Can I Negotiate My Mortgage Rate With The Bank Or Lender

By Brandon Cornett | © 2021, all rights reserved | Copyright policy

Reader question: “We are about to start the process of applying for a mortgage loan, so we’ve been reviewing the interest rates posted on various bank websites. How can we negotiate the mortgage rate offered by the bank or lender, after we apply for the loan?”

Yes, you can try to negotiate the interest rates presented by the lender. Whether or not you’ll be successful is a different story. Much will depend on your qualifications as a borrower. Generally speaking, well-qualified borrowers have more negotiating power than those who are marginally or poorly qualified for a home loan.

You can also use prepaid interest points to negotiate a lower mortgage rate from the bank. But we’re getting ahead of ourselves. Let’s start by talking about those all-important qualifications I mentioned above.

Example Of A Mortgage Refinance

Lets say you took out a 30-year mortgage for $200,000 at a fixed interest rate of 4.75 percent. Your monthly payment is $1,043. Over the life of the loan, youd pay $375,586.08, which includes more than $175,586 in interest.

Three years into the loan, youve paid $10,006 toward the principal and $28,596 in interest. Now you want to refinance the remaining $189,994 of your principal balance with a new 30-year fixed-rate loan at 3.5 percent.

Your new loan would slash your monthly mortgage payment to $853 per month, giving you an additional $190 of wiggle room in your monthly budget. Over the life of the loan, youd pay $307,136, of which $117,142 would be interest. Add in the $38,602 in principal and interest you paid in three years on the previous mortgage, and your total cost will be $345,738.

Switch From An Arm To A Fixed

When used wisely, an ARM can be an effective home loan option. Just be sure you know when the interest rate is scheduled to fluctuate. ARM rate changes tend to move upward, resulting in higher monthly payments for you. A good way to avoid this is to refinance out of the loan as youre nearing the end of the initial fixed-rate period.

Ensure you’re getting the best advice with these mortgage refinancing tips.

Recommended Reading: What Do Mortgage Rates Follow

Cutting Down Your Monthly Payments

You could ask your mortgage lender if they will agree to cut down your monthly mortgage payments, usually for a limited period of time. This might get you over a rough patch and stop a debt from building up. If a debt has already built up, youll need to find a way to clear the debt as well.

For more information about clearing mortgage debts, see How to deal with mortgage debts.

Before you agree to make any changes to your mortgage, you should ask your lender if there will be any charge for this, such as a redemption or administration charge, and how much this will be. If the charge seems very high, you should get advice from an experienced adviser.

Depending on the type of mortgage you have, you may be able to:

- reduce your monthly interest payments. Your lender will probably only agree to this if there is equity in your property. This means that the property must be worth more than how much is owed on the mortgage

- change to interest-only payments

- reduce or stop repayment of the amount you borrowed temporarily

- increase the period of time over which the mortgage is paid. This would be more than just a temporary option and would mean you paid more interest in the long term.

For more information about how to ask your mortgage lender to cut down your monthly payments, see Dealing with your mortgage lender.

Take On An Offset Sub

An offset sub-account is a useful home loan feature. Any amount of money you have in this facility will offset daily against your loan balance. Plus, you can also redraw funds from your facility when you need it.

As an example, your loan amount is $350,000, and you have $15,000 in your offset sub-account. Your lender will then calculate interest on only $335,000 instead of the original loan amount.

Also Check: How To Apply For A House Mortgage

Check Your Property Taxes

Most lenders also require you to make payments toward your property taxes in your monthly bill, which they keep in an escrow account. In general, homeowners have limited control over the amount they pay in property taxes. If you can persuade your local taxing authority to lower your property taxes, you could lower your mortgage payment too.

Increase Your Credit Score

Your credit rating is directly tied to the interest rate you receive on a mortgage. If you have poor credit, not only will you get a high rate, you may not even be eligible to refinance in the first place.

If you improve your credit score, you can apply to refinance and get a lower rate.

Believe it or not, you can increase your credit score in a relatively short period of time by doing these 5 things.

- Pay down card balances

- Become an authorized user

- Remove your collection accounts and/or late payments

Pay down your credit card balances: Credit utilization is the ratio of your credit card balances compared to the credit limit. For example: If you have a credit limit of $10,000, and you have a $5,000 balance, your credit utilization ratio is 50%.

This is very high and will have a significantly negative impact on your FICO score. Its best to keep your utilization ratio below 15%. So if youre carrying high balances, pay them off and wait a few weeks for it to update on your credit report. When its reported, your scores will increase.

Get added as an authorized user: An authorized user is a secondary account holder who has the authorization to use the account.

If you know anybody with a credit card account established for a long time with positive payment history, ask them to add you as an authorized user on that account. When youre added, the entire account history will be reported to your credit history.

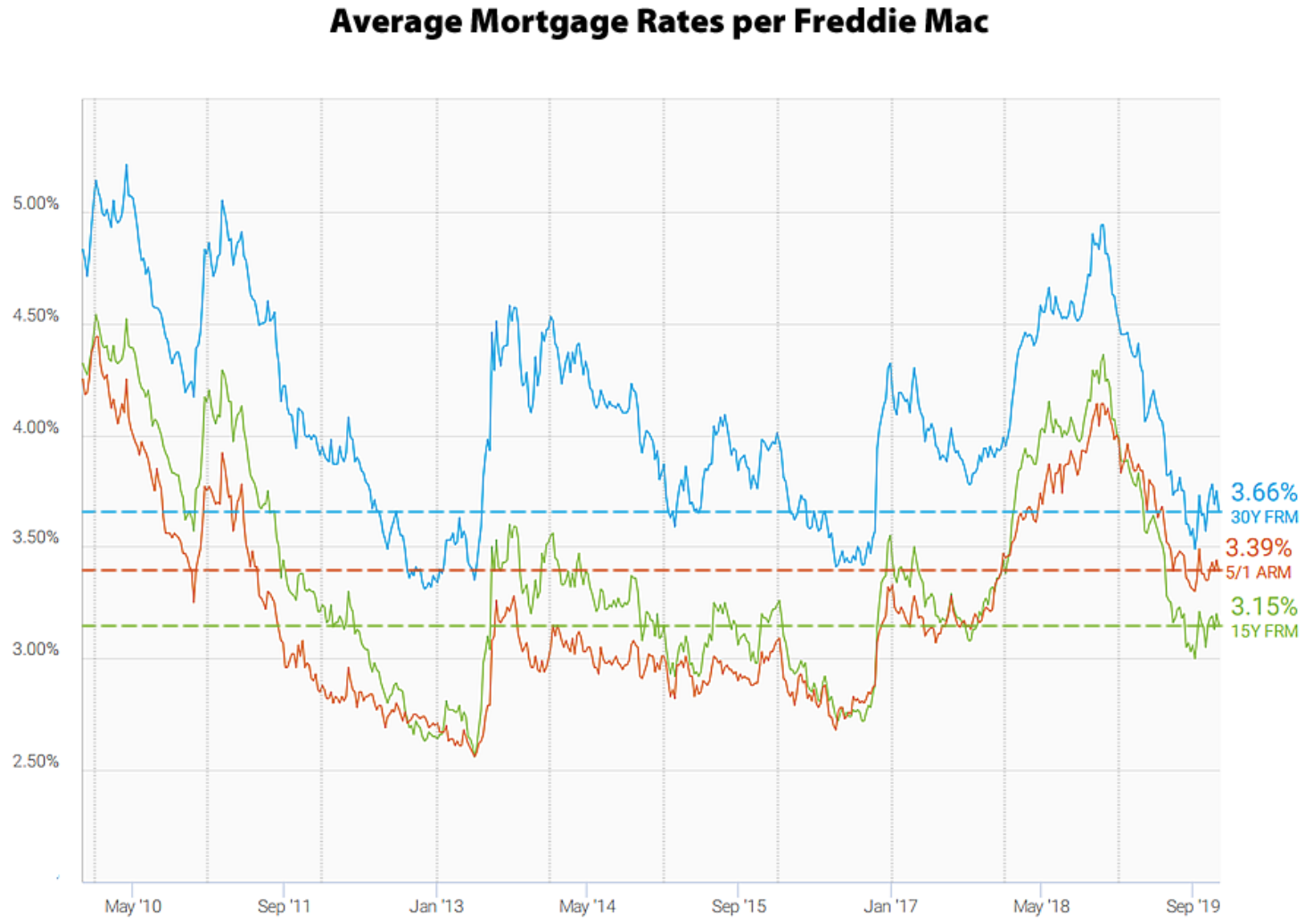

Recommended Reading: What Is The Current Trend In Mortgage Rates

Example Of How Mortgage Points Can Cut Interest Costs

If you can afford to buy discount points on top of the down payment and closing costs, you will lower your monthly mortgage payments and could save lots of money. The key is staying in the home long enough to recoup the prepaid interest. If you sell the home after only a few years, or refinance the mortgage or pay it off, buying discount points could be a money-loser.

Here is an example of how discount points can reduce costs on a 30-year, fixed-rate mortgage in the amount of $200,000:

| Loan principal | |

| None | $20,680 |

In this example, the borrower bought two discount points, with each costing 1 percent of the loan principal, or $2,000. By buying two points for $4,000 upfront, the borrowers interest rate shrank to 3.5 percent, lowering their monthly payment by $56, and saving them $20,680 in interest over the life of the loan.

How Do Mortgage Points Work

Discount points or mortgage points let you pay extra upfront to lower your mortgage interest rate. Each point typically costs 1 percent of your loan amount and lowers your rate by about 0.25%.

For example:

- Cost of one discount point: $2,500 paid at closing

- New interest rate*: 3.25%

*Interest rates are for sample purposes only. Your own mortgage rate will vary.

Mortgage discount points are equivalent to prepaid interest. Instead of paying that interest in small amounts with each monthly mortgage payment, you can pay a chunk of it upfront to reduce the total amount due.

Paying points upfront usually lowers your mortgage rate, which in turn lowers your mortgage payment, explains Katsiaryna Bardos, chair and associate professor of the Finance Department at Fairfield University.

Don’t Miss: How Much Would My Mortgage Payment Be

How To Get A Lower Mortgage Interest Rate On Your Home

- Getting approved for a mortgage can be complex, but if you do things right, you may be able to get a lower mortgage interest rate.

- Your and credit report are vital for mortgage approval.

- Your income compared to your debt obligations is another important part of getting a mortgage.

If you are looking to buy a home, you are likely preparing for the biggest purchase of your life. To finance a home purchase, many households look to a mortgage loan from a trusted lender. Mortgages make sense for millions of people.

To get the best deal, you can follow these steps to get a lower mortgage interest rate.

Refinance To Lower Your Mortgage Rate

To determine if you can save money with a lower mortgage rate, use our calculator to compare the monthly interest savings against the cost to refinance. As most mortgage brokers and lenders will cover your legal costs, the main cost you need to worry about is your break of mortgage penalty, or prepayment penalty. This penalty is charged by your lender for breaking your mortgage contract early and is based on your original contract date, current mortgage balance, mortgage rate, and other factors.

Don’t Miss: How To Remove A Cosigner From A Mortgage

How To Calculate The Break

The break-even point on a mortgage refinance occurs when savings equals costs, explains Jared Maxwell, vice president of consumer direct lending at Embrace Home Loans.

To determine the break-even point on your refinance, divide the closing costs by the amount youll save each month with your new payment.

Lets say that refinancing will save you $150 per month, and the closing costs on the new loan are $4,000:

$4,000/$150 = 26.6 months

So, if you were to close your new loan today, youd officially break even just over two years and two months from now. If you live in the home for an additional five years after that point, the savings really start to add up $9,000 total.

You can use Bankrates refinance break-even calculator to figure out how long it will take for the cost of a mortgage refinance to pay for itself. If you think you might sell the home before your break-even point, refinancing might not be worth it.

Can I Lower My Interest Rate Without Refinancing

When mortgage rates drop, homeowners often wonder if they will be able to take advantage of lower rates. In general, lenders require borrowers to refinance into a new home loan in order to change their mortgage rate, requiring the borrower to requalify, the house to pass an appraisal and the homeowner to again pay closing costs. However, there can be another way to lower your mortgage rate without refinancing: a loan modification.

Recommended Reading: What Does A Co Signer Do For A Mortgage

How Long Do You Plan To Keep The Mortgage

As when you purchased your home, you will have to pay closing costs on your refinance. If youre planning on selling your house in a few years, you may barely break even by refinancing. How come?

If the monthly savings for the remainder of your mortgage are not greater than the closing costs associated with the refinancing, youll lose out. If you roll the closing costs into your mortgage instead of paying them up front, youre paying interest on them, so youll need to factor this expense into your break-even calculation.

Are Mortgage Points Right For You

Buying mortgage points is a way to pay upfront to lower the overall cost of your loan. It makes the most sense if you plan to be in the home for a long period of time. The amount youll save each month is likely to make the upfront cost worth it.

For many borrowers, however, paying for discount points on top of the other costs of buying a home is too big of a financial stretch, and buying points might not always the best strategy for lowering interest costs.

It may make financial sense to apply these funds to a larger down payment, says Boies.

A bigger down payment can get you a better interest rate because it lowers your loan-to-value ratio, or LTV, which is the size of your mortgage compared with the value of the home.

Overall, borrowers should consider all the factors that could determine how long they plan to stay in the home, such as the size and location of the property and their job situation, then figure out how long it would take them to break even before buying mortgage points.

Don’t Miss: What Makes Mortgage Rates Change

Extend The Term Of Your Mortgage

If a lower payment is your goal, extending the term of your loan can help you get there. A longer mortgage term spreads out the loan balance over more payments.

Heres an example: Lets say you bought your home 10 years ago with a $200,000 30-year-fixed loan. Without accounting for taxes and insurance, your payment, at 4.5% interest, is $1,013.

Now lets say you want to lower your mortgage payment. Since youve been paying on your loan for 10 years, youve reduced the balance to about $160,000. By getting a new 30-year fixed loan, youd spread the smaller balance over 30 years. Your new payment, at the same interest rate, would be just $811. Thats a savings of over $300 a month.

Shop For New Homeowners Insurance

The other part of your escrow payment is your homeowners insurance premium. It might not be one you check very often but it can be subject to sudden increases. Its not uncommon to see premiums increase from year to year.

With hundreds of different homeowners insurance companies competing for your business, it may be time to shop again, even if your current homeowners insurance premium hasnt gone up.

You May Like: Does Mortgage Modification Affect Credit Score

Why We Didn’t Refinance Even Though Rates Were Low

I started by contacting a major online lender advertising low rates and filled out an application. They came back with a 2.8% rate on a 20-year mortgage. This would increase our monthly payments by about $125 but decrease the total interest paid by about $14,000.

One downside to the offer is that it required points, which is a fee you pay to secure a lower interest rate. To get a 2.8% interest rate, we would have to pay $4,000. We couldn’t find an interest rate lower than our current one without paying that fee.

Video by Stephen Parkhurst

My husband and I didn’t want to use our savings to pay for points, so the lender offered to roll that amount into the mortgage, along with the other closing costs. The points and closing costs would increase the total mortgage balance by about $7,500.

After our financial planner ran the numbers, he told us that it would take eight years to break even on just the points and closing costs. Since my husband and I only plan on staying in this house for another 10 years or so, it didn’t make sense to go through the hassle of refinancing. I was disappointed, but we did still have a low interest rate.

Refinance To A Longer Loan Term

Another way to lower your mortgage payment is to refinance to a longer loan term. For example, if you have 20 years left on your mortgage and you refinance to a new 30-year mortgage, your monthly payments might go down.

However it is important to understand that doing this could increase the total amount you pay in interest over the life of your loan. Thats because you are paying back the money you own over a longer period of time. In this case, lowering your mortgage payment does not mean you are “saving money.”

If you are a current Freedom Mortgage customer, we can often help you keep your loan term the same when you refinance your home. That means we might be able to offer you a lower interest rate without adding years to the term of your new mortgage.

Recommended Reading: How Much Second Mortgage Can I Afford

How To Refinance Your Mortgage

There are a number of ways to refinance your mortgage, but the most important step is to get prequalified with a lender. Doing this will not only help you to know whether you meet the basic requirements of the lender but will also give you an idea of your potential interest rates for the refinance. If you have an idea of your rates, you can plug that information into the mortgage refinance calculator and see for yourself how much you stand to save.

Make sure to shop around for lenders, too you may be given different rates by different lenders, which could mean the difference between refinancing at a lower rate and sticking with your current loan. Be sure to check with your current lender, too they have an incentive to keep you as a customer, so its worth seeing whether the current lender will offer you a lower rate than a new lender would.

Once youre prequalified, the refi loan process will follow similar steps as the original loan process did. Youll likely need to get another appraisal and will go through the closing process again, too.

How To Reduce Your Mortgage Payments

UK interest rates are at their lowest in 325 years. even Phil doesnt remember that far back, quipped the savings guru. Mortgage rates are at a historic low. You can get two year fixes for 1. 1 per cent. 5 year fixes from 3.5 per cent.

Image credit: Simon James / Contributor / Getty

So if you are someone who has a full income or even furlough income, that will be factored when you look at what mortgage you can get, and a good credit score you should be checking right now to see if you can cut the price of your mortgage.

So to just give you some impetus, Sam tweeted me: Thanks Martin I try to keep financially savvy, just fixed my mortgage for 5 year saving £160 a months. Nearly £10,000 saved over the fixed period.

Image credit: Colin Poole

Mortgage rates are low ,you need more equity to get them right now. If youve only got 5 per cent equity in your house, you wont be able to get one. But it is worth checking. Everybody should be checking if they can get one.

Don’t Miss: Who Owns Prosperity Home Mortgage