction. It depends on the origination date of the loan.

- For loans originated between December 31, 2000, and July 3, 2013, if you have paid at least 78% of the loan-to-value amount off, you may ask the lender to cancel the MIP.

- For loans originated after July 3, 2013, if you made a down payment of less than 10% of the home’s value at loan origination, you must pay the MIP for the life of the loan. The only way to remove the qualified mortgage insurance on an FHA loan is to refinance it into a non-FHA product.

Borrowers who qualify for a conventional loan, even if they will pay private mortgage insurance, should also look at FHA loans to determine which is the better deal. Those with lower credit scores may do better with an FHA mortgage, particularly if they can make a 10% down payment. Also, some lenders may provide a separate loan to cover the down payment amount. Be sure to talk to your tax accountant, financial advisor, and your bank to see which loan makes the most sense for your situation.

Recommended Reading: Does Rocket Mortgage Sell Their Loans

Is Mip Or Pmi More Expensive

This question is difficult to answer because the cost of mortgage insurance premiums and private mortgage insurance differs from homebuyer to homebuyer. The amount of money you borrow has a significant impact on the cost of mortgage insurance, and you’ll likely pay more if you borrow $400,000 than if you borrow $200,000. How long you will need to pay for mortgage insurance is also a significant factor in how much it will cost you over the life of the loan. Consider all the advantages and disadvantages of conventional and FHA loans when you are making your decision. See our article on conventional loans vs FHA loans. Also look at our PMI vs MIP comparison table.

| Loan Type | |

|---|---|

| 11 years or more for new loans | varies by borrower |

Federal Housing Administration Mortgage Insurance

Mortgage insurance works differently with FHA loans. For the majority of borrowers, it will end up being more expensive than PMI.

PMI doesn’t require you to pay an upfront premium unless you choose single-premium or split-premium mortgage insurance. In the case of single-premium mortgage insurance, you will pay no monthly mortgage insurance premiums. In the case of split-premium mortgage insurance, you pay lower monthly mortgage insurance premiums because you’ve paid an upfront premium. However, everyone must pay an upfront premium with FHA mortgage insurance. What is more, that payment does nothing to reduce your monthly premiums.

As of August 2020, the upfront mortgage insurance premium is 1.75% of the loan amount. You can pay this amount at closing or finance it as part of your mortgage. The UFMIP will cost you $1,750 for every $100,000 you borrow. If you finance it, youll pay interest on it, too, making it more expensive over time. The seller is permitted to pay your UFMIP as long as the sellers total contribution toward your closing costs doesnt exceed 6% of the purchase price.

With an FHA mortgage, you’ll also pay a monthly mortgage insurance premium of 0.45% to 1.05% of the loan amount based on your down payment and loan term. As the FHA table below shows, if you have a 30-year loan for $200,000 and you’re paying the FHA’s minimum down payment of 3.5%, your MIP will be 0.85% for the life of the loan. Not being able to cancel your MIPs can be costly.

Don’t Miss: Can You Get A Reverse Mortgage On A Mobile Home