How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

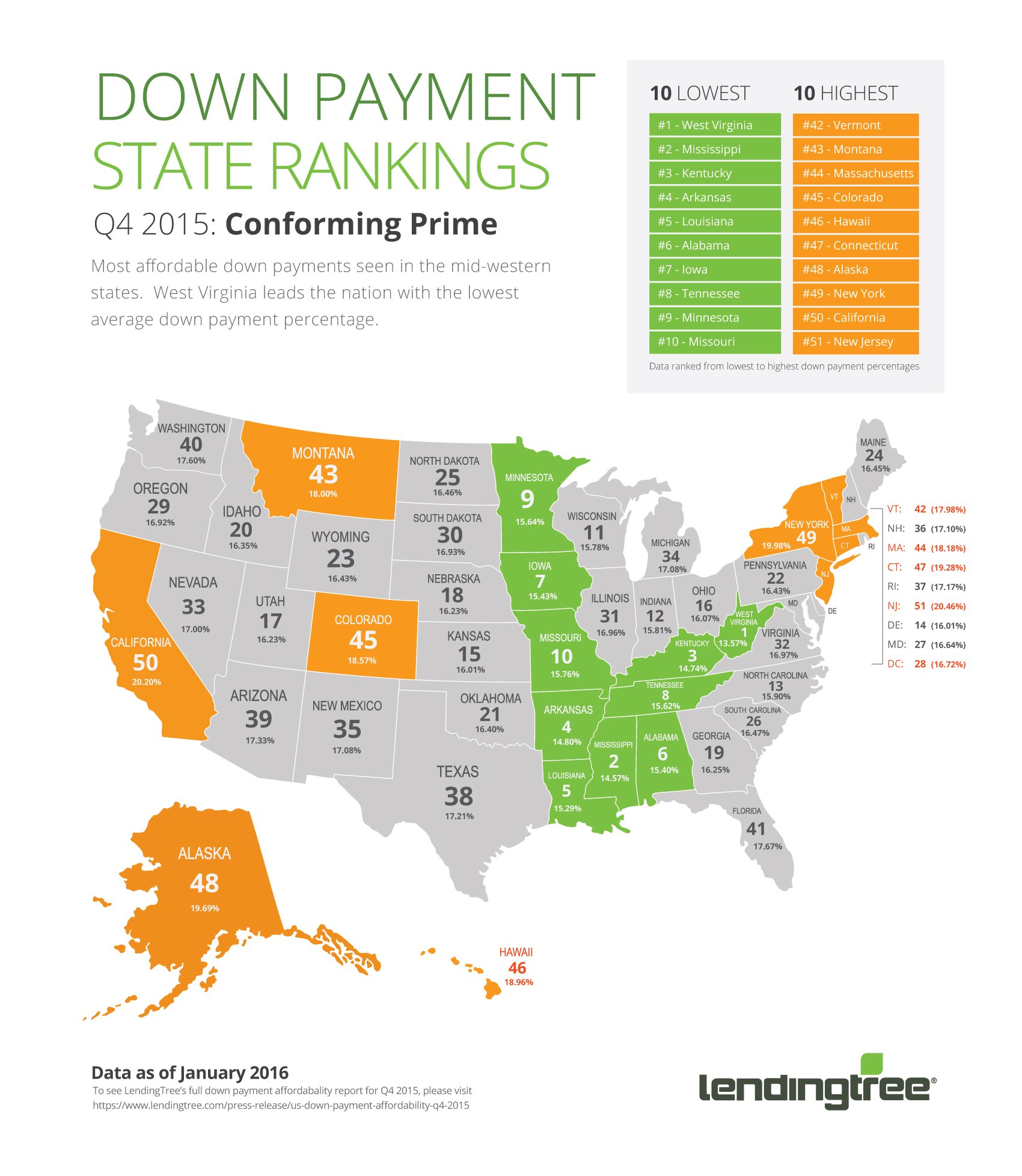

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

How To Lower Your Monthly Mortgage Payment

Mortgage payments are highly flexible. If youre worried that your home purchase may result in a toohigh monthly cost, there are quite a few ways to lower it and make homeownership more affordable.

You can:

- Apply with a cosignerwho has great credit and a low DTI

- Make a down payment large enough to avoid PMI

To get a feel for what your average monthly mortgage payment could be, check out our mortgage calculator. To get personalized rate quotes, check out the vetted mortgage lenders below.

How A Mortgage Calculator Helps You

Determining what your monthly house payment will be is an important part of figuring out how much house you can afford. That monthly payment is likely to be the biggest part of your cost of living.

Using NerdWallets mortgage calculator lets you estimate your mortgage payment when you buy a home or refinance. You can change loan details in the calculator to run scenarios. The calculator can help you decide:

Recommended Reading: Rocket Mortgage Launchpad

How Many Mortgage Accounts Are There In Canada

The total number of active mortgage accounts grew annually to 6.0 million, an increase of 1.2 per cent from last year, TransUnion said. While Canadians may be borrowing more to get into the real estate market, thus far they seem to be staying on top of their debts, as delinquency rates dropped to 0.56 per cent for the third quarter in a row.

Michigan Jumbo Loan Rates

As we mentioned, in most counties, any home loan thats $647,200 or less is a “conforming loan.” Loans exceeding that amount are considered jumbo loans and generally come with a higher interest rate. Why? Because if a bank is lending you an extra-large sum it wants some compensation for that extra risk. However, jumbo loans currently come with lower rates.

The average 30-year fixed Michigan jumbo loan rate is 3.38% .

Also Check: Mortgage Rates Based On 10 Year Treasury

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

Formula For Calculating A Mortgage Payment

The mortgage payment calculation looks like this: M = P /

The variables are as follows:

-

M = monthly mortgage payment

-

P = the principal amount

-

i = your monthly interest rate. Your lender likely lists interest rates as an annual figure, so youll need to divide by 12, for each month of the year. So, if your rate is 5%, then the monthly rate will look like this: 0.05/12 = 0.004167.

-

n = the number of payments over the life of the loan. If you take out a 30-year fixed rate mortgage, this means: n = 30 years x 12 months per year, or 360 payments.

You May Like: Monthly Mortgage On 1 Million

Increase Your Down Payment

Did you know that your down payment amount can have an impact on your mortgage rate? That’s because mortgage rates are generally tiered, and typically lower rates are available for those with a down payment of 20% or more. If possible, check with your lender to see if increasing your down payment will lower your mortgage interest rate.

Todays Mortgage Rates In Michigan

Whether youre ready to buy or refinance, youve come to the right place. Compare Michigan mortgage rates for the loan options below.

Compare current refinance rates today.

The rates below assume a few basic things:

- You have very good credit

- Your loan is for a single-family home as your primary residence

Also Check: Does Rocket Mortgage Service Their Own Loans

What Is A Mortgage Point

Some lenders may use the word “points” to refer to any upfront fee that is calculated as a percentage of your loan amount. Point is a term that mortgage lenders have used for many years and while some points may lower your interest rate, not all points impact your rate. Mortgage points can be found on the Loan Estimate that the lender provides after you apply for a mortgage.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: 10 Year Treasury Yield Mortgage Rates

How Are Average Mortgage Payments Per Month Determined

The average mortgage payment is determined by all the same factors that make up each individual borrowers monthly mortgage payment, just on a larger scale that reflects all the choices people of a given population make. After all, behind any average or median are millions of individuals, each going about their lives and making the decisions that make the most sense for them.

If youre a hopeful home buyer looking at these averages, its important to remember that your own mortgage is going to depend on factors that are unique to your situation, and your monthly payment might end up being anything but average. Thats why its a good idea to understand what factors can influence a mortgage payment, so you understand the why behind the averages.

How To Compare Mortgage Rates

While online tools, , allow you to compare current average mortgage rates by answering a few questions, you’ll still want to compare official Loan Estimates from at least three different lenders to ensure you are getting the best mortgage rate with the lowest monthly payment.

After applying for a mortgage, the lender will provide a Loan Estimate with details about the loan. Pay specific attention to which lender has the lowest mortgage rate, APR, and projected principal and interest payment. Then review the Origination Charges located on the Loan Estimate under Loan Costs to see how much the lender is charging in fees . The higher the fees and APR, the more the lender is charging to procure the loan. The remaining costs are generally applicable to all lenders, as they are determined by services and policies the borrower chooses, in addition to local taxes and government charges.

Recommended Reading: Chase Mortgage Recast Fee

How To Calculate Your Monthly Mortgage Payment

While averages can be helpful in showing you what people typically pay, when planning for your expected costs as a homeowner its much better to base your anticipated monthly payment on the factors that are unique to you: your home buying budget, your planned down payment, the interest rate youre likely to get and the area you plan on purchasing in.

To get an idea of how much you might pay for a mortgage each month, try using an online mortgage calculator like this one from Rocket Mortgage®. These calculators let you input those unique factors and give you an estimate thats specific to your circumstances.

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

You May Like: How Does The 10 Year Treasury Affect Mortgage Rates

Whats Included In A Mortgage Payment

While your mortgage is a single payment, it doesnt include just the balance of your loan. In fact, there are four main factors that go into your payment: the principal, interest, property taxes and homeowners insurance . You can calculate your expected mortgage payment based on this information. Note that if youre paying private mortgage insurance , this will be included in the payment as well, and potentially HOA fees if your home is in a homeowners association.

How Much House Can I Get For $5000 A Month

Lets say you earn $5,000 a month . According to the 25% rule we mentioned earlier, that means your monthly house payment should be no more than $1,250. Stick to that number and youll have plenty of room in your budget to tackle other financial goals like home maintenance and investing for retirement.

Don’t Miss: Rocket Mortgage Loan Types

Homeowners Insurance In Michigan

Homeowners insurance in Michigan is slightly less than the national average with a median cost of $1,073 per annum. Most insurance policies will cover theft, fire, smoke damage and more. Flood damage is not usually covered and can be purchased at an additional cost through the National Flood Insurance Program by FEMA. Flooding is Americas most common natural hazard and a policy to cover potential flood damage is an asset in Michigan due to the heavy rain the state can sometimes experience.

Mortgage Payments By City

Especially in coastal cities where space is at a premium, a monthly home payment can be much higher than the national average or median payment. According to US Census Bureau data from the 2018 American Community Survey, the median monthly home payment was more than $2,500 per month in Los Angeles, and over $2,700 per month in the New York City area.

But, not all metro areas are as expensive in Phoenix, Arizona, the median home payment is about $1,500 per month, and about $1,700 per month in Dallas. Here’s how the most populated metro areas stack up in monthly living costs according to Census Bureau data. Cities are listed by size.

| City |

| $253,300 |

Recommended Reading: 10 Year Treasury Yield And Mortgage Rates

Mortgage Payments By Income

Just like the average mortgage payment in Utah is different from payments elsewhere, this segment varies by income, as well. According to the data provided by the US Census Bureau, Americans making the most money have the highest average house payments per month. People from this income group, interestingly, dont have the highest median interest rate.

The highest mortgage interest rates are reserved for Americans making between $10,000 and $39,999. Those from the $10,000-19,999 income group are among the consumers paying the highest interest rate. Yet, they boast the lowest typical mortgage payment per month.

As you can see in the table above, households making $120,000 or more pay the highest median mortgage of about $1,600. Those making $10,000-19,999 meanwhile pay the lowest median mortgage payment per month of $607.

The difference between the highest and lowest median payments is an impressive $993. The first group gets better median rates of 4%, while the latters median mortgage rate is 5%.

Historical Mortgage Rates In Michigan

Michigan Mortgage Rates Quick Facts

- Median Home Value: $169,600

- Loan Funding Rate: 62.72%

- Homeownership Rate: 74.3%

- Median Monthly Homeownership Costs: $1,298

After trailing just behind the national average from 2011 to 2016, average mortgage rates in Michigan rose above the national average in both 2017 and 2018. So over time, mortgage rates in Michigan have seen quite a bit of fluctuation.

A financial advisor in Michigan can help you plan for the homebuying process. Financial advisors can also help with investing and financial plans, including tax, retirement and estate planning, to make sure you are preparing for the future.

Don’t Miss: Mortgage Recast Calculator Chase

Mortgage Payments By Age

Americans in their prime owe the highest average mortgage debt, our stats show. So, it makes sense that this age group also deals with the highest average house payments too.

You can find the median payments rather than the typical monthly mortgage payment for each age group in the table below. Namely, the median amount gives a better picture, and hence the US Census Bureau provides these statistics instead.

As you can see in the table, Americans aged 35-55 pay the highest mortgage of $1,192. Homeowners aged 75+, by contrast, pay significantly lower monthly installments of $696. This age group also has the lowest average mortgage payment in the US.

The difference between the highest and the lowest cost is always interesting to analyze. In this category, its only $496 or much lower than the difference of payments by income. The only Americans whose median monthly payments are above $1,000 range from 30 to 54 years. These are some amusing trends we spotted analyzing the median and average monthly house payments by age.

What Is The Average Mortgage Payment In Texas

4.3/5averagemortgage paymentaverage

Furthermore, what is the average monthly mortgage payment in the US?

$1029

Similarly, what is the average mortgage payment on a 300k house? Monthly Pay: $1,101.97

| Total | |

|---|---|

| Total of 360 Mortgage Payments | $396,707.77 |

Also to know, what is monthly payment for 250k mortgage?

Monthly payments on a $250,000 mortgageAt a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total $1,193.54 a month, while a 15-year might cost $1,849.22 a month.

What is the mortgage payment on 240k?

If you are buying a $240,000 house with 5% down then the loan amount is $228,000. Let’s use 5% interest rate for 30 years and it has a principal and interest payment of $1223. Insurance would be around 240000 x . 005 = 1200 /12 = $100/mo, taxes would be about $240,000 x .

| Mortgage Principal |

|---|

You May Like: Chase Recast Mortgage

What Is The Average Mortgage Payment In Nj

Bangalore, India

The average monthly mortgage payment in the United States is $1029*. This payment eats New Jersey, $1,355.00, 14.28%. Massachusetts

Nashik, India

The current average 30-year fixed mortgage rate in New Jersey decreased 2 to see if increasing your down payment will lower your mortgage interest rate.

San Diego, United States

That’s significantly higher than the 1.1% average throughout the United States. How do I calculate my mortgage payment? Your monthly mortgage payment

Detroit, United States

The truth is borrowers don’t necessarily need a down payment of 20% to buy a house. The average down payment among New Jersey home

Pune, India

Bankrate has offers for New Jersey mortgage and refinances from top partners that are well below the national average. Compare, apply These provide down payment assistance and affordable, government-backed mortgages. Programs

Surat, India

Mortgage payments by state. While some states have relatively low home values, homes in states like California, Hawaii, and New Jersey have”Mortgage payments by state · Mortgage payments by city

CityWorth Sets the Standards: Direct Lender Dedicated Mortgage Experts and Personalized Service Rates and Fees Delivered as Promised Quick Processing, Approval and Closing Company-wide focus on Customers Satisfaction Financing is easier than ever. Call ( or fill out this form to get started.

Django, datetime and timezones in Python Programming Language?

What Is The Average Monthly Mortgage Payment In The Us

The average monthly mortgage payment in the United States is $1029*.

This payment eats up 14.84% of the typical homeowners monthly income. That may seem low, but we are looking at homeowners specifically and homeowners tend to have much higher incomes than the general population, as we note later in this piece. When you add in other housing costs such as property taxes, association dues, utilities and maintenance costs, the median cost of housing jumps to $1,491 for homeowners with a mortgage.

On average, first-time homebuyers face higher monthly payments than the national average. According to research from the Urban Institute, in early 2018, first-time homebuyers bought houses worth $245,320 with an average down payment of $22,561, and an interest rate of 4.43%. Given these figures, first-time borrowers faced a mortgage payment of $1,235 21% more than the average homeowner.

Of course, a homeowners actual mortgage costs depend on a variety of factors, including when a homeowner purchased a home, where the home is located and the terms of the loan. Additionally, the affordability of a monthly mortgage payment depends the cost of the mortgage relative to a homeowners income.

Recommended Reading: Chase Recast Calculator

Michigan Mortgage Credit Certificate

The Michigan Mortgage Credit Certificate allows first-time homebuyers throughout the state and repeat buyers in targeted areas to claim a federal tax credit for the interest on their mortgage. The credit is worth up to 20 percent of the interest paid yearly, and can be claimed each year for up to 30 years.

With interest rates at record lows, Michigan borrowers may be interested in refinancing their mortgage into a new one with a lower rate. Use Bankrates mortgage refinance calculator to see how much you can save by lowering your rate.

Michigan mortgage resources