Average Monthly Mortgage Payments

See Mortgage Rate Quotes for Your Home

The median monthly mortgage payment for American homeowners was $1,030, according to the US Census Bureau’s 2015 American Housing Survey. The survey also reported aggregate monthly housing costs totaling $1,492 for homeowners with a mortgage. This figure typically includes property taxes, which vary based on state and city, and property insurance, which varies based on the homes cost. You can see how your potential mortgage payment compares by using the form above.

How Do You Compare Loan Offers

In any loan scenario, you have to make underlying assumptions such as:

- If you are likely to remortgage the loan again.

- When you are likely to remortgage.

- Where you think interest rates are headed.

- If you think you will sell the home soon.

- If rates head higher and your rate resets well above the initial offer, will your wages be enough to cover payments?

Look Beyond the Monthly Payment

Its important to consider the overall mortgage costs, not just the monthly payment amount. Borrowers will find interest-only payments affordable. However, compared to a full repayment mortgage, you immediately build equity in your home. This bring you closer to home ownership, stability, and grants you further life flexibility. In contrast, interest-only payments do not build equity. It does not provide financial cushion which helps protect you against shifting market conditions.

If one loan amortises and the other does not, then you have to look at how much equity you build in a home. This is a key factor in determining value. Most people also do not want to pay mortgages for the entire lifetime, or until they hit a tough patch and risk foreclosure.

Example Loan Comparison from a Reader

The key to being able to accurately compare mortgage offers is to only adjust a single variable at a time. This way you can easily see the differences between offers, instead of trying to compare apples to oranges.

The example below is based on a question from one of our users named Dan.

| Year |

|---|

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

Don’t Miss: When Will Home Mortgage Rates Go Up

Apply For A 300000 Mortgage

To find out more about our range of £300,000 mortgages simply make an application with our approved mortgage experts found here on the website. Rates are available from across the market either on a fixed rate or variable rate deal. Mortgages and lenders to suit most credit types and applicants including buy to let property.

Explore this product

Some Used Cars Are A Real Bargain

Before you take the plunge of buying a new car, consider a used one. Frugal shoppers know that new cars depreciate as soon as they are driven off the lot, and in fact lose on average 15-25% of its value each year the first five years. Buying one that’s a couple years old can still provide you with a reliable vehicle for thousands less while letting someone else take the depreciation hit. If you trade in every few years then depreciation is something to consider, so look for vehicles that traditionally hold their value such as Honda, Toyota or Lexus. If you keep your automobile until it falls apart, then depreciation is not a concern for you. New models for the upcoming year usually arrive late summer or early fall. Although selection may be limited, this is a great time to consider buying last year’s model because the dealer will need to make room for the new ones.

Do Not Buy a Lemon!

Check the used car history by the VIN# on sites like Carfax or AutoCheck. This will help eliminate anything that looks questionable. Anything that says it’s a salvage should raise a red flag. Salvage vehicles are those in accidents that the insurance company has determined repair costs are more than it is worth. Some shops will try to repair them and sale them at a steep discount. These are given salvage titles. Unless you are mechanically savvy, it’s best to avoid these.

Program Cars Are Often a Great Value

Read Also: What Credit Score Is Needed To Get A Mortgage Loan

Whats Included In My Mortgage Payment

A typical monthly mortgage payment has four parts: principal, interest, taxes and insurance. These are commonly referred to as PITI.

The mortgage payment estimate youll get from this calculator includes principal and interest. If you choose, well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment.

This calculator doesnt include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.

What Happens If A Borrower Defaults On A Loan In Canada

Borrowers who violate the terms of their loan contract are in default of the loan. People who default on their loan will receive numerous calls and letters that will ask for payment. Individuals who continue to not pay on the loan could face foreclosure. The lender will seize the home, and will use the proceeds to pay the debt on the mortgage. Many lenders in Canada will work with borrowers to help them be able to pay the loan. Borrowers who are beginning to fall behind on their payments should call the lender to see if they will negotiate. If a person has a reason for missing payments, a lender could be sympathetic and help people get back on track.

When individuals are ready to buy a new home, many of them are unfamiliar with the different options available. Buying a new home can be stressful, so it is wise for borrowers to make sure they know what to expect in the process. Individuals can then be confident knowing they have made informative decisions about their loan.

You May Like: How To Sell A Mobile Home With A Mortgage

Who Is This Calculator For +

This calculator is most useful if you:

- Calculate mortgage rates you are considering

- Compare differences of various home loan term programs

- Haven’t decided on what type of loan you want yet

- Want to get an idea of monthly or annual cost of buying a property

- Are looking to assess the long term benefit of making prepayments in addition to regular loan repayments

Mortgage Affordability And Your Down Payment

Because Canada has minimum down payment rules in place, the amount of money you’ve saved for a down payment can limit your maximum mortgage affordability. The minimum down payments in Canada are:

- 5% of the purchase price up to $500,000, plus

- 10% of any part of the price between $500,000 and $1 million, or

- 20% of the total purchase price for homes valued at over $1 million.

Let’s consider an example. If your down payment amount is fixed at $15,000, the maximum home price you will be able to afford is $15,000 divided by 5%, or $300,000. If your down payment is $30,000, then your maximum affordability will increase to $550,000. You can run the numbers yourself on our mortgage affordability calculator.

Read Also: How Long To Get A Mortgage

Getting Your First Mortgage

The traditional period for amortization of a mortgage is 25 years. But this is done in periods of five years at a time, though it is possible to pay the mortgage down in a shorter period, just not longer. The longer the amortization period, the smaller the monthly payments will be, but the more the loan will cost in total.

Most mortgages have a five year term, though shorter terms are possible. The five-year mortgage term is the amount of time a mortgage contract is in effect. At the end of each term, the mortgage must be renewed for another term, at which point there is an opportunity to consider making any changes. Possible changes include renegotiating the rate as well as other details of the contract for the next term. The agreed-upon interest rate remains in effect for the term.

It is possible to choose between an open mortgage, which provides a person the flexibility of being able to repay all or part of a mortgage at any time without a prepayment charge, or a closed mortgage, which limits prepayment options. The latter usually has a lower interest rate.

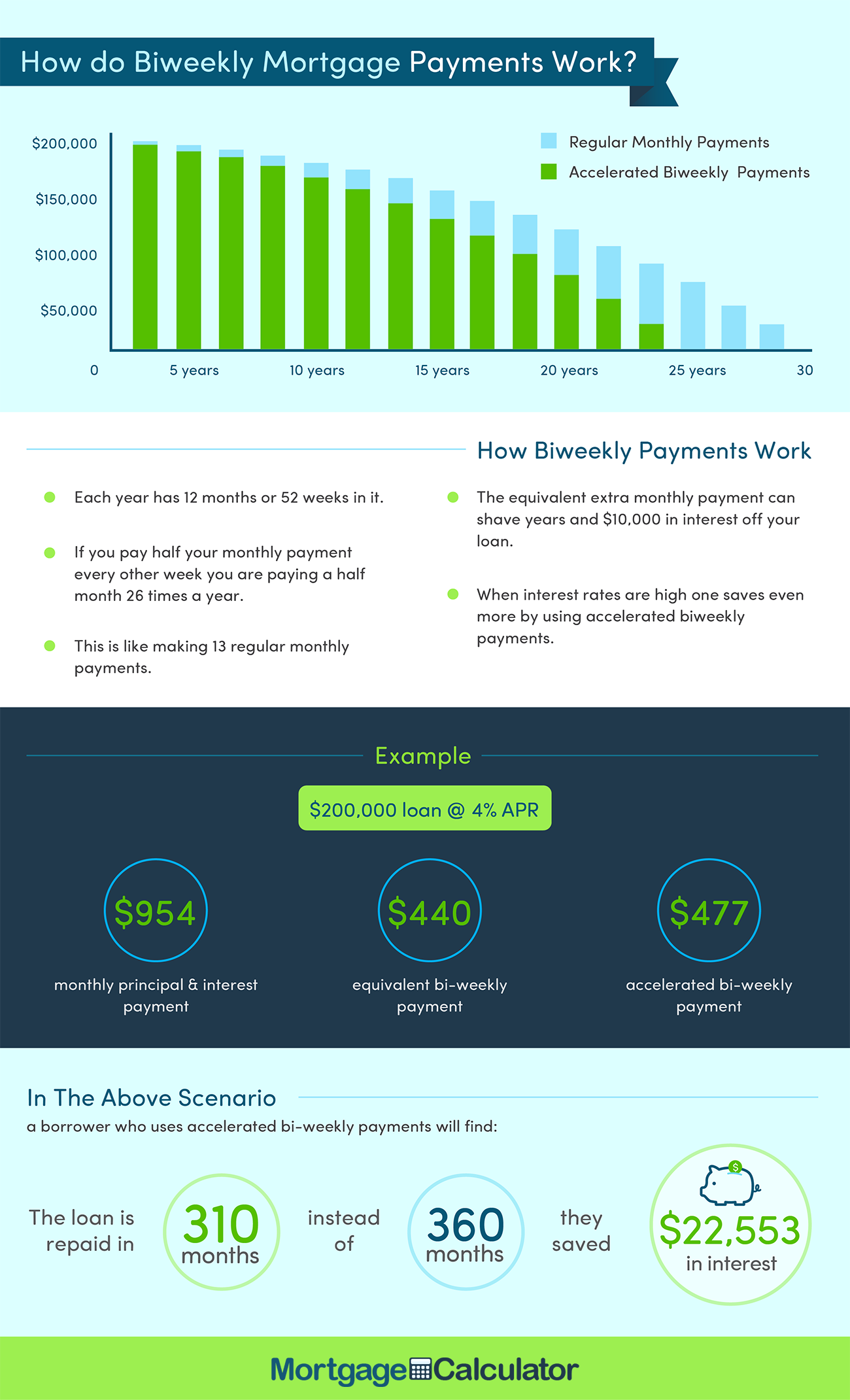

Traditionally, mortgage payments are made every month. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. A biweekly payment means making a payment of one-half of the monthly payment every two weeks. This results in 26 payments a year instead of 24.

There are also options for flexible or skipped payments.

Debt Service Ratios And Mortgage Affordability

Set by the Canada Mortgage and Housing Corporation , your debt service ratios including your gross debt service ratio and your total debt service ratio are used to calculate the maximum mortgage the lender can offer. This maximum mortgage is then combined with your available down payment to determine the maximum home price you can purchase.

Your lenders uses these ratios to ensure you can consistently make your monthly payment, as they place a limit on the amount of your income that can go towards your housing expenses and monthly debt obligations. The industry standard guideline for GDS is no more than 32% and the guideline for TDS is no more than 40%. However, you may be allowed to exceed these limits if you have a stable source of income and good credit. If the mortgage you want to take on forces your GDS or TDS above 39% and 44% respectively, you will not be approved for that amount.

To use our earlier example, even if you have $15,000 for a down payment, your GDS and TDS score may only approve you for a $250,000 mortgage. Thus when combined with your $30,000 down payment, your max affordability would be $265,000 .

The maximum GDS limit used by most lenders to qualify borrowers is 39% and the maximum TDS limit is 44%.

As of July 1st, 2020, the CMHC implemented new GDS and TDS limits for mortgages that it insures. The new GDS/TDS limits for CMHC-insured mortgages is 35/42.

Also Check: How Much Can You Get On A Reverse Mortgage

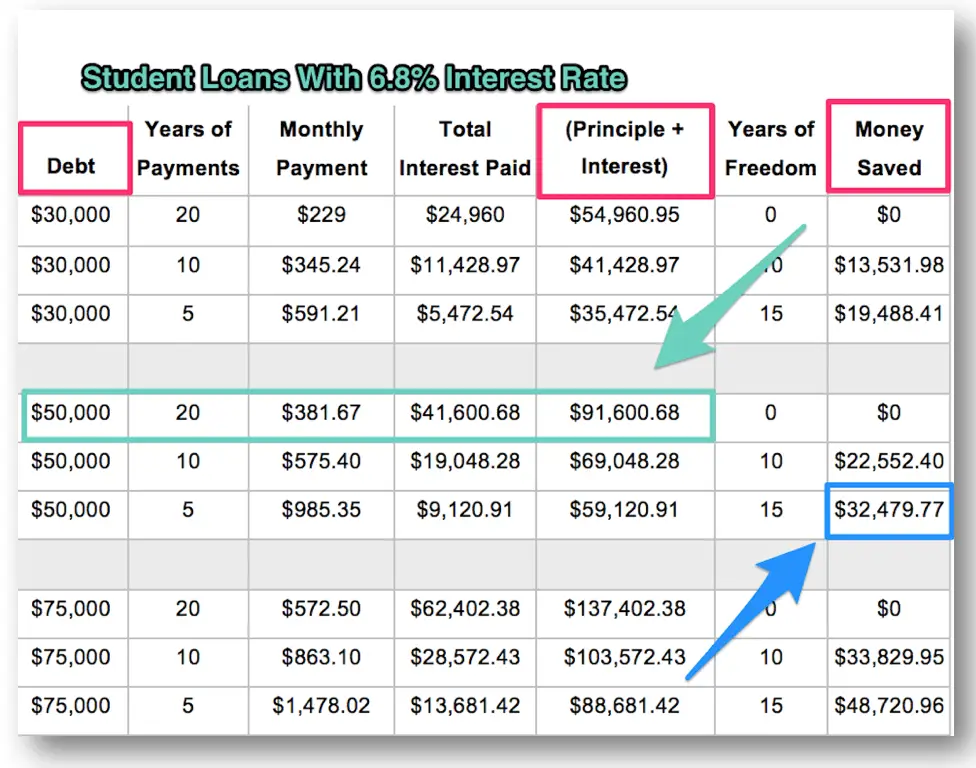

Should I Choose A Long Or Short Loan Term

It depends on your budget and goals. A shorter term will allow you to pay off the loan quicker, pay less interest and build equity faster, but youll have a higher monthly payment. A longer term will have a lower monthly payment because youll pay off the loan over a longer period of time. However, youll pay more in interest.

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Don’t Miss: What Is Tip In Mortgage

Monthly Mortgage Payments By Region

The census data we reviewed allowed us to compare mortgage payments across different regions of the country. We found that median payments in 2015 were roughly 35 to 40 percent higher for Northeast and Western states than in the Midwest or the South.

| Region | |

|---|---|

| $75,520 | $180,000 |

While mortgage interest rates were similar for all regions, this did not correlate with similarities in payment amounts. In the wealthiest regions of the country, the Northeast and West, consumers had larger outstanding balances on their mortgages and made higher monthly payments. In the South, where median annual income was the lowest, mortgages had the highest interest rates, leading to payments slightly higher than in the Midwest.

A Sample Maximum Affordability Calculation

Let’s look at an example where your gross annual income is $75,000. You’re buying a home with annual property taxes of $3,600, monthly heating costs are $200 and since you’re buying a house, there are no condo fees. In addition to your housing expenses, you have a monthly car loan at $300 and must make minimum monthly payments of $250 on your credit card debt. You have $20,000 saved up for a down payment.

Since both your GDS and TDS ratios must be less than or equal to the maximum, the largest mortgage payment you can afford is $1,450. Though your GDS suggests you can afford $1,500, at that monthly payment, your TDS will be over 40% and therefore $1,450 is the maximum payment that ensures both debt service ratios fall within the allowable range.

With a monthly mortgage payment of $1,450 per month, you can afford a $300,000 mortgage with a 5-year fixed interest rate of 3.28% and an amortization period of 25 years. Finally you must ensure you have the minimum down payment of 5%. Since $20,000 / $300,000 = 6.67% you can satisy the minimum down payment requirement.

After calculating your GDS ratio, TDS ratio and down payment percent, you can determine your maximum affordability at $300,000. Since your TDS ratio is limiting your affordability, you could try paying off some of your credit card or car debt to increase your maximum affordability.

Also Check: Can You Refinance To A 10 Year Mortgage

Will I Need A Down Payment

It depends on the type of loan.

VA loan

Backed by the Department of Veteran Affairs , VA loans dont require a down payment. To qualify for a VA loan, you or your spouse must have served 90 to 181 days in active service, or over six years in the Reserves or National Guard. The VA also extends loans to borrowers with a family member who died in the line of duty.

Conventional loan

Lenders typically require a down payment of at least 20%. So, for a $100,000 mortgage, youd need a down payment of $20,000 excluding closing costs and taxes. Some conventional lenders will accept down payments as low as 3%, but youll most likely need to purchase private mortgage insurance to secure the loan.

FHA loans

Insured by the Federal Housing Administration, these loans require a down payment of at least 3.5%. For a $100,000 mortgage, that means youll cough up $3,500. The down payment aside, youll pay an upfront mortgage insurance premium, and then continue to make monthly payments until you build 20% equity in your home.

USDA loans

Another type of government loan, USDA loans are backed by the US Department of Agriculture. They dont demand a down payment, but youll need to carry private mortgage insurance until youve built up 20% equity in your home.

Whats The Minimum Loan Amount I Can Borrow For A Mortgage

Many lenders set the bar at £25,000, though there are others who will lend smaller amounts. If youre looking to raise funds for a renovation, purchase a house at auction or if you wish to move into a more expensive property and need a small mortgage to bridge the gap, there may be other lending options available for you. Speak with an advisor for more information.

Read Also: Can I Get Cosigner For Mortgage

How Much A $300000 Mortgage Will Cost You

A $300,000 mortgage comes with upfront and long-term costs. The total costs of the loan will depend on your interest rate and loan term.

Edited byChris JenningsUpdated October 11, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Taking out a mortgage comes with many costs some upfront and some paid over long lengths of time. On a $300,000 mortgage, those costs might surprise you.

In fact, on a traditional 15- or 30-year loan of this size you might pay anywhere from $72,000 to $155,000 just in interest.

Learn more about how much a $300,000 mortgage will cost you in the long run:

Considerations Before Committing To A Mortgage

WOW: Look at those figures above! The amount of interest you will pay your bank over the period of the loan is outrageous, particularly when we consider what we have done to bail out the banks in our recent history. I know, you have no choice, you need a mortgage but, save what you can, while you can. Use a bigger deposit if you can, repay your mortgage early to save thousands on interest payments. Think about your financial future, when do you really want to pay of that mortgage, the answer should be as soon as possible.

Affordability: Be sure you can really afford to make the Mortgage repayments. Only you really know if you can afford a Mortgage or not and committing to a mortgage which you will struggle to repay will only cause you financial hardship and pain in the future. Remember,

Mortgages: READ THE SMALL PRINT: Your home may be repossessed if you do not keep up your Mortgage repayments .

Shop around: It always pays to shop around and see what deals are available. Most banks and building societies run promotions at various points of the year. Never assume that one lender is better than the other, look for the good deals as they could save you a lot of money.

Borrow Little, Repay Quickly: The best Mortgage is one repaid quickly. A quick repayment means less interest paid and less stress about your debt.

Also Check: What Does A Commercial Mortgage Broker Do