Mortgage Application Fees: Conclusion

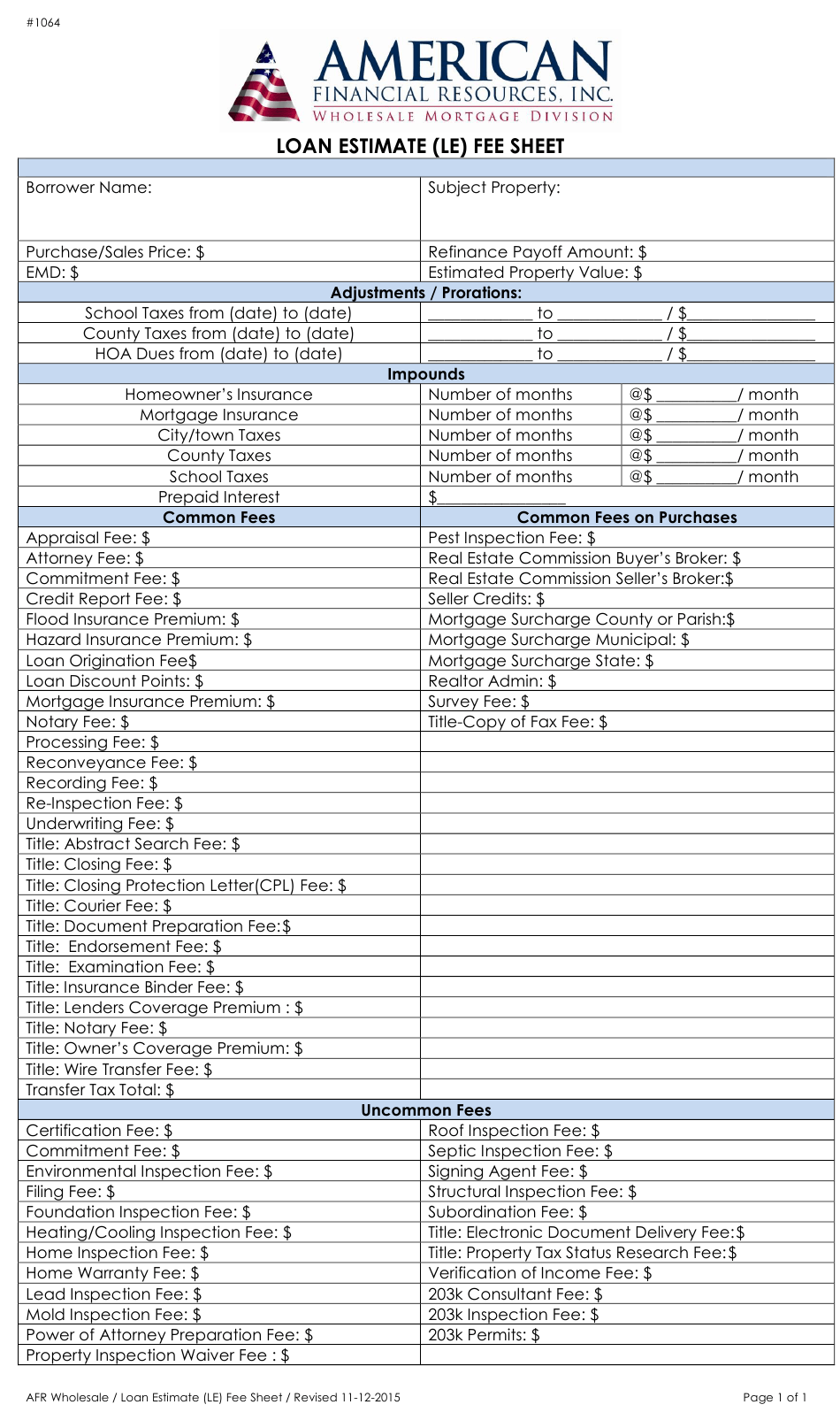

Additionally, should your mortgage application be processed and accepted, there are a multitude of fees due at closing. Most experts agree that you should submit a mortgage application to 3 or 4 different lending institutions and compare their loan estimates. Keep in mind, while the mortgage application fees are reasonable and customary, the mortgage closing costs are often arbitrary. Its in your best interest to review all the charges, ask plenty of questions, and request waivers or reduced fees before you sign on the dotted line. Finding the right mortgage lender can be time-consuming but in the long run, your diligence and attention to details of your closing costs may save you money in the long run.

Who Pays Closing Costs

Both buyers and sellers pay closing costs. However, the buyer usually pays most of them. You can negotiate with a seller to help cover closing costs, which are called seller concessions. Seller concessions can be extremely helpful if you think youll have trouble coming up with the money you need to close. There are limits on the amount that sellers can offer toward closing costs. Sellers can only contribute up to a certain percentage of your mortgage value, which varies by loan type, occupancy and down payment. Weve broken this down below:

The Property Appraisal Fee

Varies among lending institutions, but can range in price from $300 to $500. This fee is probably the most common upfront cost across the board, whether youre working with a mortgage lender, broker, bank, or credit union. Lenders require a property appraisal before approving a home loan to determine the value of the property, and more importantly, the loan-to-value ratio, which is a critical factor in determining costs that cant be known without a valuation. Additionally, the lender requires the appraisal to be paid upfront because the appraiser still needs to be compensated whether the loan moves forward or not.

You May Like: Can You Do A Reverse Mortgage On A Mobile Home

The Bottom Line: Compare Fees And Rates Carefully

A mortgage origination fee home to cover the cost of services rendered by a mortgage lender to set up your loan. They range anywhere from 0.5% 1% of the loan amount typically and are paid at closing. If you have prepaid interest points associated with getting the interest rate for your loan, these will also be listed with the other origination charges on your Loan Estimate or Closing Disclosure.

Although not every lender charges an origination fee, they typically make up for it by charging a higher interest rate on the loan itself, so always be aware of the upsides and downsides. You may be saving money at closing, but paying more in the long run.

We hope this has given you a better understanding of the structure and purpose of origination fees so that you can be a more educated mortgage shopper. If youre interested in getting started with your mortgage process, you can apply today!

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

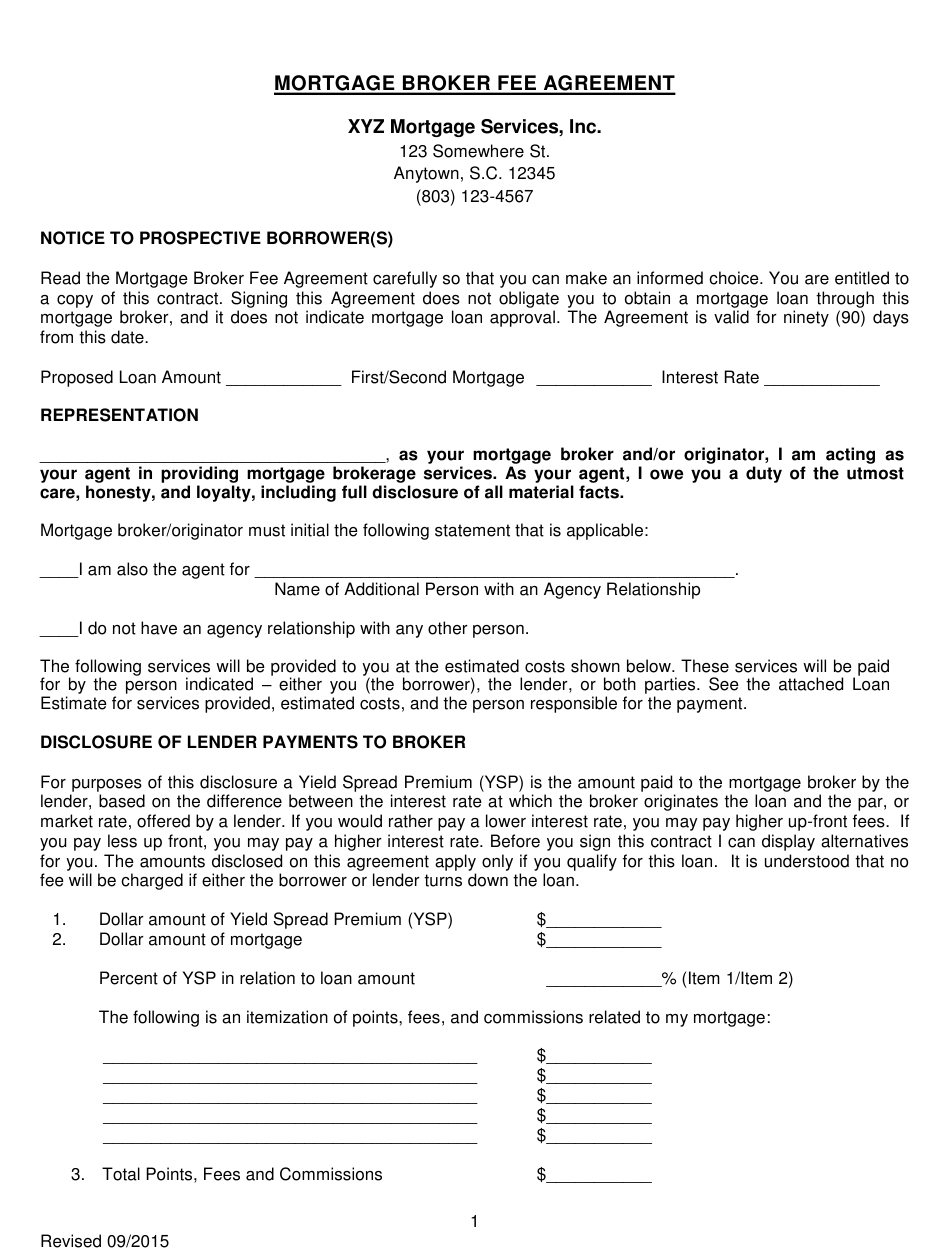

Mortgage Broker Fee Schedules: Lender

Until 2011, mortgage brokers could be compensated by both lenders and borrowers on the transactions they closed. But in 2011, new regulations outlawed this practice. Now, brokers have to choose whether they want to get paid by the borrower or by the lender.

So, which option is better for you? That depends entirely on your circumstances.

Lets take a closer look at the two types of compensation.

You May Like: Monthly Mortgage On 1 Million

Shop Around For Lenders

As the buyer, you get to choose which mortgage company you want to work with. Dont be afraid to take some time to shop around for lenders.

Contact a few competing loan providers and ask what types of fees they charge. Choose a lender that offers low fees and competitive interest rates for lower overall closing costs.

Recording Fees And Transfer Taxes

Local or county governments charge fees whenever a property changes hands. The seller is usually responsible for covering transfer taxes and recording fees. Sellers may have to pay fees to the county government, state government, both or neither it all depends on your state.

Transfer taxes are usually expressed as a set number of dollars per $100,000 of the homes appraised value.

Read Also: Mortgage Recast Calculator Chase

Mistakes You Should Avoid When Buying A House

There are a lot of mortgage tips out there but there are some mistakes you should avoid when getting a mortgage, whether you are a first-time buyer or looking to refinance.

Not Getting Pre-Approved

Not shopping for a mortgage until you have already found your dream home can be a big mistake since you can be too late. Many sellers require a pre-approval notice be given with an offer and the process can take days or even weeks. Its best to apply for pre-approval before you look at any available properties. When you do this extra step to prepare your finances, you are ready to submit an offer quickly when you find the perfect home.

Borrowing Your Max Amount

The pre-approval can help you figure out how much you can afford to spend. Many buyers believe that the amount on their pre-approval letter means that is the amount they can spend. Instead, its better to think of the loan amounts as a range. You may have the ability to borrow that much but you dont necessarily want to go that far. Its best to do some budgeting on your own. Look at your income and expenses in order to figure out how much you would be comfortable putting toward a mortgage each month. Use that number and play around with a mortgage calculator until you land on the price of how much home you should really be buying.

Overestimating Abilities

Not Reading the Fine Print

Not Getting an Inspection

Forgetting about the Closing Costs

What Does A Mortgage Broker Do

If you go directly to a lender regarding a mortgage, theyll only be able to provide you with options they offer directly, and these can be quite limited. Mortgage brokers, on the other hand, have access to an array of loan options from a variety of lenders and can help you navigate mortgage rates. They work with everyone involved in the home purchase process: real estate agents, lenders, title company representatives, underwriters, and, obviously, homebuyers. As such, mortgage brokers have a wide partner network and the ability to find mortgages with good rates.

Mortgage brokers do not provide loans or define their conditions lenders do that. But a mortgage broker will help you examine the different loan choices available to you. This way, youre able to shop for a loan based on rates and conditions and pick the right mortgage for your circumstances.

In short, a mortgage broker can save you both time and moneyand help you pick the right loan.

Lets now look at the different fee schedules of mortgage brokers and how theyre calculated.

Don’t Miss: Can I Get A Reverse Mortgage On A Condo

Mortgage Brokers Vs Loan Officers

Loan officers, unlike mortgage brokers, are employed by lending institutions such as banks or credit unions. Put simply, they approve or reject loan requests. Theyre able to give you access only to the mortgages offered by their employer and might not be as knowledgeable as mortgage brokers about the mortgage and real estate markets.

Your mortgage broker might be able to negotiate a mortgage from a banks wholesale loan program, while a loan officer usually cannot offer you preferential wholesale conditions.

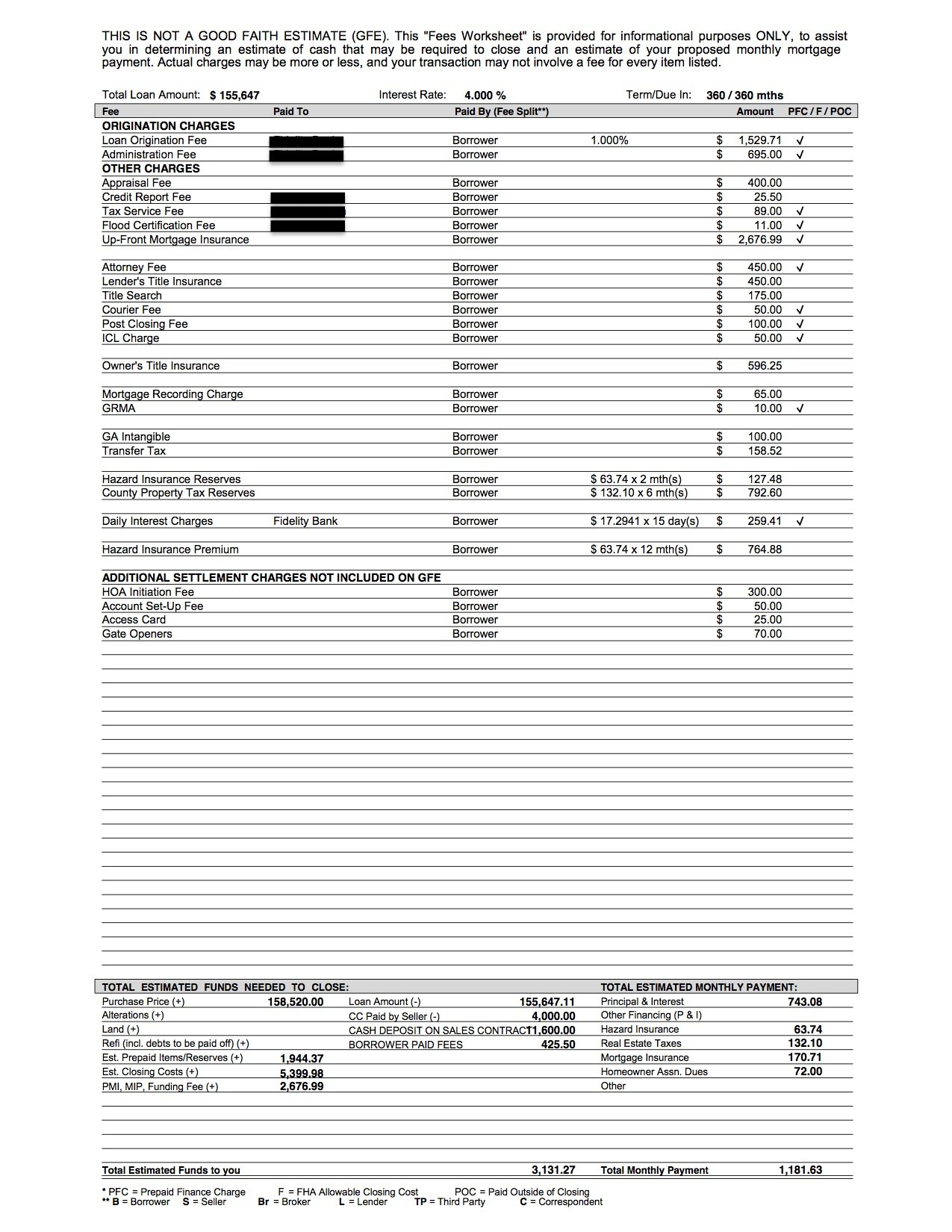

Average Closing Costs On A Home Loan

Each closing cost falls into one of three categories: lender fees, third-party fees and prepaid funds for taxes or mortgage interest. Although we looked at each closing cost individually, it’s helpful to group your upfront mortgage expenses into one of these broader groups.

| Bank of America | |

|---|---|

| $6,832 | $7,227 |

To determine an average figure for each closing cost, we collected home loan estimates from the four largest banks in the US. Our scenario assumes a loan at the median US home price of $198,000, with a down payment of 10% and a credit score of 740. Other assumptions for property tax and escrow requirements were plugged into the estimate of prepaid costs, which are explained below.

While there are several factors that can significantly raise or lower your closing costs, we found that mortgage discount points are the one area that offers you the most control as a borrower. While lenders didn’t show much variation in third-party costs or prepaid expenses, their quoted interest rates relied on very different amounts of points.

You May Like: Chase Recast Mortgage

Why Are Mortgage Origination Fees Assessed

Every lender has costs associated with originating a loan. Whether thats the overhead for their business or paying bankers, underwriters and scheduling appraisals. The goal is always to make enough money to be able to provide loans to help more people with their home financing. Origination fees cover some of these costs.

Read Your Loan Estimate Carefully

Once you choose a lender, be sure to read your Loan Estimate carefully. It outlines all the fees youll be expected to pay at closing, including the origination fee. Though this fee covers many services associated with your loan, theyre often negotiable. Never be afraid to ask your lender for a reduction or credit to offset your costs especially if youre a first-time home buyer.

Loan origination fees are common costs that cover your lenders work to process your loan. Origination fees are typically just one percent of your loan balance and theyre often negotiable. Talk with your mortgage lender about their origination fee and plan to pay this extra closing cost before you move in.

Dan Green

Dan Green is a former mortgage loan officer and an industry expert. He’s appeared on NPR and CNBC, and in The Wall Street Journal, Bloomberg, and dozens of local newspapers. Dan has helped millions of first-time home buyers get educated on mortgages, real estate, and personal finance. Have mortgage questions? Ask Dan in the chat.

Receive real estate and mortgage news by email weekly. Personalized for you & your specific homebuying goals.

Homebuyer is powered by Novus Home Mortgage, a division of Ixonia Bank, NMLS #423065. Member FDIC. Equal Housing Lender

- About

Recommended Reading: Can You Do A Reverse Mortgage On A Condo

What Is A Mortgage Origination Fee

A mortgage origination fee is a fee charged by the lender in exchange for processing a loan. It is typically between 0.5% and 1% of the total loan amount. Youll also see other origination charges on your Loan Estimate and Closing Disclosure in the event that there are prepaid interest points associated with getting a particular interest rate.

Also called mortgage points or discount points, prepaid interest points are points paid in exchange for getting a lower interest rate. One point is equal to 1% of the loan amount, but you can buy the points in increments down to 0.125%.If youre trying to keep closing costs at bay, you can also take a lender credit, which amounts to negative points. Here, you get a slightly higher rate in exchange for lower closing costs. Rather than paying up front, you effectively build some or all costs into the life of the loan.

The origination fee itself can cover a variety of things, some of which may be broken out in your Loan Estimate. It covers things like processing your loan collecting all the documentation, scheduling appointments and filling out all necessary paperwork as well as underwriting the loan.

Dont Miss: When Do I Pay Back Student Loan

Whats Included In A Mortgage Commitment Letter

Mortgage commitment letters include specifics about your loan. Whats exactly included will depend on the lender. However, most will typically include such information as the loan amount, loan purpose, length of your loan term and whether youre getting an FHA or conventional loan or other type of mortgage. The letter will also feature your lenders information, your loan number, and the date your commitment letter will expire. Youll also find the terms of you loan listed in the letter. These may include the amount of money youll pay each month and the number of monthly payments youll make until the loan is paid off. If youre going to have an escrow account, youll find information on that as well.

There are two main kinds of commitment letter: conditional commitment and final commitment.

Recommended Reading: 70000 Mortgage Over 30 Years

What Are Loan Origination Fees

A loan origination fee is a charge assessed by a mortgage lender to process your loan. It typically amounts to about 1% of your total loan balance.

Almost all lenders charge origination fees to cover the cost of processing, underwriting, and executing your loan.

These fees can show up as a single origination fee or as several different charges like an underwriting and processing fee. Origination fees cover a variety of lender-side costs, including things like:

- Verifying your employment and income

- Processing your application and documentation

- Preparing your mortgage documents

- Underwriting your loan

Loan origination fees vary. Your loan amount, type of loan, , and the presence of a co-signer can all impact costs.

Thankfully, mortgage lenders break these fees down on your Loan Estimate, which youll receive when you get pre-approved. Youll also get an updated breakdown of your costs no later than three days before closing day.

Average Closing Costs For A Mortgage

See Mortgage Rate Quotes for Your Home

A home purchase at the national median value of $198,000 requires an average of $7,227 in mortgage closing costs. We arrived at this figure by collecting mortgage estimates from several major banks and direct lenders. Major components of the closing costs on a home loan include prepaid taxes and interest, as well as discount points and service charges.

You May Like: Can You Refinance A Mortgage Without A Job

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

When Do You Pay Loan Origination Fees

Youll pay your origination fees at closing as part of your total closing costs.

Closing costs include other fees like:

- Prepaid interest, which covers the interest for the period between closing day and the end of the month.

- Discount points, which allow you to pay an upfront fee to lower your interest rate.

In some cases, lenders may offer credits to help offset some or all of these costs.

Don’t Miss: How Does The 10 Year Treasury Affect Mortgage Rates

Calculation Of The Ird

To calculate the IRD, your lender typically uses 2 interest rates. They calculate the entire interest fees left to pay on your current term for both rates. The difference between these amounts is the IRD.

To do so, they can first use one of the following interest rates:

- the posted rate at the time you signed your mortgage contract

- your current rate or discounted rate as described in your contract

Your lender can calculate a second interest rate based on the following:

- the current posted rate for a term with a similar length

- the current posted rate for a term with a similar length minus the discount you were originally offered

Examples Of Lender Fee In A Sentence

For purposes of the Application, the following will not be considered a source of financing: net operating income, capital contributions not documented in accordance with financing proposals that are not from a Regulated Mortgage Lender, fee waivers or any portion of any fees that are reimbursed by the local government.

For purposes of the Application, the following will not be considered a source of financing: net operating income, capital contributions not documented in accordance with financing proposals that are not from aRegulated Mortgage Lender, fee waivers or any portion of any fees that are reimbursed by the local government.

Third Party Lender fee is N/A, attached, to be withheld, or submitted under separate cover.

To eliminate redundancy, SBA proposes to strike the second sentence of this provision, which authorizes SBA to charge a PLP Lender fee to cover the costs of the PLP performance review.Subpart ILender Oversight.

For purposes of the Application, the following will not be considered a source of financing: net operating income, capital contributions not documented in accordance with financing proposals that are not from a Regulated Mortgage Lender, fee waivers or any portion of any fees that are reimbursement by the local government.

Accrued Lender fee must be paid six-monthly in arrear at the same time as accrued interest is payable under this Agreement.

Also Check: Rocket Mortgage Payment Options

Find The Right Mortgage Broker For Your Next Home Purchase

Ready to start shopping for a mortgage broker but not sure where to look? Weve got you covered.

Head over to the SuperMoney mortgage broker review and comparison page. Youll find a collection of industry-leading brokers who you can easily compare. Read reviews, compare offerings, and cut down on your research time!

Jessica Walrack is a personal finance writer at SuperMoney, The Simple Dollar, Interest.com, Commonbond, Bankrate, NextAdvisor, Guardian, Personalloans.org and many others. She specializes in taking personal finance topics like loans, credit cards, and budgeting, and making them accessible and fun.