Pay Attention To The Numbers

Because youre paying more up front, the reduced interest rate will only save you money over the long term. The longer you plan to own your new home, the better the chance that youll reach the break-even point where the interest you’ve saved compensates for your initial cash outlay. If you have a shorter-term plan, have limited cash, or would benefit more from a bigger down payment, paying points may not benefit you.

Your mortgage loan officer can help you decide whether paying points is an option for you.

Are Mortgage Points Tax Deductible

Just like other mortgage interest you pay during a particular tax year, you can deduct mortgage points from your taxable income when you itemize them using Schedule A of Form 1040. Discount points paid on a home purchase mortgage loan can be 100% deductible in the year theyre paid.

Discount points on a home refinance mortgage loan cannot. If you had spent a huge sum of money on mortgage points at closing, then you are most likely in for a substantial write-off when tax season comes.

> > More: What Is Mortgage Interest Deduction?

What Do Discount Points Cost

Discount points cost roughly 1% of the loan amount per point.

Purchasing the three discount points would cost you $3,000 in exchange for a savings of $39 per month. You will need to keep the house for 72 months, or six years, to break even on the point purchase. Because a 30-year loan lasts 360 months, purchasing points is a wise move in this instance if you plan to live in your new home for a long time. If, on the other hand, you plan to stay for only a few years, you may wish to purchase fewer points or none at all. There are numerous calculators available on the Internet to assist you in determining the appropriate amount of discount points to purchase based on the length of time you plan to own the home.

The second factor to consider with the purchase of discount points involves whether or not you have enough money to pay for them. Many people are barely able to afford the down payment and closing costs on their home purchases, and there simply isn’t enough money left to purchase points. On a $100,000 home, three discount points are relatively affordable, but on a $500,000 home, three points will cost $15,000. On top of the traditional 20% down payment of $100,000 for that $500,000 home, another $15,000 may be more than the buyer can afford.

Using a mortgage calculator is a good resource to budget these costs.

You May Like: How Does The 10 Year Treasury Affect Mortgage Rates

Who Should Buy Points

People who are likely to keep their current mortgage for a long time. They would have the following attributes:

- Likes the local area and plans to live in the area for at least a half-decade or more.

- Stable family needs, or a home which can accommodate additional family members if the family grows.

- Homebuyer has good credit & believes interest rates on mortgages are not likely to head lower.

- Stable employment where the employer is unlikely to fire them or request the employee relocate.

What Are The Disadvantages Of Mortgage Points

As with any mortgage offer, there are several downsides to buying mortgage points.

- You will have to pay a huge chunk of money which may affect the amount you put towards your loan down payment.

- It will take you a whole lot of time to break even on the money you spent on buying mortgage points. And if you plan on keeping the mortgage for a shorter period, you may not reap the benefits that come with paying down your interest rate.

Read Also: Can You Do A Reverse Mortgage On A Mobile Home

How Much Do The Different Types Of Mortgage Points Cost

There are two types of mortgage points you may come across during the homebuying process: origination points and discount points. In both instances, the cost of a point is typically 1% of the loan amount. So if you have a $250,000 mortgage, the cost of one point is $2,500.

- Origination points: These points are often included in the cost of originating your loan. They don’t affect the interest rate on your loan but do allow you to compare costs among mortgage lenders while you’re shopping around. This is because one lender may charge more or fewer points than another.

- Discount points: During the mortgage process, you may be able to pay for discount points in exchange for a lower interest rate. In most cases, one discount point reduces your interest rate by 0.25%. For example, let’s say you have a $250,000 mortgage with a 3.5% interest rate. By paying one point , you could reduce your rate to 3.25%.

Origination points may be negotiable, especially if you’ve found another lender that charges less. With discount points, on the other hand, it only makes sense to pay them if doing so will save you money in the long run.

Continuing with the previous example, a $250,000 loan with a 3.5% rate would give you a $1,123 payment for principal and interest. If you were to buy down the rate to 3.25%, your monthly payment would drop to $1,088a decrease of $35.

Why Are Closing Costs A One Time Fee

Why are closing costs a one time fee? a. Payment of closing costs is required because it is a sign to the lending institution that the investor has every intention of making payments on time. The closing costs cover titles, taxes, and realtor costs.

Are Mortgage Points deductible 2020? Points are prepaid interest and may be deductible as home mortgage interest, if you itemize deductions on Schedule A , Itemized Deductions. Points are allowed to be deducted ratably over the life of the loan or in the year that they were paid.

How much is 25 points on a mortgage?

25 percentage point reduction in the interest rate and costs $1,000.

Can a lender credit be removed? Remember, general lender credits and specific lender credits are aggregated together in this section on the Loan Estimate. A lender also cannot simply remove a lender credit because a service is no longer required. Lets assume a lender offers the same $500 lender credit for the appraisal and discloses it in Section J.

Also Check: How Much Is Mortgage On 1 Million

Calculate Your Breakeven Point

Youll also want to know how long it takes to recover the upfront cost based on how much you save. To find out when youll break even, divide the cost of the discount points by your monthly savings:

$3,000 / $33 = about 91 months, or 7.5 years

In this example, you would need to stay in your home for at least 7.5 years to cover the cost of the points you buy and start saving money on your mortgage.

Its hard to predict exactly how long youll stay in a home before you buy it, but try to come up with a realistic estimate when comparing mortgage quotes. This can help you make the right decision about whether to buy points.

Where To Find Points And Credits On Your Loan Estimate** And How They Affect Your Loans True Cost

Points will be found under Section A on page 2 of your official Loan Estimate. Theyll be shown as a percentage of your loan amount and as the equivalent dollar amount youll pay upfront.

Lender credits are listed under Section J as a negative number. Thats the dollar amount thatll be taken off your upfront closing costs.

When calculating the true cost of your loan, its important to only factor in costs that are mortgage-related . The costs to include are listed in Section D , Section E, and Section J under lender credits.

Simply input information from your official Loan Estimate into the following formula to calculate your true loan cost:

Costs listed under section F and section G are non-mortgage related, and will occur whether you continue with the loan or not. For this reason, they should not be included in calculating the true loan cost.

Have more questions about points and credits, or need help deciding which is right for you and your loan? Were here to help.

*The rate table displayed above is for illustrative purposes only. It does not reflect any specific loan terms and is not a commitment to lend. Your loan terms will be different based on current market rates, property type, loan amount, loan-to-value, credit score, debt-to-income ratio and other variables.

**The Loan Estimated displayed in this article is for illustrative purposes only. It does not reflect any specific loan terms and is not a commitment to lend.

- More

You May Like: Does Rocket Mortgage Sell Their Loans

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

What Are Mortgage Points And How Do They Work

1-min read

A mortgage point equals 1 percent of your total loan amount for example, on a $100,000 loan, one point would be $1,000.

Mortgage points are essentially a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payments .

In some cases, a lender will offer you the option to pay points along with your closing costs. In exchange for each point you pay at closing, your mortgage APR will be reduced and your monthly payments will shrink accordingly.

Typically, you would buy points to lower your interest rate on a fixed-rate mortgage. Buying points for adjustable rate mortgages only provides a discount on the initial fixed period of the loan and isn’t generally done.

Don’t Miss: Who Is Rocket Mortgage Owned By

Should You Buy Mortgage Discount Points

Returning to the example above, you have the option to buy down your interest rate from 3.5% to 3.25% by paying one discount point. Should you do it?

It turns out there is a right answer to that question, sort of. You can calculate how many years it would take you to break even on that deal how many years until the savings on interest caught up with the upfront fee you paid.

In this case, a 30-year, $200,000 mortgage at 3.5% interest would cost you $898 per month in principal and interest. At a 3.25% rate of interest, it would cost you $870, a monthly savings of $28. So, it would take you 71 months to recoup your initial $2,000 cost to buy one point. After six years youd reach the break-even point, having saved more than $2,000 in interest.

How Do You Calculate Basis Points For Commission

Also Check: Reverse Mortgage On Condo

How Much Do They Cost

Points cost 1% of the balance of the loan. If a borrower buys 2 points on a $200,000 home loan then the cost of points will be 2% of $200,000, or $4,000.

Each lender is unique in terms of how much of a discount the points buy, but typically the following are fairly common across the industry.

Fixed-Rate Mortgage Discount Points

Each point lowers the APR on the loan by 1/8 to 1/4 of a percent for the duration of the loan. In most cases 1/4 of a percent is the default for fixed-rate loans.

Adjustable-Rate Mortgage Discount Points

Each point lowers the APR on the loan by 3/8 of a percent , though this discount only applies during the introductory loan period with the teaser-rate.

Cost of Discount Points

As mentioned above, each discount point costs 1% of the amount borrowed. Discount points can be paid for upfront, or in some cases, rolled into the loan.

Fractional Discount Points

Some lenders may offer loans with fractional discount points. In mortgage rate listing tables it is not uncommon to see a loan with 1.1 discount points.

Discount Points Vs Origination Points

There are two different types of mortgage points: origination points and discount points. Discount points represent prepaid interest that can be used to negotiate a lower interest rate for the term of a loan.

Origination points, on the other hand, are lender fees that are charged for closing on a loan. Origination points dont save borrowers money on interest, although they can sometimes be rolled into the balance of a loan and paid off over time. Discount points, however, have to be paid up front.

Read Also: Mortgage Rates Based On 10 Year Treasury

What Are Todays Mortgage Rates

Todays mortgage rates are at historic lows. Mortgage points allow borrowers to buy down their interest rate even further, which can generate huge savings.

However, mortgage points arent always worth it. And if you opt not to pay for them, youre still likely to get a great deal in todays ultralow rate environment.

Does Buying Points Pay Off

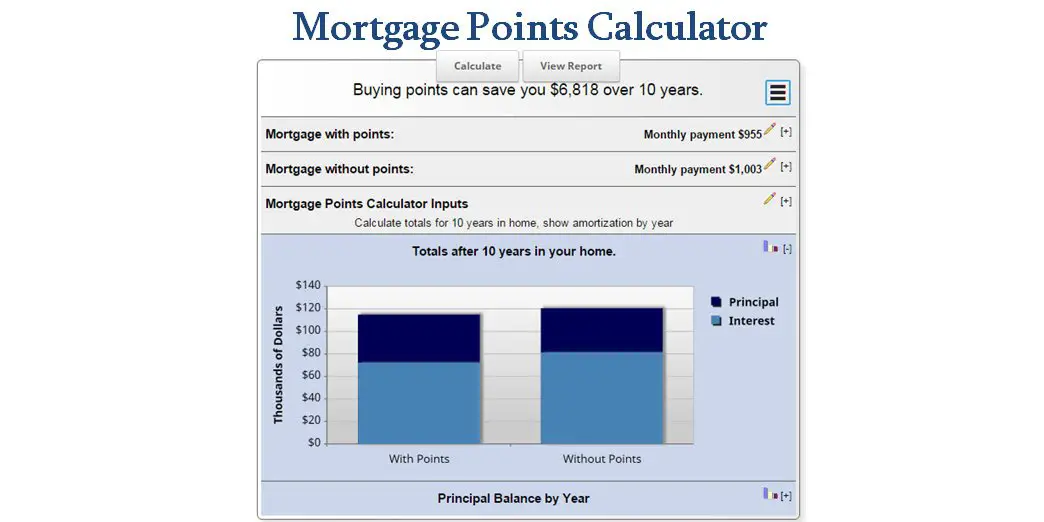

The Should I buy mortgage points calculator determines if buying points pays off by calculating your break-even point. Thats the point when youve paid off the cost of buying the points. From then on, youll enjoy the savings from your lower interest rate.

To find the break-even point, the calculator determines your monthly savings from buying points and divides that amount into the total cost of the points. For example:

On a $200,000 loan, purchasing one point brings the mortgage rate from 4.1% to 3.85%, dropping the monthly payment from $957 to $938 a monthly saving of $19. The cost: $2,000. The calculator divides the cost by the monthly savings amount to find the break-even point.

$2,000/$19 = 105 months

Back to the question: Is buying points worth it? The answer depends on how long youll keep the mortgage.

» MORE:Calculate your closing costs

You May Like: 10 Year Treasury Yield Mortgage Rates

How Much Are Mortgage Points

Mortgage points are calculated in relation to how much youre borrowing. As mentioned previously, one discount point costs 1% of the loan amount. So, if you have a $300,000 loan, one point will cost you $3,000. But if you have good credit and a large down payment, you might be able to negotiate a lower price for each discount point.

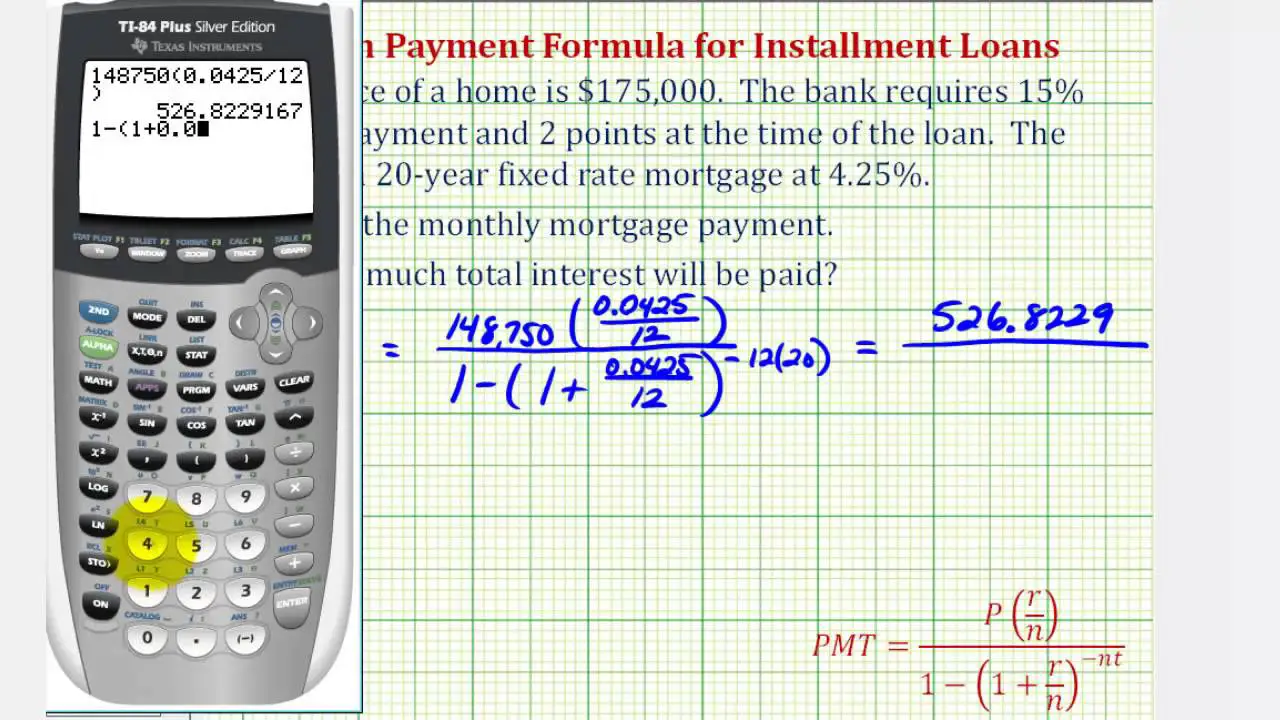

Comparing Monthly Mortgage Principal & Interest Payments With Discount Points

A home-buyer can pay an upfront fee on their loan to obtain a lower rate. The following chart compares the point costs and monthly payments for a loan without points with loans using points on a $200,000 mortgage.

| Points | |

|---|---|

| $9,072.22 | $17,997.21 |

Some lenders advertise low rates without emphasizing the low rate comes with the associated fee of paying for multiple points.

A good rule of thumb when shopping for a mortgage is to compare like with like. Shop based on

- annual percentage rate of the loan, or

- a set number of points

Then compare what other lenders offer at that level.

For example you can compare the best rate offered by each lender at 1 point.

Find the most competitive offer at that rate or point level & then see what other lenders offer at the same rate or point level.

You May Like: Can You Do A Reverse Mortgage On A Condo

When To Buy Mortgage Points

Buying mortgage points might make sense if any of the following situations apply to you:

- You want to stay in your home for a long time. The longer you stay in your home, the more it makes sense to invest in points and a lower mortgage rate. If youre sure youll have the same mortgage for the long haul, mortgage points can lessen the overall cost of the loan. The longer you stick with the same loan, the more money youll save with discount points.

- Youve determined when the breakeven point is. Do some math to figure out when the upfront cost of the points will be eclipsed by the lower mortgage payments. If the timing is right and you know you wont move or refinance before you hit the breakeven point, you should consider buying points.

How do you calculate that breakeven point, you ask? Lets run through a quick example using the numbers referenced earlier.

If you have a $200,000 loan amount, going from a 4.125% interest rate to a 3.75% interest rate saves you $43.07 per month. As mentioned earlier, the cost of 1.75 points on a $200,000 loan amount is $3,500. If you divide the upfront cost of the points by your monthly savings, youll find that your breakeven point is about 82 months , which is equal to roughly 6 years and 10 months. So, if you plan to stay in your house for longer than that amount of time and pay off your loan according to the original schedule, it makes sense to buy the points because youll save money in the long run.