Find A Lower Interest Rate

Getting the lowest possible interest rate is one of the easiest ways to save on your home loan. If its been a while since youve checked your interest rate, you could be paying too much.

Weve used the example home loan from above to demonstrate how a lower interest rate can impact your repayments and overall loan amount.

|

Calculator inputs |

|

|---|---|

|

$214,818 |

$168,915 |

*The table above assumes an owner occupier loan over a 30-year loan term with a $500,000 loan amount and $10 monthly fees.

What Is A Million Dollars Today

Remember the song âIf I Had $1,000,000â by the Barenaked Ladies? When the band released the song in 1992, $1 million had some serious purchasing power. Fast forward a couple of decades and itâs a different story.

Thanks to inflation, money loses its value over time. Inflation is the yearly increase of the cost of goods and services, affecting everything from food and electronics to wages and real estate. Because of inflation, what might have cost a million dollars in 1992 will cost much more in 2012.

Hereâs a table showing what $1 million is worth over time â starting from the release of the song:

| Year |

As you can see above, inflation has a serious impact on the value of $1 million over 40 years.

Do I Qualify For A Mortgage

A mortgage calculator can be helpful when estimating your home buying budget. But remember even if you can afford the monthly payments, you still need to qualify for a home loan.

To see if you qualify for a mortgage, a lender will check your:

- : Borrowers with higher credit scores tend to have more loan options. But mortgages are secured loans, which means you dont always need stellar credit to qualify. Some lenders can approve FHA loans for borrowers with FICO scores as low as 580

- Loan-to-value ratio : LTV measures your loan amount against your new homes value. For example, borrowing $200,000 to buy a $200,000 home equals 100% LTV. Lenders can offer VA or USDA loans at 100% LTV, but not everyone is eligible for these programs. FHA loans cant exceed 96.5% LTV, which leaves 3.5% as the minimum down payment. Conventional loans can reach 97% LTV, meaning they allow a 3% down payment

- Home appraisal: A home appraisal identifies the homes value. Lenders wont approve loan amounts that exceed the homes value, regardless of the homes listing price or agreed-upon purchase price

- Personal finances: Lenders must verify your income to make sure you can afford the loan payments. Theyll check W-2s, bank statements, and employment records. If youre self-employed, a lender will likely ask to see tax records

You can ask for a mortgage pre-approval or a prequalification to see your loan options and real budget based on your personal finances.

You May Like: Rocket Mortgage Conventional Loan

Can You Afford A Million

Hereâs the short answer: To buy a million-dollar home in Canada, youâll need a yearly income of at least $175,230, as well as a cash down payment of at least $200,000. Thatâs the minimum youâll need in order to qualify for a large enough mortgage. Well, that or youâll need $1 million in cash, to avoid taking out a mortgage altogether.

How Much Is A $1000000 Life Insurance Policy

So, do you think a million-dollar life insurance policy would be a good fit for you?

Naturally, you will want to compare quotes to get the best million-dollar life insurance rates.

Since term life insurance quotes can vary from one company to another, evaluating quotes from many companies really pays.

If you feel that you may need a significant amount of life insurance coverage, buying two policies from different companies can also be beneficial.

Each policy could run for a different time period to match your underlying need for coverage.

This strategy can also dramatically reduce your overall cost of life insurance.

5 Million Dollar Life Insurance Policy

Here is how life insurance laddering works:

Lets assume you are a successful business owner with needs requiring a 5 million dollar life insurance policy.

- You could buy a cheaper 2 million insurance policy from American General for 10 years to cover a mortgage loan.

- Then, buy another more expensive 3 million dollar life insurance policy with Prudential for 20 years to protect your income until retirement.

This life insurance laddering strategy will also allow you to diversify your risk by not having all of the coverage with a single life insurance company.

Many advisors and clients feel more comfortable not having all of their eggs in one basket.

This strategy will ultimately depend on your health and the offers granted by each insurance company.

Read Also: Chase Recast

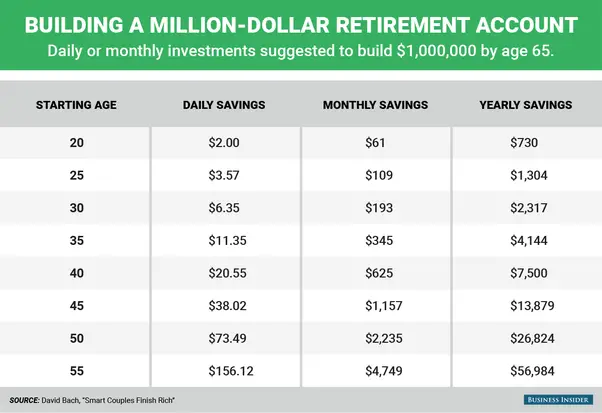

Rule : 4% Withdrawal Rate

The 4% withdrawal rule infers that you build up a retirement portfolio that provides a certain amount of income to you per annum at a 4% or so withdrawal rate. A 4% withdrawal rate is often referred to as a safe withdrawal rate.

For example, say you have figured out that you need $40,000 per year in retirement. Using a withdrawal rate of 4%, you should have a minimum of $1 million in retirement savings before you retire.

â $40,000 â 4% = $1,000,000

This rule of thumb works whether you plan to retire early at 35 or go the conventional route and retire at 65 years or later. Its the strategy often utilized by many early retirement enthusiasts or the movement popularly referred to as FIRE Financial Independence/Retire Early.

Note: For earlier retirement plans, consider that you will not be receiving a government pension or retirement benefits until later in life and adjust your income needs accordingly.

The general idea behind the funds lasting you for life is based on historical market returns. If we assume your investment portfolio generates approximately 7% annually in long-term returns, then real returns of approximately 4% are expected after accounting for inflation .

Essentially, a 4% withdrawal rate assumes your investment portfolio is not highly conservative .

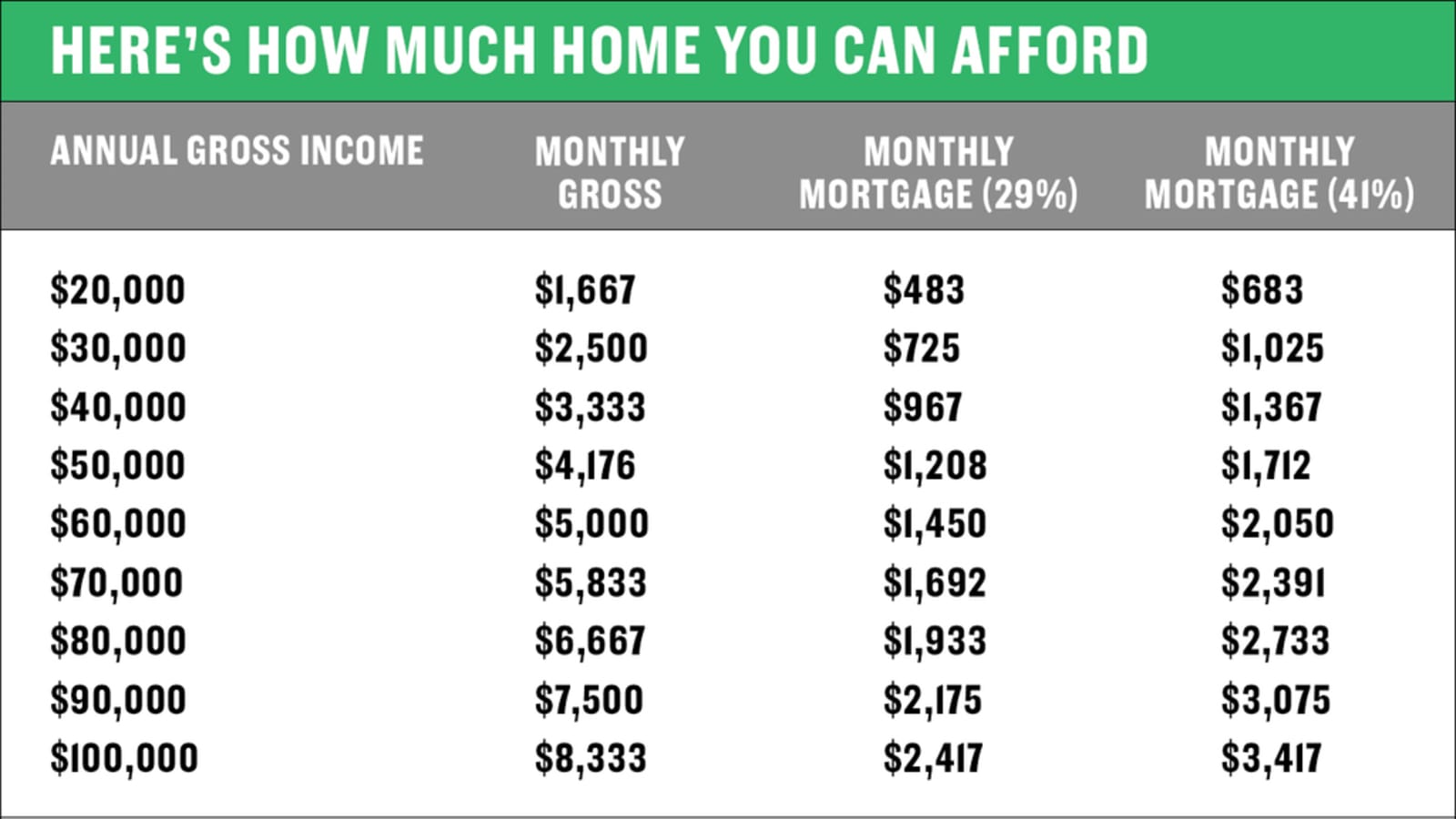

Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit a mortgage payment at 28 percent of your gross that is after-tax monthly income. So, if you simply multiply your annual income by 0.28, then divide by 12, youll find your maximum monthly mortgage payment.

The amount a borrower agrees to repay, as set forth in the loan contract.

Read Also: Can You Get A Reverse Mortgage On A Manufactured Home

How To Use Our Home Loan Calculators

Our home loan calculators are simple to use. You need to have an idea of your loan amount, the interest rate, repayment type, loan term, repayment frequency, and other information as required.

If youre not sure what your loan amount is because youre a first time buyer or have only just started thinking about taking out a home loan, thats okay. Have a think about what your budget is and enter rough numbers into the calculator that matches your budget.

Other calculators, like the stamp duty calculator, may require you to enter your location, while our income tax calculator will require you to include your income and current expenses.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Don’t Miss: Rocket Mortgage Qualifications

Do Mortgage Lenders Accept Income From Commission And Bonuses

Since the COVID pandemic in 2020, lenders will accept income from commission and bonus but will look to see current commission levels earned in the last 3 months.

Where annual bonuses are paid lenders will seek to gain some form of confirmation of the current years bonus. As high net worth brokers our job is to place the business with a lender that understands and appreciates our clients total compensation package.

Other assets are taken into consideration including vested shares and allowances such as car and living allowances.

Getting Your First Mortgage

The traditional period for amortization of a mortgage is 25 years. But this is done in periods of five years at a time, though it is possible to pay the mortgage down in a shorter period, just not longer. The longer the amortization period, the smaller the monthly payments will be, but the more the loan will cost in total.

Most mortgages have a five year term, though shorter terms are possible. The five-year mortgage term is the amount of time a mortgage contract is in effect. At the end of each term, the mortgage must be renewed for another term, at which point there is an opportunity to consider making any changes. Possible changes include renegotiating the rate as well as other details of the contract for the next term. The agreed-upon interest rate remains in effect for the term.

It is possible to choose between an open mortgage, which provides a person the flexibility of being able to repay all or part of a mortgage at any time without a prepayment charge, or a closed mortgage, which limits prepayment options. The latter usually has a lower interest rate.

Traditionally, mortgage payments are made every month. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. A biweekly payment means making a payment of one-half of the monthly payment every two weeks. This results in 26 payments a year instead of 24.

There are also options for flexible or skipped payments.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

Occupying More Than Half Of The Property

A small business is required to occupy 51 percent of the property or more than half of the premises. If you are unable to meet this criteria, you cannot qualify for a commercial mortgage. You should consider applying for an investment property loan instead.

Investment Property Loans

Investment property loans are appropriate for rental properties. Borrowers use them to buy commercial property and rent them out for extra profit. Investment property loans are also used by house flippers who renovate and sell houses in the market.

Case Study Results: Is $2 Million Enough To Retire At 60

Joe and Mary Schmoe celebrated their 35th wedding anniversary last weekend.

Their love carried them through a few moves, a few more careers, and two lovely children.

In 2021 they will each turn 60 years old. Dreams of retirement in a small town by the lake and making their $2 million last become their main focus.

It is time for them to enter a new chapter of their lives, together. Both in pristine health, they will need their money to last up to 35 years or until age 95!

I know what youâre thinking.

Planning to age 95 seems like a long time. Right? As it turns out, a 60 year old married couple in 2021 has a 30% chance of at least one individual living to age 95!

The chart below illustrates the probability of living to different ages for a 60 year old in 2021.

To help us find out if $2 million is enough to retire at age 60 for Mary and Joe, we analyzed five different case studies.

Each case uses the following assumptions:

-

35 years of portfolio withdrawals

-

Tax rate after withdrawals begin is 20%

-

Income withdrawal increases every year at 2.25% to account for inflation

-

Average projected return is 5.45% per year

The only adjustment we made to each case study was the amount of annual withdrawal from the portfolio. This reflects differing income needs based upon lifestyle.

In the chart below, we summarize the monthly after-tax withdrawal amount from a $2 million portfolio and provide the probability of the money lasting 35 years in retirement.

It all depends.

Also Check: Chase Recast Calculator

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

How Much Is A Monthly Payment On A Million Dollar Home

Monthly Payment Options

| 15 Year Mortgage | 30 Year Mortgage |

|---|---|

| 7% – $70,000 |

Furthermore, how much is a million dollar house a month?

Monthly payments on a $1,000,000 mortgageAt a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total $4,774.15 a month, while a 15-year might cost $7,396.88 a month.

One may also ask, what is the monthly payment on 1.5 million mortgage? $1,500,000 Mortgage Loan Monthly Payments Calculator

| Rate |

|---|

| 25,964.83 |

Herein, what is the monthly payment on a 1.2 million mortgage?

Mortgage Comparisons for a 1,300,000 dollar loan. Monthly Payments by Interest Rate and Loan Payoff Length.

$1,300,000 Mortgage Loan Monthly Payments Calculator.

| Monthly Payment | |

|---|---|

| Looking For a Loan or Refinance? | Get Quote |

How much do you need to make to buy a 1.5 million dollar house?

This was the basic rule of thumb for many years. Simply take your gross income and multiply it by 2.5 or 3, to get the maximum value of the home you can afford. For somebody making $100,000 a year, the maximum purchase price on a new home should be somewhere between $250,000 and $300,000.

You May Like Also

Also Check: Chase Mortgage Recast

Why Should I Use A Mortgage Repayment Calculator

A home loan is the biggest expense most people will ever have. Thats why its important to use a mortgage repayment calculator to work out how much your potential home loan repayments could be before applying for a loan, so you know how much you can afford to borrow.

A home loan repayment calculator can help you compare the costs of taking out a home loan and give you an idea of what your monthly repayments could be. Having an understanding of what your monthly repayments could be can help you to work out whether the loan is something you can afford, and what the total cost of the loan will be over the full loan term.

How Much Does A 2 Million Pound Mortgage Cost

If you plan to secure a £2 million mortgage to purchase or remortgage a property, Trinity Financial has access to HSBC for Intermediaries large loan team offering a two-year fixed-rate at 1.14%.

The monthly repayments would be as low as £1,900 on interest-only and £6,562 on full capital repayment over a 30-year term. The bank charges a £999 arrangement fee, and the APRC is 3.3%. The maximum loan is £2 million, although larger loan size rates are slightly more expensive.

To qualify for the 1.14% rate, borrowers will need to put down a 40% deposit, and after the fixed period, the mortgage reverts to the 3.54% standard variable rate. The rate is 0.1% more expensive for borrowers with a 25% deposit.

5.5 times salary mortgages

More banks and building societies are starting to offer more generous income multiples to borrowers earning over £75,000 or £100,000. While many may not need the full 5.5 times salary, it is helpful to secure the applicants’ mortgage they ask request. The lenders reduce the maximum loan size if borrowers have children, cars on finance, other residential properties or other credit commitments.

How much is a five-year fix for larger mortgage loans?

Our £2 million+ mortgage specialists have access to a five-year fixed-rate mortgage priced at 1.44% with a 2.8% APRC. The monthly repayments on a £2 million mortgage would be £2,400 on interest-only or £6,844 each month over a 30-year term.

What has happened to fixed rates recently?

Recommended Reading: Rocket Mortgage Loan Requirements

Rule : 70% Of Working Income

This rule estimates that you will need between 70% and 100% of your pre-retirement income in retirement: 70% if you are typical and do not have a mortgage, and up to 100% if you are still paying a hefty mortgage plus other atypical expenses while retired.

The idea behind this rule is that your expenses are generally expected to be lower in retirement: no mortgage payments, no longer need to save for retirement, kids are financially dependent, etc. After computing this amount, you can then proceed to calculate how much you need by going back to Rule 1 or 2.

For example, assume you earn $100,000 per year before retiring. Using the 70% rule, you will need approximately $70,000 in annual income to maintain your lifestyle in retirement. Going back to Rule 2, it implies you need:

â $70,000 x 25 â $1.75 million in retirement.

I think the 70% rule is a fairly liberal estimate of retirement income needs . A survey conducted by Sunlife and released in 2016, shows that Canadian retirees were on average living on 62% of their pre-retirement income.