What Factors Help Determine ‘how Much House Can I Afford’

Key factors in calculating affordability are 1) your monthly income 2) cash reserves to cover your down payment and closing costs 3) your monthly expenses 4) your credit profile.

- Income Money that you receive on a regular basis, such as your salary or income from investments. Your income helps establish a baseline for what you can afford to pay every month.

- Cash reserves This is the amount of money you have available to make a down payment and coverclosing costs. You can use your savings, investments or other sources.

- Debt and expenses Monthly obligations you may have, such as credit cards, car payments, student loans, groceries, utilities, insurance, etc.

- Your credit score and the amount of debt you owe influence a lenders view of you as a borrower. Those factors will help determine how much money you can borrow and themortgage interest rateyoull earn.

More:

For more information about home affordability, read about thetotal costs to consider when buying a home.

Can I Use A Mortgage Calculator Based On Income

You can gauge how much of a mortgage loan you qualify based on your income with our Mortgage Required Income Calculator. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments. The calculator will then reply with an income value with which you compare your current income.

Ways To Lower Your Total Monthly Debt Payments

The key to reducing your debts is to create a budget and debt payment plan. By creating a list with your total monthly income on one side and all of your expenses on the other, you can quickly identify unnecessary expenditures, eliminate them and allocate extra funds to paying off your loans early. After coming up with your budget, you can use one of the following debt payment plans to chip away at your debts.

Although you can choose to focus on either increasing your monthly income or lowering your debts, its recommended that you do both simultaneously. Doing so will enable you to improve your DTI faster and ensure you can qualify for a mortgage when its time to apply.

You May Like: What Is Mortgage Insurance Vs Homeowners Insurance

How Much Mortgage Can I Afford

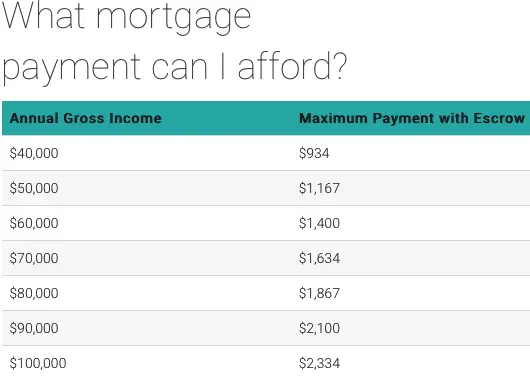

Generally speaking, most prospective homeowners can afford to finance a property that costs between two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford . Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Your Savings And Investments

Now that youve looked at your DTI and any debt you may have, think about your budget. How does a mortgage payment fit in? If you dont have a budget, keep track of your income and expenses for a couple of months. You can create a personal budget spreadsheet or use any number of budgeting apps or online budgeting tools.

In the mortgage process, its important to look at your budget and savings for a couple of reasons. One, you might need savings for a down payment, which well discuss in a later section. However, for now, lets go over something called reserves. These may be required, depending on the type of loan youre getting.

Read Also: How Much Is The Average Monthly Mortgage

What Home Can I Buy With My Income

A quick recap of the guidelines that we outlined to help you figure out how much house you can afford:

- The first is the 36% debt-to-income rule: Your total debt payments, including your housing payment, should never be more than 36% of your income.

- The second is your down payment and cash reserves: You should aim for a 20% down payment and always try to keep at least three monthsâ worth of payments in the bank in case of an emergency.

Let’s take a look at a few hypothetical homebuyers and houses to see who can afford what.

Know Which Mortgage Option Is Right For You

Okay, now lets talk about types of mortgages. Most of them are garbage designed to help you pay for a home even if you cant afford it.

But when you do the math, you find that these mortgages charge you tens of thousands of dollars more in interest and fees and keep you in debt for decades longer than the option we recommend.

Thats why getting the right mortgage is so important! Setting boundaries on the front end makes it easier to find a home you love thats in your budget.

Here are the guidelines we recommend:

- A fixed-rate conventional loan. With this option, your interest rate is secure for the life of the loan, keeping you protected from the rising rates of an adjustable-rate loan.

- A 15-year term. Your monthly payment will be higher with a 15-year term, but youll pay off your mortgage in half the time of a 30-year termand save tens of thousands in interest.

Your mortgage lender will most likely approve you for a bigger mortgage than you can actually afford. Do not let your lender set your home-buying budget. Ignore the banks numbers and stick with your own.

Knowing your house budget and sticking to it is the only way to make sure you get a mortgage you can pay off as fast as possible.

Recommended Reading: Who Is Rocket Mortgage Owned By

How Much House Does Dave Ramsey Say I Can Afford

For decades, Dave Ramsey has told radio listeners to follow the 25% rule when buying a houseremember, that means never buy a house with a monthly mortgage thats more than 25% of your monthly take-home pay.

At Ramsey, we also teach people they cant afford to buy a house unless they meet these qualifications:

- Are completely debt-free

- Have an emergency fund of 36 months of expenses

- Saved a down payment of 1020%

- Can qualify for a 15-year fixed-rate conventional mortgage

The reason we continue to teach these guidelines at Ramsey is because when people throw a mortgage on top of all their debt, unexpected expenses or a job loss can easily crush them financially. We dont want that to happen to you.

How To Calculate A Down Payment

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

Also Check: How Much Of Your Monthly Income For Mortgage

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

Six Items Included In A Home Payment:

Some ARM loans have low interest teaser rates for the first couple years. After the introductory period is over the interest rate and your monthly payment amount can double. Your lender should be able to steer clear of this after all, its in their best interest that you not default.

And if a lender says you can afford more than what you want, you may want to stick with a smaller amount. Loans are typically 15- or 30-year mortgages dont get locked into a loan youre unsure about.

Once you find the right lender and loan program, ask for a pre-approval. A pre-approval gives you a solid loan amount to show to sellers, so you can go into your house hunt with confidence.

When youre looking to buy a home, keep in mind how much you can afford to spend without putting the rest of your financial plans on hold, so you can enjoy all the benefits of homeownership. This can help you build a stronger futureinformed and equipped to succeed.

Don’t Miss: Does Usaa Have Mortgage Loans

How To Increase Your Mortgage Affordability

If you want to increase how much you can borrow, thus increasing how much you can afford to spend on a home, there are few steps you can take.

1. Save a larger down payment: The larger your down payment, the less interest youll be charged over the life of your loan. A larger down payment also saves you money on the cost of CMHC insurance.

2. Get a better mortgage rate: Shop around for the best mortgage rate you can find, and consider using a mortgage broker to negotiate on your behalf. A lower mortgage rate will result in lower monthly payments, increasing how much you can afford. It will also save you thousands of dollars over the life of your mortgage.

3. Increase your amortization period: The longer you take to pay off your loan, the lower your monthly payments will be, making your mortgage more affordable. However, this will result in you paying more interest over time.

These are just a few ways you can increase the amount you can afford to spend on a home, by increasing your mortgage affordability. However, the best advice will be personal to you. Find a licensed mortgage broker near you to have a free, no-obligation conversation thats tailored to your needs.

How Does The Down Payment Affect How Much House I Can Afford

Its crucial to consider your down payment before determining how much house you can afford because the money you put down will drain a considerable amount of your savings. If you use up your savings on a down payment and have earmarked too much of your income for paying off your mortgage and other debts, youll find yourself in serious financial trouble should any emergencies or unforeseen expenses occur.

The higher the down payment you can make, the more equity youll have in your home after you purchase it. Lets take a look at how the size of your down payment would impact your home equity if you were purchasing a home for $450,000.

Although down payments can be lower than 20% of the purchasing price, you should really try to stay as close to that number as possible, especially if youre in the market for a conventional loan. You dont want to get stuck paying PMI fees. But more importantly, you need to remember that the less you put down now, the more youll have to spend each month on your mortgage payments and the less equity youll have in your home.

You May Like: How To Track Mortgage Interest Rates

Use Our Mortgage Calculator To Determine Your Home Budget

Sure, you could crunch the numbers yourself by dividing a home price by 180 months and then multiplying the decreasing monthly principal balance by your interest rate. But if you’re anything like us, you probably broke a sweat just reading that formula.

To save yourself the time and headache of doing a ton of math, we built a mortgage calculator to do that for youphew!

Sticking with our example of an income of $5,000 a month, you could afford these options on a 15-year fixed-rate mortgage at a 4% interest rate:

- $187,767 home with a 10% down payment

- $211,238 home with a 20% down payment

- $241,415 home with a 30% down payment

- $281,650 home with a 40% down payment

Remember: This is just a ballpark! Dont forget that grown-up stuff like property taxes and home insurance will top off your monthly payment with another few hundred dollars or so . And if you think youll be buying a home thats part of a homeowners association , youll need to factor those lovely fees in as well.

For example, if you plug in a mortgage amount of $211,238 with a 20% down payment at a 4% interest rate, youll find that your maximum monthly payment of $1,250 increases to $1,515 when you add in $194 for taxes and $71 for insurance. To get that number back down to a monthly housing budget of $1,250, youll need to lower the price of the house you can afford to $172,600.

How Much Mortgage Can I Afford Based On Annual Salary

To calculate how much house can I afford, a good rule of thumb is using the 28%/36% rule, which states that you shouldnt spend more than 28% of your gross monthly income on home-related costs and 36% on total debts, including your mortgage, credit cards and other loans like auto and student loans.

Read Also: How To Find Total Interest Paid On A Mortgage

What Is The 28/36 Rule

Lenders may determine your ability to afford a new home by using the 28/36 rule. Breaking it down, the rule establishes that:

- Housing expenses should be no more than 28% of your total pre-tax income. This includes your monthly principal and mortgage interest rate, annual property taxes, and private mortgage insurance payments .

- Total debt should not exceed 36% of your total pre-tax income. This includes the housing expenses mentioned above credit cards, car loans, personal loans, and student loans so long as these monthly debt payments are expected to continue for 10 months or more.

In concrete numbers, the 28/36 rule means that a borrower who makes $5,000 a month should not spend more than $1,400 on housing costs every month. If youre a renter, thats the most you should spend on your lease to maintain good financial health.

However, for a homeowner, $1,400 should cover your monthly mortgage payment, as well as homeowners insurance premiums and property taxes.

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

Read Also: What Is Escrow Means Mortgage

Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understand how large a mortgage you can afford to borrow and the cash requirements will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.

Follow The 25 Percent Rule

Theres a straightforward way to make sure you can afford your mortgage while managing your other goals, according to Eve Kaplan, a certified financial planner in New Jersey. Housingincluding maintenanceideally shouldnt consume more than 25 percent of a household budget. This goes for folks who rent, too, Kaplan says.

Mortgage bankers would disagree. They use various calculations to figure out how much you can afford, and the amount is often much higher than financial planners recommend. A common measure that brokers use is the debt-to-income ratio , which, for a qualified mortgage, limits your total debt payments, including your mortgage, student loans, credit cards, and auto loans, to 43 percent.

Lets say you and your spouse make a combined annual income of $90,000, or about $5,600 per month after taxes. Based on your DTI and depending on your other debts, you could be approved for a mortgage of $600,000. That might sound exciting at first, but with a monthly payment of about $3,225, it would eat up more than half your take-home pay.

Following Kaplans 25 percent rule, a more reasonable housing budget would be $1,400 per month. So taking into account homeowners insurance and property taxes, youd be better off sticking to a mortgage of $240,000 or less. If you have enough for a 20 percent down payment, the maximum house you can afford is $300,000.

Also Check: How Much Is Mortgage For A Million Dollar Home