Why Charge The Va Funding Fee

The VA loan funding fee helps the Department of Veterans Affairs keep its loan program running. Paying your funding fee helps the VA offer other veterans the same home purchase benefits in the future.

Specifically, the funding fee helps insure your mortgage loan. Its the VA insurance backing your loan that lets private mortgage lenders give veterans and active duty service members loans with no down payments and no private mortgage insurance .

Plus, VA-insured loans offer competitive mortgage rates compared to other loan options.

Even with the VA funding fee included, VA loans typically provide a better deal to vets than conventional loans or FHA loans, both of which require down payments.

How Do I Pay The Funding Fee

Part of the mortgage approval process is for the lender to verify the funding fee status. During the verification process, the Certificate of Eligibility sent from the VA determines if the funding fee is waived or paid.

The lender then collects the funding fee during the loans closing. Because the fee is likely thousands of dollars, most borrowers choose to finance the funding fee and roll it into the loan, but they can also pay cash or ask the seller to pay. Veterans using refinance options can either pay the funding fee upfront, or finance payments over the lifetime of the loan.

Financed Upfront Funding Fee

If you choose to pay off your FHA Funding Fee over a period of time in similar fashion to other forms of debt, you must factor this amount into your monthly insurance premium. Assuming the current MIP rate was one-half of 1 percent , multiply your estimated average outstanding balance by this rate. When you’ve financed your Upfront MIP, you need to multiply this result by 1 plus your Upfront MIP percentage to get your annual MIP. Divide this result by 12 to get your monthly MIP.

Recommended Reading: Rocket Mortgage Loan Requirements

Roll Closing Costs Into Your Mortgage

In some instances, lenders will offer to pay your closing costs or roll them into your loan. However, youre not off the hook lenders tend to charge higher interest rates to pay themselves for absorbing your closing fees, which means you ultimately end up paying interest on those closing costs, as well as higher interest on your mortgage. Do this only as a last resort.

Can You Negotiate A Mortgage Origination Fee

Although it is possible to negotiate which of your closing costs the seller is willing to pay on your behalf, you may be hard-pressed to find a lender willing to negotiate their origination fee. Remember to shop around before choosing a mortgage lender, as not all mortgage companies will charge the same amount in fees.

Don’t Miss: Chase Recast Mortgage

How To Reduce Va Loan Funding Fees

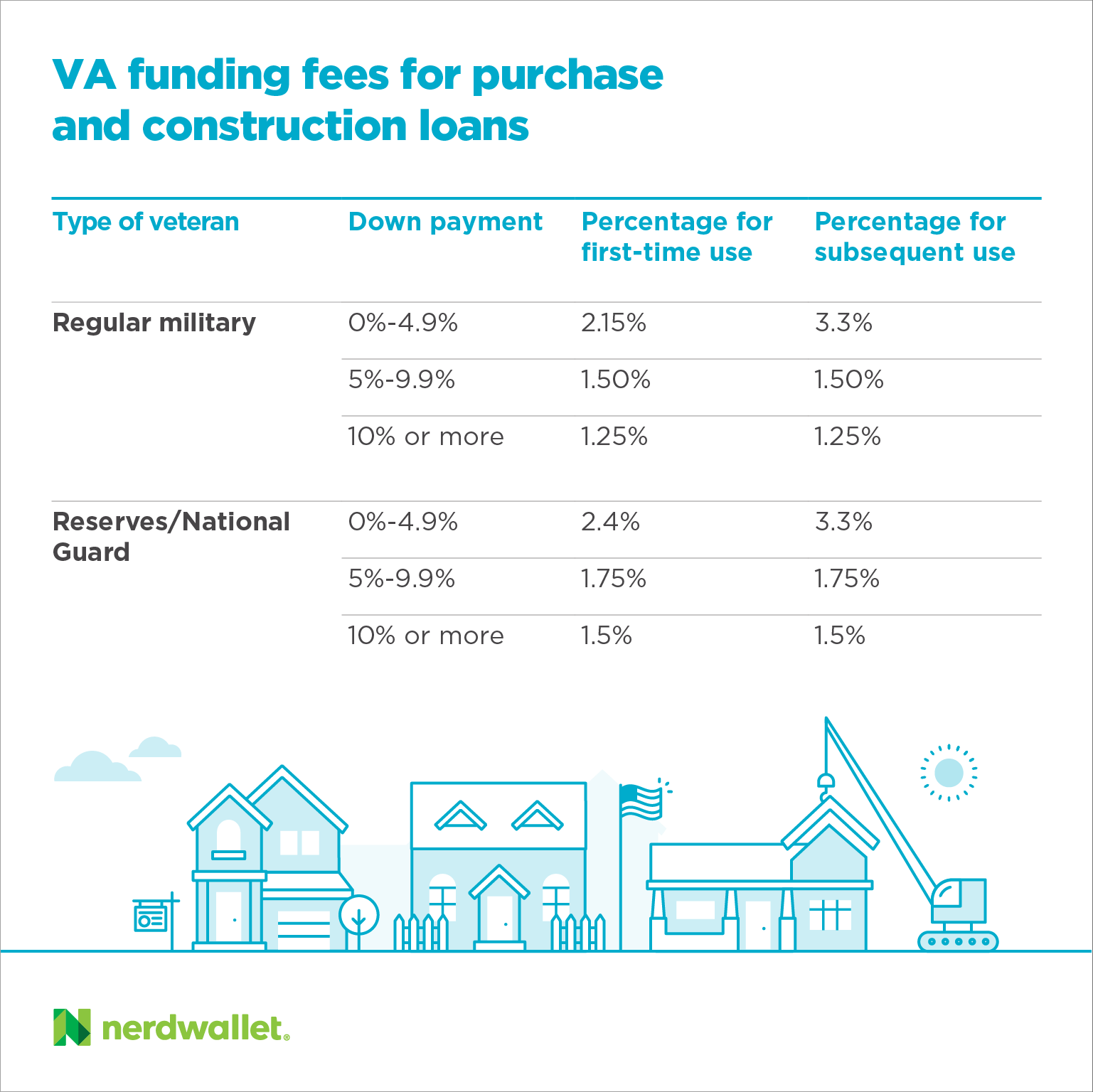

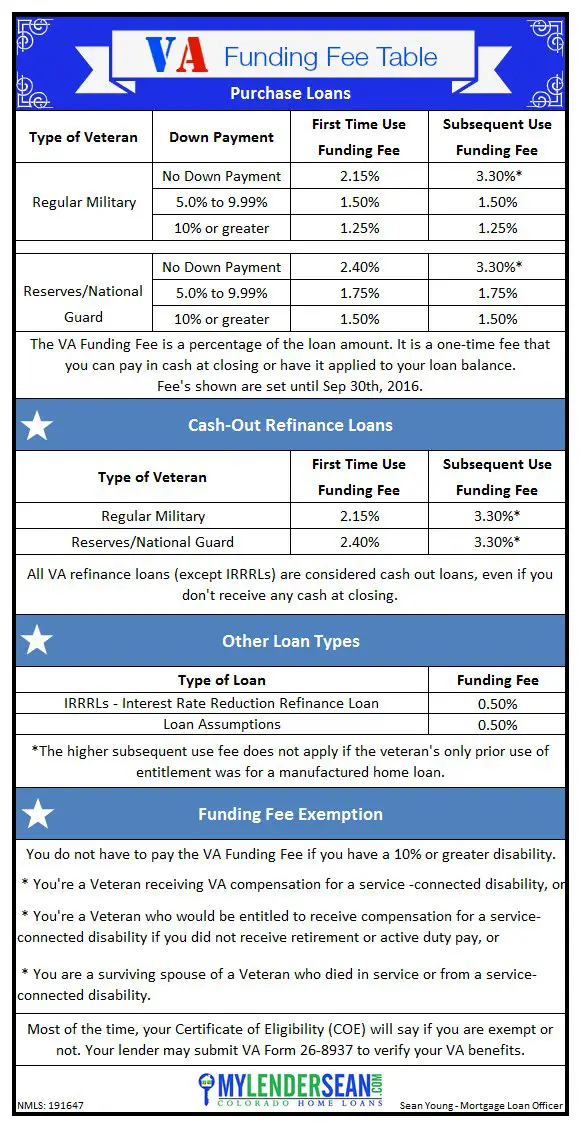

Borrowers who make a down payment may be entitled to a reduction in their VA Loan funding fees.

A down payment of 5% will result in a first time funding fee of 1.5%, greater than 10% will be 1.25% of the loan.

The funding fees are the same for military members and veterans who use the VA Loan more than once.

Members of the Guard/Reserves may pay a 2.4% fee for first-time use with no down payment, a down payment of 5% but lower than 10% requires a 1.75% fee and a down payment of 10% or more comes with a 1.5% funding fee.

Guard/Reserve veterans using the VA Loan a subsequent time are required to pay a 3.3% funding fee if they are not making a down payment, a 1.75% fee for a down payment up to 10% and a 1.5% funding fee for a 10% or greater down payment.

What Is A Mortgage Origination Fee

A mortgage origination fee is a payment you make to your mortgage lender to cover the cost of processing your home loan.

First-time homebuyers may see origination fee listed on the closing disclosure and think its an unnecessary added cost. The truth is that processing a home loan whether its a purchase or refi requires a lot of work on the lenders side.

Remember, mortgage lending is a highly complicated not to mention highly regulated industry, and even tasks as seemingly straightforward as preparing documents and filing applications are more complex than they might appear. Your origination charge compensates not fully, mind you your mortgage lender for taking on your loan application and doing the considerable upfront work to start processing your mortgage.

One last point: Origination fees are not the same as origination points. The latter are also known as mortgage points, which you can pay upfront in exchange for a lower interest rate.

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

How Do I Pay The Va Funding Fee

As a borrower, you can take care of your VA funding fee in a few ways:

Most homebuyers choose to finance the fee in order to avoid paying thousands of dollars out of pocket. That said, by financing the fee, your monthly payments will be higher and you will have to pay interest on the amount over the life of the loan.

Having the seller pay for the funding fee is considered a concession and is sanctioned by the Department of Veterans Affairs so long as the fee does not exceed 4% of the loan amount. Sometimes, these concessions may include a commission for real estate agents.

Just like most fees related to mortgages, the VA funding fee is due upon the loan closing. After you pay the fee, your lender sends the funds to the VA.

How To Get A Va Funding Fee Exemption

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

If your military service makes you eligible for a loan backed by the U.S. Department of Veterans Affairs , you might save thousands of dollars if you also qualify for a VA funding fee exemption. This exemption is exclusively for VA homebuyers with a service-related disability.

If you closed on a recent VA loan while your disability claim was pending, you may get a VA funding fee refund to recover some of the cost once your claim is approved.

Also Check: How Does The 10 Year Treasury Affect Mortgage Rates

How Much Will I Pay

This depends on the amount of your loan and other factors.

For all loans, well base your VA funding fee on:

- The type of loan you get, and

- The total amount of your loan. Well calculate your funding fee as a percentage of your total loan amount.

Depending on your loan type, we may also base your fee on:

- Whether its your first time, or a subsequent time, using a VA-backed or VA direct home loan, and

- Your down payment amount

Note: Your lender will also charge interest on the loan in addition to closing fees. Please be sure to talk to your lender about any loan costs that may be added to your loan amount.

Details Of The Funding Fee

In the simplest terms, the funding fee exists to offset costs that occur due to VA guaranteed loans that default. The fee also helps relieve U.S. taxpayers the full burden of backing the loans. The Department of Veterans Affairs receives all of the funding fees to assure future availability of VA loans to service members.

The funding fee is adjustable according to multiple factors, including the details of the military members service, if there is a down payment applied, and number of times the loan benefit has been used in the past. Active duty service members traditionally pay the lowest funding fees among their military peers, National Guardsmen, and Reservists.

Use this easy to understand example from Veterans United to compare what your funding fees might look like. On a typical $200,000 loan, a Regular Military veteran using a VA loan for the first time would borrow an additional $4,300 to cover the funding fee.

Don’t Miss: Recast Mortgage Chase

How Do I Avoid The Va Funding Fee

The funding fee is part of the VA loan program. The fee helps the VA home loan program run independently of taxpayer dollars. But you could finance the fee or ask the seller to help pay it. The VA will waive the fee for vets who are eligible for disability compensation or active duty military members who have been awarded the Purple Heart.

How Is The Va Funding Fee Calculated

The VA funding fee is calculated as a percentage of the total loan amount. Several factors, such as down payment size, disability status, and if its your first time using a VA loan or not, play into how your VA funding fee is calculated. The 2.3% for first-time use and 3.6% for subsequent use stays the same for the majority of borrowers, but the total dollar amount will depend on the size of your loan.

You May Like: Mortgage Rates Based On 10 Year Treasury

Is Anyone Eligible For A Va Funding Fee Refund

If you paid the funding fee but believe you were eligible for an exemption at the time you paid it, you may be eligible for a refund. One example of this would be if you had a pending disability claim as you went through the home buying process that was approved after closing. If the effective date of your compensation is prior to the date you closed on your home, you may be able to get a refund on your funding fee.

If you believe youre entitled to a refund, reach out to your lender or call your VA Regional Loan Center at 827-3702.

What Is The Current Funding Fee

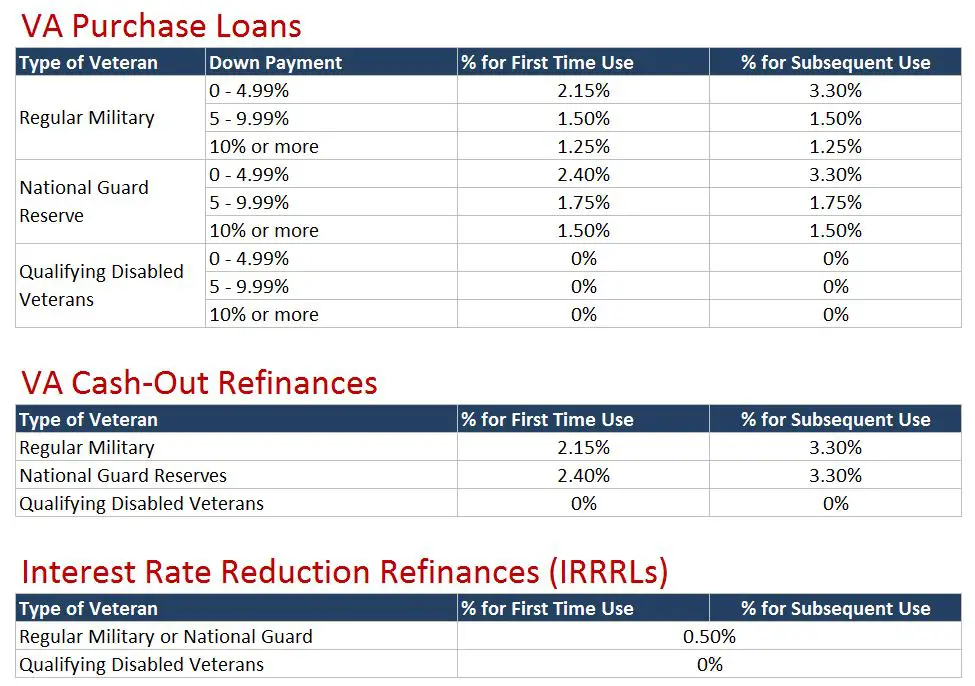

Given all the criteria listed above, theres no set funding fee that covers every VA mortgage and every loan scenario. According to the Department of Veterans Affairs, the amount you owe on your funding fee may be affected by the size of your down payment, your VA entitlement and the type of home loan youre using. Take a look at the following VA funding fee charts to see how the percentages break down depending on your circumstances:

Read Also: Reverse Mortgage On Condo

Whether It Is A First

When determining your funding fee, the VA will consider whether youve ever used a VA home mortgage loan before. For first-time borrowers, the funding fee will be 2.3% with no down payment. The rate increases to 3.6% with no down payment for borrowers who have previously purchased a home with a VA loan.

Youll notice in the charts presented here, the funding fee evens out for first-time and subsequent borrowers as a down payment is made. For both groups of borrowers, the funding fee is 1.65% for a down payment of 5%, and 1.4% for a down payment of 10% or greater. So, if youre using a VA home mortgage for at least the second time, you may want to put down at least a 5% down payment in order to reduce your funding fee.

How Much Is A Va Funding Fee

Assuming youre eligible for a VA loan, there are three key factors that determine your VA funding fee:

- Whether you have ever had a VA-backed loan before if so, a new VA loan is often referred to as “subsequent use

- How much money you are using for a down payment

- The total amount you are borrowing

You may be thinking, Wait a minute, VA loans don’t require a down payment! That’s correct, but whether or not you put money down, and how much you put down, helps to determine your funding fee.

If you’ve never used a VA Loan before, then the funding fee for a home purchase is determined as follows:

- If your down payment is less than 5%, your funding fee would be 2.3% of the loan.

- If your down payment is 5% or more, your funding fee would be 1.65% of the loan.

- If your down payment is 10% or more, your funding fee would be 1.4% of the loan.

Here is an example for you to follow if you have a home purchase price of $250,000:

- With a down payment of $0, your funding fee would be $5,750 which may be rolled into your overall loan.

- With a down payment of 7% , your funding fee would be 1.65% of the loan amount, or $4,125.

Here are the 2020 fee percentages for someone who has already used a VA Loan benefit :

- With a down payment less than 5%, the subsequent use funding fee is 3.6% of the loan.

- With a down payment more than 5%, the subsequent use funding fee is 1.65% of the loan.

- With a down payment more than 10%, the subsequent use funding fee is 1.4% of the loan.

Don’t Miss: How Does 10 Year Treasury Affect Mortgage Rates

Fees Va Lenders Can Charge

| A flat fee |

|---|

|

Trustee’s Fees or Charges |

- More detail in the “Reasonable & Customary VA Loan Fees” section below.

If the lender takes the flat 1 percent route, the fee is simple to understand. For example, if the loan is $200,000, the borrower must pay the lender $2,000 at closing. Unlike closing costs for some traditional loans, an origination fee cannot be rolled into the balance of the loan. The one exception to this rule is when refinancing a VA home loan.

Down Payment Of At Least 5%

If you’re able to make a down payment of at least 5% on your home, but less than 10%, your VA loan funding fee will be 1.65%. This holds true whether it’s your first VA loan or a subsequent one. With a down payment of 10% or more, your VA funding fee will be 1.4% whether or not it’s your first time.

Here’s a VA funding fee summary:

| Applicant Status |

|---|

You May Like: 10 Year Treasury Yield And Mortgage Rates

Appeal To The Seller For Help

You might be able to get a seller to either lower the purchase price or cover a portion of your closing costs. This is more likely if the seller is motivated and the home has been on the market for a long time with few offers. In many hot housing markets, though, conditions favor sellers, so you might get pushback or a flat-out no if you ask for a sellers help. But it doesnt hurt to ask.

Talk To Freedom Mortgage About A Va Loan

Freedom Mortgage is the #1 VA lender1 in the United States. Would you like to talk to us about VA loans? Reach out to a Loan Advisor by visiting our Get Started page or calling us at .

1. Inside Mortgage Finance, 2021

* Freedom Mortgage Corporation is not a financial advisor. The ideas outlined above are for informational purposes only, are not intended as investment or financial advice, and should not be construed as such. Consult a financial advisor before making important personal financial decisions, and consult a tax advisor regarding tax implications and the deductibility of mortgage interest and charges.

Also Check: Reverse Mortgage Manufactured Home

Reasonable & Customary Va Loan Fees

The lender can ask a borrower to pay several fees associated with the loan processing. The Real Estate Settlement Procedures Act requires lenders to submit a Good Faith Estimate to allow borrowers to prepare for upfront costs, shop around for settlement service providers, and to mitigate incidences of lender abuse.

If a veteran prefers to take advantage of an interest rate lower than the market rate, the lender can require the borrower to pay up to two discount points at closing. Each point is typically 1 percent of the loan, but it is important to understand that discount points are optional, and the cost of points is negotiable. When considering the expense of points, compare the cost to the amount that would be paid with a higher interest rate multiplied by the number of years you plan to own the home.

Other fees may also be negotiable. Also, the seller may offer to pay a portion of or all closing costs.

Fha Upfront Funding Fees

The current FHA Upfront Funding Fee is 2.25 percent of your new mortgage amount. You can simply multiply your mortgage amount by the prevailing fee percentage to calculate your Upfront Funding Fee. For example, if you buy a new home in the San Francisco area and your new mortgage amount is $200,000, your FHA Upfront Funding Fee is $4,500 . FHA allows you to pay this fee in cash at closing or add it to your mortgage balance, to be paid over time. If you pay off your FHA mortgage loan early, you may qualify for a refund of part of this fee.

Don’t Miss: Reverse Mortgage Mobile Home

What Is The Va Funding Fee

VA loans have competitive interest rates and more lenient credit standards than conventional mortgage loans, and they dont require mortgage insurance. Instead, they require most borrowers to pay a VA funding fee. The fee is a one-time charge that can be paid upfront or rolled into the mortgage, whether its for a VA home purchase or a VA refinance.

VA loans are backed by the Department of Veterans Affairs, which repays the lender a portion of the loan if the borrower defaults. The funding fee helps defray the costs of that VA guarantee.