Is It Better To Pay Extra On Principal Monthly Or Yearly

Considerations. There are other small advantages to prepaying monthly instead of yearly. With each regularly scheduled payment on a fixed rate loan, you pay a little more principal and a little less interest than on the previous payment. So the sooner you prepay, the further ahead on the payment schedule you will jump.

Related Faq For How Much Income Do You Need For A $350 000 Mortgage

What mortgage can I afford on 80k salary?

So, if you make $80,000 a year, you should be looking at homes priced between $240,000 to $320,000. You can further limit this range by figuring out a comfortable monthly mortgage payment. To do this, take your monthly after-tax income, subtract all current debt payments and then multiply that number by 25%.

How much should I pay for house?

As a general rule, your total homeownership expenses shouldn’t take up more than 33% of your total monthly budget. If your anticipated homeownership expenses take up more than 33% of your monthly budget, you’ll need to adjust your mortgage choice.

How much deposit do I need to borrow 400 000?

In most cases, home loan lenders will lend up to 80% of the property value, meaning you’ll need to come up with the other 20% . For a property of $400,000, for example, you’ll need a cash deposit of $80,000.

How much house can I afford for 5000 a month?

Let’s say you earn $5,000 a month . According to the 25% rule we mentioned earlier, that means your monthly house payment should be no more than $1,250. Stick to that number and you’ll have plenty of room in your budget to tackle other financial goals like home maintenance and investing for retirement.

How much would a 30 year mortgage be on 200 000?

For a $200,000, 30-year mortgage with a 4% interest rate, you’d pay around $954 per month.

Monthly payments for a $200,000 mortgage.

| Interest rate |

|---|

How Much Do I Need To Make For A 250k Mortgage

How Much Income Do I Need for a 250k Mortgage? You need to make $76,906 a year to afford a 250k mortgage. We base the income you need on a 250k mortgage on a payment that is 24% of your monthly income. In your case, your monthly income should be about $6,409.

How much should you put down on a $12000 car?

A typical down payment is usually between 10% and 20% of the total price. On a $12,000 car loan, that would be between $1,200 and $2,400. When it comes to the down payment, the more you put down, the better off you will be in the long run because this reduces the amount you will pay for the car in the end.

What mortgage can I afford on 60k salary? The usual rule of thumb is that you can afford a mortgage two to 2.5 times your annual income. Thats a $120,000 to $150,000 mortgage at $60,000.

What is the 28 36 rule? A Critical Number For Homebuyers

One way to decide how much of your income should go toward your mortgage is to use the 28/36 rule. According to this rule, your mortgage payment shouldnt be more than 28% of your monthly pre-tax income and 36% of your total debt. This is also known as the debt-to-income ratio.

Also Check: How Much Is Mortgage On A 1 Million Dollar House

Do Extra Payments Automatically Go To Principal

The interest is what you pay to borrow that money. If you make an extra payment, it may go toward any fees and interest first. But if you designate an additional payment toward the loan as a principal-only payment, that money goes directly toward your principal assuming the lender accepts principal-only payments.

How Much Income Do I Need For A 200k Mortgage

Before you invest 200k into a home, youll want to be sure you can afford it.

To be able to borrow a 200k mortgage, youll require an income of $61,525 per year.

The income you need is calculated using a 200k mortgage on a payment that is 24% of your monthly income. In your situation, your monthly income should be about $5,127.

Don’t Miss: Does Prequalifying For A Mortgage Affect Your Credit

How Much Do Quicken Loans Employees Make

Category: Loans 1. Average Salary for Quicken Loans Employees PayScale Aug 19, 2021 The average salary for Quicken Loans employees is $70570 per year. Visit PayScale to research Quicken Loans salaries, bonuses, reviews, Rating: 3.9 · 77 votes Aug 19, 2021 Quicken Loans employees with the job

Will I Qualify For A Mortgage +

To know if you will qualify for a mortgage based on your current income, try our Mortgage Required Income Calculator. You will need to supply information about the cost of the Mortgage, down-payment, interest rates, and other liabilities, after which the calculator responds with the required minimum income to qualify for the loan.

Don’t Miss: Recast Mortgage Chase

How Much Is A 100k Mortgage Per Month Uk

Monthly payments on a £100,000 mortgage

At a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total £477.42 a month, while a 15-year might cost £739.69 a month. Note that your monthly mortgage payments will vary depending on your interest rate, taxes and PMI, among related fees.

How much is a 200 000 mortgage A month UK?

How does the term of the mortgage affect the repayments and the total amount?

| £200,000 Mortgage Over Different Terms | ||

|---|---|---|

| Monthly Repayment | ||

| 200k Mortgage over 20 years | £1106 | £66,169 |

How much deposit do I need to buy a house 2021 UK? This means you would need a deposit of 5% of the cost of the house youre buying. You can work this out by grabbing your smartphone and firing up the calculator. Get the house price, and multiply it by 0.05. The average UK house price in February 2021 was £250,341 according to HM Land Registry.

Can you renovate a house with 50k? It is possible to renovate parts of your property for less than $50,000, depending on the location it is in, the rooms you choose to renovate, and the cost of materials and labor. If youre comfortable working with your hands, you will be able to decrease these costs significantly.

Is Gutting A House Worth It

Truthfully, theres a big difference between gutting a property and remodeling. By definition, gutting a home means bringing the entire interior down to the studs. For this reason, gutting a property is often more costly and labor-intensive than simply doing a remodel.

Is it worth renovating an old house? Old houses can be bought for less. If youre looking for a true fixer-upper, youll likely pay less than you would for a new home. And if you do the renovations yourself, you can save thousands of dollars in the long run and youll end up with a great investment. An old house has plenty of character.

How much would a 30 year mortgage be on 200 000?

On a $200,000, 30-year mortgage with a 4% fixed interest rate, your monthly payment would come out to $954.83 not including taxes or insurance. Monthly payments for a $200,000 mortgage.

| Interest rate |

|---|

| $1,073.64 |

Oct 11, 2021

How much income do you need to buy a $400 000 house? What income is required for a 400k mortgage? To afford a $400,000 house, borrowers need $55,600 in cash to put 10 percent down. With a 30-year mortgage, your monthly income should be at least $8200 and your monthly payments on existing debt should not exceed $981.

Recommended Reading: Rocket Mortgage Qualifications

Add All Fixed Costs And Variables To Get Your Monthly Amount

Figuring out whether you can afford to buy a home requires a lot more than finding a home in a certain price range. Unless you have a very generous and wealthy relative who’s willing to give you the full price of your home and let you pay it back without interest, you can’t just divide the cost of your home by the number of months you plan to pay it back and get your loan payment. Interest can add tens of thousands of dollars to the total cost you repay, and in the early years of your loan, the majority of your payment will be interest.

Many other variables can influence your monthly mortgage payment, including the length of your loan, your local property tax rate and whether you have to pay private mortgage insurance. Here is a complete list of items that can influence how much your monthly mortgage payments will be:

Monthly Payments On A 200000 Mortgage

At a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total £954.83 a month, while a 15-year term might cost £1,479.38 a month.

Note that your monthly mortgage payments will vary depending on your interest rate, taxes and PMI, among related fees.

-

See your monthly payments by interest rate.

Interest

Don’t Miss: 10 Year Treasury Vs 30 Year Mortgage

How To Use Our Loan Interest Calculator

Say that you’re going to borrow $20,000 at a 5% interest rate. You expect to repay it over 5 years. Enter:

- “$20,000” as the Loan Amount

- “5” as the Term, and

- “5” as the Annual Interest Rate.

Use this total loan interest calculator to see how much interest you can expect to pay your lender over the lifetime of your loan.

How Much I’ll Pay In Loan Interest

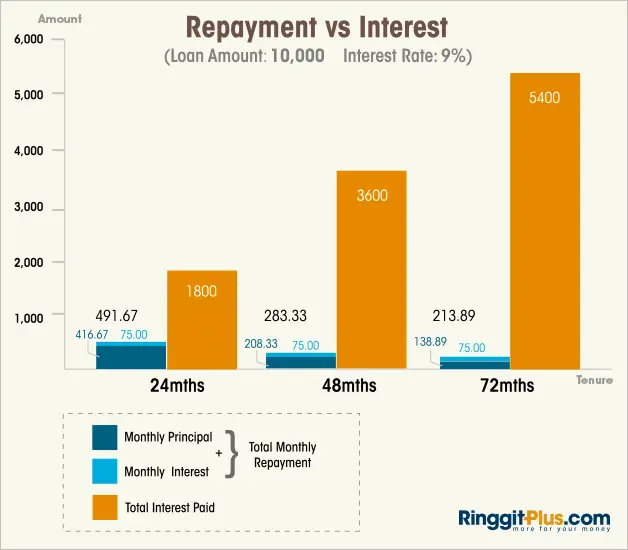

If you borrow $20,000 at 5.00% for 5 years, your monthly payment will be $377.42. Your total interest will be $2,645.48 over the term of the loan.

Note: In most cases, your monthly loan payments won’t change over time. With , the proportion of interest paid vs. principal repaid changes each month. As the loan continues to amortize, the amount of monthly interest paid will decrease .

Don’t Miss: How Does The 10 Year Treasury Affect Mortgage Rates

Can I Afford A 350k House

How much income do I need for a 350k mortgage? You need to earn $ 107,668 a year to afford a 350k mortgage. In your case, your monthly income should be around $ 8,972. The monthly payment on a 350,000 mortgage is $ 2,153.

How much do you have to earn to afford a 300,000 house? That means that to afford a $ 300,000 house, you need $ 60,000.

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loans amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Recommended Reading: Can You Do A Reverse Mortgage On A Mobile Home

What Is House Poor

House Poor Meaning

When someone is house poor, it means that an individual is spending a large portion of their total monthly income on homeownership expenses such as monthly mortgage payments, property taxes, maintenance, utilities and insurance. The down payment is just the start.

How do I know if I can afford a house? Take your gross monthly income and multiply it by 45% or . 45 on your calculator. Then subtract your minimum monthly payments on any of your consumer debts. Whats left is the amount you generally can afford for a mortgage payment.

How much salary do I need to buy a house?

The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross houshold income. This rule is based on your debt service ratios.

How much house can I afford if I make 80000 a year? So, if you make $80,000 a year, you should be looking at homes priced between $240,000 to $320,000. You can further limit this range by figuring out a comfortable monthly mortgage payment. To do this, take your monthly after-tax income, subtract all current debt payments and then multiply that number by 25%.

How Much House Can I Afford 50k Salary

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. Thats because salary isnt the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

Recommended Reading: Rocket Mortgage Requirements

How Much Income Do I Need To Qualify For A 200k Mortgage

As weve already touched on, it can come down to more than just the numbers on your wage slip. However, to give you a rough idea, some lenders cap the amount you can borrow based on x4.5 your salary, others go up to x5 and a minority to x6, under the right circumstances.

So, to give a ballpark figure, assuming two applicants, each would need a combined salary of between £33,000 and £50,000, although this does not include other varies lenders take into account when assessing affordability, such as how much deposit you have and your credit rating.

You can read more about affordability assessments here.

What Is The Monthly Payment On A $200 000 Home Equity Loan

On a $200,000, 30-year mortgage with a 4% fixed interest rate, your monthly payment would come out to $954.83 not including taxes or insurance.

Thereof Does a home equity loan require an appraisal? In a word, yes. The lender requires an appraisal for home equity loansno matter the typeto protect itself from the risk of default. If a borrower cant make his monthly payment over the long-term, the lender wants to know it can recoup the cost of the loan. An accurate appraisal protects youthe borrowertoo.

What is the payment on a 50000 home equity loan? Loan payment example: on a $50,000 loan for 120 months at 3.80% interest rate, monthly payments would be $501.49.

Beside this, How much should you put down on a 300k house? Fannie Mae and Freddie Mac require a down payment of only 3% of the purchase price. Thats $9,000 on a $300,000 home the lowest possible unless youre eligible for a zerodownpayment VA or USDA loan.

Don’t Miss: Can You Get A Reverse Mortgage On A Condo

How Much Income Do You Need For A 150 000 Mortgage

You need to earn $ 46,144 a year to afford a $ 150,000 mortgage. We base the income you need on a 150,000 mortgage on a payment that is 24% of your monthly income. In your case, your monthly income should be around $ 3,845. The monthly payment on a 150,000 mortgage is $ 923.

How much mortgage can I get approved for based on income?

The general rule is that you can afford a mortgage that is 2x to 2.5x your gross income. Total monthly mortgage repayments typically consist of four components: principal, interest, taxes and insurance .

How much income do you need to qualify for a $200 000 mortgage?

What income is required for a 200,000 mortgage loan? To be approved for a $ 200,000 mortgage with a minimum payout of 3.5 percent, you must have an approximate income of $ 62,000 annually.

Best Mortgage Lenders For A 200k Loan

When you want to buy a house with a mortgage of 200k, its a huge deal, so its wise to find the best mortgage lender to help you do that. We recommend shopping for offers from at least three different lenders to find the best rate.

You can compare mortgage rates and other loan terms and choose the best fit for you. Taking the time to do your research can really pay off big, Im talking about thousands of dollars over the life of the loan.

To help you choose the best mortgage lender, Smarts has picked the best mortgage lenders that weve found that offer an online easy application to help you get a home loan with the best terms.

One of the best online lenders is LoanDepot for borrowers looking to purchase and who want to start the application process online.

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

How Much Income Is Needed For A 250k Mortgage +

A $250k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $63,868 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a wider range of interest rates.

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

Also Check: Does Rocket Mortgage Service Their Own Loans