Typical Ontario Mortgage Amounts

Finding the right mortgage has a lot to do with determining what you can afford. And that depends on where you live.

Below are typical mortgage amounts for someone putting down 20% in select Ontario cities. Theyre based on a 30-year amortization and average purchase prices as tracked by the Canadian Real Estate Association :

- Barrie and District: $570,800

| 2,130 | 0.10% |

Thanks to Ontarios stable economy and housing market, it tends to have lower arrears rates than other provinces.

Is It Worth Working With A Mortgage Broker

There are advantages to getting a mortgage directly from a lender as well as getting a mortgage through a broker, but there are differences. While going directly to your current bank lets you consolidate your financial products, using a broker allows you to shop around quickly and easily, at no cost to you.

Luckily, you donât need to choose one of the other. You can speak to multiple banks and multiple mortgage brokers if you want to. Ratehub.ca is a great place to start, as we compare the best mortgage rates in Canada from multiple lenders and mortgage brokers. Once youâve compared your options, we can put you in contact with your chosen provider.

Is The Lowest Ontario Mortgage Rate The Best Rate

Not always. The lowest rates usually come with more limitations. These restrictions can cost you much more than the small rate savings. Such terms are common with low frills mortgages and typically kick in when you try to port, break or increase the mortgage after closing. When comparing mortgage rates, dont be afraid to ask potential lenders questions to ensure you understand the terms and conditions of your mortgage.

Also Check: Who Should You Get A Mortgage From

How Much Can I Save By Comparing Mortgage Rates In Nova Scotia

When you’re trying to get a mortgage in Nova Scotia, one of the best things you can do is to compare mortgage rates from multiple lenders. This ensures you don’t miss out on the best deal. Comparing mortgages from multiple providers can help you find a lower mortgage rate, which can save you thousands of dollars over the course of your mortgage.

Let’s look at an example. For a $500,000 mortgage with a 20-year amortization period, a 3.50% rate will see you pay $79,028 in interest over your first 5-year term. With a 3.25% rate, you’ll pay just $73,250, a savings of $5,778.

Do I Get A Lower Rate If I Make A Bigger Down Payment

Generally, not. The lowest rates in Canada are typically offered on default insured mortgages. Those are for people who put down less than 20% on their home purchase. Low insured rates are also available to people who transfer their already-insured mortgage to a new lender. Those who put down 20% or more get conventional rates, which are usually higher than insured rates. Occasionally, however, someone putting down 35% or more on a home purchase under $1 million can get great rates similar to high-ratio rates.

Read Also: What Is Mortgage Rate Vs Apr

Does The Federal Reserve Decide Mortgage Rates

While the Federal Reserve doesnt decide mortgage rates, it does influence the rate indirectly. The Federal Reserve helps to guide the economy by keeping inflation under control and encouraging growth. That means the decisions the Federal Open Market Committee makes in raising or lowering short-term interest rates may influence lenders to raise or lower theirs.

What Is A Good Mortgage Interest Rate

In general, you can consider a good mortgage rate to be the average rate in your state or below. This will vary depending on your credit score better scores tend to get better mortgage rates. Overall, a good mortgage rate will vary from person to person, depending on their financial situation. In 2020, the US saw record-low mortgage rates across the board, and it’s expected they’ll stay low throughout 2021.

Recommended Reading: Is Closing Cost Part Of Mortgage

What Happens At The End Of A Term

At the end of each term, you have the option to renew or refinance your mortgage.

- Renewing your mortgageinvolves signing for another term with your existing lender. Your monthly payment and mortgage interest rate may change.

- Refinancing your mortgageinvolves signing a new term agreement, possibly with a different rate or lender. Refinancing allows you to take advantage of lower mortgage rates or better options not offered by your current lender. You can also borrow more money by using your home equity and receiving it in cash.

Your mortgage lender might not reassess your credit score or debt service ratios if youre renewing at the same lender. If youre switching to a new lender, youll need to be reassessed and you may need to pass the mortgage stress test.

How Big A Mortgage Can I Afford

In general, homeowners can afford a mortgage thats two to two-and-a-half times their annual gross income. For instance, if you earn $80,000 a year, you can afford a mortgage from $160,000 to $200,000. Keep in mind that this is a general guideline and you need to look at additional factors when determining how much you can afford such as your lifestyle.

First, your lender will determine what it thinks you can afford based on your income, debts, assets, and liabilities. However, you need to determine how much youre willing to spend, your current expensesmost experts recommend not spending more than 28 percent of your gross income on housing costs. Lenders will also look at your DTI, meaning that the higher your DTI, the less likely youll be able to afford a bigger mortgage.

Dont forget to include other costs aside from your mortgage, which includes any applicable HOA fees, homeowners insurance, property taxes, and home maintenance costs. Using a mortgage calculator can be helpful in this situation to help you figure out how you can comfortably afford a mortgage payment.

Don’t Miss: Who Offers 20 Year Mortgages

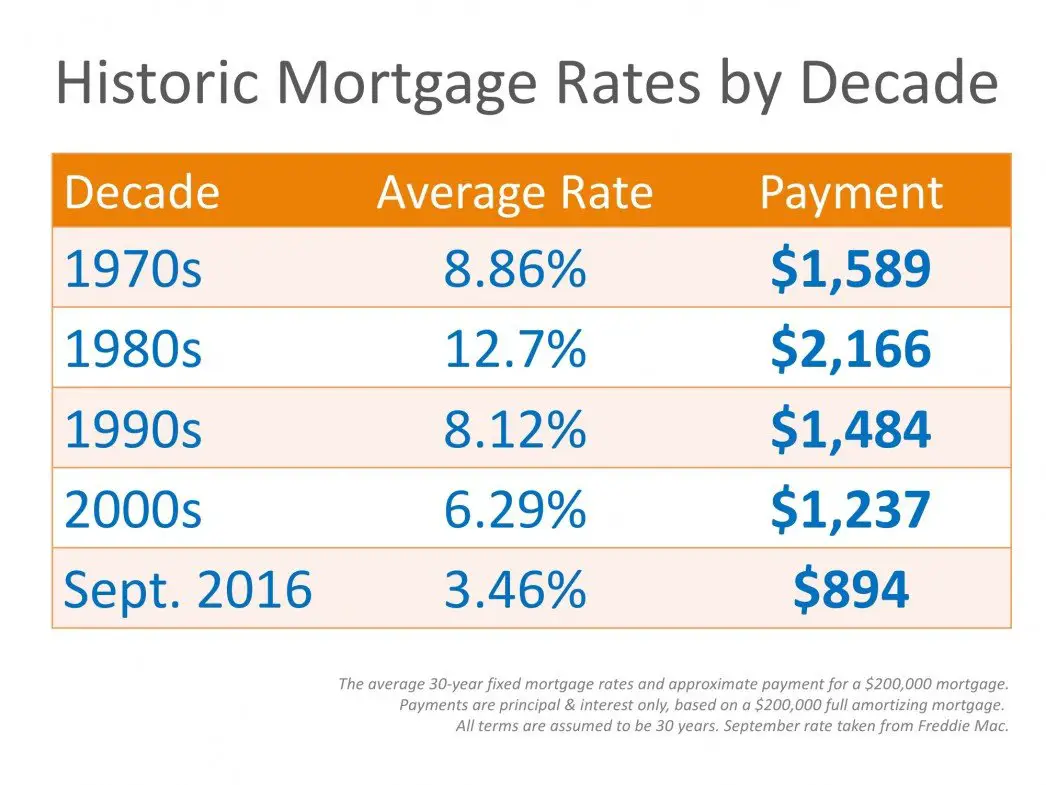

Todays Mortgage Rates And Your Monthly Payment

More than other factors, your annual percentage rate on your real estate purchase will affect your monthly payments â whether you’re refinancing or buying a new home.

On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

Refinancing to a lower interest rate could save hundreds of dollars a month if you kept the same loan terms. Shortening the loan term could negate your monthly savings but save thousands over the life of the loan. You can experiment with a mortgage calculator to find out how much a lower rate could save you.

Other factors besides interest affect how much you’ll pay in mortgage payments:

Average 5/1 Arm Rates

Average 5/1 ARMs tend to feature lower rates than comparable 30-year and 15-year home loans, at least during the initial 5 year promotional period.

Rates will adjust to market rates, plus a spread, following the expiration of the initial 5 year period.

Here are the current average 5/1 adjustable rates mortgage rates for each state.

Average 5/1-ARM Rates by State

| State |

|---|

Rates assume a loan amount of $200,000 and a loan-to-value ratio of 80%.

While ARMs do offer lower monthly payments in the short run, the variable interest rates on 5/1 ARMs means that your monthly payments adjust to market rates upon expiration of the temporary promotional rate period.

This means that your monthly payments may increase significantly on an annual basis, especially if interest rates are on the rise.

This makes them a risky proposition unless you’re committed to selling or refinancing the property within a few years.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Recommended Reading: Can I Get A Mortgage With A Fair Credit Score

Jamie David Business Director Of Mortgages

Jamie David is the Business Director of Mortgages at Ratehub.ca. A graduate of the Systems Design Engineering program at the University of Waterloo, she has over 15 years of business, marketing, and engineering experience in the financial technology, banking, education, energy and retail industries. She has worked in top organizations like TD Bank, Trading Pursuits, Petro-Canada, and the TTC. Her passion for personal finance, investing, education, and business strategy brought her to Ratehub.ca where she heads a very talented, cross-functional team that is dedicated to providing Canadians with the best mortgage experience all the way through from online search to funded mortgage.

Whats The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing money whereas the APR is the yearly cost of borrowing as well as the lender fees and other expenses associated with getting a mortgage.

The APR is the total cost of your loan, which is the best number to look at when youâre comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders , so youâll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate.

Read Also: How To Become A Mortgage Broker In Massachusetts

How To Get A Lower Mortgage Rate

Your mortgage rate is an important part of your home loan. Getting a lower mortgage rate starts when you make the decision to become a homeowner. Building a good credit history and making responsible financial decisions will show lenders youâre a responsible borrower. When you begin searching for a mortgage loan, shop around to see which lenders are offering the best terms. As you work with a lender to determine the details of your loan, consider these options to help get a lower rate.

- Save up for a large down payment. A bigger down payment means you’re financing less of the total cost of your home and can help you avoid paying private mortgage insurance.

- Purchase mortgage discount points. This is a way you can prepay interest on your mortgage loan. By paying a percentage of the cost of your loan with mortgage points, your interest drops slightly.

- Talk to a Home Lending Advisor. Talk about your financial situation and the ways your loan type and term can help you get a lower mortgage rate.

How Do I Pay For Cmhc Insurance

Your lender is actually the party responsible for payingCMHC insurancecosts. In the majority of cases, your lender will pass these costs down to you by adding the CMHC insurance premium to your mortgage loan amount. This will slightly increase your monthly or bi-weekly payment.

In some cases, your lender may allow you to pay CMHC insurance costs as a lump-sum, or not pass down the cost to you at all. Contact your lender for more details.

Read Also: What Does The Bank Need For A Mortgage

What Are The Different Types Of Mortgages

Mortgages come with all sorts of different interest rates and terms. These influence not only how long it will take to pay off your loan, but also how much your monthly payments will be.

These are some of the most common types of mortgages home buyers use:

Fixed-rate mortgage

A fixed-rate mortgage has a set interest rate for the life of the loan. With this type of loan, your mortgage rate will never change. While your overall monthly payments could still fluctuate based on property taxes or other factors changing over the course of your mortgage, a fixed rate locks in how much youll pay in interest over the course of your loan. And if interest rates drop to below your current rate, you can refinance to a lower rate.

Two of the more popular mortgage terms for fixed-rate loans are 15- and 30-year mortgages.

An ARM is usually a 30-year term loan with an interest rate that changes over time, in line with market averages. When the interest rate changes depends on the loan. Common ARM terms are 5/1, 7/1, and 10/1. The first number designates the first year your interest rate will change, and the second number is how frequently the interest rate resets after the first time. So a 5/1 ARM adjusts the rate after 5 years, and then annually after that. Most ARMs reset annually after the initial adjustment.

Government-backed loan

Should I Use A Mortgage Broker In Bc

Your mortgage is likely to be the biggest financial decision you ever make, and getting a great deal can save you thousands of dollars over time. Comparing rates and offers from different lenders is the best way to find your ideal mortgage.

Of course, with so many lenders, mortgages, and offers on the market, thatâs a daunting task. A good mortgage broker makes it more manageable, as they have access to, and knowledge of, multiple lenders and products on the market.

As well as being convenient, mortgage brokers often have access to exclusive offers and volume discounts, allowing them to get a better rate than whatâs advertised publicly – even from the big banks. BC mortgage brokers can also help by giving you advice on current mortgage deals, your credit history, or help you access a HELOC if you need one.

Mortgage brokers are also free for you to use, so thereâs no risk in speaking to one about your mortgage. At worst, youâll get free personalized advice on the mortgage process, and at best youâll get a great mortgage rate that saves you thousands.

Also Check: How Do I Qualify For A Zero Down Mortgage

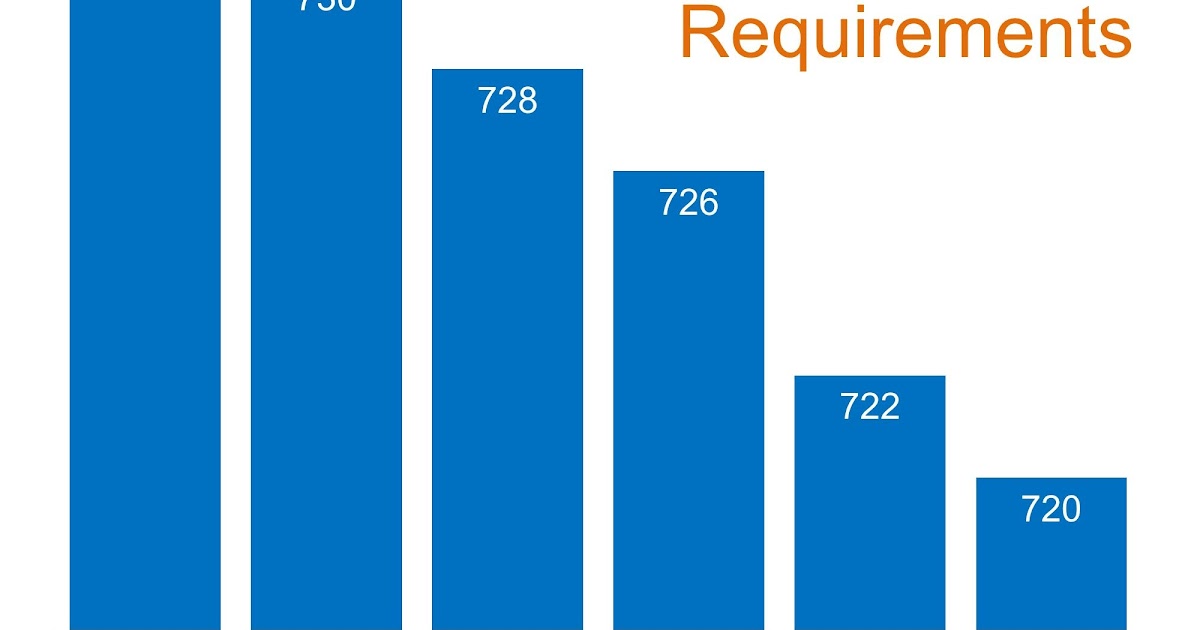

Whats That In Dollars

Say youre getting a 30year, fixed-rate mortgage of $300,000 with 5% down.

Someone with the lowest of those APRs would pay around $128,000 in interest over the life of the loan.

But someone whose score is in the 620639 range would pay closer to $218,900 in total interest payments for the same home price. So over time, what might look like a relatively small rate difference can add up to huge savings.

Va 30 Year Fixed Mortgage Rates

Since VA loans are guaranteed by the government, VA loans provide access to special benefits, including:

You May Like: What’s A Conventional Mortgage

What Is The Difference Between A Fixed And A Variable Interest Rate At Td

A fixed interest rate means your interest rate, along with your principal and interest payments, will stay exactly the same during your mortgage term.

With a variable interest rate, your interest rate can fluctuate based on changes in our TD Mortgage Prime Rate. While your payments will remain the same, the amounts from each payment that go toward the principal and interest can vary.

What Is A Mortgage Ratehold

Rateholds allow you to hold today’s current mortgage rates for 60-120 days, depending on the lender. This can be done prior to renewal or closing, to lock in a favourable rate. This protects you if rates rise, and if rates fall, your lender will typically honour the lower rate.

Remember that if you opt for a variable rate, youâll be locking the rateâs relation to prime, not the rate itself. Also note that while youâre guaranteed a rate for a given amount of time, your final mortgage approval is not guaranteed.

Recommended Reading: What Does A Co Signer Do For A Mortgage

What Is A Discount Point

Discount points are fees you pay the lender upfront in exchange for a lower interest rate. Buying down the rate with discount points can save you money if youre planning on keeping your home for a long time. But if youre going to sell or refinance before the full loan term is up, paying more fees upfront may not make sense.

Discount points can be part of a good deal, but you need to make sure you know when they are being added to your loan. When youre comparing mortgage offers, be sure to ask if the interest rate includes discount points.

How Do I Compare Current Mortgage Rates

Because mortgage rates are so individual to the borrower, the best way to find the rates available to you is to get quotes from multiple lenders. If you’re early in the homebuying process, apply for prequalification and/or preapproval with several lenders to compare and contrast what they’re offering.

If you want a broader idea without yet talking to lenders directly, you can use the tool below to get a general sense of the rates that might be available to you.

Read Also: How To Find Mortgage Payment

Fha 30 Year Fixed Mortgage Rates

With an FHA 30 year fixed mortgage, you can purchase a home with a lower down payment and flexible lending guidelines or streamline refinance with less documentation than a traditional loan.

FHA loans are backed by the Federal Housing Administration, that is, the federal government insures them. Rather than issuing mortgages, the FHA offers insurance on mortgage payments so that more people can get the financing they need to buy a house or refinance. However, borrowers are required to pay Upfront Mortgage Insurance and monthly mortgage insurance when obtaining an FHA loan.

Do I qualify for an FHA loan?

For FHA 30 year fixed rate loans, there are low down payment options, gifts are allowed, Streamline Refinances are permitted and there are no penalties for repayment.