Final Thoughts On Mortgage Rates

If youre looking for a lender that will provide you with favorable interest rates and is easy to work with, look no further than Vaster Capital. At Vaster, we prioritize total transparency, fast closings, and personalized assistance within a simple process. We also focus on flexibility and are able to lend to self-employed borrowers and foreign investors. So feel free to reach out to our lending experts today for more information about our process and loan options!

What Is The Difference Between A Mortgage Interest Rate And An Apr

Anannual percentage rate reflects the mortgage interest rate plus othercharges.

There are many costs associated with taking out a mortgage. These include:

- The interest rate

- Fees

- Other charges

The interest rate is the cost you will pay each year to borrow the money, expressed as a percentage rate. It does not reflect fees or any other charges you may have to pay for the loan.

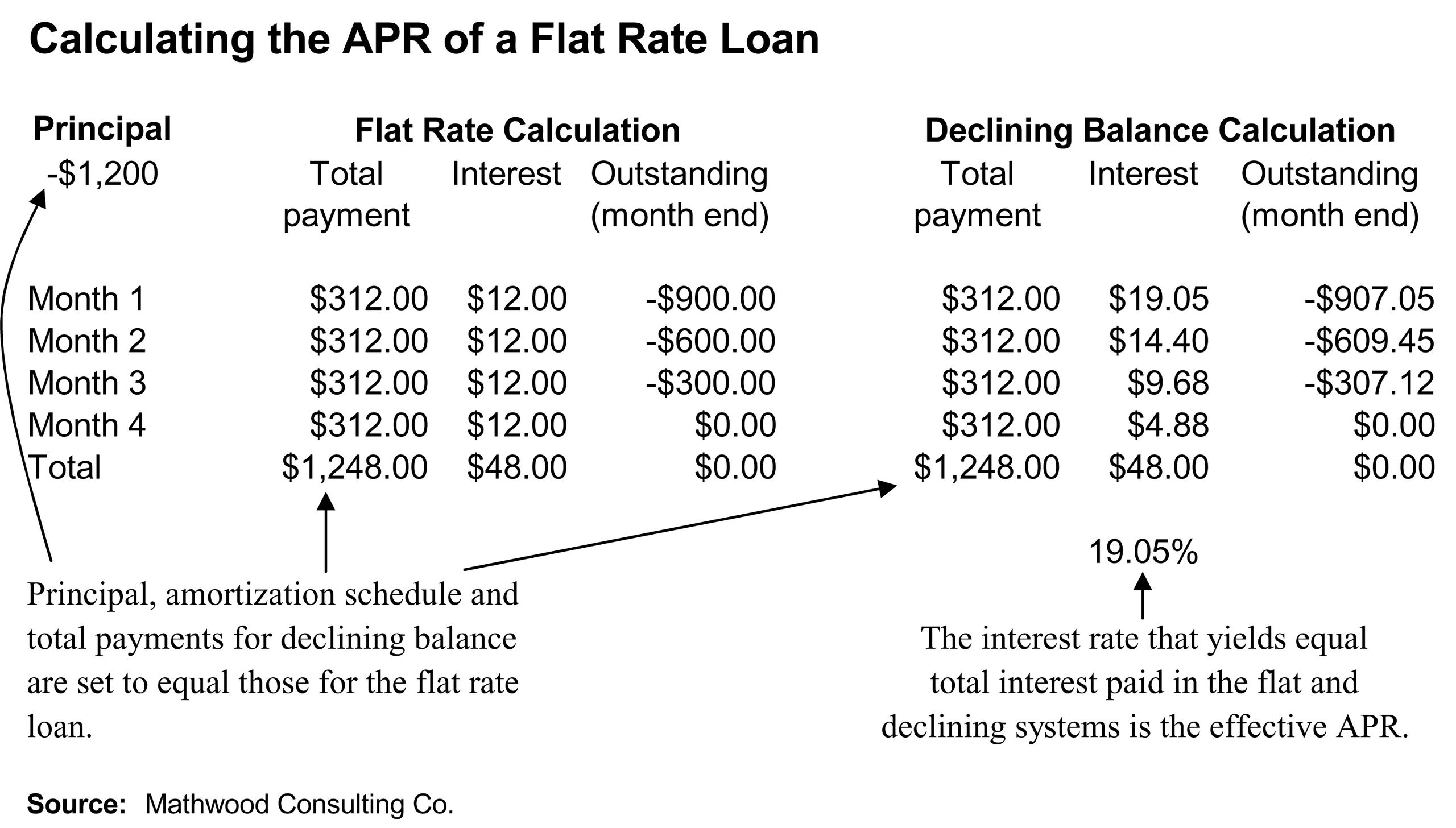

An annual percentage rate is a broader measure of the cost of borrowing money than the interest rate. The APR reflects the interest rate, any points, mortgage broker fees, and other charges that you pay to get the loan. For that reason, your APR is usually higher than your interest rate.

If you have applied for a mortgage and received a Loan Estimate from one or more lenders, you can find the interest rate on page 1 under Loan Terms, and the APR on page 3 under Comparisons.

Tip: Take care when comparing loan options to be sure you understand any differences between the terms being offered:

Learn More About Home Loans

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

Also Check: What Is The Monthly Mortgage

Why Are Interest Rates Higher On Investment Or Rental Properties

Your interest rate will generally be higher on an investment property than on an owner-occupied home because the loan is riskier for the lender.

Youre more likely to default on a loan for a home thats not your primary residence. Thats a good reason to use our investment property mortgage rate tool to compare prevailing interest rates that you qualify for.

In addition to paying higher investment property interest rates, its likely youll have to make a higher down payment.

Conventional mortgages generally require at least 15% down on a one-unit investment property and 25% down on a two- to four-unit investment property.

Loan terms are usually shorter than the typical 30-year residential mortgage. After all, its a business transaction, rather than a home purchase.

Tools To Help: Refinance Breakeven Calculator And Mortgage Points Calculator

Since Clark believes that looking at the APR is bad way to determine your best deal for a mortgage, Team Clark has some tools that can help you with your calculations.

If youre refinancing, we have a breakeven calculator that lets you plug in the terms and fees for your quotes and determine which is better based on how quickly you can recoup the cost of upfront fees via interest savings on your monthly mortgage payment.

If youre trying to decide between a loan quote with points versus one without points, we have a mortgage points calculator that will help you find the amount of time that youll need to recoup the upfront fees you may pay to lower the interest rate.

You May Like: How Much Mortgage Can I Afford On 200k Salary

What Is Apr And How Does It Affect Your Mortgage

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Annual percentage rate, or APR, reflects the true cost of borrowing. Mortgage APR includes the interest rate, points and fees charged by the lender. APR is higher than the interest rate because it encompasses all these loan costs.

Heres a primer on the difference between APR and interest rate, and how to use it to evaluate mortgage offers.

» Looking for information on?

What If My Mortgage Rate Can Change

When looking at your interest rate on the first page of the loan estimate, check the right-hand column: Can this amount increase after closing? If it says Yes, then youre taking out an adjustable-rate mortgage.

With an ARM, your interest rate can change following an initial fixed period, which means the APR wont reflect the maximum interest rate of the mortgage.

Your loan estimate should explain how your interest works in the Projected Payments table on page 1. Heres what your loan estimate might look like for an ARM:

There are also a couple of tables on page 2 the Adjustable Payment table and the Adjustable Interest Rate table that provide additional details on your ARM. Heres an example of what these tables look like:

Check Out: How to Find the Best Mortgage Lender

Read Also: What Are Prepaid Items On A Mortgage

Comparing Aprs Among Lenders

The Consumer Finance Protection Bureau requires mortgage lenders to give you a Loan Estimate document within 3 business days of receiving your financial information.

On page 3, youll find a section on Comparisons, where youll be able to see the APR and how much the loan will cost you in total over the first 5 years. It takes multiple factors into account, such as loan cost, interest, principal, and mortgage insurance.

If youre comparing different lenders, this page can help you decide which lender and home loan are right for you. Once you see each lender’s APR, youll know how much it will cost to move forward with their respective loan products, inclusive of fees and interest rates.

What Are Mortgage Interest Rates And Aprs

A mortgage interest rate is a small percentage thats applied to your loan balance to determine how much interest you owe your lender each month. When you begin to repay your loan, your rate will be used to calculate the interest portion of your monthly payment.

For example, if you owe $100,000 and your interest rate is 5%, your annual interest expense will be $5,000, and youll pay a portion of that every month as part of your mortgage payment. While the calculations are actually more complicated than that, this example helps explain the general concept.

An APR is also a percentage, but it also includes all the costs of financing, including the fees and charges that you have to pay to get the loan. The APR for a given loan is typically higher than the mortgage interest rate. An APR is never used to calculate your monthly payment.

You May Like: Are Rocket Mortgage Rates Competitive

Using Apr To Compare Mortgage Offers

Comparing APRs is not the best way to evaluate mortgage offers. Instead, its more useful as a regulatory tool to protect consumers against misleading advertising.

Federal Regulation Z, the Truth in Lending Act, requires lenders to disclose a loans APR when they advertise its interest rate. As a result, when youre checking out lenders websites to see who might give you the best interest rate, youll be able to tell from looking at the APR if the lender with the great interest rate is going to charge you a bunch of fees, making the deal not so great after all.

Page 3 of the loan estimate that lenders are required to give you when you apply for a mortgage shows the loans APR. By comparing loan estimates , you can easily compare APRs.

Still, most borrowers shouldnt use APRs as a comparison tool because most of us dont get a single mortgage and keep it until its paid off. Instead, we sell or refinance our homes every few years and end up with a different mortgage.

If youre looking at two loans and one has a lower interest rate but higher fees, and the other has a higher interest rate but lower fees, you might discover that the loan with the higher APR is actually less expensive if youre keeping the loan for a shorter term, as the table below illustrates.

What Is Investment Property Refinance Rates

If youve been thinking about refinancing your rental property, the first thing that you want to check is current interest rates.

As of the time of writing, a 30-year fixed-rate mortgage has an average rate of 2.71% while a 15-year fixed-rate mortgage has an average rate of 2.26%, according to Freddie Mac.

That said, its important to note that even if you have an excellent credit score, you likely wont get the best rate available on your to refinance loan. Unfortunately, mortgage lenders tend to view rental property mortgages as riskier than loans on primary residences.

Put simply, they believe that if you had to make a choice between paying your primary mortgage and paying the loan on your investment property, you would be more likely to default on the latter. With that in mind, as an investor, you should expect to be given a higher interest rate than the going market rate.

Recommended Reading: Are Online Mortgage Calculators Accurate

Understanding Mortgage Interest Rates

A mortgage payment is made up of the principal and the interest. The principal is the money you borrowed from your lender. The interest is a percentage-based fee that you pay the lender for borrowing that money. Paying the principal reduces the amount you owe, while paying the interest does not.

Rates can be fixed or adjustable. A fixed rate never changes, but the rate for an adjustable rate mortgage, or ARM, can adjust higher or lower while you have your loan. If your rate adjusts, your monthly payment will change. Adjustable rate mortgages typically have caps that limit how much and how often they can change. Most adjustable rate mortgages have a rate thats fixed for a number of years and then can adjust.

Lenders offer different rates to different borrowers. The rates youll be offered typically depend on the following:

- How much you want to borrow.

- How much youve saved to pay upfront.

- How many years youll have to repay your loan.

- Whether you usually pay your bills on time.

- The type of loan you choose.

- Where you live.

When you apply for a loan, the rates youre offered can be either floating or locked. A floating rate can change before you close your loan. A locked rate shouldnt change for 30, 45 or 60 days, depending on how long your rate lock lasts. If you wont be able to find a home and complete the loan process in that time frame, you can usually pay a fee to get a longer lock.

Summary Apr Vs Note Rate

The difference between APR and Note Rate is dependent on which costs are taken into consideration in its calculation. Due to the inclusion of total cost, use of APR is more beneficial than Note Rate. It also allows effective comparison of rates than the Note Rate. On the other hand, Note Rate is the usual rate used to demonstrate the annual interest on borrowings by many financial institutions.

References

Image Courtesy

Read Also: How Much Net Income Should Go To Mortgage

What Other Factors Should I Consider When Looking For A Mortgage

While the APR makes it easier to compare mortgage offers, there are many factors to consider when getting a mortgage loan. These include the size of your down payment, closing costs and money you’ll need to set aside to furnish and maintain your home. The mortgage rate and payment calculator is a good place to start.

What Is Mortgage Rate

Mortgage interest rate is the cost of borrowing money. It determines your periodic payment amount towards your mortgage. The mortgage interest rate can either remain fixed for the entire mortgage term or vary with a benchmark interest rate at certain pre-defined periods. At a macro level, the interest rate varies depending on various global economic factors such as inflation, unemployment rate and economic growth. At a micro level, it varies based on your credit score, down payment, loan type and loan tenure.

For a fully amortizing loan, each mortgage payment includes the principal and the interest components. It is important to understand that you pay interest only on the unpaid portion of the mortgage. For this reason, mortgage payments start off with a higher interest component initially and it decreases gradually. To put it another way, each successive payment goes to reduce more of the principal loan amount. Refer to the amortization schedule generated by the mortgage calculator.

The sum total of all mortgage payments over the mortgage term minus the principal amount is the total interest amount you pay towards your mortgage.

total interest = mortgage principal amount

Don’t Miss: What Does Credit Approved Mean For A Mortgage

Low Mortgage Rate Vs Low Apr: Whats More Important

When it comes to deciding between mortgage loans, its a good idea to check both the interest rate and the APR. The interest rate tells you how much interest youll pay every year, while the APR indicates the interest rate plus extra costs added by the lender.

Because the APR gives you a broader picture of the costs you pay, its the more important figure when calculating your loan costs.

Check out this example: Youre looking to buy a home for $200,000 with a 30-year fixed rate and a 20% down payment. After getting two loan estimates, you compare the costs you pay on Loan A versus Loan B.

Although Loan A has a higher interest rate, the APR is lower. You wind up paying less on Loan A over time:

| Loan A |

How Do I Find The Best Loan Available When Im Shopping For A Home Mortgage Loan

Shopping around for a mortgage loan will help you get the best deal. Start with an internet search, or contact banks, credit unions, and other lenders and brokers in your area.

The internet is a good place to start your search. By doing a broad online search for mortgage rates in your area, you will get a good sense of the market.

Next, contact banks, credit unions, or other lenders and mortgage brokers in your area. Ask each lender or broker you call for:

- A list of current interest rates for their available mortgage loans and whether the rates being quoted are the lowest for that day or week.

- What fees the lender normally charges for each loan product.

- Each loans annual percentage rate . The APR tells you the yearly cost of the loan based on the interest rate as well as points, broker fees, and certain other charges that you may be required to pay, including certain closing costs.

- Whether the rates given for various products are fixed or adjustable, and what points or fees go along with different rates. Sometimes you can get a better rate if you pay points or additional fees. But make sure that you actually get a lower interest rate in exchange for the extra points you pay.

With all of the options out there, it is important to shop around and take the time to understand the terms of the different loans offered to you. Its a good idea to request loan estimates from at least three different lenders and compare them to choose the best loan for you.

Don’t Miss: How To Add A Name To A Mortgage

How Are Mortgage Rates Set

At a high level, mortgage rates are determined by economic forces that influence the bond market.

You cant do anything about that, but its worth knowing: Bad economic or global political worries can move mortgage rates lower. Good news can push rates higher.

What you can control are the amount of your down payment and your credit score. Lenders fine-tune their base interest rate on the risk they perceive to be taking with an individual loan.

So their base mortgage rate, computed with a profit margin aligned with the bond market, is adjusted higher or lower for each loan they offer. Higher mortgage rates for higher risk lower rates for less perceived risk.

So the bigger your down payment and the higher your credit score, generally the lower your mortgage rate.

Why Do We Need Both

The primary difference between the two is that your interest rate helps estimate what your monthly payment will be. On the other hand, APR calculates the total cost of the loan. Therefore, using both can help you make a truer loan comparison.

If youre interested in determining your monthly payment, interest rate is probably what you want to focus on. Just dont forget to include any taxes, insurance, and mortgage insurance when calculating your monthly payment.

Don’t Miss: How Does The Interest Work On A Mortgage