How Much Do I Need To Earn For A 100000 250000 Or 500000 Mortgage

Our calculator shows that for a £100,000 mortgage you will need to earn at least £22,500 as a single applicant or between you if youre applying for a joint mortgage. Bear in mind that a £100,000 mortgage can result in different LTVs and therefore different rates, depending on the amount of deposit you have and the overall value of the property.

For a £250,000 mortgage you will need to earn at least £56,000 as a single applicant or between you if applying as a couple, while for a £500,000 mortgage you will need a earn at least £111,500 as a single applicant or as joint income for a shared mortgage.

How Much Income Is Needed For A 250k Mortgage

A $250k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $63,868 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a wider range of interest rates.

Read Also: What Banks Look For When Applying For A Mortgage

How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is, unless you have enough cash to purchase a property outright, which is unlikely. Use the mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

You May Like: Reverse Mortgage Manufactured Home

Can I Borrow Up To Five Times My Salary

It is possible to borrow five times your salary but only if you meet the lenders affordability tests and requirements for loan-to-value and minimum salary. To get a mortgage of this scale, youre likely to need a deposit of at least 10%, if not more to have access to a wider range of mortgage deal and may face a maximum lending cap. Some borrowers may look to lengthen their mortgage term to thirty years help make monthly payments more affordable.

Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit a mortgage payment at 28 percent of your gross that is after-tax monthly income. So, if you simply multiply your annual income by 0.28, then divide by 12, youll find your maximum monthly mortgage payment.

The amount a borrower agrees to repay, as set forth in the loan contract.

Read Also: What Does Gmfs Mortgage Stand For

First: What Is A Mortgage Payment

Mortgage payments are the amount you pay lenders for the loan on your home or property, including principal and interest. Sometimes, these payments may also include property or real estate taxes, which increase the amount you pay. Typically, a mortgage payment goes toward your principal, interest, taxes and insurance.

Many homeowners make payments once a month. But there are other options, such as a twice a month or every two weeks.

Analyze Your Monthly Expenses

When estimating what you can afford, its also important to have a clear view of your monthly expenses. These can be hard to track and will likely vary based on the size of your household and your spending habits. According to the Bureau of Labor Statistics, the average individual has monthly expenditures that include:

- Food: $644

- Internet: $47

- Cell phone: $120

For an individual, these expenses add up to a monthly total of $2,463. Some of these items are discretionary and will fluctuate based on your lifestyle, city, the size of your home, and the size of your family. The goal is to estimate how much money youll need to spend each month after you pay your mortgage and other debts.

You May Like: Reverse Mortgage On Mobile Home

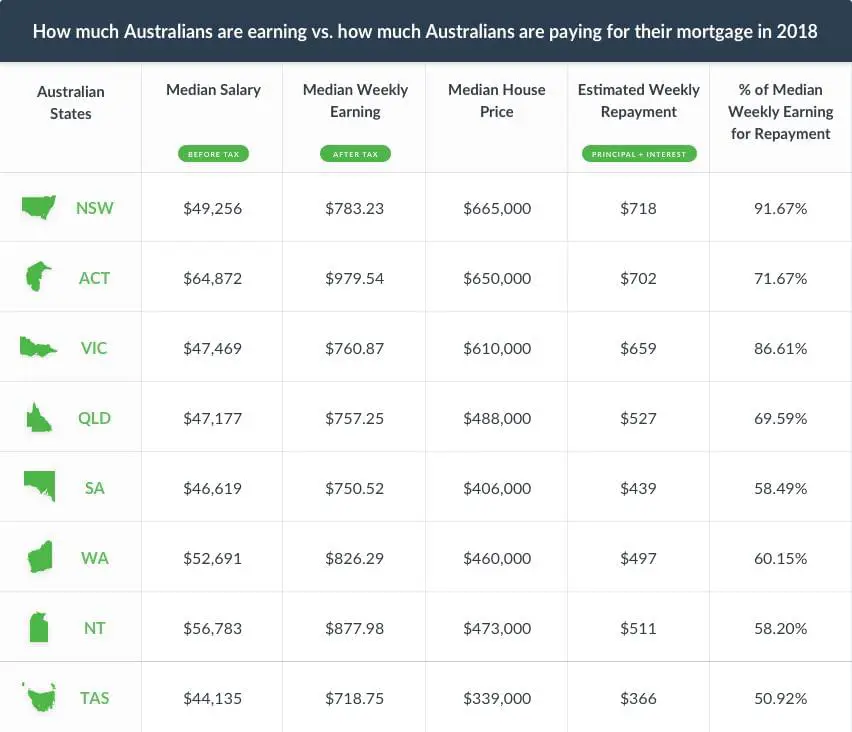

What Percentage Of Your Income Should Your Mortgage Be

Calculating the percentage of income for your mortgage payments will help you understand exactly how much you can afford to spend. Buying real estate via a mortgage is the largest personal investment that most people make in their lifetime.

For this reason, working out how much you can comfortably borrow depends on several factors. Its not just a question of how much the bank is willing to lend you. Factors such as the mortgage percent of your net income , finances, priorities, and preferences are all part of the equation.

As a general rule, most prospective homeowners can finance a property that costs anywhere between two and two-and-a-half times their gross annual income . Now, lets imagine that you earn $100,000 per year. This would mean that you can afford a mortgage between $200,000 and $250,000. However, this calculation is only a general guideline.

Ultimately, when you consider buying a property, there are several essential factors to consider. Primarily, you need to have a good idea of the amount your lender thinks you can afford . Next, it helps to take a personal inventory and think about the type of home where you would like to live. If you plan to live in your new home for many years, what sort of things will you be willing to trade-offor notto afford your dream home?

Whats Behind The Numbers

NerdWallets Mortgage Income Calculator shows you how much income you need to qualify for a mortgage. It uses five numbers – home price, down payment, loan term, interest rate and your total debt payments – to deliver an estimate of the salary you need to buy your home. After those first five inputs, you can answer optional questions to refine your result.

Also Check: Rocket Mortgage Requirements

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

How Much Can I Afford To Borrow

Knowing how much you may be able to borrow is one thing, but knowing how much you can comfortably afford and being confident in your ability to keep up with your repayments is another. This is why youll need to carefully go through your outgoings, making sure to use a mortgage repayment calculator so you get an idea of what your repayments could be and whether you could absorb them in your current salary.

Bear in mind that if youre moving to a bigger property there could be additional expenses to pay, and if youre moving from rented accommodation into homeownership, your outgoings could change again, and thats before we even get to the additional costs of moving . This means its vital to go through everything in advance to make sure youre prepared for the impact on your finances.

Once youve tallied everything up, you can make a decision about the kind of mortgage you can comfortably afford. Though make sure to be realistic its generally recommended that no more than 28% of your household income should go on housing expenses, so if your final total is above this level, it may be worth reconsidering.

Also Check: Can You Refinance Mortgage Without A Job

Required Income Calculator For A Home Purchase Or A Refinance

Have you found a home that you want to buy? Or plan on refinancing? Or you’re looking at homes around a certain price point. Can you get a loan to buy it? Need to see how much you can qualify for on a refinance?

This mortgage income calculator can give you the answer. This calculator not only takes into account the loan amount and interest rate, but also looks at a whole range of other factors that affect the affordability of a home and your ability to get a mortgage, including your other debts and liabilities that have to be paid each month, as well as costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment.

It also makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan, by using the sliding adjusters below to change your results. Just start filling out the fields indicated below. Or scroll down the page for a detailed explanation of how to use the Mortgage Required Income Calculator.

- FAQ: Great tool to use as loan amount estimates change as you shop for a new home. Or for a refinance when the appraised value forces a change in loan amounts because of loan to value .

What To Do If You Want More Home Than You Can Afford

We all want more home than we can afford. The real question is, what are you willing to settle for? A good answer would be a home that you wont regret buying and one that wont have you wanting to upgrade in a few years. As much as mortgage brokers and real estate agents would love the extra commissions, getting a mortgage twice and moving twice will cost you a lot of time and money.

The National Association of Realtors found that these were the most common financial sacrifices homebuyers made to afford a home:

These are all solid choices, except for making only the minimum payments on your bills. Having less debt can improve your credit score and increase your monthly cash flow. Both of these will increase how much home you can afford. They will also decrease how much interest you pay on those debts.

Consider these additional suggestions for what to do if you want more home than you can afford:

- Pay down debt, especially high-interest credit card debt and any debt with fewer than 10 monthly payments remaining

- Work toward excellent credit

- Ask a relative for a gift toward your down payment, especially if you can demonstrate your own efforts toward becoming an excellent candidate for a mortgage

Also Check: Chase Recast

Budget For Homeowner Costs

Beyond the costs of purchasing a home, youll likely have expenses related to owning and maintaining your home:

Homeowners insurance

Lenders will require that you carry homeowners insurance, which protects your property in case of damage. The amount will vary depending on your homes value and location. Certain areas that are prone to floods or earthquakes may have higher premiums.

Property taxes

You will also pay property taxes to your local government. This amount is based on the value of the property and land and is used to cover costs such as infrastructure, school, law enforcement, and fire service.

Maintenance and repairs

Maintenance includes the ordinary expenses that come with owning a home, such as painting, taking care of a lawn, fixing appliances, and cleaning living spaces. The average homeowner spent $2,289 a year on maintenance and repairs in 2016, according to Bureau of Labor StatisticsConsumer Expenditure Survey. If youre preparing your home for sale or just curious about general upkeep, review our home maintenance and repair checklist.

The average Homeowners Association fee is $200 to $300 per month for a typical single-family home, according to Realtor.com. This money usually covers shared amenities and services for a community such as a pool or gym, trash removal, snow removal, or maintenance to common areas.

Why Its Smart To Follow The 28/36% Rule

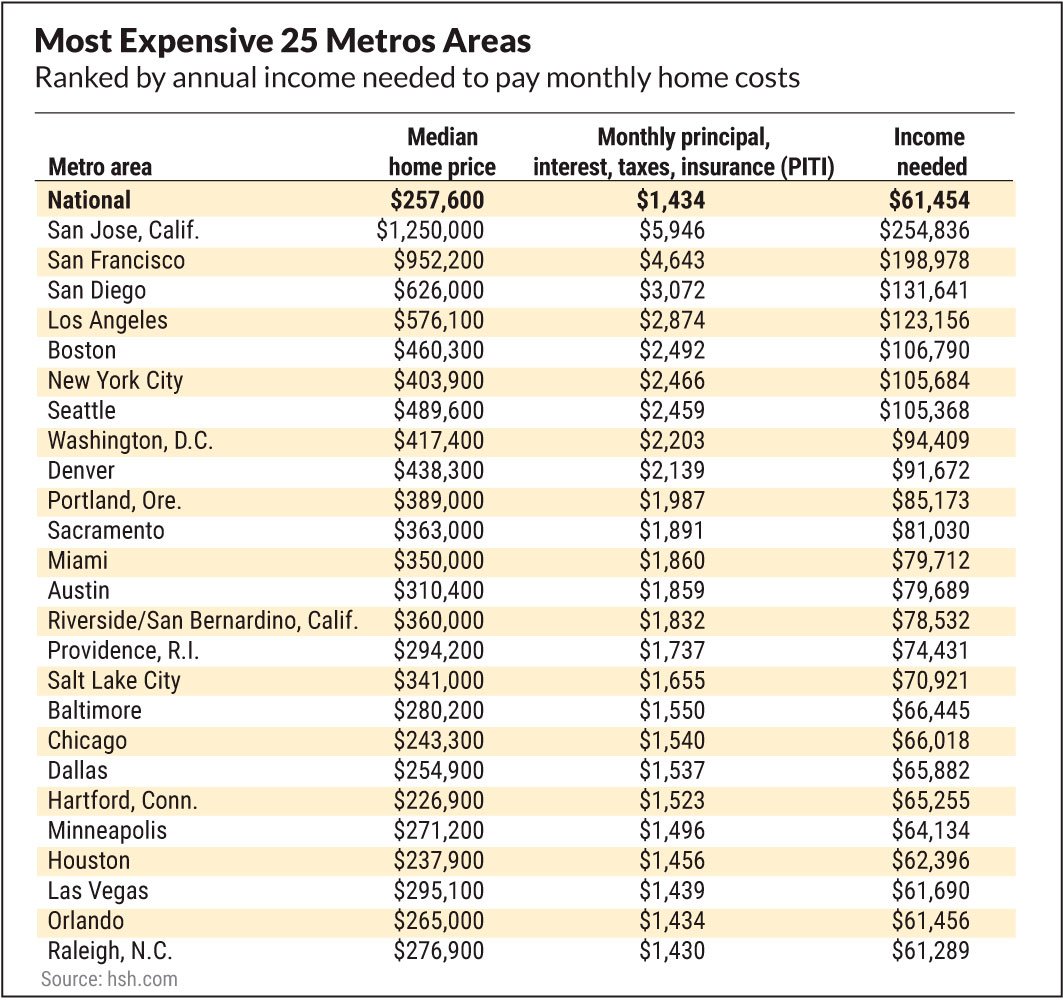

Most financial advisors agree that people should spend no more than 28 percent of their gross monthly income on housing expenses and no more than 36 percent on total debt that includes housing as well as things like student loans, car expenses and credit card payments. The 28/36 percent rule is the tried-and-true home affordability rule that establishes a baseline for what you can afford to pay every month.

Example: To calculate how much 28 percent of your income is, simply multiply your monthly income by 28. If your monthly income is $6,000, for example, your equation should look like this: 6,000 x 28 = 168,000. Now, divide that total by 100. 168,000 ÷ 100 = 1,680.

Depending on where you live and how much you earn, your annual income could be more than enough to cover a mortgage or it could fall short. Knowing what you can afford can help you take financially sound next steps. The last thing you want to do is jump into a 30-year home loan thats too expensive for your budget, even if you can find a lender willing to underwrite the mortgage.

You May Like: Chase Mortgage Recast Fee

How A Rental Suite Affects Your Mortgage Qualification

To see how much difference the change in rental income makes, lets run through an example.

GDS = /Gross household income + Gross rental income x 100

P = Mortgage Principal

I = Mortgage Interest

T = Property Taxes H = Heating

For example, if you have an annual mortgage payment of $17,400, property taxes of $3,000, heating bill of $1,320, gross household income of $72,000, and gross rental income of $9,600, your GDS under the old rules would be:

GDS = / $72,000 + x 100 = 28.28%

Under the new rules your GDS would be:

GDS = / $72,000 + $9,600 x 100 = 26.62%

Since your GDS ratio is lower under the new rules, youll be able to qualify for a higher mortgage and buy a more expensive home.

Ugh This Is Making My Head Hurt

Yup. Mortgages arent fun. Still, a house is one of, if not the, most expensive thing youll ever spend money on so its best to give it a ton of consideration. Being saddled with an unruly mortgage will affect you for years and years. To that end, the more thought you give it now, the less worry youll have later. So remember, the question isnt just How much mortgage can I afford? but How much mortgage do I want? for the long term.

More from SmartAsset

Read Also: How Does The 10 Year Treasury Affect Mortgage Rates

That Makes Sense I Think My Credit Score Is In Good Shape Thankfully Is There Anything Else That Happens Before I Get The Mortgage

As far as the lenders work goes, not really. When determining the answer to How much mortgage can I afford?, the lender can tell you what theyre willing to give you, but it is very important that you take stock of your current situation and assess your future before committing to a loan. In other words, were back to the question of what size debt are you comfortable taking on.

What Is A Mortgage Qualification

A pre-qualificationfor a mortgageis basically an opinion by a lender,provided as a letter or a certificate,that states that they believe a potential borrower will be able to qualify for a loan. The lender bases their opinion upon credit,employment,income,debt,and asset information provided by the potential borrower.

Also Check: Does Getting Pre Approved Hurt Your Credit

What Do You Mean

OK, for example, you might be making good money at your current job. But what if you dont like it and youre thinking of quitting? And what if your future job doesnt pay as well and you therefore have less monthly income? Are you going to feel comfortable continuing to pay the same amount each month?

Moreover, how is the health of your parents or your spouses parents? Are there medical bills down the road youre going to have to contend with? Are you thinking of starting or adding to your family?

Basically, you need to be honest with yourself about your personal expenses. How do you like to spend your money? Relatively small things add up and can put a dent in your monthly budget.

You also have to consider how youre going to decorate the house. Can you afford to furnish every room once you own them? And what do you expect your utility bills to be? What if the stove breaks in six months? Will you have the savings to get it repaired quickly? And speaking of savings, hows that situation going, or going to change in the months and years ahead? Are you currently trying to stow away lots of money for the future? If so, thats another issue you need to consider.

How Much House Can I Afford Based On My Salary

To calculate how much house you can afford, use the 25% rulenever spend more than 25% of your monthly take-home pay on monthly mortgage payments.

That 25% limit includes principal, interest, property taxes, home insurance, private mortgage insurance and dont forget to consider homeowners association fees. Whoathose are a lot of variables!

But dont worry, our full-version mortgage calculator makes it super easy to calculate those numbers so you can preview what your monthly mortgage payment might be.

Don’t Miss: Mortgage Recast Calculator Chase

My Monthly Rbc Mortgage Payment Will Be

$0*/month

The mortgage amount is based on the qualifying rate of%.* The payment amount is calculated based on an interest rate of %.

View Legal DisclaimersHide Legal Disclaimers

Enter your annual household salary. This includes your spouse/partner.

Consider car payments, credit cards, lines of credit and loan payments. This should not include your rent.

Enter the amount of money you plan to use as a down payment. Donât forget you can also leverage your RRSPs.

The Home Buyers’ Plan allows you to borrow funds from your RRSP to purchase your first home. Here are some of the key facts:

- You and your spouse can each withdraw up to $35,000 from your RRSP.

- The funds must have been on deposit at least 90 days before you withdrew them.

- At least 1/15 of the funds must be repaid each year, beginning two years after the funds were withdrawn.

- A signed agreement to buy or build a qualifying home is required.

- You can only participate in the program once.

For details,watch this video or seeCanada Revenue Agency

Default insurance covers the lender in case of a failure to pay off the full mortgage amount. If your down payment is from 5-19%, a default insurance premium will automatically be applied to your mortgage.

Other monthly expenses you may want to consider include such items as alimony and condo fees .