Your Savings And Investments

Now that youve looked at your DTI and any debt you may have, think about your budget. How does a mortgage payment fit in? If you dont have a budget, keep track of your income and expenses for a couple of months. You can create a personal budget spreadsheet or use any number of budgeting apps or online budgeting tools.

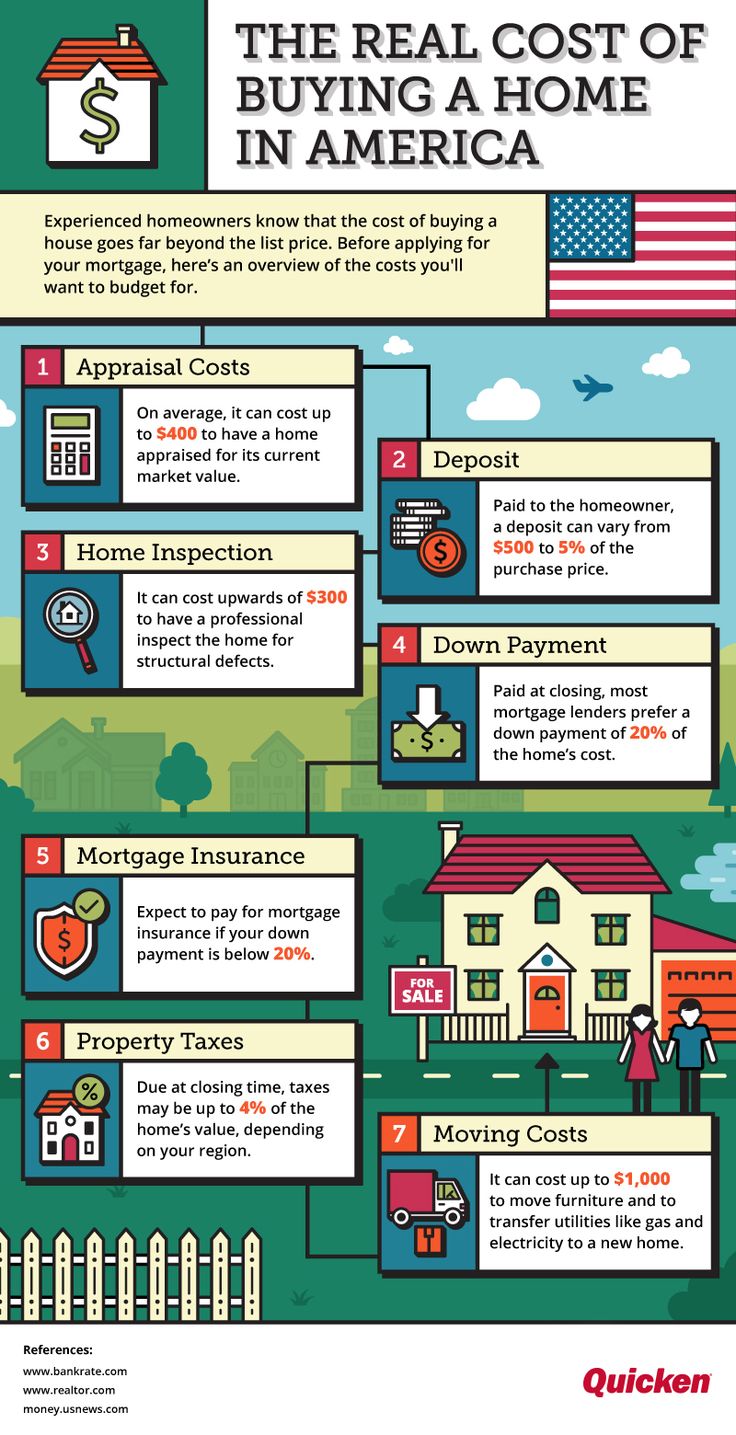

In the mortgage process, its important to look at your budget and savings for a couple of reasons. One, you might need savings for a down payment, which well discuss in a later section. However, for now, lets go over something called reserves. These may be required, depending on the type of loan youre getting.

Oops A Problem With Having No Debt

Theres one problem here. People who never borrow tend to have poor credit scores because they have thin files.

If you never or rarely borrow, you havent demonstrated that youre a responsible borrower. This could make mortgage qualifying more difficult.

However, some lenders are willing to consider alternative forms of credit, like rent and utility payments, for those with thin files.

So if you find yourself in this situation, be sure to shop around carefully and look for a lender that can help you.

Criteria For Cpp And Oas Payments

If you have lived in Canada for 40 years or more after turning 18, you should receive the full OAS pension benefit. If you have lived in Canada for less than that, your OAS benefit will be reduced by one-fortieth of the full amount for each year under 40. Here are some examples:

|

Years spent in Canada over the age of 18 |

OAS benefit at age 65 |

|

321.13 |

The earliest age you can receive OAS is 65, but you can delay receiving it up until the age of 70. You will receive an extra 7.2% for every year you delay receiving it, up to an extra 36% if you wait until youre 70. There is no incentive to delay receiving OAS any later than that.

The amount of OAS you receive is also dependent on your income. If you earn over $81,761 in 2022, you will have to start paying back 15% of the excess over this amount, up to the total amount of OAS received.

While calculating OAS payments is fairly straightforward, a CPP OAS calculator comes in very handy when working out how much CPP youll receive. The exact amount will depend on these factors:

- When you start drawing your pension

- How long you contributed to CPP

- How much you contributed to CPP

- Your average earnings during your working life

The government will exclude up to eight years of your lowest earning history when it calculates the base component of your CPP retirement pension. You can receive an estimate of what you will receive by logging into your My Service Canada Account.

Don’t Miss: 10 Year Treasury Vs Mortgage Rates

Be Conscious Of Changes In Employment

If you lose your job, how will you pay your mortgage? When you apply for a mortgage, your lender ideally will want to see a 2-year work history before they grant approval. If you choose to take the largest loan you qualify for, will you be able to make those higher monthly payments during a period of unemployment?

Your Mortgage Application Doesnt Have To Be Perfect

Sure, youll have the biggest home buying budget if you have no other debts and a large salary.

But those things arent required. As a home buyer, its all about starting where you are now.

Figure out what makes sense for you based on your own salary and needs, rather than aiming for a budget based on a rule of thumb.

Many people find that when they approach it this way, home buying is more attainable than they ever thought possible.

Don’t Miss: How Much Is Mortgage On 1 Million

Fixed Rate Vs Adjustable Rate

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

What Documentation Do I Need When Applying For A Us Mortgage

If youre a British expat looking to buy a home in the USA, you will need to provide the following alongside your mortgage application:

Permanent residents

If youre now a permanent US resident and have a Green Card, youll need:

- 2 years worth of W-2 forms

- Last months pay stub

Non-permanent residents

If youre living in the US with a resident visa but not a Green Card, youll need:

- Last years W-2 form .

- Your previous months pay stub.

- A copy of your Visa and Passport.

- Your last 3 months bank statements.

- A copy of your UK credit report.

- A copy of the most recent mortgage statement for any property you own in the UK.

You May Like: Chase Mortgage Recast

How Can Home Buyers Avoid Closing Costs

You can also avoid upfront fees on your loan by getting a no-closing cost mortgage, in which you dont pay any of the closing costs when you close on the mortgage.

Typically, when a lender offers a deal like this, it does end up costing you in the long run: The lender may charge you a higher interest rate on the loan for not paying closing costs, or the lender may wrap the closing fees into the total mortgage owed, in which case you end up paying interest on the closing costs.

Finally, home buyers can negotiate with the seller over who pays these fees. Sometimes the seller will agree to assume the buyers closing fees.

How Your Income And Debt Affect Your Mortgage

Mortgage lenders dont just want to know your salary. They want to know how much discretionary income you have the amount left over after your fixed expenses are taken care of.

Thats why income for mortgage qualifying is always viewed in the context of your debt to income ratio or DTI.

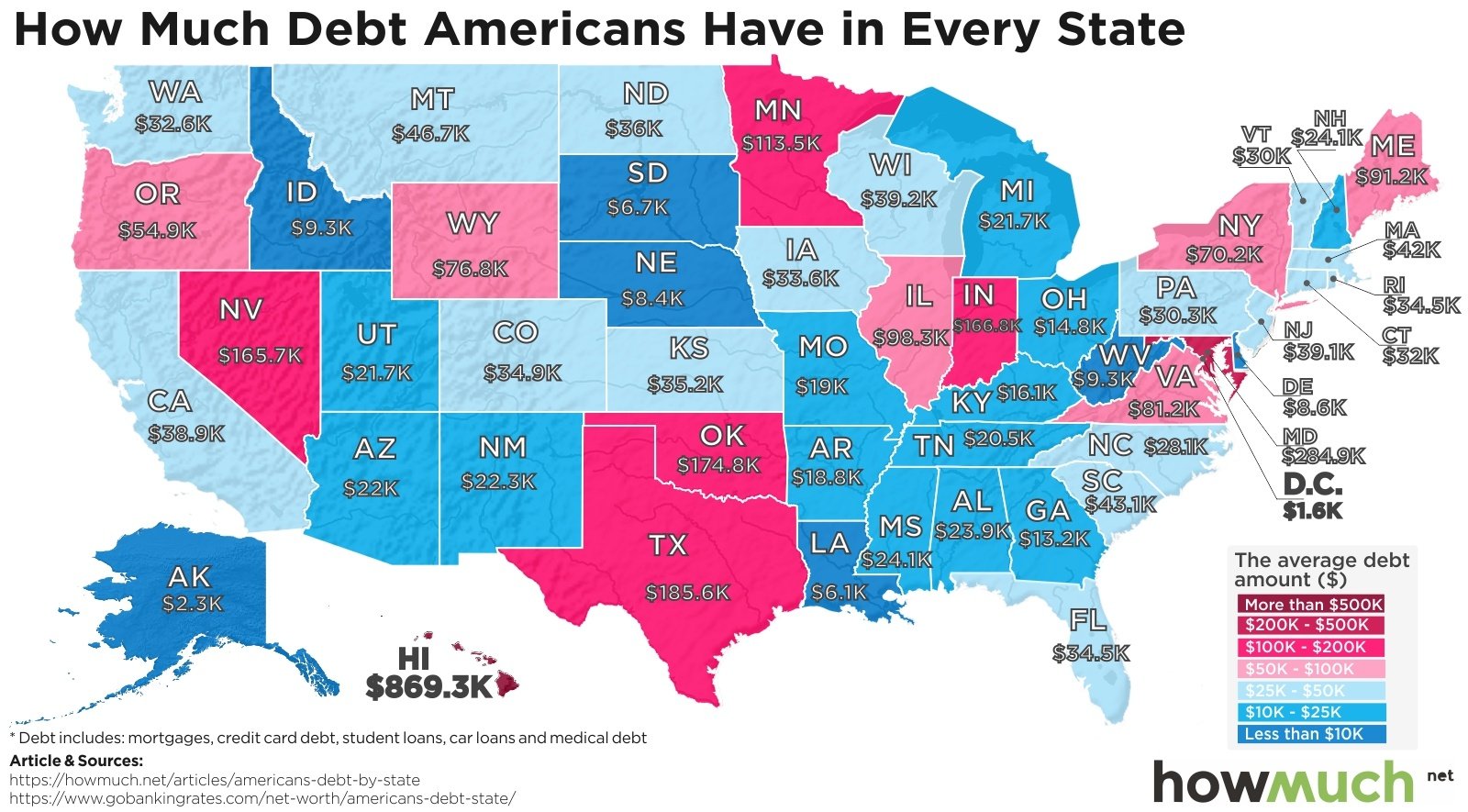

If you have any existing debt like a car payment, student loans, or a credit card payment lenders will subtract those costs from your monthy income before calculating how large a mortgage payment you qualify for.

The more debt you have, the less youll be approved to borrow for a mortgage.

Conversely, if you keep your debt low, you might be able to borrow as much as 6 times your salary for a mortgage. Heres how.

Don’t Miss: Mortgage Recast Calculator Chase

Why You Should Consider Buying Below Your Budget

There is something to be said for the idea of not maxing out your credit possibilities. If you look at houses that are priced somewhere below your maximum, you leave yourself some options. For one, you will have room to bid if you end up competing with another buyer for the house. As an alternative, youâll have money for renovations and upgrades. A little work can transform a home into your dream house â without breaking the bank.

Perhaps more importantly, however, you avoid putting yourself at the limits of your financial resources if you choose a house with a price lower than your maximum.

You will have an easier time making your payments, or you will be able to pay extra on the principal and save yourself money by paying off your mortgage early.

How To Improve Your Debt

To be comfortable with your mortgage, look for ways to reduce your DTI before you apply for a mortgage.

Lowering your DTI by paying down credit card balances and then never letting those balances exceed 30% of your is one way to do this, according to Valdes.

Its helpful to come up with a plan to pay down debtlike the debt snowball method, where you tackle your smallest debts one at a time while making minimum payments on the others, she said. Creating a budget and cutting back where necessary can also free up extra funds to pay off debt paying off small debts little by little makes a big difference.

Another tip is to space out your loan applications. For example, Edelstein advised against applying for a mortgage when youre also applying for other types of credit, like a new car loan or lease, because the new credit could lower your credit score and raise your DTI.

Here are a few other ways to improve your DTI before applying for a mortgage:

- Pay down your highest balance credit card, or pay smaller amounts to all of your credit card accounts.

- Consider a debt consolidation loan to combine credit cards or other debts at a single interest rate.

- Avoid incurring new debt during the window of time leading up to applying for a mortgage and before you’ve closed on a home.

- Consider ways you could increase your household income, such as negotiating a raise, taking on a part-time job, starting a side hustle, or seeking a higher-paying role with a different employer.

Read Also: Rocket Mortgage Payment Options

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

Personal Criteria: Deciding How Much Mortgage You Can Afford

The borrower should consider personal criteria when purchasing a home in addition to the criteria of the bank when determining what kind of mortgage can be afforded. Although someone may be approved for a certain mortgage amount, that certainly does not mean the payments can be covered. The following is personal criteria to take into account along with the criteria of the lenders:

- The ability for the borrower to pay mortgage payments is dependent upon income. Questions to consider are whether or not two incomes are needed to pay bills, how stable the current job is, and how easy it would be to find another job if the current job is lost.

- The borrower must ask if they are willing to make changes in lifestyle in order to afford the home. If tightening the budget will not impact lifestyle, then having a higher back-end ratio might be the way to go. If there are little things within the budget that are too important to eliminate, it might be better to take a more conservative approach.

- The back-end ration contains most of the current debts, but there may be debts that come about in the future that are not considered in the back-end ration. Doing things such as buying a new car or boat, or a child who will attend college are things to consider.

- Then there is the borrowers personality. Some people are more comfortable making a specific payment amount than others.

Also Check: Rocket Mortgage Vs Bank

How Much House Can I Afford With A Va Loan

Veterans and active military may qualify for a VA loan, if certain criteria is met. While VA loans require a single upfront funding fee as part of the closing costs, the loan program offers attractive and flexibleloan benefits, such as noprivate mortgage insurance premiums and no down payment requirements. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage.

With VA loans, your monthly mortgage payment and recurring monthly debt combined should not exceed 41%. So if you make $3,000 a month , you can afford a house with monthly payments around $1,230 .

Use ourVA home loan calculatorto estimate how expensive of a house you can afford.

How Can I Increase My Maximum Mortgage Amount +

If after using the maximum mortgage calculator, you find that you have a mortgage value lower than what you would have liked, do not fret. There are a few ways you can improve your mortgage amount. They include making a larger down payment, making smarter decisions as to the neighborhood where you are looking to buy from, and trying to reduce your debts, even just by a little. The final factor in particular is quite important as it helps reduce your debt-to-income ratio and in some cases, improve your credit score.

You May Like: Does Rocket Mortgage Sell Their Loans

Consider Your Mortgage Options

Lastly, it might not be anything you’re doing wrong. It’s important to consider all your mortgage options. Different lenders have different loans available. The also set their own terms and pricing, so it’s important to be aware that you won’t always get the best deal by going to the first lender you see.

One other key thing to look at is the difference between the interest rate and the annual percentage rate associated with the loan. The bigger the difference, the more the lender is charging you in closing costs.

What To Provide To Your Lender Or Mortgage Broker

Before preapproving you, a lender or mortgage broker will look at:

- your assets

- your income

Youll need to provide the following:

- identification

- proof you can pay for the down payment and closing costs

- information about your other assets, such as a car, cottage or boat

- information about your debts or financial obligations

For proof of employment, you may have to provide:

- a proof of your current salary or hourly pay rate (for example, a recent pay stub

- your position and length of time with the employer

- notices of assessment from the Canada Revenue Agency for the past 2 years, if youre self-employed

Your lender or mortgage broker may ask you to provide recent financial statements from bank accounts or investments. This will help them determine if you have the down payment.

Your debts or financial obligations may include your monthly payments for:

Recommended Reading: Can You Get A Reverse Mortgage On A Condo

Ready To Start Your Home Buying Journey

Whether you’re just thinking about buying or you’re ready to buy, you can get started online!

The Mortgage Affordability Calculator estimates a range of home prices you may be able to afford based on the accuracy and completeness of the data and information you enter. The results are intended for illustrative and general purposes only, and do not constitute, nor should they be relied upon as financial or other advice. To discuss your full range of home-buying options, please contact your branch or call

The results are calculated and generated based on the accuracy and completeness of the data and information you have entered and provide an estimate only. The results are intended for illustrative and general information purposes only, and do not constitute, nor should they be relied upon as, financial or other advice. The interest rate shown is calculated either semi-annually not in advance for fixed interest rate mortgages or monthly not in advance for variable interest rate mortgages. These rates are only available for already built, owner-occupied properties with amortization periods of 25 years or less. Any application is subject to credit approval. For more information, please contact us to discuss your home-financing options.

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment

Read Also: Can I Get A Reverse Mortgage On A Condo