That Makes Sense I Think My Credit Score Is In Good Shape Thankfully Is There Anything Else That Happens Before I Get The Mortgage

As far as the lenders work goes, not really. When determining the answer to How much mortgage can I afford?, the lender can tell you what theyre willing to give you, but it is very important that you take stock of your current situation and assess your future before committing to a loan. In other words, were back to the question of what size debt are you comfortable taking on.

How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is unless you have enough cash to purchase a property outright, which is unlikely. Use the above mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

You Can Find This By Multiplying Your Income By 28 Then Dividing That By 100

Financial calculator how much house can i afford. For example a combined monthly mortgage payment of 1200 divided by gross monthly income of 4500 equals a housing ratio of 27. How much of a down payment do you need for a house. First we calculate how much money you can borrow based on your income and monthly debt payments.

Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Which means you can build up your credit score calculator helps you estimate how much house you afford. Use this calculator to determine your maximum mortgage and how different interest rates affect your how much you can borrow.

The following mortgage calculators will help you determine how much house you can afford whether to choose a fixed-rate or adjustable-rate mortgage ARM how making bi-weekly mortgage payments can. How We Calculate Your Home Value. Remember that the spreadsheet has you enter the MONTHLY cost.

For example lets say your pre-tax monthly income is 5000. The principle is pretty simple. A good way to look at how much house you can forward is to use the popular 2836 rule.

It considers income taxes loan. Our home affordability tool calculates how much house you can afford based on several key inputs. But like any estimate its based on some rounded numbers and rules of thumb.

Your income savings and monthly debt obligations as well as the mortgages available in your area.

Also Check: Should I Pay Off My Mortgage Early

A Simple Formulathe 28/36 Rule

Here’s a simple industry rule of thumb:

- Housing expenses should not exceed 28 percent of your pre-tax household income. That includes your monthly principal and interest payments plus all the such as property taxes and insurance.

- Total debt payments should not exceed 36 percent of your pre-tax incomecredit cards, car loans, home debt, etc.

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Also Check: How Many Times Annual Salary For Mortgage

Picking A Certain Loan Amount To Avoid A Jumbo Mortgage

- It might be in your best interest to keep your loan amount at/below a certain threshold

- Like the conforming loan limit, which varies by county

- Or at/below a certain loan-to-value ratio

- This may expand financing options and allow you to obtain a lower rate

If your loan amount is really large, you could wind up in the jumbo loan realm, which is currently as high as $679,650 in high-cost regions, but as low as $453,101 in cheaper areas of the country.

If you find yourself on the cusp, it might be wise to bring in a little extra down payment to qualify for a conforming loan amount, which will make financing easier to obtain and likely lead to a lower mortgage rate.

Of course, there are some aggressive jumbo lenders out there that have been known to beat conforming pricing, so its not necessarily a deal breaker to exceed this loan limit.

Have the individual youre working with compare both scenarios to see which makes more sense financially.

Speak To A Mortgage Affordability Expert Today

If you like anything in this article or youd like to know more, call Online Mortgage Advisor today on 0808 189 2301 or make an enquiry here.

Then sit back and let us do all the hard work in finding the broker with the right expertise for your circumstances. We dont charge a fee, and theres no obligation or marks on your credit rating.

Ask a quick question

We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and we’ll get the best expert to help.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

Maximise your chances of approval, whatever your situation. Find your perfect mortgage broker

Also Check: What Type Of Mortgage For Rental Property

Ugh This Is Making My Head Hurt

Yup. Mortgages arent fun. Still, a house is one of, if not the, most expensive thing youll ever spend money on so its best to give it a ton of consideration. Being saddled with an unruly mortgage will affect you for years and years. To that end, the more thought you give it now, the less worry youll have later. So remember, the question isnt just How much mortgage can I afford? but How much mortgage do I want? for the long term.

More from SmartAsset

Mortgage Preapproval Confirms Your Home Buying Budget

Its a good idea to figure out how much home you can afford before you start shopping so that you avoid falling in love with a property you wont be able to buy.

In addition to getting an estimate through an online mortgage calculator, you can apply for preapproval with a lender to get a better idea of what they might offer you.

That allows you to search for homes in your price range, and it reassures your real estate agent and sellers that youre in the right ballpark when youre touring homes.

You can get started by requesting todays rates from top lenders.

Also Check: What Is Refinancing Your Mortgage

Is It Worth Buying Expensive Car

Quality and Worth: It is true that the value of a car depreciates with time and mileage. However, the resale value of luxury cars depreciates at a steady pace than new average or above-average cars. Also, the trust that luxury car brands, like Audi and BMW, have gained makes them a personal favourite of many.

Multiply Your Annual Income By 25

In this rule of thumb, you begin with your gross annual income. Thats the income from your W-2 . Multiply this number by 2.5 to estimate the maximum value of the home you can afford. However, keep in mind that the lower the interest rate you can obtain, the higher the home value you can afford on the same income. This is why your credit score is so important. Lets take a look at a few examples.

How much house can I afford if I make $50K per year?

On a 50k salary, how much mortgage could you afford? According to this rule of thumb, you could afford $125,000 . Lets say you have a 4.5 percent interest rate and choose a 30-year mortgage. Your monthly mortgage payment would be $633. With interest, youd pay a grand total of $228,008.

How much house can I afford if I make $70K per year?

Lets look at a mortgage on 70k salary. Assuming the same 4.5 percent interest rate and a 30-year term, you could afford a mortgage of $175,000 . This translates into $887 per month, totaling $319,212 after 30 years.

How much house can I afford if I make $100K per year?

If youre wondering with 100k salary how much house can I afford, the 2.5 rule gives you a mortgage of $250,000. Using a 4.5 percent interest rate and a 30-year term, this translates into $1267 monthly, which equals $456,017 over 30 years.

How much house can I afford if I make $200K per year?

Also Check: What Can I Do To Lower My Mortgage Payments

Why Is A$ 100 000 Personal Loan More Risky

You could be considered less of a risk if the lender believes the reason is responsible. For example, a $100,000 personal loan to start a business may be viewed as more risky than a loan to make home renovations. Credit score. The APR youre offered is affected by your credit score as well as your credit history in general.

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

Read Also: Is Chase A Good Bank To Refinance My Mortgage

If You Have Good Credit And No Other Debt The 43 Dti Rule Means A Mortgage Lender Will Assume You Can Support A Monthly Payment Of About 3500 Including Property Tax And Insurance

How much mortgage can i afford if i make 100k. 362 rows How much house can I afford if I make 100000 a year. Research Maniacs checked with different financial institutions and found that most mortgagelenders do not allow more than 36 percent of a gross income of 30000 to cover the total cost of debt payments insurance and property tax. Research Maniacs checked with different financial institutions and found that most mortgage lenders do not allow more than 36 percent of a gross income of 100000 to cover the total cost of debt payments insurance and property tax.

If you are a single applicant with a clear credit history earning at least 75000 it may be possible to borrow up to 412500. It may seem like a lot but it is possible to find a home you can actually afford while making just 70000 a year. That means two people who each make 100000 per year.

If true a couple who earn a combined annual salary of 100000 can afford a monthly payment of about 2300month. Another rule of thumb is the 30 rule. Some experts suggest that you can afford a mortgage payment as high as 28 of your gross income.

So that means at 100K you shouldnt be buying more than 395K worth of house. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage. Typically lenders will determine how much you can borrow by multiplying your salary by four and a half or five times.

How To Save 100k I Did It In 3 Years Clever Girl Finance

Pin On First Home

What House Can I Afford On 50k A Year

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. Thats because salary isnt the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

Recommended Reading: How To Calculate Self Employed Income For Mortgage

Factors That Determine How Much House You Can Afford

Income is an important factor when you apply for a mortgage.

If you make a $100k salary annually, lenders will weigh that heavily in your mortgage application.

It indicates that you likely have the income needed to cover a decentlysized mortgage payment.

However, lenders dont just look at income when they qualify you for a home loan. They also look at:

- The property youre buying

Heres what each of these factors mean to a lender.

Lenders want to see that you have a history of good credit management and ontime payments, and that youre not paying too many other debts on top of a mortgage.

To get the best mortgage rate, aim for a credit score of 720 or higher and a DTI ratio below 36%.

These indicators show that youre a responsible borrower whos not likely to default on their mortgage loan.

Down payment and LTV

In addition, lenders consider your down payment and LTV when deciding which mortgage programs you qualify for and how low of a rate youll get.

To get the best mortgage rate, aim for a down payment of 20%. Although its not required, a bigger down payment lowers your rate and increases your home buying power.

The higher your down payment is, the less risk the lender takes on since youll be asking for less money. This means a lower rate and bigger home buying budget.

LTV is a similar metric, which measures how much youre borrowing vs. how much the home is actually worth.

Low down payments are always an option

However, these things are by no means required.

How Much House Can I Afford: How The Math Works And Rule Of Thumb

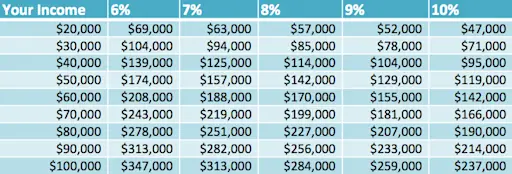

A Lower Mortgage Rate Means You Can Borrow More

If the term mortgage has crossed your mind recently and youre in the market to purchase a new home, youve probably asked yourself, How much house can I afford?

This is a very important question all prospective homeowners should know the answer to well before they begin looking at real estate, whether its a single-family home, condo, or townhouse.

Knowing how much mortgage you can afford will allow you to narrow your home search so you can save time and be more productive. And hopefully successful in finding your dream home.

In fact, if you dont already have a mortgage pre-approval in hand, which essentially details how much house you can afford, most real estate agents wont take you seriously.

And may not even take you out to see listings. Why? Because home sellers wont want to waste their time with a prospective buyer that isnt actually qualified in a given price range.

You May Like: Can A Locked Mortgage Rate Be Changed

How Much Do You Have To Earn To Get A Mortgage Of 100000

So with this is mind, roughly how much salary is needed for a £100k mortgage? Say the lender you approach will loan a maximum of 4x your income, the very minimum you would have to earn would be £25,000 .

This chart will give you a rough indication how much you could borrow depending on what multiples of income your lender caps at:

| Income |

|---|

How Much Do I Qualify For Mortgage

This rule says that your mortgage payment should be no more than 28% of your pre-tax income, and your total debt should be no more than 36% of your pre-tax income.

Just so, how much can I borrow for a mortgage based on my income?

Four components make up the mortgage payment, which are: interest, principal, insurance, and taxes. A general rule is that these items should not exceed 28% of the borrower’s gross income. However, some lenders allow the borrower to exceed 30% and some even allow 40%.

Also, how much do I need to make to afford a 300k house? The oldest rule of thumb says you can typically afford a home priced two to three times your gross income. So, if you earn $100,000, you can typically afford a home between $200,000 and $300,000.

Likewise, how much do I need to make for a 250k mortgage?

To afford a house that costs $250,000 with a down payment of $50,000, you’d need to earn $43,430 per year before tax. The monthly mortgage payment would be $1,013. Salary needed for 250,000 dollar mortgage.

How much should I spend on a house if I make 100k?

Some experts suggest that you can afford a mortgage payment as high as 28% of your gross income. If true, a couple who earn a combined annual salary of $100,000 can afford a monthly payment of about $2,300/month. That could translate to a $450,000 loan, assuming a 4.5% 30-year fixed rate.

You May Like Also

You May Like: Who Is The Trustee In A Mortgage Loan