At A Glance: Additional Key Findings

| Among our members who recently bought a home, those living in West Coast cities tend to have higher average VantageScore 3.0 credit scores, ranging from 704 in Stockton, California, to 782 in San Francisco, California. |

| Among our members, the average amount people owe on a recently opened mortgage varies widely across states, from a low of $126,321 in West Virginia to a high of $384,524 in Hawaii. |

| The average age of Credit Karma members who recently opened a mortgage ranges from 35 in Boston, Massachusetts, to 43 in Scottsdale, Arizona. As a generation, millennials have the highest average mortgage balance at $216,382. |

What Else Do Lenders Look At When You Apply

As we mentioned, your credit score is not the only factor lenders examine before they approve or decline your application. They also want to see a favourable history of debt management on your part. This means that on top of your credit score, lenders are also going to pull a copy of your to examine your payment record. So, even if your credit score is above the 600 mark, if your lender sees that you have a history of debt and payment problems, it may raise some alarms and cause them to reconsider your level of creditworthiness.

Other aspects that your lender might look at include, but arent limited to:

- Your income

- The amount youre planning to borrow

- Your current debts

- The amortization period

This is where the new stress-test will come into play for all potential borrowers. In order to qualify, youll need to prove to your lender that youll be able to afford your mortgage payments in the years to come.

Theyll also calculate your monthly housing costs, also known as your gross debt service ratio, which includes your:

- Potential mortgage payments

- Potential cost of heating and other utilities

- 50% of condominium fees

This will be followed by an examination of your overall debt load, also known as your total debt service ratio, which includes your:

Why Small Credit Score Changes Can Have A Big Impact

Let’s say you’re applying for a mortgage with a score of 759, which Fed data shows is the median for first-time homebuyers. With that score, FICO’s calculator estimates, you’d qualify for a 3.7% rate on a 30-year fixed loan. By FICO’s calculations,if you borrowed $216,000, that would result in a monthly mortgage payment of $998. Over the life of the loan, you’d pay $141,916 in interest.

Now sayyou have a FICO score of 760, meaning you’re eligible for the best rate: 3.51%. That means your monthly mortgage payment will be $972 , and you’ll pay $133,611 in interest over the life of the loan.

So a 1 point increase in your credit score can save you $8,305.

You can check out FICO’s loan savings calculator to see how your credit score affects your loan interest rate.

Video by David Fang

Also Check: Can I Get A Reverse Mortgage On A Condo

How Can I Check My Credit Score Before Applying For A Mortgage

Equifax and TransUnion are the two credit reporting bureaus in Canada. They both charge you to view your credit score. Free online alternatives are available, such as Credit Karma, Borrowell, and Mogo, as well as at some major banks. For example, RBC, CIBC, and BMO all allow you to view your credit score for free online.

Your credit report contains a list of inquiries made by lenders. TransUnion allows you to view your credit report for free once every month, whileEquifax Canadaalso allows you to request your credit report for free.

What Kind Of Mortgage Rate Can I Get With A Credit Score Of 750

A credit score of 750 is a Fair- Excellent score across all the UK credit reference agencies. This is generally a good score and will mean youll have options of mortgage lenders. The exact mortgage rate youll be offered will depend on your unique circumstances. Itll depend on things like: your employment status, the kind of property you want to buy, and the amount of deposit you have.

Recommended Reading: Requirements For Mortgage Approval

Understanding Which Credit Score Matters Most

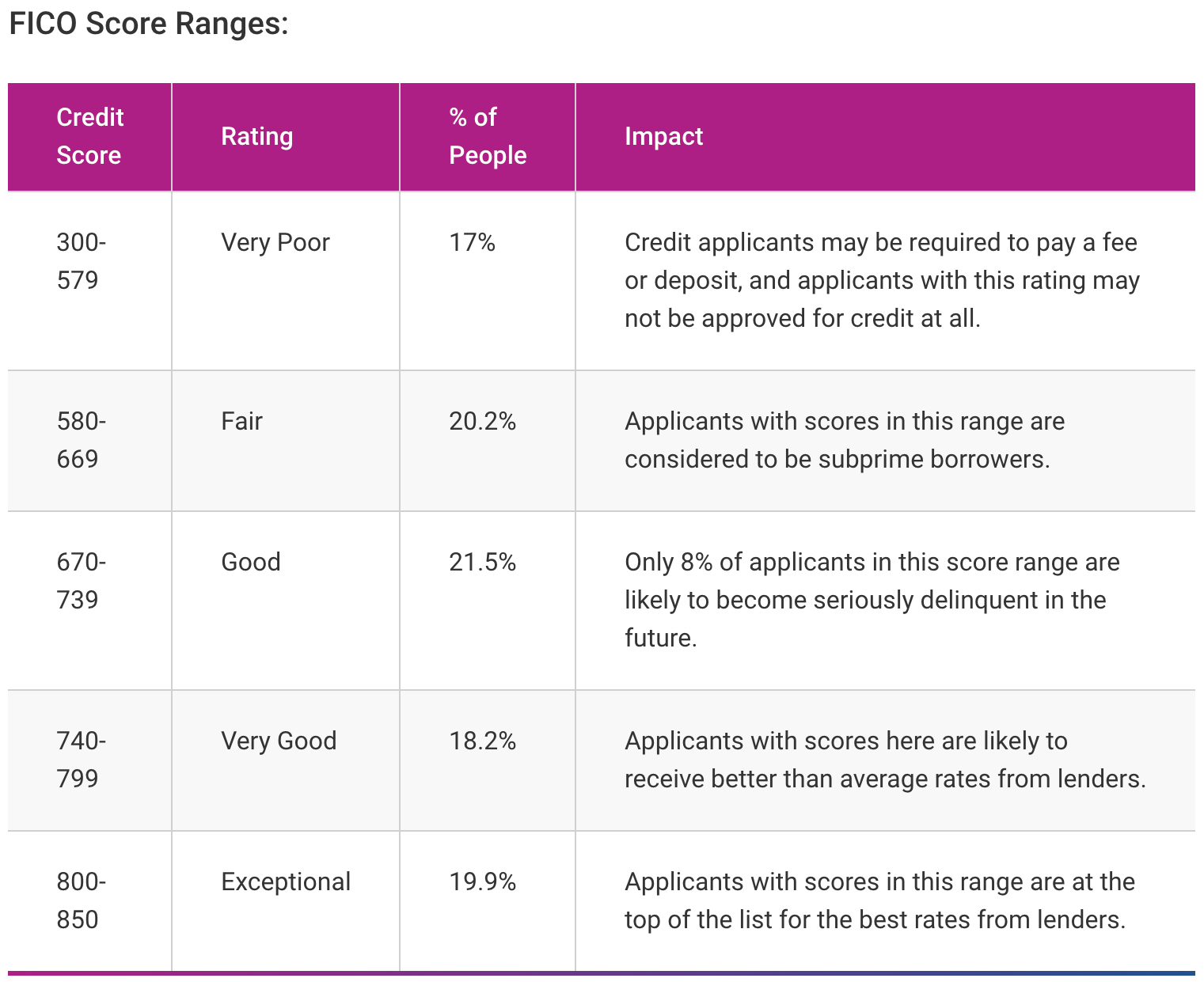

One confusing aspect of credit scores for consumers is that we each have multiple scores. And the FICO score you pull through your credit card company probably isnt the same one your mortgage lender will consider. Heres why.

Most people have information at each of the three major credit bureaus TransUnion, Equifax, and Experian. While they all calculate FICO credit scores, their data might be slightly different, which can lead to variations in scores.

Also, FICO updates its scoring methodology over time, resulting in many potential scoring models for lenders to consider. In fact, the Consumer Financial Protection Bureau states that FICO has offered more than 60 scoring models since 2011.

Before you start to worry about pulling dozens of different credit scores, there is one saving grace. Fannie Mae and Freddie Mac, the government-sponsored enterprises that purchase many of the mortgages originated in the U.S., set rules for the loans they buy. So, while your bank may have their own policies for particular types of loans, they likely comply with the standards set by Fannie and Freddie in case they want to sell loans off their balance sheet.

Fannie and Freddie actually require much older versions of the FICO credit score. Since the score pulled by your credit card company is a newer version, it might not be the same as the older version. To get a copy of the right score, you would have to purchase it from myFICO.com.

What Are The Costs For Applying For A Bad Credit Loan

If you apply for a payday loan, you may have to pay anywhere between $15 to $100 on top of the amount you are paying back to the creditor. The Consumer Financial Protection Bureau confirms this range of payment.

Some bad credit loan companies do not operate exactly like payday loan companies. You can get a loan no matter your credit score at many bad credit loan companies and still get to pay less of the cost than a payday loan while having access to cash quickly.

Read Also: Chase Recast Mortgage

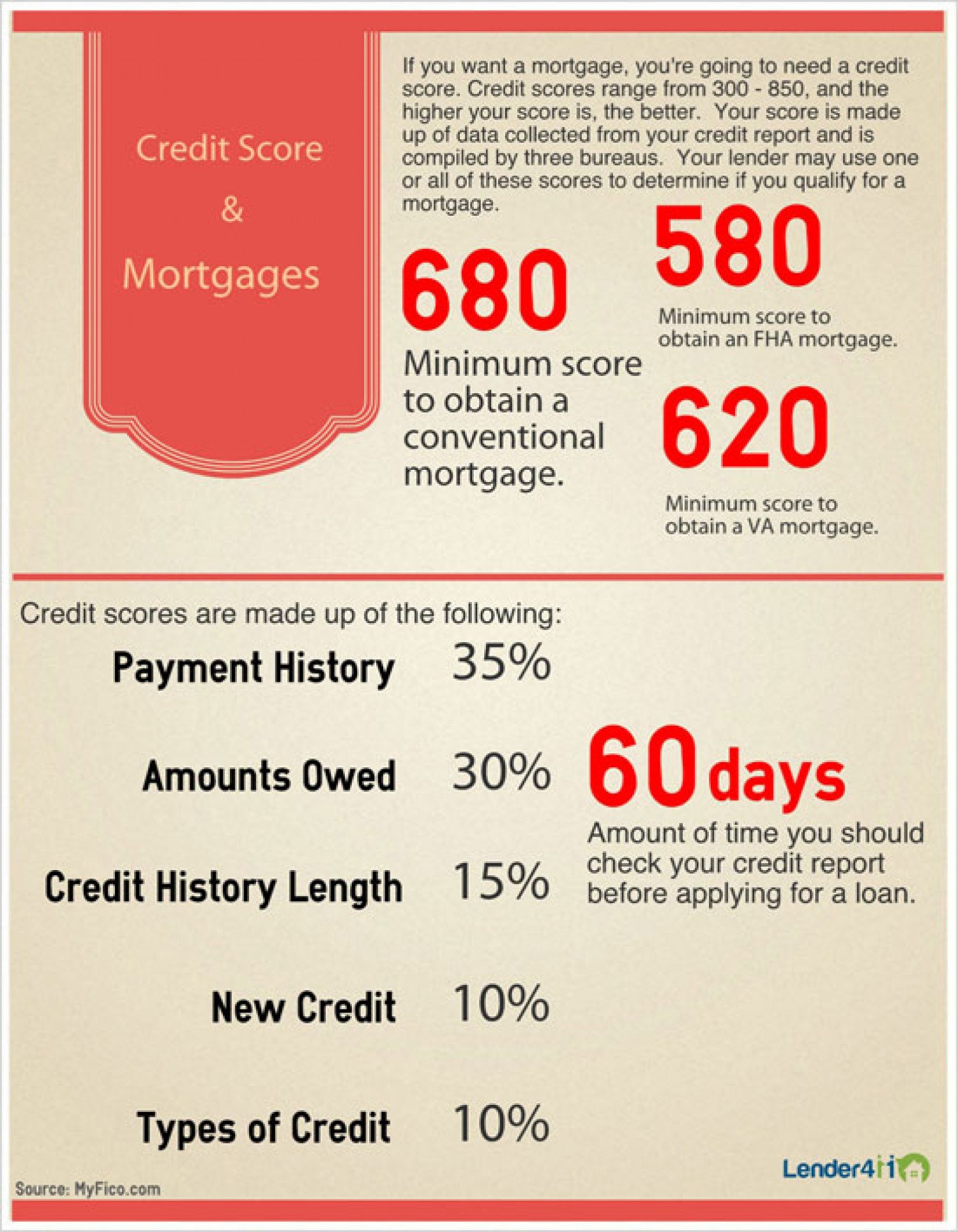

Interest Rates And Your Credit Score

While theres no specific formula, your credit score affects the interest rate you pay on your mortgage. In general, the higher your credit score, the lower your interest rate, and vice versa. This can have a huge impact on both your monthly payment and the amount of interest you pay over the life of the loan. Heres an example: Let’s say you get a 30-year fixed-rate mortgage for $200,000. If you have a high FICO credit scorefor example, 760you might get an interest rate of 3.612%. At that rate, your monthly payment would be $910.64, and youd end up paying $127,830 in interest over the 30 years.

Take the same loan, but now you have a lower credit scoresay, 635. Your interest rate jumps to 5.201%, which might not sound like a big differenceuntil you crunch the numbers. Now, your monthly payment is $1,098.35 , and your total interest for the loan is $195,406, or $67,576 more than the loan with the higher credit score. A mortgage calculator can show you the impact of different rates on your monthly payment.

How Many Years Of Credit Do I Need To Have A Good Score

Mortgage lenders will typically look back over the last six years of your credit history. If youre young and only have a couple of years credit to examine, lenders may be more cautious to lend to you. However, theres no set timeframe that will automatically boost your credit score. A 25-year-old in regular, stable employment who uses their credit card sensibly could have a better credit score than a 50-year-old with lots of debts.

The key thing to remember here is that you dont just need years of credit to improve your score those years of credit have to be good credit. Bankruptcy, CCJs, IVAs and other bad marks will stay on your file for six years, so its highly likely youll need to wait for these to be wiped before being accepted for a mortgage.

Also Check: Mortgage Recast Calculator Chase

Reputable Brand & Good Performance

While some companies have just entered the credit lending space with no good performance history yet, others have been in the industry for years and have built a great reputation. As long as the company offered quality loans options for people with various credit scores, we considered them for ranking.

Northwoods Credit Union Cloquet

Category: Credit 1. Northwoods Credit Union Cloquet, MN at 902 Stanley Avenue Cloquet Stanley Avenue Branch Northwoods Credit Union has been open since 1936. The credit union has assets totaling $158.8 Million and provides banking 1702 Avenue B, Cloquet, MN 55720. Get Directions · Rating · 4.9. (46

Don’t Miss: How Much Is Mortgage On 1 Million

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Mortgages Where Credit Score Matters Less

With conventional loans those backed by Fannie Mae and Freddie Mac a lot of focus is put on your credit score, says Dan Keller, a mortgage professional in Seattle.

The impact of a lower score wont be as substantial on some types of loans as it would be with a conventional loan, Keller notes. For the best interest rates on a Federal Housing Administration or Department of Veterans Affairs loan, the focus isnt on a 760 score as it is with conventional loans, he says its on 700-plus.

-

For an FHA loan, you may be able to have a score as low as 500.

-

VA loans don’t require a minimum FICO score, although lenders making VA loans usually want a score of 620 or more.

-

USDA loans backed by the Agriculture Department usually require a minimum score of 640.

So, theres some leniency on credit scores and underwriting guidelines with government loans. But the loan fees are more expensive: Youll have to pay mortgage insurance as well as an upfront and an annual mortgage insurance premium for an FHA loan.

But those credit score guidelines dont tell the whole story. Most lenders have overlays, which are extra requirements or standards that allow them to require higher credit scores as a precaution, regardless of mortgage type.

Also Check: Can You Get A Reverse Mortgage On A Mobile Home

Can I Get A 658 Credit Score Mortgage

Yes. You can get a mortgage with a credit score of 658. If your credit score is 658 and you checked your score with Experian, it means your score is categorised as Poor, which means youll have less mortgage lenders willing to lend to you than if you had an Excellent score, but you still have options.

A Poor credit rating often means youll need a specialist lender because theyll be willing to consider your application on a case-by-case basis. Often, specialist lenders are only available through a specialist mortgage broker. Thats where we can help. We have a network of specialist mortgage brokers who can help get you a mortgage even if you have a Poor credit rating. Get in touch now and get matched to the perfect broker.

If your credit score is 658 and you checked with TransUnion or Equifax, it means you have an Excellent credit score and you should have lots of mortgage options available to you.

What Is A Good Credit Score Out Of 700

A good credit score out of 700 depends on which credit reference agency youre getting your credit score from. Each credit reference agency has a different scoring system.

This table shows how Experian, Equifax and TransUnion rank credit scores. Experian credit scores are out of 999, whereas with Equifax, its out of 700. So if you had an account with Equifax and your credit score was 700, that would be marked as an excellent credit score. But if you checked your score through Experian, a credit score of 700 would be poor.

If you want to improve your credit score before you apply for a mortgage, check out our Guide: How to improve your credit score before you apply for a mortgage.

| Experian |

|---|

| 0-550 |

Read Also: 70000 Mortgage Over 30 Years

How Mortgage Rates Can Vary By Credit Score

Let’s see how a 100-point difference in credit scores affects one womans mortgage payment.

For example, suppose a borrower looking to buy a home worth $300,000 has a 20% down payment and applies for a 30-year fixed-rate loan of $240,000. She has a 780 FICO credit score, which gets her a 4% rate. Thats around $1,164 a month, not including taxes, insurance or homeowners association fees.

If this borrowers score dropped by about 100 points to between 680-699, her rate might increase to about 4.5%. At that interest rate, her monthly payment would increase to $1,216, an extra $62 a month, or $744 per year.

The effect of the difference in the rates may not seem significant at first, but added up over years, it could be a lot. In this example, a 100-point-drop has the borrower paying an additional $25,300 over 30 years.

At the same time, its important not to go crazy gaming your mortgage rate. If your score is already good, you should consider taking the rate you qualify for.

Industry professionals advise against taking too long to fine-tune an already-good credit score as rates could go up in the meantime and offset any benefit of a slightly higher score.

» MORE: Use our tool to see how mortgage rates differ by credit score

Add To Your Credit Mix

An additional credit account in good standing may help your credit, particularly if it is a type of credit you don’t already have.

If you have only credit cards, consider getting a loan a can be a low-cost option. Check that the loan you’re considering adding reports to all three credit bureaus.

If you have only loans or have few credit cards, a new credit card may help. In addition to improving credit mix, it can reduce your overall credit utilization by providing more available credit.

Impact: Varies. Opening a loan account is likeliest to help someone with only credit cards and vice versa. And there’s more potential gain for people with few accounts or short credit histories.

Time commitment: Medium. Consider whether the time spent researching providers and applying is worth the potential lift to your score. Weigh what you’d pay in interest and fees, too, if you’re getting a loan or card strictly to improve your credit.

How fast it could work: Fast. As soon as the new account’s activity is reported to the credit bureaus, it can start to benefit you.

Someone with a low score is better positioned to quickly make gains than someone with a strong credit history. Paying bills on time and using less of your available credit limit on cards can raise your credit in as little as 30 days.

You May Like: Reverse Mortgage For Mobile Homes

Compare Lenders For The Best Jumbo Mortgage Rates

Here is the big question: Is a jumbo loan the ideal way for you to go, or should you explore other options? To decide, youll need to compare rates for jumbo and conforming mortgage amounts. You might expect rates on jumbo loans to be higher than conforming loan rates, and sometimes they are, but not always.

Use NerdWallets jumbo mortgage rate tool to enter purchase prices above and below the conforming loan limit where you are looking to buy, and youll get a look at rates like those you might qualify for, as well as estimated monthly payments and fees.

The smart move is to shop for the best rates by getting offers from at least three lenders and comparing their annual percentage rates, or APRs.

The smart move is to shop for the best jumbo mortgage rates by getting offers from at least three lenders and comparing annual percentage rates, or APRs, which represent the full cost of the loan.

If jumbo rates are lower than conforming rates, you can move forward with a jumbo loan. If jumbo rates are higher, there are alternatives.

» MORE:Browse top jumbo mortgage lenders

What Credit Report Do Mortgage Lenders Use

Mortgage lenders dont use one credit report or credit agency. When you apply for a mortgage, lenders will look for as much information as they can see about you before they offer you a mortgage. When they do this its called a hard check. This means theyll look carefully at your credit history and the check will appear on your credit history too. They do it to check theyre happy to lend to you. A hard check will only ever happen if youre making a new application, and the creditor will always have to ask your permission first before they do a hard search.

There are three main credit report agencies in the UK: Experian, Equifax and TransUnion. They all use a different formula to give you a credit score, and all use different parameters. For example, Experian rates your score out of 999, whereas Equifax rates you out of 700. So youll have a different score depending on which one you check.

The credit checking agencies also decide what category you fall into depending on what your score is, for example, excellent, good, fair or poor. Lenders dont take these categories into consideration when making a lending decision. Instead, they look at the detail of your credit history like:

-

Do you use your overdraft, and if so, how often and whats the limit on it?

Don’t Miss: Can You Get Preapproved For A Mortgage Without Hurting Your Credit