How Much Can I Get For A Home Loan

The reason its so important to focus on your budget, rather than your borrowing power, is that lenders tend to approve borrowers for mortgage loans at the very top of their affordability range.

That might seem counterintuitive. Youd think the lender would worry that a single change in your life like a long-term illness or an unexpected child would suddenly put your payments at risk.

Its true that lending you a huge sum will make it more likely youll default on the loan. However, the bigger the loan, the greater the amount of interest youll pay over its lifespan. More interest is more money for the lender.

So lenders are motivated to balance risk and reward, allowing you to borrow a sum that will strain but not break your budget.

How Much Should You Save Before Buying

The goal is to save 20% of the land cost to pay down and 5% for closing costs. Smaller costs when buying landâ such as moving costs, new earth equipment, and initial land maintenance fundsâ can add up. You can estimate the budget for a smaller cost and add to what you expect to pay down to you.

Is 20000 enough to buy a house?

Lender Measures Down Payments states the payment as a percentage of the total loan. For example, if you buy a house worth $ 100,000, a 20% down payment equals $ 20,000. You can qualify for a mortgage with as little as 3% down with a conventional loan. If you choose an FHA loan, you need 3.5%.

How much money should I have saved before buying a house?

When saving for the earth, it is important to have a reserve of cash savings â or emergency funds â that do not work for down payments or closing costs. It is a good idea to have at least 3-6 months of living expenses saved up in this cash reserve.

How much do I need to save to buy a 300k house?

Down payment: You must have a down payment equal to 20% of the value of your land. This means that to afford a $ 300,000 home, you need $ 60,000. Closing cost: Usually, you will pay around 3% to 5% of the value of the land in closing cost. In a $ 300,000 home, you need $ 9,000 to $ 15,000.

Mortgage Loan Officer Earning Potential

Your earning potential as a Mortgage Loan Officer can increase as you gain experience and develop your career with additional education. Other factors that will impact your earnings as an MLO include the state in which you do business and the fluctuation of the mortgage market. A whopping 36% of full-time MLOs make above the national average salary, earning up to $181,000 per year.

With unlimited earning potential and the chance to gain experience and education as you go, becoming a Mortgage Loan Officer can unlock a lucrative and stable career path.

Also Check: Mortgage Recast Calculator Chase

Also Check: How Does Rocket Mortgage Work

How Do Mortgage Loan Officers Get Paid

A loan officers wage varies depending on their employer and years of experience. Mortgage loan originators earn an hourly wage or a flat salary. Some mortgage loan originators might earn commission on top of their regular payments.

Most companies offer full-time loan officers standard business benefits such as vacation time, sick days, insurance, and so on.

How Does Ltv Affect How Much You Can Borrow

A big part of the mortgage application is your loan to value ratio or LTV. This is a percentage that shows the split between your mortgage and the loan amount after youve paid your deposit.

For example, if you are buying a house worth £200,000 and your deposit is £20,000, your LTV would be 90%.

The lower the LTV, the better mortgage rate you might be offered. For instance, you might get a lower interest rate if you had an LTV of 75%, compared to someone with an LTV of 95%.

LTV isnt the only factor lenders will think about when offering you an interest rate, however.

Also Check: Rocket Mortgage Requirements

A Higher Credit Score Could Increase What You Can Borrow

Your has a big part to play in how much you can borrow. In the most extreme cases a low credit score could prevent a mortgage lender from even considering you or, more likely, a low score could mean that the lender uses a lower multiple of your income to decide how much you can borrow.

Thats why youll want to make sure your credit score is up to scratch before you even consider applying for anything. Our guide on improving your credit rating will be able to help you with this.

How Much Would A 100000 Mortgage Cost Per Month

This would depend on the term of the mortgage and the interest rate youre paying, but if we take a typical 25-year mortgage at a rate of 2.5%, your monthly repayment on a £100,000 mortgage would be £448.62. You can find more repayment scenarios by heading to our mortgage repayment calculator.

Cookies

Read Also: Rocket Mortgage Qualifications

How Many Times Your Salary Can You Borrow For A Mortgage In 2021

How much youll need to earn for a particular size mortgage varies from lender to lender, and theyll often be more concerned about how much you can afford to pay back rather than a straight income calculation. That said, 4.5x your income is generally the maximum amount youll be able to borrow, so here we go through a few scenarios to help you get an idea of the amount you could be offered.

How Much Do I Need To Earn For A 100000 250000 Or 500000 Mortgage

Our calculator shows that for a £100,000 mortgage you will need to earn at least £22,500 as a single applicant or between you if youre applying for a joint mortgage. Bear in mind that a £100,000 mortgage can result in different LTVs and therefore different rates, depending on the amount of deposit you have and the overall value of the property.

For a £250,000 mortgage you will need to earn at least £56,000 as a single applicant or between you if applying as a couple, while for a £500,000 mortgage you will need a earn at least £111,500 as a single applicant or as joint income for a shared mortgage.

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage

My Result Came Out Higher Than The Amount I Wish To Borrow What Now

Now that you have ascertained that you are in a strong enough financial situation to sustain the purchase of your desired property, you need to set about getting in touch with some mortgage providers.

Fortunately, we have made this process very easy for you. Simply click the Get FREE Quote button and you will be taken through a very brief set of questions. We will then ask our carefully selected lenders to contact you directly with the very best quotations they can provide. By reaching out to lenders this way, you get the best deal possible and are saved the effort of contacting them yourself it couldnt be simpler!

Should I Take The Maximum I Can Borrow

Again, this all comes down to your own personal level of affordability, and how comfortable you are with being able to afford the maximum amount. Remember that the bigger the mortgage, the higher your repayments are going to be, so while it can be tempting to take the maximum amount offered particularly if it means you can afford a larger property it may be wise to exercise a bit more caution.

You May Like: Requirements For Mortgage Approval

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

How Do I Qualify For A Loan

Once youve determined the right loan for you, you need to figure out if you qualify for it as different lenders have different qualification requirements. For example, you may need a certain credit score in order to qualify most lenders want credit scores above 620.

You may also need a certain debt-to-income ratio based on your gross monthly income and your monthly debt payments. Lenders generally want to see a DTI below 36%, with no more than 28% going towards housing-related expenses like your mortgage payment.

Finally, many lenders will also consider your employment history to evaluate your risk as a borrower. Specifically, they are looking for steady employment over the past two years. That said, there may be exceptions made for recent graduates and those that are self-employed.

A mortgage lender may ask to see your pay stubs, W-2s, tax returns, and more when considering your home loan.

You May Like: Bofa Home Loan Navigator

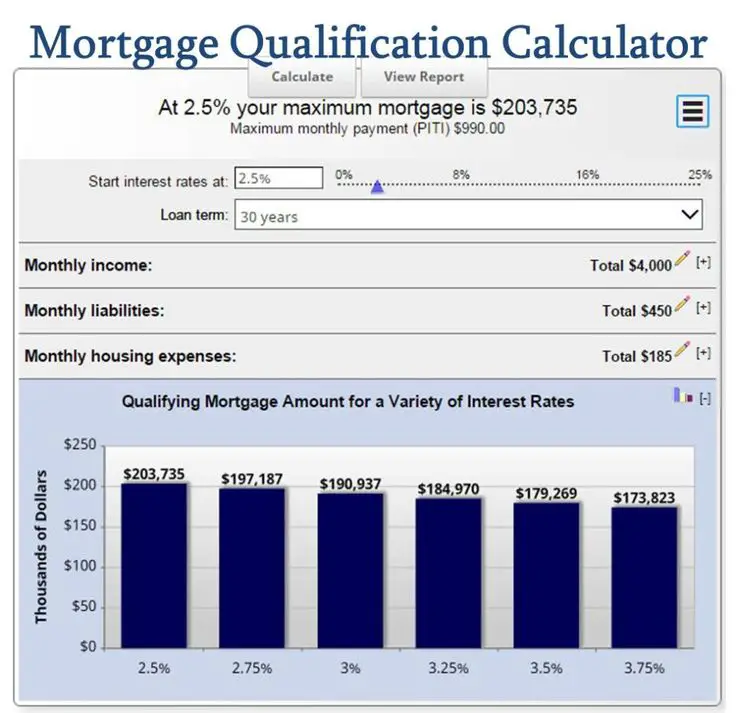

Why Use The Maximum Mortgage Calculator

Once you input your monthly obligations and income, the Maximum Mortgage Calculator will calculate the maximum monthly mortgage payment that you can afford, based on your current financial situation. This calculator will also help to determine how different interest rates and levels of personal income can have an effect on how much of a mortgage you can afford.

Income Is A Significant Part Of Deciding How Much You Could Borrow

Income is crucial for determining how big a mortgage you can have. Traditionally, mortgage lenders applied a multiple of your income to decide how much you could borrow. So, if you earn £30,000 per year and the lender will lend four times this, they may be willing to lend £120,000.

When it comes to households with two incomes, some lenders offer a choice:

The option to add the second income on top of the multiple, so if the main breadwinner earns £30,000 and the second person’s income is £15,000 a lender might offer 4x the first income, plus the second income or

A slightly lower multiple for two incomes than for one. So £30,000 + £15,000 = £45,000. Then £45,000 x 3 = £135,000

Many lenders now only use income multiples as an overall maximum that they will lend, conducting a detailed affordability assessment to decide how much they are willing to lend. This is something that has become particularly strict following mortgage regulations introduced in 2014.

If part of your income is comprised of a bonus or overtime, you may not be able to use this, or if you can, you may only be able to use 50% of the money towards what the lender deems as your income. All income you declare in your mortgage application will need to be proven usually through you providing your latest pay slips, pensions and benefits statements.

Read Also: Chase Mortgage Recast

How Much Do Mortgage Loan Officers Make

A mortgage loan officer position can offer you a fulfilling career with good pay in the mortgage industry. A loan officer in the United States earns, on average, about $50,000 a year. Some earn commission on top of that. You can become a mortgage loan officer by earning a bachelors degree, taking required classes, and passing a test to get your license.

There are many important factors when choosing a job. Salary, work-life balance, and the work environment are all things one should consider when thinking about what career you want. For those looking for a dependable, well-paying job in a good environment, becoming a mortgage loan officer is a position worth considering.

Loan officers generally work a 40-hour workweek and receive benefits. Most loan officers have a steady income, earning around $50,000 per year. Compared to other businesses in the mortgage industry, a loan officers job is not too stressful. Overall, becoming a mortgage loan originator could be a great career route for anyone interested in business, finance, accounting, or the mortgage industry in general.

What Does The Mortgage Qualifying Calculator Do

This Mortgage Qualifying Calculator takes all the key information for a you’re considering and lets you determine any of three things: 1) How much income you need to qualify for the mortgage, or 2) How much you can borrow, or 3) what your total monthly payment will be for the loan.

To do this, the calculator takes into account your mortgage rate, down payment, length of the loan, closing costs, property taxes, homeowners’ insurance, points you want to pay and more. Or, if you don’t want to go into that much detail, you can omit some of those to get a ballpark figure for the loan you’re considering.

You can also enter information about your current debts, like your car payments, credit cards and other loans to figure out how those affect what you can afford. This Mortgage Qualifying Calculator also gives you a breakdown of what your monthly mortgage payments will be, shows how much you’ll pay in mortgage interest each month and over the life of the loan, and helps you figure how you might allocate your upfront cash on hand toward closing costs. On top of that, it also lets you easily adjust any of the figures by using a sliding scale, making it simple to see how changing one or more affects the result, so you can identify where how reducing one thing or increasing another affects the final result.This Mortgage Qualifying Caculator also summarizes all your information in a detailed report, including an amortization table, for easy reference.

You May Like: Rocket Mortgage Vs Bank

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

How Much Can I Borrow For A Mortgage Based On My Income

Prior to 2014 lenders would use an income multiplier to help decide how much you could borrow on a mortgage. Now lenders need to show that the mortgage is affordable and that you could continue to pay your mortgage should there be a rise in interest rates, or you have a significant change in circumstances such as losing your job or having a child.

Lenders also have regulatory restrictions that limit their new lending above 4.5x salary to a maximum of 15% of all new mortgage loans. This means lenders can be very specific in deciding exactly which borrowers they want for these mortgage deals.

To find out more take a look at our What are mortgage affordability checks guide.

Recommended Reading: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

How Can I Drop An Ltv Band

To drop a loan-to-value band youll need to secure a larger deposit or increase your equity, which will allow you to secure a smaller mortgage in relation to the value of your property. If you cant afford a larger deposit, the only other way to secure a lower LTV is to buy a cheaper property, which would mean your deposit takes up a higher proportion of the propertys value and would reduce your LTV accordingly.

Future Changes That Might Make An Impact

The lender will assess whether youd be able to pay your mortgage if:

- interest rates increased

- you or your partner lost their job

- you couldnt work because of illness

- your life changed, such as having a baby or a career break.

Its important that you also think ahead and plan how youd meet your payments.

For example, you can help to protect yourself against unexpected drops in income by building up savings when you can.

Try to make sure it contains enough for three months outgoings, including your mortgage payments.

You May Like: Reverse Mortgage On Condo

How Much Can I Afford To Spend On A House

Perhaps the most important question to ask a mortgage lender is how much you can afford to spend on a house since the answer to this question will likely inform your entire home search.

Keep in mind that just because you qualify to spend a certain amount on a home doesnt mean you have to spend that entire amount. Your real estate agent can help you find homes within this price point.

Generally speaking, you can afford to spend up to 3x your gross annual income on a mortgage. So if you make $100,000 a year, you can afford to take out a mortgage loan worth $300,000. If you factor in a 20% down payment, that leaves you with a total purchasing budget of about $380,000.

Of course, this is just one way to calculate how much house you can afford. Your mortgage lender will likely perform a more complicated loan estimate based on your financial profile.