How Does The Irs Know If I Have Rental Income

An audit can be triggered through random selection, computer screening, and related taxpayers. Once you are selected for a tax audit, you will be contacted via mail to start the process of reviewing your records. At that point, the IRS will determine if you have any unreported rental income floating around.

Apply For An Investment Loan Now

We are mortgage brokers that specialise in finding solutions for people who are in situations that are outside of the box, and for investors that earn rental income thats difficult to prove or doesnt meet .

If youd like to know how we can help with your home loan then please call us on 1300 889 743 or fill in our . Our mortgage brokers are experts in helping people get the most out of their income sources and will help you get the best rates available!

Other Types Of Real Estate Investments

Aside from rental properties, there are many other ways to invest in real estate. The following lists a few other common investments.

REITs

Real Estate Investment Trusts are companies that let investors pool their money to make debt or equity investments in a collection of properties or other real estate assets. REITs can be classified as private, publicly traded, or public non-traded. REITs are ideal for investors who want portfolio exposure to real estate without having to go through a traditional real estate transaction.

For the most part, REITs are a source of passive income as part of a diversified portfolio of investments that generally includes stocks and bonds.

Buy and Sell

Buying and selling is similar to rental property investing, except there is no or little leasing out involved. Generally, real estate is purchased, improvements are made, and it is then sold for profit, usually in a short time frame. Sometimes no improvements are made. When buying and selling houses, it is commonly called house flipping. Buying and selling real estate for profit generally requires deep market knowledge and expertise.

Wholesaling

Wholesaling is the process of finding real estate deals, writing a contract to acquire the deal, and then selling the contract to another buyer. The wholesaler never actually owns the real estate.

Read Also: Rocket Mortgage Requirements

Do You Have A Housemate Or Sub Tenants

First home buyers that want to buy a 2 or 3 bedroom home but dont have the income to afford it may lease out a room to a friend. Technically, this is known as leasing to a sub tenant.

Again, this can cause trouble when applying for a loan as many lenders dont take any rent from flatmates into account when assessing if you can afford a loan.

In this situation, getting a home loan usually depends on:

- The percentage of the property value youre borrowing.

- How reliant youre on the income from your flatmate.

- What evidence you can provide to show the rent income.

These situations can be tricky, so please call us on 1300 889 743 or complete our to talk to our mortgage brokers about your rent income.

Here Are The Rental Income Scenarios Well Review:

Scenario #1: Using rental income from an investment property you already own to qualify for a Conventional or FHA mortgage.

Scenario #2: Using rental income from an investment property youre purchasing to qualify for a Conventional or FHA mortgage.

Read on for a review of the required documentation and the qualifying income calculation for each scenario.

Read Also: Chase Recast

Why Do Most Banks Only Accept 80%

The reason lenders use only 80% of your rent is that they assume that 20% of the rent you receive will be used to pay for managing agents fees, council rates, strata levies, repairs and to cover for any vacancies.

However, each lender has a different policy, so its best to call us on 1300 889 743 or complete our and our mortgage brokers will help you apply for a loan with the right lender.

Rental Income For Buy

While you can use rental income to apply for both buy-to-let and residential mortgage applications, there are a few key differences on what lenders require based on the type of property you want to purchase. Although there are many lenders who will treat them the same, other lenders will ask for full income verification for main residential mortgages.

If youre purchasing a buy-to-let property many lenders will happily accept rental income shown on your bank statements, especially if you havent received the income for more than 12 months. If you are a professional landlord with multiple properties it will be easier to find lenders willing to accept your rental income for your mortgage application than it would be if you were only just starting out as a buy-to-let landlord.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

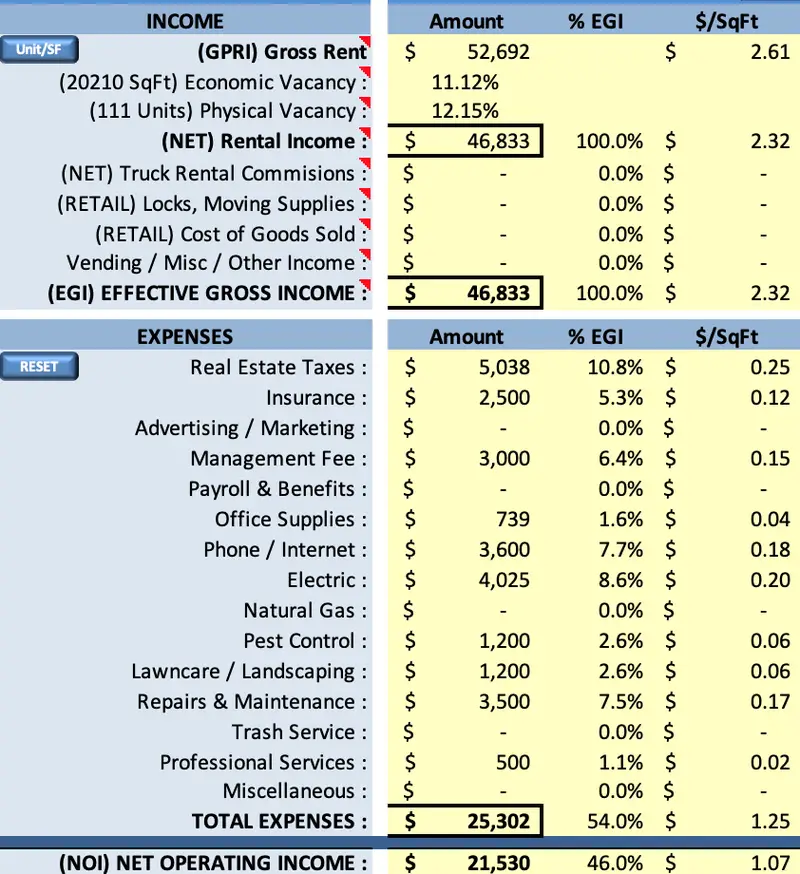

Defining The Net Operating Income Metric

Net operating income serves as a way to analyze the viability of a real estate investment property. Finding a property’s net operating income means figuring out how much money it brings in after covering all of its expenses and accounting for unrented time periods and expenses for maintenance and operations.

While NOI can change over time as the property’s revenue and expenses fluctuate, lenders and creditors still find NOI to provide valuable information about whether the property earns enough income to support payments on its debt.

NOI can be affected by property owners who delay expenses because they’re trying to make the property look more profitable. Likewise, the debt payments and interest expense don’t factor into the NOI calculation, so it can be misleading unless you also factor in these necessary payments.

When Is Predicted Rental Income Accepted For Underwriting

Sometimes, rental income cant be proven via a tax return. Say, for example, youve just purchased the property, or you purchased the property in the middle of the year and only show a portion of the rental income on your tax return.

In that case, the rental income would be considered predicted and may be used under certain circumstances for underwriting purposes. Again, its a matter of being able to show proof of the propertys income potential.

If the renter has a tenant, lenders will take a percentage of the income thats outlined on a lease and use that to determine projected rental income. They usually use 75% of your total reported income 25% is subtracted to account for potential vacancies and ongoing maintenance.

If theres no tenant, the lender will have an appraiser do an audit of the property and use comparables of rental prices for similar properties in the area to estimate the potential rental income.

When is predicted rental income not acceptable?

Predicted rental income is not always acceptable for underwriting, though. First and foremost, you may have a problem getting it counted if it cannot be documented . This is because lenders sometimes request copies of checks as proof that the rent is regularly being paid on time.

Don’t Miss: Chase Recast Calculator

Can I Have 2 Mortgages At The Same Time

This comes as a surprise to most, but there’s no law stopping you from having multiple mortgages, though you might have trouble finding lenders willing to let you take on a new mortgage after the first few! Each mortgage requires you to pass the lender’s criteria, including an affordability assessment and credit check.

What Is Your Principal Residence

Your principal residence can be any of the following types of housing units:

- a house

- an apartment in an apartment building

- an apartment in a building such as a duplex or triplex

- a trailer, mobile home, or houseboat

A property qualifies as your principal residence, for any year, if it meets all of the following conditions:

- it is a housing unit, a leasehold interest in a housing unit, or a share of the capital stock of a co-operative housing corporation you acquire only to get the right to inhabit a housing unit owned by that corporation

- you own the property alone or jointly with another person

- you, your current or former spouse or common-law partner, or any of your children lived in it at some time during the year

- you designate the property as your principal residence

The land on which your home is located can be part of your principal residence. Usually, the amount of land that you can consider as part of your principal residence is limited to one-half hectare . If you can show that you need more land to use and enjoy your home, you can consider more than 1.24 acres as part of your principal residence. For example, this may happen if the minimum lot size imposed by a municipality at the time you bought the property is larger than one-half hectare.

Recommended Reading: Rocket Mortgage Payment Options

What Is Good Rental Yield

Since there is no definite âgood yieldâ percentage, it all comes down to each propertyâs various features. Itâs easy to assume that a higher rental yield means a higher return or a greater property value, but this may not always be the case.

Typically, a property with a high rental yield implies that it is undervalued or below market value. This is usually considered to be between 8-10%. While a property with a low rental yield, which is anywhere between 2-4%, can mean that it is overvalued.

As an investor, high rental yields are better because they usually generate a steady cash flow. Investors generally aim for properties with a rental yield above 5.5% because of the stability in rental income. For potential home owners, looking at median rental yields across the country can help to determine what your interests and ideal outcomes might be.

Understanding what rental yield is and how it is calculated can help to determine your potential profits and losses on a property you already own or on one youâre looking to invest in. Evaluating and comparing property values and their respective rental yields can be useful to invest your money wisely and realise your home owning dreams.

How Much Of This Income Do Lenders Accept

Most lenders only take 80% of your wrap income into account and ignore that your tenant is paying for council rate and other outgoings. As a result, your investing grinds to a halt.

Some lenders arent as conservative with investors earning wrap and rent to buy income.

The secret to success with wrapping properties is in choosing lenders with low , low and a credit department with an appetite for investors with wrap income.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

Rental Property Vs Home: Getting A Mortgage

The mechanics of applying for a home mortgage or rental property one are similar. The biggest differentiator, however, is that the lender takes on more risk by offering an additional mortgage for a rental property. This is because lenders know that if you face financial struggles of any kind, paying your home mortgage is more important than making payments on your rental property. For this reason, there is a higher chance you could default on your rental property loan.

Because of the higher chance of default, lenders apply stricter guidelines for a mortgage on a rental property. As a result, your debt, income, credit and employment history have to be in great standing to qualify.

Should I Buy A Rental Property

Becoming a landlord can be financially abundant since it creates an additional stream of income, yields tax advantages and it aids in the accumulations of long-term financial security. But, it is also a big responsibility, so it is important to consider all of the details of owning a rental property.

For example, youre responsible for repairs or problem tenants. All of which can be very costly if youre not careful.

Here are a three key points to consider before investing in a rental property.

Your finances are in order. Any investment property requires a significant amount of financial stability. Nearly all lenders ask for a 15% down payment minimum to buy an investment property. However, this down payment amount isnt usually required to buy your first home.

Unfortunately, a higher down payment isnt the only expense, though. In addition to the initial purchasing expenses, you must budget to cover inspection costs, any reoccurring maintenance bills and repairs that may come up.

As a rental property owner, it is your responsibility to handle crucial repairs promptly. Unfortunately, repairs can become costly, especially when fixing HVAC or plumbing issues. Something to remember is that certain states allow tenants to stop paying rent until repairs are complete. That said, its wise to allow an ample budget to complete emergency and regular maintenance concerns.

- Property taxes

Read Also: Can You Get A Reverse Mortgage On A Manufactured Home

Net Operating Income Definition

Letâs first start with a definition. In real estate investing, the net operating income is a formula to measure the amount of annual profit a rental property brings in after taking into account all income collected and covering all of its expenses. In other words, the NOI formula enables real estate investors to get a better look at the potential profitability and financial health of an investment property in relation to how much it costs to operate it.

While the net operating income can change over time as the investment propertys revenue and expenses fluctuate, real estate investors still believe that it provides valuable information about whether a given property will make enough rental income to support payments on its debt. In addition, while it may seem that the net operating income formula is similar to the cash flow formula, youâll realize that theyâre actually different metrics once you learn the components of the NOI formula and how to calculate net operating income.

Related: What Are the Most Important Metrics in Real Estate Investment Property Analysis?

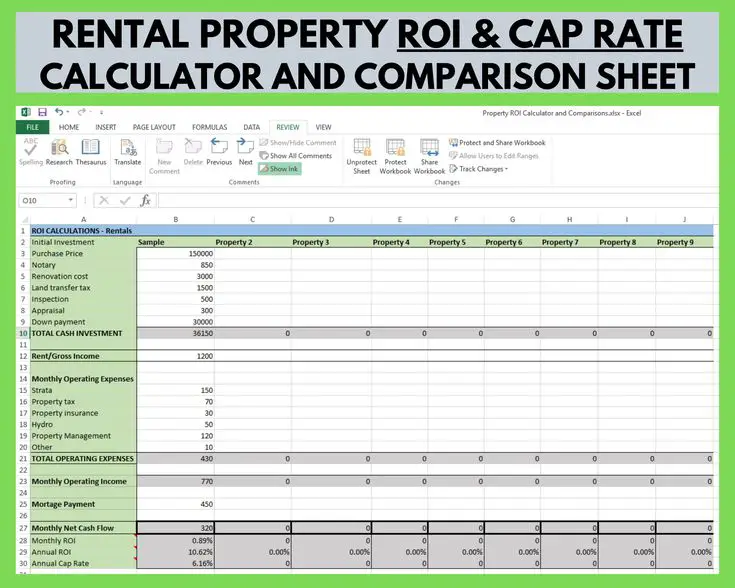

How Do You Calculate Net Rental Income For A Mortgage

The net rental income is determined by subtracting 75% of the gross rent from the full mortgage payment for the property, or 25% of the existing leases from the lesser of 75% or 75% of the rent. If the refinance requires copies of the Borrowers two-year federal tax return completed prior to closing the loan, please use this option to document the rental cash flow.

You May Like: Can I Get A Reverse Mortgage On A Condo

Is Rental Income Gross Or Net

You generally must include in your gross income all amounts you receive as rent. Rental income is any payment you receive for the use or occupation of property. Expenses of renting property can be deducted from your gross rental income. You generally deduct your rental expenses in the year you pay them.

Handling Business Taxes Online

Use the CRA’s digital services for businesses throughout the year to:

- make a payment to the CRA online with My Payment or a pre-authorized debit agreement, or create a QR code to pay in person at Canada Post

- file a return, view the status of filed returns, and adjust returns online

- submit documents to the CRA

- register to receive email notifications and to view mail from the CRA in My Business Account

- manage addresses

For more information, go to E-services for Businesses.

CRA BizApp

CRA BizApp is a mobile web app for small business owners and sole proprietors. The app offers secure access to view accounting transactions, pay outstanding balances, make interim payments, and more.

You can access CRA BizApp on any mobile device with an Internet browserno app stores needed! To access the app, go to Mobile apps Canada Revenue Agency.

Receiving your CRA mail online

Sign up for email notifications to get most of your CRA mail, like your notice of assessment, online.

For more information, go to My Account for Individuals.

MyBenefits CRA mobile app

Get your benefit information on the go! Use MyBenefits CRA mobile app throughout the year to:

For more information, go to Mobile apps Canada Revenue Agency.

Also Check: Can You Get A Reverse Mortgage On A Manufactured Home

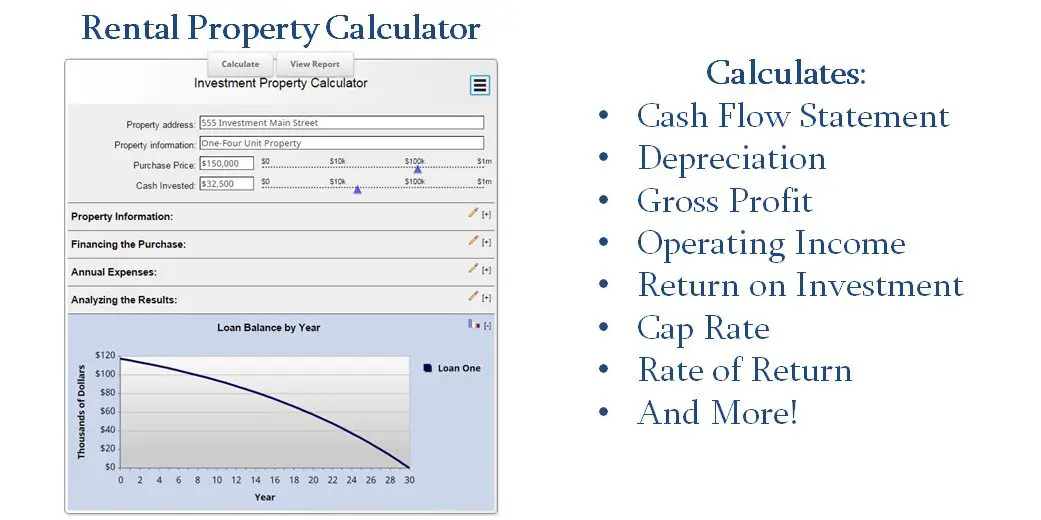

Why It’s Important To Know A Property’s Roi Before Buying Real Estate

One of the main reasons people invest is to increase their wealth. Although the motivations may differ between investorssome may want money for retirement, others may choose to sock away money for other life events like having a baby or for a weddingmaking money is usually the basis of all investments. And it doesn’t matter where you put your money, whether it goes into the stock market, the bond market, or real estate.

Real estate is tangible property that’s made up of land, and generally includes any structures or resources found on that land. Investment properties are one example of a real estate investment. People usually purchase investment properties with the intent of making money through rental income. Some people buy investment properties with the intent of selling them after a short time.

Regardless of the intention, for investors who diversify their investment portfolio with real estate, it’s important to measure return on investment to determine a property’s profitability. Here’s a quick look at ROI, how to calculate it for your rental property, and why it’s important that you know a property’s ROI before you make a real estate purchase.

How Much Mortgage Can I Afford With Rental Income

To work this out, most lenders will average these figures against a typical period of two or three years and feed them into their rental income mortgage calculator to reach an average figure on which to base affordability. A small number of lenders may use the most recent 12 months figures .

This total will then either be taken in its entirety as 100%, or treated as a second income and a percentage of the earnings will be used to calculate loan amounts .

Recommended Reading: Rocket Mortgage Loan Requirements