Consider Paying Off A Heloc With Rate

Paying off a second mortgage is sometimes considered a rate-and-term refinance rather than a cash-out refi. This can be an advantageous repayment option, since rate-and-term refis come with lower rates and fewer restrictions.

Here are the requirements if you want to pay off a HELOC with a rate-and-term refinance instead of a cash-out loan:

- The new loan will be a conventional/conforming loan issued by a Fannie Mae- or Freddie Mac-approved lender

- The HELOC or home equity loan was used to purchase the property

- The entire HELOC loan balance was used for the purchase

- No additional draws have been made against the HELOC/second mortgage

- You can provide a settlement/closing statement for the home purchase

In short, you may qualify for the rate-and-term status if you used an 80-10-10 piggyback loan. The only reason you have a HELOC is that you financed the original home purchase.

This Post Has 21 Comments

My wife and me have a home and Our HOME IS TOTALY PAYED . No mortgage.My wife have w4 . 1,200 dolars month paystubsHusband w9 independient worker $3000 p/month. Payments for company checks when the companies callme to work same work for 4 years Dental hygienist.We wan to apply HELOC 60,000 dolars for home improvementsValue of our home is 212,000 dolarsLocated in Hollywood FloridaAll titles and insurance okUrgent please call us

How Do You Pay Back A Home Equity Line Of Credit

A HELOC has two phases: the draw period and the repayment period.

During the draw period, you can borrow from the credit line by check, transfer or a credit card linked to the account. Monthly minimum payments often are interest-only during the draw period, but you can pay principal if you wish. The length of the draw period varies its often 10 years.

During the repayment period, you can no longer borrow against the credit line. Instead, you pay it back in monthly installments that include principal and interest. With the addition of principal, the monthly payments can rise sharply compared with the draw period. The length of the repayment period varies its often 20 years.

At the end of the loan, you could owe a large lump sum or balloon payment that covers any principal not paid during the life of the loan. Before you close on a HELOC, consider negotiating a term extension or refinance option so that you’re covered if you can’t afford the lump sum payment.

Don’t Miss: Reverse Mortgage Manufactured Home

How To Get A Home Equity Line Of Credit

The process of getting a HELOC is similar to that of a purchase or refinance mortgage. Youll provide some of the same documentation and demonstrate that youre creditworthy. Here are the steps youll follow:

Determine whether you have sufficient equity, using a HELOC calculator.

Once you have an idea of what you can borrow, shop HELOC lenders.

Gather the necessary documentation before you apply so the process will go smoothly.

Once you have pulled together your documentation and selected a lender, apply for the HELOC.

Youll receive disclosure documents. Read them carefully and ask the lender questions. Make sure the HELOC will fit your needs. For example, does it require you to borrow thousands of dollars upfront ? Do you have to open a separate bank account to get the best rate on the HELOC?

The underwriting process can take hours to weeks, and may involve getting an appraisal to confirm the home’s value.

The final step is the loan closing, when you sign paperwork and the line of credit becomes available.

Can You Pay Off A Heloc Early

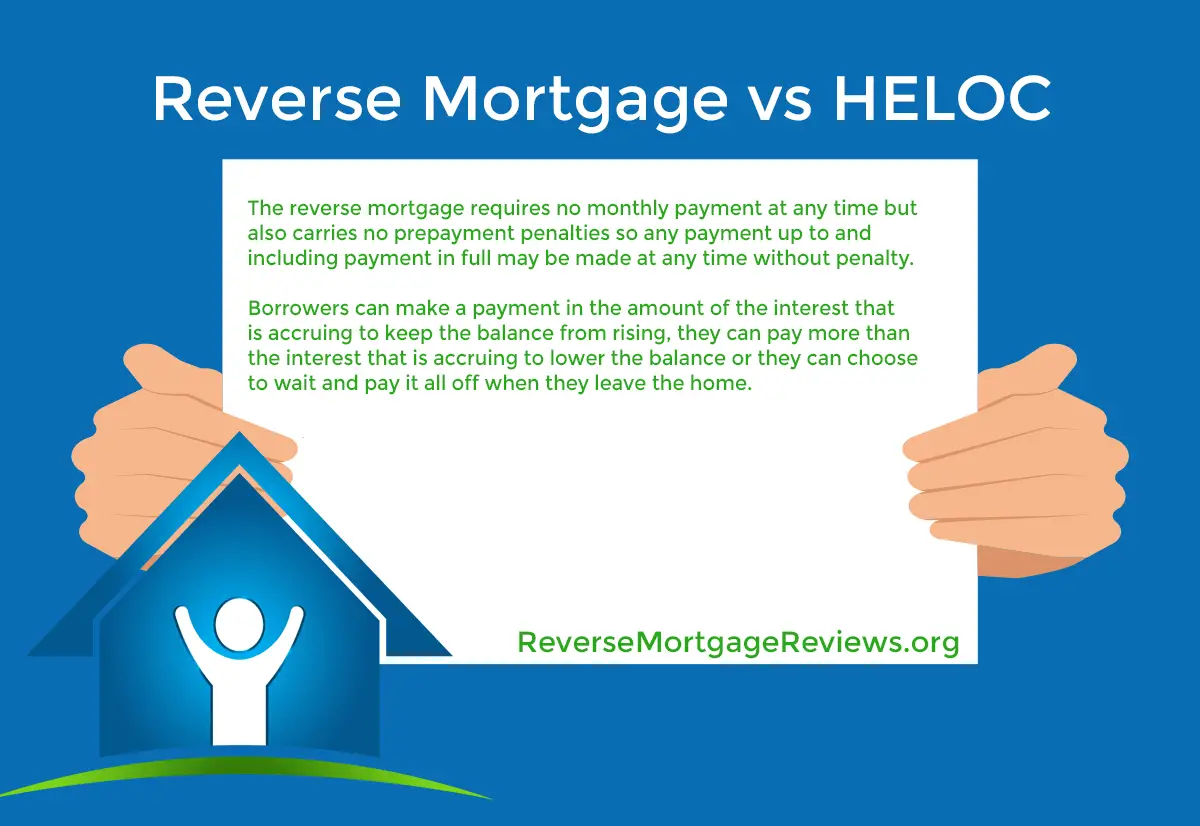

Yes, you can pay off a HELOC early. There are no associated prepayment penalties with these loans.

The best time to pay off the principal of your loan is during the draw period. You are only required to pay the interest during this time, but paying extra toward your principal as well during this period can help you avoid paying more during the repayment period.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

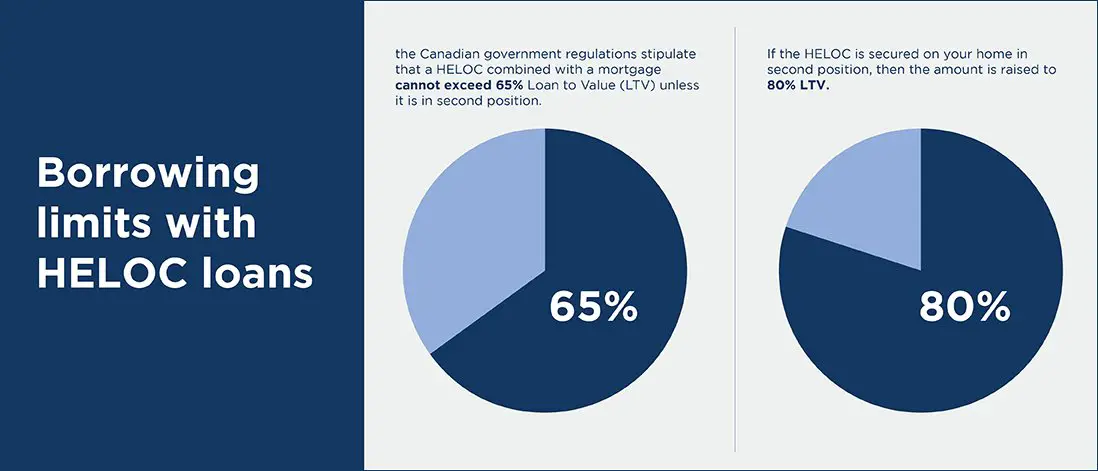

Heloc Qualifications: How To Qualify For A Heloc In Canada

A HELOC in Canada can either be in addition to your mortgage or a stand-alone product. HELOC qualifications vary depending on the lender, but the amount of equity in your home will be one of the HELOC qualifications.

Other HELOC qualifications include your income compared to your debts . For this reason, HELOC qualifications can make it difficult for some retirees to qualify. Also, HELOC qualifications typically require a good credit score.

| HELOC qualifications: |

|---|

Get Money From Your Home Equity Line Of Credit

Your lender may give you a card to access the money in your home equity line of credit. You can use this access card to make purchases, get cash from ATMs and do online banking. You may also be given cheques.

These access cards don’t work like a credit card. Interest is calculated daily on your home equity line of credit withdrawals and purchases.

Your lender may issue you a credit card as a sub-account of your home equity line of credit combined with a mortgage. These credit cards may have a higher interest rate than your home equity line of credit but a lower interest rate than most credit cards.

Ask your lender for more details about how you can access your home equity line of credit.

Read Also: Bofa Home Loan Navigator

The Bankrate Guide To Home Equity Lines Of Credit

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure our content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

When shopping for a HELOC, look for a competitive interest rate, repayment terms that meet your needs and minimal fees. Loan details presented here are current as of Aug. 4, 2021. Check the lenders websites for more current information. The top lenders listed below are selected based on factors such as APR, loan amounts, fees, credit requirements and broad availability.

When To Consider A Home Equity Line Of Credit

If you need extra money intermittently, a variable-rate home equity line of credit might be your best choice. Once the lender approves you for a maximum line amount, you can access the available funds as you need them. Use your Home Equity Line of Credit Visa Access Card anywhere Visa is accepted, write a check, visit a branch or ATM, or log in to Online or Mobile Banking and transfer money to your U.S. Bank savings or checking account. You may have ongoing access to funds for 10 years, called the draw period, following the date you open your line of credit. After the draw period you’ll have a repayment period of 20 years.

Monthly minimum payments are variable and based on the amount of the line balance and the variable interest rate. As you pay the money back, the funds are available again on your HELOC. This provides you with a renewable source of funding during the 10-year draw period. This is a good option if you anticipate the need to make periodic payments for tuition or remodeling.

Although a home equity line of credit provides ongoing access to available funds, which may be tempting for some people, there are some critical things to consider.

- You have to pledge your home as collateral

- If you dont make payments, your property can go through foreclosure

- Your credit score is on the line if you arent diligent with your payments

Read Also: Rocket Mortgage Qualifications

How To Cancel A Home Equity Line Of Credit

You have to cancel a HELOC in writing. You cant do it over the phone or even in person. Your written notice must be mailed, filed electronically, or delivered, before midnight of the third business day.

After canceling, the lender has 20 days to return whatever you paid as part of the transaction, even the cost of financing. If you already got money from the lender, you can keep it until you get proof that your home is no longer being used as collateral. Then, you have to return the money to the lender, but if the lender doesnt claim it within 20 days, its all yours.

There are some exceptions to the three-day cancellation rule.

In these instances, you wont have a grace period to hash things over:

- You apply for a loan to buy or build your principal residence

- You refinance your loan with the same lender who holds your loan and you dont borrow additional funds

- A state agency is the lender for a loan.

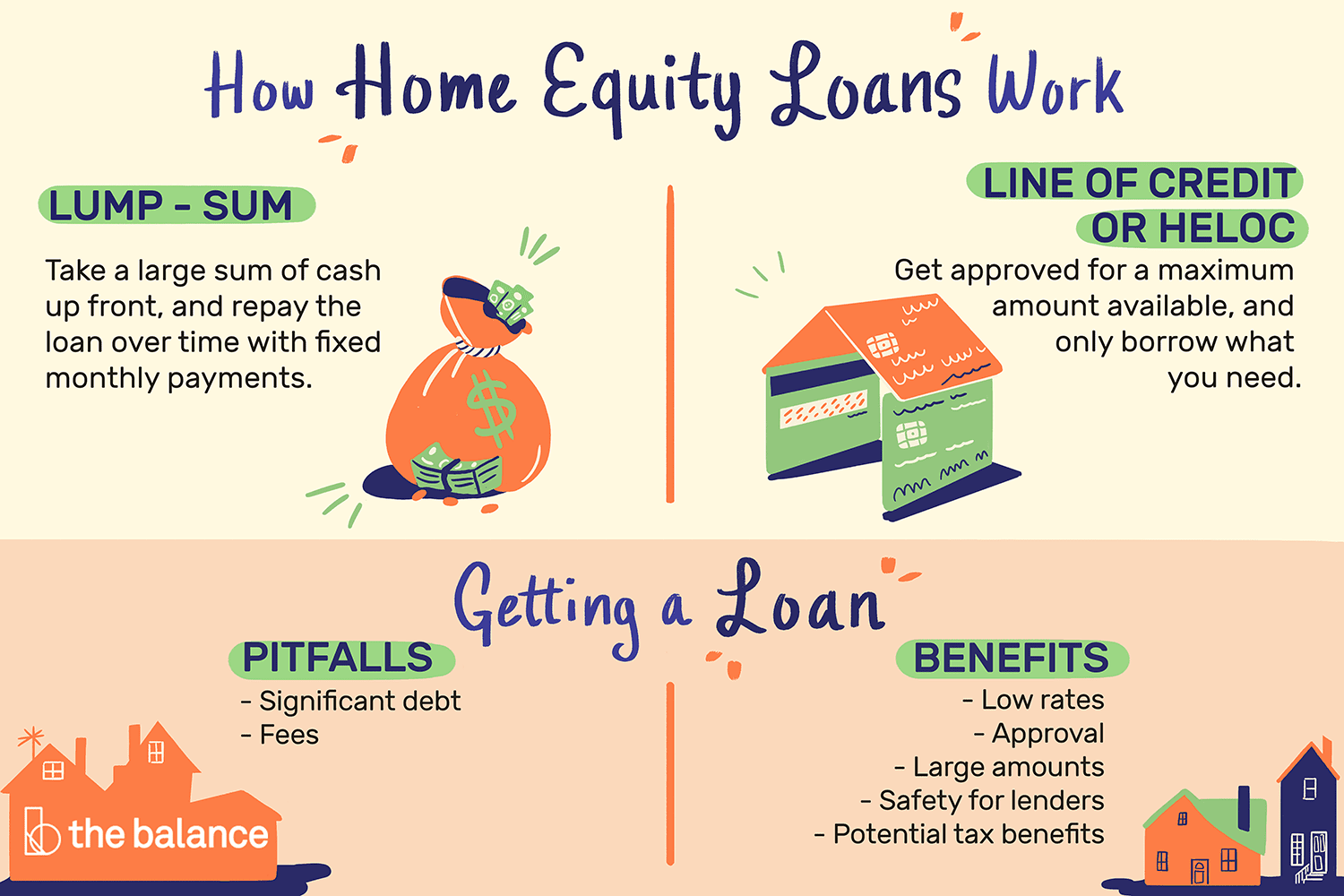

The Pros Of Home Equity Loans

- You can use the money from a home equity loan for any reason

- Depending on the loan, you can receive the money in a lump sum, in regular payments or whenever you need to withdraw it

- HELOCs allow you to access the funds through a credit card and cheques

- You dont have to make any regular payments with a reverse mortgage, which helps improve your cash flow

- Interest rates for most home equity loans in Canada are considerably lower than unsecured loans and credit cards

- You can often borrow large sums of money if you have sufficient equity

Read Also: How Much Is Mortgage On A 1 Million Dollar House

What’s The Difference Between A Heloc And A Second Mortgage

| Second Mortgages | Home Equity Lines of Credit |

| You’ll receive second mortgage proceeds in one lump sum. | The proceeds are held as a credit line that you can spend from and repay as needed. |

| You must reapply for another loan if you need more money beyond that first lump sum. | You can continue borrowing throughout the loan’s draw period without reapplying. |

A home equity loan, rather than a line of credit, functions as a second mortgage because the money is distributed in a lump sum. A home equity line of credit distributes the money on a revolving basis, something like a credit card. You can repay a portion then borrow it right back again.

Phase : The Draw Period

The first phase, called the draw period, is when your line of credit is open and available for use. During this period, youll be allowed to borrow from your line of credit as needed, making minimum payments or possibly interest-only payments on the amount youve borrowed. If you reach your limit, youll have to pay off some of what you owe before you can continue borrowing.

If you want to extend your draw period, you may be able to refinance your HELOC to do so.

You May Like: Can You Do A Reverse Mortgage On A Mobile Home

How To Calculate Home Equity

Letâs say your home has a market value of $500,000. When you first purchase your home, letâs assume you had a $100,000 down payment, so your mortgage amount was $400,000. While there may be other costs associated with opening a mortgage , weâll ignore them for simplicity. Your home equity would be calculated as:

$500,000 â $400,000 = $100,000

Now letâs jump ahead a decade or so, and assume that youâve reduced your outstanding mortgage amount by $100,000, to $300,000. Letâs also assume that the market has been good to you and that your home has appreciated in value by $100,000. Your home equity calculation now looks like this:

$600,000 â $300,000 = $300,000

Because your home equity changes as your home changes in value, your home equity is not strictly a measure of how much youâve paid off your mortgage. While paying off your mortgage directly increases your home equity, changes to your homeâs value means that your home equity will change with the real estate market. Of course, this also means that your home equity can go down over time, even if you continue to pay off your mortgage.

Are There Exceptions To The Three Day Cancellation Rule

Yes, the federal rule doesnt apply in all situations when you are using your home for collateral. Exceptions include when

- you apply for a loan to buy or to initially build your main residence

- you refinance your mortgage with the same lender who holds your loan and you dont borrow more funds

- a state agency is the lender for a loan

In these situations, you may have other cancellation rights under state or local law.

You May Like: Rocket Mortgage Payment Options

Reason To Get A Heloc

Lets determine if you want a HELOC before diving into the mechanics and terms. A home equity line of credit is great for people that need access to cash for a safety net or for those homeowners that only need a small amount of cash.

In both cases we are assuming that the homeowner has a great first-lien mortgage already in place. In other words, were assuming the existing mortgage is so good that refinancing it and getting cash out during that process doesnt make financial sense.

For example, we certainly dont want to refinance a 3.75% fixed rate loan since there isnt a financial benefit if current rates are at 5%. Conversely, a homeowner with a 5.5% rate on their first mortgage may do a normal cash out refinance loan to lower the overall interest costs. In that case, the Mortgage Mark team can help so call us.

How To Access Equity In Your Home

If youâre considering accessing the equity in your home, you have three methods to choose from:

There are different qualifying criteria and reasons to choose each method. The first question you need to answer is which option makes the most sense for you. Hereâs a quick explanation of each option, with few pros and cons.

Also Check: Chase Mortgage Recast Fee

Home Improvement Or Repairs

If youre going to be using the money to improve or even increase the value of your home, it can make sense to tap into your homes existing equity using a HELOC.

Some improvements are more valuable than others. While you may think that a full kitchen renovation will give you a dollar-for-dollar return on your investment, thats not always the case. Youll likely get more bang for your buck with something that increases your homes square footage, such as finishing your basement.

You can also see good returns by making changes to your homes exterior to increase its curb appeal, such as upgrading your landscaping.

Who Shouldnt Get A Heloc

Homeowners that need cash for the long-term are not great candidates for a HELOC. It becomes difficult to budget and plan for the long-term financial goals when the amount of interest to be paid can only be estimated.

We typically dont recommend a HELOC without having a plan to pay off the debt within one to three years. The variable interest rate makes it difficult to budget for the future. It often makes more sense to do a fixed-rate second lien equity loan or a normal cash out refinance with a fixed interest rate when the money is needed for the foreseeable future.

Recommended Reading: Recast Mortgage Chase

Which Is Better: A Heloc Or A Home Equity Loan

Choosing between a HELOC and a home equity loan comes down to your financial situation, needs and priorities.

A HELOC usually has a longer repayment period and allows you to take only the money you need, when you need it, so it’s best for people who have ongoing expenses or those who prefer to pay back debt at their own pace.

A home equity loan, on the other hand, offers more predictability in terms of monthly payments, since you’ll receive a large sum of money upfront and pay it back in monthly installments with a fixed interest rate. Home equity loans are usually best for people who need a lump sum right away and want a predictable monthly payment.

Are Heloc Rates Fixed

Like credit cards, HELOCs typically have variable interest rates, meaning the rate you initially receive may rise or fall during your draw and repayment periods. However, some lenders have begun offering options to convert all or part of your variable-rate HELOC into a fixed-rate HELOC, sometimes for an additional fee.

Read Also: Rocket Mortgage Conventional Loan

What Is A Heloc

A home equity line of credit is similar to a second mortgage. However, the issuing financial institution doesnt release all of the funds in one lump sum. You can access the money as you need it, and money is re-advanceable if you pay it back. You only pay interest on the amount of equity you actually use. Home equity loan requirements are the strictest for HELOCs however you will need good credit and solid, provable income.

How A Home Equity Line Of Credit Works

A home equity line of credit is a revolving line of credit. The bank opens a credit line for you and the equity in your home guarantees the loan. As a revolving line of credit, you can borrow up to a certain amount and make monthly payments on the amount you’ve borrowed. Your payments are determined by how much you currently owe in that particular month.

HELOCs usually have a draw period, such as 10 years. You can only borrow the money during this time. Then there’s a repayment period, often as long as 20 years, when you pay the loan back. You don’t owe anything on the loan until you start drawing from it.

You can borrow from the HELOC repeatedly up to the line of credit amount, or without applying for another loan after you’ve paid the balance off, similar to a credit card. But you can put your home at risk if you miss payments on your HELOC, just as with a second mortgage.

Your lender may freeze your line of credit if the value of your home should drop significantly for some reason during the draw period.

Recommended Reading: 10 Year Treasury Yield Mortgage Rates