Choose The Mortgage Refinance Thats Right For You

At Freedom Mortgage, we offer refinancing on conventional home loans, which are the mortgages many homeowners have across the United States. We also offer refinancing for VA, FHA, and USDA loans.

Your refinancing choices depend on the mortgage you have and the mortgage you want. You can refinance any type of mortgage with a conventional loan. Streamline refinances are only available for VA, FHA, and USDA loans. Our loan comparison can help you decide.

Home Loan Refinancing Example

The most common reason torefinance is for a lower interest rate.

Say you bought a house twoyears ago. The house cost $300,000. You made a $30,000 down payment and tookout a mortgage for $270,000 to cover the rest of the purchase price.

Now, interest rates havefallen, and you want to lock in a lower mortgage rate to reduce your monthlypayments. So you decide to refinance.

Note, you dont have to work with yourcurrent mortgage lender or loan servicer.

If the lender you used to buy your home can now offer you a lower rate and better terms, youre free to refinance with your current lender.

But youre also free to shop around for another company that can offer you an even better deal.

In fact, its highly recommended that you do so. Your finances havelikely changed since you got your first mortgage which means theres a goodchance your original lender is no longer your best bet.

Should I Refinance If Interest Rates Are Low

When interest rates fall, the possibility of getting a lower mortgage rate is a strong reason to consider refinancing if you need additional funds. A reduction in your mortgage rate could lead to significantly lower monthly payments.

However, you must factor in the costs of ending your current mortgage, including any prepayment charges, as well as how long you expect to live in your home. Only then can you determine whether its worthwhile to refinance at a lower rate.

Also Check: How Much Is Mortgage On 1 Million

Accessing Equity In Your Home

By refinancing your mortgage, you may be able to access the equity in your home. You could potentially access up to 80% of your home’s value, less any outstanding debt. Thatâs extra money for investment opportunities, home renovations, or your childrenâs education. There are several ways to access this equity including breaking your mortgage, taking on a home equity line of credit , or blending and extending your mortgage with your current lender.

Get The Cash You Need And The Rate You Deserve

- Compare lenders and save on interest

- Get cash out to pay off high-interest debt

- Prequalify in just 3 minutes

Compare rates from:

- Actual rates from multiple lendersIn 3 minutes, get actual prequalified rates without impacting your credit score.

- Smart technologyWe streamline the questions you need to answer and automate the document upload process.

- End-to-end experience

Compare

Also Check: Rocket Mortgage Vs Bank

How Long Will You Own The Home

Consider when you plan to sell the home, or if you have to sell sooner than expected. The closing costs to sell a home can tally up to thousands of dollars. So paying more than the value could make it very expensive to sell if you dont live in the home long enough to build up enough equity.

For example, if you sell the house in less than three to five years, youre taking a significant risk since the value might not catch up with what you paid.

Does Refinancing Affect My Credit

Refinancing a mortgage can have some impact on your credit, but its usually minimal. This can occur for multiple reasons:

- Mortgage lenders conduct a credit check to see if you qualify for a refinance, and this appears on your credit report. A single inquiry can shave up to five points off your score.

- If you plan to apply for other types of debt, such as a car loan or credit card, in addition to refinancing, your credit score can also be affected.

- When you refinance, youre closing one loan and opening another. Your credit history makes up 15 percent of your score, so having one loan close and then taking on a new one shortens the duration, impacting your score.

In general, these effects will only be felt for a short period of time. If youre concerned about hurting your score while you compare refinance offers, try to shop for loans within a 45-day window. Any credit pulls related to your refinance in this timeframe will only be counted as one inquiry.

Also Check: Rocket Mortgage Payment Options

Disadvantages Of Mortgage Refinancing

Because the lender is taking a security interest in real estate, many of the same closing costs associated with the original mortgage may be present. Costs such as title insurance, recording fees, attorney fees, appraisal fees and other closing costs may have to be paid again. The lending institution may be willing to waive some of these fees, especially if the original mortgage was recent. However, in many cases, the interest savings over time will more than make up for the payment of additional closing costs.It is best to determine what closing costs and other fees might be associated with refinancing. At First Foundation, we will be happy to discuss the advantages and disadvantages of mortgage refinancing in order to determine if it is a good choice for you.

Related Terms:

When Is Refinancing Worth It

There are many scenarios where refinancing makes sense. In general, refinancing is worth it if you can save money or if you need to access equity for emergencies.

Borrowers with FHA loans must refinance into a conventional loan in order to get rid of their mortgage insurance premium, which can save hundreds or thousands of dollars per year.

Some borrowers refinance because they have an adjustable-rate mortgage and they want to lock in a fixed rate. But there are also situations when it makes sense to go from a fixed-rate to an adjustable-rate mortgage or from one ARM to another: Namely, if you plan to sell in a few years and youre comfortable with the risk of taking on a higher rate should you end up staying in your current home longer than planned.

Also Check: Mortgage Rates Based On 10 Year Treasury

How Does Refinancing Work

Refinancing involves takingout a new mortgage loan to replace your existing one.

When you refinance, youapply for a new home loan just as you did when you bought the house. But thistime, instead of using the loan money to purchase a home, its used to pay offyour existing mortgage.

Refinancing effectively erases the debt on your current mortgage. It also lets you choose the rate and loan terms on your new mortgage, so you can get a new home loan that saves you money or helps you accomplish other financial goals.

The result is that you continue to pay off your home but now youre making payments on the new loan instead of your old one.

Note, you dont actually pay off the first mortgage yourself. The mortgage lender involved handle that part on the back end.

As far as youre involved, the mortgage refinance process typically looks a lot like your original home loan process did.

Homeowners refinance becauseyou get to choose the rate and loan terms on your new mortgage. So you can takeout a new loan thats more affordable or benefits you in another way .

When Is Refinancing Your Mortgage Not The Best Idea

With so many homeowners running to refinance their mortgages these days, its also a good idea to pause and consider the big picture. Just because you can refinance doesnt mean you should.

For starters, if your interest rate will not drop at least 0.5 to 0.75 percentage points, most experts will argue that its not worth it.

Refinancing also means closing costs and other potential fees. Even if you are paying less each month, it does not make sense to refinance if you will not recoup closing costs before you expect to move.

The following are a handful of reasons to reconsider a mortgage refinance:

- If your refi terms wont save you much in interest

- Your credit score has taken a dive since your original mortgage

- High closing costs

- Your new minimum monthly payment will be out of your budget

- You have plans to move out in the near future

If any of the above apply to your particular situation, its worth it to take a closer look at the specifics of a potential refinance and evaluate whether its the right choice for you.

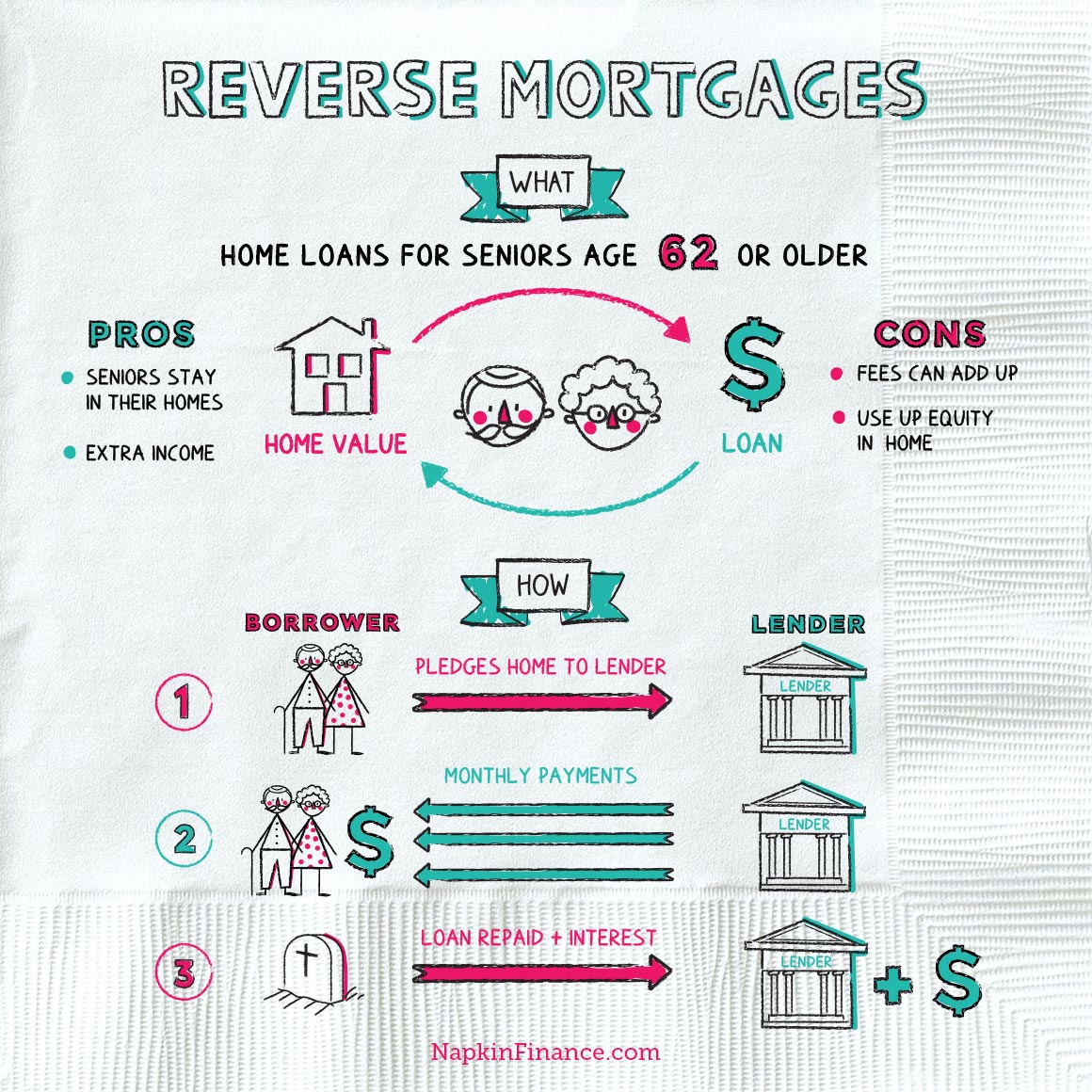

Don’t Miss: Reverse Mortgage Manufactured Home

Why Is It Important To Look At The History Of The 30

Rates were well above 4% as recently as 2018 and 2019. Before the 2008 crash, a good rate was still above 5%. Current mortgage interest rates are still very good from a long-term view, even if theyre breaking through the psychological barrier of 4%. If your current rate is higher than todays rates, then a refinance could be a good option.

This chart, which uses data from a survey by Freddie Mac that differs slightly but generally tracks with the Bankrate survey used by NextAdvisor. This graph offers a glimpse at how todays rates compare with the past two decades. Theyre up from the historically low years of 2020 and 2021, but they still arent high if you zoom out more than a few years.

How Much Do I Pay To Refinance

Mortgage refinancing isn’t free. Youll pay several fees to your new lender, and other professionals as well to compensate them for processing the loan. Some of the costs of refinancing include:

- Application fees: This expense covers the cost to process your loan and perform credit checks.

- Origination fees: This is a one-time fee that you pay for loan preparation.

- Appraisal fees: This covers the cost of an appraisal to assess the value of your home.

- Inspection fees: You’ll be charged this fee if your home requires an inspection to assess its condition prior to being approved for a new mortgage.

- Closing costs: This includes fees for the attorney who handles the closing of the loan on behalf of the lender.

Altogether, refinancing fees can amount to 3% to 6% of the remaining principal on the mortgage. Your lender might not require that you pay these fees upfront if you qualify for a “no-cost refinancing,” but you’ll still effectively pay them through a higher interest rate over the course of the loan.

Don’t Miss: Can You Get A Reverse Mortgage On A Mobile Home

The Pros And Cons Of Refinancing

| Pros of refinancing | Cons of refinancing |

|---|---|

| Access the equity youve built up in your home. | Increasing the amount you are borrowing may lengthen the time it takes to pay off your mortgage. |

| Consolidate your debts and lower your overall interest rate. | Your overall interest rate might be lower but the amount owing on your mortgage may be higher. |

| Possibly get a lower interest rate and pay less for your mortgage over time. | There may be additional costs, including a prepayment charge. |

Tap Into Your Home Equity

When you make payments on your mortgage, you build equity in your home. Your home equityOpens a popup. is the difference between your property’s market value and the outstanding balance of your mortgage plus any other debts secured by your property. If you need funds, you can refinance your mortgage to access up to 80% of your home’s appraised value1 in cash.

Estimate your available equity and find out how much you may qualify to borrow with our home equity calculator.

Recommended Reading: Rocket Mortgage Qualifications

How Has The Covid

- Mortgage rates plummeted to historic lows. Despite the uncertainty brought on by the COVID-19 pandemic, homebuyer demand and refinance activity experienced a surge in 2020, fueled primarily by record-low interest rates. According to Freddie Mac, interest rates dipped below 3% for the first time in half a century. The 30-year fixed-rate average also declined every month in 2020.

- Loans are taking longer to process. Since homeowners have scrambled to take advantage of these historically low interest rates, theres been a massive influx in the volume of home loan applications. The average amount of days it took to close a home refinance was up year-over-year in 2020.

- Qualifying for a loan is harder as lenders have tightened requirements.Widespread layoffs and unemployment caused by the COVID-19 pandemic have forced lenders to become more cautious about who they lend to. As a result, most lenders have implemented stricter refinance requirements. These include requesting higher credit scores, larger down payments, lower debt-to-income ratios, and more documentation.

What Should You Know Before You Refinance The Loan On Your House

Whether or not refinancing your home loan makes financial sense for you depends upon several factors. They all have to do with your goals, financial situation and the options available to you. Here are some factors that will impact your home loan refinancing decision:

- How much equity you have in your home the more the better.

- Your credit score higher scores can get lower interest rates

- Your debt-to-income ratio how much you owe compared to how much you take in

- The rates available and the length of the terms you are considering

- Any fees or expenses or closing costs associated with refinancing, and any tax implications

- Whether or not you will require private mortgage insurance

You May Like: Chase Recast Mortgage

Other Companies We Considered

When we looked at the refinance mortgage lending industry, we found that many of the biggest lenders didnt necessarily offer the best refinance products, though they might excel in other areas.

Highlights from Chase

- The eighth-largest originator of mortgage loans in the country

- Large variety of loans: ARMs, 10-, 15-, 20-, 25- and 30-year mortgages, FHA and VA loans and DreamMaker Mortgage Program

- Competitive mortgage interest rates

Why You Shouldnt Spend More Than Appraised Value

In competitive housing markets with limited supply, its easy to get sucked into bidding wars and overpay for a house, driven by the fear of missing out. If you have had offers rejected a few times, which is fairly common nowadays, it might feel like you have to go above and beyond to buy your dream home.

Before you decide to pay above the appraised value, its important for you to consider your budget and goals carefully. Otherwise, you could be making a very expensive long-term mistake.

Here are a few questions to ask yourself before you agree to a higher home valuation.

Don’t Miss: Does Prequalifying For A Mortgage Affect Your Credit

What Is Refinancing And Why Would You Do It

Refinancing is the process of switching your existing home loan to a different lender or changing loan products. Many borrowers choose to refinance to take advantage of benefits like lower interest rates, additional features and flexibility, to access home equity or for debt consolidation requirements.

There are a number of pros and cons to refinancing and a lot will depend on your personal situation. But, if youve had you current loan for some time and are thinking of making the switch, weve put together a simple guide to help you understand the process.

Closing On Your New Loan

Once underwriting and home appraisal are complete, its time to close your loan. A few days before closing, your lender will send you a document called a Closing Disclosure. Thats where youll see all the final numbers for your loan.

The closing for a refinance is faster than the closing for a home purchase. The closing is attended by the people on the loan and title, and a representative from the lender or title company.

At closing, youll go over the details of the loan and sign your loan documents. This is when youll pay any closing costs that arent rolled into your loan. If your lender owes you money , youll receive the funds after closing.

Once you’ve closed on your loan, you have a few days before you’re locked in. If something happens and you need to get out of your refinance, you can exercise your right of rescission to cancel any time before the 3-day grace period ends.

Get approved to refinance.

You May Like: Reverse Mortgage Mobile Home

Calculate A Target Refinance Interest Rate

To lower the principal and interest portion of your monthly payment, youll need to find an interest rate you can qualify for that is lower than the interest rate on your existing loan. Over the past decade, interest rates for refinancing have typically ranged from 3% to 5% on a 30-year fixed mortgage.

Your mortgage loan will likely be amortized, which means initial costs are gradually written off over a period of time. Early in your loan term, the majority of your principal and interest payment is applied to the interest. Over time, a higher percentage is applied to the principal. Depending on how far along you are in your mortgage loan term, you may need a lower refinance interest rate to see the financial savings you were expecting.

Research current mortgage rates: If youre watching rate trends, youll know when rates are low enough to pursue an advantageous refinance loan.

Use a mortgage refinance calculator: To determine your total savings, you will need to know your current loan amount, loan interest rate, term and origination year.

Mortgage refinance calculation example using Zillows refinance calculator tool.