Should I Use A Mortgage Broker In Ontario

A mortgage is probably one of the largest loans youâll ever take out, so it makes sense to choose the best mortgage product that matches your circumstances and needs. Mortgage brokers have access to a number of different lenders like the Big Banks, small banks, credit unions, and trust companies. They also work with some special financial institutions and digital banks that have less overhead and therefore offer lower rates. Many brokers also have access to special rates and can get volume discounts, that they then pass on to you. This is how mortgage brokers are often able to offer Big Bank mortgages at a lower rate than from the Big Bank itself. Moreover, with a mortgage broker, you can apply once and get quotes from multiple lenders .

Beyond just the lower rates, brokers have a thorough knowledge of the mortgage market and can provide you with information on different mortgage lenders and solutions. They can help you understand how much of a mortgage you can afford, advise you on which mortgage product best fits your situation, guide you through the entire mortgage process from quote to close, and can even assist you in getting a HELOC.

Most importantly, most mortgage brokers in Ontario do not charge a fee for their services as they are compensated directly by the mortgage lender. So it doesnât hurt to inquire with a mortgage broker and see what they can offer you.

The End Of The Fixed Period

Fixed-rate mortgages

When your fixed period ends the rate will move to the HSBC Standard Variable Rate, unless you switch your HSBC rate.

Tracker mortgages

The tracker mortgage will track the Bank of England base rate for a 2-year fixed period, then it will move to the HSBC Standard Variable Rate, unless you switch your HSBC rate.

Current standard variable rate

Our current standard variable rate for residential mortgages is 3.54%, effective from 1st April 2020. These rates only apply when a fixed or tracker rate no longer applies.

Why Compare Edmonton Mortgage Rates With Ratehubca

Ratehub.ca makes it easy to compare Edmonton mortgage rates, but pulling rates from the big banks, Edmonton mortgage brokers, and smaller lenders like credit unions, all in one place. By seeing whatâs available in Edmonton, youâll be able to make sure you get the best possible deal. We do this at no cost to you.

Don’t Miss: How To Lower My Mortgage Interest Rate

Mortgage Rates And The Housing Market: Looking Forward

The upcoming busy spring 2022 homebuying season is expected to be a sellers market with low inventory, high demand, and a continuation of rising home values. Still, experts like Kerry Melcher, head of real estate at Opendoor, say it will not be as intense as 2021 and more like a regular spring season.

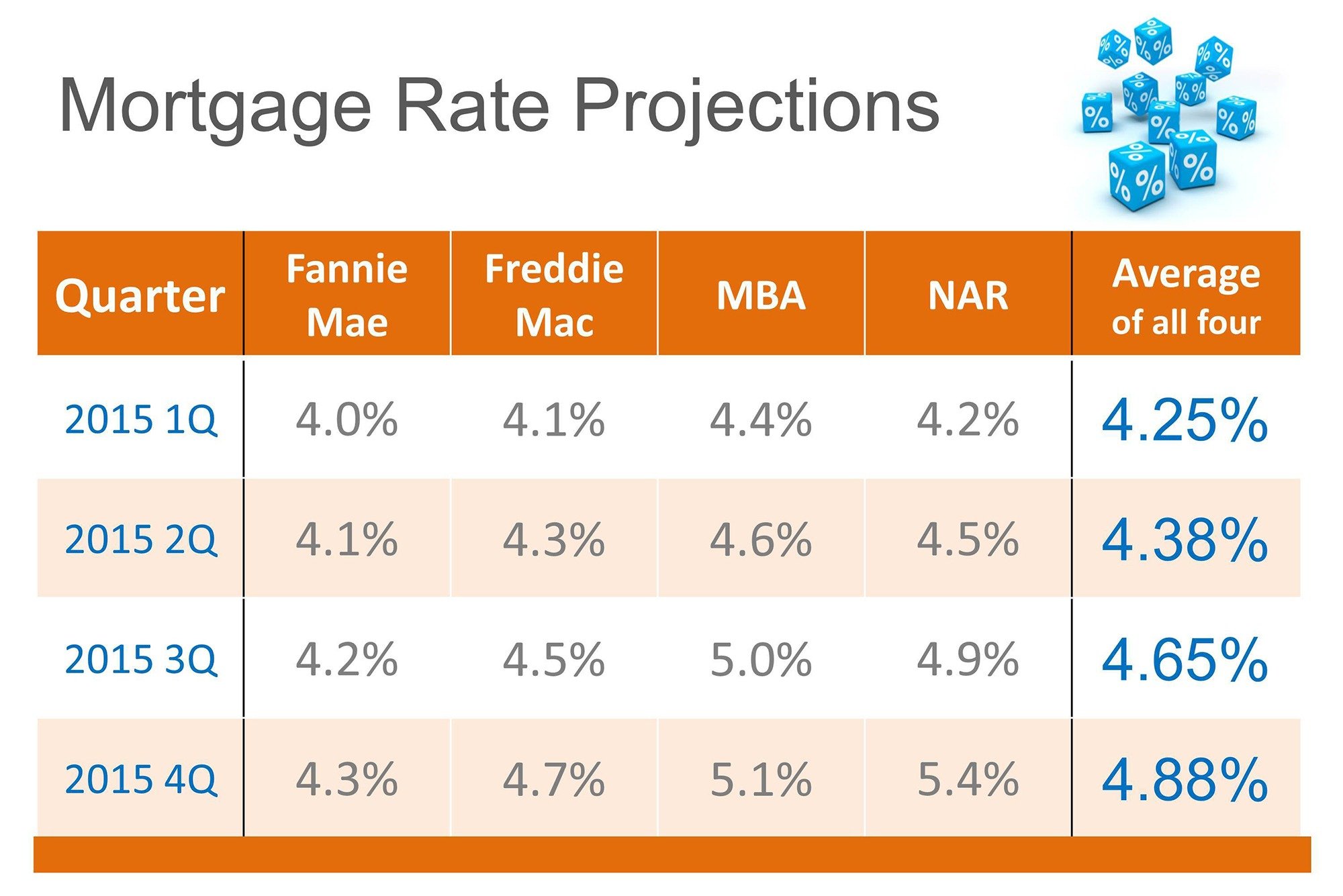

On the rate front, several experts we spoke with say to expect rate volatility in December and going forward into early 2022. Consumers tend to agree with the experts that rates will increase over the next 12 months, according to a recent Fannie Mae housing study. How fast or slow they increase is likely to be dependent on a number of economic factors.

Rising inflation, strained supply chains, and a strong employment outlook have been cited by experts as reasons behind the upward pressure on mortgage rates. Fears over the Omicron variant may push rates down, but some experts believe it will be short-lived. Raphael Bostic, the Federal Reserve Bank of Atlanta president, recently stated: Each successive wave of COVID-19 has led to milder economic slowdowns. If that holds, the economy will continue to grow through it.

Factors That Can Affect Your Personal Interest Rate

Itâs important to understand that the best mortgage rates in Canada are not necessarily the rates that you, personally, are able to qualify for. There are a number of factors that will affect your personal mortgage rate. Below are some of the most significant ones.

Your down payment: If your down payment is less than 20% of the purchase price youâll need to pay for mortgage default insurance . While this will cost you more overall, it will result in a lower mortgage rate, as your mortgage is less risky for your lender.

Your credit score: If you have bad credit, you may only be able to borrow from a B lender, instead of a big bank or credit union. B lenders are happy to work with people with a poor credit history, but they will charge higher mortgage rates.

What the home will be used for: Your mortgage rate will probably be higher if the home will be rented out, rather than lived in as your primary residence.

Your amortization period: Insurable mortgages in Canada have a maximum amortization period of 25 years. If you take out a type of mortgage that allows a longer amortization period, it will probably have higher interest rates.

The type of mortgage: If your mortgage is for a refinance, rather than a new purchase or renewal, youâll probably be offered a higher rate.

Also Check: Should I Refinance My Mortgage Or Make Extra Payments Calculator

Is It Safe To Get A Mortgage Online

Yes, its safe you no longer need to visit a bank branch or mortgage brokers office in person to apply for a mortgage. Its becoming increasingly common for Canadians to apply for mortgages online. LowestRates.ca only works with reputable, trustworthy financial institutions. Your credit score wont be affected and your information is secure. We dont share your information with anyone unless you want to connect with a mortgage broker. We take care of the heavy lifting by comparing the market for you and can connect you with the best mortgage lenders not only in British Columbia, but across the country.

What Is A Discount Point

Discount points are fees you pay the lender upfront in exchange for a lower interest rate. Buying down the rate with discount points can save you money if youre planning on keeping your home for a long time. But if youre going to sell or refinance before the full loan term is up, paying more fees upfront may not make sense.

Discount points can be part of a good deal, but you need to make sure you know when they are being added to your loan. When youre comparing mortgage offers, be sure to ask if the interest rate includes discount points.

Also Check: How Much Money Do Mortgage Brokers Make

What Is A Mortgage Ratehold

Rateholds allow you to hold today’s current mortgage rates for 60-120 days, depending on the lender. This can be done prior to renewal or closing, to lock in a favourable rate. This protects you if rates rise, and if rates fall, your lender will typically honour the lower rate.

Remember that if you opt for a variable rate, youâll be locking the rateâs relation to prime, not the rate itself. Also note that while youâre guaranteed a rate for a given amount of time, your final mortgage approval is not guaranteed.

Why Compare Saskatchewan Mortgage Rates On Ratehub

The process of comparing mortgage rates, terms, and conditions between multiple providers can be a confusing one. However, it’s one of the most important steps you should take to get the right mortgage for you. With Ratehub.ca, you can compare rates from the big banks, top mortgage brokers, and small lenders, all in one place. All this, at no cost to you.

Also Check: How Much Is A 180k Mortgage Per Month

Factor: Your Property Type

Youll generally get better mortgage rates if you live in the property being financed. Non-owner-occupied properties, for example, tend to have higher rates due to the added risk to the lender. Thats especially true if theyre rented out.

As well, properties that are less liquid rarely qualify for the lowest rates due to potential resale risk if a customer defaults.

Nextadvisors Best Mortgage Lenders Of 2021

You should always compare several different lenders when shopping for a home loan. Not only will the rates and fees you pay vary, but the quality of service as well. Even within the same company or the same branch office the experience from one loan officer to the next can be vastly different.

So regardless of what lender you end up working with, its important to find someone that can help you navigate challenges of your individual situation. If youre a military veteran getting a VA loan, youll want to work with someone who has experience with those types of loans.

How we chose the best mortgage lenders

To narrow down the best mortgage lenders of 2021, we started by looking at the top 20 largest mortgage lenders, according to the Scotsman Guide rankings. Each of our top five lenders from that list has an A+ rating with the Better Business Bureau, operates in 40+ states, and has less than 0.30 complaints per 1,000 loans originated, according to the Consumer Financial Protection Bureau complaint database.

Recommended Reading: What Can I Do To Lower My Mortgage Payments

How Do I Know Im Getting The Lowest Rate

We have a strong selection of lenders on LowestRates.ca, including the big banks and many independent providers, and were adding more lenders all the time. This ensures were always delivering you a competitive rate. Even if youre not ready to commit to anything, you can use our site as a starting point for research .

The better informed you are, the more likely you’ll negotiate a better deal for yourself. And, really, thats what we care about the most.

LowestRates.ca Staff

Whats The Difference Between Variable And Fixed Rates

Variable rates can change over the course of your mortgage term . On the other hand, fixed rates remain constant throughout your mortgage term, even if the prime rate changes.

The advantage of variable rates is that if rates fall across the market, then your rate will also drop. The downsides are that rates can go up. This would also cause your rate to rise, which means paying more on your regular mortgage payment.

The advantage of fixed rates is that your regular mortgage payments will stay the same for your entire term. However, if prime rates were to drop, youâd be missing out on the savings that a lower rate would offer.

Learn more about fixed and variable rates here.

Also Check: How Much Mortgage 200k Salary

Ontarios Housing Market Trend

Ontarios new tagline is A Place to Grow, which is also whats expected for the provinces population. The Ontario Ministry of Finance projects the population of Ontario will increase some 30.2% over the next two decades, bringing the total population to 18.5 million by July 1, 2041.

There are so many incredible aspects to Canadas most populous province, from its lush natural resources to its growing cities. That and solid job growth make the population boom less of a surprise.

As a result of its popularity, home prices in Southern Ontario are expected to continue rising. Prices are particularly prone to inflation in Ontarios Golden Horseshoe region where immigration is high, land is limited by the protected green belt and homes remain in short supply.

That, in turn, implies that Ontario mortgage amounts will grow faster than the national average.

How Much Does Getting A Lower Interest Rate Matter In British Columbia

B.C. is definitely an expensive destination for both first-time and seasoned homebuyers. Larger cities have seen substantial increases in home prices in just one year. Finding the best mortgage rates in B.C. is paramount, but its not the only way to ensure affordability of your mortgage. Other features can help, including:

Prepayment privileges: Some lenders will offer prepayment privileges, which give the homebuyer the right to pay off part or all of their mortgage balance prior to maturity without penalties. Substantial savings can be had by saving on future interest payments.

Penalties for breaking a mortgage: Some lenders will charge a fee if you pay more than the allowed additional amount on your mortgage, break your contract, transfer your mortgage to another lender before the end of your term, and pay back your entire mortgage before the end of your term. Avoiding these events will prevent extra fees, but homebuyers need to calculate the pros of breaking a contract in order to get a better rate and/or pay off the mortgage in full.

Porting your mortgage: Its not unusual to consider moving houses before your mortgage is paid off. Porting your mortgage means taking your existing mortgage, with its current rate and terms, and attaching it to your new home. Porting can generally occur if you are purchasing a new home at the same time you are selling your current home. This can help save on penalties and fees in the future.

Don’t Miss: Why Do You Need Mortgage Insurance

Open Vs Closed Mortgages

You may often notice a significant difference in mortgage rates betweenopen and closed mortgages. Open mortgages allow you to make principal prepayments at any time without any charges or penalties, which makes it very flexible. This flexibility is counterbalanced by open mortgage rates being higher than closed mortgage rates.

Choosing a closed mortgage can let you access much lower mortgage rates at the risk of prepayment penalties if you go over your lenders annual prepayment limit. Things like selling your home or a mortgage refinance can cause you to have to pay significant prepayment penalties. This could be avoided with an open mortgage, but youll have to pay a higher mortgage rate.

Mortgage Interest Rates Forecast For Next Week

Mortgage rates could go either way next week or roughly hold steady. Unfortunately, nobody can predict either what the Fed might say or what might happen to Omicron.

Mortgage and refinance rates usually move in tandem. And a gap that had grown between the two has been largely eliminated by the scrapping of the adverse market refinance fee.

Meanwhile, another recent regulatory change has likely made mortgages for investment properties and vacation homes more accessible and less costly.

Read Also: What Are 15 Year Mortgage Interest Rates

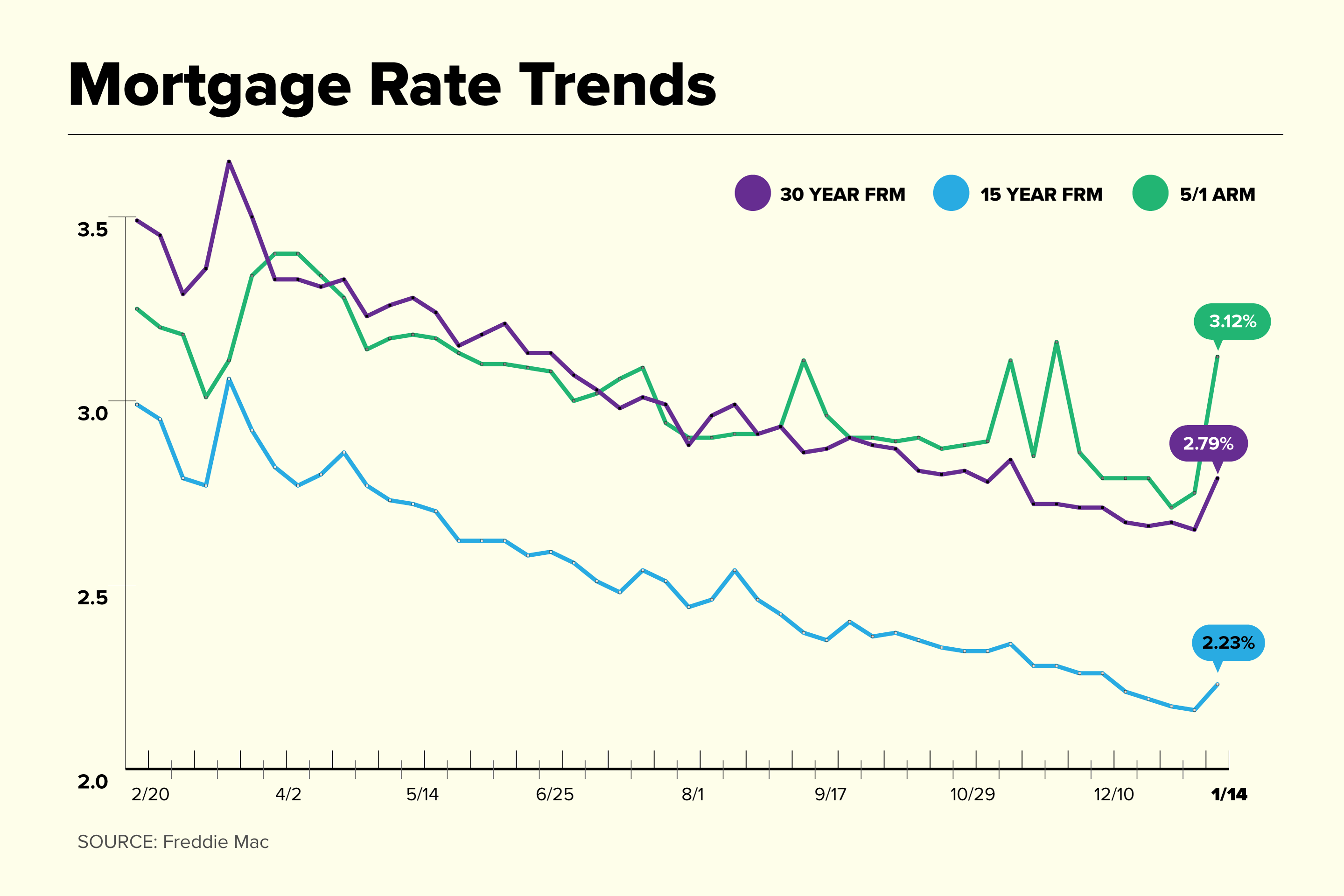

Today’s Mortgage Rates On Dec 13 : Despite Uptick Rates Stay Low For Homebuyers

Mortgage interest rates are never set in stone. We’ll help you follow how rates change through the end of the year.

A couple of closely followed mortgage rates crept upward today, including 15-year fixed and 30-year fixed mortgage rates. Average rates for 5/1 adjustable-rate mortgages also went up since last week’s figures. Though mortgage interest rates change all the time, interest rates have been historically low. Because of this, right now is a great time for prospective homebuyers to get a fixed rate. But as always, make sure to first consider your personal goals and circumstances before buying a home, and talk to multiple lenders to find a lender who can best meet your needs.

Why Save Up For A Large Down Payment If The Mortgage Rate Is Higher

In most cases, a high-ratio insured mortgage will have a mortgage rate that is lower than a low-ratio mortgage with a down payment greater than 20%. Why bother saving up for a large down payment if you can make a small down payment and get an even lower mortgage rate? The answer lies in the cost of the mortgage default insurance, which isnt free.

CMHC insurance premiumscan add thousands of dollars to the cost of your mortgage. The cost of this mortgage default insurance will either need to be paid upfront or it will be added to your mortgage principal balance. Adding the cost of the mortgage insurance to your principal means that you will be paying interest on the insurance over time, adding on to the cost of your mortgage. The CMHC insurance premium will depend on the size of your down payment.

Recommended Reading: How Do Mortgage Loan Officers Make Money

What Is A Mortgage Rate

A mortgage rate is the interest rate on a mortgage. Itâs also known as the mortgage interest rate. The mortgage rate is the amount youâre charged for the money you borrowed. Part of every payment that you make goes toward interest that accrues between payments.

While interest expense is part of the cost built into a mortgage, this part of your payment is usually tax-deductible, unlike the principal portion.

How Are Mortgage Rates Set

Several economic factors influence rates, from inflation to monetary policy. Likewise, different lenders charge different mortgage rates for a variety of reasons, including varying operating costs, risk tolerance and even how much they want new business. Your personal financial informationâincluding credit score, debt-to-income ratio and income historyâalso have a significant impact on interest rates.

Also Check: How Much Income For A 250k Mortgage

What Is A Mortgage Rate Lock

A mortgage rate lock allows you to lock in the interest rate your lender quotes you for a certain period of time. This gives you a chance to close on the loan without risking an increase in the mortgage interest rate before you finalize the loan process.

Once you find a rate you like, lock it in as soon as possible because rates can change overnight. If they rise, then you could end up paying more on your mortgage.

If you get a floating rate lock, then you can lock in a lower interest rate if rates fall, but you wonât be obligated to pay higher interest rates than you were quoted if they go up.

While 30-day rate locks are typically included in the cost of a mortgage, a floating rate lock could cost extra. Depending on how volatile the rate environment is, you might find that a floating lock is worthwhile.

Renting Vs Buying A Home

However, over the long term, buying a home can be a good way to increase your net worth. And when you buy, you can lock in a fixed interest rate, which means your monthly payments are less likely to increase compared to renting. Owning a home also has the added benefit of providing a stronger sense of stability for you and your family. And when you own, you have the freedom to customize your living space however you like.

Don’t Miss: How To Get A Mortgage On A Foreclosure