Look At Interest Rate And Apr

Most borrowers tend to focus on mortgage rates. But the APR you pay on a loan is often just as or even more important than the basic interest rate.

Annual percentage rate looks at all your costs of borrowing and spreads them over the potential life of your loan. So APRs are higher than straight rates. And they can tell you about what youre actually going to pay.

Just note, APR assumes youll keep your loan its full term, which most borrowers dont. They either sell or refinance before the mortgage term ends.

So look at APR, but remember that its not always the last word on what youll pay. You can learn more about how to compare interest rates and APR effectively in this article.

Sample Mortgage Apr Calculation

Let’s look at two sample mortgage offers to see how APR helps you better understand the cost of a home loan. For this example, we’ve assumed you are buying a house with a conventional 30-year fixed-rate mortgage. We’ve assumed you are borrowing $200,000 and that you do not have to pay for private mortgage insurance because you have made a 20% down payment.

How Can You Get A Low

As we mentioned, there are cards with 0 percent introductory APRs, but these APRs are temporary. Borrowers who are considering this option should know when this initial period will end and what the new APR will be after this time.

The best way to get a low-APR credit card is by building a positive credit history with your existing credit. You can do this by making on-time payments, keeping your credit utilization low and minimizing debt. Additionally, dont apply for credit too often, and regularly check your credit score and report.

Remember, APR is determined using your credit history and score, among other factors. You can reach out to Lexington Law if you want to learn how you can work on your credit. And if you apply for a loan, credit card or mortgage and are concerned about your credit health, be sure to check the terms and conditions, cardholder agreements and other contracts for information about applying with poor credit.

Reviewed by Paola Bergauer, an Associate Attorney at Lexington Law Firm. by Lexington Law.

Paola Bergauer was born in San Jose, California then moved with her family to Hawaii and later Arizona. In 2012 she earned a Bachelors degree in both Psychology and Political Science. In 2014 she graduated from Arizona Summit Law School earning her Juris Doctor. Prior to joining Lexington Law, Paola has worked in Immigration, Criminal Defense, and Personal Injury. Paola is licensed to practice in Arizona and is an Associate Attorney in the Phoenix office.

You May Like: 10 Year Treasury Vs 30 Year Mortgage

An Example Of Apr Vs Apy

Say XYZ Corp. offers a credit card that levies interest of 0.06273% daily. Multiply that by 365, and thats 22.9% per year, which is the advertised APR. Now, if you were to charge a different $1,000 item to your card every day and waited until the day after the due date to start making payments, youd owe $1,000.6273 for each thing you bought.

To calculate the APY or effective annual interest ratethe more typical term for credit cardsadd one and take that number to the power of the number of compounding periods in a year subtract one from the result to get the percentage:

\begin & ^ ) – 1 = .257 \\ \end 365)1=.257

If you only carry a balance on your credit card for one months period, you will be charged the equivalent yearly rate of 22.9%. However, if you carry that balance for the year, your effective interest rate becomes 25.7% as a result of compounding each day.

Where To Find Your Credit Cards Apr

Your credit cards APR should be listed in the terms and conditions of your specific card agreement. You can also find the APR on your monthly credit card statements, or potentially on your card issuers website.

If you still cant find your cards APR or you have other questions about it, you can reach out to your card issuer directly.

Don’t Miss: Chase Recast Mortgage

What’s The Difference Between Apr And Interest Rate

The difference between a loan’s can depend on the type of financial product.

For installment loans, such as personal, auto, student and mortgage loans, the APR and interest rate may be the same if there are no finance charges. However, if there is a finance charge, such as an origination fee, the APR will be higher than the interest rate because your cost of borrowing is more than the interest charges alone. The difference between the APR and interest rate can also increase if the loans term is shorter, as youll be repaying the entire finance charge more quickly.

On credit cards, the APR and interest rate are the same because a credit card APR never takes the cards fees into account. As a result, you may want to compare not only cards APRs, but also their annual fees, balance transfer fees, foreign transaction fees and any other fees when deciding on a credit card. Keep in mind that you can generally avoid paying interest on your credit card if you pay off the balance in full every month.

Is It Really Possible For Mortgage Rates To Climb Much Higher

by Christy Bieber | Published on April 22, 2022

You may be surprised at the answer.

Mortgage rates have been rising all year, making it much more expensive to buy a home. They are up considerably since the start of 2022, and many homeowners are wondering if they’ll continue at this current trajectory or if there’s an upper limit.

Take a look at how rates are trending on Friday, April 22:

| Mortgage Type |

|---|

Data source:The Ascent’s national mortgage interest rate tracking.

Also Check: Reverse Mortgage Manufactured Home

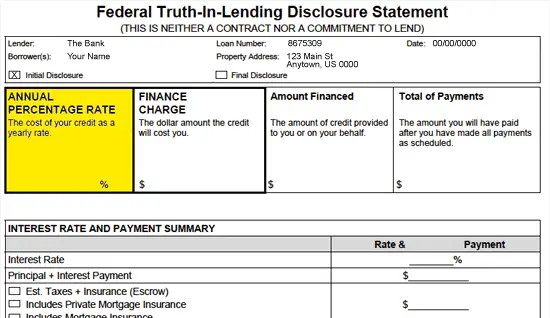

Annual Percentage Rate Helps You Understand A Mortgage’s Total Cost

When you are buying or refinancing a home, it is a good idea to look at the mortgage’s annual percentage rate versus its interest rate.

That’s because the APR expresses the total cost of the mortgage. APR includes the interest charged on the monthly principal balance as well as costs and fees the lender may charge you to get the mortgage. The annual percentage rate gives you a better idea of the total cost of a loan, and helps you choose the right mortgage for you.

How Your Apr Is Calculated

Likewise, you pay interest on your credit card every month you carry a balance past your grace period. Keep that balance for a year, and you end up paying interest charges equivalent to your APR. If your APR is 22.99% and your revolving credit card balance averages out to $5,000, that’s $1,149.50 in interest paid per year until you pay it off.

Interest is a simple concept, but understanding how it’s billed can be a little tricky. Read more about how APR is calculatedhere.

Don’t miss: How the prime rate works and how it affects you

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

Pay Attention To Mortgage Insurance

If your down payment is less than 20% of the purchase price, youll typically have to pay private mortgage insurance . And those premiums can add significantly to your monthly payments.

The cost of mortgage insurance will be reflected in your APR but not in your interest rate. The same goes for the mortgage insurance premiums on an FHA loan.

So make sure you learn about the cost and benefits of mortgage insurance before you commit to a loan.

What Apr Should I Get For A Mortgage

In many cases, its best to choose a mortgage loan with the lowest APR. However, sometimes a loan offer with a lower APR may require you to pay mortgage points or other fees. You may prefer to use that money toward a down payment or to buy appliances and furniture for your new home. If so, you might consider a loan with a slightly higher APR that doesn’t have mortgage points or other fees. Contact a U.S. Bank mortgage loan officer for help determining the best mortgage loan for your specific needs.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

How Does Apr Work On A Mortgage Loan

Understanding how an APR affects your home loan is an important part of the decision-making process. You may choose one option over another based on the APR a lender offers.

When it comes to the APR of a mortgage loan, there is more involved than just interest. Along with interest, the APR can include processing and underwriting fees, mortgage points and private mortgage insurance. The APR determines the total annual cost of borrowing money from a lender. It’s important to learn as much as you can about your loan before you accept and sign because APR fees can vary from lender to lender

Why The Length Of Your Loan Matters

If you plan to stay in your home for decades, it makes sense to take out a loan that has the lowest APR because youll end up paying the least to finance your house. If you dont plan to stay in the house that long, it may make sense to pay fewer upfront fees and get a higher rate and a higher APR because the total cost will be less over the first few years.

Because APR spreads the fees over the course of the entire loan, its value is optimized only if a borrower plans to stay in the home throughout the entire mortgage, says Gloria Shulman, founder of CenTek Capital Group in Beverly Hills, California.

Recommended Reading: Monthly Mortgage On 1 Million

Other Factors Besides Your Credit Score

Remember, FICO is looking only at the difference your credit score makes in the chart above.

Lenders will check more than your credit history when you apply for a new mortgage loan. They will also need to know your:

- Debt-to-income ratio This ratio measures how much of your income goes toward existing monthly debts

- Income stability Homebuyers need to show W2 forms or pay stubs to prove a steady income. If youre selfemployed, you can provide tax forms or even bank statements

- Down payment Most loans require a minimum down payment amount . Putting more than the minimum down could help lower your interest rate

- Home equity for refinancing Mortgage refinance lenders will check your home equity which, measures how much your home value exceeds your mortgage debt. Having more equity can lower your rate

In short, the better your personal finances look, the lower your mortgage interest rate will be. Taking steps like raising your credit score or savings for a bigger down payment before you buy can help you get the best rates available.

What Is An Apr

An annual percentage rate represents the cost of borrowing over the life of the loan expressed as an annual rate. People commonly reference interest rates and APRs when comparing mortgage loans. APRs are typically higher than the interest rate because they include fees associated with getting the loan, like points, origination fees and other charges, as well as interest.

There are two types of mortgage interest rates: Fixed and adjustable. A fixed rate stays the same throughout your loan. A adjustable or variable rate changes with an index such as the prime rate which is based on the Federal Funds Rate outlined by the Federal Reserve Board . This means that if you get a loan with an adjustable rate, your interest rate could change depending on changes in the index The APR for a variable rate loan estimates how the rate could change over time, but actual changes could be very different.

Read Also: Can You Do A Reverse Mortgage On A Mobile Home

How To Find The Best Mortgage Rate For You

Different lenders will look at your financial circumstances in different ways.

For example, a lender that specializes in FHA loans will rarely raise an eyebrow if your credit score is in the 580620 range. But one that caters to superprime borrowers likely wont give you the time of day.

Ideally, you want a mortgage lender that is used to dealing with people who are financially similar to you. And the best way to find your ideal lender is by comparing loan offers.

Heres how to do that.

Mortgage Interest Rates Forecast For Next Week

Nothings changed since last week. And I will continue to predict that mortgage rates might rise next week. But dont take these weekly suggestions too seriously. Amid the current volatility, my success rate has more to do with luck than judgment.

Mortgage and refinance rates usually move in tandem. And the scrapping of the adverse market refinance fee last year has largely eliminated a gap that had grown between the two.

Meanwhile, another recent regulatory change has likely made mortgages for investment properties and vacation homes more accessible and less costly.

You May Like: 10 Year Treasury Yield And Mortgage Rates

Example Of Mortgage With Different Rates And Aprs

Here are examples comparing different interest rates and APRs for a $300,000, 30-year fixed-rate mortgage:

| $503,235 | $534,463 |

If youre planning to stay in your home for a shorter period and want to purchase discount points to lower your rate, you need to do the math to determine your break-even point. Bankrates mortgage points calculator will help. Simply put, you need to stay in the home long enough to allow enough time for the rate savings to balance out those extra upfront costs.

Economic Reports Next Week

One thing that might influence the Fed between now and its next meeting is the official Personal Consumption Expenditures Price Index, which is due out next Friday. Its not only the central banks preferred inflation measure, but its also the one closest to its May 4 meeting.

If inflations running hotter than expected, the Fed might rein in inflation more aggressively than it currently plans. So, markets will eye that figure closely, too.

The other big report next week is the first reading of gross domestic product for the first quarter of this year . Nobodys expecting growth to have been as strong as in the previous quarter. But how much weaker will it be?

The potentially most important reports, below, are set in bold. The others are unlikely to move markets much unless they contain shockingly good or bad data.

- Tuesday March durable goods orders. Plus February home price indexes from S& P Case-Shiller and the Federal Housing Finance Agency. Also April consumer confidence index

- Wednesday Marchpending home sales

- Thursday Q1/22 gross domestic product. Plus weekly new claims for unemployment insurance to April 23

- Friday March Personal Consumption Expenditures Price Index. Plus April consumer sentiment index

Look out for Thursday and Friday.

You May Like: Reverse Mortgage Mobile Home

Which Loan Is Cheaper Interest Rate Vs Apr

| Loan 1: $200,000 principal 3.00% fixed interest rate $10,000 fees 3.40% APR | Loan 2: $200,000 principal 3.40% fixed interest rate $4,000 fees 3.56% APR |

|---|---|

|

Loan 1: $200,000 principal 3.00% fixed interest rate $10,000 fees 3.40% APR |

Loan 2: $200,000 principal 3.40% fixed interest rate $4,000 fees 3.56% APR |

|

Time into loan |

|

|

+ $4,000 = $322,960 |

$9,480: Loan 1 is cheaper |

Eventually, you might pay off your mortgage and own your home free and clear, ideally before retirementunless youre the type whos happy to carry a low-rate mortgage so you can have extra cash to invest .

But each time you get a new loan, you pay closing costs all over again, except in the case of a no-closing-cost refinance. That means all the loan fees you pay should really be averaged out over, say, five years or however long you think youll keep the loan, not 15 or 30 years, to give you an accurate APR. You can do this math yourself with an online APR calculator. This same logic can help you determine whether it makes sense to pay mortgage points.

A Note On Discount Points

Heres an insider tip when comparing mortgage rates: lenders often advertise rates based on the assumption youre going to buy discount points.

Those discount points are an extra sum you can choose to pay at closing to shave a little off your mortgage rate.

Often, you pay 1% of the loan amount to reduce your interest rate by about 0.25%. So, on a $200,000 loan, you might pay $2,000 to reduce your 3% rate offer to 2.75%.

Theres nothing wrong with these points , and theyre often a good idea. But comparing an advertised rate that assumes youll buy discount points with ones that dont make the same assumption is like comparing apples with oranges. You wont get a fair answer.

Also Check: Recast Mortgage Chase

Strategies To Get A Lower Interest Rate

Heres a recap of the best strategies to get a lower interest rate and save on your mortgage loan:

And, if you have time before you plan to buy or refinance:

- Boost your credit score before you apply

- Reduce your debts before you apply

- Save a bigger down payment. The higher your down payment, the lower your mortgage rate is likely to be

With those last three, theres only so much you can do. Few of us could save more at the same time were paying down debt.

But prioritize areas where you think you have the most room to grow as a borrower. And just do what you can. Because even a little can sometimes help a lot.