How To Make A Mortgage More Affordable

No matter how good you look as a borrower, your mortgage will be a serious drain on your finances. Youll want to explore every avenue to keep costs down:

-

Provide a larger down payment, if you have the cash. When you pay more now, you have a smaller mortgage to pay off and thus lower monthly payments. And if you put down 20%, you wont have to worry about mortgage default insurance or CMHC restrictions.

-

Consider the First-Time Home Buyer Incentive. This program gives the federal government a cut of your home in exchange for cash to put toward the down payment. Not everyone considers it a good deal, however.

-

Extend your amortization period. By giving yourself more time to pay off your mortgage, you wont have to pay nearly as much each month. You will end up paying a lot more in interest in the long run, but your payments will be more manageable while you deal with other expenses.

-

Go a-hunting for a better deal. Dont just go to your local bank and accept whatever interest rate they offer you. Shop around and get quotes from many different lenders, because even a fraction of a percentage point can save you buckets of money month after month.

If you dont have time to hunt for the best mortgage yourself, get Homewise to work the market for you. This online brokerage will negotiate on your behalf with more than 30 big banks and other lenders, completely free, and it only takes five minutes to apply.

Explore Your Mortgage Options And Home Affordability With Newrez

If you’re interested in purchasing a home, Newrez’s handy online mortgage calculators can help you assess what you can afford. And if you do decide to buy a property, consider turning to a Newrez adviser to explore your mortgage options and discover which one is best for your needs and financial goals. They can help you determine your finances and what mortgage type is best for you. Contact Newrez today to get started.

How Much House Can I Afford

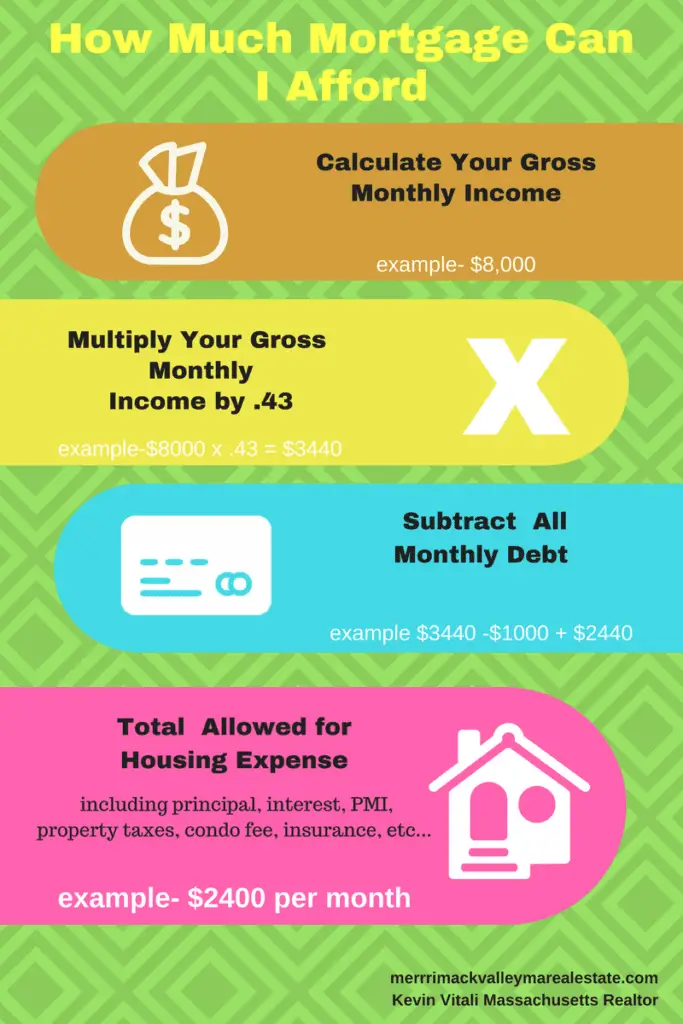

While you may have heard of using the 28/36 rule to calculate affordability, the correctDTI ratiothat lenders will use to assess how much house you can afford is 36/43. This ratio says that your monthly mortgage costs should be no more than 36% of your gross monthly income, and your total monthly debt should be no more than 43% of your pre-tax income.

For example, if you make $3,000 a month , you can afford a mortgage with a monthly payment no higher than $1,080 . Your total household expense should not exceed $1,290 a month .

Read Also: Can I Get A Reverse Mortgage On A Condo

What Is Property Tax

As a homeowner, youll pay property tax either twice a year or as part of your monthly home payment. This tax is a percentage of a homes assessed value and varies by area. For example, a $500,000 home in San Francisco, taxed at a rate of 1.159%, translates to a payment of $5,795 annually.Its important to consider taxes when deciding how much house you can afford. When you buy a home, you will typically have to pay some property tax back to the seller, as part of closing costs. Because property tax is calculated on the homes assessed value, the amount typically can change drastically once a home is sold, depending on how much the value of the home has increased or decreased.

Understand The Different Types Of Mortgages

Conventional loan: A conventional loan will allow you to get a home with as little as 3% down. Another big advantage of this option is if you’re moving to put down a little bit more, you can get a vacation home or investment property.

VA loan: A VA loan is a mortgage option available to United States veterans, service members and their non-remarried spouses. Theyre offered by traditional lenders and backed by the U.S. Department of Veteran Affairs. VA loans are no-down-payment loans that offer more lenient credit and income requirements. Rocket Mortgage® requires a 620 median credit score.

FHA loan: An FHA loan is a loan that is backed by the Federal Housing Administration. If you have a lower credit score and less money for a down payment, you might qualify for an FHA loan. To qualify through Rocket Mortgage®, youll need a 580 median credit score and a 3.5% down payment.

Jumbo loan: Jumbo Smart loans allow you to get a loan amounts higher than $548,250, the current conforming loan limit. You’ll need a higher down payment, at least 10.01% for loans up to $2 million and a credit score of at least 680.

USDA Loan: A USDA loan is backed by the U.S. Department of Agriculture. You could be eligible for a USDA loan if you want property in a qualifying rural or suburban area and if youre a low-to-moderate income earner. You can get a USDA loan with no down payment.

Read Also: Mortgage Recast Calculator Chase

How Down Payment Size Impacts Home Equity

| Percentage | |

|---|---|

| $250,000 | $0 |

The rule of thumb still stands: 20% of the home value is the ideal amount of money for a down payment. This amount buys you equity in the home, which helps secure the loan. When you donât have a least 20% to put down, you have to find alternate means to secure the mortgage.

This can mean private mortgage insurance , which is an added monthly charge to secure your loan. If you donât have enough money for a down payment, many lenders will require that you have mortgage insurance. Youâll have to pay your monthly mortgage as well as a monthly insurance payment, so itâs not the best option if your budget is tight.

Youâll stop paying PMI when your mortgage reaches about 78% of the homeâs value. While certain homebuyers can qualify for little or no down payment, through VA loans or other 0% down payment programs, most homeowners who donât have a large enough down payment will have to pay the extra expense for PMI.

Many Americans Spend More Than They Should On Housing These Guidelines Can Help You Avoid That Trap

Buying a new home is a big decision that involves a whole lot of smaller ones. Many people focus on the number of bedrooms or the quality of the kitchen appliances as they contemplate where they want to live.

But new homebuyers shouldnt let considerations like those persuade them to buy a home thats more expensive than they can comfortably afford.

With home prices on the rise in many parts of the U.S., keeping things affordable is getting harder to do. In May the median listing price for a home rose 6 percent from the previous year, to $315,000, a record high, according to a report by Realtor.com. Meanwhile, the number of homes priced above $750,000 rose 11 percent from a year ago.

Buyers say that those high prices are forcing them to spend more than they planned. One-third of buyers report that they spent more than they expected to on their home, and nearly one-third put down a higher down payment than they anticipated, according to a by CoreLogic, a real estate data analytics firm.

Financial planners recommend limiting the amount you spend on housing to 25 percent of your monthly budget. Yet the average married couple with children between the ages of 6 and 17 spends 32 percent of their budget on housing, and single people spend almost 36 percent, according to data from the Bureau of Labor Statistics.

To make sure you dont spend more than you should, here’s some advice on getting a mortgage you can afford.

Read Also: Reverse Mortgage For Condominiums

How Much Money Do You Have

The first factor in the calculation is your down payment. In Canada, homebuyers must be able to provide at least 5% of a homes purchase price upfront if the place costs $500,000 or less. If the place costs more than $500,000, tack on another 10% of the excess. If the place costs more than $1 million, you need to put down 20%.

Regardless of the price of the home, if you dont have enough savings to put 20% down, youre labelled a risky high-ratio buyer. That means your lender is forced to buy mortgage default insurance that will protect them in case you go broke and stop paying. The cost of that insurance will be passed on to you in the form of larger mortgage payments.

If you were thinking of using a loan or credit card to make a down payment, youre out of luck. Canada Mortgage and Housing Corporation rules that came into effect July 1, 2020 say non-traditional sources of down payment that increase indebtedness are no longer OK.

First-time buyers can lean on the federal Home Buyers Plan, which allows you to borrow up to $35,000 from a registered retirement savings plan to purchase your first home.

Once youve got your down payment ready, dont forget to budget for closing costs. A lot goes into finalizing a deal on the house market, including lawyer fees, land transfer taxes and title insurance. The total could land anywhere between 1.5% to 4% of your homes price. On a $500,000 home, that means you might need an extra $20,000 in the bank.

Dont Forget To Factor In Closing Costs

Alright, dont freak out here. But a down payment isnt the only cash youll need to save up to buy a home. There are also closing costs to consider.

On average, closing costs are about 34% of the purchase price of your home.1 Your lender and real estate agent buddies will let you know exactly how much your closing costs are so you can pay for them on closing day.

These costs cover important parts of the home-buying process, such as:

- Appraisal fees

- Attorneys

- Home insurance

Dont forget to factor your closing costs into your overall home-buying budget. For example, if youre purchasing a $200,000 home, multiply that by 4% and youll get an estimated closing cost of $8,000. Add that amount to your 20% down payment , and the total cash youll need to purchase your home is $48,000.

If you dont have the additional $8,000 for closing costs, youll either need to hold off on your home purchase until youve saved up the extra cash or youll have to shoot a little lower on your home price range.

Whatever you do, dont let the closing costs keep you from making the biggest down payment possible. The bigger the down payment, the less youll owe on your mortgage!

Also Check: How Does 10 Year Treasury Affect Mortgage Rates

How We Calculate Home Affordability

The first step is figuring out what you can actually afford. You want to look for the perfect backyard and kitchen, but you should also understand what your monthly mortgage payments, property taxes, and home expenses will look like.

Our calculator takes into account your income, debts , and the savings you have for the down payment.

Still, even if your monthly payments are consistent, you need to consider your overall savings and how much you can set aside for emergencies. Your down payment and monthly expenses shouldn’t empty your entire bank account. Make sure you have a healthy reserve in liquid assets for life events you can’t plan.

What Are The Different Types Of Home Loans

There are several types of home loans, but which one is right for you will depend entirely on what you qualify for and what ultimately makes the most sense for your financial situation. Below are the five most common home loans you will encounter.

Fixed-Rate Loan

Fixed-rate loans have the same interest rate for the entire duration of the loan. That means your monthly home payment will be the same, even for long-term loans, such as 30-year fixed-rate mortgages. Two benefits to this mortgage loan type are stability and being able to calculate your total interest on your home upfront.

Adjustable-Rate Loan

Adjustable-rate mortgages have interest rates that can change over time. Typically, they start out at a lower interest rate than a fixed-rate loan and hold that rate for a set number of years before changing interest rates from year to year. For example, if you have a 5/1 ARM, you will have the same interest rate for the first 5 years, and then your mortgage interest rate will change from year to year. The main benefit of an adjustable-rate loan is starting off with a lower interest rate to improve affordability.

FHA Loan

USDA Loan

This loan type is specifically designed for families looking to buy homes in rural areas. Similar to the FHA loan, this home loan lets lower-income families become homeowners. The loan does not require a down payment, but you will have to get private mortgage insurance.

VA Loan

You May Like: How Much Is Mortgage On A 1 Million Dollar House

Learn About Your Mortgage Options

Home buyers can typically choose from two main types of mortgages:

- A conventional loan that is guaranteed by a private lender or banking institution

- A government-backed loan

When choosing a loan, youll want to explore the types of rates and the terms for each option. There may also be a mortgage option based on your personal circumstances, like if youre a veteran or first-time home buyer.

Conventional loans

A conventional loan is a mortgage offered by private lenders. Many lenders require a FICO score of 620 or above to approve a conventional loan. You can choose from terms that include 10, 15, 20 or 30 years. Conventional loans require larger down payments than government-backed loans, ranging from 5 percent to 20 percent, depending on the lender and the borrowers credit history.

If you can make a large down payment and have a credit score that represents a lower debt-to-income ratio, a conventional loan may be a great choice because it eliminates some of the extra fees that can come with a government-backed loan.

Government-backed loans

Buyers can also apply for three types of government-backed mortgages. FHA loans were established to make home buying more affordable, especially for first-time buyers.

Rate types

First-time homebuyers

Check Your Credit History

When you apply for a mortgage, lenders usually pull your credit reports from the three main reporting bureaus: Equifax, Experian and TransUnion. Your credit report is a summary of your credit history and includes your credit card accounts, loans, balances, and payment history, according to Consumer.gov.

In addition to checking that you pay your bills on time, lenders will analyze how much of your available credit you actively use, known as credit utilization. Maintaining a credit utilization rate at or below 30 percent boosts your credit score and demonstrates that you manage your debt wisely.

All of these items make up your FICO score, a credit score model used by lenders, ranging from 300 to 850. A score of 800 or higher is considered exceptional 740 to 799 is very good 670 to 739 is good 580 to 669 is fair and 579 or lower is poor, according to Experian, one of the three main credit reporting bureaus.

When you have good credit, you have access to more loan choices and lower interest rates. If you have poor credit, you will have fewer loan choices and higher interest rates. For example, a buyer who has a credit score of 680 might be charged a .25 percent higher interest rate for a mortgage than someone with a score of 780, says NerdWallet. While the difference may seem minute, on a $240,000 fixed-rate 30-year mortgage, that extra .25 percent adds up to an additional $12,240 in interest paid.

Recommended Reading: Rocket Mortgage Qualifications

Cash Reserve And Your Ability To Pay Your Mortgage

| Cash Reserve | |

|---|---|

| $1,425 | 17.5 |

The table above is for a $250,000 home in Kansas City, Missouri. The mortgage payments assume a 20% down payment, and they include property taxes and home insurance.

Think of your cash reserve as the braking distance you leave yourself on the highway – if thereâs an accident up ahead, you want to have enough time to slow down, get off to the side or otherwise avoid disaster.

Your reserve could cover your mortgage payments – plus insurance and property tax – if you or your partner are laid off from a job. It gives you wiggle room in case of an emergency, which is always helpful. You donât want to wipe out your entire savings to buy a house. Homeownership comes with unexpected events and costs , so keeping some cash on hand will help keep you out of trouble.

How Much Should I Have Saved When Buying A Home

Lenders generally want to know you will have a cash reserve remaining after youâve purchased your home and moved in, so you donât want to empty your savings account on a down payment.

Having some money in the bank after you buy is a great way to help ensure that youâre not in danger of default and foreclosure. Itâs the buffer that shows mortgage lenders you can cover upcoming mortgage payments even if your financial situation changes.

While maintaining a debt-to-income ratio under 36% protects you from minor changes in your finances, a cash reserve protects against major ones.

At a minimum, itâs a good idea to be able to make three monthsâ worth of housing payments out of your reserve, but something like six months would be even better. That way, if you experience a loss of income and need to find a new job, or if you decide to sell your house, you have plenty of time to do so without missing any payments.

Also Check: Chase Mortgage Recast