Reverse Mortgage Income Isnt Taxed

You can take payment from a reverse mortgage in a few ways: in a lump sum, in incremental payments, or in combination. However you choose to take it, the money isnt taxable because its not income, as mentioned. Its the equity in your home converted to cash. The IRS calls the money loan proceeds.

Are Reverse Mortgage Disbursements Taxable

While the homeowner uses funds generated from a reverse mortgage as income, it is usually not taxed like typical income. The government considers the money to be loan proceeds, like money you might receive through a home equity loan or line of credit, or personal loan. As a result, its typically not taxable.

Interest Must Be Paid

Remember, interest is accruing monthly on your reverse mortgage, but youre not making any mortgage payments toward it. An IRS rule for claiming the mortgage interest deduction is that the interest has to have been paid to qualify. You cant deduct accruing interest that you still owe. Therefore, your interest would not be deductible until you pay off the reverse mortgage loan.

You can deduct the interest portion of any payments you voluntarily elect to make before you vacate the home, even if you dont pay off the reverse mortgage in full.

Read Also: Can You Get A Reverse Mortgage On A Condo

If You Can Get A Lower Interest Rate Or Get Better Terms

Refinancing can be a great move if interest rates are significantly lower than they were when you first obtained your reverse mortgage. If you can qualify for a lower rate, that can help reduce your loan costs over time.

In addition, if you are currently in an adjustable-rate reverse mortgage, you might consider refinancing into a more predictable fixed-rate loan. Finally, there are three different types of reverse mortgages: the federally backed home equity conversion mortgage single-purpose reverse mortgages and private reverse mortgage loans. You could move from one type to another that better suits your needs.

How Much Equity Is Needed To Get A Reverse Mortgage

Home equity is derived by subtracting any outstanding secured debts against the home from the appraised value of your home. The total amount that you can borrow must be greater than or equal to any outstanding secured debt on the home. To get a reverse mortgage, your home must be valued at a minimum of $200,000.

You May Like: What Does Gmfs Mortgage Stand For

How Does A Reverse Mortgage Affect Tax Deductions

As the name implies, a reverse mortgage is essentially the opposite of a regular mortgage. That means that not only are tax implications different, but tax deductions are different as well. With a regular mortgage, interest the borrower pays can be written off on their taxes each year. With a reverse mortgage, however, that interest isnt written off until the loan is paid back .

According to IRS Publication 936, Any interest accrued on a reverse mortgage isnt deductible until you actually pay it, which is usually when you pay off the loan in full. Read up on IRS Publication 936 if you want to know exactly how writing off mortgage interest works.

Since youre still responsible for paying them, property taxes can still be written off as a deduction while you have a reverse mortgage, but only about 30 percent of people do that with a regular mortgage anyway . And since new tax laws allow homeowners to write off less of their property taxes than before, this is a situation that wont apply to most people.

Youre Protected If The Balance Exceeds Your Homes Value

Because a reverse mortgage balance grows in size, its possible that it can exceed the fair market value of the property over time. However, the amount of debt that must be repaid can never exceed the propertys value, because a reverse mortgage is an example of non-recourse financing. The result is that a mortgage lender can have no claims against your other assets, or heirs, in this scenario.

Also Check: Rocket Mortgage Conventional Loan

How Will I Receive My Money

Reverse mortgage proceeds can be distributed in a variety of ways, such as immediate cash advance, line of credit, or monthly cash advance. Not every option will be available to every borrower, so it is important to make sure you understand your options by talking to your lender and an attorney or housing counselor.

What If You Dont Qualify

If you dont qualify for any of these loans, what options remain for using home equity to fund your retirement? You could sell and downsize, or you could sell your home to your children or grandchildren to keep it in the family, perhaps even becoming their renter if you want to continue living in the home.

Recommended Reading: Does Prequalifying For A Mortgage Affect Your Credit

Is Interest Paid On A Reverse Mortgage Tax Deductible

Some or all of the interest accrued on a HECM loan may be deductible but only when the interest is actually paid. The interest must be paid when the loan becomes Due and Payable. This happens when a maturity event occurs. A maturity event may be one of the following life occurrences:

- You sell your home

- You live outside of the property for 12 consecutive months

- You fail to keep up with home maintenance such as repairs according to FHA standards

- You fail to pay property taxes or insurance

The final loan balance owed for your reversemortgage includes the interest accrued over the life of the loan, mortgageinsurance premiums, and any other unpaid financial obligations.

Your reverse mortgage interest deduction has the same limits as other home equity loans you can deduct interest on no more than a loan of $100,000.

My Will States That My Home Goes To My Daughter When I Die What Effect Will Taking Out A Reverse Mortgage Have On That Provision

A reverse mortgage will become due upon the death of the last borrower. Your daughter will be given an opportunity to pay of the balance of the reverse mortgage. However, if the balance of the loan is not paid off, the property will go into foreclosure and eventually be auctioned off. The proceeds of the auction will go toward paying off the loan balance. New York is a non-recourse state, which means that even if the proceeds from the sale of the home do not cover the loan balance, your lender cannot go after you or your estate for the remaining loan balance. If, on the other hand, there is money left over after the loan is paid off, your heirs will be given an opportunity to claim the surplus.

Don’t Miss: Reverse Mortgage On Condo

Selling Your Home With A Reverse Mortgage

You may still sell your home if you have a reverse mortgage. However, you must pay back the debt youve accrued after you sell your home. Before you list your home for sale, contact your lender and confirm the amount you owe. You may keep the remainder and put it toward a new home if your home sells for more than your appraised value.

If your home sells for less than whats owed on the loan, you wont be responsible for paying the difference. As long as your loan is a non-recourse loan, youll never pay more on the loan than the value of your home.

Tax Implications Of A Reverse Mortgage

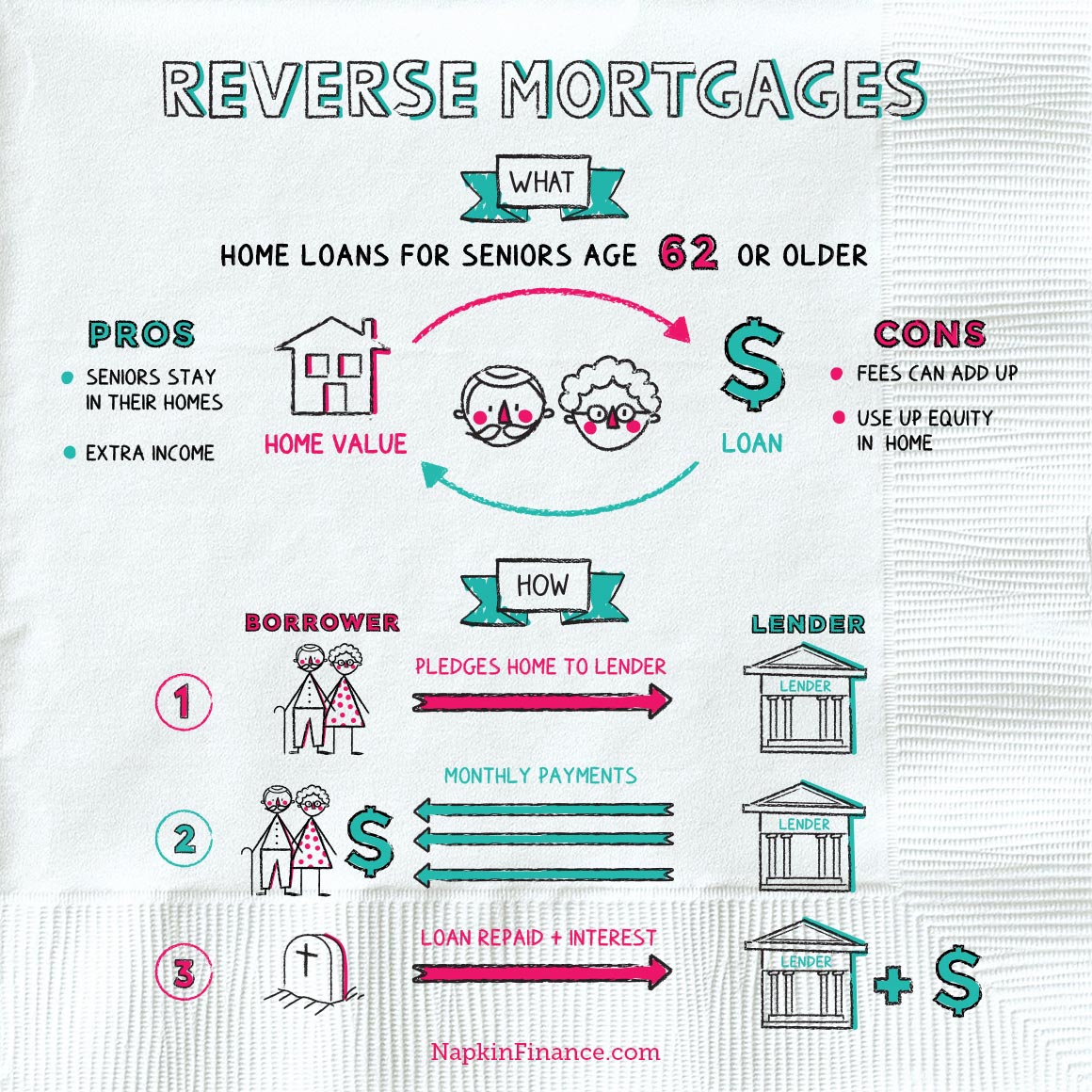

The good news is that the money you receive from a reverse mortgage isnt considered taxable income. But that doesnt mean there arent any tax implications for you as the borrower or your heirs. Below, well walk you through the reverse mortgage pros and cons to help you plan for the future.

Recommended Reading: Recasting Mortgage Chase

Paying Property Charges For Loans After April 27 2015

|

Lender’sevaluation |

Whopaysthepropertytaxes& homeownersinsurance |

|---|---|

|

Ifyourlenderdeterminedthat you had enoughmoney to pay future property taxes and homeowners insurance |

You can choose to:

|

|

Ifyourlenderdeterminedthat you need to setaside a portion of yourloan proceeds as a reserve to pay your property taxes and homeowners insurance |

Your lender will choose to:

|

For loans that were made before April 27, 2015, you could have requested at the time the loan documents were signed that your lender or servicer pay the property taxes and homeowners insurance from the reverse mortgage loan funds. You were not required to do so. Generally, for reverse mortgages made before April 27, 2015, borrowers need to budget each year to make sure their taxes and insurance are paid on time.

If you are unsure if loan money was set aside, check your monthly account statement or contact your lender or servicer.

If the reserve can no longer cover your property taxes or homeowners insurance, your lender will tell you.

Which Lenders Does Homewise Work With To Fund Their Client’s Reverse Mortgages

Homewise acts as a mortgage Advisor for clients to provide advice on if a reverse mortgage is right for our clients and from which lender. We work with multiple lenders, which include Equitable Bank and CHIP through Home Equity Bank. Our goal is to help clients determine which lender provides them the best option for their unique needs.

Recommended Reading: Rocket Mortgage Launchpad

Am I Eligible For A Reverse Mortgage

In order to be eligible for a reverse mortgage, typically you must:

- Own your home

- Be at least 60 years of age

- Live in your home for more than half of the year

- Have a single-family home, a 1- to 4-unit building or a federally-approved condominium or planned unit development

- Have no liens on your home or qualify for a large enough cash advance from the reverse mortgage to pay off any existing liens

- If your home needs physical repairs to qualify for a reverse mortgage, qualify for a large enough cash advance from the reverse mortgage to pay for the cost of repairs

No Monthly Mortgage Payments Greater Cash Flow

The same amount of money once directed toward making monthlymortgage payments is now money that can increase your cash flow. Without theburden of monthly mortgage payments, you have more freedom and flexibility tomanage your retirement. However, borrower must continue to pay propertytaxes and homeowners insurance, maintain the home, and otherwise comply withthe loan terms.

If your home equity is greater than what was needed to payoff your existing mortgage, or your home was already paid off, a portion ofyour home equity will be distributed to you in a payment plan of your choice.Popular options include a lump sum payment, monthly payments, or a line ofcredit. You also have the option of combining plans.

When you consider that areverse mortgage loan requires no monthly mortgage payments mustcontinue to pay property taxes and homeowners insurance, maintain the home,and otherwise comply with the loan terms) and offers the possibility that you canreceive periodic cash payments from your lender, it stands out as a viableretirement solution for many older Americans. How you use your tax-free cash isup to you.

To qualify for a reverse mortgage, you must:

- Be 62 or older .

- Own and live in your home as your primaryresidence.

- Have enough home equity, such that any remainingmortgage balance you have is well below the value of your home. To learn moreabout reverse mortgages, speak to your AAG reverse mortgage professional.

You May Like: Can You Do A Reverse Mortgage On A Mobile Home

Reverse Mortgage Costs And Fees

Quite often we get asked the question about what hidden or buried costs there are in a reverse mortgage.

This is largely because the whole product can come across of having a feeling of being too good to be true. Being skeptical like this is a good thing considering how many financial products out there bury their costs or have hidden fees that you dont learn about until it is too late.

Today, in response to many of the queries on this, I thought Id go through all the costs involved in setting this up.

That is, the initial costs before you do anything else.

This will include every single cost you need to know about you can factor these into your decision.

Deductibility Of Hecm Reverse Mortgage Interest

While the tax treatment of the proceeds from a HECM reverse mortgage loan is rather straightforward , there is far more tax complexity when it comes to the deductibility of reverse mortgage interest. This is due both to the limitations of the general rules for deducting mortgage interest in the context of how reverse mortgages are typically used, and also because of the way that reverse mortgage interest is usually paid .

Don’t Miss: Reverse Mortgage For Condominiums

Costs You Have To Pay But That Are Deducted From The Amount Borrowed

These costs rather than being upfront costs that you have to pay out of your own pocket can be deducted from the amount that you receive.

So lets say you arrange a reverse mortgage for $150,000 and these costs are $2,000. Then you will receive $148,000 instead.

You can choose to pay them if you like but almost every single person chooses to have them deducted from the amount borrowed instead.

These are split between two different sets of legal costs:

How Does A Reverse Mortgage Affect Your Taxes

As we will explain a little more in depth below, a reverse mortgage allows you to convert the equityor, the ownership stake in your hometo loan proceeds. Because of this, one of the advantages of a reverse mortgage is that youre not required to pay taxes to the IRS on said loan proceeds.

The costs you are responsible for in a reversemortgage include property taxes, homeowners insurance, and anyproperty-related expenses, among other reverse mortgage fees that vary based onthe lender and circumstances.

Read Also: Rocket Mortgage Requirements

Social Security And Medicare Benefits

Because a reverse mortgage loan doesnt count as income, that money generally wont affect your Social Security or Medicare benefits. However, it could affect your eligibility for Supplemental Security Income , because any reverse mortgage funds that you retain might count as assets.

For example, say your reverse mortgage lender gives you $4,000, and you spend it the same month to pay medical bills. In that case, your SSI wouldnt be affected. However, if you dont use the money that monthand it sits in your bank accountthen it would count as an asset, potentially affecting your eligibility for need-based benefits.

Mortgage lending discrimination is illegal. You cant be discriminated against based on race, color, national origin, religion, sex , familial status, or disability. If you think you have experienced such discrimination, file a complaint with the Consumer Financial Protection Bureau or the U.S. Department of Housing and Development .

What Happens If I Want To Sell My Home But Its Not Worth As Much As The Reverse Mortgage

Selling a home with a reverse mortgage is simple if the homes value is greater than the mortgage balance. Sell the house, pay off the reverse mortgage and pocket the difference. But if the value of your home has fallen below the amount you owe, the lender will accept 95% of the homes appraised value, or the full loan balance, whichever is less.

You may need to conduct a short sale selling your home for less than the balance owed if you have to sell when your home is valued at less than what you owe. The problem is, any real estate agent you work with will have to get the lenders permission to list the home for less than the mortgage balance, and the lender may require an appraisal before agreeing to the listing. This is one of the reverse mortgage pitfalls: Short-selling a home with a reverse mortgage is usually time-consuming and complicated.

You May Like: Does Rocket Mortgage Sell Their Loans

Bottom Line: Should You Get A Reverse Mortgage

Reverse mortgages have gained a less-than-perfect reputation thanks to some scams that target unsuspecting seniors. Even legitimate companies have used dishonest marketing to try to get homeowners to take out reverse mortgages: Recently, the Consumer Financial Protection Bureau filed a complaint and levied a $1.1 million fine against American Advisors Group, one of the biggest names in reverse mortgages, for deceptive marketing.

So, the simple rule: Be very, very cautious about putting your home at risk.

Still, there are two key reasons that seniors might consider examining their reverse mortgage options today:

- Elevated equity Over the past decade, home equity has grown as home values have risen. The average American homeowner gained more than $56,000 in equity between the third quarter of 2020 and the third quarter of 2021, according to CoreLogic.

- Record-low interest rates While interest rates are beginning to rise and will likely continue on that path in 2022, its still a cheap time to borrow money. Interest rates on 30-year loans are currently estimated to stay below 4 percent throughout the next year.

Remember that you have other options to access cash, too. Compare a home equity loan versus a reverse mortgage to see which one is a better fit for your needs.

With additional reporting by David McMillin

Social Security And Medicare Eligibility

Since reverse mortgage loan proceeds arent considered income, they wont impact your Social Security retirement or Medicare benefits. However, they can impact need-based benefits such as Supplemental Security Income or Medicaid.

This isnt an issue if you intend to use the reverse mortgage proceeds right away, according to the National Reverse Mortgage Lenders Association , which says, funds that you retain count as an asset and could impact eligibility.

For example, if you borrow $5,000 from a reverse mortgage for home repairs and spend it in the same month, your SSI wont be affected. However, if you keep the money in your bank account, it counts as an asset, which could make you ineligible for need-based benefits.

Don’t Miss: Rocket Mortgage Loan Requirements