There May Be Fees For Closing A Reverse Mortgage

At closing, borrowers can expect to pay anywhere from 1% – 4% of the loan balance in upfront mortgage insurance premium costs. This amount is nonrefundable if borrowers decide later they don’t want to take out their reverse mortgages anymore. This way, the additional fees turn out to be among many cons of reverse mortgage.

If You Die Your Children Or Your Living Spouse Will Have To Start Paying For The Debt

We have laid this one out clearly earlier. In an unfortunate event of the death of the borrower, the loan will become due. If youre dead, who pays? Straight answer, your family pays the debts.

This wont be a disadvantage if you have left them enough reserves to pay for it, or if they have enough income to pay for it themselves. But if they dont have the capacity to make payments, they are at risk of losing the house.

There can be two scenarios, they can sell the property to repay the loan or the lender may take the home instead because the loan cannot be repaid. Whichever of the two happens, they end up in the same situation they wont be able to keep the house.

This brings us to another disadvantage.

Find Out If Youre Eligible And How You Could Use Your Loan Proceeds

HUD Requires borrowers to qualify for the loan but they give lenders a number of ways to meet qualifications.

To be eligible:

- All borrowers must be titleholders and age 62 or older .

- You must have equity in your home.

- Generally, the home must be paid off or have a very strong equity position . Existing loans must be paid in full with reverse mortgage proceeds or with another acceptable source ofcash at your disposal.

- Your home must be a single-family home, a 2-4 unit home, a condominium, a planned unit development or amodular home. Manufactured homes are eligible in some circumstances. Mobile homes are not eligible.

Read Also: How Much Does Getting Pre Approval Hurt Credit

Hecms Are Nonrecourse Loans

If the lender accelerates a HECM and the home is foreclosed, the loan is nonrecourse, so the lender can’t seek a deficiency judgment against you or your estate.

What Does “Nonrecourse” Mean?

When a lender forecloses and the home is sold to a new owner at a foreclosure sale, the sale proceeds go toward paying off the borrower’s loan. If the foreclosure sale price isn’t sufficient to repay the debt, the difference between the borrower’s total debt and the sale price is called a “deficiency.” Depending on state law and the circumstances, the lender might be able to get a deficiency judgment from a court, which makes the borrower personally responsible for paying the deficiencyâbut not with a HECM.

Who Is A Bad Candidate For A Reverse Mortgage

There are plenty of signs that a reverse mortgage is not a good choice:

- If youre planning to move Remember that you need a long runway to make paying all the closing costs, mortgage insurance premiums and other fees worth it. So, if you think you might want to relocate to a new destination or downsize to a smaller place anytime soon, steer clear of a reverse mortgage.

- If you might need to move due to health issues A reverse mortgage requires you to live in the home, which means that relocating to a nursing home or any kind of assisted living arrangement could result in needing to pay back the loan. If youve been concerned about health issues, its probably wise to avoid a reverse mortgage.

- If youre struggling to cover the other costs of your home One of the key components of a reverse mortgage is your ability to pay your property taxes and homeowners insurance. If youve faced challenges coming up with the cash for these essential costs, adding to your debt should not be on the table.

You May Like: Chase Mortgage Recast Fee

Money Comes To You Tax

Any money you receive from a reverse mortgage is not considered income for tax purposes. Instead, its technically considered a loan advance.

This money will not be taxed by the government, and should not impact your Social Security income, either.

It is worth noting, though, that any interest you pay on the reverse mortgage is not tax-deductible until you pay it. Thus, theres a good chance you wont get a tax break during your lifetime.

Which Banks Offer Them

Commonwealth and NAB no longer offer reverse mortgage loans, but ANZ and Westpac have similar products they call Equity Manager and Equity Access loans.

Banks offering standard reverse mortgage products for over-60s include IMB Bank, Heritage Bank, G& C Mutual Bank and P& N Bank as well as specialised lenders such as Heartland Finance and Household Capital.

Recommended Reading: Recasting Mortgage Chase

You Must Pay Back The Loan When You Leave A Home

Many people get a reverse mortgage because it gives them income that allows them to stay in their home.

However, what happens if your health declines and you must be moved to a long-term care facility? What if you need to move for any other reason?

In this case, you will be required to pay back the reverse mortgage within one year thus, potentially forcing the sale of your home.

If you are the only borrower on the loan, your spouse and other people living in the home may then be forced to move.

Of course, this could be burdensome for you and your relatives, who may have to address your long-term care needs while also dealing with the sale of your home.

Higher Interest Rates Are Common Cons Of Reverse Mortgage

Not only do borrowers have to pay half of their mortgage insurance premiums when they first take out a reverse mortgage, but they also end up having higher interest rates on their loans since these kinds of mortgages are considered “riskier.” Some loans may even have fees for early payoff, which means you’ll end up having to pay interest on the money you owe until you sell your home.

You May Like: How Does The 10 Year Treasury Affect Mortgage Rates

Q: What Are The Costs For Reverse Mortgage Products

Costs for reverse mortgage products include origination and processing fees, third-party closing costs and possibly a monthly servicing fee and mortgage insurance premium. Many of these costs can be financed with the loan, and may vary depending upon which product you select. There is also counseling required for which you may have to pay a fee.

Also See: Breaking Down Reverse Mortgage Closing Costs

What Happens To A Reverse Mortgage When You Die

Death of the last surviving borrower is a maturity event on a reverse mortgage loan which means the loan becomes due and payable. Your heirs will have 6 months to refinance the loan or up to 12 months by filing an extension to sell. Any remaining equity after the loan is repaid belongs to your heirs. If there is a shortfall in the loan amount to the current appraised value, you may rest assured, reverse mortgages are non-recourse in nature and therefore cannot transfer debt to your heirs or estate.

Read Also: Can You Get A Reverse Mortgage On A Manufactured Home

Guaranteed Line Of Credit For Life

As long as you have funds left on your line of credit and you meet your obligations, HUD ensures your funds are always available.

Banks have been known to freeze or eliminate HELOC lines of credit without advance notice in the past.

They also come to the end of the draw period at which time you enter a repayment phase where funds are no longer available, and payments can double or triple when your income may not be as high as when you received your loan.

It is comforting to know this cannot happen with the reverse mortgage line of credit.

No matter how long you live in your home, no matter how many payments you take or what happens to the real estate values, you and your heirs will never be required to pay back more than the propertys value to repay the loan in full.

A Reverse Loan Will Decrease Your Home Equity

This goes along with the first pitfall we mentioned. Since the loan balance grows, it means your equity may be decreasing. That just depends on whether you choose to make payments or not. It also is dependent on whether home prices are increasing, decreasing, or have been flat for some time.

Want more info from Reverse Mortgage Loan Advisors?

Recommended Reading: Reverse Mortgage Manufactured Home

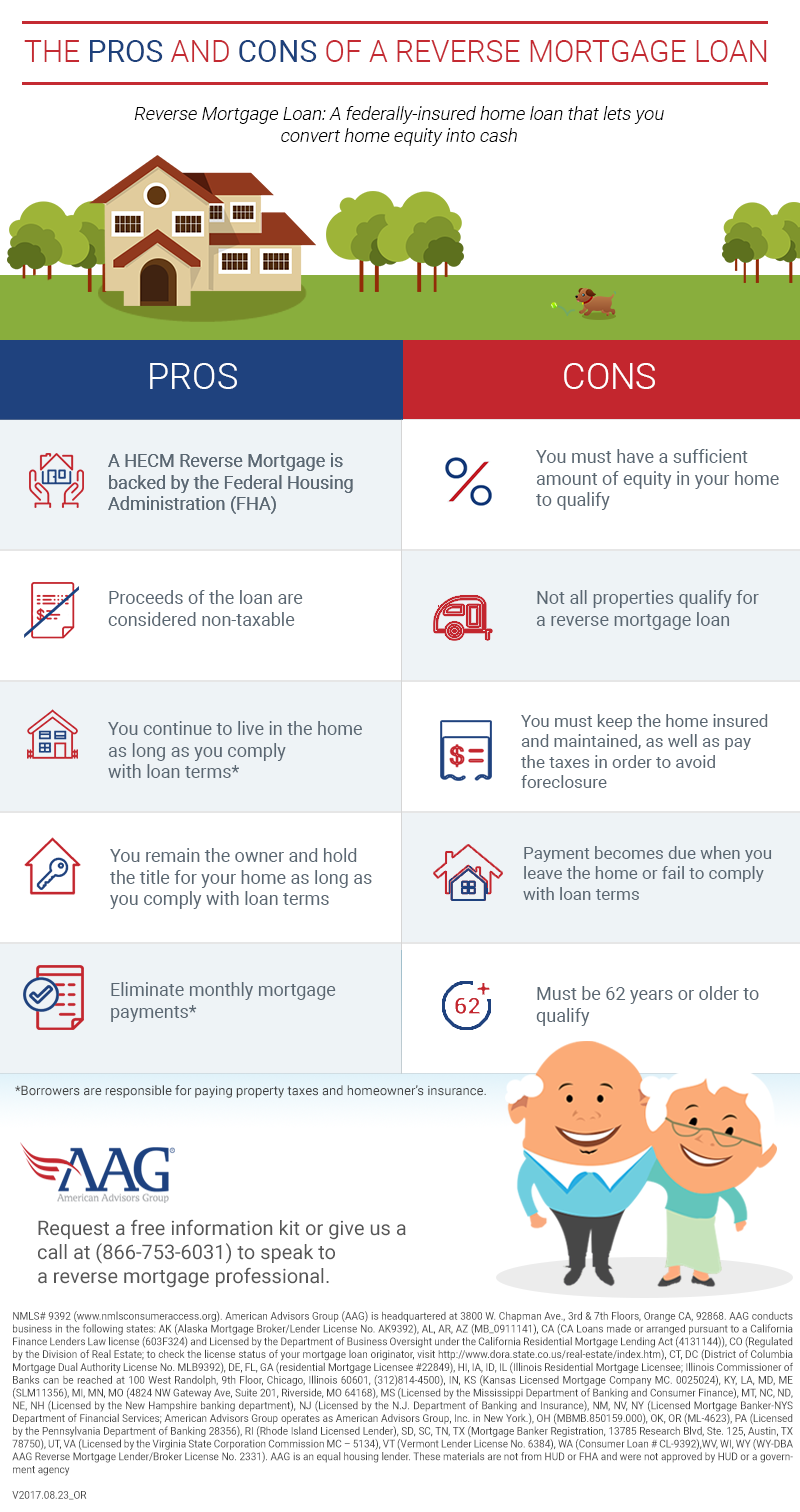

The Pros And Cons Of A Reverse Mortgage

As people approach retirement, many wonder if they can supplement their income. There are many ways to generate funds, but one often overlooked financial tool is a reverse mortgage. Many consumers and even some financial planners dont completely understand how they work or the pros and cons of a reverse mortgage. Here is a look at the advantages and disadvantages of these loans.

Money From A Reverse Mortgage Is Not Free

All banks and lenders are in business to make money and reverse mortgage lenders are no different. But sometimes someone will ask why they have to pay interest to borrow their own money. Here is what I tell them:

A reverse mortgage is a loan against the equity in your home. Anyone who loans money will charge interest. This works no different than any other loan against your home. Whether its a normal 30 year fixed rate loan or a HELOC, the company loaning you the money will charge interest on the loan.

In the case of the reverse mortgage, the lender defers the interest until the last homeowner permanently leaves the home. When you no longer live there as your primary residence, the loan balance plus all accrued interest and MIP charges are due at that time.

Also Check: Does Rocket Mortgage Service Their Own Loans

You Can Afford Ongoing Costs

Keeping up with your property taxes, homeowner’s insurance, and home maintenance is essential if you have a reverse mortgage. If you fall behind, the lender can declare your loan due and payable.

If you dont pay your property taxes for long enough, the county tax authorities can place a lien on your home, take possession, and sell it to recoup the taxes owed. The tax authoritys claim to your property supersedes the lenders. So, if you dont pay your property taxes, youre putting the lenders collateral at risk.

Not paying your homeowners insurance premiums also puts the lenders collateral at risk. If your house burns down, theres no insurance to pay the costs of rebuilding. Your lender doesnt want to get stuck with a burned-out shell of a home that isnt worth nearly what you owe on the reverse mortgage.

Not keeping up with home maintenance also causes your home to lose value. If you dont replace a failing roof, for example, your home could end up with extensive water damage after it rains or snows. Prospective buyers would pay a lower price than they would for similar houses in good repair in your neighborhood. The need to spend money to replace the roof and fix the water damage to return the home to a good condition may deter buyers altogether.

How Might A Reverse Mortgage Affect Your Benefits

Having a reverse mortgage could affect your government benefits. For example, a lump sum payment could increase your asset balance to the point where you do not qualify for a full age pension.

Its best to check with Centrelink before you apply for a reverse mortgage.

How home loans for pensioners work.

Don’t Miss: Does Rocket Mortgage Sell Their Loans

As The Loan Grows Your Equity Will Decrease

The equity you have in your home will diminish as you pay back your reverse loan. Reverse mortgages will remove some of the equity that you have accrued over time and make it disappear. It’s possible to lose all equity in the event that you decide to sell your house in the near future to help pay for the costs of long-term care or to pay for a relocation.

Beyond Advantages And Disadvantages Reverse Mortgages Are Not For Everyone

While the following are not strictly disadvantages, it is important to remember that a Reverse Mortgage may not be for everyone, consider the following:

- Beware if You are Eligible for Low-Income Assistance: If you are currently or will be eligible to receive low-income assistance from the Federal or State government , you will want to be careful that proceeds from a Reverse Mortgage does not disqualify you from that assistance.

- Reconsider if You Are Planning to Move in the Near Term: Since a Reverse Home Mortgage loan is due if your home is no longer your primary residence and the up front closing costs are typically higher than other loans, it is not a good tool for those that plan to move soon to another residence .

- Evaluate if You are Willing to Reduce Your Heirs Inheritance: Many people dismiss a Reverse Mortgage as a retirement option because they want to be sure their home goes to their heirs. And it is true, a Reverse Mortgage decreases your home equity affecting your estate. However, you can still leave your home to your heirs and they will have the option of keeping the home and refinancing or paying off the mortgage or selling the home if the home is worth more than the amount owed on it. There are numerous potential Estate and Retirement Planning benefits to a Reverse Mortgage see Innovative Uses of a Reverse Mortgage for more information on these options.

Read Also: Can You Refinance A Mortgage Without A Job

Reverse Mortgages: Pros And Cons

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

For older homeowners struggling to cover basic expenses, a reverse mortgage could provide much-needed relief.

Effectively, such a loan allows you to stay in your home while trading fees, interest and home equity that’s the current market value of your home minus what you owe for cash or a line of credit. The most widely used loans are Home Equity Conversion Mortgages, or HECMs, which are federally insured and available to applicants 62 and older who meet certain requirements.

These loans aren’t a cure-all for retirement money problems, though. You could default and risk losing your home if you dont meet certain ongoing requirements. And if your cash shortfall is temporary, there may be lower-cost and lower-risk alternatives.

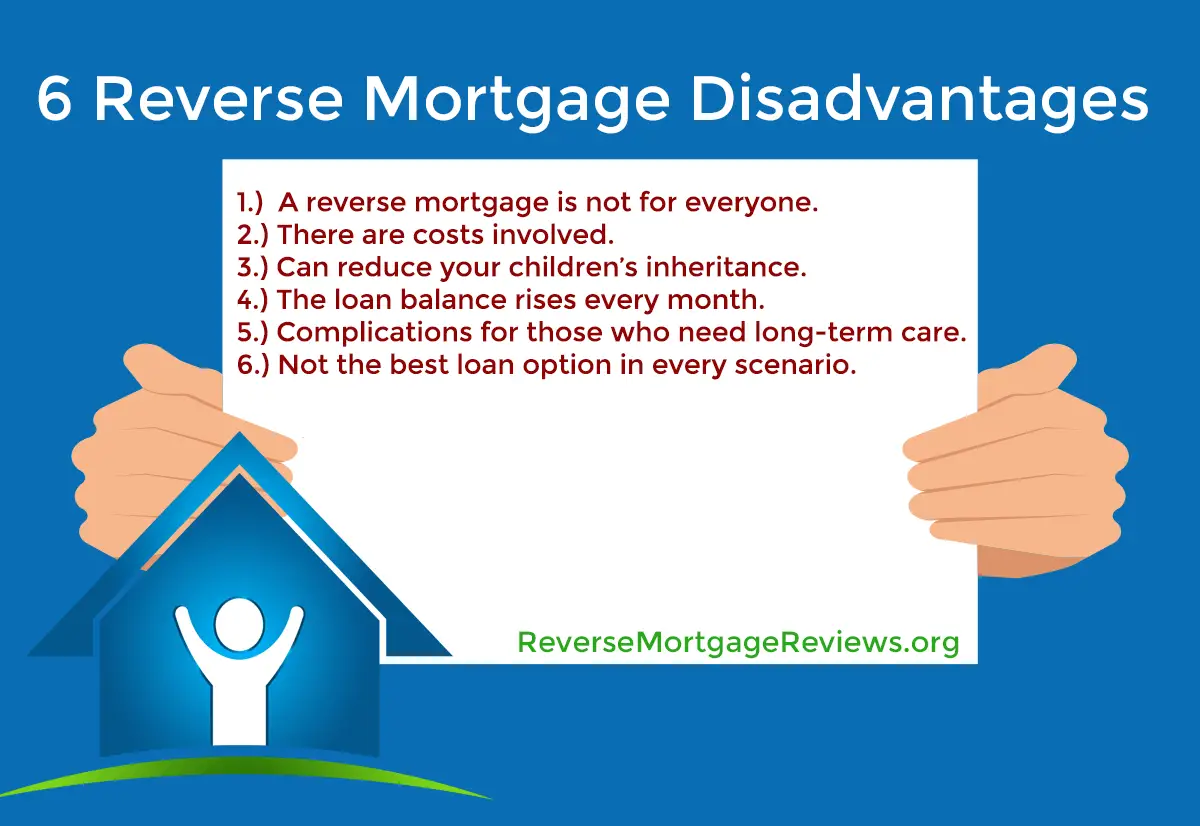

What Are The Cons Reverse Mortgage

The equity in a person’s home can be used to purchase a house, pay for an emergency, or even take an extended vacation. A reverse mortgage is considered one way of using this equity. With many benefits to using this financial strategy, it does come with some risks you must consider. Here are some cons of Reverse Mortgage to think of.

Also Check: Can I Get A Reverse Mortgage On A Condo

Is A Reverse Mortgage Right For You

Its important when planning to think long term.

Retirement is tricky and people are living longer. If you choose a reverse mortgage now and later decide to move, you might have less available equity for your next purchase. If your current home is fully accessible and you can foreseeably stay there for your lifetime, the reverse mortgage can help fund a more secure retirement.

We have seen reverse mortgages do some great things for peoplewho really wanted and needed them. However, only you, in conjunction with your trusted financial advisor and family, can decide if this is the right loan for you!

ARLO recommends these helpful resources:

No Penalties For Early Withdrawals

It’s possible to borrow against your reverse mortgage even before you’ve reached age 62 if it’s for a good cause, such as college tuition or medical bills. No penalties are among a few of the reasonable pros of reverse mortgage. You may also be able to take out money earlier if your spouse dies, you move out of the home, or your property goes into foreclosure. While you will have to pay back all the money eventually, you won’t incur a penalty for doing so early.

Also Check: Are Discount Points Worth It

When Is A Reverse Mortgage A Good Idea

Reverse mortgages are best for homeowners who plan to stay in their home for the rest of their lives. Ideally, your heirs will be able to sell the home after your death and pay off the loan with the proceeds. However, you should know that this will cut into their inheritance. You should always weigh a reverse mortgage against other options that don’t involve additional debt later in life.

Heres A Flexible Solution That Helps You Enjoy A Stable Retirement Designed For Homeowners Age 62 And Older A Reverse Mortgage Lets You:

- Access a portion of your available home equity whenever you need it and use it in a variety of ways.

- Continue to live in your home with no monthly mortgage payments.

- Retain the title to your home.

- Finance most of the loans fees so there are minimal out-of-pocket expenses.

- Choose how you want to receive your loan proceeds: lump sum, monthly installments, a line of credit or a combination of these options.

- Access additional loan proceeds with an annual credit-line increase .

- Buy a new home.

Also Check: 10 Year Treasury Vs Mortgage Rates