Monetize Your Current Home

This is an excellent solution if you own a larger home that has a separate entrance that can easily be converted to a small apartment. By converting a basement, attic over a garage, or second floor into a small apartment, you are able to rent to a tenant and use the added income towards your mortgage.

Renting a portion of your real property can also give you significant tax breaks. Use the tax savings to pay down more principal on your mortgage.

Homeowners in college towns find that renting a room to a college student works well. This is a great solution since it requires no renovation. The downside is that renting a room means that the tenant will share common space, so written house rules about common areas are imperative.

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

How Do I Find Out The Current Balance On My Mortgage

If youre registered for Online Banking, you can log in to your account and check the balance there. Youll find your mortgage in the list of accounts displayed on your Online Banking homepage. Just click on the ‘View information’ link for more.

You can also find it in the Barclays app. To register for the app youll need a current account with Barclays.

You can also call us on 0800 022 4022. Lines are open 8:30am to 5:30pm, Monday to Friday, and 9am to 1pm on Saturday. .

To maintain a quality service, we may monitor or record phone calls.

Also Check: How Much Is Mortgage On A 1 Million Dollar House

Calculating The Outstanding Loan Balance

We have seen above that, the present value of the loan installments is equal to the loan amount, it follows that as loan installments are paid, the present value of the remaining loan installments must be equal to the loan amount at that particular point, that is to say equal to the outstanding loan balance.

We can use this information to calculate the outstanding loan balance at any point in time. For example, after the first installment has been paid, the outstanding loan balance should be the present value of the remaining three installments calculated as follows:

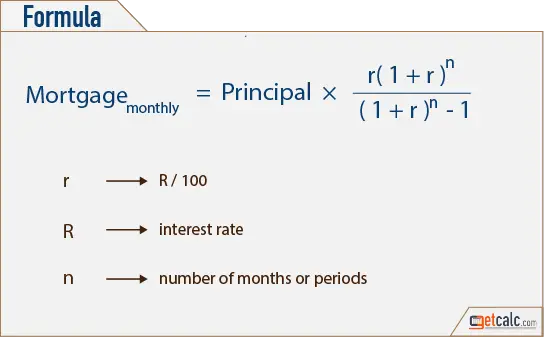

Pmt = Periodic loan payment = 28,859.15i = Loan interest rate per period = 6% per yearn = Number of loan payments remaining = 3PV = Pmt x n) / iPV = 28,859.15 x 3) / 6%PV = 77,140.85Outstanding loan balance = 77,140.85

As a check, we can show this to be the case by calculating the outstanding loan balance without using the annuity formula. As each payment is made the balance on the loan falls. So for example after the first repayment, the outstanding loan balance will be the original loan, plus the interest for a year, less the first installment, as follows:

Loan balance = Loan amount + Interest - InstallmentLoan balance = 100,000 + 100,000 x 6% - 28,859.15Outstanding loan balance = 77,140.85

The same answer as given by the annuity formula applied to the remaining three installments

How To Calculate Mortgage Principal & Interest

The easiest way to find out what is owed on your mortgage is to check the most recent statement you’ve received from your lender or access your lender’s online banking system. If you don’t have access to that information for whatever reason, you can use an outstanding mortgage balance calculator tool or manually apply a mortgage balance formula based on the interest rate, the amount you borrowed and the payments you’ve made.

TL DR

Find out your outstanding mortgage balance from your lender if possible. If that isn’t an option, or you want to double-check the numbers, use a mortgage payoff calculator tool or formula.

Also Check: 70000 Mortgage Over 30 Years

Understand What Information Is Public

Before you spend time searching for mortgage information, its important that you understand exactly what information youll be able to find. To protect a sellers privacy, some information simply isnt public record. For instance, you wont ever be able to get the account number or other sensitive information.

A public mortgage records search may reveal the following:

- Borrowers name

- Square footage of dwelling

- Propertys assessed value

During your search, you may also uncover information about previous sales, listings, and the price for which the property was listed/sold in the past. Youll also be able to look back on how the propertys assessed value has changed over time.

Use Of Remaining Balance Formula

Using this formula, a simple interest loan will return an incorrect answer in most cases because the portion of principal and interest is determined by the date the payment was made on.

It is also important to note that the remaining balance on a loan formula shown is only used for conventional loans where the payment, rate, and term are fixed. Specialized loans like graduating payment, option, and negative amortization will require special calculations to determine the loan balance at a particular time.

The remaining balance on a loan formula can be used with mortgages, consumer loans, and commercial loans. Where the money is spent does not have an affect on how to calculate the remaining balance on a loan.

Don’t Miss: 10 Year Treasury Vs Mortgage Rates

Calculating Your Interest Rate

Knowing the principal balance of your loan won’t tell you how much you actually owe. For this, you need to understand the interest rate on the loan. Multiply the interest rate by the amount of the loan to see how much interest you’re paying and add this to the balance to understand the total sum of the loan. If you take out a $1,000 loan with 10% interest, you’re paying $100 in interest, making the total loan $1,1000.

If your loan has compound interest, you will need to calculate the interest rate for each year of the loan to determine the total interest for the life of the loan.

Use Conditional Formatting To Make It Pretty

Recall that we set up this spreadsheet so that it could handle a maximum of 30 years of monthly payments. What would happen if the loan term was less than that ? Well, you would end up with a bunch of rows with zeros in them after the loan is paid off. Ugly.

We can fix this with the Conditional Formatting functionality that is built in to recent versions of Excel. Basically, we’d like to make those “empty” cells disappear. If would also be nice if we could underline the last payment as well.

First, select cells A10:E369 since we are going to apply the formatting to all of them at once. Now, go to Format » Conditional Formatting from the menus. That will launch the following dialog box.

Notice that I have set two conditional formats. The first is the most important. It sets the text color to white for any cells after the last payment has been made. This effectively hides them, but the formulas are still there. We can determine if a cell is after the last payment by comparing the payment number with the total number of payments .

I am using the “Formula Is” option, so select that from the drop-down list and then enter the formula: =$A10> and type it exactly. The $A10 is a relative reference so that in the next row it will change to $A11, then $A12, and so on. Now, press the Format button and set the font color to white.

Recommended Reading: 10 Year Treasury Yield And Mortgage Rates

Home Equity As A Financial Asset

As a financial asset, home equity is considered one of the most solid of personal assets. Its value is secured by the property and verified by appraisal and sales records.

However, it is not a very liquid asset, since it cant be quickly converted into cash. In order to access financial liquidity, many homeowners either take out a loan against their equity known, predictably enough, as a home equity loan or establish a home equity line of credit .

A HELOC is a line of credit secured by the homeowners equity interest in their home. Based on the monetary value of the homeowners equity, a lender will establish a line of credit for the homeowner. The homeowner can then access funds, as needed, up to a maximum amount that is correlated to the dollar value of their home equity.

Important Notes Regarding The Mortgage Balance Calculator

There is a difference between your mortgage balance and your mortgage payoff amount. If you are looking to pay off your mortgage, your mortgage balance may not provide you with the relevant information needed. The payoff amount will be higher than your mortgage balance. This is because of additional fees required by the lender to close out the mortgage.

Related:5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

Also remember this mortgage balance calculator only works with fixed-rate mortgages. Fixed-rate mortgages have fixed interest rates â meaning the interest rate stays the same over the course of the loan term. Adjustable-rate mortgages, on the other hand, have interest rates that are periodically adjusted.

There are, however, additional ways to find your mortgage balance. The Mortgage Balance Calculator isn’t the only way. Try one of these methods too . . .

Read Also: Rocket Mortgage Loan Types

Mortgage Calculator With Taxes And Insurance

Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

How To Find Remaining Mortgage On Property

- South River, NJ

i am trying to find data source on properties in NJ. I found the tax info pretty easily, but I am struggling to find useful data on the mortgage. I was talking to my lawyer and he seems to have no problem pulling that kind of info on an property.

- Grand Rapids, MI

That is all public record . I’d start here in your case: https://wwwnet1.state.nj.us/DOS/Admin/ArchivesDBPortal/index.aspx

Originally posted by :

i am trying to find data source on properties in NJ. I found the tax info pretty easily, but I am struggling to find useful data on the mortgage. I was talking to my lawyer and he seems to have no problem pulling that kind of info on an property.

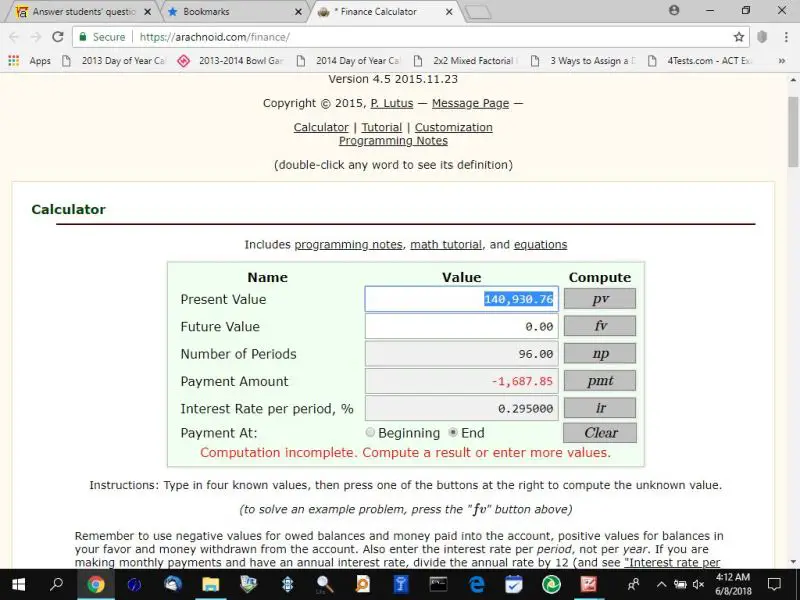

Anyone that has the following two characteristics can guesstimate outstanding mortgage balances:

1) Title/escrow companies want to bribe them, which they do by granting access to property profiles or title lookups or whatever you want to call it.

2) Has a financial calculator and knows how to use it.

I can’t look up the exact current mortgage balance, but I can guess at a ballpark initial interest rate based on when it closed, and from there back into what the current balance would be if they made minimum payments.

Your realtor can look up property profiles, though she probably generally avoids it b/c as a rule of thumb FTHB will start getting distracted by things not relevant to the current market value of the home. She may make an exception if you aren’t a FTHB.

You May Like: Who Is Rocket Mortgage Owned By

Contacting The New Mortgage Servicer

Mortgage lenders commonly sell the mortgage loans in their portfolios. If your mortgage has been sold you may have to track down the new mortgage servicer to get your mortgage balance.

References

- If your mortgage has been sold you may have to track down the new mortgage servicer.

Writer Bio

Melvin J. Richardson has been a freelance writer for two years with Associated Content, and writes about topics such as banking, credit and collections, goal setting, financial services, management, health and fitness. Richardson has worked for several banks and financial institutions and gained invaluable experience and knowledge. Richardson holds a Master of Business Administration in Executive Management from Ashland University in Ashland Ohio.

Funny Business Not Allowed

Some owners have tried to finagle short sales or foreclosures with relatives in the wings. The approach lets the bank take the defaulted house, a relative buys the home without declaring the relationship, and sells it back to the original owner at a discount, thereby seemingly getting rid of the bank loan and lender. This is considered financial fraud and a felony.

References

Read Also: Recast Mortgage Chase

Mortgage Balance Calculator Terms & Definitions:

- Mortgage Loan â A debt instrument, secured by the collateral of specified real estate property, that the borrower is obliged to pay back with a predetermined set of payments.

- Mortgage Balance â The full amount owed at any period of time during the duration of the mortgage.

- Principal â Denoting an original sum of money lent.

- Annual Interest Rate â Money paid regularly at a particular rate for the use of money lent â in this case, it’s a percentage.

- Monthly Payment â The action or process of paying someone or something on a monthly basis â in this case, a mortgage.

- Loan Term â The length time it takes to pay off a loan â in this case, a mortgage.

What Is A Fixed

A fixed-rate mortgage is a home loan that has the same interest rate for the life of the loan. This means your monthly principal and interest payment will stay the same. The proportion of how much of your payment goes toward interest and principal will change each month due to amortization. Each month, a little more of your payment goes toward principal and a little less goes toward interest.

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

Loan Amortizationwith Microsoft Excel

Are you a student? Did you know that Amazon is offering 6 months of Amazon Prime – free two-day shipping, free movies, and other benefits – to students?

This is the first of a two-part tutorial on amortization schedules. In this tutorial we will see how to create an amortization schedule for a fixed-rate loan using Microsoft Excel and other spreadsheets . Almost all of this tutorial also applies to virtually all other spreadsheet programs such as Open Office Calc and . Spreadsheets have many advantages over financial calculators for this purpose, including flexibility, ease of use, and formatting capabilities.

You can download the example spreadsheet or follow the example and create your own.

Fully amortizing loans are quite common. Examples include home mortgages, car loans, etc. Typically, but not always, a fully amortizing loan is one that calls for equal payments throughout the life of the loan. The loan balance is fully retired after the last payment is made. Each payment in this type of loan consists of interest and principal payments. It is the presence of the principal payment that slowly reduces the loan balance, eventually to $0. If extra principal payments are made, then the remaining balance will decline more quickly than the loan contract originally anticipated.

How Long Youll Stay In Your Current Home

When you refinance, there are origination and other closing costs associated with taking out the new loan. Because of this, its important to have a decent idea of the number of years you might stay in the home.

Your time in the home will help you calculate the breakeven point and determine whether its worth it for you to do the refinance. For instance, if it takes you 2 years to break even in payment and interest savings after paying closing costs, you know you have to stay in the home longer than that for the refi to make sense.

The key here is to have an idea of your situation. If you have some sense of what your future plans might be, then you can sit down and do the math.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

How To Use Credit Karmas Loan Amortization Calculator

When youre deciding how much to borrow or comparing loans, its helpful to get an estimate of your monthly payment and the total amount youll pay in principal versus interest. You can use our loan amortization calculator to explore how different loan terms affect your payments and the amount youll owe in interest. You can also see an amortization schedule, which shows how the share of your monthly payment going toward interest changes over time.

Keep in mind that this calculator provides an estimate only, based on your inputs. It doesnt consider other variables, such as mortgage closing costs or loan fees, that could add to your loan amount and increase your monthly payment. It also doesnt consider the variable rates that come with adjustable-rate mortgages.

To get started, youll need to enter the following information about your loan:

Principal And Interest: Mortgage Payment Basics

There are two basic components that make up every mortgage payment: principal and interest. The principal is the amount of funding borrowed for your home loan, and the interest is the money paid monthly for use of the loan. Understanding both principal and interest can help you choose the best mortgage option for you.

In this article, well share everything you need to know about principal and interest. Well cover the differences between the two and help you determine what you owe, or will pay, on your mortgage. Keep in mind, there may be other expenses that could find their way into your monthly payment as well.

Also Check: Can You Get A Reverse Mortgage On A Mobile Home