Different Methods To Keep Away From Over

Whereas the 2 methods outlined above might help you zero in on the quantity of scholar debt you possibly can tolerate, there are some methods you should use to borrow much less generally. For instance, Kantrowitz says you will need to begin by evaluating faculties utilizing the online value, which is the distinction between complete school prices and present help like grants and scholarships.

That is the sum of money you will must pay from financial savings, contributions from revenue, and scholar loans, he says, including that theres a sturdy correlation between the online value and scholar mortgage debt.

When you full this evaluation, you should have a greater deal with on which faculty you are contemplating might be a greater deal.

Your least costly choice will often be an in-state public school, he says.

Kantrowitz additionally says to borrow solely what you want, not as a lot as you possibly can. In different phrases, do not take out further scholar loans to pay for creature comforts or holidays or anything not associated to highschool. By borrowing much less now, you possibly can safe a decrease scholar mortgage cost that leaves you with additional cash so you possibly can afford a greater life-style afterward.

Reside like a scholar when youre at school, so you do not have to reside like a scholar after you graduate, says Kantrowitz.

Lastly, be sure youre making the most of any work-related tuition reimbursement choices you will have entry to.

Check If A Dro Is Right For You

If youre thinking about getting a DRO its important to know:

- if you dont meet the criteria or give extra information when youre asked for it, your application could be turned down – check what to do if your DRO application is refused

- it costs £90 to apply – you can pay this in installments but you wont get it back if your application is refused

- it wont cover all debts – you’ll still have to pay back child maintenance arrears, court fines, student loans, social fund loans, personal injury compensation and any debts caused by fraud

- if you have rent arrears in a DRO your landlord cant force you to pay what you owe, but they can still try to evict you

- it might make it harder to borrow money in the future – check how a DRO will affect your credit rating

- youll have to tell the creditor about your DRO if you want to borrow more than £500 during the 12 months

- you wont be able to set up your own company or be a director of another company, even under a different name, without the courts permission

If you get a DRO but your situation improves during the 12 months – for example if your income goes up or you get a payment for backdated benefits, the DRO can be stopped. You wont get your £90 application fee back. Check what to do if your circumstances change.

How Much Is Too Much Debt For Mortgage Eligibility

Finding your dream home can lift your spirits and make your day. When you go to apply for a mortgage for that home, however, it may produce some shock, especially if you have a considerable amount of debt. Certain types of debt will affect your ability to get a loan more than others. Here is a look at different types of debt and how they can affect your ability to get a loan.

Don’t Miss: Rocket Mortgage Loan Requirements

How Much Debt Is Okay

Some argue that any debt is too much. Others say that you should have only good debt and no bad debt . In reality though, debt is simply a financial tool that you should use wisely to avoid getting in over your head.

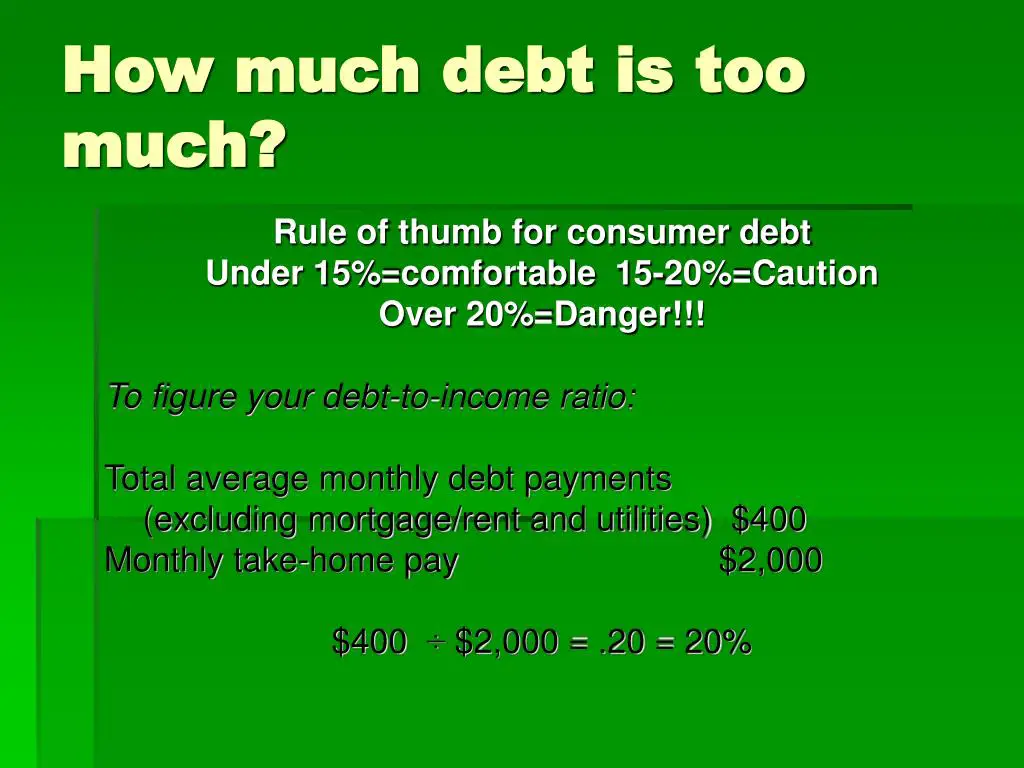

There are several measures you can use to determine whether youre carrying too much debt. One we rely on is known as the total debt service ratio. As a general guideline, no more than 40% of your monthly gross income should go towards mortgage loan payments and other monthly debt obligations.

Realistically, the amount of credit you can afford depends on your personal situation. If your current employment is not secure, you will probably want to take on less credit than the recommended guidelines. On the other hand, if you have no other obligations, such as a mortgage, and your source of income is reliable, you may want to take on more credit, depending on your goals.

Number Too High There Are Options

No matter what, if you find your DTI is too high, dont stop looking. You may find that there are loan options available, even if you have a high debt-to-income ratio. Always shop around and speak with multiple lenders, especially lenders with a wide variety of resources and decades of experience, as they are more likely to find a loan that fits you needs.

Recommended Reading: Rocket Mortgage Launchpad

Ways To Tell That You Have Too Much Credit Card Debt

There are three simple ratios you can use to assess if you have too much credit card debt:

Check If A Dmp Is Right For You

If youre thinking about getting a DMP its important to know:

- it doesnt usually include priority debts so might not help you if youre struggling with your rent or council tax, for example

- it can take a long time to pay off your debts if youre only making small payments

- your creditors dont have to agree to the plan and they can stop accepting it or ask for more money at any time – it isnt a legal agreement

- your creditors can still contact you about the debts you owe

- it could make it harder for you to borrow money in the future – check how a DMP might affect your credit rating

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

Check If You Can Apply For Bankruptcy

You might be able to apply for bankruptcy if you can’t pay your debts and the amount you owe is more than the value of the things you own.

The bankruptcy period usually lasts 12 months. If you go bankrupt your creditors wont be able to contact you about your debts or take you to court.

Bankruptcy can have very serious consequences, for example you could lose your home or your job. It’s important to understand how it could affect you and get help from your nearest Citizens Advice before applying.

There are strict rules to follow if you apply for bankruptcy. Some of the rules apply for the time before you applied for bankruptcy. You could go to prison or get a fine if youve done anything that counts as a bankruptcy offence. You could also have restrictions put on you by the court which make your bankruptcy period longer. Check what counts as a bankruptcy offence.

How Much Mortgage Can I Borrow If I Have Debt

Before approving a loan, mortgage lenders will run affordability calculations to work out whether you can afford to meet your payments.

As part of this assessment, lenders will look at your level of debt repayments, including credit cards, car loans, student loans or an advance from your employer. They will then add these repayments to your monthly expenses, and weigh this up against your income.

- Find out more:how much can you borrow? – how mortgage lenders work it out

Most lenders will assume that youre making monthly repayments of between 3% to 5% on credit card debt and factor that into their affordability calculations.

Taking that into consideration will reduce the potential amount you have to comfortably meet your mortgage repayments and any other outgoings you have an could affect the amount you can borrow.

EXAMPLE:

You currently owe £20,000 on your credit card. The lenders assumed payment rate is 3% of your debt.

The lender will assume that you have to pay £600 per month for your credit card debt, and factor this into how much you can afford to pay on your mortgage.

If youre buying the property with a partner, affordability assessments may also take into account any debt the partner is carrying.

Don’t Miss: 10 Year Treasury Yield Mortgage Rates

What Is The 28 36 Rule

A Critical Number For Homebuyers One way to decide how much of your income should go toward your mortgage is to use the 28/36 rule. According to this rule, your mortgage payment shouldn’t be more than 28% of your monthly pre-tax income and 36% of your total debt. This is also known as the debt-to-income ratio.

How Credit Scores Affect Mortgage Applications

Falling behind on minimum credit card payments or carrying a balance thats more than 35% of your total credit limit can hurt your credit rating. Thats a problem, because lenders use to determine overall mortgage eligibility as well as the interest rate youll pay.

Banks usually wont approve borrowers whose scores are less than 600, while trust companies require a score of 550 or more. Even if lower-score applicants are approved, the rate of interest offered will be extremely high, since the most favourable rates are reserved for applicants with the best credit their history with borrowing and repayment indicates they are lower-risk.

Higher interest rates translate into higher mortgage payments, which in turn lowers your mortgage loan affordability.

Read Also: How Much Is Mortgage On 1 Million

What Is The 10 Savings Rule

The 10% savings rule is a simple equation: your gross earnings divided by 10. Money saved can help build a retirement account, establish an emergency fund, or go toward a down payment on a mortgage. … Adjust your savings accordingly if faced with a low income or severe debt, but don’t give up entirely.

How Much Debt Is Too Much To Secure A Mortgage

A lender will consider many different factors when approving your mortgage application. They will look at items like your credit score, down payment, and income to determine whether you should be issued a loan.

Another factor they will consider is your debt load. To decide whether you should get the loan, they will take into account how much debt payments you have every month. Its far from the only thing they consider, but its one of the most important.

You May Like: Reverse Mortgage For Condominiums

How Much Debt Is Too Much

There are common fixed expenses for nearly every American household that cant be avoided. Its impossible to avoid mortgage/rent auto credit cards and, in many cases, student loans.

The question that should be answered is what the spending limit should be in each area? Here are some guidelines from financial experts on how much to spend in these areas.

Most mortgages fall in the range of 31% to 36% of total income, including principal, interest, taxes, insurance and association fees. In some cases, usually in larger cities, it can push upward of 45% to 50%.

Those limits might need adjustment in times when regular pay raises cant be counted on. Plus, past generations paid less for health care and college. Due to shorter lifespans and greater pensions, there wasnt as much pressure to save for retirement.

So, what is reasonable? By capping housing costs at 25% of your income, it will give you flexibility in other areas. It should also allow you to have the house paid off by retirement age. Its a huge advantage to choose a 15-year mortgage and stick with it, but reality for most people is that the lower monthly payment of a 30-year mortgage is more comfortable.

Automobiles are not a good investment. Car payments should be no more than 5% to 10% of gross monthly income. Shoot for a four-year loan and a 20% down payment to maximize your flexibility.

Zero? OK, make it one credit card and for emergency use only!

You Use Balance Transfers

Many creditors offer new credit cards with balance transfers available at low interest rates for an introductory period. Its important to remember, though, that after the introductory period the interest rates typically skyrocket to 18% or more. Additionally, credit card companies are charging fees for transferring balances. If you keep switching credit card balances, you may have a problem managing your finances.

Also Check: Can You Refinance A Mortgage Without A Job

How To Deal With Too Much Debt

Between the warning signs and the debt-income-ratio, hopefully youll come up with an answer to the question of how much debt is too much debt for you.

If your DTI is below 35% and no red warning flags are waving, congratulations! But if you determine your debt is too much, it raises an even more important question: What are you going to do about it?

The simple solution is to make more money, cut expenses or both. It takes dedication and a display of personal responsibility, but it also takes a plan.

Write down all your expenses and see where you can cut back. The devilish thing about unsecured debt is that the less you pay on those bills each month, the more youll eventually pay in interest charges.

One way to combat that is to get the lowest interest rate possible. A lot of consumers have turned to debt management programs, where a credit counselor helps you consolidate payments and lower interest rates on credit cards.

The counselor also helps you design a budget that with expenses you can afford and simultaneously helps get rid of your debt.

The Great American Debt Mountain isnt getting any smaller, but theres no law saying you have to help it grow.

What If I Plan To Pay Off My Debts Soon After Getting A Mortgage

If you have a plan to pay off your debt in full before you buy a property or soon after, banks may be willing to factor this into their affordability assessment so that you can potentially borrow more than you could with the debt. They may even make paying off your debt a condition of their mortgage offer.

However, many lenders are wary of doing this theres a difference between saying youre going to pay off your debts and actually doing it!

Some may agree to subtract 50% from the debt amount, on the assumption that this is how much youre likely to pay off. Others will not subtract anything at all, and make their calculations assuming you will just repay at the minimum rate.

- Find out more:how to plan your budget – work out a realistic plan for paying your bills

Also Check: Can You Get A Reverse Mortgage On A Condo

What Is Debttoincome Ratio

When applying for a mortgage loan, lenders want to know that home buyers arent taking on more debt than they can afford. Your debttoincome ratio tells lenders how much money you spend relative to how much income you earn. This will help them determine how large a mortgage payment you can comfortably make.

DTI is expressed as a percentage that is determined by dividing your monthly minimum debt payments with your gross monthly income .

For example, if you make $5,000 per month before taxes, and you owe $1,800 per month on student loans and minimum credit card payments, your DTI is 36% .

Lenders look at two types of DTI when applying for a home loan.

What Is The 5 C’s Of Credit

Understanding the Five C’s of Credit Familiarizing yourself with the five C’scapacity, capital, collateral, conditions and charactercan help you get a head start on presenting yourself to lenders as a potential borrower. Let’s take a closer look at what each one means and how you can prep your business.

Don’t Miss: 10 Year Treasury Yield And Mortgage Rates

If You’re Earning And Have A Small Amount Spare

You might be asked to make payments towards your bankruptcy debts during the 12 months. This is called an income payments agreement . IPAs usually last for 3 years.

If you dont agree, the court can make an income payments order so your creditors get payments straight from your salary.

Why Is Debt Not Always Bad

The Bottom Line. Although debt is viewed as primarily bad by most people, there are times when its use can be warranted in order to achieve a higher rate of return on investments over time. Advisors can help individuals learn when to use debt and when to use other means in order to achieve financial goals.

Don’t Miss: Mortgage Rates Based On 10 Year Treasury

You Get Eaten Alive By Your House

Here again, dont buy more home than you can afford just because credit is cheap. Even with a cheap fixed-rate mortgage, many experts advise you should keep your mortgage costs to 28% or less of your gross income. If youre buying a house in your 40s or 50s, consider a 15-year loan so you have it paid off by the time you retire.

How Do You Calculate Your Debt

To calculate how much your debt is affecting your monthly finances, take your total monthly debt and divide it by your monthly income. However, your debt doesnt include all of your monthly expenditures but does include the following:

- Monthly credit card payments

- Monthly subscriptions

- Groceries

If your monthly income is $3,000 and your monthly debts are $1,000, your DTI would be 33 percent . That is a good number to be at and isnt considered too high by lenders.

Also Check: Rocket Mortgage Payment Options