How Much Income Do I Need For A $500 000 Mortgage

4.3/5mortgageincomeincome$500,000about it here

To afford a house that costs $800,000 with a down payment of $160,000, you‘d need to earn $138,977 per year before tax. The monthly mortgage payment would be $3,243. Salary needed for 800,000 dollar mortgage.

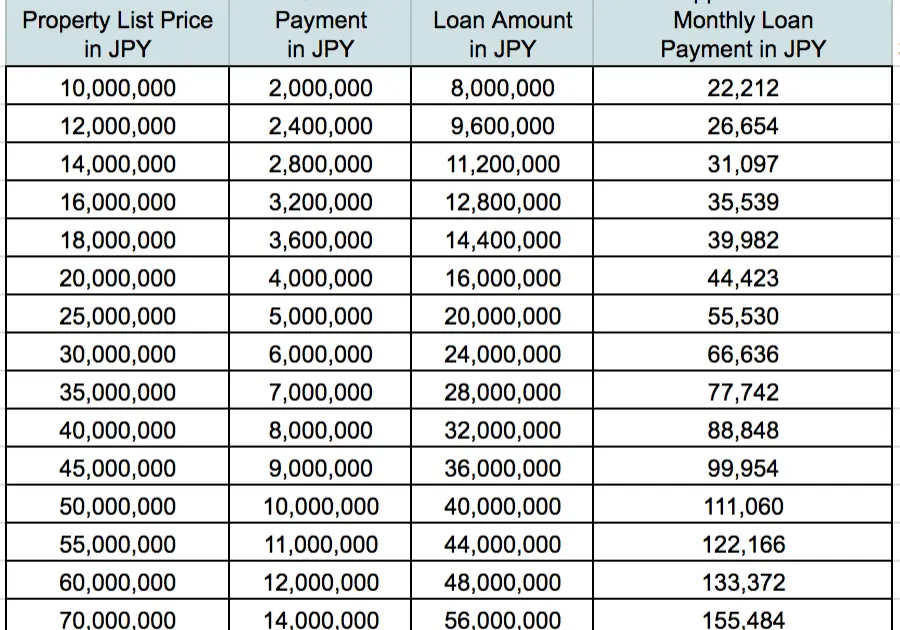

Furthermore, how much income do you need to qualify for a $200 000 mortgage? Example Required Income Levels at Various Home Loan Amounts

| Home Price |

|---|

| $76,918.59 |

Secondly, what’s the monthly payment on a $500 000 mortgage?

Monthly payments on a $500,000 mortgageAt a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total $2,387.08 a month, while a 15-year might cost $3,698.44 a month.

How much do I need to make to afford a 450k house?

A $450,000 loan for 30 years at 4% would cost about $2150/month. With taxes and insurance it’d be around $2650/month. Assuming no mortgage insurance and $2650/month as the payment, you’d need to make $102k per year. A lender will let you use about 31% of your gross income for a monthly payment.

can700can

| Home Price |

|---|

How To Calculate Your Debt

To find your debt-to-income ratio, first add together all of your monthly debt payments. For example, if you pay $200 each month on a student loan, $400 on a personal loan and $500 on an auto loan, your total debt payments are $200 + $400 + $500, which equals $1,100.

Next, determine your gross monthly income.

Take your total debt payments and divide that number by your gross monthly income. Lets say for this example that your monthly income is $4,000. Then your total monthly debt payments divided by your gross monthly income is $1,100 ÷ $4,000, or 0.275. We can convert the result to a percentage: 0.275 x 100% = 27.5%.

Is Your Dti Ratio Within A Good Range

Debt-to-income ratio or DTI is a risk indicator that measures how much of your monthly salary goes to your debts. In particular, DTI ratio is a percentage that compares your total monthly debts to your gross monthly salary. Generally, a high DTI ratio means you are not in a good position to acquire more debt. Likewise, a low DTI ratio is a sign that you have enough salary coming in to pay for your mortgage and other debt obligations.

If you have a high DTI ratio, make sure to reduce it before applying for a mortgage. This increases your chances of securing approval. You can lower your DTI by paying off or reducing large debts, such as high-interest credit card balances.

The 2 Main Types of DTI Ratio

Front-end DTI: The percentage of your salary that pays for housing expenses. It includes monthly mortgage payments, property taxes, home insurance, homeowners association dues, etc.Back-end DTI: The percentage of your salary that goes to housing expenses as well as other debt obligations. This includes credit card debt, student debt, car loans, any personal loans, etc.

Lenders assign different DTI limits depending on the type of loan. Most homebuyers obtain conventional loans in the market. These are common mortgages that come with thorough credit and background requirements.

The Two Main Types of Conventional Loans

Meanwhile, borrowers have the option to choose from the following government-backed loans:

Government-Backed Mortgage Programs

Don’t Miss: Rocket Mortgage Vs Bank

How Can I Buy A Million Dollar House With No Money

Purchasing Real Estate With No Money Down

What mortgage can I afford on 80k salary? So, if you make $80,000 a year, you should be looking at homes priced between $240,000 to $320,000. You can further limit this range by figuring out a comfortable monthly mortgage payment. To do this, take your monthly after-tax income, subtract all current debt payments and then multiply that number by 25%.

How much do you have to make a year to afford a $400 000 house?

What income is required for a 400k mortgage? To afford a $400,000 house, borrowers need $55,600 in cash to put 10 percent down. With a 30-year mortgage, your monthly income should be at least $8200 and your monthly payments on existing debt should not exceed $981.

What mortgage can I afford on 80k salary? So, if you make $80,000 a year, you should be looking at homes priced between $240,000 to $320,000. You can further limit this range by figuring out a comfortable monthly mortgage payment. To do this, take your monthly after-tax income, subtract all current debt payments and then multiply that number by 25%.

How Much Income Is Needed For A 250k Mortgage

You need to make $76,906 a year to afford a 250k mortgage. We base the income you need on a 250k mortgage on a payment that is 24% of your monthly income. In your case, your monthly income should be about $6,409. The monthly payment on a 250k mortgage is $1,538.

Thereof What salary do I need for a 500K mortgage? The Income Needed To Qualify for A $500k Mortgage

A good rule of thumb is that the maximum cost of your house should be no more than 2.5 to 3 times your total annual income. This means that if you wanted to purchase a $500K home or qualify for a $500K mortgage, your minimum salary should fall between $165K and $200K.

Can I buy a house making 40k a year? Take a homebuyer who makes $40,000 a year. The maximum amount for monthly mortgage-related payments at 28% of gross income is $933.

Beside this, What house can I afford on 80k a year? So, if you make $80,000 a year, you should be looking at homes priced between $240,000 to $320,000. You can further limit this range by figuring out a comfortable monthly mortgage payment. To do this, take your monthly after-tax income, subtract all current debt payments and then multiply that number by 25%.

You May Like: 10 Year Treasury Yield And Mortgage Rates

Increasing Your Down Payment Can Afford You More

If you are able to increase your down payment to 20% you wont have to pay mortgage default insurance and your monthly payments will decrease allowing you to afford more. There are other ways to increase your down payment that we discuss in our Step-by-Step Guide to Saving for a Down Payment.

Ways you can increase your down payment:

- Using the Home Buyers Plan, which allows first-time home buyers to loan themselves funds from their RRSPs

- Using funds from your Tax-Free Savings Account

- Getting a gifted down payment from the bank of Mom & Dad

Be sure to use our Mortgage Affordability Calculator along with the Gross Debt and Total Debt Service equations from above to help you with your budget. When youre ready, book a call with us to discuss your unique financial situation so we can take you one step closer to homeownership!

What Financial Requirements Must Be Met To Qualify For A Mortgage

Current minimum requirements for a conventional loan

- Down payment. The minimum down payment is 3% for conventional loans and can come from your own money or a gift from a family member.

- Mortgage insurance.

Likewise, what financial requirements must be met to qualify for a mortgage in Canada?

You’ll need to provide your lender or mortgage broker with the following:

- identification.

- proof you can pay for the down payment and closing costs.

- information about your other assets, such as a car, cottage or boat.

- information about your debts or financial obligations.

Beside above, how much income do you need to qualify for a $400 000 mortgage? To afford a $400,000 house, for example, you need about $55,600 in cash if you put 10% down. With a 4.25% 30-year mortgage, your monthly income should be at least $8178 and your monthly payments on existing debt should not exceed $981.

Just so, what do you need to qualify for a mortgage in Alberta?

1. Credit. In order to qualify for a first mortgage with a 5% down payment, there are certain credit baselines that potential homeowners need to meet. As someone looking to apply for your first mortgage, you will need to have 2 forms of credit in place for a minimum of 2 years, and a credit score of 610 at a minimum.

How do you know if you qualify for a mortgage?

Recommended Reading: How Much Is Mortgage On A 1 Million Dollar House

What Are The Monthly Payments For A $400000 Mortgage

The monthly payment on a $400,000 mortgage is fairly easy to predict. Mainly, you need to know the interest rate youll be paying. For a common APR of 4%, your monthly payment on a 30-year mortgage would be $1,910 .

Your monthly payment amount has three main components.

- Principal: This is the amount that goes toward paying down the $400,000 balance of the mortgage.

- Interest: This is the cost of borrowing money, paid to the lender.

- Escrow costs: This typically covers homeowners insurance, homeowners association fees, and annual property taxes, and can vary significantly depending on where you live. You pay a bit each month, and your lender handles the payment. Holding the money in escrow helps your lender ensure that youll make these required payments.

Your monthly payment depends mostly on the interest rate and term of your mortgage. You can use your APR to calculate what your monthly payment will be for a $400,000 fixed-rate mortgage, but that doesnt include escrow costs. These costs typically add a few hundred dollars onto your monthly payment, but youll need to talk to your lender to get an estimate.

With a 3.5% APR, your monthly payment on a 15-year mortgage would be $2,860. Your monthly payment on a 30-year mortgage with the same APR would be $1,796.

Meanwhile, with a 5% APR, your 15-year monthly payment would be $3,163, while a 30-year mortgage payment would be $2,147.

Budget For Homeowner Costs

Beyond the costs of purchasing a home, youll likely have expenses related to owning and maintaining your home:

Homeowners insurance

Lenders will require that you carry homeowners insurance, which protects your property in case of damage. The amount will vary depending on your homes value and location. Certain areas that are prone to floods or earthquakes may have higher premiums.

Property taxes

You will also pay property taxes to your local government. This amount is based on the value of the property and land and is used to cover costs such as infrastructure, school, law enforcement, and fire service.

Maintenance and repairs

Maintenance includes the ordinary expenses that come with owning a home, such as painting, taking care of a lawn, fixing appliances, and cleaning living spaces. The average homeowner spent $2,289 a year on maintenance and repairs in 2016, according to Bureau of Labor StatisticsConsumer Expenditure Survey. If youre preparing your home for sale or just curious about general upkeep, review our home maintenance and repair checklist.

The average Homeowners Association fee is $200 to $300 per month for a typical single-family home, according to Realtor.com. This money usually covers shared amenities and services for a community such as a pool or gym, trash removal, snow removal, or maintenance to common areas.

Also Check: Does Rocket Mortgage Sell Their Loans

Talk To A Whole Of Market Mortgage Expert Today

If you like what youre reading or require more information surrounding your £400,000 mortgage, call Online Mortgage Advisor on 0808 189 2301 or make an enquiry. Then sit back and let us do all the hard work in finding the broker with the right expertise for your circumstances. We dont charge a fee, and theres no obligation or marks on your credit rating.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

We are an information-only website and aim to provide the best guides and tips but cant guarantee to be perfect, so do note you use the information at your own risk and we cant accept liability if things go wrong. Please email us at if you see anything that needs updating and we will do so ASAP.

Total Interest Paid On A $400000 Mortgage

The total interest youll pay will depend on both your APR and the length of your loan. Longer loan terms and higher APRs will result in more interest costs in the long run.

Use Credible to shop around for competitive rates from our partner lenders.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

On a 15-year, $400,000 mortgage loan with a 3% APR, for example, youd pay $97,218 in total interest by the end of your loan term.

On a 30-year loan with the same details, your interest costs would jump to $207,109 a shocking $110,000 more.

Use the below calculator to see how much interest youll pay, as well as what your home will cost you every month.

Enter your loan information to calculate how much you could pay

Check Out: How to Buy a House: Step-by-Step Guide

Read Also: Can You Refinance A Mortgage Without A Job

The Mortgage Qualifying Calculator Says I Cant Afford My Dream Home What Can I Do

It can be disappointing to learn that the home you have set your heart on is out of financial reach, but dont give up hope! It may be that you can reach your goal by adjusting some of your other constraints. Perhaps you can save for a little longer in order to amass a larger down payment, or wait until your credit card and loans are paid off.

These small but significant changes could make all the difference and enable you to get the mortgage you require. If the down payment is causing you an issue, you might consider an FHA loan, which offers competitive rates while requiring only 3.5 percent down, even for borrowers with imperfect credit.

The Income Needed To Qualify For A $400k Mortgage

Unfortunately, there’s no magic bullet for determining the exact income needed for a $400K mortgage. However, we can generate an estimate based on some basic calculations.

Most mortgage lenders follow the 43% rule, which stipulates that all of the bills you pay each month including your mortgage, taxes, insurance premiums, credit card payments, and utilities should total less than 43% of your total annual income.

Essentially, banks wont consider borrowers with a debt-to-income ratio or DTI above 43%.

In order to calculate how much you can afford to pay each month, you’ll need to know:

Although these considerations can vary widely, we can make a broad-scale estimate to roughly determine the income needed to qualify for a $400K mortgage.

For example, if you make a $55,600 downpayment on a $400K house and qualify for a 4.25% 30-year mortgage, your minimum monthly income should be $8,178 .

According to this calculation, a prospective homebuyer looking to purchase a $400K house should make roughly $100,000 a year. Again, this number may vary with other considerations such as budget limitations, other loan obligations, and the details of your mortgage. However, it should hopefully serve as a working estimate.

You May Like: Reverse Mortgage Manufactured Home

How Much Do I Need To Make To Afford A 300k House

Before you get into determining if you can afford monthly payments, figure out how much money you have available now for up-front costs of a home purchase. These include: A down payment: You should have a down payment equal to 20% of your home’s value. This means that to afford a $300,000 house, you’d need $60,000.

Higher Outgoings Reduce How Much You Could Borrow

Your regular household expenses, debts and insurances can all affect what a mortgage lender will let you borrow. Outgoings that a lender may take into consideration include:

Loan and credit card repayments Council tax Domestic utilities Insurances Car running costs Child maintenance payments

Some lenders also apply a reduction to the amount you can borrow for the number of children you have , while others have started to take things like discretionary spending into account. They’ll also require you to prove that you can afford the repayments in the event of an increase to interest rates, so make sure you have suitable means to ensure that ideally through reducing your unnecessary expenditure as this could have a clear impact on the amount of mortgage you’ll be able to borrow.

Also Check: How Does Rocket Mortgage Work

Have A Question About Our Mortgage Calculators

What is a mortgage calculator?

Its a tool that gives you an estimate of how much you could borrow from us or what your monthly repayments and other costs might be, for a mortgage in the UK.

We have different calculators that can help you in different ways each calculator does something slightly different.

Who is a mortgage calculator for?

Its for you if youre a first time buyer, youre looking to remortgage, move or buy an additional home, or youre a buy-to-let landlord.

What information do I need to use a calculator and how do you decide what I can afford?

When you apply for a mortgage or use our calculator, well ask you for information like

- How many people are applying

- Your income

- How much you regularly spend on things like your credit or store cards, loans, overdrafts, maintenance and pension

- Why youre applying for example, buying your first home, moving home, or buying a second home

We wont ask about groceries, utility bills or travel.

How much can I afford to borrow?

Our calculators give you a idea of what you might be able to borrow from us to buy a home, and what your monthly and total mortgage payments could be, for different types of mortgages.

Which mortgage calculator is right for me?

The most popular place to start is our borrowing calculator or our affordability calculator.