Tips To Pay Off Your Mortgage Faster

If you’ve calculated your results and decided you want to pay your home loan off faster there are many things you can do.

- Increase your repayments, more often. Weekly and fortnightly repayments will save you money in interest and if you increase your repayments then you are also cutting down your principal. Double win. Just be sure to check that your loan allows you to make extra repayments.

- Pay off more when you have unexpected funds. Consider dumping your tax refunds, work bonuses or dividends from any other investments into your loan. This can also help you cut down the interest payable.

- Increase your repayments when interest rates are low. If interest rates fall, keep your mortgage repayments at the same level before the rate drop and you can cut years off your loan. This trick effectively repays your loan faster.

- Consider an offset account to have your wages paid into. This is when your savings compensate for a portion of the interest charged on your principal. The more funds you have in your offset account, the less interest you pay.

- Conduct a mortgage health check. Your loan may not be the most competitive product in the market anymore. Look at refinancing with your current lender and determine whether its worth staying.

More home loan calculators

Early Auto Loan Payoff Calculator Faqs

What is a pay-off car loan early calculator? +

A pay-off car loan early calculator is a calculator that helps you know how much time you can shave-off from your car payment and the interest you can save by increasing your monthly car payments.

How will an auto loan calculator help me with extra payments? +

Auto loans that span for a long period are great, but they accrue a lot of interest to be paid over time. Our auto loan calculator will show you just how much you can save on these interests by making extra monthly payments.

Youll Free Up Cash For Other Purposes

Once your home mortgage is paid off, you can put the money that would have been earmarked for a monthly payment toward any number of other goals. You could:

- Pay off other debt, such as or student loans

- Boost your retirement contributions

- Put more money toward investments

- Pay for big life expenses, such as your kids college tuition

- Purchase a second home or rental property

The opportunities are endless and only depend on your goals and existing financial situation.

Read Also: Does Prequalifying For A Mortgage Affect Your Credit

Why Shouldn’t You Pay Off Your House Early

When you pay down your mortgage, you’re effectively locking in a return on your investment roughly equal to the loan’s interest rate. Paying off your mortgage early means you’re effectively using cash you could have invested elsewhere for the remaining life of the mortgage as much as 30 years.

How can I pay my 30 year mortgage in 15 years? Options to pay off your mortgage faster include:

How can I pay my house off in 10 years?

Expert Tips to Pay Down Your Mortgage in 10 Years or Less

How can I pay off my 30 year mortgage faster?

How to Pay Off a 30-Year Mortgage Faster

What to do after home is paid off? What to Do After Paying Off Your Mortgage?

Early Loan Repayment: A Little Goes A Long Way

One of the most common ways that people pay extra toward their mortgages is to make bi-weekly mortgage payments. Payments are made every two weeks, not just twice a month, which results in an extra mortgage payment each year. There are 26 bi-weekly periods in the year, but making only two payments a month would result in 24 payments.

Instead of paying twice a week, you can achieve the same results by adding 1/12th of your mortgage payment to your monthly payment. Over the course of the year, you will have paid the additional month. Doing so can shave four to eight years off the life of your loan, as well as tens of thousands of dollars in interest.

However, you don’t have to pay that much to make an impact. Even paying $20 or $50 extra each month can help you to pay down your mortgage faster.

Calculating Your Potential Savings

If you have a 30-year $250,000 mortgage with a 5 percent interest rate, you will pay $1,342.05 each month in principal and interest alone. You will pay $233,133.89 in interest over the course of the loan. If you pay an additional $50 per month, you will save $21,298.29 in interest over the life of the loan and pay off your loan two years and four months sooner than you would have.

You can also make one-time payments toward your principal with your yearly bonus from work, tax refunds, investment dividends or insurance payments. Any extra payment you make to your principal can help you reduce your interest payments and shorten the life of your loan.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

What Happens If I Pay An Extra $300 A Month On My Mortgage

By adding $300 to your monthly payment, you’ll save just over $64,000 in interest and pay off your home over 11 years sooner. Consider another example. You have a remaining balance of $350,000 on your current home on a 30-year fixed rate mortgage. You decide to increase your monthly payment by $1,000.

Is a 30 year mortgage Smart? The advantages of a 30-year mortgage. The 30-year mortgage is the most popular option for homeowners in the US for many reasons. But one of its main advantages is that the payments are stretched out over a period that’s twice as long as a 15-year mortgage, which means 30-year mortgages have lower monthly payments.

What happens if you make 1 extra mortgage payment a year?

3. Make one extra mortgage payment each year. Making an extra mortgage payment each year could reduce the term of your loan significantly. For example, by paying $975 each month on a $900 mortgage payment, you’ll have paid the equivalent of an extra payment by the end of the year.

How can I pay my 30 year mortgage in 10 years? How to Pay Your 30-Year Mortgage in 10 Years

What is the average age to be mortgage free?

While the average age borrowers expect to pay off their mortgage is 59, the number of survey participants who have no idea when they will pay it off at all stood at 16%. In 2019, 9% of those asked didn’t know and in 2020, 11% gave this answer.

Pay Off Your Mortgage Or Grow Your Wealth: Which Is Best

The choice often comes down to whether you have retirement savings or not. The younger you are, the more you should focus on retirement savings.

Later, when compound interest has grown your wealth, you could make extra payments toward your home loan principal to build equity quickly.

If your retirement portfolio is in good shape, try to make extra mortgage payments early to reduce the principal youre paying interest on.

You May Like: Rocket Mortgage Payment Options

When To Consider Loan Recasting

In some cases, if you make a large enough mortgage payment, your lender might offer to recast your loan. If youre not aware of this, you may actually ask your lender for recasting.

Mortgage recasting is when you pay a large amount toward your principal balance, which is then reamortized to reflect the remaining balance. Basically, your lender recalculates the remaining balance into a new amortization schedule. You might want to consider recasting if you happen to have large funds from inheritance pay or a windfall from a side-business.

Under the law, only conforming conventional loans can be recasted. This excludes government-backed loans such as FHA loans, USDA loans, and VA loans. Majority of jumbo loans also do not qualify for recasting. To be eligible for recasting, you must have a pristine record of timely mortgage payments and enough lumps sum funds.

Homeowners usually recast their loan to reduce their monthly payment. Like refinancing, recasting decreases overall interest charges. However, it retains your original repayment schedule and interest rate. This means if you have 25 years left to pay, your monthly payment will be lower, but your loan term will still be 25 years. It does not actually shorten your payment term. But its worth it to have lower monthly payments.

To give you a better idea, heres an example below. Lets say you received an inheritance payment worth $200,000. If you happen to have a new loan worth $300,000, you can try recasting.

Calculate By Loan Term

This option will help you to determine how long it will take to pay off your loan, based on the loan amount, the interest rate, and the proposed term of the loan. If youre simply playing around with different numbers, you can adjust the length of the loan term to determine a payment level thats acceptable to you.

But this option will also give you another important piece of information you need to know, and thats the amount of interest youll pay over the length of the loan. The longer the term, the higher the total interest paid will be. In that way, youll be able to make an intelligent decision about both the monthly payment and the total interest cost of the loan.

When you select this option, youll be asked two additional questions:

- Loan term ranging from 12 to 84 months.

- Extra monthly payment enter any additional principal you plan to add to your monthly payment, but leave it blank if you only intend to make occasional additional payments.

For demonstration purposes, enter 60 months for the loan term. Then hit the black Calculate button.

The loan payoff calculator will display two results:

- Your estimated monthly payment will be $198.01.

- Interest paid $1,880.60, which is the total amount of interest youll pay over the 60-month term of the loan.

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

Why You Shouldn’t Pay Your House Off Early

If you have no emergency fund because you put your extra money toward an early mortgage payoff, a single financial disaster could force you to take out costly loans. Or, if your mortgage hasnt been paid off in full yet, an emergency could lead to foreclosure on your house if it means cant pay the mortgage later.

Mortgage Break Penalty Calculator

Are you looking to pay off your mortgage early? Or refinance the terms of your mortgage at a lower interest rate? Maybe you sold your home and purchasing a new home, in which a mortgage transfer will apply. Whatever the case, you most likely will have to pay a mortgage break penalty set by your lender. Whatever the situation, our calculator will help you determine the cost to break your mortgage so you can be confident about your mortgage decisions.

What is the remaining balance on your mortgage?

What is the term-length and type of your current mortgage?

What is your current mortgage interest rate?

If applicable, what was the rate discount you received when you signed your current mortgage agreement?

If you are unaware of any discount, you can skip this step.

When did your current mortgage start?

Who is your current mortgage lender?

What is TD Bank’s current interest rate for a3-year fixed rate mortgage?

Also Check: 10 Year Treasury Yield And Mortgage Rates

Should I Pay Off My Mortgage Early

Whether you experience a sudden financial windfall or just find yourself with leftover cash in your budget each month, you might be wondering what to do with those extra funds. One option is to contribute more money toward the loan on your home, but should you pay off a mortgage early, or are there better places to focus your efforts? Here are some key factors to keep in mind. Consider working with a financial advisor as you weigh your options.

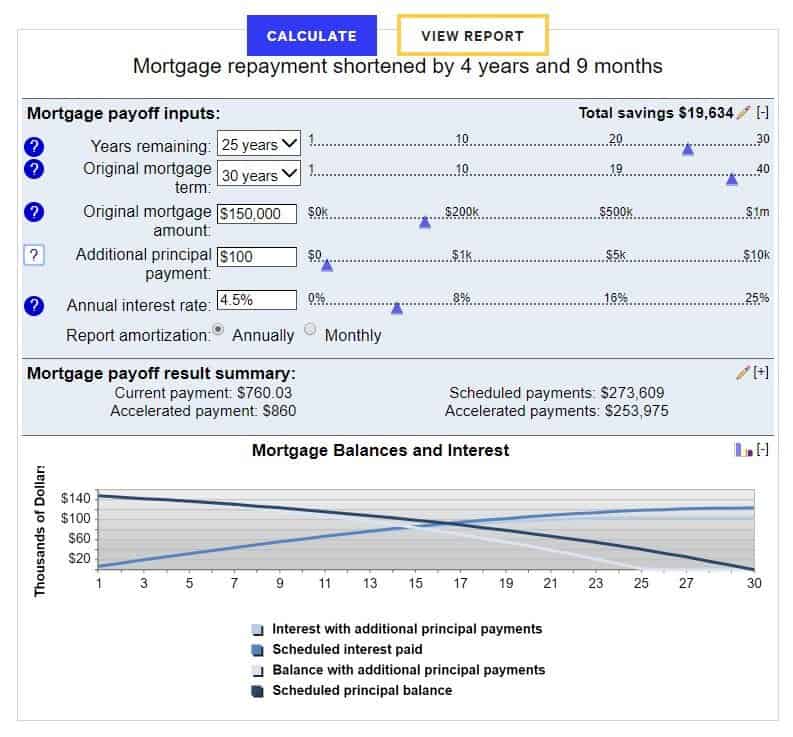

What The Early Mortgage Payoff Calculator Does

Do you want to pay off your mortgage early? Maybe you have 27 years remaining on your home loan but you would rather pay it off in 18 years instead. The early payoff calculator demonstrates how to reach your goal.

The mortgage payoff calculator shows you:

-

How much more principal you would have to pay every month so you can pay off the loan in a certain number of years.

-

How much interest you would save by paying off the loan early.

There are many reasons you might want to accelerate the mortgage’s payoff, but the motivation usually boils down to either or both of these:

-

You want to own your home free and clear by a milestone in life, such as your retirement or the beginning or end of your kids’ college years.

-

You want to reduce the total interest you pay over the life of the loan.

To steadily pay off the mortgage early, you need to know how much more to pay toward the principal balance every month to accomplish that goal. This calculator lets you do that.

When paying down the principal on a mortgage faster, keep in mind that each servicer has its own procedures for assuring that your extra payments go toward the principal balance instead of toward future payments. Contact your servicer for instructions.

Don’t Miss: Rocket Mortgage Vs Bank

Ready To Refinance Your Mortgage

If you want to refinance to a mortgage you can pay off fast, talk to our friends at Churchill Mortgage. The home loan specialists at Churchill Mortgage show you the true costand savingsof each loan option. They coach you to make the best decision based on your budget and goals.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Calculate By Monthly Payment

For many consumers, the monthly payment on a new loan is the single most important factor. You can use the Calculate by Monthly Payment option to find what you feel will be the right payment for you.

Just as was the case when I did Calculate by Loan Term, Ill start by entering a loan amount of $10,000 and a loan APR of 7%.

Next, click the Calculate by Monthly Payment option. Then hit the Calculate button.

Youll be asked to enter the Expected monthly payment. For the sake of example, lets enter $155, then hit the Calculate button.

The loan payoff calculator will display three results:

- Months to Payoff 81 months.

- Years to Payoff 6.75 years.

- Interest Paid $2,555.

Now, most lenders wont make a loan for 81 months, since it doesnt represent a specific number of years. Youll likely be asked to choose either 72 months, which will raise the payment somewhat, or 84 months, which will lower the payment slightly.

But notice that the lower monthly payment $155 vs. $198.01 I used in Calculate by Loan Term also results in a much higher amount of interest paid over the life of the loan.

With the term at 60 months, youll pay $1,880.60 over the life of the loan. But at 81 months and the lower monthly payment youll pay $2,555, which will raise the cost of the loan by $675.

Read Also: Can You Refinance A Mortgage Without A Job

Principal And Interest Of A Mortgage

A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lender’s charge to borrow the money. This interest charge is typically a percentage of the outstanding principal. A typical amortization schedule of a mortgage loan will contain both interest and principal.

Each payment will cover the interest first, with the remaining portion allocated to the principal. Since the outstanding balance on the total principal requires higher interest charges, a more significant part of the payment will go toward interest at first. However, as the outstanding principal declines, interest costs will subsequently fall. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises.

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data.

Aside from selling the home to pay off the mortgage, some borrowers may want to pay off their mortgage earlier to save on interest. Outlined below are a few strategies that can be employed to pay off the mortgage early.:

How To Use The Early Payoff Mortgage Calculator

- Enter the original loan amount and date you took out the mortgage

- Input the loan term and interest rate

- Select the date of extra payment

- Along with the amount and frequency

To use the early payoff mortgage calculator, simply enter your original loan amount when you first received the loan, along with the date you took out the home loan.

Then enter the loan term, which defaults to 30 years. You may also enter 360 months for a 30-year loan, or 15 years for a 15-year fixed depending on loan type desired.

Speaking of loan type, youll save a lot more money by paying extra on a mortgage with a longer term, such as the 30-year fixed. And if the loan amount is larger.

Next, enter the mortgage rate and the date you plan to make the extra payment. Then input the additional payment amount and whether itll be a monthly, annual, or one-time extra payment.

For example, if you plan to pay an extra $100 per month, you shouldnt have to change anything with the default settings. If you want to make a lump sum extra payment of $1,000, enter it and change the Monthly to One Time for an accurate calculation.

Once you click compute, youll see how much the extra mortgage payments will save in the way of interest over the life of the loan, and also how much faster youll pay off your mortgage.

Recommended Reading: Rocket Mortgage Conventional Loan