What Is Your Interest Payment

The second major part of your monthly mortgage payment is interest. Interest is money you pay to your mortgage lender in exchange for giving you a loan. Most lenders calculate and determine your mortgage rate in terms of an annual percentage rate . APR is the actual amount of interest that you pay on your loan per year . For example, if you borrow $100,000 at an APR of 5%, youd pay a total of $5,000 per year in interest. At the beginning of your loan , most of your monthly payment goes toward paying off interest.

Just a few percentage points of interest can make a huge difference in how much you eventually end up paying for your loan. For example, lets say you borrow $150,000 at a 4% interest on a 30-year loan. With this loan, your monthly payment would be $716.12. If you take the same loan with a 6% interest rate, youd pay $899.33 each month.

The interest rate on your loan depends upon a number of factors. Your credit score, income, down payment, and the location of your home can all influence how much you pay in interest. If you know your credit history isnt that great, you may want to take some time to raise your credit score so you can save thousands of dollars in interest over time. Lets take a look at an example.

Say you have a choice between two lenders. One offers you $150,000 for a 30-year loan with 4% interest. The other lender offers you the same $150,000 for a 30-year loan, but with a 6% interest rate.

Find out what you can afford.

How To Beat Mortgage Interest Rate Rises

If you’re on a variable-rate deal such as a discount or tracker mortgage, changes to the Bank of England base rate or your bank’s standard variable rate will have an immediate impact on how much you’re paying each month.

If this happens, it’s worth investigating whether you could save money by remortgaging.

A rate rise can also hit you hard when you reach the end of an initial deal period – for example, if you’ve reached the end of your fixed-rate mortgage’s introductory period, which might be two or five years.

When this period runs out, youll usually revert to your lenders standard variable rate , which is likely to be a lot higher.

In most cases, youll be able to get a better deal if you remortgage your home at this point, as youll have built up more equity in your property and introductory rates on new deals will almost always be cheaper than your current lenders SVR.

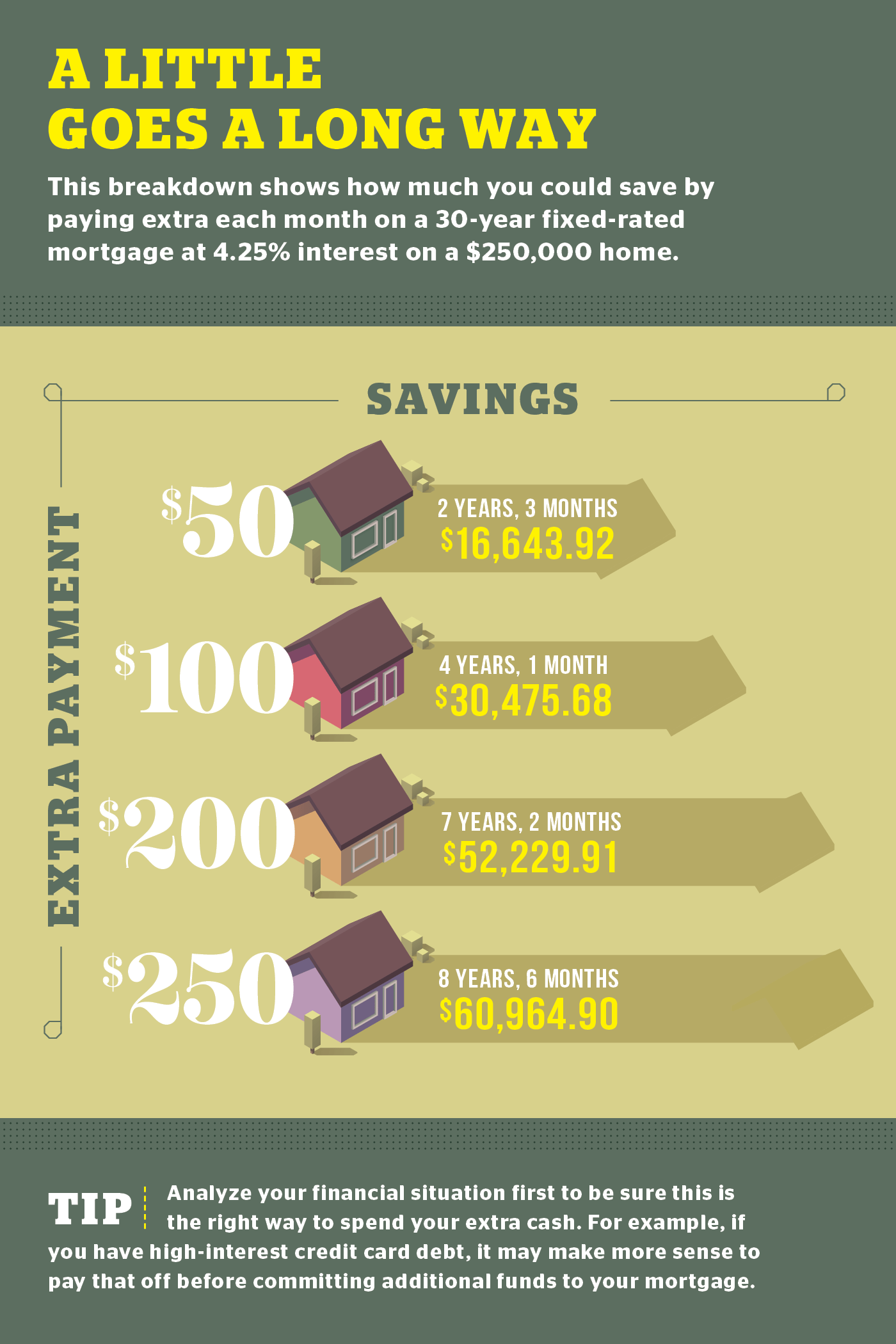

How Does Pay Extra On Your Mortgage Reduce The Interest Calculation

In my last post, I said one thing you can do to reduce the interest paid on your mortgage is by paying extra on the mortgage. Let put that in our example and see how $100/month extra can reduce the interest.

The first month will be the same as we havent made any payment. We will still have $2083.33 interest needs to pay. However, if we increase the monthly payment to $2183.33, we will reduce the mortgage amount by $2183.33 2083.33 = $700.78. On your second month, the new mortgage balance is $499,299.22 and the daily interest will be $499299.22 x 5% / 365 = $68.40. At the end of the month, we will accumulate $2080.41 in interest, $0.42 less.

You may think that just $0.42, hardly make any difference. However, that is the saving on the second month only. You will save more and more each month. Paying extra on the mortgage will have a knock on effect on the mortgage amount reduced. You will end up pay off your mortgage in 27.6 years and saved $42.6K on interest.

Don’t Miss: Rocket Mortgage Vs Bank

Mortgage Balances Over Time

Mortgage balances accelerate toward zero over time. The root word is mort, or to the death, meaning until the loan dies.

The rate at which your mortgage balance falls will not remain constant. In the early years your payments will primarily be interest and in the later years the payments will be mostly principal creating a natural acceleration over the course of your loan term toward payoff.

Don’t be surprised if you check your mortgage balance early in your loan term and find it hasn’t dropped much. That is natural. This shifts midway through your loan term, with the principal taking the majority of the mortgage payments later in the term.

Remember: The longer you pay your mortgage, the faster your mortgage balance will fall.

See What Goes Towards Your Principal

When you buy your first home, you may get a shock when you take a look at your first mortgage statement: You’ll hardly make a dent in your principle as the majority of your payment will apply toward interest. Even though you may be paying over $1,000 a month toward your mortgage, only $100-$200 may be going toward paying down your principal balance.

The amount that you pay in principle each month depends on a number of variables, including:

- Amount of the loan

- Length of the loan

- How many months you have already paid in to the loan

The reason that the majority of your early payments consist of interest is that for each payment, you are paying out interest on the principle balance that you still owe. Therefore, at the beginning of your loan, you may owe a couple hundred thousand dollars and will still have a hefty interest charge. With each payment, you will reduce the principle balance and, therefore, the amount of interest you have to pay. However, since your loan is structured for equal payments, that means that you’re just shifting the ratio, not actually paying less each month. With each successive payment, you are putting in a little more toward principle and a little less toward interest. By the end of your loan term, the majority of each payment will be going toward principle.

Making Extra Payments Early

Also Check: Bofa Home Loan Navigator

Mortgage Interest Is Paid In Arrears

In the United States, interest is paid in arrears. Your principal and interest payment will pay the interest for the 30 days immediately preceding your payment’s due date. If you are selling your home, for example, your closing agent will order a beneficiary demand, which will also collect unpaid interest. Let’s take a closer look.

For example, suppose your payment of $599.55 is due December 1. Your loan balance is $100,000, bearing interest at 6% per annum, and amortized over 30 years. When you make your payment by December 1, you are paying the interest for the entire month of November, all 30 days.

If you are closing your loan on October 15, you will prepay the lender interest from October 15 through October 31.

It may seem like you get 45 days free before your first payment is due on December 1, but you do not. You will pay 15 days of interest before you close, and another 30 days of interest when you make your first payment.

Fixed & Variable Rates

The standard variable rate is the basic interest rate lenders use for mortgages. Each lender sets their default SVR. Its the default rate mortgages revert to after the introductory period of a loan, which is usually 2 to 5 years. SVR mortgages usually have higher interest rates than other mortgage options.

Standard variable rates move based on fluctuations in the Bank of England base rate. When rates reset higher, borrowers must be prepared to make higher monthly payments. To avoid reverting to the SVR, borrowers would remortgage to a new deal with a favourable rate.

In recent years, standard variable rates have been on the rise. Because of this, many consumers find fixed-rate mortgage options more attractive. According to the Bank of England, since 2016, fixed-rate options are more preferred by borrowers, especially first-time homebuyers.

In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans. The average fixed-rate mortgage was priced at 1.91%. In contrast, the average variable rate mortgage was priced at 1.85%, bringing the overall market average to 1.91%.

What is a Fixed Rate?

The UK government provides subsidy programs in Help to Buy and Help to Buy London. These government schemes offer mortgage deposit assistance. However, few lenders in the UK provide loans which have fixed rates extending beyond 5 years.

Which Loans Structures Do Most Buyers Prefer?

Only 1 in 50 mortgages come with a fixed rate longer than 5 years.

Also Check: 10 Year Treasury Vs 30 Year Mortgage

What Interest Rate Am I Receiving On My Investment/savings

To calculate the rate of return on an investment or savings balance, we use an adapted version of thecompound interest formula used in our calculators.We enter into the formula your current balance, original principal amount, number of compounds per year and time period and the formula gives us a resulting balance figure.

We also have other options for investments involving calculation of future values and returns. Should wish to work out the rate of interest you might receive on an investment based upon a current value andfuture value, give the CAGR calculator a try. For assistance calculating returns on investments, trythe IRR calculator

How To Calculate Repayments On A Mortgage

To calculate how much interest you’ll pay on a mortgage each month, you can use the monthly interest rate. Generally, you’ll find this by dividing your annual interest rate by 12. Then, multiply this by the amount of principal outstanding on the loan. Note that this means you’ll pay less interest later in the life of the mortgage, but keep in mind that this won’t always hold true for adjustable rate mortgages.

TL DR

Divide you annual mortgage interest rate by 12 to get your monthly rate. Multiply this number by the total amount outstanding on the loan to get how much interest you owe for the month.

Don’t Miss: Rocket Mortgage Loan Types

Choose An Accelerated Option For Your Mortgage Payments

An accelerated payment option lets you make weekly or biweekly payments. With this option, youre putting more money toward your mortgage than with a monthly payment.

Accelerated payments can save you money on interest charges. By accelerating your payments, you make the equivalent of one extra monthly payment per year.

Calculate Annual Interest Amount

Lets say you took out a mortgage for $150,000 at a 4.25% interest rate for 30 years. How do you figure out how much youll pay in interest per year?

First, youre going to convert the annual interest rate percentage into a decimal interest rate. To do this divide the interest rate percentage by 100.

4.25% / 100 = 0.0425

In this example, 4.25% converts to 0.0425.

Now youre ready to calculate the annual mortgage interest amount.

Current Principal Balance x Mortgage Interest Rate = Annual Mortgage Interest Amount

This formula calculates the total interest on your mortgage per year.

Based on the example above:

- Current Principal Balance: $150,000

- Interest Rate: 4.25% or 0.0425

$150,000 x 0.0425 = $6,375 per year

In this example, youll pay $6,375 in interest for the year.

How about if your interest is 5% and you have a $350,000 loan. How much will your annual interest be then? If you calculated $17,500 a year thats correct!

- Current Principal Balance: $350,000

- Interest Rate: 5% or 0.05

$350,000 x 0.05 = $17,500 per year

Helpful Tip: Remember since the interest you pay is directly tied to the current balance, every month after making a payment, your principal goes down. That means that youll pay slightly less interest and more principal with each payment.

Recommended Reading: How Much Is Mortgage On 1 Million

Calculating The Numbers Yourself

If you don’t want to use a premade calculator, you can do the math yourself with a pocket calculator, a calculator app or a spreadsheet program.

First, you’ll want to compute yourmonthly interest rate. This is found by dividing your annual interest rate by 12, since there are 12 monthly payments in a year. For example, if your annual interest rate is 6 percent, your monthly interest rate is 6 / 12 = 0.5 percent. Once you have that rate, determine how much principal is currently owed on your mortgage. You should be able to see that on your most recent mortgage statement or through an online banking site or app.

Then, multiply the principal amount by the monthly interest rate to get the monthly interest amount. If the principal is $200,000 and the monthly interest rate is 0.5 percent, for example, the monthly interest amount is $200,000 * = $200,000 * = $1,000.

Your monthly mortgage payment minus the interest portion is the amount of principal you are paying down in that particular month.

How To Calculate Your Mortgage Payment

Mortgage calculators take into account a variety of different factors when determining your monthly mortgage costs. They can include the price of your home, your down payment, your monthly interest rate and the term length of your mortgage. If your math skills are a little rusty, a mortgage calculator does the hard work for you in order to determine your monthly payment and associated costs.

The basic formula for calculating your mortgage costs: P = A/

- P stands for your monthly payment

- A stands for your loan amount

- T stands for the term of your loan in months

- R stands for the monthly interest rate for your loan

For example, lets say that John wants to purchase a house that costs $125,000 and has saved up a $25,000 down payment. His loan amount is $100,000, the term length is 15 years and the monthly interest rate is 4.20%. In this scenario, Johns monthly mortgage payment will be $749.75.

Johns mortgage cost formula will look like: 749.75 = 100,000[4.2^180/[^180-1)

If John wants to purchase the same house with a 30-year term length, the formula works in much the same way. In this scenario, his loan amount is $100,000, term length is 30 years and monthly interest rate is 4.20%. With a 30-year mortgage, Johns monthly mortgage payment will be $489.02.

Johns mortgage cost formula will look like: 489.02 = 100,000[4.2^360/[^180-1)

You May Like: Reverse Mortgage On Condo

How Mortgage Payments Are Calculated

With most mortgages, you pay back a portion of the amount you borrowed plus interest every month. Your lender will use an amortization formula to create a payment schedule that breaks down each payment into principal and interest.

If you make payments according to the loan’s amortization schedule, the loan will be fully paid off by the end of its set term, such as 30 years. If the mortgage is a fixed-rate loan, each payment will be an equal dollar amount. If the mortgage is an adjustable-rate loan, the payment will change periodically as the interest rate on the loan changes.

The term, or length, of your loan, also determines how much youll pay each month. The longer the term, the lower your monthly payments will typically be. The tradeoff is that the longer you take to pay off your mortgage, the higher the overall purchase cost for your home will be because youll be paying interest for a longer period.

Typical Costs Included In A Mortgage Payment

- Principal: This is the amount you borrowed from the lender.

- Interest: This is what the lender charges you to lend you the money. Interest rates are expressed as an annual percentage.

- Property taxes: Local authorities assess an annual tax on your property. If you have an escrow account, you pay about one-twelfth of your annual tax bill with each monthly mortgage payment.

- Homeowners insurance: Your insurance policy can cover damage and financial losses from fire, storms, theft, a tree falling on your home and other hazards. If you live in a flood zone, youll have an additional policy, and if youre in Hurricane Alley or earthquake country, you might have a third insurance policy. As with property taxes, you pay one-twelfth of your annual insurance premium each month, and your lender or servicer pays the premium when it’s due.

- Mortgage insurance: If your down payment is less than 20 percent of the homes purchase price, youll probably be on the hook for mortgage insurance, which also is added to your monthly payment.

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home

How Much I’ll Pay In Loan Interest

If you borrow $20,000 at 5.00% for 5 years, your monthly payment will be $377.42. Your total interest will be $2,645.48 over the term of the loan.

Note: In most cases, your monthly loan payments won’t change over time. With , the proportion of interest paid vs. principal repaid changes each month. As the loan continues to amortize, the amount of monthly interest paid will decrease .

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnât feature every company or financial product available on the market, weâre proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward â and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Mortgage calculator

Recommended Reading: Mortgage Recast Calculator Chase

How Much Interest Are You Paying On Your Mortgage

Do you know how much youre paying in interest on your mortgage every day, month or year? Interest has always been one of my biggest motivators for getting out of debt because its what you pay on top of what you borrowed. Regardless of what debt you have: car note, mortgage, credit card debt or student loans I would bet that a lot of what youre paying every month goes towards interest.

For example, lets take a look at my mortgage.

Although my monthly mortgage payment includes principal, interest, property insurance, city tax and PMI , my interest makes up 35% of my monthly payment. With that being said, right now Im paying $20.37 a day in mortgage interest.

Gosh, thats expensive!

Reading this out loud and sharing this publicly with you is enough to make my heart beat fast! Although this really sucks, its motivating me to pay off my 30-year mortgage fast. Yes, you got that right my interest is motivating me to take action!

Similar to how I used my daily interest to track my student loan repayment progress, I plan to do the same thing when it comes to tackling my mortgage.

Even though you can certainly use a mortgage calculator to figure out how much youre paying in interest, here are 3 easy ways to calculate mortgage interest.