Interfirst Mortgage Company Best Online Lender

Interfirst Mortgage Company is available in 28 states and Washington, D.C., and offers both rate-and-term and cash-out refinancing.

Strengths: With Interfirst Mortgage Company, you can find out if you qualify for a competitive refi rate in minutes after filling out a form online, and get your refinance preapproved in as little as one day if youre eligible.

Weaknesses: The lender doesnt offer government loans , so you wont be able to refinance those kinds of mortgages. Importantly, you also cant view rates online, which can make it tougher to compare offers with other lenders.

Read Bankrate’s full Interfirst Mortgage Company review

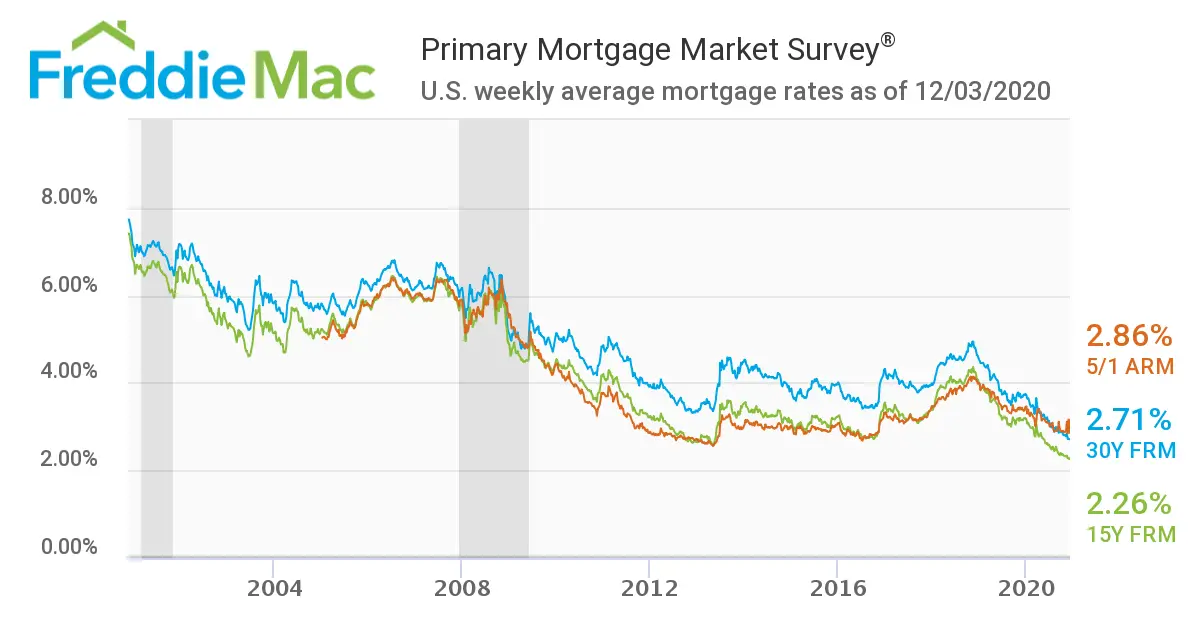

Todays Mortgage Rates And Your Monthly Payment

More than other factors, your annual percentage rate on your real estate purchase will affect your monthly payments â whether you’re refinancing or buying a new home.

On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

Refinancing to a lower interest rate could save hundreds of dollars a month if you kept the same loan terms. Shortening the loan term could negate your monthly savings but save thousands over the life of the loan. You can experiment with a mortgage calculator to find out how much a lower rate could save you.

Other factors besides interest affect how much you’ll pay in mortgage payments:

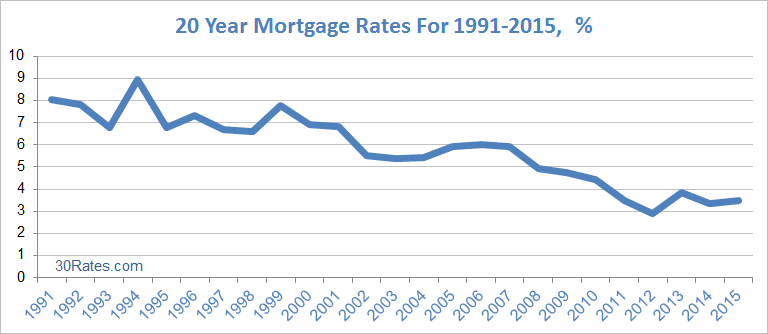

Securing A 20 Year Fixed Mortgage

The continually changing mortgage market often creates a confusing spectrum of choices for borrowers. By acquiring a general understanding of the types of mortgage products available and the advantages found in each, the consumer gains the ability to choose the best option. The 20 year fixed mortgage is available from a wide variety of financial institutions, though it is not marketed anywhere near as aggressively as 30-year fixed-rate mortgages.. The 20-year loan option provides distinct advantages over other products.

Also Check: Can You Get A Mortgage With Less Than 20 Down

Insured Insurable And Uninsurable Mortgages

Theinsurability of your mortgagewill affect your mortgage rate. Insured mortgages are those with CMHC mortgage default insurance or private default insurance from Canada Guaranty or Sagen. The borrower will pay for the mortgage insurance premiums.

Since the lender has zero risk, they will offer the lowest mortgage rates for insured mortgages. The mortgage rates that you see advertised online are often only for insured high-ratio mortgages, which are mortgages with a down payment less than 20%. Insured mortgages will need to meetCMHC mortgage requirements.

With insurable mortgages, the borrower wont pay for mortgage insurance. The mortgage wont be individually insured either. Instead, the lender can choose to bulk insure their portfolio of insurable mortgages and pay for this insurance themselves.

What this means to you is that the cost of mortgage insurance isnt directly paid by you if mortgage insurance isnt required. Insurable mortgages will have to meet the same requirements as an insured mortgage, but the only difference is that an insurable mortgage will need to have a down payment of at least 20%. Insurable mortgage rates are also slightly higher than insured mortgage rates.

An insurable mortgage can have a mortgage rate that is around 20 basis points added on top of an insured mortgage rate. Uninsurable mortgage rates will have around 25 basis points to 35 basis points added on top of insured mortgage rates.

How Much Can I Save Comparing 5

Your mortgage is likely to be the largest financial commitment youâll ever make, and getting a better rate can save you thousands of dollars over a 5-year term. Even a slightly lower mortgage rate can result in big savings, especially early on in your mortgage.

For example, on a $500,000 mortgage with a 25 year amortization period, a rate of 3.00% would see you pay $69,347 interest over 5 years. With a 2.75% rate, youâd pay $63,454 interest over the term. So, a difference of just 0.25% can save you $â5,893⬠over your 5-year term.

Read Also: Who Benefits From A Reverse Mortgage

What Type Of Mortgage Do You Need

First-time homebuyers can walk into a mortgage brokerage office or visit an online lender without knowing what kind of mortgage they need. But it’s always better to have an idea of what you’re shopping for, especially since you can’t control other factors such as home prices and current rates.

Mortgage loan types include:

Why Your Mortgage Rate May Be Higher Than Current Mortgage Rates

Not all applicants will receive the very best rates when taking out a mortgage or refinancing. Credit scores, loan term, interest rate types , down payment size, home location, and the loan size will affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their realtors. Yet this means that they may miss out on a lower rate elsewhere.

Last year, Freddie Mac reported that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Don’t Miss: How To Shave Years Off Your Mortgage

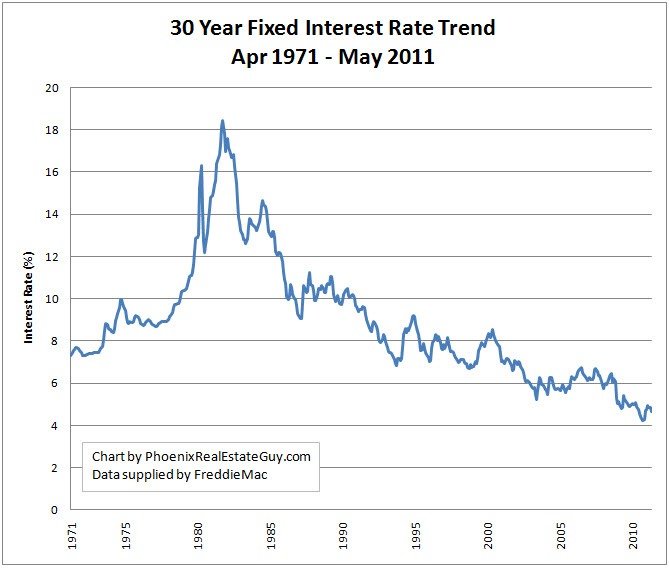

What Is A 30

When you apply for a mortgage, you choose between two basic types of loans: a fixed-rate loan or an adjustable-rate loan.

A fixed mortgage locks in your rate for the entire life of your loan. An adjustable mortgage keeps your rate the same for the first few years, then changes it periodically, usually once per year.

When you choose a fixed mortgage, you select the term length. A 30-year loan is the most common term length for new mortgages, but lenders offer other term options.

Popular Articles

A 30-year fixed mortgage keeps your rate the same for all 30 years, until you’ve completely paid off your mortgage. If mortgage rates in the US trend upward or downward during those 30 years, you won’t be affected. Whereas if you had chosen an adjustable-rate mortgage, then your rate would go up or down every year based on the economy.

Do I Need Cmhc Insurance

UnderOffice of the Superintendent of Financial Institutions regulations, you are required to purchase CMHC insurance if your down payment is below 20%.

You may beineligible for CMHC insuranceif:

- your purchase price is $1,000,000 or above, or

- your amortization period is longer than 25 years.

In these cases, you must make a down payment of 20% or higher.

Don’t Miss: Is A Mortgage A Line Of Credit

Are Mortgage Rates Impacting Home Sales

The number of mortgage applications ticked up 0.3% for the week ending September 10, according to the Mortgage Bankers Association. The increase takes an adjustment for the Labor Day holiday into consideration.

- Purchase applications were up a seasonally adjusted 8% from the previous week and 12% lower than the same week last year. On an unadjusted basis, purchase loan volume was 5% lower week-over-week.

- Refinance applications also ticked lower, decreasing 3% from the week prior and 3% lower than the same week last year. Refinancing continued to slow as the share of refi applications dropped to 65% of all applications, the lowest total since July.

Make sure we land in your inbox, not your spam folder.

Nationwide Relaunches Trackers With Rates From 079%

Nationwide is relaunching its tracker range tomorrow with rates starting from 0.79%. The new two-year products are priced at 40 basis points below equivalent fixed rates in each category. Nationwide withdrew its previous tracker range last Thursday ahead of the Bank of England base rate decision. For new customers moving home it is offering: Two-year

You May Like: What Is The Monthly Mortgage

Someone Moving In Less Than 10 Years

A 30-year term with a fixed rate buys you security and predictability over three decades. But suppose you dont need all that time, because you know youll be moving on in ten years or fewer.

In this case, you might be better off with an adjustable-rate mortgage .

Adjustable-rate mortgages typically come in 3 forms: the 5/1, 7/1, and 10/1 ARM. All have 30-year terms, but the first number refers to the amount of time your interest rate is fixed.

If youre certain youll be moving before that fixed-rate period ends, you could opt for an ARM and enjoy the introductory rate it offers which is usually significantly lower than 30-year mortgage rates.

Canada’s Most Popular Mortgage: The 5

In Canada, out of the $1.2 trillion CAD in outstanding residential mortgages in May 2021, the 5-year fixed rate mortgage takes the crown with over $660 billion, or more than 50%, of all mortgages in Canada. There are more 5-year fixed rate mortgages than all variable rate mortgages combined. The 5-year fixed rate mortgage is so popular that the CMHC uses the Bank of Canada’s 5-Year Benchmark Posted Rate for itsmortgage stress test.

Recommended Reading: Why Are Mortgage Closing Costs So High

More Financial Flexibility Than A 15

With a 20-year mortgage, it may take longer to build up equity in your home and pay off your loan, but your monthly payments are significantly lower than theyd be with a 15-year term. While some people like the idea of getting rid of debt faster, others believe its better to have more financial flexibility.

How much lower would your monthly payments be with a 20-year term compared to a 15-year term? Suppose youre looking for a $350,000 loan to purchase a home, and your lender tells you they can offer you a 20-year mortgage with an interest rate of 4.38% or a 15-year mortgage with an interest rate of 4.25%.

If you choose the 20-year term, your monthly payments would be $2,190.73, but if you select the 15-year term, your payments would jump to $2,632.97 each month. By getting a 20-year mortgage, you save $442.25 each month and have the flexibility to choose how to use the funds.

Choosing the 15-year mortgage may ultimately put you at risk of defaulting. If your financial circumstances change due to job loss or unexpected medical bills, you may find that you cant pay the full amount.

However, with a 20-year mortgage, you can use the savings from your lower monthly payments to build up an emergency fund, invest or pay for daily expenditures. Furthermore, even if you choose a 20-year term, you can still make larger payments than youre required and pay off your mortgage early.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

What Is A Mortgage Rate Hold

A mortgage rate hold is the locking in of a specified mortgage rate for a set period of time. This only applies to fixed rate mortgages, since the interest rate of variable rate mortgages can fluctuate.

Once you have a TD Mortgage Pre-Approval, you get a 120-day rate hold which holds the interest rate on your pre-approval term for 120 days subject to all the conditions, even if interest rates go up.

Also Check: Can You Add Money To Mortgage For Improvements

How To Find The Best Mortgage For You

Once youve settled on the length of the mortgage, its time to do your research to find the best mortgage for you . This due diligence will mean comparing mortgage rates from several lenders, which might include mortgage brokers, traditional banks and online lenders. Its smart to prepare for your mortgage search by reviewing your credit report to confirm its correct and evaluating your financial landscape to determine how much you can afford to put toward a home each month. The key is to make sure the client is comfortable with their budget and payment, says Reiling.

While there is no official best season to shop for a mortgage since rates are driven by the market and overall economic landscape, Reiling says, Banks are much more competitive on rates when business is slow, which tends to be in the dead of winter around January or February.

How Do I Find Current 20

NerdWallets mortgage rate tool can help you find competitive 20-year fixed mortgage rates. In the filters above, enter a few details about the loan youre looking for, and youll get a personalized rate quote in moments, without providing any personal information. From there, you can start the process to get preapproved for your home loan. Its that easy.

Choose two or three that seem to best fit what youre looking for and get set to take the next step.

Also Check: How Much Is A Habitat For Humanity Mortgage

Ontarios Housing Market Trend

Ontarios new tagline is A Place to Grow, which is also whats expected for the provinces population. The Ontario Ministry of Finance projects the population of Ontario will increase some 30.2% over the next two decades, bringing the total population to 18.5 million by July 1, 2041.

There are so many incredible aspects to Canadas most populous province, from its lush natural resources to its growing cities. That and solid job growth make the population boom less of a surprise.

As a result of its popularity, home prices in Southern Ontario are expected to continue rising. Prices are particularly prone to inflation in Ontarios Golden Horseshoe region where immigration is high, land is limited by the protected green belt and homes remain in short supply.

That, in turn, implies that Ontario mortgage amounts will grow faster than the national average.

Why Should I Compare Mortgage Rates

Choosing a mortgage is a major financial decision since it involves borrowing a significant amount of money. The mortgage interest rate is one of the factors that affects the total amount of money you will have to pay over the course of the amortization period. So, you could save money by finding the lowest rate. But, along with the mortgage rate, you should also compare the terms and conditions of each type of mortgage in order to find the right one for you.

Also Check: Do Mortgage Lenders Look At Medical Collections

What Is A Mortgage Rate Lock

A mortgage rate lock allows you to lock in the interest rate your lender quotes you for a certain period of time. This gives you a chance to close on the loan without risking an increase in the mortgage interest rate before you finalize the loan process.

Once you find a rate you like, lock it in as soon as possible because rates can change overnight. If they rise, then you could end up paying more on your mortgage.

If you get a floating rate lock, then you can lock in a lower interest rate if rates fall, but you wonât be obligated to pay higher interest rates than you were quoted if they go up.

While 30-day rate locks are typically included in the cost of a mortgage, a floating rate lock could cost extra. Depending on how volatile the rate environment is, you might find that a floating lock is worthwhile.

How To Get A Good 30

Lenders take your financial profile into consideration when determining an interest rate. The better your finances are, the lower your rate will be.

Lenders look at three main factors: down payment, credit score, and debt-to-income ratio.

- Down payment: Depending on which type of mortgage you take out, a lender might require anywhere from 0% to 20% for a down payment. But the higher your down payment is, the lower your rate will likely be. If you can provide more than the minimum, you could score a better rate.

- : Most mortgages require a minimum 620 credit score, and an FHA loan lets you get a mortgage with a 580 score. But the higher your score is, the better. If you can get your credit score above the minimum requirement, then you could snag a lower rate. To improve your score, try making payments on time, paying down debts, and letting your credit age.

- Debt-to-income ratio: Your DTI is the amount you pay toward debts each month in relation to your monthly income. Most lenders want to see a minimum DTI ratio of 36%, but you can land a lower rate with a lower DTI ratio. To decrease your DTI ratio, you either need to pay down debts or earn more money.

If you have a large down payment, excellent credit score, and low DTI ratio, then you should be able to get a low 30-year fixed rate.

Recommended Reading: When To Refinance Your Mortgage Dave Ramsey

How Do You Find Personalized 30

We’re showing today’s average mortgage rates, but you can find personalized rates based on your down payment amount, credit score, and debt-to-income ratio.

You can Google “mortgage rate calculator” to enter your information and get an idea of what rate you’d pay.

Some online lenders, such as Ally and Better.com, provide personalized rates with their own digital calculators.

If you’re a little further along in the homebuying process, then you can speak with multiple lenders to receive personalized rates to compare and contrast rates before choosing a lender.

Comparing Current Mortgage Rates

Borrowers who comparison shop tend to get lower rates than borrowers who go with the first lender they find. You can compare rates online to get started. However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders.

The advantage of going with a broker is you do less of the work and youâll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender whoâs suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee.

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you donât have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time wonât show up on your credit report as itâs usually counted as one query.

Finally, when youâre comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual basis.

Read Also: How Are Interest Rates Calculated On A Mortgage