What Is A Mortgage Rate Lock

A mortgage rate lock allows you to lock in the interest rate your lender quotes you for a certain period of time. This gives you a chance to close on the loan without risking an increase in the mortgage interest rate before you finalize the loan process.

Once you find a rate you like, lock it in as soon as possible because rates can change overnight. If they rise, then you could end up paying more on your mortgage.

If you get a floating rate lock, then you can lock in a lower interest rate if rates fall, but you wont be obligated to pay higher interest rates than you were quoted if they go up.

While 30-day rate locks are typically included in the cost of a mortgage, a floating rate lock could cost extra. Depending on how volatile the rate environment is, you might find that a floating lock is worthwhile.

Shop Around For A Great Rate

Once you’ve settled on a 15-year mortgage for your refi and have determined your credit score looks solid, check rates from multiple lenders in your area. Review them side by side to identify the best deal available to you.

As you research rates online, you may want to look at the websites of major banks operating where you live. They often have similar pricing on their mortgages, but you might find one offering a cheaper rate or more favorable terms.

Small local banks and credit unions often have affordable rates, but the approval processes can be slower.

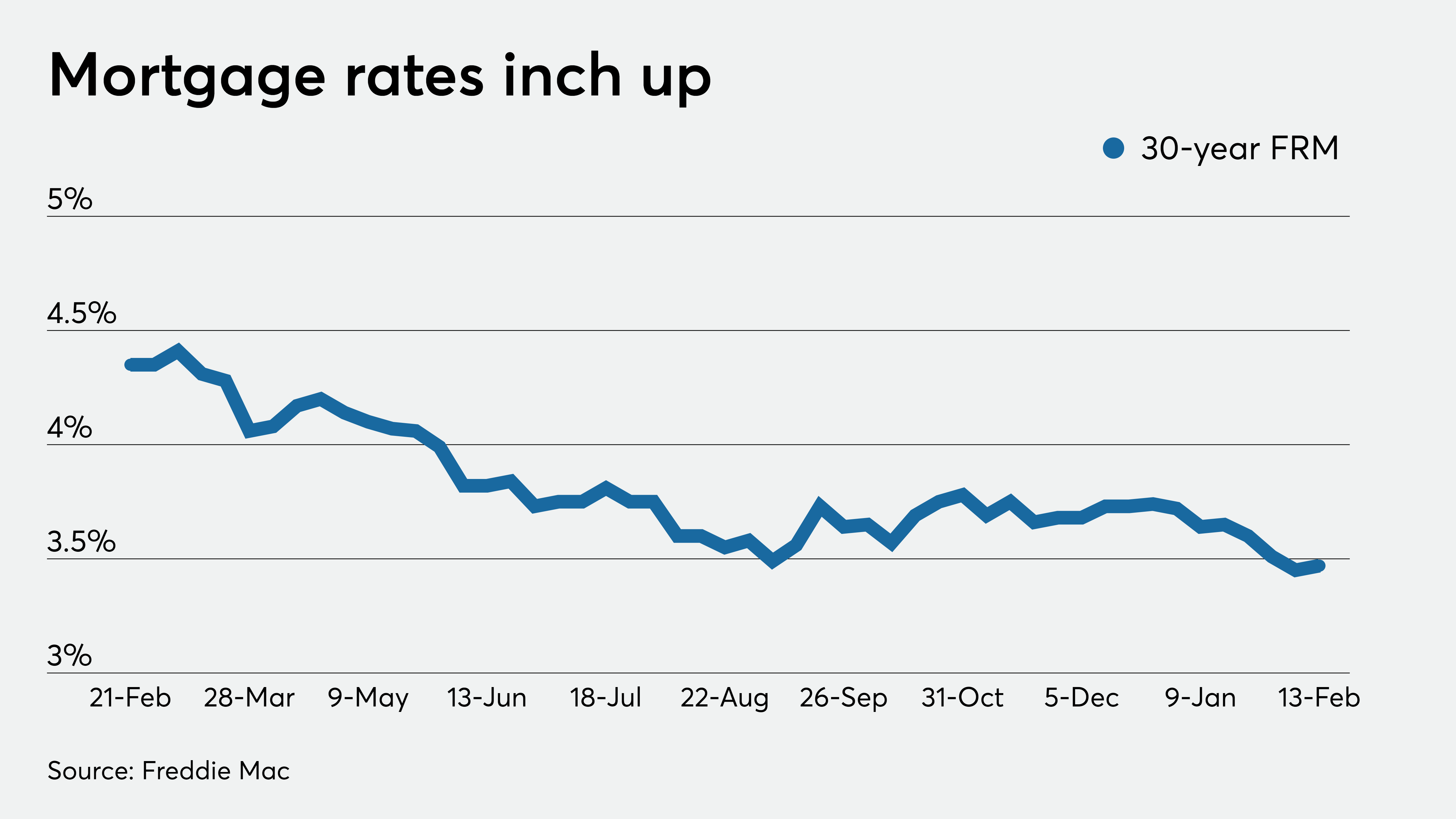

You’ll want to move quickly, because experts say mortgage rates are likely to rise this fall as lenders start to factor in a new 0.5% fee on refinance loans.

Freddie Mac and Fannie Mae two government-sponsored mortgage giants that buy or guarantee most U.S. mortgages say they’re introducing the fee because they need to offset billions in losses from defaults and other issues related to the COVID-19 crisis.

Are Current Mortgage Rates Good For Buying A Home Right Now

High prices and rising interest rates are being felt by homebuyers, who are seeing their purchasing power dwindle.

That doesnt mean that this is the wrong time to buy a house, just be sure youre not panic buying. Dont rush into a home purchase because youre afraid rates or prices will increase forever. Instead, if its the right time for you to purchase, then take the time to find the right home for you at a price you can afford.

Owning a home is a better choice if you plan on staying for a long time. By giving yourself more time in the home, youll be able to weather the inevitable market fluctuations. Purchase a home with a monthly payment you can comfortably fit in your budget. According to experts, you shouldnt spend more than 28% of your pretax income on housing.

Don’t Miss: Requirements For Mortgage Approval

How To Get The Lowest 15

Given this year’s unbelievably low mortgage rates, refinancing remains at the top of many homeowners’ to-do lists and it has taken on more urgency as a new refi fee has some lenders pushing rates higher.

A 30-year fixed-rate mortgage might be a borrower’s automatic first choice for a refinance loan. But if you’ve been in your house a few years, refinancing to a 15-year mortgage can keep you from dragging out the debt and piling up massive interest costs.

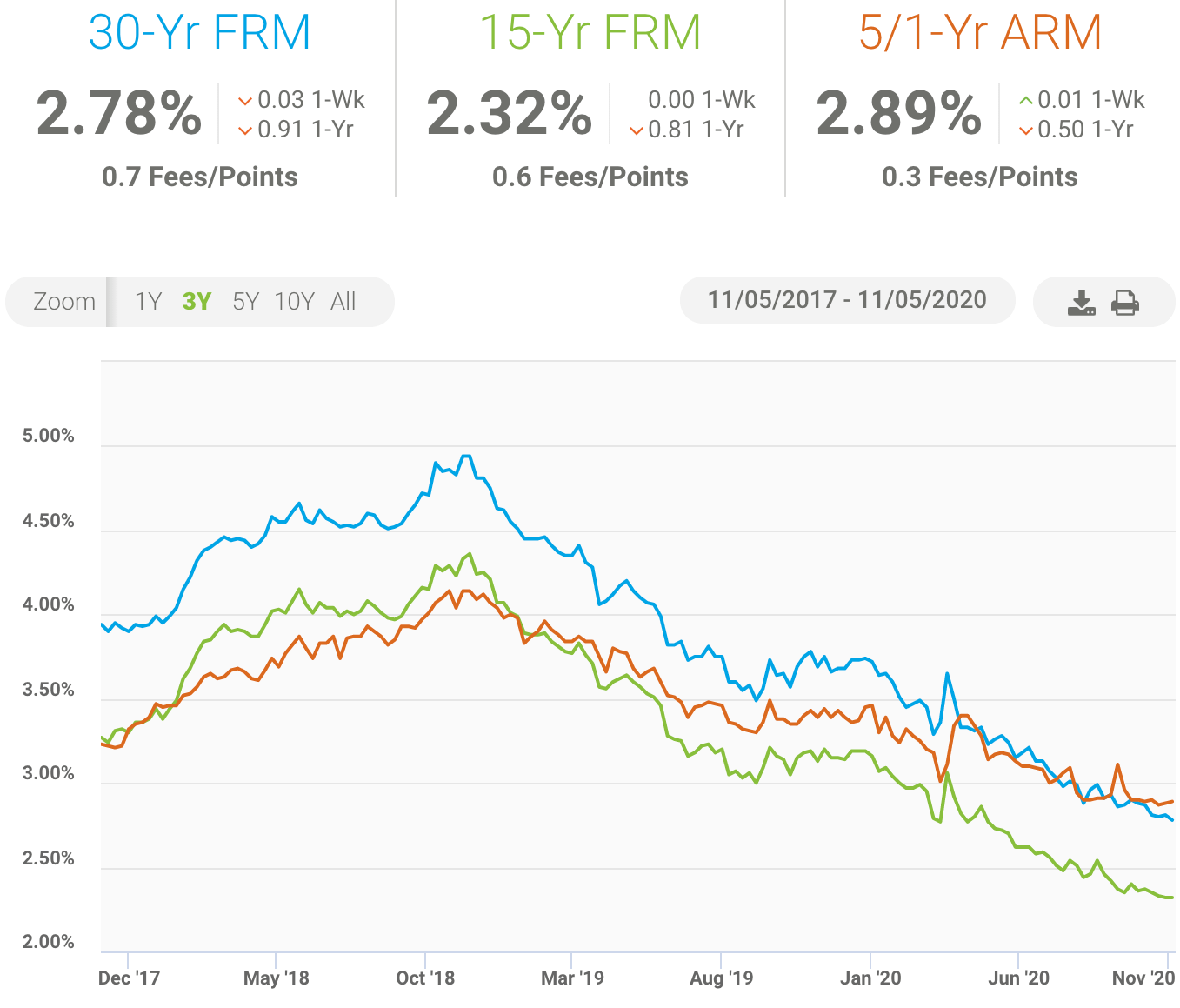

The monthly payments with a 15-year home loan can be steeper, but the interest rates are lower currently averaging a record low 2.32%, about one-half of 1 percentage point below the typical 30-year mortgage rate, according to mortgage company Freddie Mac. Some lenders have even been offering 15-year loans at under 2%.

Here are four tips on how to get the very best deal when refinancing into a 15-year mortgage.

Benefits Of Refinancing To A 15

In deciding whether the monthly payment on a refinance works for you, you might use the 28/36 rule that’s recommended by many experts. This rule of thumb advises against mortgage payments and housing expenses higher than 28% of your pretax income and total debt of more than 36% of pretax income. Its also helpful to have at least three to six months of living expenses saved in an emergency fund as well.

Recommended Reading: Rocket Mortgage Payment Options

Rocket Mortgage By Quicken Loans Best For Online

For those who prefer to undergo an online application process, Rocket Mortgage may be a good choice. The company offers a streamlined digital application with clearly outlined loan specifications. The minimum down payment for a 15-year mortgage is 3%, but as with all mortgage loans, it costs you less in the long run if you put down more upfront. Rockets interest rates and APR are higher than some of their bank and credit union competitors, but they allow access to the market for those with credit challenges their minimum FICO score is 620 or who may experience other barriers to entry.

Whats The Difference Between Interest Rate And Apr

The interest rate is the percentage that the lender charges for borrowing the money. The APR, or annual percentage rate, is supposed to reflect a more accurate cost of borrowing. The APR calculation includes fees and discount points, along with the interest rate.

A major component of APR is mortgage insurance a policy that protects the lender from losing money if you default on the mortgage. You, the borrower, pay for it.

Lenders usually require mortgage insurance on loans with less than 20% down payment or less than 20% equity .

Recommended Reading: Reverse Mortgage On Condo

Comparison To Other Options

While the 15 year is one of the more popular mortgages, there are several other products which are available. A 15 year can be compared to the following:

Get the Best of Both Worlds

You can take out a 30-year mortgage then use that interest rate to calculate how much you would need to pay each month to get your home paid off in 15 years. This method would have you pay a slightly higher interest rate than the 15-year fixed, but it would give you more financial flexibility month to month. If your loan is structured as a fixed-rate loan and interest rates go up then you can pay off the home loan more slowly while investing in other faster appreciating assets.

Why To Consider Refinancing Into A Shorter

Today, rates on 30-year fixed home loans are averaging just 2.93%, according to mortgage company Freddie Mac. That’s the lowest since mid-February.

If you were to refinance your $190,000 balance to a new 30-year mortgage at 2.93%, and stay with the loan for the entire term, the lifetime interest would total close to $96,000.

You could choose to do a 15-year refinance instead. Fifteen-year mortgages have lower interest rates than 30-year loans: The average for a 15-year is currently just 2.24%.

With a $190,000, 15-year mortgage at 2.24%, you’d pay interest of just roughly $34,000 over the life of the loan. That’s $62,000 less than the 30-year refinance.

Many refinancers don’t opt for a 15-year loan because they don’t think they can afford the higher payments:

-

The monthly payment on a 30-year refi in the amount of $188,000 at 2.87% is about $794.

-

The monthly payment on a 15-year refi in the amount of $190,000 at 2.24% is $1,244.

But Orman says in recent years 15-year mortgage rates have been so low “that you may be able to refinance your remaining balance and end up with a payment that is not much different than what you were paying on your 30-year.”

And in our example, it’s true:

-

The monthly payment on the original 30-year mortgage in the amount of $250,000 at 6.75% was $1,622. The new 15-year loan costs $378 less per month.

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score between both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

Who Should Consider A 15

Homeowners who want to save significantly on their home loan and can afford to pay the higher monthly mortgage payments are best suited for 15-year mortgages. Thats because these types of loans tend to have lower interest ratesgovernment-supported agencies like Fannie Mae and Freddie Mac tend to impose loan-level price adjustments, which drive up the costs of 30-year mortgages.

Borrowers considering 15-year mortgages need to consider whether they can afford the monthly payments, as they will be higher compared to a 30-year or 20-year mortgage because you are paying the loan off in less time. Its critical that you determine whether you have ample savings set aside and room in your budget to afford the higher payments in addition to your other monthly obligations.

You May Like: 10 Year Treasury Vs 30 Year Mortgage

Year Mortgage Rates Faq

What are 15-year mortgage rates?

Just like all interest rates, 15year mortgage rates go up and down most days sometimes more than once a day. You can see current 15year mortgage rates in the table above. They move roughly in line with 30year rates meaning theyve fallen a lot over the last decade or so. At the time of writing, 15year fixed rates are close to alltime lows.

Are 15-year mortgage rates always lower than 30-year rates?

It would be a very weird day indeed if 15year fixed mortgage rates were higher than 30year fixed rates. That almost never happens. But the gap between the two sometimes narrows or widens. For instance, at one point in 2013, 15year fixed rates were nearly 1% lower than 30year rates. Currently, they are about 0.50% lower. A 15year fixed mortgage becomes more attractive it offers substantially lower rates than the 30year.

How much is a 15-year mortgage?Is a 15-year mortgage a good idea?Is it harder to qualify for a 15-year mortgage?

Its harder to qualify for a 15year mortgage because a lender needs to determine you can afford the higher monthly payments on your current budget. Aside from this consideration, its not too different. Minimum credit score and down payment requirements are typically the same for 15 and 30year fixed mortgages.

Who has the best 15-year fixed mortgage rates? Is it better to get a 15-year mortgage or pay extra on a 30-year mortgage? How can I get the best 15-year interest rate?

Summary Of Current Mortgage Rates

This week’s rate averages were lower for all loan types:

- The current rate for a 30-year fixed-rate mortgage is 3.05% with 0.7 points paid, 0.07 percentage points lower week-over-week. Last year, the average rate was 2.66%.

- The current rate for a 15-year fixed-rate mortgage is 2.30% with 0.7 points paid, a of 0.04 percentage points from last week. A year ago the average rate was 2.19%.

- The current rate on a 5/1 adjustable-rate mortgage is 2.37% with 0.4 points paid, down by 0.o8 percentage points from last week. The average rate was 2.79% last year.

- Categories

Don’t Miss: Who Is Rocket Mortgage Owned By

When Is A 15

A 15-year mortgage is a smart option for borrowers who want to save money on interest and can afford the larger monthly payments and are still able to meet their other financial goals and responsibilities. Its also smart for people who have a steady and reliable income.

For instance, borrowers who want to take out a 15-year mortgage but cant afford to set aside money in their retirement accounts or savings goals like creating an emergency fund, should probably stick to a longer-term mortgage . That way, the lower monthly payments allow them more wiggle room in their monthly budget.

For borrowers who have variable income or sporadic income sources, a 15-year mortgage makes sense if there is a realistic plan. In other words, borrowers need to account for the fact that they may not make enough in any given month to make the monthly payments. Having a plansuch as having larger reserves in savingscan ensure borrowers can still make on-time payments and not put their home at risk.

If you make sure you have a plan, the savings are worth it. Lets say you have a $300,000 mortgage and the rate is 4.25% for a 30-year term, compared to 4.00% for a 15-year term. By the end of the 30-year term, youll have paid $231,295.08 in interest compared to $99,431.48, a savings difference of $131,863.60. Thats pretty significant.

Is It Worth Refinancing To A 15

You can save money and build home equity faster with a 15-year mortgage than with a 30-year mortgage. But the monthly mortgage payment will be higher on a 15-year mortgage because there is less time to pay off the loan.

Its worth comparing 15-year mortgage rates if youll be able to afford the monthly payments and still have enough money for other needs, such as saving for retirement.

Getting a lower interest rate could save you hundreds of dollars over a year of mortgage payments and thousands of dollars over the life of the mortgage.

When you compare 15-year refinancing offers using the Loan Estimates you receive from lenders, youll feel confident when you identify the offer that has the best combination of rate and fees.

Read Also: 10 Year Treasury Yield Mortgage Rates

Homebuyers Looking For A 30

Homebuyers looking for a 30-year fixed-rate mortgage will see rates averaging 5.93% today, an increase of 0.111 percentage points from a day ago.

Rates for other loan categories are also higher than yesterday with the 15-year fixed-rate mortgage averaging 4.776% and the 5/1 adjustable-rate mortgage averaging 4.473%.

- The latest rate on a 30-year fixed-rate mortgage is 5.93%.

- The latest rate on a 15-year fixed-rate mortgage is 4.776%.

- The latest rate on a 5/1 ARM is 4.473%.

- The latest rate on a 7/1 ARM is 4.791%.

- The latest rate on a 10/1 ARM is 4.956%.

Moneys daily mortgage rates are a national average and reflect what a borrower with a 20% down payment and a 700 credit score roughly the national average score might pay if he or she applied for a home loan right now. Each days rates are based on the average rate 8,000 lenders offered to applicants the previous business day. Freddie Macs weekly rates will generally be lower since they measure rates offered to borrowers with higher credit scores. Your individual rate will vary depending on your location, lender and financial details.

Looking for a loan? Check out Moneys lists of the best mortgage lenders and best refinance lenders.

How Your Interest Rate Is Determined

We can only show you todays 15year mortgage rates as averages. The rate you actually end up paying will be determined by a large number of factors.

You can influence some of the factors that determine you interest rate and get yourself a better deal. These include things like:

- The mortgage lender you choose

- Your credit score and credit report

- The size of your down payment

- Your debttoincome ratio

- Your employment history

Of course, mortgage interest rates also move up and down on a broader scale with the overall interest rate market. Supply and demand for mortgagebacked securities will have a big impact on your rate.

But theres little you can do about that so focus on factors you can control, like your loantovalue ratio and credit score, if you want to save money.

Also Check: Chase Mortgage Recast Fee

Our Mortgage Rate Methodology

Moneys daily mortgage rates show the average rate offered by over 8,000 lenders across the United States the most recent business day rates are available. Today, we are showing rates for Wednesday, June 1, 2022. Our rates reflect what a typical borrower with a 700 credit score might expect to pay for a home loan right now. These rates were offered to people putting 20% down and include discount points.

Refinance Rates Move In Opposite Directions

Refinancing an existing mortgage tends to be slightly more expensive than getting a new one, especially in a low-rate environment.

- 30-year fixed: The average rate to refinance rose to 6.04% from 5.93% the previous business day. A week ago, it was 5.96%. For every $100,000 borrowed, monthly payments would cost about $602.12, or $5.14 more than a week ago.

- 15-year fixed: The average rate to refinance fell to 5.04% from 5.14% the previous business day. A week ago, it was 4.99%. For every $100,000 borrowed, monthly payments would cost about $792.88, or $2.61 more than a week ago.

Recommended Reading: Rocket Mortgage Conventional Loan

Wendy’s Puts Free Breakfast On The Menu

“Even then, you might be better off investing your money elsewhere than tying up more of your wealth in the most illiquid asset you have – your home,” he said. “Just 28% of American households have a sufficient emergency savings cushion, so why the hurry to pay off a low, fixed rate, tax deductible debt. Money in the bank will pay the bills, home equity will not.”

How to Get a Low Rate

Low mortgage rates can play a large factor the ability of homeowners to save tens of thousands of dollars in interest. Even a 1% difference in the mortgage rate can save a homeowner $40,000 over 30 years for a mortgage valued at $200,000. Having a top notch credit score plays a critical factor in determining what interest rate lenders will offer consumers, but other issues such as the amount of your down payment also impact it.

A high credit score is the key to ensuring that borrowers receive a low mortgage rate. Here’s a quick rundown of what the numbers mean: a score of anything below 620 ranks as poor, 620-699 is fair, 700-749 is good and anything over 750 is excellent. Think carefully before canceling a credit card with a long, positive history. And naturally, be sure to decrease your debt. One of the biggest factors which impact your credit score is your credit utilization rate.