What Does Your Credit Score Have To Be To Buy A House In Texas

Key Research Points for First-Time Buyers in Texas First-time home buyers clearly have financial concerns, such as the minimum home credit score and down payment assistance available in Texas. Minimum mortgage scores can even vary within the same state, but a score of 620 or higher is generally considered good.

It Is A Gift And Not A Loan

When people think about financial help from a parent, a gifted down payment is the most common thought that comes to mind. With home prices rising pretty much all across Canada during the Covid-19 pandemic, affording a home has become that much more challenging, especially if youre buying on your own. Thats where a gift down payment from your parents can come in handy.

The math is simple. Any gifted money you receive is added on top of the maximum purchase price you can afford. For example, if you qualify to spend $500,000 on a home on your own, if you get a $100,000 gift from you parents, youre able to spend $600,000 in that instance.

Its important that the funds be a gift and not a loan. Your parents must sign a gift letter to the lender saying that its a gift and doesnt need to be repaid. If its a loan, it wont really help you, as it will need to be added as debt, therefore, you wont be able to afford to spend more on a property.

And its not just your parents who could gift you your down payment. Most lenders are okay with any immediate family member gifting you a down payment. It could be a sister, brother or even your grandparents in many cases.

What Is The Difference Between Pre

Both pre-qualification and pre-approval involve a review of an applicant’s credit report. The difference is the degree of credit review. Pre-qualification involves a quick review of one’s credit and only provides a potential borrower with a general idea of how much mortgage they could qualify for and under what terms. Pre-approval involves a full credit review, while only offered for a limited time window, provides the potential borrower with a solid offer of credit from a lender with which they can use to make good faith offers on homes for sale.

You May Like: Chase Recast

If I Meet A Minimum Credit Score Will I Be Accepted For A Mortgage

Not necessarily as lenders take lots of factors regarding your affordability into consideration. You are more likely to be accepted if you meet a minimum score as this suggests that youre a careful borrower.

However, its also important to prepare for your application for a mortgage by organising your:

-

Pay slips and proof of bonuses/commission and tax paid or self-assessment tax accounts if youre applying for a self-employed mortgage

-

Passport, birth certificate and drivers license

-

Proof of deposit

-

Proof of address

-

Gift letter If you’re receiving help with your deposit, the lender will need a letter from the person providing the gift explaining that they are gifting the deposit and understand that they in no way own any share of the property being mortgaged or expect the money to be paid back.

Lenders work across a lot of different criteria, and your credit score is just one part, so even if you do not meet the minimum levels, you should speak to one of our specialist mortgage advisors to see how we can help.

How Can I Reduce My Chances Of Being Rejected For A Mortgage

As well as taking the steps above to build a strong credit history, there are other ways to get yourself in the best financial shape for a mortgage:

- Avoid applying for anything that requires a hard credit search at least 12 months before applying for a mortgage.

- Try and keep your credit use below 25%. This will show youre responsibly using things like a credit card or overdraft.

- Keep making credit payments on time. If youre having problems, contact your lender immediately and discuss other options that could help you avoid a negative mark on your credit record.

Once youve built up your credit score to the best level you can achieve, contact a mortgage broker so that they can find you the best available mortgage deal and interest rates.

Let us match you to your perfect mortgage adviser

Also Check: 10 Year Treasury Vs 30 Year Mortgage

How Do Lenders Make Their Decisions

Not all lenders think the same way, and they may have different ways of making their decisions. But all of them will look at some key factors to help them decide. These include:

- information on your on your credit report including your credit history and public record data

- information youâve given them on your application form

- information they may already hold on you, for example if you have a bank account with them

- their own lending policy, which may be different from those of other lenders

Looking at your credit report will give them a detailed insight into your credit history, and will show things like how much you owe on credit cards, if youâre registered to vote and if youâve missed payments in the past. Theyâll put that all together and give you a credit score of their own.

Do You Earn Enough Income To Make Monthly Loan Payments

When you apply for credit, your monthly debt payments should not exceed 40% of your monthly income. If you are applying for a mortgage, you must also make sure that your shelter payments are less than 32% of your income. If your monthly payments exceed these levels, then you most likely wont qualify for further credit.

Also Check: Reverse Mortgage On Condo

What Else Do Mortgage Lenders Consider

Your credit score is a key factor in determining whether you qualify for a mortgage. But its not the only one lenders consider.

Income: Lenders will also look at your income. They want to make sure you make enough money each month to afford your payments.

Debt-to-income ratio: Lenders also look at your monthly debts. Lenders vary, but they generally want your total monthly debts, including your estimated new mortgage payment, to consume no more than 43% of your gross monthly income. If your debt-to-income ratio is higher, you might struggle to qualify for a mortgage.

Down payment: The bigger your down payment, the more likely it is that youll qualify for a mortgage with a lower interest rate. Thats because lenders think you are less likely to stop making your payments if youve already invested a significant amount of your money into your loan. A higher down payment makes your loan less risky for lenders.

Savings: Lenders want to make sure that you have funds available to make your mortgage payment if your income should unexpectedly dry up. Because of this, most will want to see that you have enough money saved to cover at least two months of mortgage payments.

Employment history: Lenders vary, but they usually like to see that youve worked at the same job, or in the same industry, for at least 2 years. They believe youre less likely to lose that job, and that stream of income, if youve built up a longer work history.

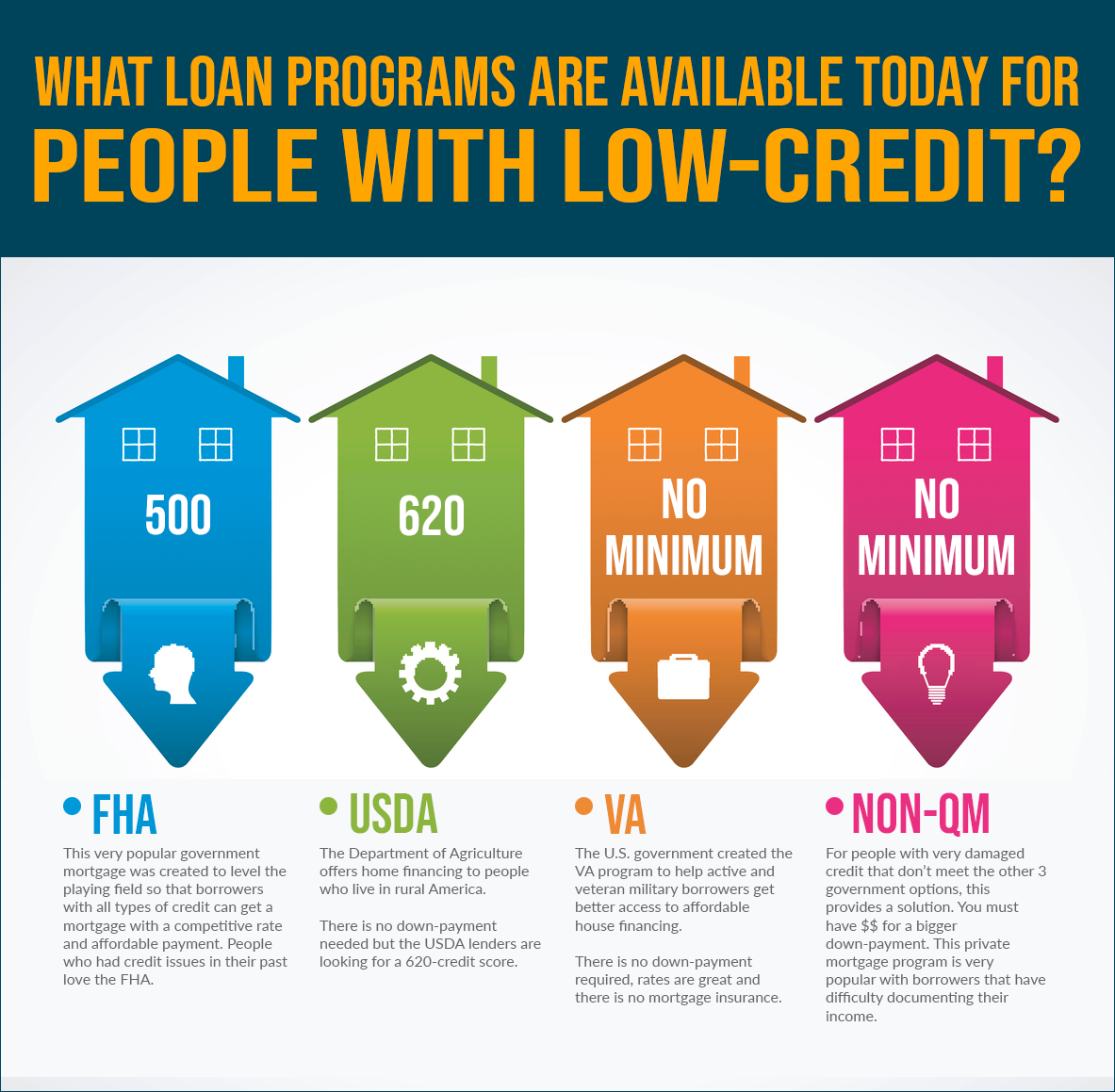

Minimum Credit Score To Buy A House By Loan Type

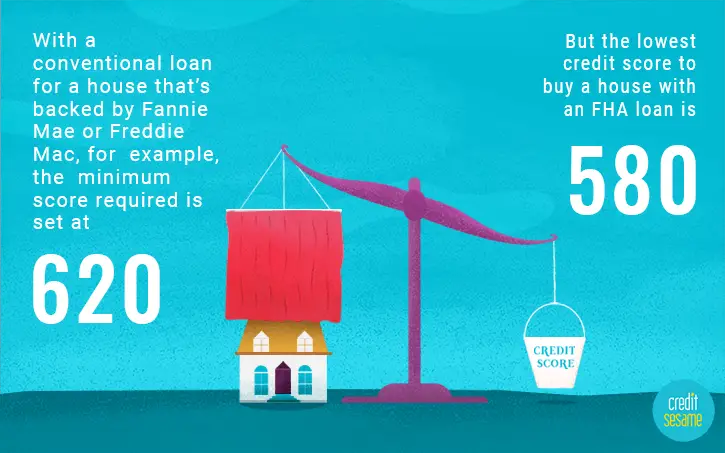

Conventional loans are the most common home loan and have a hard minimum credit score of 620. Conventional loans are issued through mortgage lenders, mortgage brokers, and credit unions. Conventional loans are the default option for home buyers because of their low rates and simple approvals.

Conventional loan approval requires:

- Current credit score

FHA mortgages are the original mortgage loan, developed by the Federal Housing Administration in the 1930s to keep homeownership attainable. FHA loans are more inclusive than other loan options because of their relaxed down payment requirements, and because the FHA doesnt change your interest rate based on your credit score.

In fact, FHA loans dont require home buyers to have a credit score at all, although many lenders want to see a minimum score of 580.

FHA loan approval requires:

- Loan lengths must be 15 years or longer

VA loans are backed by the Department of Veterans Affairs. VA loans are affordable home loans for active-duty servicemembers and veterans.

Because the VA guarantees its loans against losses, mortgage lenders make VA loans at very low interest rates and, historically, VA mortgage rates are often the lowest of all available mortgage loans. VA loans dont require a downpayment.

VA loans:

- Are available as 100% mortgage loans

- Have lower interest rates as compared to conventional loans

- Require a Certificate of Eligibility

USDA loans:

Jumbo loans can be used for a variety of property types.

Jumbo loans:

Don’t Miss: Can I Get A Reverse Mortgage On A Condo

What Credit Score Do You Need To Buy A House In 2022

A lot of first-time home buyers worry that their credit scores are too low to buy a home. First, know that whether your credit score is good or bad is subjective and wont affect your home-buying. Second, mortgage lenders are bound by specific rules which determine what credit scores you need to buy a house, and those rules vary by your loan type.

Conventional loans are the most common loan type. On the credit score scale, which ranges from 350-850, conventional loans require a credit score of at least 620. Other loan types allow for lower credit score minimums, and some mortgage programs have no credit score requirement whatsoever.

Read on for details by loan type, or jump to learn more about your credit score:

Tips To Maximize Your Home Buying Budget

We started with the question, How much income do I need for a $200K mortgage? And we have demonstrated that theres no easy answer.

What we can do is give you some tips for maximizing your home buying budget on your current income.

Of course, its difficult for anyone to do all these things at once. But start where you can.

Even a small improvement in your credit score or DTI can make a big difference in your home buying budget. Remember, every little bit counts!

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

What Is The Minimum Credit Score Needed For A Home Loan In Australia

In Australia, lenders have differing standards when it comes to credit scores when applying for a loan. This means that there is not a standardised credit rating criteria needed to apply for a home loan, however, there is an average that lending providers look for before accepting an application.

Average scores in Australia are usually between 500 to 700, while below-average credit scores are considered unfavourable to some home loan lenders. However, smaller specialist lenders may be willing to provide support.

In this way, it is challenging to define the minimum credit score required to get a home loan as most lenders in Australia donât make their credit criteria public and use different calculations to determine loan eligibility.

Credit bureaus have benchmarks that can be used as a guide for individuals to check their credit score to see if they qualify or if they are in a lower score bracket.

In regards to different states, the approach to credit score ranges is similar, however, a score that is considered good or bad in Sydney may not be good enough for an area such as Perth or vice versa. Statewide house price falls and rises also play a part in if a loan is accepted or declined.

With these ranges in mind, it may be disheartening at first to know that a lower credit score is difficult to initially get a loan with. Even with a bad credit score it is still possible to get a loan from providers but this may come at a cost.

Notes On Using The Mortgage Income Calculator

This calculator provides a standard calculation of the income needed to obtain a mortgage of a certain amount based on common industry guidelines. These guidelines assume that your mortgage payments, including taxes, insurance, association fees and PMI/FHA insurance, should be no greater than 28 percent of your monthly gross income.

- FAQ: These guidelines assume that your mortgage payment and other monthly debt obligations combined should not exceed 36 percent of your monthly gross income.

Those are the base guidelines however, borrowers with excellent credit and healthy financial reserves can often exceed those guidelines, going as high as 41 percent of gross monthly income for mortgage payments and debt obligations combined. You may wish to take that into account when considering your own situation.

Read Also: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Other Types Of Mortgages

Several of the best mortgage lenders for first-time home buyers offer lower down payments and more flexible credit requirements. In addition to conventional and FHA mortgages, the credit score for a mortgage can be lower with the following types of mortgage loans:

VA Loans:VA Loans are available to certain current and former members of the U.S. Armed Forces. There is no formal minimum credit score for a home loan, but most lenders want to see a FICO® Score of at least 620 to originate a VA loan.

USDA Loans: A USDA loan is a type of financing available for borrowers with low-to-moderate income buying homes in certain rural areas. While there isn’t a set-in-stone credit requirement, most USDA lenders want to see a score of at least 640.

Owning A House In Canada: The Property Type

Property type is another important factor. It mainly comes down to personal preference and budget. You may want to own a house in Toronto or Vancouver, but affording one is a different story.

If youre buying a home the first time, you may have the choice between a condo or townhouse. If you prefer to live close to downtown, a condo can offer that. Just make sure youll enjoy the lifestyle. If youre looking for more space, thats when a townhouse can make sense. However, you might have to move a bit further out, so make sure youre okay with that.

Read Also: Recast Mortgage Chase

What Can Your Experian Credit Score Tell You

The credit score you need to get a mortgage varies, as thereâs no one credit score or universal âmagic numberâ. However, if you have a good credit score from one of the main such as Experian, you are likely to have a good credit score with your lender. Checking your Experian Credit Score before you apply for a mortgage can give you an idea of how lenders may see you, based on information in your Experian Credit Report. It can also help you work out if you need to improve your credit history before making your mortgage application.

How Is A Credit Score Compiled

Credit scores can range from 300 to 850 points, but the rating is not just based on how quickly you pay off your debts. While payment history does account for 35% of the score, the total amount owed is important , because the larger your debt, the higher the risk. The length of time youve used credit is taken into account the longer, the betterand also how much new credit youve recently accessed . Finally, your overall mix of credit is worth 10%. A diverse mix may be comprised of student loans, car loans and unsecured revolving debt .

Recommended Reading: What Does Gmfs Mortgage Stand For

Fha Mortgages Have Lower Credit Score Standards

An FHA mortgage is insured by the federal government. In order to be eligible for an FHA mortgage, borrowers must have at least two established credit lines, a debt-to-income ratio of 31% or less excluding the expected mortgage payment, and no delinquent federal debts.

As long as those requirements are met, an FHA borrower with a rather low credit score for a home loan can still qualify. FHA loans with a rock-bottom 3.5% down payment are available with FICO® Scores as low as 580. And if a borrower can come up with at least 10% down, the FICO® Score requirement drops to 500.

It’s important to mention that lenders can set stricter standards if they want, just as with conventional loans. For example, a mortgage lender that offers the low-down-payment FHA loan could potentially set its own minimum FICO® Score requirement at 600, not 580.

The caveat to FHA loans is that the mortgage insurance is expensive. FHA loans have ongoing annual mortgage insurance premiums of between 0.45% to 1.05% of the loan balance. That’s competitive with the private mortgage insurance paid by conventional borrowers with less than 20% down. However, FHA loans also have an upfront mortgage insurance premium of 1.75% of the loan amount. With a $250,000 loan, this translates to $4,375 — not a small amount of money. See our list of the best FHA lenders to research more.