Understanding Mortgage Credit Scores

Your credit report is separate from your credit score, though the score is developed from the report. In addition to viewing credit reports from the three major reporting bureaus, you also should obtain your FICO score. Your score is like a report card. Fair Isaac & Co. assigns you a number based on the information in your credit report. Since there are three credit-reporting bureaus, you have three FICO scores. Here are the scoring factors:

Introducing The Fico Score 10 Suite The Most Recent Updated Fico Score Version

FICO Score 10 relies on the same design and key ingredients of prior models as well as captures the subtle shifts in consumer credit data that have occurred over the 5+ years since FICO Score 9 launched, such as the increasing use of personal loans, especially for purposes of debt consolidation.

As long as consumers practice good habits like consistently paying bills on time, lowering their debt as much as possible, and applying for credit only when needed, they can achieve and maintain a good FICO Score 10.

FICO Score 10 T builds on FICO Score 10 by also assessing “trended credit bureau data” when determining your score. Scores that don’t use trended data typically use the most recently reported month of data to drive certain components of the score such as the most recently reported balance and/or credit limit on an account.

The trended data allows the credit scoring model to determine what your “trend” is: are your balances trending up, down, or staying the same? Someone whose balances are trending up may be higher risk than someone whose balances are trending down or staying the same.

FICO Score 10 and FICO Score 10 T are currently available to lenders.

Fico Scores By Percent Of Scorable Population

| FICO Score Ranges | ||

| < 580 | Poor | Your score is well below the average score of U.S. consumers and demonstrates to lenders that you are a risky borrower. |

| 580-669 | Fair | Your score is below the average score of U.S. consumers, though many lenders will approve loans with this score. |

| 670-739 | Good | Your score is near or slightly above the average of U.S. consumers and most lenders consider this a good score. |

| 740-799 | Very Good | Your score is above the average of U.S. consumers and demonstrates to lenders that you are a very dependable borrower. |

| 800+ | Exceptional | Your score is well above the average score of U.S. consumers and clearly demonstrates to lenders that you are an exceptional borrower. |

Also Check: Who Is Rocket Mortgage Owned By

Get A Credit Strong Credit Builder Loan

One of the best ways to build payment history is to get a Credit Strong credit builder account. Credit Strong is part of an FDIC insured bank and offers credit builder loans. Credit builder loans are special types of loan accounts that build credit easily.

When you apply for a loan from Credit Strong, you can select the term of the loan and the amount of the monthly payment. Credit Strong does not immediately release the funds to you. Instead, the company places the money in a savings account for you.

As you make your monthly payments, it improves your credit by building your payment history. Credit Strong will report your payments to each credit bureau.

When you finish paying off the loan, Credit Strong will give you access to the savings account it established for you, making the program a sort of forced savings plan that also helps you build credit.

Ultimately, with interest and fees, youll pay a bit more for the loan than youll get back at the end, but this can still be a solid option for a borrower who wants to improve their credit while building savings.

Unlike some other credit builder loan providers, Credit Strong is highly flexible, letting you choose from a variety of payment plans. You can also cancel your plan at any time so you wont damage your credit by missing payments if you fall on hard times.

See the credit builder loan pricing and plans here.

Mortgage Lenders Pull All Three Reports But Only Use This One

According to Darrin Q. English, a senior community development loan officer at Quontic Bank, mortgage lenders pull your FICO score from all three bureaus, but they only use one when making their final decision.

“A bank will use all three bureaus,” tells CNBC Select. “It’s called a tri-merge.”

If all three of your scores are the same, then their choice is simple. But what if your scores are different?

“We’ll use that median score as the qualifying credit score,” says English. “Not the highest or lowest.”

If two of the three scores are the same, lenders use that one, regardless of whether it’s higher or lower than the other one.

And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant’s FICO 2, 4 and 5 scores are pulled. The bank identifies the median score for both parties, then uses the lowest of the final two.

You May Like: Reverse Mortgage Manufactured Home

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Why Mortgage Credit Scores Are Little Known And Often Low

Many consumers dont even know they have one until they try to qualify for a home loan

When Raquel Moore of Atlanta began shopping for her first home last summer, she thought her credit score was 760 based on the number shown by her credit monitoring service. That placed her in the very good range, which qualified her for an affordable interest rate.

But during the preapproval process, Moores bank said that her mortgage credit scorea number she didn’t even know existedwas just 700. It placed her in the good credit range but not high enough for the rate she wanted.

I was never aware of the huge discrepancy between my mortgage score and other credit scores until I was trying to buy a home, says Moore, 38, a self-employed contractor. It was really disheartening.

Many home buyers are just as surprised to find out they have a mortgage credit scoreand that its often much lower than their primary credit score.

In fact, consumers have dozens of credit scores, many of which they dont know about and may never see. Because a house is usually a familys biggest financial commitment, the mortgage score is one of the most important. It helps determine whether you qualify for a home loan and what rate you pay.

The problem is consumers often dont even know that mortgage scores exist and that there may be a big disparity compared with the credit score they commonly see, says Syed Ejaz, a policy analyst at Consumer Reports.

You May Like: Who Is Rocket Mortgage Owned By

What Interest Rate Can I Get With My Credit Score

While a specific credit score doesnt guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, lets assume that you meet the highest standards for all other criteria in your loan application. Youre putting down at least 20% of the home value, you have additional savings in case of an emergency and your income is at least three times your total payment. If all of that is true, heres how your interest rate might affect your credit score.

- Excellent Your credit score will have no impact on your interest rate. You will likely be offered the lowest rate available.

- Very good Your credit score may have a minimal impact on your interest rate. You could be offered interest rates 0.25% higher than the lowest available.

- Good Your credit score may have a small impact on your interest rate. This means rates up to .5% higher than the lowest available are possible.

- Moderate Your credit score will affect your interest rate. Be prepared for rates up to 1.5% higher than the lowest available.

- Poor Your credit score is going to seriously affect your interest rates. You may be hit with rates 2-4% higher than the lowest available.

- Very Poor This is trouble. If you are offered a mortgage, youll be paying some very high rates.

More from SmartAsset

How Your Credit Score Affects Your Interest Rates

Knowing your credit score is the first step in getting the best rates on your mortgage. While mortgage interest rates are currently at an all-time low, they drop even lower when your credit score is above 760.

According to FICO, the current interest rate for a 30-year fixed mortgage is 2.377% APR for a 760+ borrower, and 3.966% for a borrower with a score between 620 and 639 .

This 1.589% savings in APR may seem negligible. But it means saving about $260 per month on your mortgage, or $3,120 per year and roughly $93,600 over the lifetime of the loan.

If you currently have a mortgage and are interested in seeing if you can switch to a better rate, look into the pros and cons of refinancing your home.

Recommended Reading: Reverse Mortgage For Condominiums

How Is A Credit Score Calculated On A Joint Mortgage

When two people decide to buy a house together, they have a lot to consider. You and your partner have likely talked about how you’ll combine your finances, share expenses and save for major purchases.

Buying a home is one of the biggest decisions people will make. You’ve probably kept careful track of your credit score and made sure not to do anything that could lower it.

But what about your partner’s credit score? If you and your partner decide on a joint mortgage, both of your credit scores will come into play. This guide will review how credit scores work, how they affect mortgage applications, how to calculate credit score on a joint mortgage and what to do if your partner has bad credit.

Assess Your Unique Circumstances Before You Decide

On the other hand, applying on your own means the lender will only take into account your income and not your partners. This means you might qualify for a smaller mortgage. Regardless of whether one partner name is on the mortgage, his or her name can still be on the title of the home.

Understanding the ins and outs of credit scores and joint mortgages will help you and your partner take this major step together and get you closer to becoming homeowners. For answers to any questions you might have about joint mortgages, give our home lending advisors a call. Theyre happy to help.

Recommended Reading: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

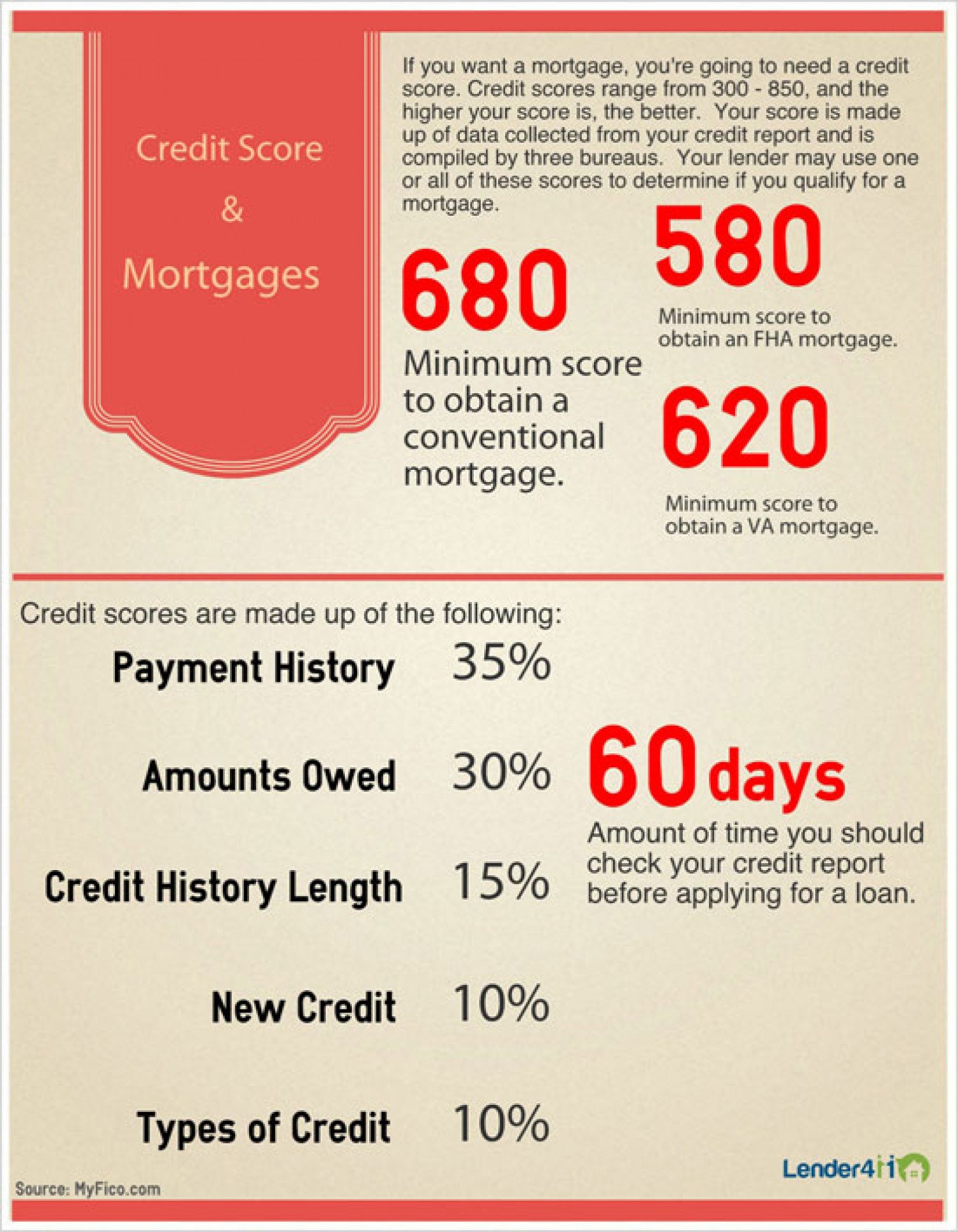

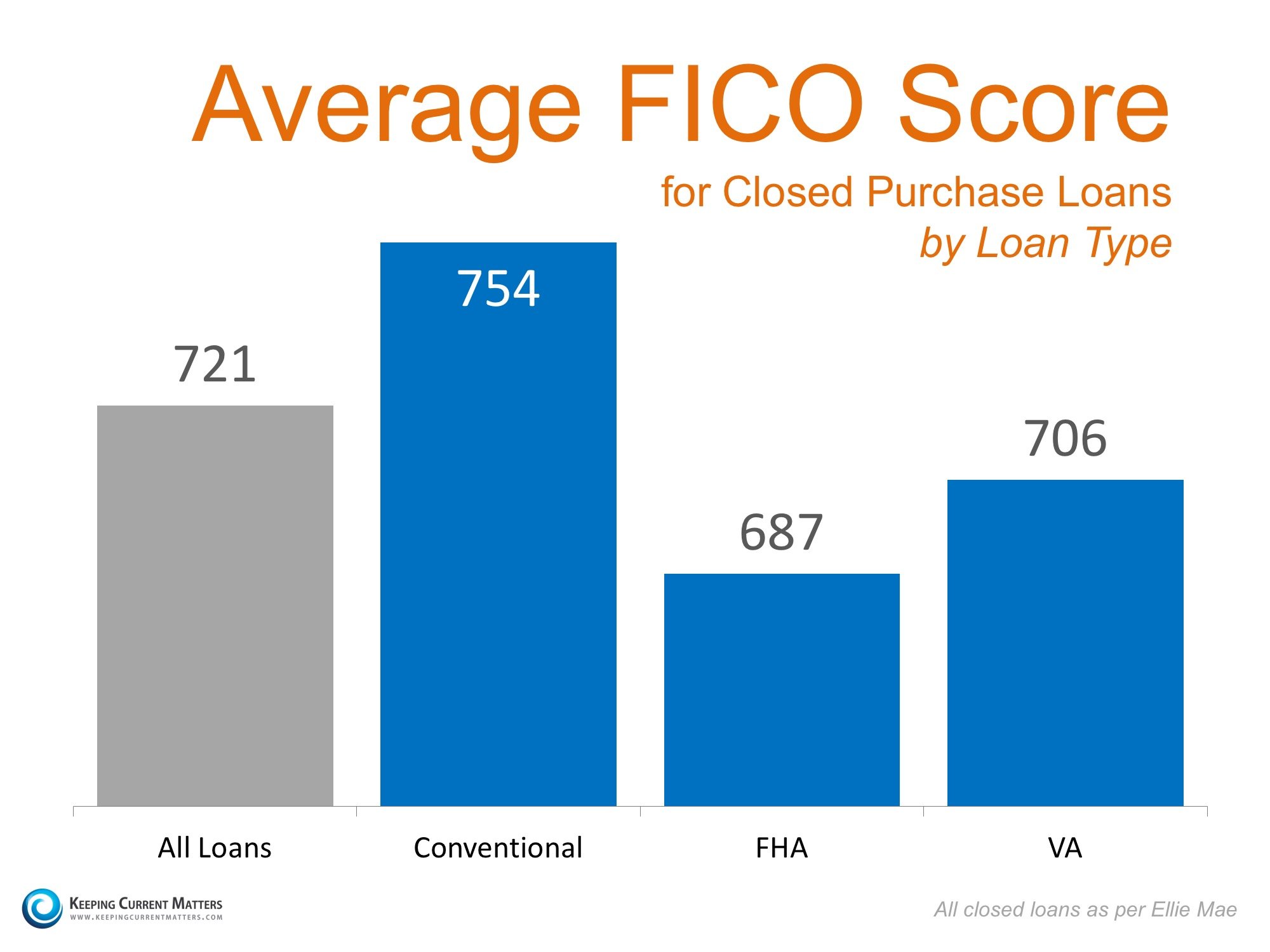

How Does Credit Score Determine Loan Type

Conventional loans require that you have a higher credit score, while Federal Housing Administration loans are a bit more forgiving when it comes to your score.

With an excellent credit score, you can expect to pay less for your loan because your interest rate will be lower.

Not only will a poor score affect your ability to get a loan, but if you do qualify for one, you could be paying thousands of dollars extra over the life of your loan due to a higher interest rate.

Your Fico Score And How It Impacts Your Mortgage

When it comes to home buying, we talk a lot about credit scores and what it takes to qualify for a mortgage. Youve probably heard credit scores being referred to as a FICO score but what does that mean, exactly? And what does it entail? Below, well share the important details you should know about your credit score and how it affects getting a mortgage loan.

Recommended Reading: How Much Does Getting Pre Approval Hurt Credit

Which Fico Score Do Mortgage Lenders Use

When you apply for a loan or credit card, its practically a given that a lender will check one of your credit reports and one of your credit scores as part of the underwriting process. Credit scores help lenders assess the risk of doing business with you and ultimately decide whether its a wise investment to loan you money.

As such, its smart to check your credit reports and scores before you apply for new financing. There is, however, a small catch.

You certainly do not have just one credit score you have hundreds. So, which credit score will a lender check when you apply for a loan? The answer is, as it usually is when it comes to credit scoring, it depends.

In this case, it depends entirely on what kind of loan youve applied for. For our purposes today, were going to look at the scores used for mortgage lending.

How Can You Protect Your Credit Score During The Covid

Taking steps to protect your credit score is more crucial than ever during the coronavirus crisis. Thats especially true if youre planning on buying a home.

So its important to stay on top of your finances during this challenging time. That includes paying your bills on time, and contacting lenders and service providers if you do run into trouble. Here are a few things you can do:

- Create a budget to know where you stand. The Barclays Budget Planner can help.

- If you foresee problems paying your loan or credit cards, contact them right away to explore your options.

- If you think youll be late paying your phone, utilities or other service providers, contact them to let them know and to discuss a possible arrangement. You can also find helpful advice at Barclays money management.

- To help you manage during this period, you can also find valuable ideas and resources at Barclaycard coronavirus help and support about protecting yourself from fraud and managing your finances.

- Youll also find other information about managing your Barclaycard account during the crisis at the Frequently Asked Questions page.

Also Check: 10 Year Treasury Vs Mortgage Rates

What Are Older Fico Models

FICO 8 and 9 arent the only versions in use. Some lenders and industries use older versions like FICO 2, 4, and 5. In fact, these are still used by the mortgage industry when assessing creditworthiness for new mortgages and deciding on interest rates.

FICO 2, 4, and 5 are very similar. The main differences between the three is that 2, 4,and 5 use data from Experian, TransUnion, and Equifax respectively. Mortgage lenders pull one of each and compile the reports in a document called a Residential Mortgage Credit Report. Duplicate data is screened and removed, and the middle score of the three is picked to represent your worthiness to pay back the mortgage.

FICO 8 and 9 use data from a single credit bureau, so using FICO 2, 4, and 5 together gives mortgage lenders a more complete view of your creditworthiness because they can see the history of every account youve opened. This is especially helpful for mortgage lenders as many creditors don’t report account history to all three credit bureaus.

Checking Your Credit Score

You should check your credit score well before you begin the mortgage process so you will know where you stand and the mortgage rate you could qualify for. You can check your credit score for free through several online services. Many banks, credit unions, and credit card providers offer credit scores as a regular feature. Since most major mortgage lenders use your credit score in their decision, it’s worthwhile to obtain all three of your reports to make sure the information on your record is accurate.

It’s a good idea to research your credit score and your credit reports well in advance of making a major purchase so you have time to address any errors or other issues you might discover.

Recommended Reading: Does Prequalification For Mortgage Affect Credit Score

What Credit Scores Do Mortgage Lenders Use

As a consumer, youve likely been offered opportunities to access your free credit report and scores through many online sources.

You may have even taken advantage of free credit report and scores through your bank or credit card company.

All of these are excellent ways to check and monitor your personal credit report as well as your credit scores. But theres a catch: The credit scores you receive from the majority of these free offers are not the same credit scores mortgage lenders will use when you apply for credit.

What Is The Difference Between A Fico Score And Other Credit Scores

Only FICO Scores are created by the Fair Isaac Corporation and are used by over 90% of top lenders when making lending decisions.

Why? Because FICO Scores are the industry standard for making accurate and fair decisions about creditworthiness. They help millions of people get the credit they need for a home, a new car, or a special purchase.

You may have seen ads for other credit scores, or likely even purchased them in the past. These other credit scores calculate your scores differently than FICO Scores. So while the other credit scores may seem similar to the FICO Score, they aren’t. Only FICO Scores are used by 90% of the top lenders.

Also Check: What Does Gmfs Mortgage Stand For