Which Lenders Offer Repayment Holidays

Many lenders offer repayment holidays, though the exact conditions will vary between them.

With Halifax for example, you will need to have had the mortgage for at least 12 months, owe less than 75% of the value of the property and not have taken any additional borrowing within the last six months. You also cannot have had previous payment holidays totalling six months nor taken one in the last three years.

Its largely similar with Nationwide, though your outstanding debt can be up to 80% of the propertys valuation.

Some lenders, like Barclays, wont allow you to take a full holiday, but will allow you to underpay for a period should you have overpaid in the past, while others, like Santander, will only offer them to borrowers on an offset mortgage.

Its important to check your mortgage details to establish just what sort of payment holiday facility if any, your lender offers.

When Will I Make My First Mortgage Repayment

Your first mortgage repayment will be made in the month after you complete the mortgage.

Your mortgage lenders will write to you to set out the exact date that the money will come out of your account.

Most lenders allow you to change the date for your regular payments, so you can pick a date which is more convenient for you, perhaps because it is the same day that you receive your monthly salary.

Its worth remembering that your first mortgage payment will usually be much larger than your regular monthly repayment.

Thats because the first payment will include an initial interest payment, covering the interest for the days between the date you complete on the house and the end of that month.

So lets say you complete on the 10th. Interest will be charged from that date to the end of the month, and then added to your standard monthly payment the following month.

How Long Will It Take Me To Pay Off My Student Loan: Uk

In the UK, student loans are repaid as a percentage of earnings, and only when your annual income is over a certain threshold. So when youre not earning or not earning much you dont need to make any loan repayments.

Of course, interest still accrues over this time, so any downtime where youre not paying off your loan means that there will be more to repay in the long run. However, and this is the critical part, the slate is wiped clean in the end there will never be a knock at the door demanding a huge, snowballed sum of money if youve been making low or no repayments.

Depending on the year in which you took out your loan, it will simply be written off after 25 years, 30 years, or when you turn 65. Phew. For this reason, repaying a student loan in the UK can be considered to work a bit like a graduate tax, applied in a similar way as income tax or national insurance.

Recommended Reading: Can You Do A Reverse Mortgage On A Condo

Payoff In 14 Years And 4 Months

The remaining term of the loan is 24 years and 4 months. By paying extra $500.00 per month, the loan will be paid off in 14 years and 4 months. It is 10 years earlier. This results in savings of $94,554.73 in interest.

If Pay Extra $500.00 per month

| Remaining Term | 14 years and 4 months |

| Total Payments |

| 24 years and 4 months |

| Total Payments |

The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options, including making one-time or periodic extra payments, biweekly repayments, or paying off the mortgage in full. It calculates the remaining time to pay off, the difference in payoff time, and interest savings for different payoff options.

How To Figure Out How Much Is Left On A Mortgage

With a few pieces of information, you can calculate your remaining mortgage balance.

When you make your monthly mortgage payment, only a portion of that money actually goes toward paying off the loan. Part of the payment is interest on the money you’ve borrowed if it’s still fairly early in the term of your mortgage, interest will be a huge chunk of your payment. That makes it hard to figure out at a glance just how much is left on your mortgage.

Recommended Reading: Rocket Mortgage Launchpad

Whats Included In My Mortgage Payment

A typical monthly mortgage payment has four parts: principal, interest, taxes and insurance. These are commonly referred to as PITI.

The mortgage payment estimate youll get from this calculator includes principal and interest. If you choose, well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment.

This calculator doesnt include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.

Read Also: Are Mortgage Rates Going To Rise

Can You Afford The Loan

Lenders tend to offer you the largest loan that theyll approve you for by using their standards for an acceptable debt-to-income ratio. However, you dont need to take the full amountand its often a good idea to borrow less than the maximum available.

Before you apply for loans or visit houses, review your income and your typical monthly expenses to determine how much youre comfortable spending on a mortgage payment. Once you know that number, you can start talking to lenders and looking at debt-to-income ratios. If you do it the other way around , you might start shopping for more expensive homes than you can afford, which affects your lifestyle and leaves you vulnerable to surprises.

Its safest to buy less and enjoy some wiggle room each month. Struggling to keep up with payments is stressful and risky, and it prevents you from saving for other goals.

Recommended Reading: 10 Year Treasury Yield Mortgage Rates

The High Cost Of Quick Decisions

Between 2015 and 2016, nearly one in three UK consumers chose mortgage products which cost them more than £550 per year. They got more expensive options over cheaper alternatives that were readily available and which they also qualified for. This fee difference amounts to 12.7% of what consumers spend annually on their mortgage.

The remortgage market is more competitive amongst lenders than the first-time buyer market. So only around 12% in that category opted for strongly dominated product choices. About 18% of first-time buyers fall into the strongly dominated product choice category, and well over 20% of mover mortgages fall in this category. Movers who are in a rush often make emotionally driven or time-sensitive decisions. This compromises their ability to obtain the best deal the way a person who is remortgaging can.

About 14% of borrowers in the top credit score quartile secured strongly dominated products, while more than 20% of consumers in the bottom quartile did not. In general, people who are young, including borrowers with low incomes, low credit scores, and limited funds for deposit are more likely to get an unfavourable mortgage deal. If there are factors that make your transaction more complex, you might find it more challenging to obtain a good loan.

How To Use Our Mortgage And Household Bills Calculator

You can find a step-by-step guide of how to use the calculator below. Bear in mind it applies to repayment mortgages only, where you pay both the capital and interest with each monthly payment.

1. Enter the property price and deposit . Youll find this on the left of the screen. If you dont have a specific property in mind, you can experiment with the numbers to see what you may be able to afford.

2. Enter the interest rate. Use a comparison website or contact a mortgage broker to find out what kind of rates are available for your deposit level. You may have a rate from a lender already through a mortgage agreement in principle.

3. Select a mortgage term. To calculate your monthly mortgage payment, input the term of the mortgage in years. A maximum of 30 years is available on our calculator but bear in mind the term you are offered will depend on your age and circumstances.

4. Add in the cost of monthly household bills. If you want to see the full monthly cost of running your home, add in the cost of major bills, including council tax and broadband. If youre not sure of these, the estate agent or local authority may be able to help.

5. Review your loan details. Now youve entered all the relevant information, the calculator will auto-populate your payment breakdown . You can see not only your monthly payments, but the estimated month and year by which you could pay off your mortgage if you continue to make them in full.

Don’t Miss: How Does Rocket Mortgage Work

Exercising Additional Payment Options

When you sign on for a 30-year mortgage, you know you’re in it for the long haul. You might not even think about trying to pay off your mortgage early. After all, what’s the point? Unless you’re doubling up on your payments every month, you aren’t going to make a significant impact on your bottom line right? You’ll still be paying off your loan for decades right?

Not necessarily. Even making small extra payments over time can shave years off your loan and save you thousands of dollars in interest, depending on the terms of your loan.

Early Mortgage Payoff Calculator

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Don’t Miss: Who Is Rocket Mortgage Owned By

What Will My Mortgage Cost

See examples of costs for different mortgage types, payment terms and interest rates.

The monthly payment and rate you’ll pay until your introductory period ends.

Follow-on payments and rate

The payments and rate you’ll pay after your introductory period ends if you dont change anything.

Use the annual percentage rate of charge to compare the cost of our mortgages, including interest and fees, with those from other lenders.

Mortgage fee

You can pay this fee when you submit a mortgage application, or add it to the amount you borrow.

Total of monthly payments

The information below shows roughly how your monthly payments will affect your mortgage balance over time. But they don’t include any other fees or payments you may need to make.

Loan to value

The percentage of the property value that you’re going to borrow. We divide your mortgage amount by the property value to work out the LTV.

Early repayment charge

The amount you’ll pay if you want to pay off the mortgage early or make an overpayment that’s more than we’ve agreed to.

Fixed-rate

Your rate stays the same for a set period, so your monthly payments remain the same even if our base rate changes.

Tracker

Your rate is a certain amount above our base rate. If base rate goes up or down, your payments will too .

Offset

Money you have in another account with us is used to lower the mortgage balance we charge interest on. All our offset mortgages are trackers.

Filter your results

When Mortgage Payments Start

The first mortgage payment is due one full month after the last day of the month in which the home purchase closed. Unlike rent, due on the first day of the month for that month, mortgage payments are paid in arrears, on the first day of the month but for the previous month.

Say a closing occurs on January 25. The closing costs will include the accrued interest until the end of January. The first full mortgage payment, which is for the month of February, is then due March 1.

As an example, lets assume you take an initial mortgage of $240,000, on a $300,000 purchase with a 20% down payment. Your monthly payment works out to $1,077.71 under a 30-year fixed-rate mortgage with a 3.5% interest rate. This calculation only includes principal and interest but does not include property taxes and insurance.

Your daily interest is $23.01. This is calculated by first multiplying the $240,000 loan by the 3.5% interest rate, then dividing by 365. If the mortgage closes on January 25, you owe $161.10 for the seven days of accrued interest for the remainder of the month. The next monthly payment, which is the full monthly payment of $1,077.71, is due on March 1 and covers the February mortgage payment.

You May Like: Does Rocket Mortgage Service Their Own Loans

How To Use The Existing Loan Calculator

Follow these steps:

You May Like: How Much Income For A 250k Mortgage

Important Notes Regarding The Mortgage Balance Calculator

There is a difference between your mortgage balance and your mortgage payoff amount. If you are looking to pay off your mortgage, your mortgage balance may not provide you with the relevant information needed. The payoff amount will be higher than your mortgage balance. This is because of additional fees required by the lender to close out the mortgage.

Related:5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

Also remember this mortgage balance calculator only works with fixed-rate mortgages. Fixed-rate mortgages have fixed interest rates â meaning the interest rate stays the same over the course of the loan term. Adjustable-rate mortgages, on the other hand, have interest rates that are periodically adjusted.

There are, however, additional ways to find your mortgage balance. The Mortgage Balance Calculator isn’t the only way. Try one of these methods too . . .

You May Like: Can You Get A Reverse Mortgage On A Condo

How Do You Find Initial Velocity With Only Time

How do you calculate principal balance? The principal is the amount of money you borrow when you originally take out your home loan. To calculate your mortgage principal, simply subtract your down payment from your homes final selling price. For example, lets say that you buy a home for $300,000 with a 20% down payment.

Secondly What is remaining principal balance? The current principal balance is the amount still owed on the original amount financed without any interest or finance charges that are due. A payoff quote is the total amount owed to pay off the loan including any and all interest and/or finance charges.

Additional Ways To Find Your Mortgage Balance

Mortgage companies will send out a mortgage statement â electronically or by mail â on an annual basis. These statements reveal the mortgage balance, number of payments that were made, and interest charged.

But what if you want to proactively find your exact mortgage balance â as stated by your mortgage company? Two popular options include:

- â Your mortgage company can give you your mortgage balance over the phone. Simply call and ask.

- Go online â Your mortgage company website will probably show your mortgage balance. You’ll have to create an online account â with a login and password â that will enable you to view your mortgage balance anytime you wish.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

Extra Home Mortgage Payment Calculator

You may also come into some more money that you want to put toward your mortgage. For example, you may get a great bonus from work at the end of the year or at the completion of a special project. You may win some money through a raffle or a special trip to the casino. You may come into some inheritance that you want to use to pay down your mortgage quicker. You may just get a better job in which you’re making more money, or you may eliminate some other debts or free up some money in your monthly budget that you now want to put toward your mortgage to pay it off faster.

Paying extra money on your mortgage, whether you do it each month or you do it in periodic payments such as when you get a bonus, can help you to save money over the life of the loan. You’ll reduce the overall interest you have to pay. Depending on how much extra you pay, you could save yourself thousands in interest charges over the years.

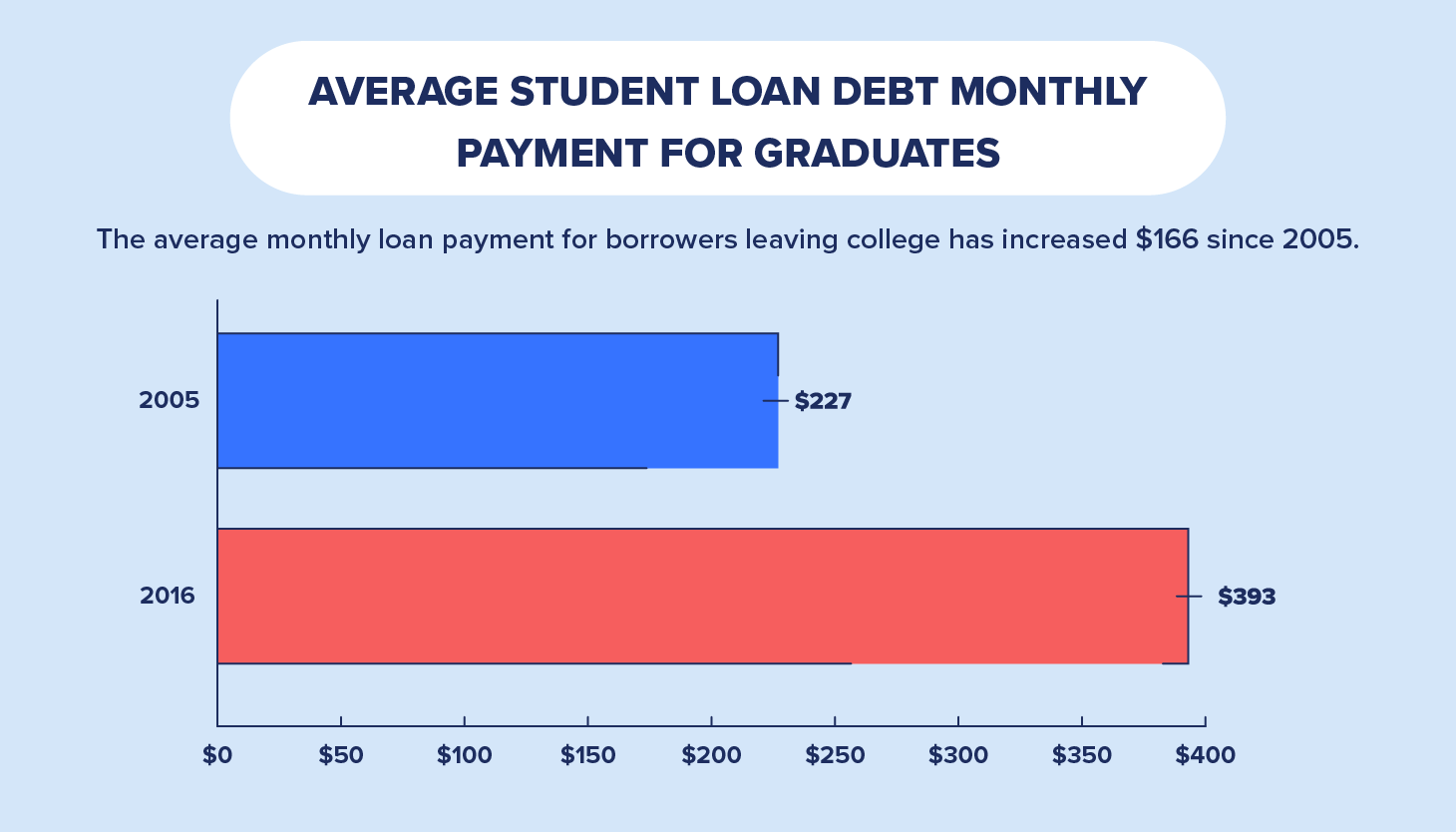

How Long Will It Take Me To Pay Off My Student Loan

The value of your student debt depends on a number of factors: where you studied, when you studied, and how long for. Ultimately though, the general rule remains the same: the more you pay towards it, the faster the debt will shrink.

Whether you really need to concern yourself with overpaying to shrink the debt is dependent on where you studied. British students have a more relaxed, means-tested approach, whilst US students face a harsher system and therefore more urgency in paying off their loans.

You May Like: Mortgage Rates Based On 10 Year Treasury

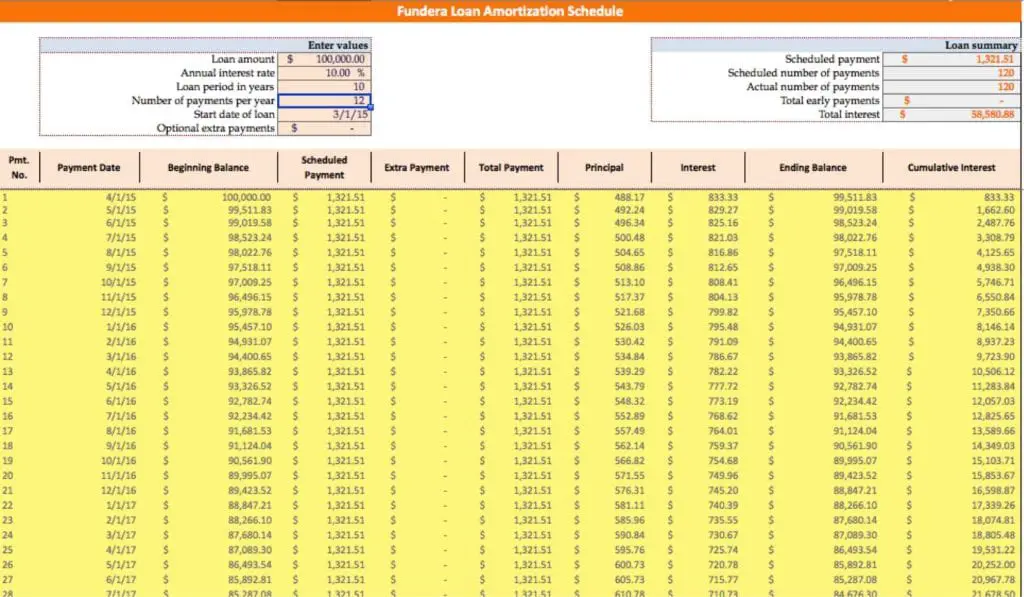

Principal And Interest Of A Mortgage

A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lender’s charge to borrow the money. This interest charge is typically a percentage of the outstanding principal. A typical amortization schedule of a mortgage loan will contain both interest and principal.

Each payment will cover the interest first, with the remaining portion allocated to the principal. Since the outstanding balance on the total principal requires higher interest charges, a more significant part of the payment will go toward interest at first. However, as the outstanding principal declines, interest costs will subsequently fall. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises.

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data.

Aside from selling the home to pay off the mortgage, some borrowers may want to pay off their mortgage earlier to save on interest. Outlined below are a few strategies that can be employed to pay off the mortgage early.: